Key Insights

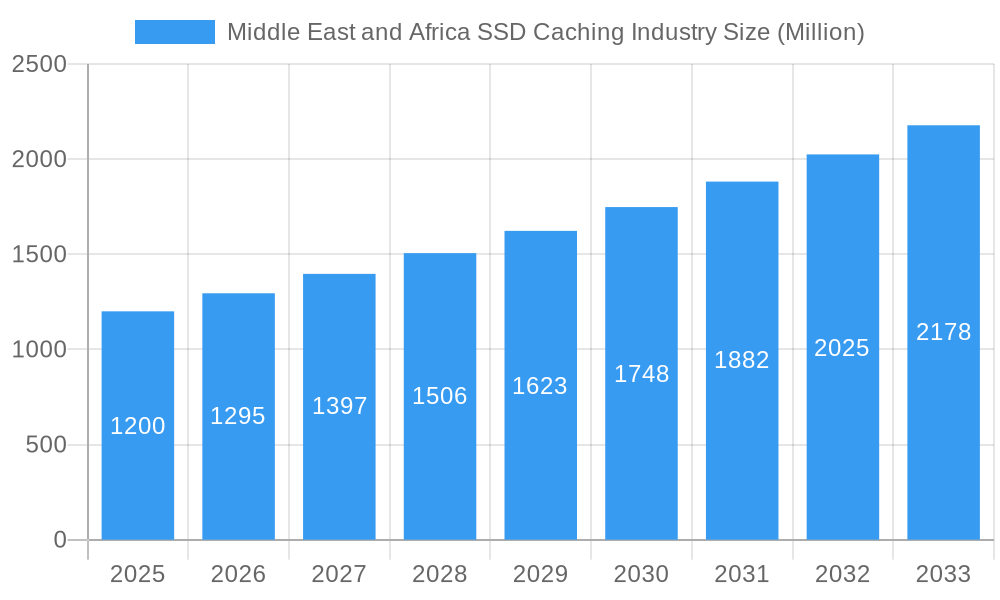

The Middle East and Africa (MEA) SSD Caching market is projected for substantial growth, expected to reach $52.94 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 14.94% from the base year 2025 through to 2033. This expansion is driven by the increasing demand for accelerated data access and superior application performance in both enterprise and consumer segments. Businesses are increasingly integrating SSD caching to boost critical application speed, database responsiveness, and virtualized environment efficiency, thereby elevating productivity and minimizing latency. Simultaneously, the growing adoption of personal computers and gaming consoles, alongside the need for rapid data retrieval in consumer electronics, is fueling growth in personal storage applications. The region's ongoing digital transformation, coupled with expanding investments in cloud infrastructure and data centers, further solidifies this market's strong potential.

Middle East and Africa SSD Caching Industry Market Size (In Billion)

Key growth catalysts include the inherent performance superiority of Solid State Drives (SSDs) over traditional Hard Disk Drives (HDDs), offering significantly faster read/write speeds and reduced latency. The decreasing cost of SSD technology also enhances accessibility across diverse applications. Moreover, the proliferation of big data analytics, artificial intelligence, and the Internet of Things (IoT) mandates high-performance storage solutions, positioning SSD caching as a compelling choice. Potential market restraints include the initial investment for enterprise-grade SSD caching solutions and limited awareness in certain emerging MEA markets. However, the demonstrable advantages in operational efficiency and user experience are anticipated to overcome these obstacles, ensuring sustained market expansion. Leading companies such as Seagate Technology, Western Digital, Samsung Electronics, and Intel Corporation are at the forefront of innovation and market development in this evolving sector.

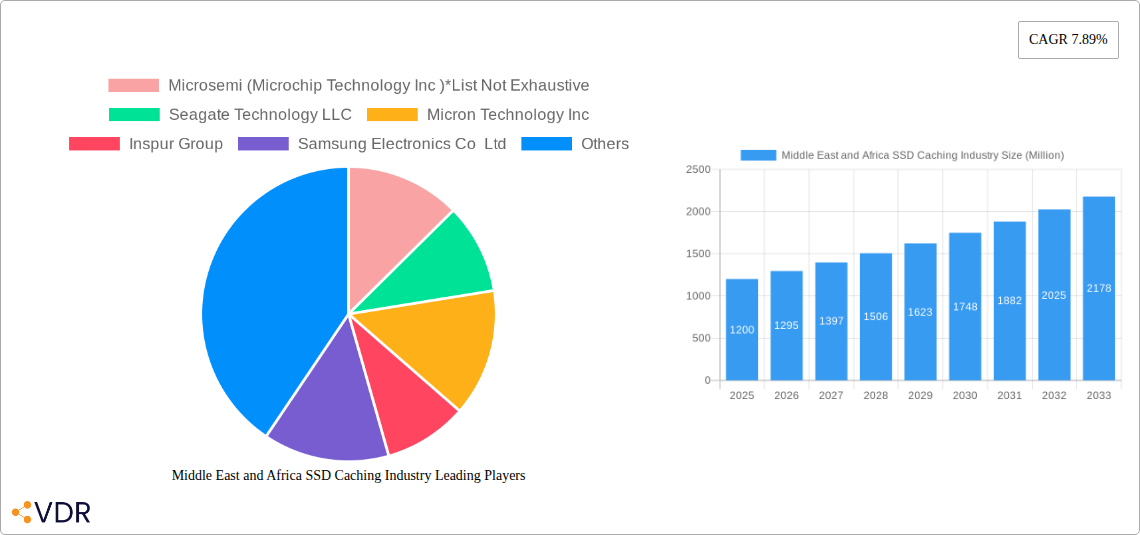

Middle East and Africa SSD Caching Industry Company Market Share

Middle East and Africa SSD Caching Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Middle East and Africa (MEA) SSD Caching industry, providing critical insights into market dynamics, growth trajectories, dominant segments, product landscapes, and key players. The study meticulously examines the market from 2019 to 2033, with a base and estimated year of 2025, and a forecast period spanning 2025-2033, building upon historical data from 2019-2024. With a focus on high-traffic keywords and structured analysis, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the burgeoning MEA SSD caching market.

Middle East and Africa SSD Caching Industry Market Dynamics & Structure

The MEA SSD Caching industry is characterized by a dynamic interplay of technological innovation, evolving end-user demands, and a growing competitive landscape. Market concentration is influenced by a few dominant players, but the increasing adoption of advanced storage solutions fuels a competitive environment. Technological innovation drivers are primarily centered around the relentless pursuit of higher performance, lower latency, and increased data efficiency, pushing the boundaries of NVMe SSD caching capabilities. Regulatory frameworks, while still developing in some parts of the region, are increasingly aligning with global standards to foster innovation and market growth. Competitive product substitutes, such as advanced HDDs and other storage tiers, exist, but the superior performance of SSD caching continues to drive its adoption. End-user demographics are shifting, with both enterprise and personal storage segments recognizing the substantial benefits of SSD caching for data-intensive applications. Merger and acquisition (M&A) trends, though nascent, are expected to shape market structure as larger players seek to consolidate their positions and acquire innovative technologies.

- Market Concentration: Moderate to high, with a few key global players holding significant market share, but increasing competition from regional and emerging vendors.

- Technological Innovation Drivers: Demand for faster data access, improved application performance, reduced operational costs, and enhanced end-user experience.

- Regulatory Frameworks: Increasingly favorable, with governments promoting digital transformation and data infrastructure development.

- Competitive Product Substitutes: High-performance HDDs, tiered storage solutions, and alternative caching technologies.

- End-User Demographics: Growing adoption across SMBs and enterprises for both data centers and personal computing.

- M&A Trends: Emerging opportunities for consolidation and acquisition of specialized SSD caching technologies.

Middle East and Africa SSD Caching Industry Growth Trends & Insights

The MEA SSD Caching industry is poised for significant expansion, driven by a confluence of factors that are reshaping the regional data storage landscape. The market size evolution is projected to witness a robust Compound Annual Growth Rate (CAGR) over the forecast period, fueled by increasing investments in digital infrastructure, cloud computing adoption, and the burgeoning demand for high-performance computing solutions. Adoption rates for SSD caching solutions are steadily climbing across various sectors, as businesses and individuals recognize the tangible benefits of accelerated data access and improved application responsiveness. Technological disruptions, particularly the advancement of NVMe technology and its integration into SSD caching architectures, are playing a pivotal role in this growth. Consumer behavior shifts are also contributing, with a growing preference for seamless and rapid data experiences, leading to increased demand for SSD caching in personal storage devices and gaming consoles. The penetration of SSD caching technology is expected to deepen significantly as costs become more accessible and awareness of its advantages spreads.

The increasing digitalization across the Middle East and Africa is a primary catalyst for the growth of the SSD Caching industry. Governments are actively promoting e-governance initiatives, smart city projects, and the development of robust digital ecosystems, all of which necessitate high-performance data storage. The rise of cloud computing services is another major driver, as cloud providers are increasingly incorporating SSD caching to offer faster and more reliable storage options to their customers. This trend is further amplified by the burgeoning startup ecosystem in the region, which often relies on scalable and performant cloud infrastructure.

In the enterprise segment, the adoption of SSD caching is directly linked to the need for improved operational efficiency and competitive advantage. Businesses are leveraging SSD caching to accelerate critical applications such as databases, financial trading platforms, big data analytics, and AI/ML workloads. The reduction in latency and increase in read/write speeds offered by SSD caching translate into significant productivity gains and cost savings. For instance, in the financial sector, even milliseconds of latency reduction can have a substantial impact on trading outcomes.

The personal storage segment is also witnessing a surge in demand for SSD caching, particularly with the proliferation of high-definition content, online gaming, and the increasing complexity of operating systems and applications. Gamers, content creators, and power users are actively seeking solutions that offer faster game loading times, quicker video editing, and smoother multitasking experiences. This trend is driving the adoption of SSD caching in consumer-grade PCs, laptops, and external storage devices.

Furthermore, the increasing affordability and accessibility of SSD technology are making SSD caching a more viable option for a wider range of users. As NAND flash prices continue to decline and manufacturing processes become more efficient, the cost-per-gigabyte for SSDs is becoming increasingly competitive, further encouraging broader adoption. The development of innovative caching algorithms and software optimizations is also enhancing the effectiveness and efficiency of SSD caching solutions, making them more attractive to both enterprise and consumer markets.

Dominant Regions, Countries, or Segments in Middle East and Africa SSD Caching Industry

Within the Middle East and Africa SSD Caching industry, the Enterprise Storage segment stands out as the dominant force driving market growth. This dominance is underpinned by a confluence of factors including rapid economic development, substantial investments in digital transformation initiatives, and the critical need for high-performance data handling across various industries. Countries like the United Arab Emirates (UAE), Saudi Arabia, and South Africa are at the forefront of this growth, due to their advanced technological infrastructure, supportive government policies, and a robust presence of multinational corporations.

The UAE, with its ambition to become a global hub for innovation and technology, has been a significant contributor to the growth of enterprise SSD caching. Government initiatives focused on building smart cities, fostering a digital economy, and attracting foreign investment have led to a surge in demand for sophisticated data storage solutions. The financial sector, e-commerce platforms, and the burgeoning AI and big data analytics industries in the UAE are all heavily reliant on the performance enhancements provided by SSD caching.

Saudi Arabia is another key player, propelled by its Vision 2030 plan which emphasizes economic diversification and technological advancement. Massive infrastructure projects, the establishment of new industrial zones, and the push towards digital governance are creating an immense demand for enterprise-grade storage, where SSD caching plays a crucial role in optimizing database performance, cloud services, and critical business applications.

South Africa, as one of the most developed economies in Africa, also exhibits strong growth in the enterprise SSD caching market. The country's established financial services sector, telecommunications industry, and growing e-commerce landscape necessitate high-speed data processing and storage. The increasing adoption of cloud computing services by South African enterprises further fuels the demand for SSD caching solutions.

The dominance of the Enterprise Storage segment is further reinforced by:

- High Transactional Workloads: Industries such as finance, retail, and telecommunications handle vast volumes of real-time transactions that require ultra-low latency, which SSD caching effectively provides.

- Big Data Analytics and AI/ML: The burgeoning adoption of big data analytics and artificial intelligence/machine learning across the region necessitates rapid data ingest and processing capabilities, making SSD caching indispensable.

- Cloud Infrastructure Expansion: The continuous expansion of cloud data centers by local and international providers in the MEA region directly translates to a higher demand for high-performance storage components like SSD caches.

- Data Sovereignty and Security: Increasing awareness and regulations surrounding data sovereignty are leading enterprises to invest in localized, high-performance storage solutions, including SSD caching, to ensure data control and compliance.

While the Personal Storage segment is also growing, particularly with the increasing affordability of consumer SSDs, its market share and growth rate in terms of dedicated SSD caching solutions are still relatively lower compared to the critical needs and substantial investments seen in the enterprise sector.

Middle East and Africa SSD Caching Industry Product Landscape

The MEA SSD Caching industry's product landscape is defined by continuous innovation focused on enhancing performance, capacity, and integration. Products range from high-performance NVMe SSDs specifically designed for caching roles to integrated hardware/software solutions. Unique selling propositions include significantly reduced latency for read-intensive workloads, improved application response times, and the ability to boost the performance of existing storage infrastructure without a complete overhaul. Technological advancements are centered on faster interconnects, more sophisticated wear-leveling algorithms, and denser flash memory, leading to more cost-effective and powerful SSD caching solutions.

Key Drivers, Barriers & Challenges in Middle East and Africa SSD Caching Industry

The primary forces propelling the Middle East and Africa SSD Caching industry include the escalating demand for high-speed data processing across enterprises, the rapid growth of cloud computing services, and the increasing adoption of big data analytics and AI/ML. Government initiatives promoting digital transformation and smart city development further act as significant growth accelerators. The falling prices of SSDs are also making them more accessible for a wider range of applications.

- Technological Drivers: Advancements in NVMe technology, increased NAND flash density, and intelligent caching algorithms.

- Economic Drivers: Growing IT budgets in enterprises, cloud service expansion, and the need for operational efficiency.

- Policy-Driven Factors: Government support for digital infrastructure, cybersecurity initiatives, and data localization.

Key challenges and restraints impacting the MEA SSD Caching industry include the initial high cost of enterprise-grade SSDs compared to traditional HDDs, a lack of widespread awareness regarding the specific benefits of SSD caching in certain market segments, and the need for skilled IT professionals to effectively manage and deploy these advanced solutions. Supply chain disruptions and geopolitical uncertainties can also pose risks to component availability and pricing.

- Cost Barriers: High upfront investment for premium SSD caching solutions.

- Awareness Gaps: Limited understanding of the ROI and benefits of SSD caching in some smaller businesses.

- Talent Shortage: Demand for specialized IT expertise in managing advanced storage technologies.

- Supply Chain Vulnerabilities: Potential disruptions in the global supply of NAND flash and other critical components.

Emerging Opportunities in Middle East and Africa SSD Caching Industry

Emerging opportunities in the MEA SSD Caching industry lie in the untapped potential of the SMB sector, where cost-effective and simplified caching solutions can offer significant performance boosts. The expansion of edge computing across the region presents a unique application for low-latency SSD caching. Furthermore, the growing demand for specialized solutions in sectors like healthcare (for rapid access to patient records) and the entertainment industry (for faster content delivery) offers fertile ground for innovation and market penetration.

Growth Accelerators in the Middle East and Africa SSD Caching Industry Industry

Catalysts driving long-term growth in the MEA SSD Caching industry are robust. Technological breakthroughs in SSD controllers and NAND flash manufacturing are leading to greater performance and reduced costs. Strategic partnerships between storage vendors and cloud service providers are expanding market reach and integration. Furthermore, ongoing market expansion strategies by key players, focusing on education and localized support, are crucial for sustained growth and deeper market penetration across diverse MEA economies.

Key Players Shaping the Middle East and Africa SSD Caching Industry Market

- Microsemi (Microchip Technology Inc)

- Seagate Technology LLC

- Micron Technology Inc

- Inspur Group

- Samsung Electronics Co Ltd

- Transcend Information Inc

- Kioxia (Toshiba Memory Corporation)

- ADATA Technology Co Ltd

- Western Digital Corporation

- SK Hynix Inc

- NetApp Inc

- Intel Corporation

- QNAP Systems Inc

Notable Milestones in Middle East and Africa SSD Caching Industry Sector

- October 2022: Lenovo launched ThinkSystem DM5000H, a unified, hybrid storage system developed for midsize companies to deliver performance, simplicity, capacity, security, and high availability. ThinkSystem DM5000H, powered by ONTAP software, provides enterprise-class storage management capabilities with a wide range of host connectivity choices, customizable drive configurations, increased data management tools, and acceleration of read-centric workloads with onboard NVMe SSD caching.

- September 2022: Amazon Relational Database Service for Oracle supports the instance store for temporary tablespaces and the Database Smart Flash Cache (flash cache) for M5d and R5d instances. M5d and R5d instances are ideal for applications that require high-speed, low-latency local storage, such as those that require temporary data storage for scratch space, temporary files, and caches.

In-Depth Middle East and Africa SSD Caching Industry Market Outlook

The future market potential for SSD caching in the Middle East and Africa is exceptionally promising, driven by sustained demand for high-performance computing and the ongoing digital transformation across all sectors. Strategic opportunities lie in tailoring solutions to meet the specific needs of emerging markets within Africa, alongside continued innovation in enterprise data centers and cloud infrastructure. The increasing focus on data analytics, AI, and IoT across the region will further solidify the role of SSD caching as a foundational technology for achieving speed, efficiency, and competitive advantage in the coming years.

Middle East and Africa SSD Caching Industry Segmentation

-

1. Application

- 1.1. Enterprise Storage

- 1.2. Personal Storage

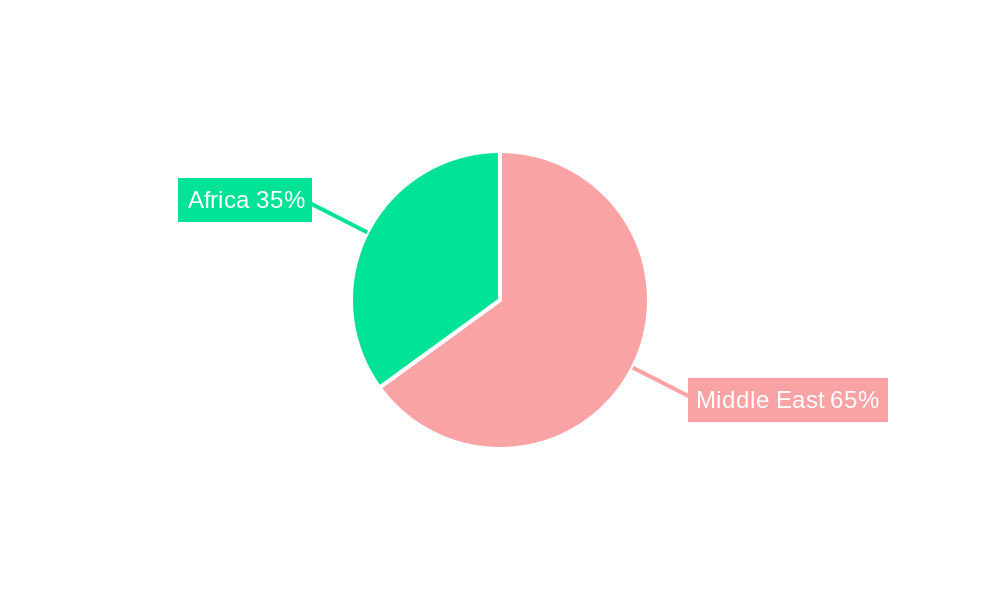

Middle East and Africa SSD Caching Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa SSD Caching Industry Regional Market Share

Geographic Coverage of Middle East and Africa SSD Caching Industry

Middle East and Africa SSD Caching Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements Offered by SSDs Over Conventional HDDs; Demand for the Cloud Storage Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Slow Pace in Development of Applications Despite Heavy investments in R&D; Commplexities in Hardware Designing

- 3.4. Market Trends

- 3.4.1. Enterprise Storage Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise Storage

- 5.1.2. Personal Storage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Microsemi (Microchip Technology Inc )*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seagate Technology LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Micron Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Inspur Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Transcend Information Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kioxia (Toshiba Memory Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ADATA Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Western Digital Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SK Hynix Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 NetApp Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Intel Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 QNAP Systems Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Microsemi (Microchip Technology Inc )*List Not Exhaustive

List of Figures

- Figure 1: Middle East and Africa SSD Caching Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa SSD Caching Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa SSD Caching Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Middle East and Africa SSD Caching Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Middle East and Africa SSD Caching Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Middle East and Africa SSD Caching Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle East and Africa SSD Caching Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa SSD Caching Industry?

The projected CAGR is approximately 14.94%.

2. Which companies are prominent players in the Middle East and Africa SSD Caching Industry?

Key companies in the market include Microsemi (Microchip Technology Inc )*List Not Exhaustive, Seagate Technology LLC, Micron Technology Inc, Inspur Group, Samsung Electronics Co Ltd, Transcend Information Inc, Kioxia (Toshiba Memory Corporation), ADATA Technology Co Ltd, Western Digital Corporation, SK Hynix Inc, NetApp Inc, Intel Corporation, QNAP Systems Inc.

3. What are the main segments of the Middle East and Africa SSD Caching Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.94 billion as of 2022.

5. What are some drivers contributing to market growth?

Improvements Offered by SSDs Over Conventional HDDs; Demand for the Cloud Storage Driving the Market Growth.

6. What are the notable trends driving market growth?

Enterprise Storage Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Slow Pace in Development of Applications Despite Heavy investments in R&D; Commplexities in Hardware Designing.

8. Can you provide examples of recent developments in the market?

October 2022: Lenovo launched ThinkSystem DM5000H a unified, hybrid storage system developed for midsize companies to deliver performance, simplicity, capacity, security, and high availability. ThinkSystem DM5000H, powered by ONTAP software, provides enterprise-class storage management capabilities with a wide range of host connectivity choices, customizable drive configurations, increased data management tools, and acceleration of read-centric workloads with onboard NVMe SSD caching.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa SSD Caching Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa SSD Caching Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa SSD Caching Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa SSD Caching Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence