Key Insights

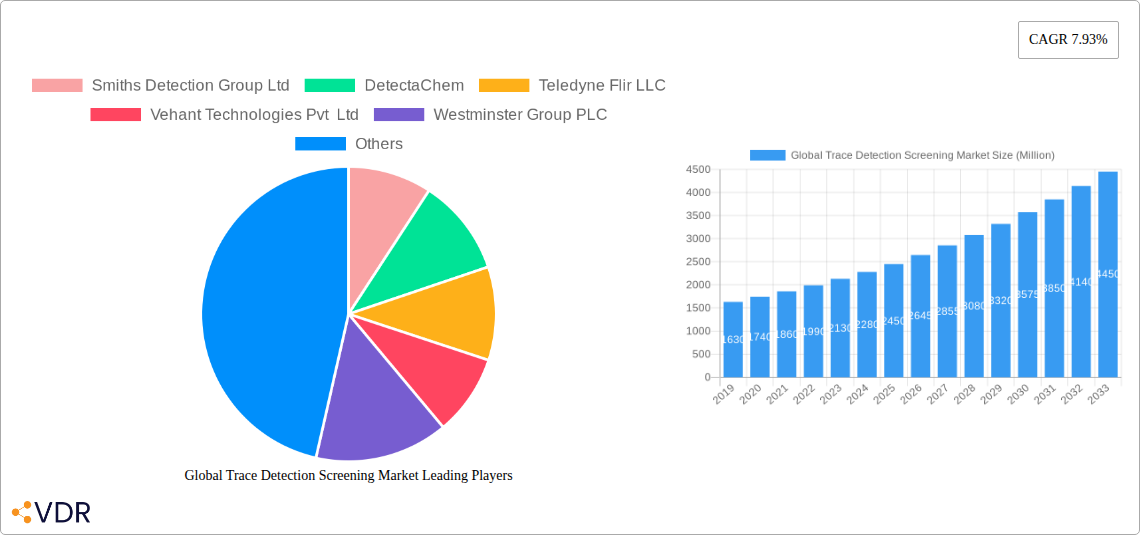

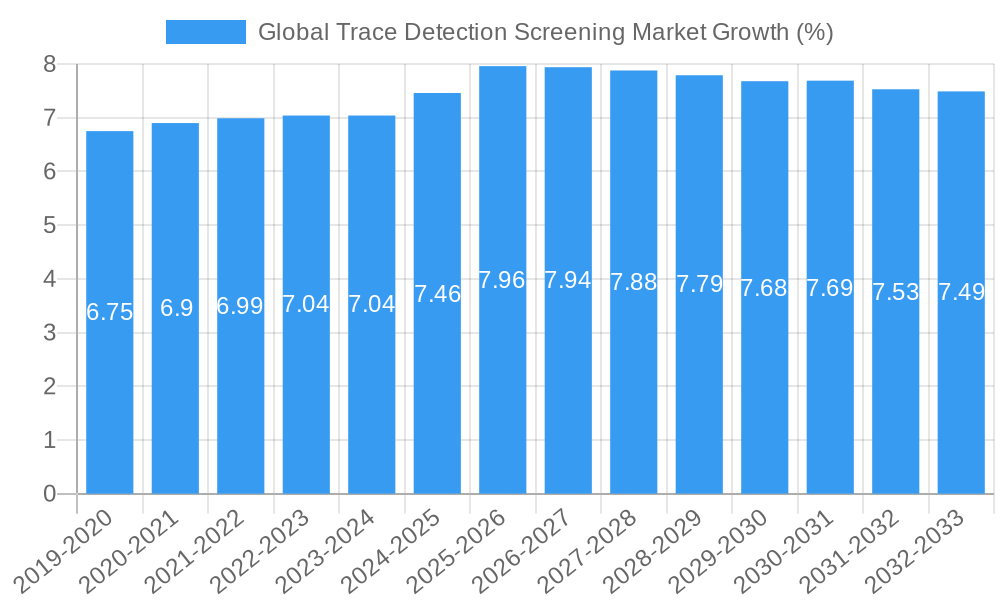

The Global Trace Detection Screening Market is poised for significant expansion, projected to reach a substantial valuation by 2033. With a robust Compound Annual Growth Rate (CAGR) of 7.93%, the market's estimated size in 2025 stands at USD 2.45 billion. This upward trajectory is primarily propelled by escalating global security concerns and the increasing need for advanced threat detection solutions across various sectors. The demand for sophisticated trace detection systems is driven by the imperative to identify minute traces of explosives, narcotics, and other hazardous substances, thereby safeguarding public spaces, critical infrastructure, and transportation hubs. Advancements in technology, including the development of more sensitive and user-friendly handheld and portable devices, are further fueling market growth. These innovations enable faster and more accurate screening, contributing to enhanced operational efficiency for law enforcement, military and defense organizations, and commercial entities alike.

The market is characterized by diverse segments, catering to a broad spectrum of applications. The "Explosives" and "Narcotics" categories represent key areas of focus, reflecting the ongoing global fight against terrorism and illicit drug trafficking. In terms of product type, the market is witnessing a strong demand for "Handheld" and "Portable/Movable" devices due to their flexibility and ease of deployment. However, "Fixed" detection systems also maintain a significant presence, particularly in high-security environments. The primary end-user industries driving this market include "Law Enforcement," "Military and Defense," and "Public Safety," where the stakes are highest. The "Commercial" sector, including airports and shipping ports, is also a crucial growth area, alongside "Ports and Borders" operations. Emerging trends point towards the integration of artificial intelligence and machine learning into detection systems for improved identification accuracy and reduced false alarms, alongside a growing emphasis on non-invasive and rapid screening technologies to minimize disruption in busy environments.

This comprehensive report provides an in-depth analysis of the global trace detection screening market, a critical sector safeguarding public and private spaces against threats. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report leverages extensive data to deliver actionable insights for industry stakeholders. Explore market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities within this vital security domain. We delve into the parent and child market segments, offering a granular view of the evolving trace detection technology landscape.

Global Trace Detection Screening Market Market Dynamics & Structure

The global trace detection screening market is characterized by a moderate to high degree of market concentration, with a few key players dominating innovation and market share. Technological innovation is a primary driver, fueled by the continuous need for enhanced sensitivity, speed, and accuracy in detecting explosives and narcotics. Regulatory frameworks, driven by international security mandates and national standards, play a significant role in shaping market adoption and product development. Competitive product substitutes, though limited in specialized trace detection, exist in broader security screening technologies. End-user demographics are diverse, ranging from government agencies to commercial entities, each with specific security requirements. Mergers and acquisitions (M&A) trends are notable, as larger companies seek to acquire specialized technologies and expand their market reach. For instance, the acquisition of VOTI Detection Inc. by Rapiscan Systems Inc. in January 2023 exemplifies this trend, aiming to bolster service capabilities and global reach. Key innovation drivers include the miniaturization of detection equipment, development of non-contact screening methods, and integration of artificial intelligence for improved threat identification. Barriers to innovation often stem from the high cost of research and development, stringent validation processes, and the need for interoperability with existing security infrastructure.

- Market Concentration: Moderate to High, with significant influence from established players.

- Technological Innovation Drivers: Miniaturization, AI integration, non-contact detection, multi-threat identification.

- Regulatory Frameworks: Driven by international security agreements and national compliance standards for explosives and narcotics detection.

- Competitive Product Substitutes: Broader security screening technologies and traditional manual inspection methods.

- End-User Demographics: Government (Military & Defense, Law Enforcement, Ports & Borders, Public Safety), Commercial Aviation, Critical Infrastructure, and Private Sector.

- M&A Trends: Strategic acquisitions to enhance product portfolios and expand service networks.

- Innovation Barriers: High R&D costs, rigorous testing and certification, integration challenges.

Global Trace Detection Screening Market Growth Trends & Insights

The global trace detection screening market is poised for significant expansion, driven by escalating security concerns and advancements in detection technologies. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033, expanding from an estimated $2,100 million in 2025 to a projected $3,900 million by 2033. This growth is underpinned by increasing adoption rates across various end-user industries, particularly in sectors with high-risk profiles like commercial aviation and public transportation. Technological disruptions are continuously reshaping the landscape, with a focus on improving detection limits, reducing false alarm rates, and enhancing user-friendliness. The introduction of advanced sensors and algorithms, such as those integrated into Smiths Detection's Lightweight Chemical Detector (LCD) 4 and LCD XID extension (March 2023), exemplifies this trend, enabling the identification of a wider spectrum of threats, including street explosives and narcotics. Consumer behavior shifts are also contributing, with an increasing demand for rapid, non-intrusive screening solutions that minimize passenger or cargo dwell times. Market penetration is steadily increasing as governments and organizations prioritize homeland security and counter-terrorism efforts. The evolution from basic detection to intelligent screening systems, capable of real-time analysis and data integration, will further accelerate market growth. This market growth is also influenced by the evolving threat landscape, prompting continuous investment in sophisticated detection capabilities.

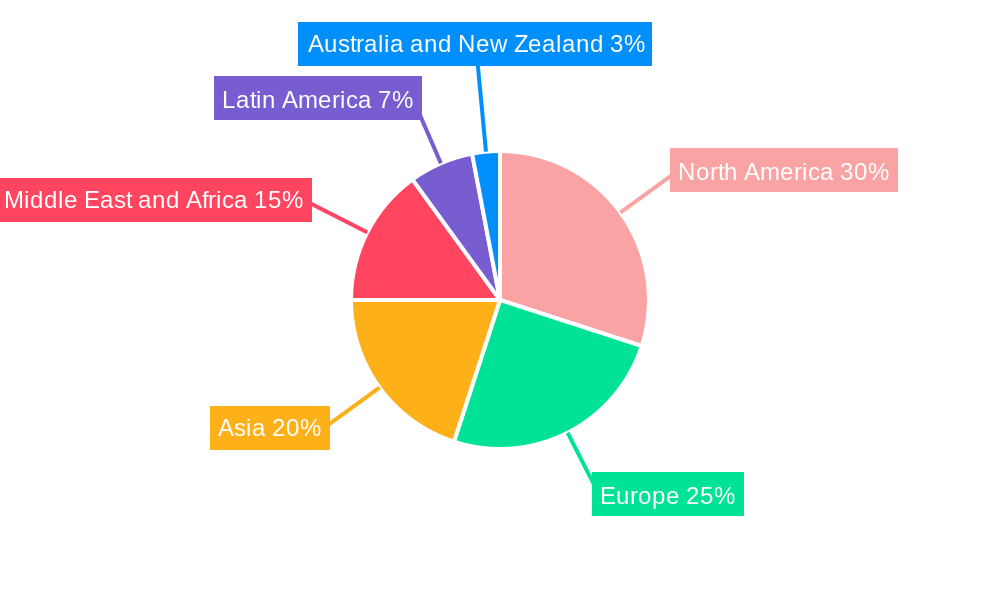

Dominant Regions, Countries, or Segments in Global Trace Detection Screening Market

The North America region currently stands as the dominant force in the global trace detection screening market, driven by stringent security regulations, substantial government investment in homeland security, and a high concentration of key market players. The United States, in particular, accounts for a significant portion of this regional dominance due to its robust counter-terrorism initiatives and extensive deployment of trace detection systems in airports, ports, and critical infrastructure.

Key Drivers in North America:

- Government Investment: Significant funding allocated to national security agencies for advanced screening technologies.

- Technological Advancement: Presence of leading R&D centers and technology developers fostering innovation.

- Strict Regulatory Environment: Mandates for passenger and cargo screening at various security checkpoints.

- Awareness of Security Threats: High public and governmental awareness of potential terrorist activities.

Within the Segments, the Handheld product category is experiencing the most significant growth and adoption. This is primarily due to their versatility, ease of deployment, and cost-effectiveness for mobile screening operations. Law enforcement agencies and first responders widely utilize handheld trace detectors for immediate threat identification at various locations.

- Handheld Product Dominance Factors:

- Portability and Agility: Enables rapid deployment in dynamic environments.

- Cost-Effectiveness: Generally more affordable than fixed or large portable systems.

- Versatility: Suitable for a wide range of applications, from event security to routine checks.

- Ease of Use: Designed for quick operation by trained personnel.

In terms of End-user Industry, Military and Defense and Law Enforcement are the largest segments contributing to the market's growth. These sectors require sophisticated trace detection capabilities to secure personnel, assets, and critical installations against a wide array of threats, including explosives, chemical agents, and narcotics. The increasing global geopolitical instability and the persistent threat of terrorism necessitate continuous upgrades and deployments of advanced trace detection systems in these domains.

- Military and Defense & Law Enforcement Dominance Factors:

- High-Security Requirements: Need for reliable detection of diverse threats in challenging environments.

- Counter-Terrorism Operations: Essential tools for intelligence gathering and threat mitigation.

- Border Security: Crucial for preventing the illicit trafficking of explosives and narcotics.

- Force Protection: Safeguarding military personnel and assets.

The Explosives detection type segment is the largest within the market, reflecting the paramount concern regarding explosive threats globally. However, the Narcotics detection segment is also exhibiting substantial growth, driven by the global war on drug trafficking and the increasing use of trace detection for interdiction.

- Explosives Detection Growth Drivers:

- Persistent Terrorist Threat: Ongoing concerns about improvised explosive devices (IEDs) and other explosive threats.

- Airport and Public Space Security: Essential for screening passengers and cargo.

- Narcotics Detection Growth Drivers:

- Drug Interdiction Efforts: Law enforcement agencies increasingly rely on trace detection for illicit substance identification.

- Evolving Drug Trafficking Methods: The need for detection of new synthetic drugs.

Global Trace Detection Screening Market Product Landscape

The product landscape within the global trace detection screening market is characterized by continuous innovation focused on enhancing detection capabilities and user experience. Companies are developing increasingly sensitive and rapid trace detectors capable of identifying a broad spectrum of hazardous substances, including explosives, narcotics, and chemical agents. Innovations such as the integration of spectroscopic technologies, advanced sensor arrays, and AI-powered algorithms are leading to devices that offer higher accuracy, lower detection limits, and reduced false alarm rates. The market offers a range of products, from highly portable handheld devices for immediate field use to larger, more sophisticated portable/movable and fixed systems designed for high-throughput screening at critical infrastructure points. Smiths Detection's recent launch of the Lightweight Chemical Detector (LCD) 4 with an XID extension showcases this evolution, enabling the detection of street explosives, narcotics, and toxic chemicals in a ruggedized, mobile format suitable for CBRNE scenarios. These advancements are crucial for adapting to evolving threat landscapes and ensuring effective security measures across diverse applications.

Key Drivers, Barriers & Challenges in Global Trace Detection Screening Market

The global trace detection screening market is propelled by several key drivers, including the escalating global security threats and the continuous need for advanced threat detection capabilities. Government mandates for enhanced security in public spaces, transportation hubs, and critical infrastructure significantly drive demand. Technological advancements, such as increased sensitivity, faster detection times, and improved portability, also act as crucial growth accelerators. The rising global trade and the need for efficient cargo screening further contribute to market expansion.

- Key Drivers:

- Increasing global security threats (terrorism, illicit trafficking).

- Strict government regulations and compliance requirements.

- Technological innovation in sensor technology and data analytics.

- Growing demand for non-intrusive screening solutions.

- Expansion of end-user applications beyond traditional security.

Conversely, the market faces significant challenges and barriers. High research and development costs associated with cutting-edge technology development can be a restraint. The stringent certification and validation processes required for security equipment can prolong product deployment timelines. Economic slowdowns or budget constraints in government and commercial sectors can impact procurement cycles. Moreover, the need for specialized training to operate and maintain advanced trace detection systems can pose a barrier to widespread adoption, especially in resource-limited regions. Competitive pressures from established players and emerging technologies also present ongoing challenges.

- Key Barriers & Challenges:

- High cost of R&D and advanced technology.

- Lengthy and complex certification processes.

- Economic fluctuations affecting government and commercial spending.

- Need for specialized training and skilled personnel.

- Supply chain disruptions impacting component availability.

- Intense market competition and rapid technological obsolescence.

Emerging Opportunities in Global Trace Detection Screening Market

Emerging opportunities in the global trace detection screening market are significantly driven by the increasing integration of artificial intelligence (AI) and machine learning (ML) into detection systems. This allows for more sophisticated data analysis, predictive threat identification, and reduced false alarm rates, enhancing operational efficiency. The growing demand for integrated security solutions, where trace detection is part of a larger, networked security infrastructure, presents a significant avenue for growth. Furthermore, the expansion of trace detection applications into new sectors, such as the food and beverage industry for quality control and pharmaceutical manufacturing for contamination detection, opens up untapped markets. The development of advanced sensor technologies, including those based on nanotechnology and quantum sensing, promises even greater sensitivity and specificity in the future, creating opportunities for novel product development and market penetration.

Growth Accelerators in the Global Trace Detection Screening Market Industry

The long-term growth of the global trace detection screening market is significantly accelerated by ongoing technological breakthroughs, particularly in the miniaturization of detection components and the development of multi-modal sensing capabilities. Strategic partnerships between technology providers, system integrators, and end-users are fostering collaborative innovation and faster market adoption of new solutions. Market expansion strategies, such as the penetration into emerging economies with rapidly growing security needs and increasing disposable income, are also crucial growth accelerators. Furthermore, the increasing awareness and focus on public health security, following global events, are creating new avenues for trace detection in areas like biosecurity and pandemic response, further fueling market expansion and innovation.

Key Players Shaping the Global Trace Detection Screening Market Market

- Smiths Detection Group Ltd

- DetectaChem

- Teledyne Flir LLC

- Vehant Technologies Pvt Ltd

- Westminster Group PLC

- DSA Detection LLC

- Rapiscan Systems Inc

- Leidos Holdings Inc

- Autoclear LLC

- Biosensor Applications A

- High Tech Detection Systems (HTDS)

- Bruker Corporation

- Mass Spec Analytical Ltd

Notable Milestones in Global Trace Detection Screening Market Sector

- March 2023: Smiths Detection announced the launch of its latest chemical agent identifier, Lightweight Chemical Detector (LCD) 4, along with the LCD XID extension. This would expand the detection capabilities of the LCD to include street explosives, narcotics, pharmaceuticals, and other super toxic chemical threats. The capability of LCD could also be transformed by placing the detector into the XID cradle, where it immediately turns the vapor detection device into a ruggedized mobile trace detector that can be utilized in any CBRNE (chemical, biological, radiological, nuclear, and explosive) scenario.

- January 2023: Rapiscan Systems Inc. announced that it acquired all assets of VOTI Detection Inc. According to Rapiscan, the Rapiscan Global Service has a significant global reach and over 350 service professionals, which is expected to deliver a more streamlined and superior experience than the one customers have enjoyed over the years from VOTI Detection.

In-Depth Global Trace Detection Screening Market Market Outlook

The future outlook for the global trace detection screening market is exceptionally positive, driven by a confluence of factors that promise sustained growth and innovation. The increasing sophistication of global security threats necessitates continuous investment in advanced detection technologies, ensuring a robust demand for trace detection systems. Emerging opportunities in dual-use applications, such as environmental monitoring and industrial safety, alongside traditional security roles, will further broaden the market's scope. Strategic collaborations and the ongoing development of miniaturized, AI-integrated, and highly sensitive detection devices are set to redefine the market landscape. The anticipated growth in emerging economies, coupled with favorable government policies supporting security infrastructure development, will act as significant catalysts for market expansion, positioning the trace detection screening sector as a vital component of global safety and security for the foreseeable future.

Global Trace Detection Screening Market Segmentation

-

1. Type

- 1.1. Explosive

- 1.2. Narcotics

-

2. Product

- 2.1. Handheld

- 2.2. Portable/Movable

- 2.3. Fixed

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Military and Defense

- 3.3. Law Enforcement

- 3.4. Ports and Borders

- 3.5. Public Safety

- 3.6. Other End-user Industries

Global Trace Detection Screening Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Global Trace Detection Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Terrorist Activities Across the Globe; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. The Law Enforcement Segment is Anticipated to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosive

- 5.1.2. Narcotics

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Handheld

- 5.2.2. Portable/Movable

- 5.2.3. Fixed

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Military and Defense

- 5.3.3. Law Enforcement

- 5.3.4. Ports and Borders

- 5.3.5. Public Safety

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Middle East and Africa

- 5.4.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Explosive

- 6.1.2. Narcotics

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Handheld

- 6.2.2. Portable/Movable

- 6.2.3. Fixed

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Commercial

- 6.3.2. Military and Defense

- 6.3.3. Law Enforcement

- 6.3.4. Ports and Borders

- 6.3.5. Public Safety

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Explosive

- 7.1.2. Narcotics

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Handheld

- 7.2.2. Portable/Movable

- 7.2.3. Fixed

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Commercial

- 7.3.2. Military and Defense

- 7.3.3. Law Enforcement

- 7.3.4. Ports and Borders

- 7.3.5. Public Safety

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Explosive

- 8.1.2. Narcotics

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Handheld

- 8.2.2. Portable/Movable

- 8.2.3. Fixed

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Commercial

- 8.3.2. Military and Defense

- 8.3.3. Law Enforcement

- 8.3.4. Ports and Borders

- 8.3.5. Public Safety

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Explosive

- 9.1.2. Narcotics

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Handheld

- 9.2.2. Portable/Movable

- 9.2.3. Fixed

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Commercial

- 9.3.2. Military and Defense

- 9.3.3. Law Enforcement

- 9.3.4. Ports and Borders

- 9.3.5. Public Safety

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Explosive

- 10.1.2. Narcotics

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Handheld

- 10.2.2. Portable/Movable

- 10.2.3. Fixed

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Commercial

- 10.3.2. Military and Defense

- 10.3.3. Law Enforcement

- 10.3.4. Ports and Borders

- 10.3.5. Public Safety

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Latin America Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Explosive

- 11.1.2. Narcotics

- 11.2. Market Analysis, Insights and Forecast - by Product

- 11.2.1. Handheld

- 11.2.2. Portable/Movable

- 11.2.3. Fixed

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Commercial

- 11.3.2. Military and Defense

- 11.3.3. Law Enforcement

- 11.3.4. Ports and Borders

- 11.3.5. Public Safety

- 11.3.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Latin America Global Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Smiths Detection Group Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 DetectaChem

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Teledyne Flir LLC

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Vehant Technologies Pvt Ltd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Westminster Group PLC

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 DSA Detection LLC

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Rapiscan Systems Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Leidos Holdings Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Autoclear LLC

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Biosensor Applications A

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 High Tech Detection Systems (HTDS)

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Bruker Corporation

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Mass Spec Analytical Ltd

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.1 Smiths Detection Group Ltd

List of Figures

- Figure 1: Global Global Trace Detection Screening Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Latin America Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Latin America Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Global Trace Detection Screening Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Global Trace Detection Screening Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Global Trace Detection Screening Market Revenue (Million), by Product 2024 & 2032

- Figure 17: North America Global Trace Detection Screening Market Revenue Share (%), by Product 2024 & 2032

- Figure 18: North America Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: North America Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: North America Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Global Trace Detection Screening Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Global Trace Detection Screening Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Global Trace Detection Screening Market Revenue (Million), by Product 2024 & 2032

- Figure 25: Europe Global Trace Detection Screening Market Revenue Share (%), by Product 2024 & 2032

- Figure 26: Europe Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Europe Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Global Trace Detection Screening Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Global Trace Detection Screening Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Global Trace Detection Screening Market Revenue (Million), by Product 2024 & 2032

- Figure 33: Asia Global Trace Detection Screening Market Revenue Share (%), by Product 2024 & 2032

- Figure 34: Asia Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Asia Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Asia Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by Product 2024 & 2032

- Figure 41: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by Product 2024 & 2032

- Figure 42: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 43: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 44: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by Product 2024 & 2032

- Figure 49: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by Product 2024 & 2032

- Figure 50: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 51: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 52: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Latin America Global Trace Detection Screening Market Revenue (Million), by Type 2024 & 2032

- Figure 55: Latin America Global Trace Detection Screening Market Revenue Share (%), by Type 2024 & 2032

- Figure 56: Latin America Global Trace Detection Screening Market Revenue (Million), by Product 2024 & 2032

- Figure 57: Latin America Global Trace Detection Screening Market Revenue Share (%), by Product 2024 & 2032

- Figure 58: Latin America Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 59: Latin America Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 60: Latin America Global Trace Detection Screening Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Latin America Global Trace Detection Screening Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Trace Detection Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Trace Detection Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Global Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Global Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Global Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Global Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Global Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 20: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 24: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 25: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 32: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 33: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 36: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 37: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 41: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Trace Detection Screening Market?

The projected CAGR is approximately 7.93%.

2. Which companies are prominent players in the Global Trace Detection Screening Market?

Key companies in the market include Smiths Detection Group Ltd, DetectaChem, Teledyne Flir LLC, Vehant Technologies Pvt Ltd, Westminster Group PLC, DSA Detection LLC, Rapiscan Systems Inc, Leidos Holdings Inc, Autoclear LLC, Biosensor Applications A, High Tech Detection Systems (HTDS), Bruker Corporation, Mass Spec Analytical Ltd.

3. What are the main segments of the Global Trace Detection Screening Market?

The market segments include Type, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Terrorist Activities Across the Globe; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening.

6. What are the notable trends driving market growth?

The Law Enforcement Segment is Anticipated to Drive the Market Demand.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

March 2023: Smiths Detection announced the launch of its latest chemical agent identifier, Lightweight Chemical Detector (LCD) 4, along with the LCD XID extension. This would expand the detection capabilities of the LCD to include street explosives, narcotics, pharmaceuticals, and other super toxic chemical threats. The capability of LCD could also be transformed by placing the detector into the XID cradle, where it immediately turns the vapor detection device into a ruggedized mobile trace detector that can be utilized in any CBRNE (chemical, biological, radiological, nuclear, and explosive) scenario.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Trace Detection Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Trace Detection Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Trace Detection Screening Market?

To stay informed about further developments, trends, and reports in the Global Trace Detection Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence