Key Insights

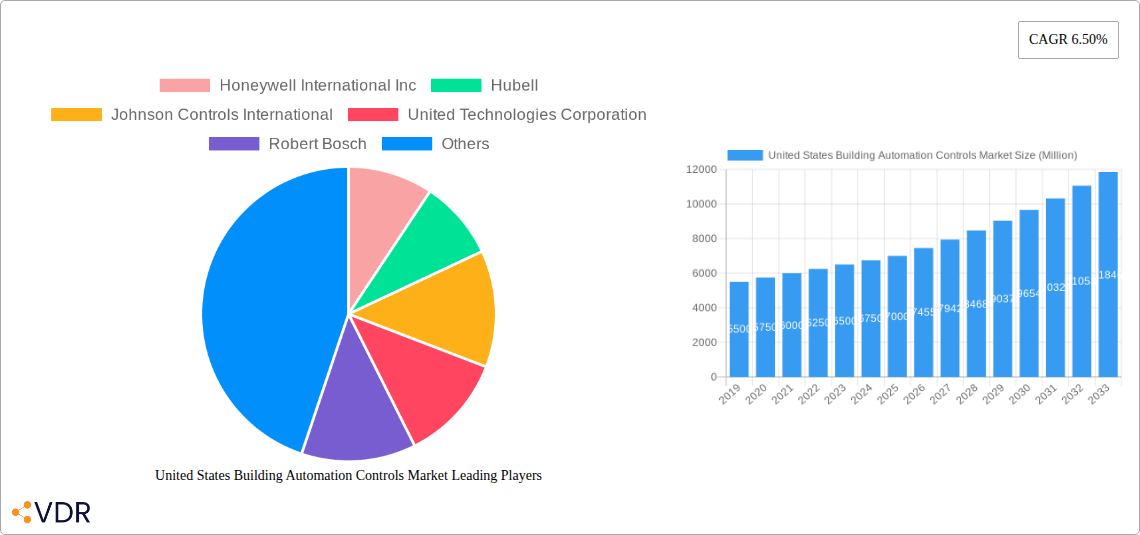

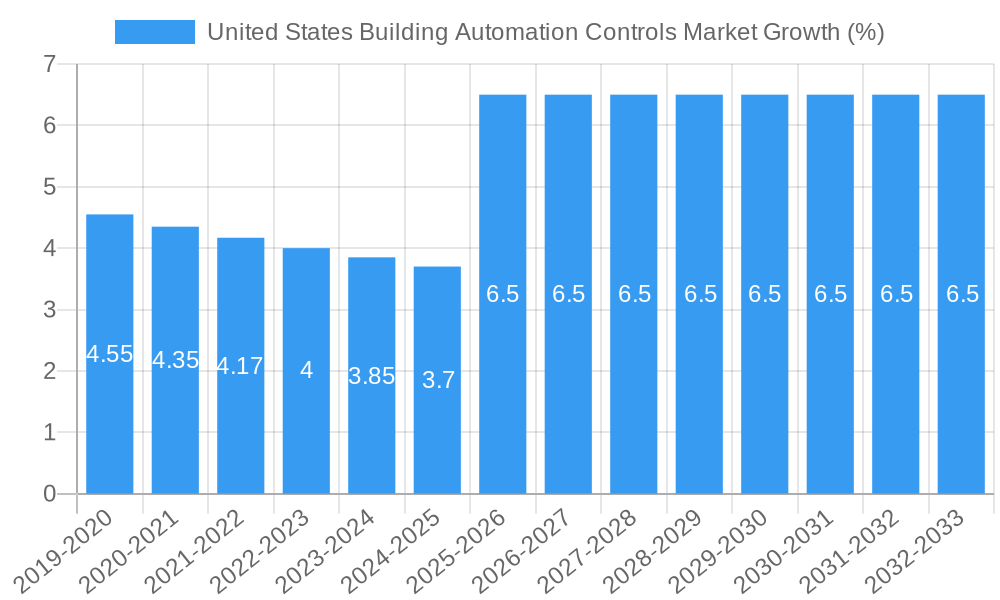

The United States Building Automation Controls (BAC) market is poised for significant expansion, driven by a confluence of factors including increasing energy efficiency mandates, growing adoption of smart building technologies, and the imperative for enhanced security and occupant comfort. With an estimated market size of approximately $7,500 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.50% through 2033, the market is expected to reach a substantial valuation, underscoring its dynamic nature. Key growth drivers include the escalating demand for integrated solutions that streamline building operations, reduce operational costs through optimized energy consumption, and improve the overall occupant experience. Furthermore, the continuous evolution of IoT (Internet of Things) technologies, artificial intelligence (AI), and advanced analytics is enabling more sophisticated and predictive building management systems, further fueling market penetration across residential, commercial, and industrial sectors.

The BAC market in the United States is characterized by a diverse range of segments, with Lighting Controls and HVAC Systems currently holding substantial market shares due to their direct impact on energy savings and comfort. However, the rapid advancements and increasing integration of Security and Access Control systems, alongside the critical role of Fire Protection Systems, are witnessing robust growth. The Software segment, particularly Building Energy Management Systems (BEMS), is emerging as a pivotal enabler, providing centralized control, data analytics, and actionable insights for building managers. Professional services, encompassing installation, maintenance, and consulting, are also crucial for the successful implementation and ongoing optimization of these complex systems. While the market benefits from strong growth drivers, restraints such as the high initial investment costs for some advanced systems and the need for skilled labor for installation and maintenance pose challenges. Nevertheless, the overarching trend towards sustainable and intelligent buildings is expected to propel the market forward, with companies like Honeywell, Johnson Controls, and Siemens leading the innovation and adoption curve.

Here's the SEO-optimized report description for the United States Building Automation Controls Market, crafted to maximize visibility and engagement.

This comprehensive report delves into the dynamic United States Building Automation Controls Market, providing an exhaustive analysis from 2019 to 2033. We offer granular insights into market size, growth trends, segmentation, and key player strategies, with a strong focus on parent and child market dynamics to uncover hidden growth avenues. Covering essential segments such as Lighting Controls, HVAC Systems, Security and Access Control, Fire Protection Systems, Software (BEMS), and Services (Professional), and end-user verticals like Residential, Commercial, and Industrial, this report is an indispensable resource for stakeholders seeking to capitalize on the evolving landscape of smart buildings.

United States Building Automation Controls Market Market Dynamics & Structure

The United States Building Automation Controls Market is characterized by a moderate to high concentration, with key players like Honeywell International Inc., Johnson Controls International, and Siemens AG holding significant market share. Technological innovation is a primary driver, fueled by advancements in IoT, AI, and cloud computing, enabling more sophisticated and integrated building management solutions. Stringent regulatory frameworks, particularly concerning energy efficiency and building safety standards, are also shaping market demand and product development. Competitive product substitutes are emerging, but integrated building automation systems offer a compelling value proposition through enhanced operational efficiency and occupant comfort. End-user demographics are shifting towards a greater demand for smart, connected, and sustainable buildings, particularly in the commercial and industrial sectors. Mergers and acquisitions (M&A) activity remains a strategic tool for market consolidation and technology acquisition, with an estimated XX M&A deals in the historical period. Innovation barriers include the high initial cost of implementation for smaller businesses and the need for skilled personnel to manage complex systems.

- Market Concentration: Moderate to high, driven by a few major global players.

- Technological Innovation: Propelled by IoT, AI, cloud computing, and data analytics.

- Regulatory Frameworks: Energy efficiency standards (e.g., ASHRAE), safety regulations, and smart city initiatives.

- Competitive Substitutes: Standalone smart devices versus integrated BACS solutions.

- End-User Demographics: Growing demand for energy-efficient, secure, and occupant-centric buildings.

- M&A Trends: Strategic acquisitions for technology integration and market expansion.

- Innovation Barriers: High upfront investment, interoperability challenges, and workforce skills gap.

United States Building Automation Controls Market Growth Trends & Insights

The United States Building Automation Controls Market is poised for robust growth, projected to expand at a significant CAGR of XX% during the forecast period. This expansion is underpinned by increasing awareness of energy conservation, rising utility costs, and the growing adoption of smart building technologies across residential, commercial, and industrial sectors. The market size is expected to reach an estimated USD XXXX Million units by 2033. Technological disruptions, such as the proliferation of AI-powered predictive maintenance and the integration of advanced sensor networks, are significantly enhancing the capabilities and appeal of building automation systems. Consumer behavior is shifting towards a preference for connected, convenient, and sustainable living and working environments, further accelerating the demand for smart building solutions. The penetration of BEMS software is witnessing a notable surge, driven by the need for centralized control and data-driven insights. Industry developments, including the growing emphasis on occupant well-being and indoor air quality management, are creating new avenues for growth in specialized control systems. The integration of renewable energy sources and the need for their efficient management within buildings will also contribute to market expansion. The increasing complexity of building infrastructure and the growing emphasis on operational efficiency are compelling facility managers and building owners to invest in sophisticated automation solutions.

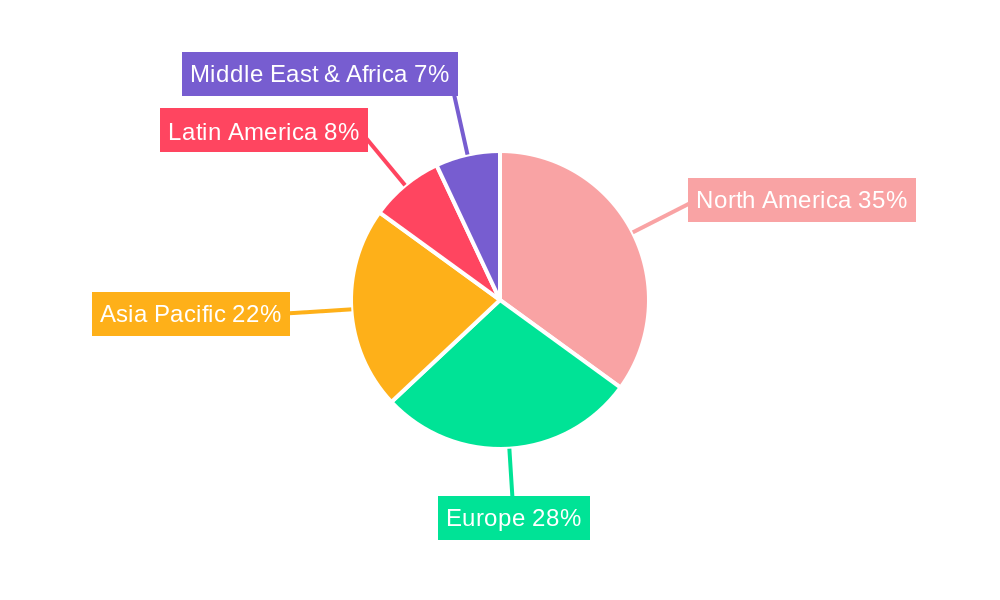

Dominant Regions, Countries, or Segments in United States Building Automation Controls Market

The Commercial segment within the United States Building Automation Controls Market is currently the dominant force driving market growth. This dominance is attributed to several factors, including the high concentration of large office buildings, retail spaces, and hospitality venues that prioritize energy efficiency, occupant comfort, and enhanced security. These facilities often have the capital investment capacity and the immediate need to optimize operational costs and meet stringent sustainability mandates. The HVAC Systems segment within the Type categorization is also a significant contributor to the commercial sector's dominance, given its crucial role in energy consumption and occupant comfort. Economic policies and federal incentives promoting energy-efficient building upgrades further bolster the commercial segment's growth. Furthermore, the increasing demand for smart office spaces and the integration of IoT technologies to create seamless working environments are propelling the adoption of advanced BEMS software and professional services. The industrial sector, with its focus on process optimization and safety, also presents a substantial and growing market for building automation controls. However, the sheer volume and value of installations in commercial real estate solidify its leading position.

- Leading Segment (End User): Commercial, driven by large-scale installations and operational efficiency demands.

- Key Drivers in Commercial: Energy cost reduction, regulatory compliance, occupant comfort, and enhanced security.

- Dominant Segment (Type): HVAC Systems, due to its significant energy footprint and impact on building performance.

- Supporting Factors: Favorable economic policies, growing trend of smart office spaces, and integration of IoT.

- Growth Potential: Strong outlook for the industrial sector driven by process automation and safety.

United States Building Automation Controls Market Product Landscape

The United States Building Automation Controls Market product landscape is characterized by continuous innovation and increasing sophistication. Key product developments include highly integrated BEMS platforms offering advanced analytics and predictive maintenance capabilities, smart thermostats with AI-driven learning algorithms for optimized energy usage, and sophisticated access control systems leveraging biometric and mobile credentials. Lighting controls are evolving to incorporate daylight harvesting and occupancy sensing for maximum energy savings and enhanced user experience. HVAC systems are becoming more energy-efficient, featuring variable speed drives and advanced zone control for precise temperature management. Security and access control solutions are integrating seamlessly with other building systems for unified threat management. Fire protection systems are incorporating smart sensors and networked alarms for faster and more accurate response. Software solutions are increasingly cloud-based, offering remote accessibility and scalability.

Key Drivers, Barriers & Challenges in United States Building Automation Controls Market

Key Drivers:

- Energy Efficiency Mandates: Government regulations and corporate sustainability goals are compelling the adoption of BACS.

- Operational Cost Reduction: Automation leads to significant savings in energy consumption, maintenance, and labor.

- Technological Advancements: IoT, AI, and cloud computing are enabling more intelligent and integrated building management.

- Occupant Comfort and Well-being: Growing demand for environments that enhance productivity and health.

- Smart City Initiatives: Integration of buildings into broader smart city ecosystems.

Barriers & Challenges:

- High Initial Investment: The upfront cost can be a deterrent for smaller businesses and older buildings.

- Interoperability Issues: Integrating systems from different manufacturers can be complex.

- Cybersecurity Concerns: Protecting sensitive building data from threats is paramount.

- Skilled Workforce Gap: A shortage of trained professionals for installation, maintenance, and operation.

- Retrofitting Complexity: Integrating BACS into existing structures can be challenging and costly.

- Supply Chain Disruptions: Potential for delays in component availability, impacting project timelines.

Emerging Opportunities in United States Building Automation Controls Market

Emerging opportunities lie in the growing demand for predictive maintenance solutions powered by AI, which can significantly reduce downtime and operational costs. The integration of BACS with renewable energy sources, such as solar and wind power, presents a substantial growth area for optimizing energy generation and consumption within buildings. The increasing focus on occupant health and well-being is driving demand for advanced indoor air quality (IAQ) monitoring and control systems. Furthermore, the expansion of smart home technologies into multi-unit residential buildings and the increasing use of BACS in older, retrofitted commercial spaces offer significant untapped market potential. The development of user-friendly, intuitive interfaces and mobile applications will also be crucial in capturing new customer segments.

Growth Accelerators in the United States Building Automation Controls Market Industry

Long-term growth in the United States Building Automation Controls Market will be accelerated by continuous technological breakthroughs, including advancements in machine learning for autonomous building operation and the development of more energy-efficient sensors and actuators. Strategic partnerships between BACS providers, IoT platform developers, and cybersecurity firms will foster greater integration and enhance system robustness. Market expansion strategies focusing on underserved segments, such as small and medium-sized enterprises (SMEs) and educational institutions, will unlock new revenue streams. The increasing adoption of digital twins for building design and management will also drive demand for sophisticated BACS solutions. Furthermore, evolving building codes and standards that emphasize smart building functionalities will act as significant growth catalysts.

Key Players Shaping the United States Building Automation Controls Market Market

- Honeywell International Inc.

- Hubbell

- Johnson Controls International

- United Technologies Corporation

- Robert Bosch

- Siemens AG

- Schneider Electric

- Delta Controls

- ABB Limited

- Lutron Electronics

- List Not Exhaustive

Notable Milestones in United States Building Automation Controls Market Sector

- 2019: Increased focus on cybersecurity in BACS, with major vendors launching enhanced security features.

- 2020: Accelerated adoption of cloud-based BEMS due to the rise of remote work and building management.

- 2021: Significant product launches in the smart HVAC control space, emphasizing energy efficiency and zone control.

- 2022: Growing integration of AI and machine learning for predictive maintenance and energy optimization.

- 2023: Increased M&A activity aimed at consolidating market share and acquiring innovative technologies.

- 2024: Growing emphasis on occupant well-being and IAQ monitoring features within BACS solutions.

In-Depth United States Building Automation Controls Market Market Outlook

The future outlook for the United States Building Automation Controls Market is exceptionally positive, driven by sustained technological innovation and a growing societal emphasis on sustainability and efficiency. Growth accelerators will continue to propel market expansion, with the integration of AI for autonomous building operations and the increasing adoption of BEMS software expected to be key differentiators. Strategic partnerships and market expansion into new verticals and customer segments will further solidify the market's growth trajectory. The continued evolution of smart city initiatives and the demand for resilient, energy-efficient infrastructure will create enduring opportunities for advanced building automation solutions. The market is poised to witness substantial growth, offering significant strategic opportunities for stakeholders to invest and innovate.

United States Building Automation Controls Market Segmentation

-

1. Type

- 1.1. Lighting Controls

- 1.2. HVAC Systems

- 1.3. Security and Access Control

- 1.4. Fire Protection Systems

- 1.5. Software(BEMS)

- 1.6. Services(Professional)

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

United States Building Automation Controls Market Segmentation By Geography

- 1. United States

United States Building Automation Controls Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable local regulations driving adoption of security & fire protection systems; Rising demand for energy efficient buildings in the region; Technological advancements in the field of IoT & wireless infrastructure

- 3.3. Market Restrains

- 3.3.1. Cost Implications In Line With Retrofits; European Macroeconomic and Geopolitical Factors

- 3.4. Market Trends

- 3.4.1. Fire Protection Systems are one of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Building Automation Controls Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lighting Controls

- 5.1.2. HVAC Systems

- 5.1.3. Security and Access Control

- 5.1.4. Fire Protection Systems

- 5.1.5. Software(BEMS)

- 5.1.6. Services(Professional)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States Building Automation Controls Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Building Automation Controls Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Building Automation Controls Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of the World United States Building Automation Controls Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hubell

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Johnson Controls International

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 United Technologies Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Robert Bosch

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Delta Controls

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ABB Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Lutron Electronics*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: United States Building Automation Controls Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Building Automation Controls Market Share (%) by Company 2024

List of Tables

- Table 1: United States Building Automation Controls Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Building Automation Controls Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Building Automation Controls Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: United States Building Automation Controls Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Building Automation Controls Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Building Automation Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Building Automation Controls Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Building Automation Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Building Automation Controls Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Building Automation Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Building Automation Controls Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Building Automation Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Building Automation Controls Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: United States Building Automation Controls Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: United States Building Automation Controls Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Building Automation Controls Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the United States Building Automation Controls Market?

Key companies in the market include Honeywell International Inc, Hubell, Johnson Controls International, United Technologies Corporation, Robert Bosch, Siemens AG, Schneider Electric, Delta Controls, ABB Limited, Lutron Electronics*List Not Exhaustive.

3. What are the main segments of the United States Building Automation Controls Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable local regulations driving adoption of security & fire protection systems; Rising demand for energy efficient buildings in the region; Technological advancements in the field of IoT & wireless infrastructure.

6. What are the notable trends driving market growth?

Fire Protection Systems are one of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

Cost Implications In Line With Retrofits; European Macroeconomic and Geopolitical Factors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Building Automation Controls Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Building Automation Controls Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Building Automation Controls Market?

To stay informed about further developments, trends, and reports in the United States Building Automation Controls Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence