Key Insights

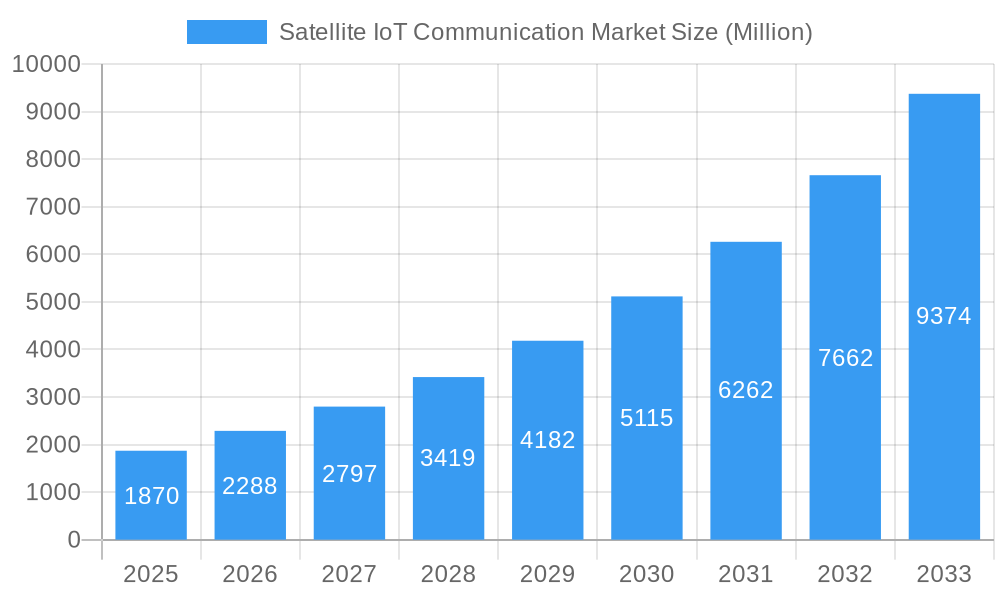

The Satellite IoT Communication Market is poised for remarkable expansion, projected to reach USD 1.87 billion in 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 19.76% through 2033. This impressive growth is primarily fueled by the escalating demand for ubiquitous connectivity in remote and underserved regions where terrestrial networks are either absent or unreliable. The proliferation of the Internet of Things (IoT) across various sectors, including agriculture, logistics, maritime, and energy, is a significant driver, as these industries increasingly rely on satellite communications to connect their dispersed assets and enable real-time data transmission. Advancements in satellite technology, such as the deployment of Low Earth Orbit (LEO) constellations, are further accelerating market adoption by offering lower latency, higher bandwidth, and more affordable solutions. These LEO systems are particularly instrumental in democratizing satellite IoT, making it accessible to a broader range of applications and businesses.

Satellite IoT Communication Market Market Size (In Billion)

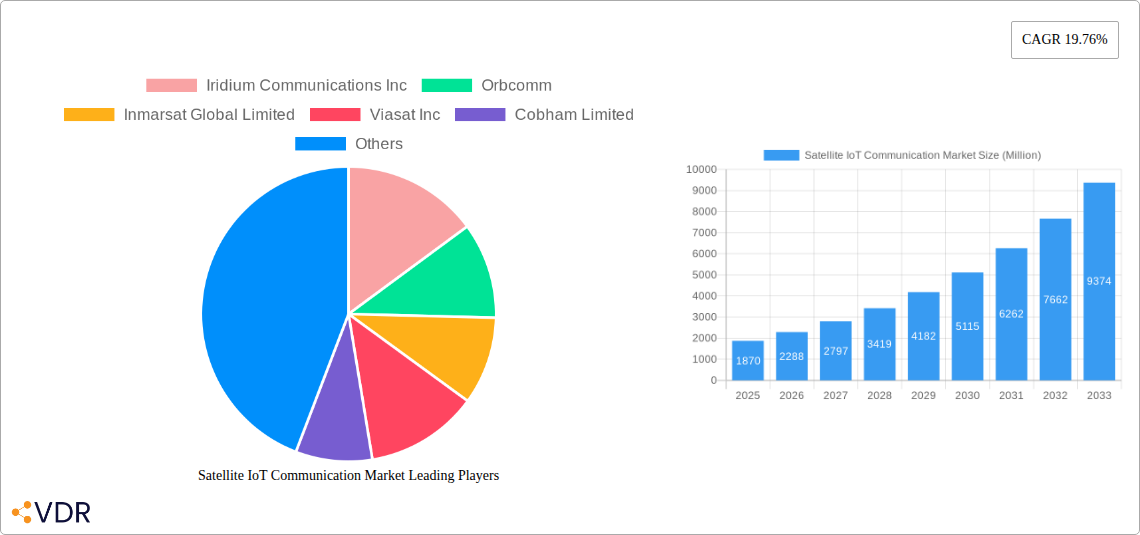

Emerging trends underscore a shift towards more integrated and sophisticated satellite IoT solutions. This includes the development of miniaturized satellite payloads, the integration of AI and machine learning for enhanced data analytics at the edge, and the growing interest in private satellite networks for secure and dedicated IoT deployments. While the market is experiencing substantial growth, certain restraints exist, such as the initial high cost of satellite terminal hardware and the ongoing need for regulatory approvals in different regions. However, the increasing number of innovative companies, including Iridium Communications Inc., Orbcomm, Inmarsat Global Limited, and Viasat Inc., investing in advanced satellite constellations and services, alongside the emergence of disruptive players like Fleet Space Technologies, signifies a dynamic and competitive landscape. These companies are continuously pushing the boundaries to offer more cost-effective and feature-rich solutions, thereby mitigating existing challenges and paving the way for sustained and accelerated market penetration across diverse geographical regions and industry verticals.

Satellite IoT Communication Market Company Market Share

Satellite IoT Communication Market: Unlocking Global Connectivity and Future Growth

Report Description:

Dive into the rapidly expanding Satellite IoT Communication Market with this comprehensive report, offering in-depth analysis and actionable insights for stakeholders. Explore the intricate dynamics of this burgeoning sector, from the critical role of Low Earth Orbit (LEO) constellations to the evolving landscape of Geostationary Orbit (GEO) services. This report provides a detailed market outlook for 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033, encompassing historical trends from 2019–2024.

Gain an unparalleled understanding of market size evolution, adoption rates, technological disruptions, and crucial end-user demographics. We meticulously analyze the impact of industry developments, including significant contracts for satellite manufacturing and the launch of high-performance satellites designed to bridge the digital divide. Discover key drivers such as advancements in satellite manufacturing, the demand for remote connectivity solutions, and the increasing adoption of IoT devices in challenging environments.

This report also delves into the competitive landscape, featuring insights into major players like Iridium Communications Inc, Orbcomm, Inmarsat Global Limited, Viasat Inc, Cobham Limited, Fleet Space Technologies Private Limited, L3Harris Technologies, Globalstar Inc, and Boeing. Understand the strategic partnerships and M&A trends shaping the future of satellite communication for IoT.

Whether you are a satellite operator, IoT solution provider, investor, or industry analyst, this report is your essential guide to navigating the opportunities and challenges within the global satellite IoT communication market. Prepare to unlock new revenue streams and strategic advantages in this transformative industry. All values are presented in Million units.

Satellite IoT Communication Market Market Dynamics & Structure

The Satellite IoT Communication Market is characterized by a dynamic interplay of technological innovation, increasing demand for ubiquitous connectivity, and evolving regulatory landscapes. Market concentration is gradually shifting as new players, particularly in the LEO segment, challenge established giants. The primary drivers of technological innovation are the miniaturization of satellite components, advancements in propulsion systems enabling LEO constellations, and the development of more efficient ground segment technologies. Regulatory frameworks, while generally supportive, can present hurdles related to spectrum allocation and orbital debris management. Competitive product substitutes, primarily terrestrial networks, are being outpaced in remote and underserved regions, driving demand for satellite solutions. End-user demographics are expanding from traditional maritime and aviation sectors to include agriculture, logistics, utilities, and environmental monitoring, all seeking reliable data transmission for their IoT devices. Mergers and acquisitions (M&A) are anticipated to increase as companies seek to consolidate market share, acquire critical technologies, or expand their service offerings. For instance, recent funding rounds and partnerships highlight the increasing investment in LEO constellations aimed at providing low-latency IoT services.

- Market Concentration: Shifting from concentrated to moderately fragmented with emerging LEO players.

- Technological Innovation Drivers: Miniaturization, efficient propulsion, advanced ground terminals, AI integration.

- Regulatory Frameworks: Spectrum allocation, orbital debris mitigation, national security considerations.

- Competitive Product Substitutes: Terrestrial networks (fiber, 5G), which are less effective in remote areas.

- End-User Demographics: Expanding beyond traditional sectors to include agriculture, logistics, mining, and smart cities.

- M&A Trends: Increasing consolidation for market share and technological integration.

Satellite IoT Communication Market Growth Trends & Insights

The Satellite IoT Communication Market is poised for remarkable growth, driven by an insatiable global demand for connectivity in areas underserved by terrestrial infrastructure. The market size is projected to expand significantly from xx million units in 2024 to an estimated xx million units by 2033, exhibiting a compelling Compound Annual Growth Rate (CAGR) of approximately xx%. This growth trajectory is fueled by the increasing adoption of IoT devices across a multitude of industries, from agriculture and logistics to environmental monitoring and disaster management. The launch of numerous Low Earth Orbit (LEO) constellations has been a pivotal technological disruption, offering lower latency and more affordable data transmission capabilities, thereby enhancing the viability of real-time IoT applications. Medium Earth Orbit (MEO) satellites continue to play a crucial role in providing a balance between coverage and latency for certain applications, while Geostationary Orbit (GEO) satellites remain vital for broadcasting and high-bandwidth services.

Consumer behavior shifts are also playing a significant role, with industries increasingly recognizing the value of real-time data for operational efficiency, predictive maintenance, and enhanced decision-making. The proliferation of affordable IoT sensors and devices, coupled with the decreasing cost of satellite bandwidth, is further accelerating adoption rates. Market penetration is deepening as satellite IoT solutions become more accessible and tailored to specific industry needs. For example, in the agriculture sector, satellite IoT enables precision farming through remote sensing and data analytics, optimizing resource allocation and crop yields. Similarly, in the logistics industry, it provides real-time tracking and monitoring of goods, enhancing supply chain visibility and security. The ongoing development of standardized protocols and interoperability between different satellite constellations will further streamline integration and drive broader market acceptance. This sustained innovation and expanding application landscape paint a robust picture of future market expansion.

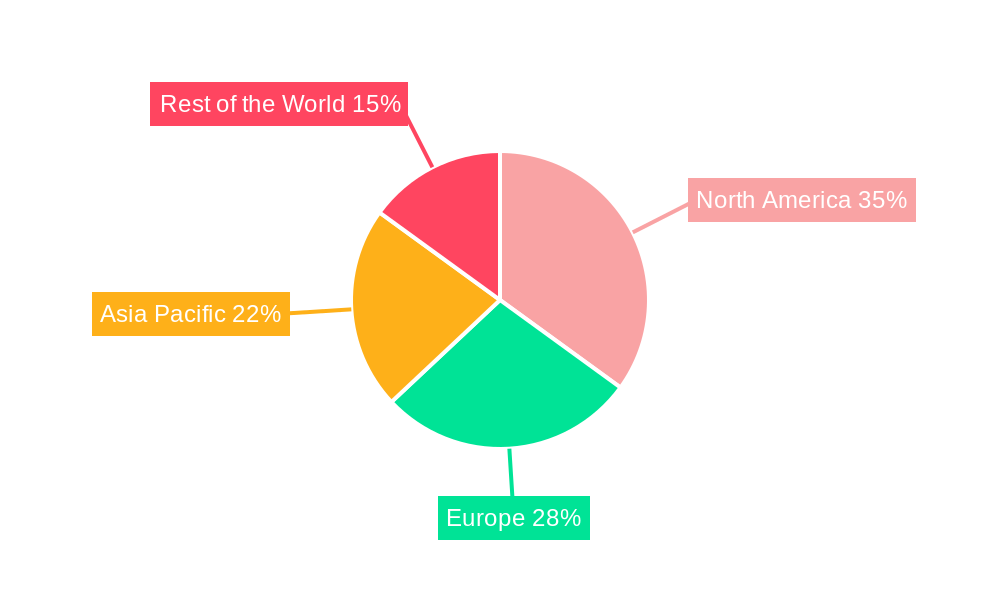

Dominant Regions, Countries, or Segments in Satellite IoT Communication Market

The Low Earth Orbit (LEO) segment is emerging as the dominant force in the Satellite IoT Communication Market, driven by its inherent advantages in terms of lower latency, higher bandwidth potential, and the ability to deploy large constellations for comprehensive global coverage. LEO satellites orbit at altitudes of approximately 160 to 2,000 kilometers, enabling near real-time data transmission crucial for many IoT applications such as autonomous vehicles, remote asset monitoring, and industrial automation. The proliferation of LEO constellations by companies like SpaceX (Starlink) and OneWeb has significantly increased competition and driven down service costs, making satellite IoT more accessible than ever before.

The Americas region, particularly North America, is currently a leading market for satellite IoT communication. This dominance is attributed to several factors, including a high concentration of technological innovation, substantial investments in space technologies, and a diverse industrial base with a strong demand for remote connectivity. Countries like the United States are at the forefront of satellite IoT development, with significant government and private sector initiatives supporting space exploration and commercialization. Economic policies that encourage private investment in space infrastructure and a robust ecosystem of satellite manufacturers and service providers further bolster this leadership. The vast geographical expanse of the Americas, encompassing remote areas in Canada, the United States, and Latin America, creates a compelling need for satellite-based communication solutions for industries such as agriculture, mining, oil and gas, and disaster relief. The growth potential in these underserved regions is immense, further cementing the Americas' position as a key market.

- Dominant Segment: Low Earth Orbit (LEO) due to low latency and global coverage potential.

- Leading Region: The Americas, driven by technological advancement and diverse industry needs.

- Key Countries: United States, Canada, and emerging markets in Latin America.

- Drivers of Dominance: High investment in space technology, supportive economic policies, vast remote areas requiring connectivity.

- Market Share (LEO): Estimated to hold xx% of the market by 2033, growing from xx% in 2025.

- Growth Potential: Significant untapped potential in remote agricultural lands, industrial sites, and off-grid communities.

Satellite IoT Communication Market Product Landscape

The Satellite IoT Communication Market's product landscape is characterized by innovation focused on miniaturization, increased data throughput, and enhanced reliability for diverse environmental conditions. Terminals are becoming smaller, more energy-efficient, and capable of multi-band operation, facilitating seamless connectivity for various IoT devices. Advanced antenna designs and integrated modem solutions are key developments. Applications span a wide spectrum, including remote asset tracking for logistics and agriculture, real-time environmental monitoring for climate research and disaster preparedness, machine-to-machine (M2M) communication for industrial automation, and connectivity for autonomous vehicles and drones in areas beyond terrestrial network reach. Performance metrics are continually improving, with reduced latency, increased data rates up to xx Mbps, and enhanced service availability in challenging terrains and weather conditions. The focus is on delivering robust, cost-effective, and scalable solutions that meet the stringent demands of the Internet of Things.

Key Drivers, Barriers & Challenges in Satellite IoT Communication Market

Key Drivers:

The Satellite IoT Communication Market is propelled by several key forces. Technologically, the continuous advancement in satellite technology, particularly the development of smaller, more powerful LEO constellations, significantly reduces latency and increases data capacity. The growing global demand for remote connectivity, driven by the expansion of IoT applications in industries like agriculture, logistics, and maritime, is a primary economic driver. Furthermore, government initiatives and investments in space infrastructure and digital transformation policies are creating a conducive environment for market growth. The increasing need for reliable communication in disaster-prone areas and for global supply chain visibility also fuels demand.

Barriers & Challenges:

Despite robust growth drivers, the market faces significant barriers and challenges. High initial capital expenditure for satellite deployment and ground infrastructure remains a considerable hurdle for new entrants. Regulatory complexities, including spectrum licensing and international coordination, can slow down service deployment. The competition from an ever-expanding terrestrial network infrastructure, where available, presents a challenge to market penetration in developed regions. Supply chain disruptions in the manufacturing of specialized satellite components can impact production timelines and costs. Lastly, the need for specialized technical expertise for deployment and maintenance of satellite IoT systems can limit adoption in certain sectors.

Emerging Opportunities in Satellite IoT Communication Market

Emerging opportunities in the Satellite IoT Communication Market are vast and transformative. The burgeoning fields of smart agriculture and precision farming offer immense potential, with satellite IoT enabling real-time monitoring of soil conditions, weather patterns, and crop health across vast agricultural landscapes. The expansion of autonomous systems, including self-driving vehicles and drone delivery services, relies heavily on reliable satellite connectivity for navigation and data transmission in remote or unserved areas. The development of smart cities and critical infrastructure monitoring in remote locations, such as pipelines, power grids, and bridges, presents another significant growth avenue. Furthermore, the increasing emphasis on environmental sustainability and climate change monitoring is driving demand for satellite-based IoT solutions for tracking emissions, deforestation, and oceanographic data.

Growth Accelerators in the Satellite IoT Communication Market Industry

Several key catalysts are accelerating growth within the Satellite IoT Communication Market. Technological breakthroughs, particularly the innovation in reusable rocket technology and the mass production of small satellites, are dramatically lowering launch costs, making satellite deployment more economically viable. Strategic partnerships between satellite operators, IoT solution providers, and cloud service providers are fostering the development of integrated end-to-end solutions, simplifying adoption for end-users. Market expansion strategies focusing on underserved regions, such as developing countries and remote industrial sites, are opening up new revenue streams. The increasing adoption of AI and machine learning for data analysis and network management within satellite IoT systems is enhancing efficiency and intelligence, further stimulating demand. The growing awareness and regulatory push for enhanced cybersecurity measures in IoT deployments are also indirectly benefiting satellite solutions, which can offer more secure and resilient communication channels.

Key Players Shaping the Satellite IoT Communication Market Market

- Iridium Communications Inc

- Orbcomm

- Inmarsat Global Limited

- Viasat Inc

- Cobham Limited

- Fleet Space Technologies Private Limited

- L3Harris Technologies

- Globalstar Inc

- Boeing

Notable Milestones in Satellite IoT Communication Market Sector

- October 2023: An SAR1 billion (USD 266.6 million) contract was signed with a Hong Kong space company to establish satellite manufacturing facilities in Saudi Arabia. ASPACE will increase investment in R&D, component production, subsystems, and final satellite assembly, positioning the Kingdom as a global manufacturing hub. This investment in advanced satellites, representing 70% of the global satellite market, leverages the region's strategic location to enhance space capabilities.

- February 2023: Hispasat launched the Amazonas Nexus, a high-performance geostationary satellite, ushering in a new era of satellite communications. This satellite provides high-speed internet across the Americas, Atlantic corridors, and off-grid locations like Greenland and the Amazon rainforest, specifically catering to maritime and aviation connectivity and bridging the digital gap in Latin America.

- February 2023: Cobham Satcom and RBC Signals extended their agreement to globally deploy Cobham Satcom's Tracker 6000 and 3700 series ground stations. This partnership will significantly expand RBC Signals' ground network, offering integrated communication services for Non-Geostationary Orbit (NGSO) missions and constellations supporting Earth Observation, IoT, and Space Situational Awareness.

In-Depth Satellite IoT Communication Market Market Outlook

The Satellite IoT Communication Market is set for an accelerated growth trajectory, driven by the relentless pursuit of global connectivity and the increasing sophistication of IoT applications. The foundational growth accelerators lie in the continuous technological advancements, especially in LEO satellite technology, which is democratizing access to reliable, low-latency communication for previously unserved or underserved markets. Strategic alliances and partnerships are proving pivotal, enabling the creation of seamless, end-to-end IoT solutions that integrate satellite connectivity with cloud platforms and data analytics. This synergy is crucial for industries seeking to leverage real-time data for operational optimization and innovation. Furthermore, the expansion into emerging economies and remote industrial sectors represents a significant untapped potential, promising substantial market penetration. The integration of AI and machine learning within satellite networks will further enhance efficiency and intelligence, solidifying satellite IoT's role as a critical enabler of the digital economy in the years to come.

Satellite IoT Communication Market Segmentation

-

1. Type of Orbit

- 1.1. Low Earth Orbit (LEO)

- 1.2. Medium Earth Orbit (MEO)

- 1.3. Geostationary Orbit (GEO)

Satellite IoT Communication Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Satellite IoT Communication Market Regional Market Share

Geographic Coverage of Satellite IoT Communication Market

Satellite IoT Communication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development and Growth of 5G Wireless Connectivity; Considerable Investments in the LEO Satellite Constellations

- 3.3. Market Restrains

- 3.3.1. Safety Concerns Associated with the Use of Surgical Robots; High Initial and Maintenance Costs of the Equipment

- 3.4. Market Trends

- 3.4.1. Low Earth Orbit (LEO) drives the Growth of the Satellite IoT Communication

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite IoT Communication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 5.1.1. Low Earth Orbit (LEO)

- 5.1.2. Medium Earth Orbit (MEO)

- 5.1.3. Geostationary Orbit (GEO)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 6. North America Satellite IoT Communication Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 6.1.1. Low Earth Orbit (LEO)

- 6.1.2. Medium Earth Orbit (MEO)

- 6.1.3. Geostationary Orbit (GEO)

- 6.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 7. Europe Satellite IoT Communication Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 7.1.1. Low Earth Orbit (LEO)

- 7.1.2. Medium Earth Orbit (MEO)

- 7.1.3. Geostationary Orbit (GEO)

- 7.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 8. Asia Pacific Satellite IoT Communication Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 8.1.1. Low Earth Orbit (LEO)

- 8.1.2. Medium Earth Orbit (MEO)

- 8.1.3. Geostationary Orbit (GEO)

- 8.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 9. Rest of the World Satellite IoT Communication Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 9.1.1. Low Earth Orbit (LEO)

- 9.1.2. Medium Earth Orbit (MEO)

- 9.1.3. Geostationary Orbit (GEO)

- 9.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Iridium Communications Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Orbcomm

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Inmarsat Global Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Viasat Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cobham Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fleet Space Technologies Private Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 L3Harris Technologies*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Globalstar Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Boeing

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Iridium Communications Inc

List of Figures

- Figure 1: Global Satellite IoT Communication Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2025 & 2033

- Figure 3: North America Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2025 & 2033

- Figure 4: North America Satellite IoT Communication Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Satellite IoT Communication Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2025 & 2033

- Figure 7: Europe Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2025 & 2033

- Figure 8: Europe Satellite IoT Communication Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Satellite IoT Communication Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2025 & 2033

- Figure 11: Asia Pacific Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2025 & 2033

- Figure 12: Asia Pacific Satellite IoT Communication Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Satellite IoT Communication Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2025 & 2033

- Figure 15: Rest of the World Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2025 & 2033

- Figure 16: Rest of the World Satellite IoT Communication Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Satellite IoT Communication Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2020 & 2033

- Table 2: Global Satellite IoT Communication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2020 & 2033

- Table 4: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2020 & 2033

- Table 6: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2020 & 2033

- Table 8: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2020 & 2033

- Table 10: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite IoT Communication Market?

The projected CAGR is approximately 19.76%.

2. Which companies are prominent players in the Satellite IoT Communication Market?

Key companies in the market include Iridium Communications Inc, Orbcomm, Inmarsat Global Limited, Viasat Inc, Cobham Limited, Fleet Space Technologies Private Limited, L3Harris Technologies*List Not Exhaustive, Globalstar Inc, Boeing.

3. What are the main segments of the Satellite IoT Communication Market?

The market segments include Type of Orbit.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Development and Growth of 5G Wireless Connectivity; Considerable Investments in the LEO Satellite Constellations.

6. What are the notable trends driving market growth?

Low Earth Orbit (LEO) drives the Growth of the Satellite IoT Communication.

7. Are there any restraints impacting market growth?

Safety Concerns Associated with the Use of Surgical Robots; High Initial and Maintenance Costs of the Equipment.

8. Can you provide examples of recent developments in the market?

October 2023 - An SAR1 billion (USD 266.6 million) contract has been signed with the Hong Kong space company, which will set up satellite manufacturing facilities in Saudi Arabia. ASPACE will continue to increase its investment in line with the project phases, including R&D, component production, subsystems, and final assembly of satellites, as the Kingdom cements its position as a global manufacturing hub for foreign companies. By investing in advanced satellites, which represent 70% of the global satellite market, this deal will ensure that ASPACE is leveraging the strategically located region to improve its space capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite IoT Communication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite IoT Communication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite IoT Communication Market?

To stay informed about further developments, trends, and reports in the Satellite IoT Communication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence