Key Insights

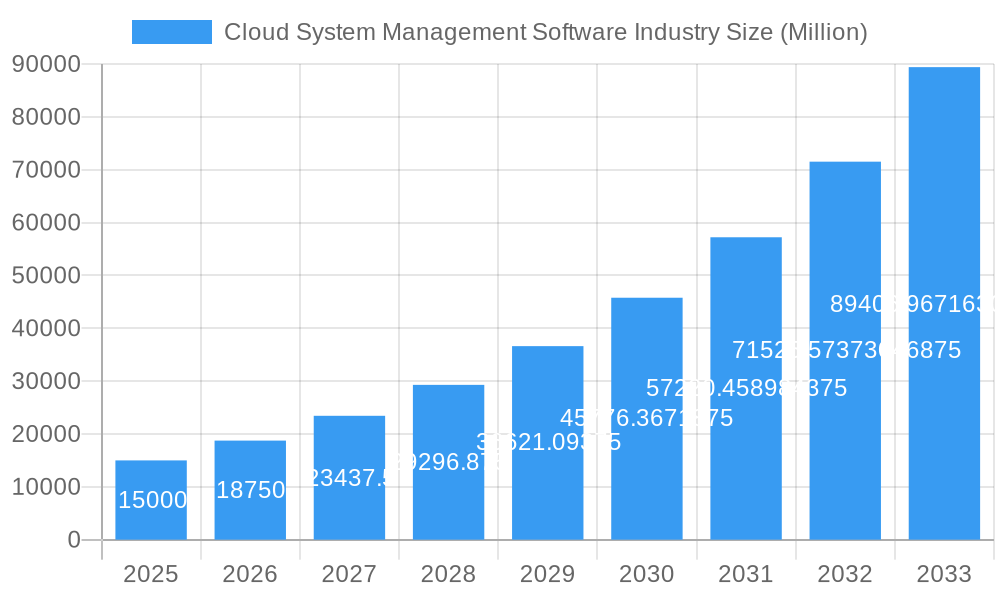

The Cloud System Management Software market is poised for explosive growth, projected to reach a significant valuation with a Compound Annual Growth Rate (CAGR) exceeding 25.10% over the forecast period of 2025-2033. This rapid expansion is fueled by a confluence of critical drivers, including the escalating complexity of multi-cloud environments, the paramount need for enhanced operational efficiency, and the imperative for robust security and compliance measures. Businesses across all sectors are increasingly migrating their IT infrastructure to the cloud, creating an unprecedented demand for sophisticated tools to monitor, manage, and automate these dynamic ecosystems. Key trends shaping the market include the rise of AIOps for proactive issue resolution, the increasing adoption of serverless computing requiring specialized management solutions, and the growing integration of security and compliance functionalities directly into management platforms. The market is segmented across various components such as Cloud IT Operations Management, Cloud IT Automation and Configuration Management, and Cloud IT Service Management, catering to diverse operational needs. Deployment models such as Public, Private, and Hybrid clouds are all contributing to this demand, with organizations strategically choosing the model that best suits their specific requirements and risk appetites.

Cloud System Management Software Industry Market Size (In Billion)

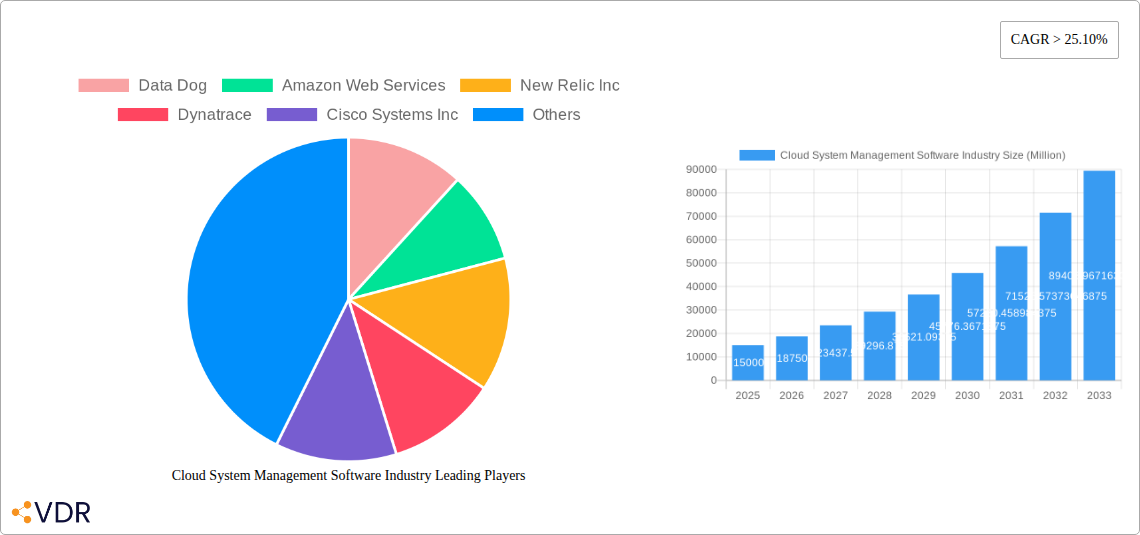

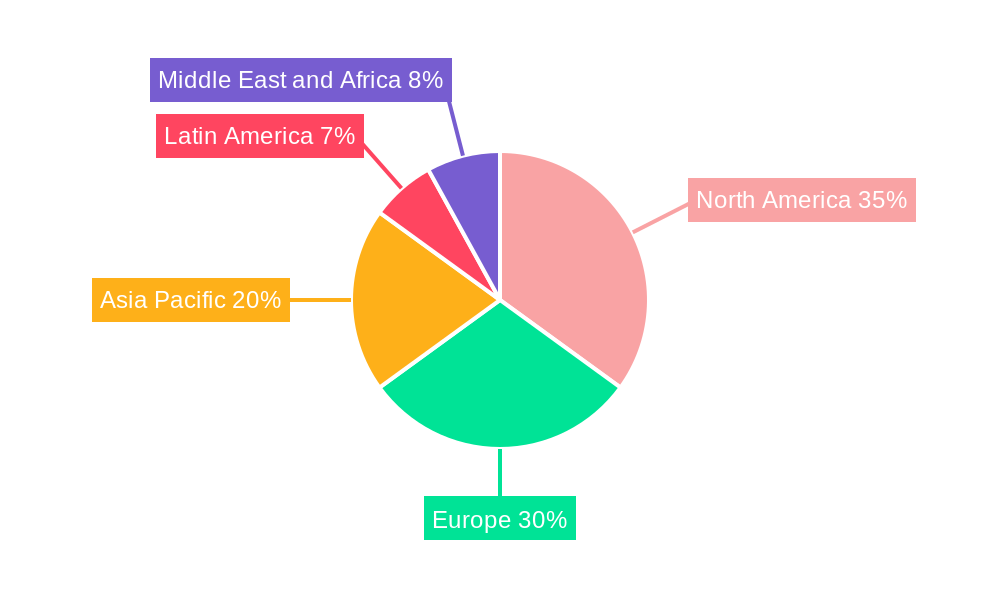

The expansive nature of the Cloud System Management Software market is further underscored by its broad adoption across organization sizes, from large enterprises to small and medium-sized businesses, all striving to optimize their cloud investments. Furthermore, its impact spans a wide array of end-user industries, with Healthcare, Banking and Financial Services, Retail and Consumer Services, Manufacturing, Transport and Logistics, Media and Entertainment, and IT and Telecommunication being prominent adopters. This widespread application highlights the universal necessity of effective cloud management. Major players like Data Dog, Amazon Web Services, New Relic Inc., Dynatrace, Cisco Systems Inc., Broadcom Inc., Solarwind, Microsoft Corp, Oracle, and Splunk Inc. are actively innovating and competing within this dynamic landscape. Geographically, North America and Europe currently lead in market share due to early cloud adoption and technological advancements. However, the Asia Pacific region is expected to witness the fastest growth, driven by increasing digital transformation initiatives and a burgeoning IT infrastructure. Restraints such as the high cost of implementation and the need for skilled IT professionals to manage these complex systems, while present, are being gradually overcome by the overwhelming benefits of efficient cloud management.

Cloud System Management Software Industry Company Market Share

Comprehensive Report: Cloud System Management Software Industry Analysis - Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Cloud System Management Software market, covering its intricate dynamics, robust growth trajectory, and future potential. With a comprehensive study period from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages proprietary data XXX to deliver unparalleled insights. It explores key segments like Cloud IT Operations Management, Cloud IT Automation and Configuration Management, and Cloud IT Service Management, across deployment models including Public Cloud, Private Cloud, and Hybrid Cloud. The analysis also segments the market by Organisation Size (Large Enterprises, Small-Medium Enterprises) and diverse End-user Industries such as Healthcare, Banking and Financial Services, Retail and Consumer Services, Manufacturing, Transport and Logistics, Media and Entertainment, IT and Telecommunication, and Other End-user Industries. This report is an essential resource for industry stakeholders seeking to understand market trends, competitive landscapes, and strategic growth opportunities within the rapidly evolving cloud management ecosystem.

Cloud System Management Software Industry Market Dynamics & Structure

The Cloud System Management Software market is characterized by a moderately concentrated competitive landscape, with a few dominant players like Amazon Web Services, Microsoft Corp, and Oracle holding significant market share. However, the industry is also fostering innovation from specialized vendors such as Datadog, New Relic Inc, Dynatrace, and Splunk Inc, particularly in areas like observability and AIOps. Technological innovation is the primary driver, with advancements in AI, machine learning, and containerization continuously shaping product offerings and demanding sophisticated management solutions. Regulatory frameworks, while not overtly restrictive, focus on data privacy and security, pushing for robust compliance features within management platforms. Competitive product substitutes exist in the form of in-house developed tools and more basic native cloud provider offerings, but comprehensive, integrated solutions are gaining traction. End-user demographics are shifting, with a growing demand from small and medium-sized enterprises seeking cost-effective and scalable cloud management. Mergers and acquisitions (M&A) activity is a notable trend, as larger players acquire innovative startups to expand their capabilities and market reach. For instance, the acquisition of Broadcom’s infrastructure software business by Symphony Technology Group signals consolidation and strategic realignment.

- Market Concentration: Moderately concentrated with a mix of large cloud providers and specialized software vendors.

- Technological Innovation Drivers: AI/ML for automation, observability, AIOps, container orchestration, serverless computing.

- Regulatory Frameworks: Data privacy (GDPR, CCPA), security compliance, and industry-specific regulations.

- Competitive Product Substitutes: Native cloud tools, open-source solutions, internal IT solutions.

- End-user Demographics: Increasing adoption by SMEs, driven by digital transformation initiatives.

- M&A Trends: Strategic acquisitions to enhance product portfolios and gain market share.

Cloud System Management Software Industry Growth Trends & Insights

The global Cloud System Management Software market is poised for substantial expansion, driven by the accelerating adoption of cloud technologies across all industries. The market size is projected to grow significantly from approximately $12,500 million in 2025 to over $25,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.0% during the forecast period. This robust growth is fueled by the increasing complexity of cloud environments, the proliferation of multi-cloud and hybrid cloud strategies, and the growing need for streamlined IT operations, enhanced security, and cost optimization. Adoption rates are soaring as organizations of all sizes recognize the indispensable role of effective cloud management in achieving business agility and operational efficiency. Technological disruptions, such as the widespread adoption of Kubernetes for container orchestration and the emergence of serverless computing, are creating new demands for specialized management tools.

Consumer behavior shifts are also playing a crucial role. IT leaders are increasingly prioritizing solutions that offer comprehensive visibility, automated remediation, and proactive issue detection. The demand for integrated platforms that can manage infrastructure, applications, and security from a single pane of glass is at an all-time high. Furthermore, the rise of DevOps and Site Reliability Engineering (SRE) practices necessitates tools that facilitate collaboration, accelerate deployment cycles, and ensure system reliability. The increasing volume and velocity of data generated by cloud applications are driving the adoption of advanced analytics and observability solutions, which are core components of cloud system management software.

- Market Size Evolution: Projected to grow from an estimated $12,500 million in 2025 to over $25,000 million by 2033.

- Adoption Rates: Rapidly increasing across all organization sizes and end-user industries due to digital transformation.

- Technological Disruptions: Kubernetes, serverless computing, microservices architecture are driving demand for specialized management tools.

- Consumer Behavior Shifts: Prioritization of integrated platforms, automation, proactive issue detection, and enhanced visibility.

- Key Metric: Estimated CAGR of approximately 9.0% during the forecast period (2025-2033).

Dominant Regions, Countries, or Segments in Cloud System Management Software Industry

The IT and Telecommunication sector stands out as a dominant end-user industry within the Cloud System Management Software market, driven by its inherent reliance on scalable, secure, and efficient cloud infrastructure. This sector's rapid adoption of cloud-native architectures, extensive use of virtualized environments, and the continuous demand for high availability and performance make robust cloud management solutions imperative. Consequently, this segment represents a significant portion of the market's revenue and growth potential. North America, particularly the United States, continues to be a leading region due to its early and widespread adoption of cloud technologies, a mature IT ecosystem, and a high concentration of technology companies and financial institutions.

Within the Component segment, Cloud IT Operations Management is a primary growth driver. This segment encompasses monitoring, performance management, and AIOps, which are crucial for maintaining the health and efficiency of complex cloud environments. The increasing adoption of multi-cloud and hybrid cloud strategies across Large Enterprises further bolsters this segment, as these organizations require sophisticated tools to manage disparate cloud resources.

The Public Cloud deployment model is witnessing the most significant growth, owing to its scalability, cost-effectiveness, and accessibility. However, Hybrid Cloud solutions are also gaining substantial traction as organizations seek to leverage the benefits of both public and private clouds, balancing agility with control over sensitive data. The ongoing digital transformation across industries like Healthcare and Banking and Financial Services, which are increasingly migrating critical workloads to the cloud, further fuels the demand for comprehensive cloud system management.

- Dominant End-user Industry: IT and Telecommunication, driven by cloud-native adoption and infrastructure demands.

- Leading Region: North America, spearheaded by the United States, due to early cloud adoption and a strong tech ecosystem.

- Dominant Component Segment: Cloud IT Operations Management, crucial for maintaining complex cloud environments.

- Key Deployment Model: Public Cloud leading in growth, with Hybrid Cloud gaining significant traction.

- Organization Size Impact: Large Enterprises are significant adopters, driving demand for advanced management capabilities.

- Growth Drivers in Key End-user Industries: Digital transformation in Healthcare and Banking and Financial Services.

Cloud System Management Software Industry Product Landscape

The Cloud System Management Software product landscape is characterized by a wave of innovation focused on intelligent automation, enhanced observability, and unified security. Leading vendors are introducing advanced solutions that leverage Artificial Intelligence for IT Operations (AIOps) to predict and prevent issues, automate complex tasks, and optimize resource utilization. Products are increasingly offering end-to-end visibility across multi-cloud and hybrid environments, enabling seamless management of applications, infrastructure, and data. Unique selling propositions often lie in the software's ability to integrate disparate data sources, provide actionable insights, and facilitate rapid troubleshooting. Technological advancements include real-time performance monitoring, predictive analytics for capacity planning, automated security compliance checks, and self-healing capabilities for cloud services.

Key Drivers, Barriers & Challenges in Cloud System Management Software Industry

The Cloud System Management Software market is propelled by several key drivers, including the escalating adoption of cloud computing across enterprises of all sizes, the increasing complexity of cloud infrastructure, and the growing need for enhanced security and compliance. The shift towards digital transformation initiatives mandates efficient management of cloud resources, while advancements in AI and machine learning are enabling more intelligent automation and predictive capabilities. Furthermore, the demand for cost optimization and improved operational efficiency in cloud environments significantly boosts market growth.

However, the market faces certain barriers and challenges. The significant upfront investment and ongoing operational costs associated with sophisticated cloud management solutions can be a restraint, particularly for smaller organizations. Skills gaps in cloud management expertise and a lack of standardization across different cloud platforms present hurdles for seamless integration and deployment. Fierce competition from established cloud providers offering native management tools and the potential for vendor lock-in also pose challenges. Supply chain disruptions are less of a direct issue for software, but can indirectly impact hardware dependencies. Regulatory hurdles related to data sovereignty and compliance in certain industries can also create complexities.

Emerging Opportunities in Cloud System Management Software Industry

Emerging opportunities in the Cloud System Management Software industry are abundant, driven by the continuous evolution of cloud technologies and enterprise needs. The burgeoning demand for FinOps solutions, focused on optimizing cloud spending and improving financial accountability, presents a significant growth area. As organizations embrace edge computing and IoT, there is a growing need for management platforms that can extend their reach to these distributed environments. The increasing focus on sustainability and green IT practices is also creating opportunities for software that can monitor and optimize cloud resource consumption for environmental benefit. Furthermore, the integration of cybersecurity and compliance management directly within system management tools is a key trend, offering a more holistic approach to cloud governance. The expansion of AI and machine learning capabilities to drive more proactive and autonomous management systems, including self-healing infrastructure, represents a frontier of innovation.

Growth Accelerators in the Cloud System Management Software Industry Industry

Several factors are acting as growth accelerators for the Cloud System Management Software industry. The ongoing digital transformation across virtually all sectors is fundamentally reliant on robust and scalable cloud infrastructure, thus driving sustained demand for management solutions. Strategic partnerships between cloud providers and specialized management software vendors are expanding market reach and enhancing product offerings, creating integrated ecosystems that benefit end-users. The increasing adoption of hybrid and multi-cloud strategies necessitates sophisticated management tools that can bridge disparate environments, acting as a significant catalyst for growth. Furthermore, the evolution of DevOps and SRE practices, which emphasize automation and continuous improvement, directly fuels the adoption of advanced cloud management platforms that support these methodologies. The increasing focus on observability and AIOps is also a major accelerator, as organizations seek deeper insights and automated remediation capabilities.

Key Players Shaping the Cloud System Management Software Industry Market

- Data Dog

- Amazon Web Services

- New Relic Inc

- Dynatrace

- Cisco Systems Inc

- Broadcom Inc

- Solarwind

- Microsoft Corp

- Oracle

- Splunk Inc

- Sematext

Notable Milestones in Cloud System Management Software Industry Sector

- Oct 2022: Datadog launched a new product for creating, managing, and running end-to-end tests for web applications without scripting, integrating with CI processes.

- Oct 2022: Dynatrace introduced the Grail initiative, a massively parallel processing (MPP) analytics engine for a causal data warehouse, revolutionizing data analytics and management in observability and security.

- Jan 2023: New Relic enhanced its error-tracking features to identify, classify, and address issues across the entire software stack, providing a central location for engineers to prioritize and resolve problems.

In-Depth Cloud System Management Software Industry Market Outlook

The Cloud System Management Software market is on an upward trajectory, driven by the perpetual expansion of cloud adoption and the increasing complexity of digital infrastructures. Future growth will be significantly influenced by advancements in AI and machine learning, leading to more autonomous and predictive management systems. The ongoing integration of security and compliance functionalities directly into management platforms will be a key differentiator. Opportunities lie in addressing the specific needs of emerging technologies like edge computing and IoT, as well as catering to the growing demand for FinOps solutions and sustainable cloud practices. Strategic collaborations and the continuous innovation in observability and AIOps will further solidify the market's growth, ensuring that organizations can effectively navigate and optimize their cloud environments for maximum efficiency and resilience.

Cloud System Management Software Industry Segmentation

-

1. Component

- 1.1. Cloud IT Operations Management

- 1.2. Cloud IT Automation and Configuration Management

- 1.3. Cloud IT Service Management

-

2. Deployment Model

- 2.1. Public

- 2.2. Private

- 2.3. Hybrid

-

3. Organisation Size

- 3.1. Large Enterprises

- 3.2. Small-Medium Enterprises

-

4. End-user Industry

- 4.1. Healthcare

- 4.2. Banking and Financial Services

- 4.3. Retail and Consumer Services

- 4.4. Manufacturing

- 4.5. Transport and Logistics

- 4.6. Media and Entertainment

- 4.7. IT and Telecommunication

- 4.8. Other End-user Industries

Cloud System Management Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 4. Rest of Asia Pacific

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Rest of Latin America

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

- 6.4. Rest of Middle East and Africa

Cloud System Management Software Industry Regional Market Share

Geographic Coverage of Cloud System Management Software Industry

Cloud System Management Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 25.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emerging Technologies Investing into Advanced Data Centers; IT Companies Turning to BYOD and CYOD Systems Create Demand for Cloud Management Services; Adoption of Multi-cloud Platform

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concers; Increased Cyber Attacks

- 3.4. Market Trends

- 3.4.1. BFSI Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud System Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Cloud IT Operations Management

- 5.1.2. Cloud IT Automation and Configuration Management

- 5.1.3. Cloud IT Service Management

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. Public

- 5.2.2. Private

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Organisation Size

- 5.3.1. Large Enterprises

- 5.3.2. Small-Medium Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Healthcare

- 5.4.2. Banking and Financial Services

- 5.4.3. Retail and Consumer Services

- 5.4.4. Manufacturing

- 5.4.5. Transport and Logistics

- 5.4.6. Media and Entertainment

- 5.4.7. IT and Telecommunication

- 5.4.8. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of Asia Pacific

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Cloud System Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Cloud IT Operations Management

- 6.1.2. Cloud IT Automation and Configuration Management

- 6.1.3. Cloud IT Service Management

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. Public

- 6.2.2. Private

- 6.2.3. Hybrid

- 6.3. Market Analysis, Insights and Forecast - by Organisation Size

- 6.3.1. Large Enterprises

- 6.3.2. Small-Medium Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Healthcare

- 6.4.2. Banking and Financial Services

- 6.4.3. Retail and Consumer Services

- 6.4.4. Manufacturing

- 6.4.5. Transport and Logistics

- 6.4.6. Media and Entertainment

- 6.4.7. IT and Telecommunication

- 6.4.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Cloud System Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Cloud IT Operations Management

- 7.1.2. Cloud IT Automation and Configuration Management

- 7.1.3. Cloud IT Service Management

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. Public

- 7.2.2. Private

- 7.2.3. Hybrid

- 7.3. Market Analysis, Insights and Forecast - by Organisation Size

- 7.3.1. Large Enterprises

- 7.3.2. Small-Medium Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Healthcare

- 7.4.2. Banking and Financial Services

- 7.4.3. Retail and Consumer Services

- 7.4.4. Manufacturing

- 7.4.5. Transport and Logistics

- 7.4.6. Media and Entertainment

- 7.4.7. IT and Telecommunication

- 7.4.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Cloud System Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Cloud IT Operations Management

- 8.1.2. Cloud IT Automation and Configuration Management

- 8.1.3. Cloud IT Service Management

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. Public

- 8.2.2. Private

- 8.2.3. Hybrid

- 8.3. Market Analysis, Insights and Forecast - by Organisation Size

- 8.3.1. Large Enterprises

- 8.3.2. Small-Medium Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Healthcare

- 8.4.2. Banking and Financial Services

- 8.4.3. Retail and Consumer Services

- 8.4.4. Manufacturing

- 8.4.5. Transport and Logistics

- 8.4.6. Media and Entertainment

- 8.4.7. IT and Telecommunication

- 8.4.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of Asia Pacific Cloud System Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Cloud IT Operations Management

- 9.1.2. Cloud IT Automation and Configuration Management

- 9.1.3. Cloud IT Service Management

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. Public

- 9.2.2. Private

- 9.2.3. Hybrid

- 9.3. Market Analysis, Insights and Forecast - by Organisation Size

- 9.3.1. Large Enterprises

- 9.3.2. Small-Medium Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Healthcare

- 9.4.2. Banking and Financial Services

- 9.4.3. Retail and Consumer Services

- 9.4.4. Manufacturing

- 9.4.5. Transport and Logistics

- 9.4.6. Media and Entertainment

- 9.4.7. IT and Telecommunication

- 9.4.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Cloud System Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Cloud IT Operations Management

- 10.1.2. Cloud IT Automation and Configuration Management

- 10.1.3. Cloud IT Service Management

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. Public

- 10.2.2. Private

- 10.2.3. Hybrid

- 10.3. Market Analysis, Insights and Forecast - by Organisation Size

- 10.3.1. Large Enterprises

- 10.3.2. Small-Medium Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Healthcare

- 10.4.2. Banking and Financial Services

- 10.4.3. Retail and Consumer Services

- 10.4.4. Manufacturing

- 10.4.5. Transport and Logistics

- 10.4.6. Media and Entertainment

- 10.4.7. IT and Telecommunication

- 10.4.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Cloud System Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Cloud IT Operations Management

- 11.1.2. Cloud IT Automation and Configuration Management

- 11.1.3. Cloud IT Service Management

- 11.2. Market Analysis, Insights and Forecast - by Deployment Model

- 11.2.1. Public

- 11.2.2. Private

- 11.2.3. Hybrid

- 11.3. Market Analysis, Insights and Forecast - by Organisation Size

- 11.3.1. Large Enterprises

- 11.3.2. Small-Medium Enterprises

- 11.4. Market Analysis, Insights and Forecast - by End-user Industry

- 11.4.1. Healthcare

- 11.4.2. Banking and Financial Services

- 11.4.3. Retail and Consumer Services

- 11.4.4. Manufacturing

- 11.4.5. Transport and Logistics

- 11.4.6. Media and Entertainment

- 11.4.7. IT and Telecommunication

- 11.4.8. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Data Dog

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Amazon Web Services

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 New Relic Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dynatrace

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cisco Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Broadcom Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Solarwind

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Microsoft Corp

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Oracle

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Splunk Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sematext

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Data Dog

List of Figures

- Figure 1: Global Cloud System Management Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cloud System Management Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Cloud System Management Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Cloud System Management Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 5: North America Cloud System Management Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 6: North America Cloud System Management Software Industry Revenue (Million), by Organisation Size 2025 & 2033

- Figure 7: North America Cloud System Management Software Industry Revenue Share (%), by Organisation Size 2025 & 2033

- Figure 8: North America Cloud System Management Software Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America Cloud System Management Software Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Cloud System Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Cloud System Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Cloud System Management Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Cloud System Management Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Cloud System Management Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 15: Europe Cloud System Management Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: Europe Cloud System Management Software Industry Revenue (Million), by Organisation Size 2025 & 2033

- Figure 17: Europe Cloud System Management Software Industry Revenue Share (%), by Organisation Size 2025 & 2033

- Figure 18: Europe Cloud System Management Software Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe Cloud System Management Software Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Cloud System Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Cloud System Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Cloud System Management Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 23: Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Cloud System Management Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 25: Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 26: Asia Pacific Cloud System Management Software Industry Revenue (Million), by Organisation Size 2025 & 2033

- Figure 27: Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Organisation Size 2025 & 2033

- Figure 28: Asia Pacific Cloud System Management Software Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Cloud System Management Software Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Cloud System Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of Asia Pacific Cloud System Management Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 33: Rest of Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 34: Rest of Asia Pacific Cloud System Management Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 35: Rest of Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 36: Rest of Asia Pacific Cloud System Management Software Industry Revenue (Million), by Organisation Size 2025 & 2033

- Figure 37: Rest of Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Organisation Size 2025 & 2033

- Figure 38: Rest of Asia Pacific Cloud System Management Software Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Rest of Asia Pacific Cloud System Management Software Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Rest of Asia Pacific Cloud System Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of Asia Pacific Cloud System Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Cloud System Management Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 43: Latin America Cloud System Management Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 44: Latin America Cloud System Management Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 45: Latin America Cloud System Management Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 46: Latin America Cloud System Management Software Industry Revenue (Million), by Organisation Size 2025 & 2033

- Figure 47: Latin America Cloud System Management Software Industry Revenue Share (%), by Organisation Size 2025 & 2033

- Figure 48: Latin America Cloud System Management Software Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 49: Latin America Cloud System Management Software Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Latin America Cloud System Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Latin America Cloud System Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 52: Middle East and Africa Cloud System Management Software Industry Revenue (Million), by Component 2025 & 2033

- Figure 53: Middle East and Africa Cloud System Management Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 54: Middle East and Africa Cloud System Management Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 55: Middle East and Africa Cloud System Management Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 56: Middle East and Africa Cloud System Management Software Industry Revenue (Million), by Organisation Size 2025 & 2033

- Figure 57: Middle East and Africa Cloud System Management Software Industry Revenue Share (%), by Organisation Size 2025 & 2033

- Figure 58: Middle East and Africa Cloud System Management Software Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Cloud System Management Software Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 60: Middle East and Africa Cloud System Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Cloud System Management Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud System Management Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Cloud System Management Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 3: Global Cloud System Management Software Industry Revenue Million Forecast, by Organisation Size 2020 & 2033

- Table 4: Global Cloud System Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Cloud System Management Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Cloud System Management Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Cloud System Management Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 8: Global Cloud System Management Software Industry Revenue Million Forecast, by Organisation Size 2020 & 2033

- Table 9: Global Cloud System Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Cloud System Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Cloud System Management Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 16: Global Cloud System Management Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 17: Global Cloud System Management Software Industry Revenue Million Forecast, by Organisation Size 2020 & 2033

- Table 18: Global Cloud System Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Cloud System Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Germany Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Russia Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Cloud System Management Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 26: Global Cloud System Management Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 27: Global Cloud System Management Software Industry Revenue Million Forecast, by Organisation Size 2020 & 2033

- Table 28: Global Cloud System Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Cloud System Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: China Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: India Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Australia Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Cloud System Management Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 35: Global Cloud System Management Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 36: Global Cloud System Management Software Industry Revenue Million Forecast, by Organisation Size 2020 & 2033

- Table 37: Global Cloud System Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Cloud System Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Global Cloud System Management Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 40: Global Cloud System Management Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 41: Global Cloud System Management Software Industry Revenue Million Forecast, by Organisation Size 2020 & 2033

- Table 42: Global Cloud System Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Cloud System Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Brazil Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Mexico Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Latin America Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Cloud System Management Software Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 48: Global Cloud System Management Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 49: Global Cloud System Management Software Industry Revenue Million Forecast, by Organisation Size 2020 & 2033

- Table 50: Global Cloud System Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 51: Global Cloud System Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: United Arab Emirates Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Saudi Arabia Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Africa Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Rest of Middle East and Africa Cloud System Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud System Management Software Industry?

The projected CAGR is approximately > 25.10%.

2. Which companies are prominent players in the Cloud System Management Software Industry?

Key companies in the market include Data Dog, Amazon Web Services, New Relic Inc, Dynatrace, Cisco Systems Inc, Broadcom Inc, Solarwind, Microsoft Corp, Oracle, Splunk Inc, Sematext.

3. What are the main segments of the Cloud System Management Software Industry?

The market segments include Component, Deployment Model, Organisation Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emerging Technologies Investing into Advanced Data Centers; IT Companies Turning to BYOD and CYOD Systems Create Demand for Cloud Management Services; Adoption of Multi-cloud Platform.

6. What are the notable trends driving market growth?

BFSI Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concers; Increased Cyber Attacks.

8. Can you provide examples of recent developments in the market?

Oct 2022: Datadog, the monitoring and security platform for cloud applications, launched a new product that helps developers and quality engineers quickly create, manage, and run end-to-end tests for their web applications. With this product, engineers can create tests right from the UI without scripting, run tests in parallel, and integrate with popular CI tools, so tests become a part of their existing CI processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud System Management Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud System Management Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud System Management Software Industry?

To stay informed about further developments, trends, and reports in the Cloud System Management Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence