Key Insights

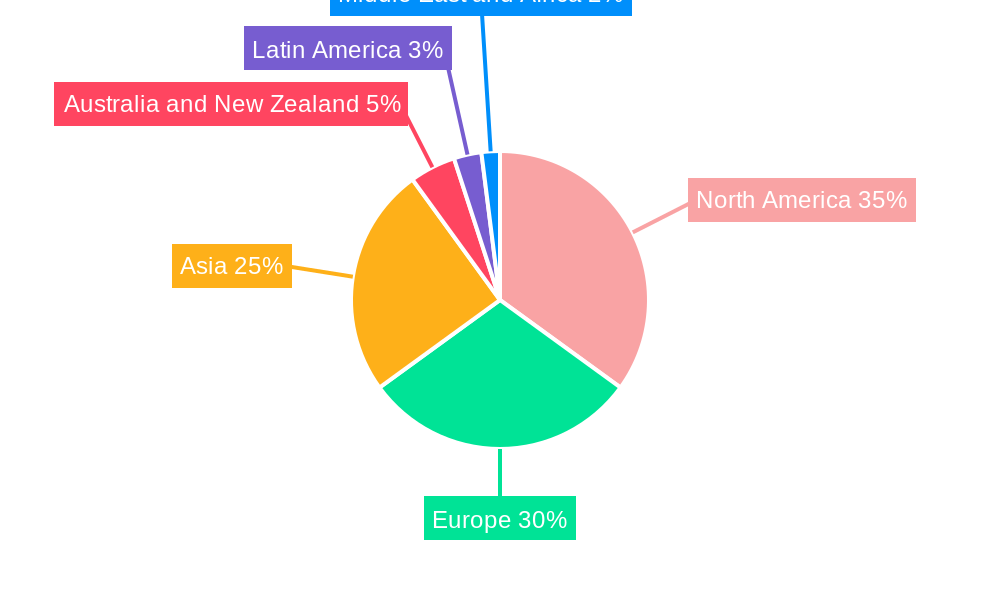

The global pyro fuse market, valued at $546.29 million in 2025, is projected to experience robust growth, driven by increasing demand from the automotive and industrial sectors. The market's Compound Annual Growth Rate (CAGR) of 11.87% from 2019 to 2033 indicates a significant expansion opportunity. This growth is fueled by the rising adoption of electric vehicles (EVs), necessitating advanced protection mechanisms like pyro fuses for battery systems and power electronics. Furthermore, increasing automation and electrification in industrial settings contribute significantly to the market's expansion. The high-voltage segment is anticipated to dominate due to its application in high-power systems. However, challenges such as stringent safety regulations and the potential for material cost fluctuations may act as restraints on market growth. Technological advancements focusing on miniaturization, improved performance, and enhanced safety features are expected to shape future market trends. Competition within the market is intense, with established players such as Pacific Engineering Corporation (PEC), Rheinmetall AG, and Robert Bosch GmbH alongside other significant manufacturers vying for market share. The geographic distribution is likely to see growth across all regions, with North America and Europe maintaining strong positions due to established automotive and industrial bases, while Asia-Pacific is expected to witness substantial growth due to increasing industrialization and automotive production.

The forecast period from 2025 to 2033 presents significant opportunities for market players to capitalize on the increasing demand for reliable and efficient protection solutions. Strategic partnerships, technological innovations, and expansion into emerging markets will be key success factors. Focus on developing high-performance, cost-effective pyro fuses that meet stringent safety standards will be crucial for maintaining a competitive edge in this dynamic market. Detailed regional analysis, considering market-specific regulations and consumer preferences, will enable businesses to tailor their product offerings and strategies for optimized market penetration.

Pyro Fuse Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Pyro Fuse Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. This analysis delves into both parent (Fuse Market) and child (Pyro Fuse) markets to provide a complete understanding of this crucial component in various industries. The market size is valued in million units.

Pyro Fuse Market Market Dynamics & Structure

The Pyro Fuse market is characterized by a dynamic and evolving landscape, demonstrating a moderate level of concentration among key industry players. In 2024, the market's structure is influenced by a strategic interplay of innovation, regulatory pressures, and the emergence of competing technologies. Technological advancements, particularly in advanced materials science and the pursuit of miniaturization, are pivotal in driving the development of pyro fuses with enhanced performance characteristics and superior reliability. This innovation is crucial for meeting the increasingly demanding requirements across various end-use industries.

Stringent safety regulations, especially those governing the automotive sector, play a significant role in shaping market dynamics. These regulations not only drive demand for compliant pyro fuses but also encourage continuous product development to meet evolving safety standards. Furthermore, the presence of competitive product substitutes, such as advanced electronic fuses, exerts continuous pressure on the pyro fuse market, necessitating a focus on unique value propositions and technological differentiation.

- Market Concentration: Moderately concentrated, with a trend towards strategic partnerships and acquisitions to bolster market position.

- Top 5 Players Market Share: Estimated at approximately xx% (2024), indicating a significant presence of leading entities.

- Key Drivers: Sustained demand for advanced safety and protection systems, particularly within the automotive and burgeoning industrial automation sectors. Ongoing technological innovations in materials and design are also critical.

- Challenges: The competitive pressure from alternative protection technologies, fluctuations in raw material costs, and the inherent complexities within global supply chains present ongoing hurdles.

- M&A Activity: The past five years have seen approximately xx strategic merger and acquisition deals. These transactions have primarily aimed at broadening product portfolios, securing new market segments, and expanding geographical footprints, leading to an estimated xx% increase in market consolidation.

Pyro Fuse Market Growth Trends & Insights

The global Pyro Fuse Market is experiencing robust growth, driven by the increasing demand for safety and protection in diverse applications. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by factors such as technological advancements resulting in improved fuse performance and the burgeoning electric vehicle (EV) and renewable energy sectors. Adoption rates are particularly high in developed economies due to higher safety standards and increased industrial automation. Consumer behavior shifts are also influencing the market, as awareness of safety features grows, boosting demand.

Dominant Regions, Countries, or Segments in Pyro Fuse Market

The Automotive segment continues to assert its dominance within the Pyro Fuse market, capturing an estimated xx% of the global market share in 2024. This leadership is propelled by the widespread adoption of sophisticated Advanced Driver-Assistance Systems (ADAS) and the exponential growth of the electric vehicle (EV) industry, both of which rely heavily on advanced electrical protection solutions. In terms of voltage types, the Low Voltage segment remains the largest, accounting for xx% of the market, due to its broad applicability across a multitude of consumer and industrial devices.

Geographically, North America and Europe stand out as the leading regions, boasting substantial market size and robust growth rates. This prominence is attributed to their proactive regulatory environments and the early adoption of cutting-edge technologies. The Asia Pacific region is projected to experience significant expansion in the forecast period, fueled by escalating industrialization efforts and the burgeoning automotive manufacturing sectors in key economies such as China and India.

- Leading Segment: Automotive (xx% market share in 2024), driven by ADAS and EV penetration.

- Fastest Growing Segment: High Voltage, projected to exhibit a Compound Annual Growth Rate (CAGR) of xx%, driven by grid modernization and renewable energy applications.

- Leading Region: North America (xx% market share in 2024), characterized by strong regulatory frameworks and high technological adoption.

- High Growth Region: Asia Pacific (Projected CAGR of xx%), propelled by increasing industrial output and automotive production.

Pyro Fuse Market Product Landscape

The product landscape of pyro fuses is a testament to continuous innovation and a relentless pursuit of superior functionality. Key development trajectories include an intensified focus on miniaturization, enabling smaller and lighter electronic devices, alongside enhanced performance metrics and an unwavering commitment to increased reliability. Recent breakthroughs are increasingly integrating "smart" features, offering advanced diagnostic capabilities and improved self-monitoring functions. These innovations are primarily driven by the imperative for heightened safety standards and optimized efficiency in critical applications such as sophisticated battery management systems and advanced powertrain control units within the automotive sector.

The evolution of software-programmable driver chips, incorporating built-in diagnostic functionalities, is further bolstering safety and reliability. These advancements signify a shift towards intelligent protection solutions that not only safeguard electrical systems but also provide valuable operational insights, contributing to overall system integrity and performance optimization.

Key Drivers, Barriers & Challenges in Pyro Fuse Market

Key Drivers: The escalating demand for robust safety and protection mechanisms across a diverse spectrum of applications, with a particular emphasis on the automotive and industrial sectors, serves as a primary growth catalyst. Furthermore, continuous technological advancements that result in improved performance, enhanced reliability, and more compact form factors are instrumental in driving market expansion. The stringent regulatory landscape, which mandates safer electrical systems in vehicles and industrial equipment, also acts as a significant impetus for market growth.

Challenges: The market faces significant hurdles, including intense competition from alternative protection technologies such as sophisticated electronic fuses. Disruptions within the global supply chain can impact the availability of crucial raw materials and consequently affect manufacturing costs. Additionally, the substantial investment required for research and development associated with pioneering innovative designs presents a considerable challenge to widespread market penetration and expansion.

Emerging Opportunities in Pyro Fuse Market

The growing electric vehicle market presents significant untapped opportunities, as pyro fuses are critical components in battery management systems and powertrain control units. Increasing demand for energy-efficient solutions in industrial automation and renewable energy sectors also creates ample growth opportunities. Innovative applications in aerospace and defense further expand the market’s potential. The development of smart pyro fuses with integrated diagnostics and predictive maintenance capabilities represents a notable opportunity.

Growth Accelerators in the Pyro Fuse Market Industry

Technological advancements in material science and semiconductor technology, enabling the production of smaller, faster, and more reliable pyro fuses, are key growth accelerators. Strategic partnerships between manufacturers and automotive or industrial equipment producers are vital to expand market reach and integrate new technologies. Furthermore, expansion into emerging economies with growing industrialization presents a lucrative avenue for growth.

Key Players Shaping the Pyro Fuse Market Market

- Pacific Engineering Corporation (PEC): A prominent player known for its specialized fuse solutions and commitment to innovation.

- Rheinmetall AG: A diversified technology group with a strong presence in automotive components and safety systems.

- Robert Bosch GmbH: A global leader in technology and services, offering a broad range of automotive and industrial components.

- Littelfuse Inc: A leading provider of circuit protection solutions, with a comprehensive portfolio of fuses and related products.

- STMicroelectronics: A major semiconductor manufacturer, offering integrated solutions that include protection devices.

- Autoliv Inc: A world leader in automotive safety systems, which often incorporate pyro fuses.

- Daicel Corporation: A diversified chemical company with interests in various industrial applications, including safety components.

- Mersen Group: A specialist in electrical power and advanced materials, offering a wide range of protection solutions.

- MTA SpA: A key supplier of electrical and electronic components for the automotive industry.

- Astotec Holding GmbH: A significant contributor to automotive safety systems, including those utilizing pyro technology.

- Eaton Corporation: A global power management company with a diverse range of electrical products and solutions.

Notable Milestones in Pyro Fuse Market Sector

- January 2024: Texas Instruments (TI) introduced the AWR2544 77GHz millimeter-wave radar sensor chip and new software-programmable driver chips (DRV3946-Q1 and DRV3901-Q1) for pyro fuses, enhancing ADAS capabilities and functional safety.

- January 2024: Honda announced the construction of an electric vehicle facility in Canada, potentially including in-house battery manufacturing, significantly boosting demand for pyro fuses in EV battery packs.

In-Depth Pyro Fuse Market Market Outlook

The Pyro Fuse market is poised for sustained growth, driven by the continued expansion of the electric vehicle market, increasing demand for safety and protection features, and ongoing technological advancements. Strategic investments in research and development, coupled with strategic partnerships and expansion into new geographic markets, will further enhance market growth potential in the coming years. The focus on smart and integrated fuse technologies, enabling enhanced safety and predictive maintenance, will shape the future landscape of the Pyro Fuse market.

Pyro Fuse Market Segmentation

-

1. Voltage Type

- 1.1. High Voltage (More than 700 V)

- 1.2. Medium Voltage (Between 400 V to 700 V)

- 1.3. Low Voltage (Below 400 V)

-

2. Application

- 2.1. Automotive

- 2.2. Industrial

Pyro Fuse Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Pyro Fuse Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Adoption of Eco-friendly Electric Vehicles (BEV

- 3.2.2 HEV); Rising Demand for Electrical Protection Against Short Circuits In Different Industries

- 3.3. Market Restrains

- 3.3.1. Surging Demand for Alternative Components Like Semiconductor Switches

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Voltage Type

- 5.1.1. High Voltage (More than 700 V)

- 5.1.2. Medium Voltage (Between 400 V to 700 V)

- 5.1.3. Low Voltage (Below 400 V)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Voltage Type

- 6. North America Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Voltage Type

- 6.1.1. High Voltage (More than 700 V)

- 6.1.2. Medium Voltage (Between 400 V to 700 V)

- 6.1.3. Low Voltage (Below 400 V)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Voltage Type

- 7. Europe Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Voltage Type

- 7.1.1. High Voltage (More than 700 V)

- 7.1.2. Medium Voltage (Between 400 V to 700 V)

- 7.1.3. Low Voltage (Below 400 V)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Voltage Type

- 8. Asia Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Voltage Type

- 8.1.1. High Voltage (More than 700 V)

- 8.1.2. Medium Voltage (Between 400 V to 700 V)

- 8.1.3. Low Voltage (Below 400 V)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Voltage Type

- 9. Australia and New Zealand Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Voltage Type

- 9.1.1. High Voltage (More than 700 V)

- 9.1.2. Medium Voltage (Between 400 V to 700 V)

- 9.1.3. Low Voltage (Below 400 V)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Voltage Type

- 10. Latin America Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Voltage Type

- 10.1.1. High Voltage (More than 700 V)

- 10.1.2. Medium Voltage (Between 400 V to 700 V)

- 10.1.3. Low Voltage (Below 400 V)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive

- 10.2.2. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Voltage Type

- 11. Middle East and Africa Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Voltage Type

- 11.1.1. High Voltage (More than 700 V)

- 11.1.2. Medium Voltage (Between 400 V to 700 V)

- 11.1.3. Low Voltage (Below 400 V)

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Automotive

- 11.2.2. Industrial

- 11.1. Market Analysis, Insights and Forecast - by Voltage Type

- 12. North America Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Pyro Fuse Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Pacific Engineering Corporation (PEC)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Rheinmetall AG

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Robert Bosch Gmbh

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Littelfuse Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 STMicroelectronics

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Autoliv Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Daicel Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Mersen Group

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 MTA SpA

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Astotec Holding Gmb

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Eaton Corporation

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Pacific Engineering Corporation (PEC)

List of Figures

- Figure 1: Global Pyro Fuse Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Pyro Fuse Market Revenue (Million), by Voltage Type 2024 & 2032

- Figure 15: North America Pyro Fuse Market Revenue Share (%), by Voltage Type 2024 & 2032

- Figure 16: North America Pyro Fuse Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Pyro Fuse Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Pyro Fuse Market Revenue (Million), by Voltage Type 2024 & 2032

- Figure 21: Europe Pyro Fuse Market Revenue Share (%), by Voltage Type 2024 & 2032

- Figure 22: Europe Pyro Fuse Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Pyro Fuse Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pyro Fuse Market Revenue (Million), by Voltage Type 2024 & 2032

- Figure 27: Asia Pyro Fuse Market Revenue Share (%), by Voltage Type 2024 & 2032

- Figure 28: Asia Pyro Fuse Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Pyro Fuse Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Pyro Fuse Market Revenue (Million), by Voltage Type 2024 & 2032

- Figure 33: Australia and New Zealand Pyro Fuse Market Revenue Share (%), by Voltage Type 2024 & 2032

- Figure 34: Australia and New Zealand Pyro Fuse Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Australia and New Zealand Pyro Fuse Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Australia and New Zealand Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Pyro Fuse Market Revenue (Million), by Voltage Type 2024 & 2032

- Figure 39: Latin America Pyro Fuse Market Revenue Share (%), by Voltage Type 2024 & 2032

- Figure 40: Latin America Pyro Fuse Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Pyro Fuse Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Pyro Fuse Market Revenue (Million), by Voltage Type 2024 & 2032

- Figure 45: Middle East and Africa Pyro Fuse Market Revenue Share (%), by Voltage Type 2024 & 2032

- Figure 46: Middle East and Africa Pyro Fuse Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Pyro Fuse Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Pyro Fuse Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Pyro Fuse Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pyro Fuse Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pyro Fuse Market Revenue Million Forecast, by Voltage Type 2019 & 2032

- Table 3: Global Pyro Fuse Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Pyro Fuse Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Pyro Fuse Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Pyro Fuse Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Pyro Fuse Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Pyro Fuse Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Pyro Fuse Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Pyro Fuse Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Pyro Fuse Market Revenue Million Forecast, by Voltage Type 2019 & 2032

- Table 18: Global Pyro Fuse Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Pyro Fuse Market Revenue Million Forecast, by Voltage Type 2019 & 2032

- Table 21: Global Pyro Fuse Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Pyro Fuse Market Revenue Million Forecast, by Voltage Type 2019 & 2032

- Table 24: Global Pyro Fuse Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Pyro Fuse Market Revenue Million Forecast, by Voltage Type 2019 & 2032

- Table 27: Global Pyro Fuse Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Pyro Fuse Market Revenue Million Forecast, by Voltage Type 2019 & 2032

- Table 30: Global Pyro Fuse Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Pyro Fuse Market Revenue Million Forecast, by Voltage Type 2019 & 2032

- Table 33: Global Pyro Fuse Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Pyro Fuse Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pyro Fuse Market?

The projected CAGR is approximately 11.87%.

2. Which companies are prominent players in the Pyro Fuse Market?

Key companies in the market include Pacific Engineering Corporation (PEC), Rheinmetall AG, Robert Bosch Gmbh, Littelfuse Inc, STMicroelectronics, Autoliv Inc, Daicel Corporation, Mersen Group, MTA SpA, Astotec Holding Gmb, Eaton Corporation.

3. What are the main segments of the Pyro Fuse Market?

The market segments include Voltage Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 546.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Eco-friendly Electric Vehicles (BEV. HEV); Rising Demand for Electrical Protection Against Short Circuits In Different Industries.

6. What are the notable trends driving market growth?

Automotive Segment to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Surging Demand for Alternative Components Like Semiconductor Switches.

8. Can you provide examples of recent developments in the market?

January 2024 - Texas Instruments (TI) introduced the AWR2544 77GHz millimeter-wave radar sensor chip, the industry’s first for satellite radar architectures, enabling higher levels of autonomy by improving sensor fusion and decision-making in ADAS. TI’s new software-programmable driver chips, the DRV3946-Q1 integrated contactor driver and DRV3901-Q1 integrated squib driver for pyro fuses, offer built-in diagnostics and support functional safety for battery management and powertrain systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pyro Fuse Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pyro Fuse Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pyro Fuse Market?

To stay informed about further developments, trends, and reports in the Pyro Fuse Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence