Key Insights

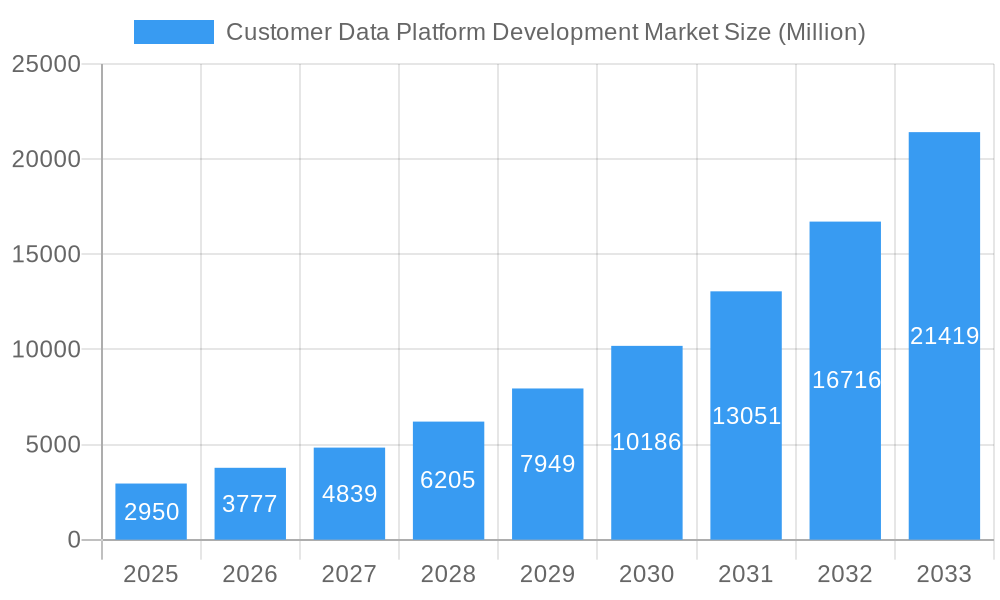

The Customer Data Platform (CDP) Development Market is poised for explosive growth, projected to reach USD 2.95 billion with a remarkable Compound Annual Growth Rate (CAGR) of 27.91% during the forecast period of 2025-2033. This surge is primarily driven by the escalating need for businesses to unify and activate disparate customer data sources into a single, comprehensive view. Companies are increasingly recognizing the strategic imperative of leveraging this unified data to deliver personalized customer experiences, enhance marketing ROI, and optimize operational efficiency. The proliferation of digital channels and the consequent explosion of customer touchpoints have created a complex data landscape, making robust CDP solutions indispensable for effective customer engagement and competitive advantage. The market's robust expansion signifies a fundamental shift in how organizations approach customer relationship management and data utilization.

Customer Data Platform Development Market Market Size (In Billion)

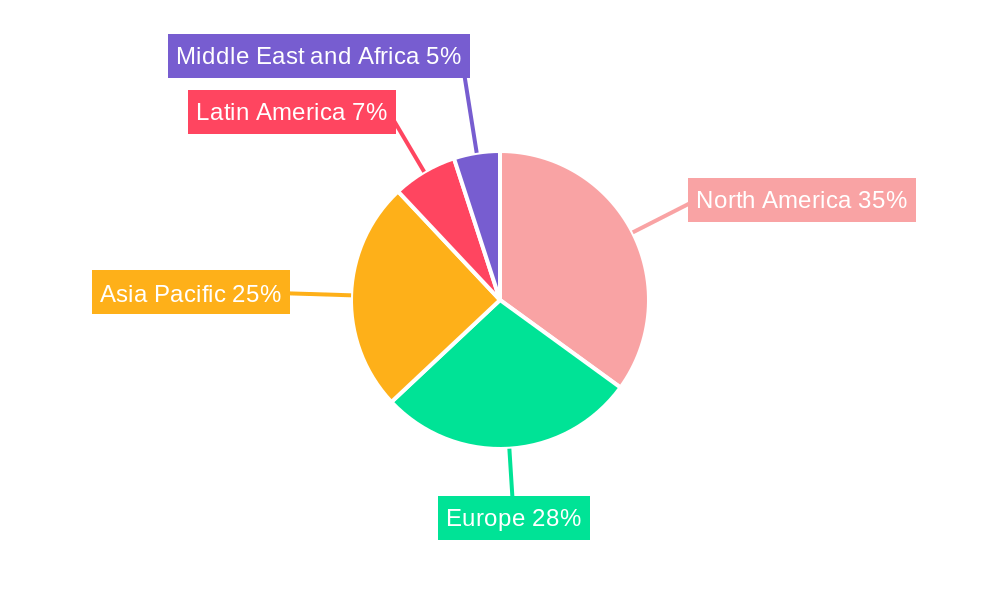

Key market drivers fueling this expansion include the growing demand for hyper-personalization in marketing and customer service, the imperative for enhanced data privacy and compliance amidst evolving regulations, and the increasing adoption of AI and machine learning for advanced customer analytics and predictive modeling within CDP platforms. Cloud deployment models are expected to dominate, offering scalability, flexibility, and cost-effectiveness, though on-premise solutions will continue to cater to specific enterprise needs regarding data security and control. Small and medium-sized enterprises (SMEs) are increasingly recognizing the value of CDPs to compete with larger players, alongside large enterprises seeking to refine their existing customer data strategies. The Retail & E-commerce, BFSI, and IT & Telecommunication sectors are leading the charge in CDP adoption, followed closely by Media & Entertainment and Healthcare, all seeking to harness the power of unified customer data for improved outcomes. The market's growth is geographically widespread, with North America and Europe currently leading, while the Asia Pacific region is exhibiting particularly strong growth potential due to its rapidly expanding digital economy and increasing focus on customer-centric strategies.

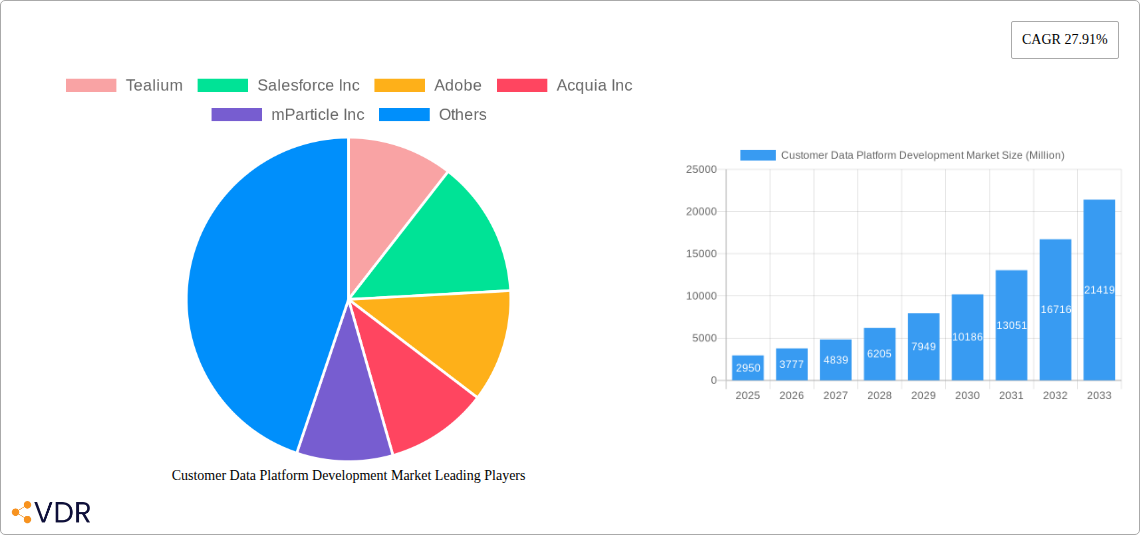

Customer Data Platform Development Market Company Market Share

This comprehensive report delves into the dynamic Customer Data Platform (CDP) development market, analyzing its growth trajectory, key drivers, and future outlook. The market is poised for significant expansion as businesses increasingly prioritize unified customer views to deliver personalized experiences and optimize marketing efforts. This study covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033. We explore the intricate parent and child market structures, providing deep insights into deployment modes, organization sizes, and end-user verticals.

Customer Data Platform Development Market Dynamics & Structure

The Customer Data Platform development market is characterized by a moderately concentrated landscape, with a blend of established technology giants and agile specialists vying for market share. Technological innovation is the primary driver, fueled by the escalating demand for sophisticated customer analytics, real-time data unification, and AI-powered personalization. Regulatory frameworks, particularly data privacy laws like GDPR and CCPA, are shaping development strategies and fostering trust. While competitive product substitutes exist, such as Customer Relationship Management (CRM) systems and data warehouses, CDPs offer a distinct advantage in unifying disparate customer data sources for a single, actionable view. End-user demographics are expanding, with a growing adoption across various industries seeking to enhance customer engagement. Mergers and acquisitions (M&A) are prevalent, with companies consolidating capabilities to offer more robust CDP solutions. For instance, recent M&A activities in the CDP space have seen a XX% increase in deal volume over the historical period. Barriers to innovation include the complexity of data integration from diverse sources and the need for skilled personnel to manage and leverage CDP capabilities effectively.

- Market Concentration: Moderately concentrated with key players like Tealium, Salesforce Inc, Adobe, and Oracle.

- Technological Innovation Drivers: Demand for real-time data unification, AI-driven personalization, predictive analytics.

- Regulatory Frameworks: Growing influence of data privacy regulations (GDPR, CCPA) driving compliant CDP development.

- Competitive Product Substitutes: CRM systems, data warehouses, marketing automation platforms; CDPs offer superior data unification.

- End-User Demographics: Broadening adoption across Retail & E-commerce, BFSI, Media & Entertainment, IT & Telecommunication, Healthcare.

- M&A Trends: Active consolidation to enhance product portfolios and expand market reach.

- Innovation Barriers: Data silos, integration complexity, talent shortage.

Customer Data Platform Development Market Growth Trends & Insights

The global Customer Data Platform development market is projected to witness robust growth, driven by the imperative for businesses to move beyond fragmented customer data towards a unified, actionable 360-degree view. The market size is expected to expand from an estimated USD XXX million in 2025 to USD XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This significant expansion is underpinned by increasing adoption rates across Small and Medium Enterprises (SMEs) and Large Enterprises alike, who are recognizing the tangible ROI of personalized customer journeys. Technological disruptions, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) into CDP functionalities, are revolutionizing how data is collected, analyzed, and utilized for hyper-personalization. For example, the integration of generative AI tools, as announced by Adobe in March 2023, signifies a paradigm shift in content creation and marketing alignment directly within the CDP. Consumer behavior is also a key influencer; empowered by digital access, customers now expect seamless, individualized interactions across all touchpoints, pushing organizations to invest in CDP solutions that can deliver such experiences. The market penetration of CDPs, which stood at approximately XX% in 2024, is anticipated to climb steadily as more businesses understand the strategic advantage of unified customer data. The shift from basic data collection to sophisticated customer journey orchestration is a defining trend. Furthermore, the ability of CDPs to ingest and process data from an ever-increasing number of sources – including web, mobile, social media, CRM, and transactional systems – is crucial in today's data-rich environment. This comprehensive data ingestion capability allows for a more accurate and holistic understanding of customer preferences, behaviors, and intent. The forecast period will likely see increased emphasis on real-time data activation, enabling immediate responses to customer actions and fostering more effective engagement strategies. The evolution of CDPs also includes advancements in identity resolution techniques, ensuring that individual customer profiles are accurately stitched together across various devices and platforms, thereby minimizing data duplication and enhancing data integrity.

Dominant Regions, Countries, or Segments in Customer Data Platform Development Market

North America currently stands as the dominant region in the Customer Data Platform development market, driven by its early adoption of advanced marketing technologies, a strong presence of key technology vendors, and a robust digital economy. The United States, in particular, represents a significant share of this dominance, fueled by its large base of retail and e-commerce businesses, financial institutions, and media companies actively seeking to leverage data for competitive advantage. The Cloud deployment mode segment is the primary growth engine within the CDP market, accounting for an estimated XX% of the total market share in 2025. This dominance is attributed to the scalability, flexibility, and cost-effectiveness offered by cloud-based solutions, enabling organizations of all sizes to implement and manage CDPs without substantial upfront infrastructure investments. Large Enterprises are also significant contributors to market growth, with their substantial data volumes and complex customer engagement strategies necessitating sophisticated CDP solutions. However, the Small and Medium Enterprises (SMEs) segment is exhibiting a higher CAGR, indicating a growing awareness and adoption of CDPs among smaller businesses looking to compete with larger players through enhanced personalization.

In terms of end-users, the Retail and E-commerce sector remains the leading segment, driven by the intense competition and the critical need for personalized shopping experiences, targeted promotions, and efficient customer retention strategies. This sector is expected to contribute approximately XX% to the market revenue by 2025. The BFSI (Banking, Financial Services, and Insurance) sector is also a major driver, utilizing CDPs to improve customer onboarding, personalize financial advice, and enhance fraud detection through unified data insights. The IT and Telecommunication sector is another key adopter, leveraging CDPs to manage complex customer relationships and offer tailored service packages.

- Dominant Region: North America, with the United States as a key contributor.

- Dominant Deployment Mode: Cloud, accounting for an estimated XX% of the market share in 2025.

- Dominant Organization Size: Large Enterprises are major contributors, with SMEs showing a higher CAGR.

- Dominant End-User: Retail and E-commerce, expected to contribute XX% to market revenue by 2025.

- Key Drivers of Dominance:

- North America: Early tech adoption, strong vendor presence, robust digital economy.

- Cloud Deployment: Scalability, flexibility, cost-effectiveness, ease of implementation.

- Large Enterprises: High data volumes, complex engagement needs.

- SMEs: Growing awareness, need to compete through personalization.

- Retail & E-commerce: Intense competition, demand for personalization, customer retention.

- BFSI: Customer onboarding, personalized financial advice, fraud detection.

Customer Data Platform Development Market Product Landscape

The Customer Data Platform development market is defined by a continuous stream of product innovations aimed at enhancing data unification, activation, and intelligence. Modern CDPs offer sophisticated features for real-time data ingestion from a multitude of sources, advanced identity resolution capabilities for creating single customer views, and robust segmentation tools for targeted marketing. Performance metrics are increasingly focused on the speed of data processing, the accuracy of customer profiling, and the effectiveness of campaign personalization. Unique selling propositions often revolve around seamless integration with existing marketing stacks, AI-powered predictive analytics, and compliance with evolving data privacy regulations. Technological advancements are pushing the boundaries of what CDPs can achieve, enabling dynamic customer journey orchestration and proactive engagement strategies.

Key Drivers, Barriers & Challenges in Customer Data Platform Development Market

The Customer Data Platform development market is propelled by several key drivers. The escalating demand for personalized customer experiences across all touchpoints is paramount, as businesses recognize that tailored interactions drive higher engagement and loyalty. The need for a unified view of the customer, breaking down data silos and enabling a 360-degree perspective, is another significant catalyst. Technological advancements in AI and ML are empowering CDPs with predictive analytics and intelligent automation capabilities. Furthermore, the growing importance of data privacy compliance, such as GDPR and CCPA, is driving the adoption of CDPs that can manage consent and ensure responsible data usage.

Conversely, the market faces several challenges and restraints. The complexity of integrating data from diverse and often legacy systems remains a significant hurdle, requiring substantial technical expertise and resources. High implementation costs and the ongoing need for skilled personnel to manage and leverage CDP effectively can be a barrier, particularly for SMEs. The evolving regulatory landscape, while a driver for some, can also present challenges in terms of compliance complexities. Moreover, fierce competition among CDP vendors and the presence of alternative solutions can create market fragmentation. Supply chain issues, though less direct, can impact the availability of hardware and software components crucial for some on-premise deployments.

Emerging Opportunities in Customer Data Platform Development Market

Emerging opportunities within the Customer Data Platform development market lie in several key areas. The increasing adoption of CDPs in emerging economies and developing markets presents a significant untapped potential. The application of CDPs in niche industries, beyond the traditional retail and BFSI sectors, such as non-profit organizations and government agencies, offers new avenues for growth. The integration of advanced AI capabilities, including generative AI for content personalization and predictive AI for customer churn prevention, represents a major opportunity to enhance CDP value propositions. Evolving consumer preferences for hyper-personalized and context-aware interactions will continue to drive demand for CDPs that can facilitate these experiences. Furthermore, the development of industry-specific CDP solutions tailored to the unique data challenges and regulatory requirements of sectors like healthcare and manufacturing will open up new market segments.

Growth Accelerators in the Customer Data Platform Development Market Industry

Several growth accelerators are poised to propel the Customer Data Platform development market forward. Technological breakthroughs in areas like real-time data processing, enhanced identity resolution, and advanced AI/ML algorithms will continue to refine CDP capabilities, making them more powerful and accessible. Strategic partnerships between CDP providers and complementary technology vendors, such as marketing automation platforms, CRM providers, and analytics tools, will foster integrated ecosystems and expand market reach. Market expansion strategies, including geographical expansion into underserved regions and increased focus on enterprise-wide CDP implementations, will also contribute to sustained growth. The ongoing digital transformation initiatives across industries globally provide a fertile ground for CDP adoption as businesses prioritize customer-centric strategies.

Key Players Shaping the Customer Data Platform Development Market Market

- Tealium

- Salesforce Inc

- Adobe

- Acquia Inc

- mParticle Inc

- Twilio Inc

- Zeta Global Corp

- Oracle

- SAP SE

- BlueConic

Notable Milestones in Customer Data Platform Development Market Sector

- August 2023: Twilio announced a new CDP tool that unites data for more personalization. Twilio's new tool uses its customer data platform, Segment, to connect real-time unified customer profiles with isolated data and boost marketing customization for better CX.

- March 2023: Adobe announced its plans to weave generative artificial intelligence tools in Adobe's realtime customer data platform through Sensei, its artificial intelligence and machine learning technologies, where Adobe's advertisers will be able to train AI models with their own data and content in Adobe's Customer Data Platform so that the output is aligned with their brand style, said Ryan Fleisch, Adobe's product marketing manager for Adobe's Customer Data Platform.

In-Depth Customer Data Platform Development Market Market Outlook

The future outlook for the Customer Data Platform development market is exceptionally bright, driven by the fundamental shift towards data-driven, customer-centric business models. Growth accelerators, including continuous technological innovation in AI and data analytics, strategic alliances that create unified customer experience ecosystems, and aggressive market expansion by key players into new geographies and industry verticals, will all contribute to sustained expansion. The increasing recognition of CDPs as a critical component for achieving competitive advantage in hyper-personalized marketing, improving customer retention, and optimizing operational efficiency will further solidify its market position. The market is expected to witness a surge in demand for CDPs that offer enhanced real-time capabilities, robust privacy controls, and seamless integration with an ever-growing MarTech stack, ensuring a future where unified customer insights are paramount to business success.

Customer Data Platform Development Market Segmentation

-

1. Deployment Mode

- 1.1. Cloud

- 1.2. On-premise

-

2. Organization Size

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. End-User

- 3.1. Retail And E-commerce

- 3.2. BFSI

- 3.3. Media And Entertainment

- 3.4. IT and Telecommunication

- 3.5. Healthcare

- 3.6. Other End-users

Customer Data Platform Development Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Customer Data Platform Development Market Regional Market Share

Geographic Coverage of Customer Data Platform Development Market

Customer Data Platform Development Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Importance of Customer Satisfaction and Relationship Maintenance4.; Increase In Real-time and Personalized Data Analysis

- 3.3. Market Restrains

- 3.3.1. 4.; Data Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Healthcare is Expected To Drive The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Customer Data Platform Development Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Retail And E-commerce

- 5.3.2. BFSI

- 5.3.3. Media And Entertainment

- 5.3.4. IT and Telecommunication

- 5.3.5. Healthcare

- 5.3.6. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6. North America Customer Data Platform Development Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Retail And E-commerce

- 6.3.2. BFSI

- 6.3.3. Media And Entertainment

- 6.3.4. IT and Telecommunication

- 6.3.5. Healthcare

- 6.3.6. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7. Europe Customer Data Platform Development Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Retail And E-commerce

- 7.3.2. BFSI

- 7.3.3. Media And Entertainment

- 7.3.4. IT and Telecommunication

- 7.3.5. Healthcare

- 7.3.6. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8. Asia Pacific Customer Data Platform Development Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Retail And E-commerce

- 8.3.2. BFSI

- 8.3.3. Media And Entertainment

- 8.3.4. IT and Telecommunication

- 8.3.5. Healthcare

- 8.3.6. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9. Latin America Customer Data Platform Development Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Retail And E-commerce

- 9.3.2. BFSI

- 9.3.3. Media And Entertainment

- 9.3.4. IT and Telecommunication

- 9.3.5. Healthcare

- 9.3.6. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10. Middle East and Africa Customer Data Platform Development Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Small and Medium Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Retail And E-commerce

- 10.3.2. BFSI

- 10.3.3. Media And Entertainment

- 10.3.4. IT and Telecommunication

- 10.3.5. Healthcare

- 10.3.6. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tealium

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Salesforce Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adobe

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Acquia Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 mParticle Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Twilio Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zeta Global Corp*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oracle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SAP SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BlueConic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tealium

List of Figures

- Figure 1: Global Customer Data Platform Development Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Customer Data Platform Development Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 3: North America Customer Data Platform Development Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 4: North America Customer Data Platform Development Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America Customer Data Platform Development Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Customer Data Platform Development Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Customer Data Platform Development Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Customer Data Platform Development Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Customer Data Platform Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Customer Data Platform Development Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 11: Europe Customer Data Platform Development Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 12: Europe Customer Data Platform Development Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 13: Europe Customer Data Platform Development Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Customer Data Platform Development Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Customer Data Platform Development Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Customer Data Platform Development Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Customer Data Platform Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Customer Data Platform Development Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 19: Asia Pacific Customer Data Platform Development Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 20: Asia Pacific Customer Data Platform Development Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific Customer Data Platform Development Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific Customer Data Platform Development Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Customer Data Platform Development Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Customer Data Platform Development Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Customer Data Platform Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Customer Data Platform Development Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 27: Latin America Customer Data Platform Development Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 28: Latin America Customer Data Platform Development Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Latin America Customer Data Platform Development Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Latin America Customer Data Platform Development Market Revenue (Million), by End-User 2025 & 2033

- Figure 31: Latin America Customer Data Platform Development Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Latin America Customer Data Platform Development Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Customer Data Platform Development Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Customer Data Platform Development Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 35: Middle East and Africa Customer Data Platform Development Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 36: Middle East and Africa Customer Data Platform Development Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 37: Middle East and Africa Customer Data Platform Development Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Middle East and Africa Customer Data Platform Development Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: Middle East and Africa Customer Data Platform Development Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East and Africa Customer Data Platform Development Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Customer Data Platform Development Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Customer Data Platform Development Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 2: Global Customer Data Platform Development Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global Customer Data Platform Development Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Customer Data Platform Development Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Customer Data Platform Development Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 6: Global Customer Data Platform Development Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 7: Global Customer Data Platform Development Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Customer Data Platform Development Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Customer Data Platform Development Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 10: Global Customer Data Platform Development Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 11: Global Customer Data Platform Development Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Customer Data Platform Development Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Customer Data Platform Development Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 14: Global Customer Data Platform Development Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 15: Global Customer Data Platform Development Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Customer Data Platform Development Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Customer Data Platform Development Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 18: Global Customer Data Platform Development Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 19: Global Customer Data Platform Development Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Customer Data Platform Development Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Customer Data Platform Development Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 22: Global Customer Data Platform Development Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 23: Global Customer Data Platform Development Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 24: Global Customer Data Platform Development Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Customer Data Platform Development Market?

The projected CAGR is approximately 27.91%.

2. Which companies are prominent players in the Customer Data Platform Development Market?

Key companies in the market include Tealium, Salesforce Inc, Adobe, Acquia Inc, mParticle Inc, Twilio Inc, Zeta Global Corp*List Not Exhaustive, Oracle, SAP SE, BlueConic.

3. What are the main segments of the Customer Data Platform Development Market?

The market segments include Deployment Mode, Organization Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.95 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Importance of Customer Satisfaction and Relationship Maintenance4.; Increase In Real-time and Personalized Data Analysis.

6. What are the notable trends driving market growth?

Healthcare is Expected To Drive The Market Growth.

7. Are there any restraints impacting market growth?

4.; Data Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

August 2023, Twilio announced a new CDP tool that unites data for more personalization; Twilio's new tool uses its customer data platform, Segment, to connect real-time unified customer profiles with isolated data and boost marketing customization for better CX.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Customer Data Platform Development Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Customer Data Platform Development Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Customer Data Platform Development Market?

To stay informed about further developments, trends, and reports in the Customer Data Platform Development Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence