Key Insights

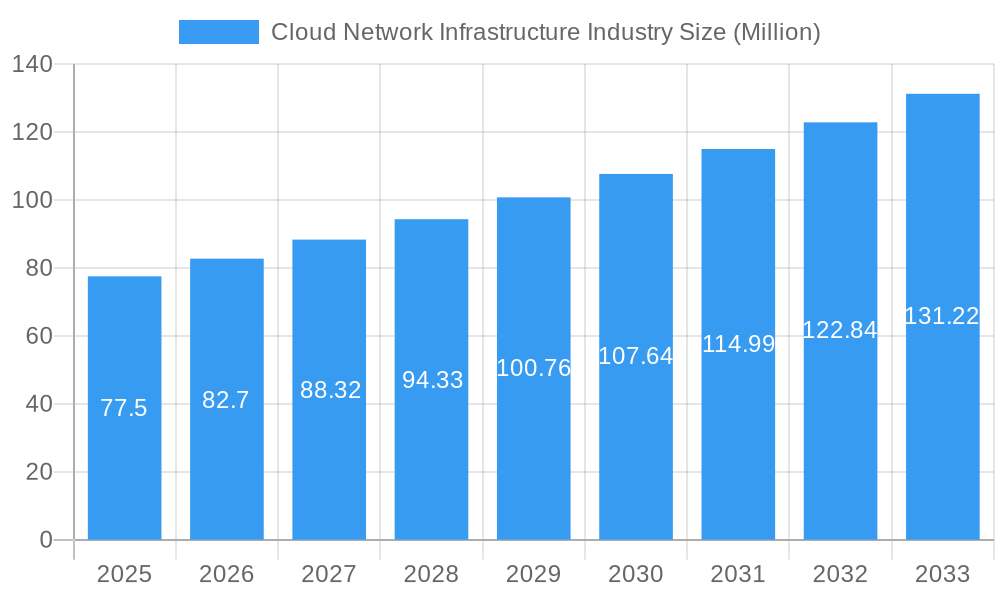

The global Cloud Network Infrastructure market is poised for significant expansion, projected to reach an estimated USD 77.50 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.62% anticipated throughout the forecast period of 2025-2033. This growth is fueled by an increasing demand for scalable, flexible, and cost-effective networking solutions across various industries. The proliferation of cloud adoption, driven by the need for enhanced agility and reduced operational overheads, forms the bedrock of this market's upward trajectory. Key drivers include the escalating adoption of hybrid and multi-cloud strategies, the growing complexity of data traffic, and the imperative for businesses to leverage advanced networking capabilities to support emerging technologies like IoT, AI, and 5G. Furthermore, the continuous innovation in networking services, such as Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), is enabling more efficient and programmable network management, thus stimulating market growth.

Cloud Network Infrastructure Industry Market Size (In Million)

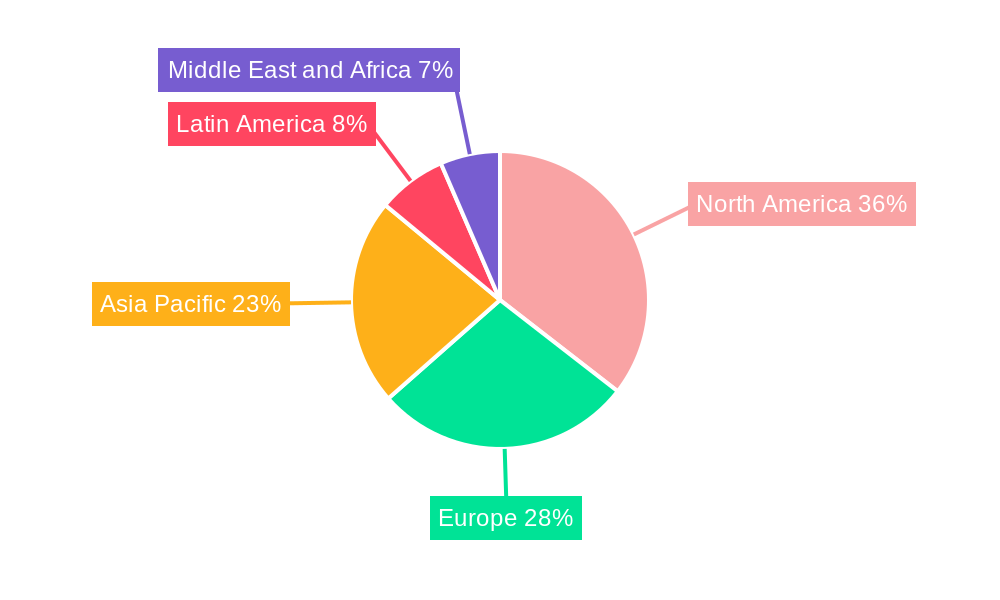

The market is segmented across diverse service types including Compute as a Service, Storage as a Service, and Networking as a Service, each contributing to the comprehensive cloud network ecosystem. Deployment models span Public, Private, and Hybrid Clouds, offering organizations tailored solutions to meet their specific security and compliance needs. The demand for cloud network infrastructure is pronounced across both Small and Medium-Sized Enterprises (SMEs) and Large Enterprises, reflecting its universal applicability. Key end-user verticals like BFSI, IT & Telecommunications, Retail, Healthcare & Life Sciences, and Government are significant contributors, leveraging cloud networking for digital transformation initiatives, improved customer experiences, and operational efficiencies. Geographically, North America and Europe are expected to lead the market, driven by early adoption and mature cloud ecosystems, while the Asia Pacific region presents substantial growth opportunities due to rapid digital adoption and increasing IT investments.

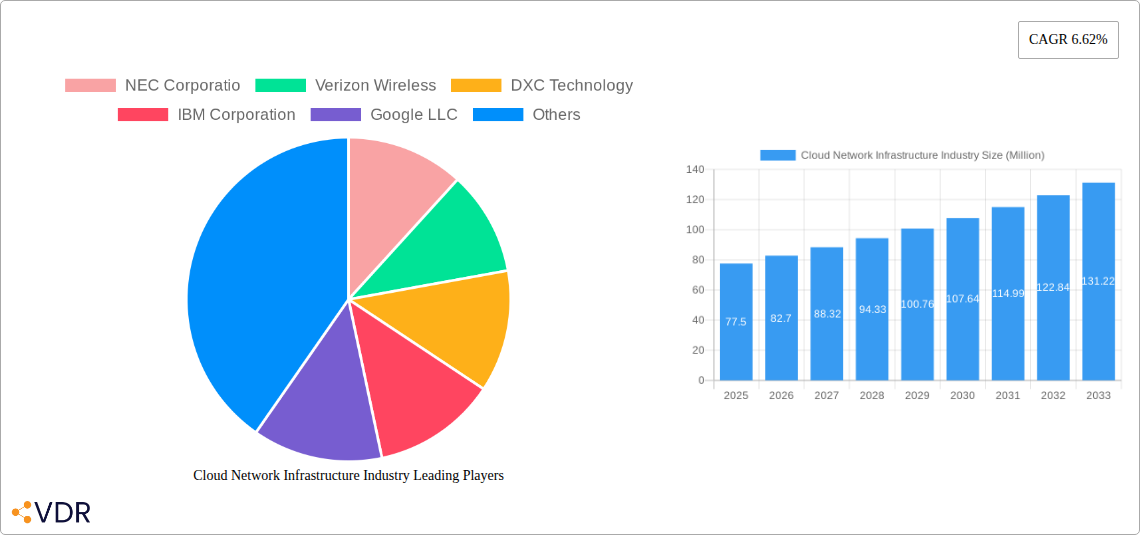

Cloud Network Infrastructure Industry Company Market Share

Cloud Network Infrastructure Industry: Market Dynamics, Growth, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic and rapidly evolving Cloud Network Infrastructure industry. Analyzing from 2019 to 2033, with a base and estimated year of 2025, this study provides invaluable insights into market size, growth trends, competitive landscapes, and future opportunities. It meticulously examines the parent market and its child segments, offering a holistic view for industry professionals. All values are presented in millions of units.

Cloud Network Infrastructure Industry Market Dynamics & Structure

The Cloud Network Infrastructure market is characterized by a moderate to high level of concentration, with a few dominant players like Amazon Web Services Inc., Microsoft Corporation, and Google LLC holding significant market shares. Technological innovation remains a primary driver, fueled by the relentless demand for enhanced performance, scalability, and security in cloud environments. Key innovation drivers include the development of advanced Software-Defined Networking (SDN) solutions, network function virtualization (NFV), and edge computing capabilities, all designed to optimize cloud network performance and reduce latency.

Regulatory frameworks, while evolving, are largely focused on data privacy, security, and interoperability, impacting how cloud network infrastructure is designed and deployed. Competitive product substitutes are emerging, particularly in the form of private cloud solutions and on-premises networking technologies that offer greater control, though often at a higher initial cost and with less scalability compared to public cloud offerings. End-user demographics are shifting, with a growing adoption by Small and Medium-Sized Enterprises (SMEs) alongside large enterprises, driven by the accessibility and cost-effectiveness of cloud services. Mergers and acquisitions (M&A) trends are active, with strategic consolidations aimed at expanding service portfolios and market reach. For instance, recent M&A activities reflect a push towards integrated cloud solutions, encompassing networking, compute, and storage.

- Market Concentration: Dominated by major cloud providers, with increasing participation from specialized network infrastructure vendors.

- Technological Innovation Drivers: SDN, NFV, AI-powered network management, 5G integration, and edge computing are key differentiators.

- Regulatory Frameworks: Focus on data sovereignty, cybersecurity standards, and compliance across different regions.

- Competitive Product Substitutes: Rise of hybrid cloud solutions and advanced on-premises networking for specific use cases.

- End-User Demographics: Broadening adoption across SMEs and large enterprises across diverse verticals.

- M&A Trends: Strategic acquisitions to enhance service offerings and expand global presence.

Cloud Network Infrastructure Industry Growth Trends & Insights

The Cloud Network Infrastructure market is poised for significant expansion, driven by the escalating global adoption of cloud computing services across all organizational sizes and industries. The study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, highlights a robust Compound Annual Growth Rate (CAGR) of xx% in market value, reaching an estimated USD XXXX million by 2033. This growth is underpinned by several key trends. Firstly, the increasing demand for high-speed, reliable, and scalable network connectivity to support data-intensive applications, big data analytics, AI/ML workloads, and the proliferation of IoT devices is a primary catalyst. Organizations are increasingly migrating their critical workloads to the cloud, necessitating advanced networking solutions that can ensure seamless performance and low latency.

Secondly, the ongoing digital transformation initiatives across various sectors, including BFSI, IT & Telecommunications, Retail, Healthcare & Life Sciences, and Government, are directly contributing to the growth of cloud network infrastructure. These sectors are leveraging cloud-based solutions for enhanced operational efficiency, improved customer engagement, and robust data management. For example, the BFSI sector is adopting cloud for secure transaction processing and real-time data analytics, while healthcare is utilizing it for electronic health records and telemedicine.

Technological disruptions are also playing a pivotal role. The advancements in 5G technology are creating new avenues for cloud network infrastructure, enabling faster speeds, lower latency, and greater capacity, especially for mobile edge computing applications. Furthermore, the integration of AI and machine learning in network management and automation is optimizing resource allocation, improving security, and enhancing overall network performance, leading to more efficient and cost-effective cloud operations. Consumer behavior shifts are also evident, with a growing preference for on-demand access to services and data, which is naturally facilitated by cloud-based network infrastructure. The increasing reliance on remote work models further accentuates the need for robust and secure cloud networking solutions. The adoption rates for cloud network infrastructure are projected to climb steadily, with market penetration expected to reach xx% by 2033, signifying a substantial shift from traditional on-premises solutions.

Dominant Regions, Countries, or Segments in Cloud Network Infrastructure Industry

North America is currently leading the Cloud Network Infrastructure industry, driven by its established technological infrastructure, high adoption rates of cloud services, and a significant presence of major cloud providers and technology giants. The United States, in particular, is a powerhouse, with extensive investments in data centers, advanced research and development, and a strong regulatory environment that fosters innovation while ensuring data security. This dominance is further bolstered by the presence of key players like Microsoft Corporation, Amazon Web Services Inc., and Google LLC, which are continuously expanding their cloud offerings and network capabilities.

From a Service Type perspective, Networking as a Service is a significant growth driver, offering scalable and flexible network solutions for businesses of all sizes. This segment is crucial for enabling hybrid and multi-cloud strategies. Compute as a Service and Storage as a Service also hold substantial market share, forming the foundational pillars of cloud infrastructure.

In terms of Deployment Model, the Public Cloud segment is the most dominant, offering unparalleled scalability and cost-effectiveness. However, Hybrid Cloud solutions are rapidly gaining traction as organizations seek to balance the benefits of public cloud with the security and control of private clouds, leading to increased demand for integrated networking solutions.

The Organization Size segment sees Large Enterprises as the primary consumers, due to their extensive IT needs and substantial budgets for cloud migration. However, Small and Medium-Sized Enterprises (SMEs) are increasingly adopting cloud network infrastructure, driven by accessible pricing models and the need to compete with larger players without significant upfront investment.

The End-user Vertical that contributes most significantly to market growth is IT & Telecommunications, given its inherent reliance on advanced network infrastructure for service delivery. Following closely are BFSI, with its stringent security and performance demands, and Retail, leveraging cloud for e-commerce and supply chain management. Healthcare & Life Sciences is a rapidly growing vertical, driven by the increasing adoption of telemedicine and the need for secure data management.

- Dominant Region: North America, particularly the United States, leading in cloud adoption, R&D, and infrastructure investment.

- Key Service Type: Networking as a Service, crucial for enabling diverse cloud strategies.

- Dominant Deployment Model: Public Cloud, offering scalability and cost efficiency, with Hybrid Cloud experiencing rapid growth.

- Leading Organization Size: Large Enterprises, with SMEs showing significant and growing adoption.

- Key End-user Verticals: IT & Telecommunications, BFSI, and Retail are major contributors, with Healthcare & Life Sciences showing strong growth potential.

Cloud Network Infrastructure Industry Product Landscape

The Cloud Network Infrastructure product landscape is characterized by continuous innovation, offering a wide array of solutions designed to enhance connectivity, performance, and security within cloud environments. Key product categories include advanced Software-Defined Networking (SDN) controllers, virtualized network functions (VNFs) for agile service deployment, and high-performance network fabrics for data centers. Application Delivery Controllers (ADCs) are crucial for optimizing application performance and ensuring high availability, while cloud-native security solutions are integrated to protect data and workloads. Performance metrics such as low latency (measured in milliseconds), high throughput (measured in Gbps), and robust uptime (measured in 99.999%) are critical differentiators. Unique selling propositions often revolve around seamless integration with existing cloud platforms, AI-driven network automation, and enhanced resilience against cyber threats. The ongoing development of edge networking solutions further expands the product landscape, enabling localized processing and reduced latency for IoT and real-time applications.

Key Drivers, Barriers & Challenges in Cloud Network Infrastructure Industry

The Cloud Network Infrastructure industry is propelled by several key drivers. The escalating demand for data processing and storage, coupled with the rapid adoption of cloud-native applications and digital transformation initiatives across enterprises, fuels its growth. The ongoing advancements in 5G technology and the burgeoning Internet of Things (IoT) ecosystem necessitate robust and scalable cloud networking solutions. Furthermore, the economic benefits of cloud adoption, including reduced capital expenditure and operational efficiency, act as significant catalysts.

However, the industry faces notable barriers and challenges. Security concerns, including data breaches and compliance risks, remain a primary restraint, prompting organizations to invest heavily in robust security measures. The complexity of managing multi-cloud and hybrid cloud environments presents significant operational challenges, requiring specialized expertise and advanced management tools. Interoperability issues between different cloud providers and legacy systems can hinder seamless integration. High initial migration costs and potential vendor lock-in can also be deterrents for some organizations. Furthermore, the scarcity of skilled professionals in cloud networking and cybersecurity poses a significant challenge to the industry's rapid expansion.

- Key Drivers:

- Growing demand for data processing and storage.

- Widespread adoption of cloud-native applications.

- Advancements in 5G and IoT ecosystems.

- Economic benefits of cloud adoption (cost savings, efficiency).

- Key Barriers & Challenges:

- Security and data privacy concerns.

- Complexity in managing multi-cloud and hybrid environments.

- Interoperability issues and vendor lock-in.

- High initial migration costs.

- Shortage of skilled cloud networking professionals.

Emerging Opportunities in Cloud Network Infrastructure Industry

Emerging opportunities within the Cloud Network Infrastructure industry are vast and diverse, presenting significant avenues for growth and innovation. The continued expansion of edge computing is creating demand for localized network infrastructure that can support real-time data processing and AI at the network's periphery, reducing latency for applications like autonomous vehicles and smart factories. The growing adoption of private 5G networks by enterprises for dedicated, high-performance wireless connectivity in industrial settings, campuses, and large venues represents a substantial untapped market. Furthermore, the increasing need for secure and resilient network solutions for remote work and hybrid work models is driving demand for advanced VPN technologies, zero-trust network access (ZTNA), and secure access service edge (SASE) solutions. The development of quantum-resistant encryption for network security also presents a future-proofing opportunity.

Growth Accelerators in the Cloud Network Infrastructure Industry Industry

Several key catalysts are accelerating the long-term growth of the Cloud Network Infrastructure industry. Technological breakthroughs, such as advancements in high-speed optical networking, AI-powered network automation, and the evolution of Software-Defined Wide Area Networks (SD-WAN), are continuously enhancing performance, efficiency, and cost-effectiveness. Strategic partnerships and alliances between cloud providers, network equipment manufacturers, and software vendors are fostering greater integration and a more comprehensive service offering, leading to increased adoption. Market expansion strategies, particularly the growing penetration of cloud services in emerging economies and specialized verticals like healthcare and manufacturing, are opening up new revenue streams. The continuous drive towards hybrid and multi-cloud strategies by enterprises also accelerates demand for robust and flexible cloud network infrastructure solutions that can bridge disparate environments.

Key Players Shaping the Cloud Network Infrastructure Industry Market

- NEC Corporation

- Verizon Wireless

- DXC Technology

- IBM Corporation

- Google LLC

- CenturyLink Inc

- Alibaba Cloud

- Microsoft Corporation

- Fujitsu Limited

- Tencent Holdings Ltd

- Amazon Web Services Inc

- Dimension Data

- Oracle Corporation

- AT&T Mobility LLC

- VMware Inc

- Rackspace Inc

Notable Milestones in Cloud Network Infrastructure Industry Sector

- Dec 2022: Avalanche announced its partnership with Alibaba Cloud to develop tools that allow users to launch validator nodes on Avalanche's public blockchain platform in Asia. The partnership would let Avalanche developers use Alibaba Cloud's plug-and-play infrastructure to launch new validators.

- June 2022: VMware, Inc. announced the launch of VMware vSAN+ and VMware vSphere+ to support organizations by bringing the benefits of the cloud to their existing on-premises infrastructure without disrupting their workloads or hosts.

In-Depth Cloud Network Infrastructure Industry Market Outlook

The Cloud Network Infrastructure industry is set for a period of sustained and accelerated growth, driven by an increasingly digitalized global economy. The ongoing digital transformation across all sectors, coupled with the pervasive integration of AI, machine learning, and the Internet of Things, will continue to fuel demand for robust, scalable, and secure network capabilities. The industry's future is intrinsically linked to its ability to provide seamless connectivity, optimize performance, and ensure data integrity in increasingly complex and distributed computing environments. Strategic opportunities lie in the continued development of edge computing solutions, the expansion of private 5G networks, and the provision of advanced cybersecurity services tailored for cloud environments. Companies that can effectively navigate the evolving technological landscape, forge strategic partnerships, and cater to the growing demand for hybrid and multi-cloud strategies will be well-positioned for significant success. The market outlook indicates a strong trajectory towards greater automation, intelligence, and resilience in cloud network infrastructure.

Cloud Network Infrastructure Industry Segmentation

-

1. Service Type

- 1.1. Compute as a Service

- 1.2. Storage as a Service

- 1.3. Networking as a Service

- 1.4. Other Se

-

2. Deployment Model

- 2.1. Public Cloud

- 2.2. Private Cloud

- 2.3. Hybrid Cloud

-

3. Organization Size

- 3.1. Small and Medium-Sized Enterprises (SMEs)

- 3.2. Large Enterprises

-

4. End-user Vertical

- 4.1. BFSI

- 4.2. IT & Telecommunications

- 4.3. Retail

- 4.4. Healthcare & Life Sciences

- 4.5. Government

- 4.6. Other En

Cloud Network Infrastructure Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud Network Infrastructure Industry Regional Market Share

Geographic Coverage of Cloud Network Infrastructure Industry

Cloud Network Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing IaaS Benefits; Increased Cost-Savings and Return on Investments (ROI); Growing Use of Edge Computing

- 3.3. Market Restrains

- 3.3.1. Lack of Technical Expertise

- 3.4. Market Trends

- 3.4.1. Public Cloud Holds a Dominant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Network Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Compute as a Service

- 5.1.2. Storage as a Service

- 5.1.3. Networking as a Service

- 5.1.4. Other Se

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. Public Cloud

- 5.2.2. Private Cloud

- 5.2.3. Hybrid Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium-Sized Enterprises (SMEs)

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. BFSI

- 5.4.2. IT & Telecommunications

- 5.4.3. Retail

- 5.4.4. Healthcare & Life Sciences

- 5.4.5. Government

- 5.4.6. Other En

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Cloud Network Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Compute as a Service

- 6.1.2. Storage as a Service

- 6.1.3. Networking as a Service

- 6.1.4. Other Se

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. Public Cloud

- 6.2.2. Private Cloud

- 6.2.3. Hybrid Cloud

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small and Medium-Sized Enterprises (SMEs)

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.4.1. BFSI

- 6.4.2. IT & Telecommunications

- 6.4.3. Retail

- 6.4.4. Healthcare & Life Sciences

- 6.4.5. Government

- 6.4.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Cloud Network Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Compute as a Service

- 7.1.2. Storage as a Service

- 7.1.3. Networking as a Service

- 7.1.4. Other Se

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. Public Cloud

- 7.2.2. Private Cloud

- 7.2.3. Hybrid Cloud

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small and Medium-Sized Enterprises (SMEs)

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.4.1. BFSI

- 7.4.2. IT & Telecommunications

- 7.4.3. Retail

- 7.4.4. Healthcare & Life Sciences

- 7.4.5. Government

- 7.4.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Cloud Network Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Compute as a Service

- 8.1.2. Storage as a Service

- 8.1.3. Networking as a Service

- 8.1.4. Other Se

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. Public Cloud

- 8.2.2. Private Cloud

- 8.2.3. Hybrid Cloud

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small and Medium-Sized Enterprises (SMEs)

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.4.1. BFSI

- 8.4.2. IT & Telecommunications

- 8.4.3. Retail

- 8.4.4. Healthcare & Life Sciences

- 8.4.5. Government

- 8.4.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Cloud Network Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Compute as a Service

- 9.1.2. Storage as a Service

- 9.1.3. Networking as a Service

- 9.1.4. Other Se

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. Public Cloud

- 9.2.2. Private Cloud

- 9.2.3. Hybrid Cloud

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small and Medium-Sized Enterprises (SMEs)

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.4.1. BFSI

- 9.4.2. IT & Telecommunications

- 9.4.3. Retail

- 9.4.4. Healthcare & Life Sciences

- 9.4.5. Government

- 9.4.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Cloud Network Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Compute as a Service

- 10.1.2. Storage as a Service

- 10.1.3. Networking as a Service

- 10.1.4. Other Se

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. Public Cloud

- 10.2.2. Private Cloud

- 10.2.3. Hybrid Cloud

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small and Medium-Sized Enterprises (SMEs)

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.4.1. BFSI

- 10.4.2. IT & Telecommunications

- 10.4.3. Retail

- 10.4.4. Healthcare & Life Sciences

- 10.4.5. Government

- 10.4.6. Other En

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NEC Corporatio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Verizon Wireless

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DXC Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CenturyLink Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alibaba Cloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microsoft Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fujitsu Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tencent Holdings Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amazon Web Services Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dimension Data

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Oracle Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AT&T Mobility LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 VMware Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Rackspace Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 NEC Corporatio

List of Figures

- Figure 1: Global Cloud Network Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cloud Network Infrastructure Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud Network Infrastructure Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America Cloud Network Infrastructure Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 5: North America Cloud Network Infrastructure Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Cloud Network Infrastructure Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Cloud Network Infrastructure Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 8: North America Cloud Network Infrastructure Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 9: North America Cloud Network Infrastructure Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 10: North America Cloud Network Infrastructure Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 11: North America Cloud Network Infrastructure Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 12: North America Cloud Network Infrastructure Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 13: North America Cloud Network Infrastructure Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: North America Cloud Network Infrastructure Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 15: North America Cloud Network Infrastructure Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 16: North America Cloud Network Infrastructure Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 17: North America Cloud Network Infrastructure Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: North America Cloud Network Infrastructure Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 19: North America Cloud Network Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Cloud Network Infrastructure Industry Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Cloud Network Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Cloud Network Infrastructure Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Cloud Network Infrastructure Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 24: Europe Cloud Network Infrastructure Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 25: Europe Cloud Network Infrastructure Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 26: Europe Cloud Network Infrastructure Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 27: Europe Cloud Network Infrastructure Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 28: Europe Cloud Network Infrastructure Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 29: Europe Cloud Network Infrastructure Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 30: Europe Cloud Network Infrastructure Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 31: Europe Cloud Network Infrastructure Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 32: Europe Cloud Network Infrastructure Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 33: Europe Cloud Network Infrastructure Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 34: Europe Cloud Network Infrastructure Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 35: Europe Cloud Network Infrastructure Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 36: Europe Cloud Network Infrastructure Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 37: Europe Cloud Network Infrastructure Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 38: Europe Cloud Network Infrastructure Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 39: Europe Cloud Network Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Cloud Network Infrastructure Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Cloud Network Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Cloud Network Infrastructure Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Cloud Network Infrastructure Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 44: Asia Pacific Cloud Network Infrastructure Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 45: Asia Pacific Cloud Network Infrastructure Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 46: Asia Pacific Cloud Network Infrastructure Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 47: Asia Pacific Cloud Network Infrastructure Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 48: Asia Pacific Cloud Network Infrastructure Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 49: Asia Pacific Cloud Network Infrastructure Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 50: Asia Pacific Cloud Network Infrastructure Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 51: Asia Pacific Cloud Network Infrastructure Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 52: Asia Pacific Cloud Network Infrastructure Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 53: Asia Pacific Cloud Network Infrastructure Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 54: Asia Pacific Cloud Network Infrastructure Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 55: Asia Pacific Cloud Network Infrastructure Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Asia Pacific Cloud Network Infrastructure Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 57: Asia Pacific Cloud Network Infrastructure Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Asia Pacific Cloud Network Infrastructure Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Asia Pacific Cloud Network Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Cloud Network Infrastructure Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Cloud Network Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Cloud Network Infrastructure Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Latin America Cloud Network Infrastructure Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 64: Latin America Cloud Network Infrastructure Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 65: Latin America Cloud Network Infrastructure Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 66: Latin America Cloud Network Infrastructure Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 67: Latin America Cloud Network Infrastructure Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 68: Latin America Cloud Network Infrastructure Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 69: Latin America Cloud Network Infrastructure Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 70: Latin America Cloud Network Infrastructure Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 71: Latin America Cloud Network Infrastructure Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 72: Latin America Cloud Network Infrastructure Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 73: Latin America Cloud Network Infrastructure Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 74: Latin America Cloud Network Infrastructure Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 75: Latin America Cloud Network Infrastructure Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 76: Latin America Cloud Network Infrastructure Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 77: Latin America Cloud Network Infrastructure Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 78: Latin America Cloud Network Infrastructure Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 79: Latin America Cloud Network Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America Cloud Network Infrastructure Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Latin America Cloud Network Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Cloud Network Infrastructure Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Cloud Network Infrastructure Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 84: Middle East and Africa Cloud Network Infrastructure Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 85: Middle East and Africa Cloud Network Infrastructure Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 86: Middle East and Africa Cloud Network Infrastructure Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 87: Middle East and Africa Cloud Network Infrastructure Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 88: Middle East and Africa Cloud Network Infrastructure Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 89: Middle East and Africa Cloud Network Infrastructure Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 90: Middle East and Africa Cloud Network Infrastructure Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 91: Middle East and Africa Cloud Network Infrastructure Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 92: Middle East and Africa Cloud Network Infrastructure Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 93: Middle East and Africa Cloud Network Infrastructure Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 94: Middle East and Africa Cloud Network Infrastructure Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 95: Middle East and Africa Cloud Network Infrastructure Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 96: Middle East and Africa Cloud Network Infrastructure Industry Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 97: Middle East and Africa Cloud Network Infrastructure Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 98: Middle East and Africa Cloud Network Infrastructure Industry Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 99: Middle East and Africa Cloud Network Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 100: Middle East and Africa Cloud Network Infrastructure Industry Volume (K Unit), by Country 2025 & 2033

- Figure 101: Middle East and Africa Cloud Network Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 102: Middle East and Africa Cloud Network Infrastructure Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 3: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 4: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 5: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 6: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 7: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 13: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 14: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 15: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 16: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 17: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 19: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 23: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 24: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 25: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 26: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 27: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 32: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 33: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 34: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 35: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 36: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 37: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 38: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 39: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 42: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 43: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 44: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 45: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 46: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 47: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 48: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 49: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 52: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 53: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 54: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 55: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 56: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 57: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 58: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 59: Global Cloud Network Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Cloud Network Infrastructure Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Network Infrastructure Industry?

The projected CAGR is approximately 6.62%.

2. Which companies are prominent players in the Cloud Network Infrastructure Industry?

Key companies in the market include NEC Corporatio, Verizon Wireless, DXC Technology, IBM Corporation, Google LLC, CenturyLink Inc, Alibaba Cloud, Microsoft Corporation, Fujitsu Limited, Tencent Holdings Ltd, Amazon Web Services Inc, Dimension Data, Oracle Corporation, AT&T Mobility LLC, VMware Inc, Rackspace Inc.

3. What are the main segments of the Cloud Network Infrastructure Industry?

The market segments include Service Type, Deployment Model, Organization Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing IaaS Benefits; Increased Cost-Savings and Return on Investments (ROI); Growing Use of Edge Computing.

6. What are the notable trends driving market growth?

Public Cloud Holds a Dominant Market Share.

7. Are there any restraints impacting market growth?

Lack of Technical Expertise.

8. Can you provide examples of recent developments in the market?

Dec 2022: Avalanche announced its partnership with Alibaba Cloud to develop tools that allow users to launch validator nodes on Avalanche's public blockchain platform in Asia. The partnership would let Avalanche developers use Alibaba Cloud's plug-and-play infrastructure to launch new validators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Network Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Network Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Network Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Cloud Network Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence