Key Insights

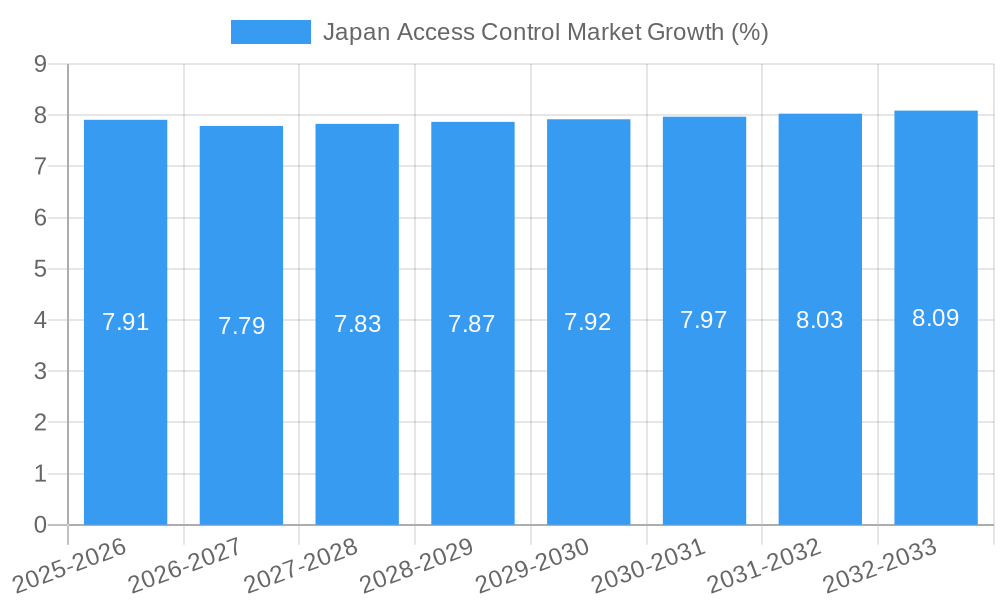

The Japanese access control market is poised for robust expansion, projected to reach a substantial valuation of $640 million. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 7.91% from 2025 to 2033. A significant driver for this upward trajectory is the increasing demand for advanced security solutions across various end-user verticals, including commercial enterprises, residential complexes, and government facilities. The escalating need to safeguard sensitive data and physical assets, coupled with a growing awareness of sophisticated security threats, is compelling organizations and individuals to invest in comprehensive access control systems. Furthermore, the rising adoption of smart technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), is fueling innovation in access control, leading to the development of more intelligent, user-friendly, and integrated solutions. This technological evolution is a key factor in attracting new adopters and encouraging upgrades to existing systems.

The market segmentation reveals a dynamic landscape, with card readers and access control devices, particularly smartcard (contact and contactless) and biometric readers, expected to dominate. The increasing sophistication and declining costs of biometric technologies are making them more accessible and attractive for enhanced security. Electronic locks are also gaining traction, offering convenient and secure alternatives to traditional locking mechanisms. In parallel, the software segment, encompassing management platforms and analytics, is crucial for enabling seamless integration, remote management, and data-driven security insights. While the commercial and residential sectors represent significant demand, the government and industrial segments are also showing strong growth due to stringent security regulations and the critical nature of their operations. Key players are actively innovating and expanding their portfolios to capture market share, driven by these evolving trends and the persistent need for enhanced security and operational efficiency.

Japan Access Control Market: Comprehensive Insights and Future Projections (2019-2033)

This in-depth report offers a comprehensive analysis of the Japan Access Control Market, meticulously examining its dynamics, growth trajectory, and competitive landscape. Spanning the historical period of 2019-2024, the base year of 2025, and a robust forecast period extending to 2033, this research provides invaluable insights for stakeholders seeking to understand and capitalize on this evolving sector. The report delves into granular details across various market segments, including card reader and access control devices (card-based, proximity, smartcard - contact and contactless), biometric readers, electronic locks, software, and other types. Furthermore, it analyzes the market across critical end-user verticals such as commercial, residential, government, industrial, transport and logistics, healthcare, military and defense, and other end-user verticals. With a focus on quantitative data, presented in million units, and qualitative analysis, this report is an indispensable resource for industry professionals, investors, and decision-makers.

Japan Access Control Market Market Dynamics & Structure

The Japan Access Control Market exhibits a moderately concentrated structure, with a few key players holding significant market share, while a larger number of smaller vendors compete for niche segments. Technological innovation is a primary driver, fueled by the demand for enhanced security and convenience. The adoption of IoT-enabled access control systems and cloud-based solutions is on the rise, driven by advancements in artificial intelligence and machine learning for sophisticated threat detection and user authentication. Regulatory frameworks, particularly concerning data privacy and cybersecurity, play a crucial role in shaping product development and market entry strategies. Competitive product substitutes, ranging from traditional key-based systems to advanced biometric solutions, continuously push vendors to innovate and differentiate their offerings. End-user demographics are shifting towards a greater demand for integrated security solutions that offer seamless user experiences and remote management capabilities. Mergers and acquisitions (M&A) are observed as companies aim to expand their product portfolios, gain access to new technologies, and consolidate their market positions.

- Market Concentration: Dominated by key players with a significant portion of the market share, alongside a fragmented landscape of smaller, specialized vendors.

- Technological Innovation: Driven by the integration of AI, IoT, and cloud computing, leading to advanced features like remote management and predictive security.

- Regulatory Frameworks: Stringent data privacy laws (e.g., APPI) influence the development and deployment of access control systems, particularly those involving biometric data.

- Competitive Landscape: Intense competition between traditional security providers and newer tech-focused companies offering integrated and smart solutions.

- End-User Demographics: Increasing demand from commercial and residential sectors for user-friendly, mobile-based, and integrated access control solutions.

- M&A Trends: Strategic acquisitions and partnerships are prevalent as companies seek to broaden their offerings and geographic reach.

Japan Access Control Market Growth Trends & Insights

The Japan Access Control Market is poised for substantial growth, driven by a confluence of factors including escalating security concerns, increasing adoption of smart building technologies, and government initiatives promoting digitalization across sectors. Over the historical period (2019-2024), the market has witnessed a steady increase in the adoption of sophisticated access control solutions, moving beyond basic card-based systems to more advanced biometric readers and smartcard technologies. The base year 2025 marks a pivotal point, with an estimated market size of XX million units, reflecting the cumulative impact of these trends. The forecast period (2025-2033) is projected to experience a healthy Compound Annual Growth Rate (CAGR) of approximately XX%, indicating sustained expansion driven by recurring revenue from software subscriptions and ongoing hardware upgrades.

Technological disruptions, such as the proliferation of mobile credentials and the integration of access control with other building management systems (BMS) and Internet of Things (IoT) devices, are fundamentally reshaping consumer behavior. Businesses are increasingly prioritizing solutions that offer centralized management, real-time monitoring, and robust data analytics for enhanced operational efficiency and security. The residential sector, influenced by the global smart home trend, is also showing growing interest in connected access control systems that offer convenience and peace of mind. Furthermore, the ongoing digital transformation across various industries, including healthcare and transportation, necessitates the deployment of highly secure and efficient access control mechanisms to protect sensitive data and critical infrastructure. The market's growth is further bolstered by continuous product innovation, with vendors focusing on developing solutions that are not only secure but also user-friendly and aesthetically integrated into modern environments.

- Market Size Evolution: Projected to grow from an estimated XX million units in 2025 to a significant XX million units by 2033.

- Adoption Rates: Increasing adoption of advanced technologies like biometrics and mobile credentials, surpassing traditional card-based systems.

- Technological Disruptions: The integration of IoT, AI, and cloud-based solutions is transforming the access control landscape, enabling smarter and more connected systems.

- Consumer Behavior Shifts: Growing demand for integrated, user-friendly, and mobile-first access control solutions that enhance convenience and security.

- CAGR: Expected to witness a robust CAGR of approximately XX% during the forecast period (2025-2033).

- Market Penetration: Deeper penetration in commercial and government sectors, with increasing adoption in the residential and industrial segments.

Dominant Regions, Countries, or Segments in Japan Access Control Market

Within the Japan Access Control Market, the Commercial end-user vertical emerges as the most dominant segment, driving significant market growth and adoption. This dominance is attributed to several key factors, including the increasing need for robust security solutions in corporate offices, retail establishments, and hospitality venues, coupled with the growing implementation of smart building technologies. The commercial sector's investment in access control is further amplified by the need to manage employee access, track visitor movements, and protect sensitive company data and assets. The presence of numerous multinational corporations and a strong emphasis on business continuity and operational efficiency within Japan significantly contribute to the demand for advanced access control systems.

The Commercial segment's growth is propelled by a combination of economic policies that encourage business investment and technological infrastructure that supports the integration of sophisticated security solutions. Furthermore, the increasing adoption of Software as a key component within access control systems, offering features like centralized management, analytics, and remote monitoring, plays a crucial role in its leading position. This software component allows businesses to adapt their access control policies dynamically and gain valuable insights into building usage.

Within the Commercial vertical, specific sub-segments like office buildings and retail spaces exhibit particularly high adoption rates for Card Reader and Access Control Devices, especially those utilizing Smartcard (Contact and Contactless) technologies due to their balance of security and convenience. However, Biometric Readers are gaining substantial traction, particularly in high-security areas or for employee identification, driven by their enhanced security features. The market share within this segment is substantial, estimated to be around XX% of the total Japan Access Control Market.

- Dominant End-User Vertical: Commercial sector, encompassing offices, retail, hospitality, and other business environments.

- Key Drivers for Commercial Dominance:

- Escalating security concerns for physical assets and data.

- Mandates for employee and visitor management.

- Implementation of smart building and IoT technologies.

- Focus on operational efficiency and business continuity.

- Dominant Segment by Type: Card Reader and Access Control Devices, with a strong preference for Smartcard (Contact and Contactless) technologies.

- Emerging Segment by Type: Biometric Readers, witnessing rapid adoption for enhanced security.

- Dominant Software Component: Software for centralized management, analytics, and remote access control.

- Market Share within Commercial Vertical: Estimated at XX% of the total Japan Access Control Market.

- Growth Potential: Continued strong growth driven by ongoing technological advancements and the increasing demand for integrated security solutions.

Japan Access Control Market Product Landscape

The Japan Access Control Market is characterized by a dynamic product landscape, driven by continuous innovation and a focus on enhancing security, convenience, and interoperability. Key product categories include advanced Card Reader and Access Control Devices, with a significant shift towards contactless Smartcard solutions and the integration of mobile credentials via smartphones. Biometric Readers, particularly fingerprint and facial recognition technologies, are gaining prominence for their high-security authentication capabilities, finding applications in sensitive areas. Electronic Locks are becoming increasingly sophisticated, offering wireless connectivity, remote control, and integration with smart home and building management systems. The Software segment is crucial, encompassing cloud-based platforms, mobile access management applications, and analytics tools that provide centralized control and insights. Unique selling propositions revolve around AI-powered threat detection, seamless user experience, and robust cybersecurity features, ensuring compliance with stringent data protection regulations.

Key Drivers, Barriers & Challenges in Japan Access Control Market

Key Drivers:

- Rising Security Threats: Increasing awareness and incidence of security breaches are a primary impetus for adopting advanced access control solutions across all sectors.

- Technological Advancements: The integration of IoT, AI, and mobile technologies offers enhanced functionality, convenience, and centralized management capabilities, driving adoption.

- Smart Building Initiatives: The growing trend towards smart homes and smart cities necessitates integrated security solutions, including sophisticated access control.

- Government Regulations: Stricter data privacy and cybersecurity regulations encourage the adoption of compliant and secure access control systems.

- Demand for Convenience: End-users are increasingly seeking user-friendly and seamless access experiences, such as mobile credentials and biometric authentication.

Barriers & Challenges:

- High Initial Investment Costs: Advanced access control systems, particularly those with comprehensive features and integration capabilities, can involve significant upfront costs, posing a barrier for some businesses, especially SMEs.

- Cybersecurity Vulnerabilities: As systems become more connected, they also become more susceptible to cyber-attacks, requiring continuous investment in security updates and threat mitigation.

- Interoperability Issues: Lack of standardization across different vendors and product types can create challenges in integrating new systems with existing infrastructure, leading to compatibility issues.

- Skills Gap: A shortage of skilled professionals capable of installing, configuring, and maintaining complex access control systems can hinder widespread adoption and efficient deployment.

- Data Privacy Concerns: While regulations drive adoption, managing and securing sensitive biometric and personal data collected by access control systems remains a significant challenge.

Emerging Opportunities in Japan Access Control Market

Emerging opportunities within the Japan Access Control Market lie in the continued expansion of cloud-based access control solutions, offering enhanced scalability and remote management capabilities for businesses of all sizes. The increasing demand for contactless and hygienic access methods presents a significant opportunity for the widespread adoption of biometric readers and advanced mobile credential technologies. Furthermore, the integration of access control with building management systems (BMS) and other IoT devices to create truly smart and automated environments offers a fertile ground for innovation. The residential sector, driven by the smart home trend, represents an untapped market for user-friendly and aesthetically pleasing access control solutions. The development of AI-powered analytics for access control systems, providing insights into building occupancy and security patterns, also presents a significant growth avenue.

Growth Accelerators in the Japan Access Control Market Industry

Several key catalysts are accelerating the growth of the Japan Access Control Market. The continuous pursuit of enhanced cybersecurity by businesses and governments is a major driver, pushing for more robust and multi-layered access control solutions. Technological breakthroughs in biometric authentication, such as liveness detection and multi-modal biometrics, are improving accuracy and reliability, making them more attractive alternatives to traditional methods. The increasing digitalization of various industries, including healthcare and transportation, necessitates secure and efficient access management, further boosting market expansion. Strategic partnerships between hardware manufacturers, software developers, and system integrators are also crucial, enabling the creation of comprehensive and tailored solutions for diverse end-user needs. Finally, the growing adoption of mobile-based access control offers a significant growth spurt by leveraging the ubiquity of smartphones.

Key Players Shaping the Japan Access Control Market Market

- Hanwha Techwin Co Ltd

- Thales Group (Gemalto NV)

- Bosch Security System Inc

- HID Global Corporation

- Honeywell International Inc

- Tyco International PLC (Johnson Controls)

- Allegion PLC

- ASSA ABLOY AB Group

- Schneider Electric SE

- Panasonic Corporation

- Brivo Systems LLC

- Identiv Inc

- Dormakaba Holding AG

- NEC Corporation

- Idemia Group

- Axis Communications AB

- Dahua Technology

- Genetec Inc

- BioConnect Inc

Notable Milestones in Japan Access Control Market Sector

- April 2024: ASSA ABLOY launched Centrios, a mobile-first access control business within the company, to provide small businesses with advanced mobile-first access control solutions. Centrios offers distributors, integrators, locksmiths, and security professionals the opportunity to grow their businesses through a thoughtful partnership program.

- April 2024: Johnson Controls showcased its portfolio of in-house developed and cyber-hardened access control and video surveillance solutions for enterprise applications during ISC West. Also, the OSDP G2-RM-4E Door Control Module offers unique flexibility, working in both OSDP mode and legacy “RM” mode to enable convenient backward compatibility, which is key to a cost-effective security system update.

In-Depth Japan Access Control Market Market Outlook

The Japan Access Control Market is on a robust upward trajectory, fueled by relentless technological innovation and an ever-increasing demand for secure and integrated access management solutions. The market is expected to witness sustained growth driven by the widespread adoption of advanced technologies such as AI-powered analytics, cloud-based platforms, and sophisticated biometric readers. Strategic partnerships and acquisitions will continue to shape the competitive landscape, leading to more comprehensive and specialized offerings. The increasing focus on contactless and hygienic access methods, coupled with the integration of access control into the broader smart building ecosystem, presents significant future market potential. Organizations that can effectively leverage these trends and offer solutions that balance high security with user convenience and seamless integration will be well-positioned for success in this dynamic market.

Japan Access Control Market Segmentation

-

1. Type

-

1.1. Card Reader and Access Control Devices

- 1.1.1. Card-based

- 1.1.2. Proximity

- 1.1.3. Smartcard (Contact and Contactless)

- 1.2. Biometric Readers

- 1.3. Electronic Locks

- 1.4. Software

- 1.5. Other Types

-

1.1. Card Reader and Access Control Devices

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Residential

- 2.3. Government

- 2.4. Industrial

- 2.5. Transport and Logistics

- 2.6. Healthcare

- 2.7. Military and Defense

- 2.8. Other End-user Verticals

Japan Access Control Market Segmentation By Geography

- 1. Japan

Japan Access Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements

- 3.4. Market Trends

- 3.4.1. The Smart Card Segment is Expected to Register Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Access Control Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Card Reader and Access Control Devices

- 5.1.1.1. Card-based

- 5.1.1.2. Proximity

- 5.1.1.3. Smartcard (Contact and Contactless)

- 5.1.2. Biometric Readers

- 5.1.3. Electronic Locks

- 5.1.4. Software

- 5.1.5. Other Types

- 5.1.1. Card Reader and Access Control Devices

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Government

- 5.2.4. Industrial

- 5.2.5. Transport and Logistics

- 5.2.6. Healthcare

- 5.2.7. Military and Defense

- 5.2.8. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hanwha Techwin Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thales Group (Gemalto NV)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bosch Security System Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HID Global Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honeywell International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tyco International PLC (Johnson Controls)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allegion PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ASSA ABLOY AB Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Brivo Systems LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Identiv Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dormakaba Holding AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NEC Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Idemia Group

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Axis Communications AB

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Dahua Technology

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Genetec Inc

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 BioConnect Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Hanwha Techwin Co Ltd

List of Figures

- Figure 1: Japan Access Control Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Access Control Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Access Control Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Access Control Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Japan Access Control Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Japan Access Control Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Japan Access Control Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Japan Access Control Market Volume Million Forecast, by End-user Vertical 2019 & 2032

- Table 7: Japan Access Control Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Access Control Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Japan Access Control Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Japan Access Control Market Volume Million Forecast, by Type 2019 & 2032

- Table 11: Japan Access Control Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Japan Access Control Market Volume Million Forecast, by End-user Vertical 2019 & 2032

- Table 13: Japan Access Control Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Japan Access Control Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Access Control Market?

The projected CAGR is approximately 7.91%.

2. Which companies are prominent players in the Japan Access Control Market?

Key companies in the market include Hanwha Techwin Co Ltd, Thales Group (Gemalto NV), Bosch Security System Inc, HID Global Corporation, Honeywell International Inc, Tyco International PLC (Johnson Controls), Allegion PLC, ASSA ABLOY AB Group, Schneider Electric SE, Panasonic Corporation, Brivo Systems LLC, Identiv Inc, Dormakaba Holding AG, NEC Corporation, Idemia Group, Axis Communications AB, Dahua Technology, Genetec Inc, BioConnect Inc.

3. What are the main segments of the Japan Access Control Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 640 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements.

6. What are the notable trends driving market growth?

The Smart Card Segment is Expected to Register Significant Growth in the Market.

7. Are there any restraints impacting market growth?

Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats; Technological Advancements.

8. Can you provide examples of recent developments in the market?

April 2024: ASSA ABLOY launched Centrios, a mobile-first access control business within the company, to provide small businesses with advanced mobile-first access control solutions. Centrios offers distributors, integrators, locksmiths, and security professionals the opportunity to grow their businesses through a thoughtful partnership program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Access Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Access Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Access Control Market?

To stay informed about further developments, trends, and reports in the Japan Access Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence