Key Insights

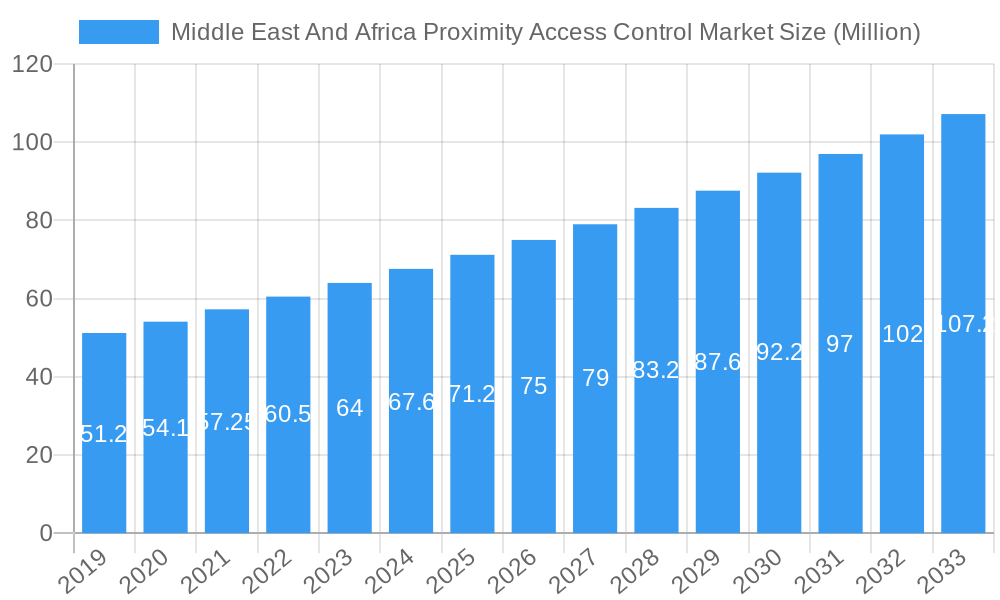

The Middle East and Africa (MEA) Proximity Access Control Market is poised for significant expansion, projected to reach a market size of USD 71.20 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.70% expected to persist through 2033. This growth is fundamentally driven by escalating security concerns across diverse sectors, including government, finance, and retail, where the need for robust and convenient access management solutions is paramount. The increasing adoption of advanced technologies like biometric scanners and wireless locks, alongside the integration of proximity readers with broader security systems, is a key trend shaping market dynamics. Furthermore, the ongoing digital transformation initiatives within the region, particularly in urban centers, are fueling investments in sophisticated access control infrastructure. Government efforts to enhance public safety and secure critical infrastructure, coupled with the burgeoning e-commerce and smart city development, are creating fertile ground for market expansion. The region's strong emphasis on modernization and infrastructure development, especially in countries like Saudi Arabia and the UAE, is a substantial catalyst for the widespread deployment of proximity access control systems.

Middle East And Africa Proximity Access Control Market Market Size (In Million)

The market's trajectory is also influenced by the diverse application landscape, spanning across government services, banking, IT, transportation, retail, healthcare, and residential segments. While the demand for sophisticated hardware and software solutions continues to rise, the increasing sophistication of security threats necessitates continuous innovation in areas such as advanced encryption and threat detection within access control systems. Restraints, such as the initial cost of implementation for advanced systems and the varying levels of technological infrastructure across different sub-regions, are being mitigated by the long-term benefits of enhanced security, operational efficiency, and compliance. The competitive landscape is characterized by the presence of established global players and emerging regional innovators, all vying to capture market share through product differentiation, strategic partnerships, and localized solutions tailored to the specific needs of the MEA region. The integration of proximity access control with broader smart building and IoT ecosystems is a prevailing trend, promising further growth and interconnected security solutions.

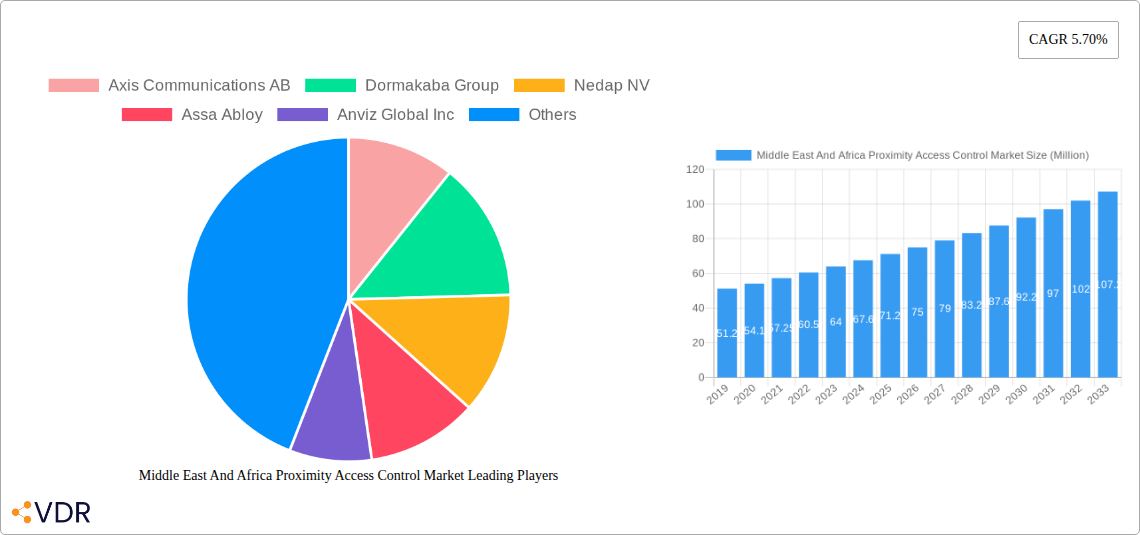

Middle East And Africa Proximity Access Control Market Company Market Share

Middle East and Africa Proximity Access Control Market: Comprehensive Industry Analysis and Future Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the Middle East and Africa (MEA) Proximity Access Control Market, providing granular insights into market dynamics, growth trends, and future projections. Covering the historical period from 2019 to 2024, base year 2025, and a forecast period extending to 2033, this report offers invaluable intelligence for stakeholders seeking to capitalize on this rapidly evolving sector. With a focus on high-traffic keywords such as "MEA access control," "proximity security solutions," "biometric access MEA," and "card reader technology," this report is optimized for maximum search engine visibility and engagement. Values are presented in Million units for clarity and ease of use.

Middle East And Africa Proximity Access Control Market Market Dynamics & Structure

The Middle East and Africa Proximity Access Control Market is characterized by a dynamic interplay of technological innovation, evolving security needs, and a fragmented yet consolidating competitive landscape. Market concentration is gradually shifting as larger global players expand their presence alongside robust local integrators. Technological innovation is a primary driver, fueled by the increasing demand for sophisticated, contactless, and mobile-enabled access solutions across diverse end-user industries. Regulatory frameworks are becoming more stringent, particularly concerning data privacy and cybersecurity, influencing the adoption of compliant access control systems. Competitive product substitutes are abundant, ranging from traditional key-based systems to advanced biometric and IoT-integrated solutions, pushing vendors to continuously innovate. End-user demographics are diverse, with governments, financial institutions, and burgeoning IT sectors leading the charge in adopting advanced security measures. Merger and acquisition (M&A) trends are on the rise, as established companies seek to acquire innovative technologies and expand their market reach, with an estimated XX M&A deals recorded in the historical period. Barriers to innovation include high initial investment costs for advanced technologies and the need for skilled personnel for implementation and maintenance.

- Market Concentration: Moderate to high, with a growing influence of global security giants and a rise in strategic partnerships.

- Technological Innovation Drivers: Demand for contactless access, mobile credentials, IoT integration, and AI-powered analytics.

- Regulatory Frameworks: Increasing emphasis on data privacy, cybersecurity standards (e.g., GDPR-like regulations), and government security mandates.

- Competitive Product Substitutes: Traditional locks, PIN-based systems, RFID, NFC, Bluetooth, facial recognition, fingerprint scanners.

- End-User Demographics: Government, BFSI, IT, transportation, retail, healthcare, and residential sectors are key adopters.

- M&A Trends: Strategic acquisitions for technology enhancement and market penetration are expected to increase.

- Innovation Barriers: High upfront costs, limited skilled workforce, and slow adoption rates in certain sub-regions.

Middle East And Africa Proximity Access Control Market Growth Trends & Insights

The Middle East and Africa Proximity Access Control Market is poised for significant expansion, driven by escalating security concerns, rapid urbanization, and the increasing adoption of smart building technologies. Market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period, expanding from an estimated USD XXXX million in 2025 to USD YYYY million by 2033. Adoption rates for proximity access control solutions are accelerating, particularly in sectors like banking and financial services and government services, where the need for robust and secure access management is paramount. Technological disruptions, including the widespread integration of AI, IoT, and cloud-based platforms, are reshaping the market, enabling more intelligent and seamless access experiences. Consumer behavior shifts are evident, with a growing preference for user-friendly, mobile-first access solutions that offer convenience and enhanced security. The penetration of proximity access control systems is expected to rise significantly across residential and commercial segments as awareness of its benefits grows. The increasing investment in smart infrastructure across MEA countries is a major catalyst for the adoption of advanced access control solutions. The demand for contactless solutions, amplified by global health concerns, continues to be a critical factor driving market growth. Furthermore, the rising incidence of cyber threats and physical security breaches is prompting organizations to invest more heavily in sophisticated access control systems that offer layered security.

Dominant Regions, Countries, or Segments in Middle East And Africa Proximity Access Control Market

Within the Middle East and Africa Proximity Access Control Market, several regions, countries, and segments stand out as significant growth drivers. The Government Services end-user industry is a dominant force, accounting for an estimated XX% market share in 2025, due to heightened national security imperatives, border control modernization, and the demand for secure access to critical infrastructure. The United Arab Emirates (UAE) and Saudi Arabia are leading countries, contributing over XX% of the regional market revenue, driven by substantial government investment in smart city initiatives, large-scale infrastructure projects, and a strong focus on enhancing public and private sector security.

In terms of Solution, the Hardware segment, particularly Card Readers and Door Controllers, currently holds the largest market share, estimated at XX% and YY% respectively in 2025, due to their established presence and cost-effectiveness in various applications. However, the Software segment is exhibiting the highest growth rate, driven by the increasing demand for cloud-based access management systems, analytics, and integration capabilities with other security platforms. Among the Type segments, Biometric Scanners are witnessing rapid adoption, projected to grow at a CAGR of XX%, fueled by advancements in fingerprint, facial, and iris recognition technologies that offer enhanced security and convenience. The Banking and Financial Services sector also represents a substantial market segment, driven by the stringent regulatory requirements for data security and physical asset protection. The Transportation and Logistics sector is another key growth area, with a rising need for secure access control at ports, airports, and logistics hubs.

- Dominant End-User Industry: Government Services, driven by national security and critical infrastructure protection.

- Leading Countries: United Arab Emirates and Saudi Arabia, fueled by smart city initiatives and infrastructure development.

- Dominant Solution Segment: Hardware (Card Readers and Door Controllers) currently leads, but Software is experiencing rapid growth.

- Fastest Growing Type Segment: Biometric Scanners, propelled by technological advancements and enhanced security needs.

- Key Growth Segments: Banking and Financial Services, and Transportation and Logistics are experiencing significant demand.

- Key Drivers for Dominance: Economic policies, infrastructure development, heightened security awareness, and government mandates.

- Market Share & Growth Potential: Government services and leading economies exhibit strong current market share and substantial future growth potential.

Middle East And Africa Proximity Access Control Market Product Landscape

The Middle East and Africa Proximity Access Control Market is witnessing a surge in innovative product offerings designed to enhance security, convenience, and integration. Key product innovations include the proliferation of contactless smart card readers and mobile credential solutions, enabling access via smartphones using NFC and Bluetooth technology. Biometric scanners, encompassing advanced facial recognition and fingerprint readers, are gaining traction for their high security and user-friendliness. Wireless locks are offering flexible installation options, reducing cabling complexities. The integration of AI and machine learning into access control software is enabling predictive analytics for threat detection and user behavior analysis. Performance metrics like read range, authentication speed, and tamper resistance are continuously being improved, catering to diverse environmental and security requirements. Unique selling propositions often revolve around seamless integration capabilities with existing security infrastructure, robust data encryption, and compliance with international security standards.

Key Drivers, Barriers & Challenges in Middle East And Africa Proximity Access Control Market

Key Drivers:

- Rising Security Concerns: Increasing threats of physical and cyber intrusions are compelling organizations to invest in advanced access control.

- Smart City Initiatives: Government-led smart city projects across MEA are driving the demand for integrated security solutions, including proximity access control.

- Technological Advancements: Continuous innovation in biometrics, IoT, and mobile credentialing is enhancing functionality and user experience.

- Growing IT and Telecommunications Sector: Expansion in data centers and IT infrastructure necessitates stringent access control measures.

- Increased Construction and Infrastructure Development: New commercial and residential buildings are being equipped with modern access control systems from inception.

Barriers & Challenges:

- High Initial Investment Costs: Advanced proximity access control systems can have significant upfront costs, challenging adoption for smaller businesses and organizations with limited budgets.

- Lack of Skilled Workforce: The implementation, maintenance, and management of sophisticated access control systems require specialized expertise, which is currently scarce in some MEA regions.

- Cybersecurity Vulnerabilities: Despite being a driver, the inherent risks associated with connected systems can also be a barrier, as potential vulnerabilities need to be constantly addressed.

- Interoperability Issues: Integrating new access control systems with legacy infrastructure can be complex and costly.

- Regulatory and Compliance Hurdles: Navigating diverse and evolving regulatory landscapes across different MEA countries can pose a challenge for vendors and end-users.

- Price Sensitivity: In certain market segments, cost remains a significant factor, leading to a preference for more basic or traditional solutions.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of hardware components, affecting project timelines and profitability.

Emerging Opportunities in Middle East And Africa Proximity Access Control Market

Emerging opportunities in the MEA Proximity Access Control Market lie in the untapped potential of smaller enterprises and the growing demand for integrated security solutions. The increasing adoption of IoT devices in commercial and residential spaces presents a significant opportunity for smart, connected access control systems that can seamlessly integrate with other building management systems. The healthcare sector is increasingly looking for sophisticated access control solutions to secure sensitive patient data and restricted areas, creating a niche market. Furthermore, the development of specialized access control solutions for remote or harsh environments, such as oil and gas facilities, offers a promising avenue for growth. The demand for cloud-based access control management services is also on the rise, offering recurring revenue streams and greater scalability for service providers. The growing awareness and adoption of AI-powered analytics for enhanced security and operational efficiency represent a significant future growth area.

Growth Accelerators in the Middle East And Africa Proximity Access Control Market Industry

Several key catalysts are accelerating the growth of the MEA Proximity Access Control Market. Technological breakthroughs in biometric authentication, such as enhanced liveness detection and multi-modal biometrics, are driving higher security and user adoption. Strategic partnerships between hardware manufacturers, software developers, and system integrators are creating comprehensive end-to-end solutions. Market expansion strategies, including increased localization of sales and support teams, are crucial for penetrating diverse regional markets effectively. The growing focus on cybersecurity by governments and enterprises worldwide is indirectly accelerating the adoption of robust access control as a foundational security layer. The continuous development of standardized protocols for IoT device communication is also fostering greater interoperability and encouraging the adoption of integrated smart building solutions.

Key Players Shaping the Middle East And Africa Proximity Access Control Market Market

- Axis Communications AB

- Dormakaba Group

- Nedap NV

- Assa Abloy

- Anviz Global Inc

- Mobotix

- Johnson Controls

- HID Global

- Schneider Electric

- Milestone Systems

- Genetec

- Honeywell International Inc

- Innovatrics

- SALTO Systems

- Idemia

- Dahua Technology Co Ltd

- Vicon

Notable Milestones in Middle East And Africa Proximity Access Control Market Sector

- April 2024: Johnson Controls introduced Security Lifecycle Management with OpenBlue Services, empowering customers to bolster building safety, mitigate risks, and optimize returns on security technology investments by merging its OpenBlue suite for multi-vendor device monitoring and management, coupled with remote support and a zero-trust cybersecurity shield.

- April 2024: HID launched the OMNIKEY SE Reader Core, a cutting-edge module designed to enhance smart access solutions by improving authentication and verification practices for physical and logical access across various settings, including connected workspaces, healthcare, and educational campuses, enabling advanced mobile features for integrators.

In-Depth Middle East And Africa Proximity Access Control Market Market Outlook

The future outlook for the Middle East and Africa Proximity Access Control Market is exceptionally promising, driven by a confluence of technological innovation, increasing security imperatives, and supportive government initiatives. Growth accelerators include the sustained demand for contactless and mobile-based access solutions, the integration of AI and IoT for smarter building management, and the expansion of critical infrastructure projects across the region. Strategic partnerships and the development of localized solutions will be key to unlocking the full market potential. The increasing focus on data security and compliance will further propel the adoption of advanced access control technologies, solidifying its position as a critical component of modern security infrastructure. The MEA market is poised for sustained growth, offering significant opportunities for stakeholders investing in this dynamic sector.

Middle East And Africa Proximity Access Control Market Segmentation

-

1. Solution

- 1.1. Hardware

- 1.2. Software

-

2. Type

- 2.1. Card Readers

- 2.2. Biometric Scanners

- 2.3. Proximity Readers

- 2.4. Alarms

- 2.5. Metal Detectors

- 2.6. Door Controllers

- 2.7. Wireless Locks

-

3. End-user Industry

- 3.1. Government Services

- 3.2. Banking and Financial Services

- 3.3. IT and Telecommunications

- 3.4. Transportation and Logistics

- 3.5. Retail

- 3.6. Healthcare

- 3.7. Residential

- 3.8. Other End-user Industries

Middle East And Africa Proximity Access Control Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

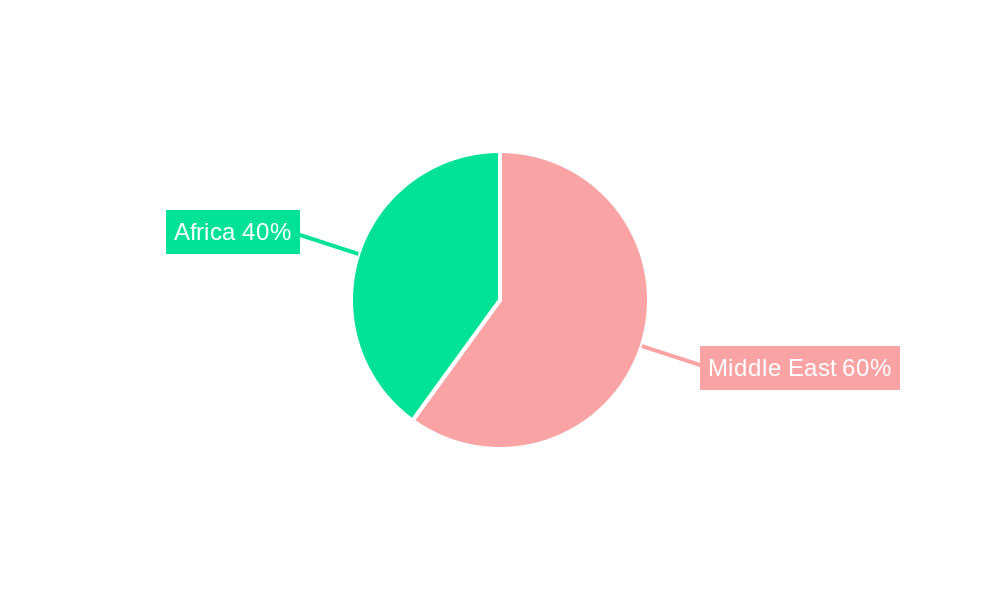

Middle East And Africa Proximity Access Control Market Regional Market Share

Geographic Coverage of Middle East And Africa Proximity Access Control Market

Middle East And Africa Proximity Access Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incorporation with Building Management Systems for More Efficient Energy Use; Advancements in Technology and Increasing Awareness of Security Risks; Increasing Demand for Multi-factor Authentication

- 3.3. Market Restrains

- 3.3.1. Increasing Incorporation with Building Management Systems for More Efficient Energy Use; Advancements in Technology and Increasing Awareness of Security Risks; Increasing Demand for Multi-factor Authentication

- 3.4. Market Trends

- 3.4.1. The Biometric Scanners Segment is Expected to Hold a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Proximity Access Control Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Card Readers

- 5.2.2. Biometric Scanners

- 5.2.3. Proximity Readers

- 5.2.4. Alarms

- 5.2.5. Metal Detectors

- 5.2.6. Door Controllers

- 5.2.7. Wireless Locks

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Government Services

- 5.3.2. Banking and Financial Services

- 5.3.3. IT and Telecommunications

- 5.3.4. Transportation and Logistics

- 5.3.5. Retail

- 5.3.6. Healthcare

- 5.3.7. Residential

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dormakaba Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nedap NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Assa Abloy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anviz Global Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mobotix

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Johnson Controls

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HID Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Milestone Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Genetec

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Honeywell International Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Innovatrics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SALTO Systems

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Idemia

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Dahua Technology Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Vicon*List Not Exhaustive

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: Middle East And Africa Proximity Access Control Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Proximity Access Control Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 2: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by Solution 2020 & 2033

- Table 3: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by Type 2020 & 2033

- Table 5: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 10: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by Solution 2020 & 2033

- Table 11: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by Type 2020 & 2033

- Table 13: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Middle East And Africa Proximity Access Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East And Africa Proximity Access Control Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Saudi Arabia Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: United Arab Emirates Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Arab Emirates Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Israel Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Israel Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Qatar Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Qatar Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Kuwait Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Kuwait Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Oman Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Oman Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Bahrain Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Bahrain Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Jordan Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Jordan Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Lebanon Middle East And Africa Proximity Access Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Lebanon Middle East And Africa Proximity Access Control Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Proximity Access Control Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Middle East And Africa Proximity Access Control Market?

Key companies in the market include Axis Communications AB, Dormakaba Group, Nedap NV, Assa Abloy, Anviz Global Inc, Mobotix, Johnson Controls, HID Global, Schneider Electric, Milestone Systems, Genetec, Honeywell International Inc, Innovatrics, SALTO Systems, Idemia, Dahua Technology Co Ltd, Vicon*List Not Exhaustive.

3. What are the main segments of the Middle East And Africa Proximity Access Control Market?

The market segments include Solution, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incorporation with Building Management Systems for More Efficient Energy Use; Advancements in Technology and Increasing Awareness of Security Risks; Increasing Demand for Multi-factor Authentication.

6. What are the notable trends driving market growth?

The Biometric Scanners Segment is Expected to Hold a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Increasing Incorporation with Building Management Systems for More Efficient Energy Use; Advancements in Technology and Increasing Awareness of Security Risks; Increasing Demand for Multi-factor Authentication.

8. Can you provide examples of recent developments in the market?

April 2024: Johnson Controls introduced Security Lifecycle Management with OpenBlue Services. This innovative offering is tailored to empower customers to bolster building safety, mitigate risks, and optimize returns on their security technology investments. The solution merges Johnson Controls' OpenBlue suite of interconnected solutions, enabling the monitoring and management of security devices from various vendors. It also includes remote support services, expert insights from engineers, and a streamlined, integrated zero-trust cybersecurity shield.April 2024: HID launched its latest innovation: the OMNIKEY SE Reader Core. This cutting-edge module is crafted to enhance the intelligence of smart access solutions, empowering organizations to bolster their authentication and verification practices. The HID OMNIKEY SE Reader Core is revolutionizing both physical and logical access in many settings, spanning from connected workspaces and healthcare facilities to educational campuses and office buildings. Notably, it equips integrators with the capability to infuse advanced mobile features into devices, catering to physical and logical access needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Proximity Access Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Proximity Access Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Proximity Access Control Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Proximity Access Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence