Key Insights

The Latin America POS Terminal Devices Market is projected for significant growth, reaching an estimated $787.74 billion by 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 10.13% from the base year 2025. Key growth drivers include accelerating digital transformation in Latin American economies, increased adoption of contactless payment solutions, and a rising demand for enhanced customer experiences. Government initiatives promoting economic formalization and financial inclusion, coupled with the proliferation of SMEs seeking cost-effective payment solutions, further bolster market expansion. Dominant trends include the growing demand for mobile and portable POS systems for flexible transactions and the integration of advanced security features to ensure data integrity.

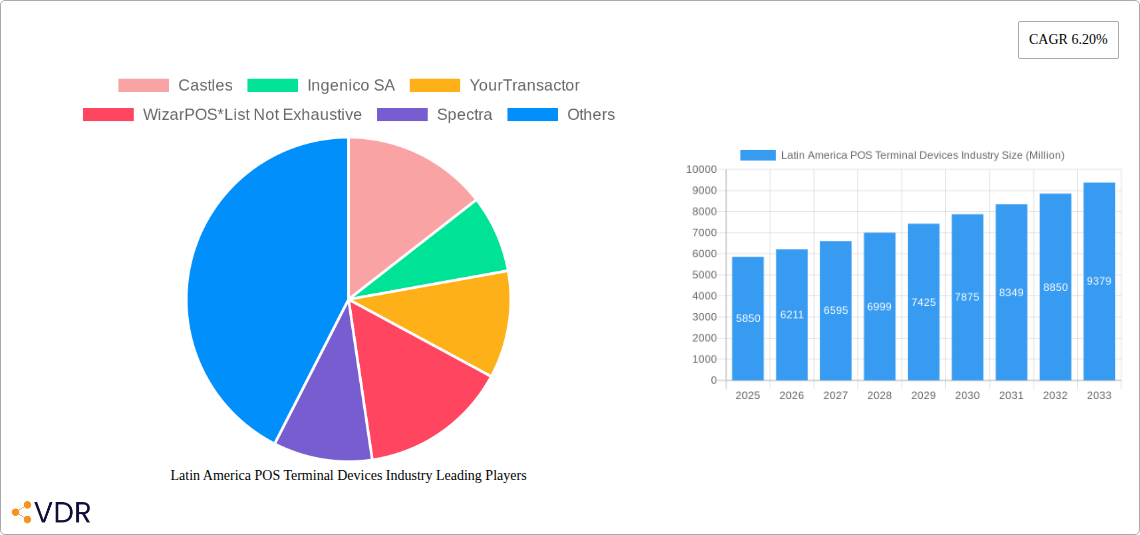

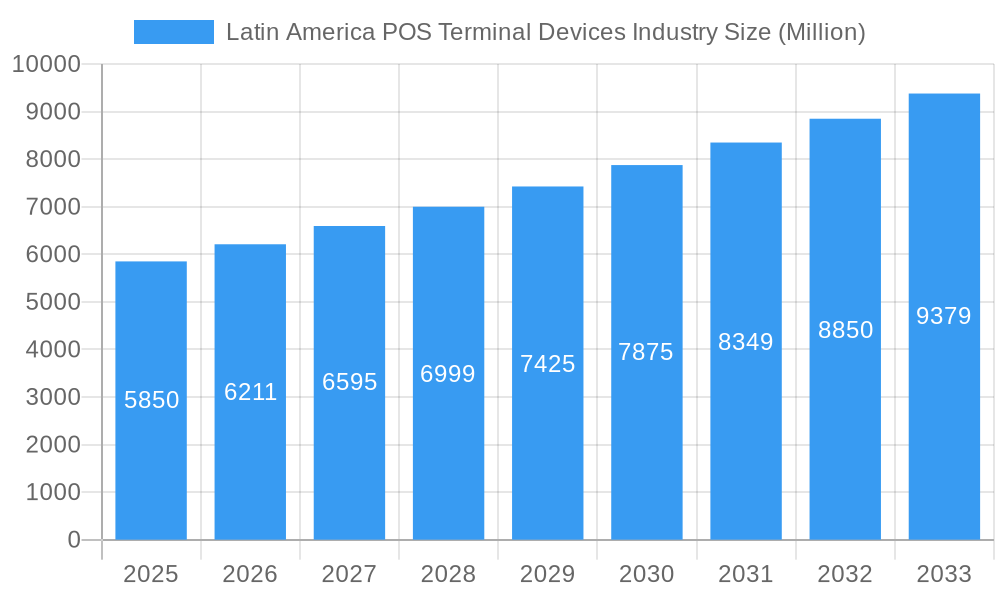

Latin America POS Terminal Devices Industry Market Size (In Billion)

The market is segmented into Fixed POS Systems and Mobile/Portable POS Systems. While fixed systems maintain a substantial market share, the mobile POS segment is experiencing accelerated growth due to its inherent flexibility and cost-effectiveness, particularly for businesses with dynamic operational needs. Leading players such as Ingenico SA, VeriFone System Inc., PAX Technology, and BBPOS are driving innovation with cloud-based solutions, EMV chip compatibility, and robust security protocols. Challenges such as varying technological infrastructure and affordability across regions are being mitigated through innovative business models and governmental support. The Latin America POS Terminal Devices Market demonstrates a highly positive outlook, underpinned by sustained economic development and the unwavering trend towards digital payments.

Latin America POS Terminal Devices Industry Company Market Share

Latin America POS Terminal Devices Industry: Market Analysis and Growth Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America Point-of-Sale (POS) terminal devices industry, offering critical insights into market dynamics, growth trajectories, and competitive landscapes. Leveraging extensive data from the 2019–2033 study period, with a base year and estimated year of 2025, and a forecast period of 2025–2033, this report details historical trends from 2019–2024. It is an essential resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this dynamic market. We meticulously analyze parent and child market segments, ensuring a holistic view for strategic decision-making. All values are presented in Million units.

Latin America POS Terminal Devices Industry Market Dynamics & Structure

The Latin America POS terminal devices market exhibits a moderately concentrated structure, with a few key players like PAX Technology, Ingenico SA, and VeriFone System Inc dominating significant market share. Technological innovation is a primary driver, fueled by the increasing demand for secure and integrated payment solutions. The proliferation of EMV-compliant terminals, contactless payment capabilities, and the integration of mobile POS systems are transforming transaction experiences. Regulatory frameworks, such as data privacy laws and payment security standards, play a crucial role in shaping product development and market entry strategies. While established players have strong footholds, competitive product substitutes, particularly software-based POS solutions and mobile payment applications, pose a growing challenge. End-user demographics are shifting, with a rising middle class and increasing smartphone penetration driving the adoption of advanced POS devices across various industries.

- Market Concentration: Dominated by a few major international and regional players, with growing influence from emerging local manufacturers.

- Technological Innovation: Driven by demand for EMV compliance, contactless payments (NFC), QR code scanning, and Android-based smart POS terminals.

- Regulatory Frameworks: Compliance with PCI DSS, local data protection laws, and central bank mandates influences device security and functionality.

- Competitive Product Substitutes: Mobile payment apps, e-wallets, and cloud-based POS software solutions are increasingly competing with traditional hardware.

- End-User Demographics: Growing adoption in retail, hospitality, and small businesses, driven by increasing digital payment acceptance and the need for efficient transaction processing.

- M&A Trends: Strategic acquisitions aim to expand market reach, integrate payment ecosystems, and enhance product portfolios. The December 2021 acquisition of Redelcom by Mercado Libre exemplifies this trend.

Latin America POS Terminal Devices Industry Growth Trends & Insights

The Latin America POS terminal devices market is poised for substantial growth, driven by the accelerating digital transformation and the increasing adoption of electronic payments across the region. The market size is projected to expand significantly, moving from approximately 5.8 million units in 2019 to an estimated 18.5 million units by 2033. This robust expansion is underpinned by a Compound Annual Growth Rate (CAGR) of approximately 10.5% during the forecast period. A key driver is the increasing demand for mobile POS (mPOS) solutions, which offer flexibility and affordability, particularly for small and medium-sized enterprises (SMEs) and independent vendors. The penetration of these devices is rapidly increasing as businesses seek to reduce reliance on cash and offer diverse payment options to their customers.

Technological disruptions are continuously reshaping the market. The shift towards Android-based smart POS terminals, offering advanced functionalities like inventory management, customer relationship management (CRM) integration, and loyalty programs, is a significant trend. This move away from traditional, purely transactional devices enhances the value proposition for merchants and fosters deeper customer engagement. Furthermore, the growing acceptance of contactless payments, accelerated by global health concerns, has spurred the demand for NFC-enabled POS terminals. This has led to higher adoption rates across various industries, from retail and hospitality to transportation and healthcare.

Consumer behavior shifts are also playing a pivotal role. As consumers become more accustomed to digital transactions, their expectations for seamless, fast, and secure payment experiences are rising. This necessitates merchants investing in modern POS systems that can accommodate these evolving preferences. The increasing pervasiveness of e-commerce is also indirectly boosting the demand for physical POS terminals, as businesses aim to create an omnichannel experience, bridging the gap between online and offline sales channels. The expansion of financial inclusion initiatives across Latin American countries further fuels this growth, as more individuals gain access to banking services and digital payment methods, thereby expanding the addressable market for POS devices.

The market penetration of POS terminals, particularly in countries with historically lower adoption rates, presents a significant opportunity. Governments and financial institutions are actively promoting cashless economies, further incentivizing businesses to adopt electronic payment infrastructure. The increasing sophistication of cybersecurity measures integrated into POS devices is also building consumer trust, encouraging wider adoption of digital transactions. The report will delve deeper into these growth drivers, providing quantitative metrics and qualitative analysis to paint a comprehensive picture of the market's future trajectory.

Dominant Regions, Countries, or Segments in Latin America POS Terminal Devices Industry

The Mobile/Portable Point-of-sale Systems segment is unequivocally the dominant force driving the Latin America POS terminal devices industry. This segment's ascendancy is attributed to a confluence of factors, including increasing entrepreneurial activity, the growing informal economy seeking to legitimize transactions, and the cost-effectiveness and flexibility offered compared to their fixed counterparts. As of the estimated year 2025, this segment is projected to account for approximately 65% of the total market volume, a significant increase from its historical share.

Several key drivers underpin the dominance of mobile POS terminals. Firstly, economic policies and initiatives aimed at financial inclusion and promoting digital payments across the region have been instrumental. Governments and central banks are actively encouraging the adoption of electronic transactions, which directly benefits the deployment of accessible and portable POS solutions. Secondly, the infrastructure development, while still evolving in some areas, has seen significant improvements in mobile network coverage, enabling reliable transaction processing for mPOS devices even in remote locations.

The entrepreneurial spirit in Latin America, characterized by a large number of small and medium-sized enterprises (SMEs) and street vendors, makes mobile POS systems an ideal fit. These businesses often operate with limited capital and require flexible payment solutions that can be used anywhere, a need perfectly met by mPOS devices. The affordability of these devices, coupled with lower transaction fees compared to some traditional payment methods, makes them an attractive investment. Furthermore, the technological advancements in smartphone and tablet capabilities have enabled sophisticated mPOS applications, transforming basic transaction devices into comprehensive business management tools.

Beyond the mPOS segment, Brazil and Mexico stand out as the leading countries within the Latin American POS terminal devices market. These nations represent a substantial portion of the region's economic activity and population, translating into a larger merchant base and higher demand for payment solutions. Brazil, with its large and diverse retail sector and proactive stance on digital payments, is a significant contributor to both fixed and mobile POS terminal sales. Mexico, driven by its growing e-commerce landscape and increasing adoption of EMV-compliant terminals, also represents a robust market. Colombia and Argentina, while smaller in market size, exhibit strong growth potential due to expanding financial inclusion programs and a rising consumer preference for digital payment methods. The interplay between these dominant countries and the leading mobile POS segment creates a powerful growth engine for the entire Latin America POS terminal devices industry.

Latin America POS Terminal Devices Industry Product Landscape

The Latin America POS terminal devices product landscape is characterized by a rapid evolution towards smart, integrated, and secure solutions. Innovations are focused on enhancing user experience for both merchants and consumers, improving transaction speed, and offering added value beyond basic payment processing. Android-based smart POS terminals are gaining significant traction, offering advanced functionalities like inventory management, CRM integration, and loyalty program capabilities. These devices often feature high-resolution touchscreens, built-in barcode scanners, and robust connectivity options, including Wi-Fi, Bluetooth, and cellular data. The seamless integration of contactless payment technologies, such as NFC for tap-to-pay transactions, is becoming standard across the product spectrum. Security remains paramount, with devices incorporating advanced encryption, tamper-proof hardware, and compliance with international payment security standards. Performance metrics are continuously being optimized for faster transaction approvals and reliable operation, even in challenging network conditions.

Key Drivers, Barriers & Challenges in Latin America POS Terminal Devices Industry

Key Drivers:

- Growing Adoption of Digital Payments: Increasing consumer preference for cashless transactions and government initiatives promoting financial inclusion are major catalysts.

- Rise of SMEs and E-commerce: The expansion of small and medium-sized businesses and the growth of online retail necessitate versatile and affordable POS solutions.

- Technological Advancements: Demand for EMV-compliant, contactless, and smart POS terminals with enhanced functionalities drives innovation and adoption.

- Increasing Smartphone Penetration: The widespread availability of smartphones facilitates the adoption of mobile POS solutions.

Barriers & Challenges:

- Infrastructure Limitations: Inconsistent internet connectivity in some rural areas can hinder the reliable operation of online POS systems.

- Regulatory Hurdles: Navigating diverse and sometimes complex regulatory frameworks across different Latin American countries can be challenging for manufacturers and service providers.

- Cybersecurity Concerns: Ensuring robust security to protect sensitive transaction data from evolving cyber threats remains a critical concern, requiring continuous investment.

- Competition from Alternative Payment Methods: The growing popularity of mobile wallets and peer-to-peer payment apps presents a competitive challenge to traditional POS hardware.

- Economic Volatility: Fluctuations in local economies and currency exchange rates can impact business investment in new POS technology.

Emerging Opportunities in Latin America POS Terminal Devices Industry

Emerging opportunities within the Latin America POS terminal devices industry are multifaceted, stemming from untapped markets and evolving consumer preferences. The expansion into previously underserved rural and semi-urban areas presents a significant growth avenue, as financial inclusion initiatives bring more individuals into the digital payment ecosystem. The development of specialized POS solutions for niche industries such as agriculture, micro-finance, and informal vendor markets is also gaining momentum. Furthermore, the increasing demand for integrated payment and business management platforms that go beyond mere transaction processing offers significant potential for value-added services. Innovative applications leveraging AI and data analytics to provide merchants with actionable insights into customer behavior and sales trends are also expected to drive adoption.

Growth Accelerators in the Latin America POS Terminal Devices Industry Industry

Several key catalysts are poised to accelerate long-term growth in the Latin America POS terminal devices industry. Strategic partnerships between POS hardware manufacturers, payment processors, and fintech companies are crucial for creating integrated ecosystems and expanding service offerings. The continuous development of next-generation smart POS terminals that offer advanced analytics, loyalty management, and integration with e-commerce platforms will further enhance their value proposition. Government support and regulatory clarity in promoting digital transactions and standardizing security protocols will also play a vital role in de-risking investments and fostering market expansion. Finally, localization efforts, including the development of POS solutions tailored to specific cultural and linguistic nuances of different Latin American countries, will be instrumental in achieving deeper market penetration and customer acceptance.

Key Players Shaping the Latin America POS Terminal Devices Industry Market

- PAX Technology

- Ingenico SA

- VeriFone System Inc

- Castles

- WizarPOS

- BBPOS

- Spectra

- DSpread

- YourTransactor

- SZZT

Notable Milestones in Latin America POS Terminal Devices Industry Sector

- December 2021: Redelcom, a Chilean provider of payment services, was acquired by the Latin American e-commerce giant Mercado Libre. This strategic acquisition by Mercado Libre signifies its intent to bolster the expansion of its diverse payment instruments and digital financial solutions within Chile and reinforce its overall value proposition in the region's burgeoning fintech landscape.

In-Depth Latin America POS Terminal Devices Industry Market Outlook

The future outlook for the Latin America POS terminal devices industry is exceptionally promising, driven by a confluence of robust growth accelerators. The ongoing digital transformation across the region, coupled with increasing consumer adoption of electronic payments, forms the bedrock of this optimistic forecast. We anticipate a sustained demand for innovative POS solutions that offer enhanced security, efficiency, and value-added services. Strategic partnerships between technology providers and financial institutions will continue to be pivotal in expanding market reach and developing comprehensive payment ecosystems. The evolution towards smart POS terminals, integrating advanced analytics and business management capabilities, will further solidify their indispensability for merchants of all sizes. As economic conditions stabilize and government initiatives promoting cashless societies gain traction, the market is poised for significant expansion, presenting lucrative opportunities for stakeholders to capitalize on the dynamic growth of the Latin American payment landscape.

Latin America POS Terminal Devices Industry Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

Latin America POS Terminal Devices Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America POS Terminal Devices Industry Regional Market Share

Geographic Coverage of Latin America POS Terminal Devices Industry

Latin America POS Terminal Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. High Costs Involved

- 3.4. Market Trends

- 3.4.1. Mobile/Portable Point-of-Sale Terminals Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America POS Terminal Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Castles

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ingenico SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 YourTransactor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WizarPOS*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Spectra

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSpread

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SZZT

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VeriFone System Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PAX Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BBPOS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Castles

List of Figures

- Figure 1: Latin America POS Terminal Devices Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America POS Terminal Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America POS Terminal Devices Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Latin America POS Terminal Devices Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Latin America POS Terminal Devices Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Latin America POS Terminal Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Brazil Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Argentina Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Chile Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Colombia Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Peru Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Venezuela Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Ecuador Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bolivia Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Paraguay Latin America POS Terminal Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America POS Terminal Devices Industry?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the Latin America POS Terminal Devices Industry?

Key companies in the market include Castles, Ingenico SA, YourTransactor, WizarPOS*List Not Exhaustive, Spectra, DSpread, SZZT, VeriFone System Inc, PAX Technology, BBPOS.

3. What are the main segments of the Latin America POS Terminal Devices Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 787.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Mobile/Portable Point-of-Sale Terminals Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

High Costs Involved.

8. Can you provide examples of recent developments in the market?

December 2021 - Redelcom, a Chilean provider of payment services acquired by the Latin American eCommerce company Mercado Libre. The Mercado Libre intends to strengthen the expansion of its various payment instruments and digital financial solutions in Chile and consolidate its value proposition

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America POS Terminal Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America POS Terminal Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America POS Terminal Devices Industry?

To stay informed about further developments, trends, and reports in the Latin America POS Terminal Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence