Key Insights

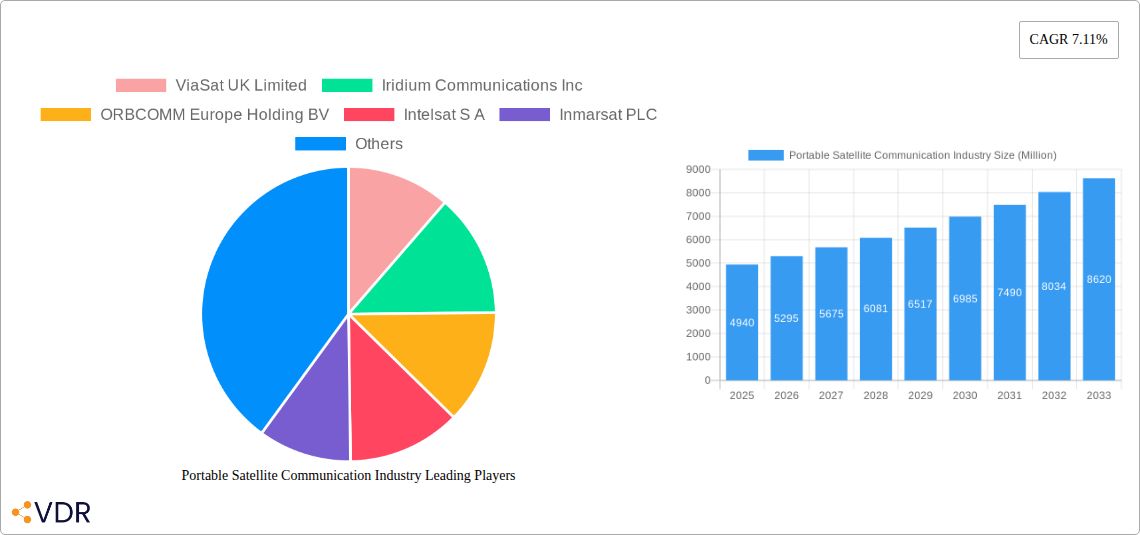

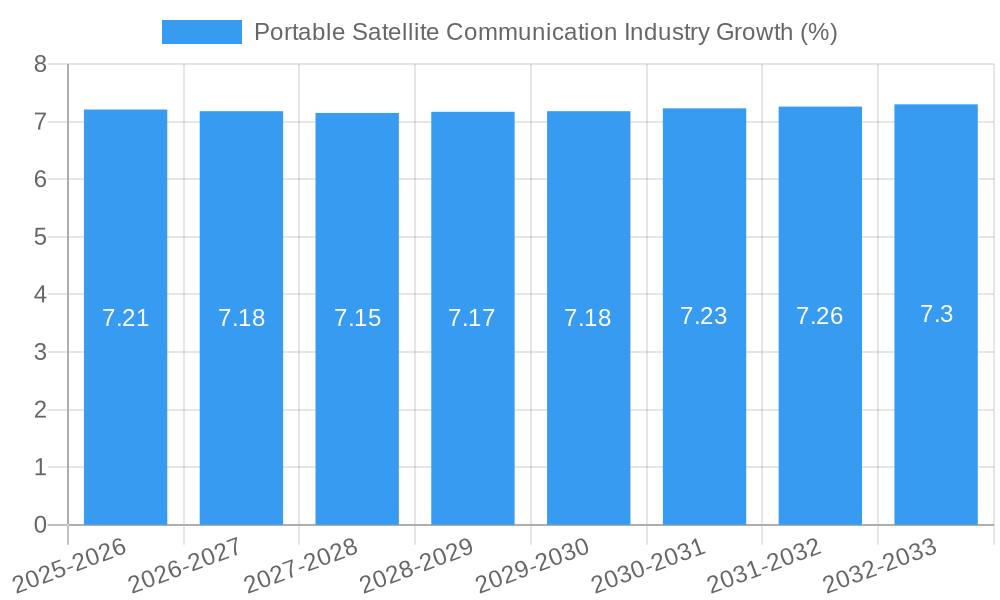

The global Portable Satellite Communication market is poised for robust expansion, with an estimated market size of USD 4.94 billion in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of 7.11% through 2033. This impressive growth is propelled by several key drivers, including the escalating demand for reliable connectivity in remote and underserved regions, the increasing adoption of satellite communication solutions by enterprises for mission-critical operations, and the expanding use cases in sectors like maritime, aviation, and government for enhanced safety, efficiency, and operational continuity. The continuous innovation in satellite technology, leading to smaller, more powerful, and cost-effective devices, further fuels this upward trajectory. Furthermore, the burgeoning Internet of Things (IoT) ecosystem, which relies heavily on ubiquitous connectivity, is creating significant opportunities for portable satellite communication services. The market is segmented by service into Voice and Data, with Data services expected to witness higher adoption due to the increasing reliance on real-time information exchange and the growth of data-intensive applications.

The market landscape is characterized by significant competitive activity, with prominent players such as ViaSat UK Limited, Iridium Communications Inc., ORBCOMM Europe Holding BV, Intelsat S.A., and Inmarsat PLC actively shaping the industry through strategic partnerships, mergers, and acquisitions, alongside continuous product development. Emerging trends include the miniaturization of satellite terminals, the integration of artificial intelligence for optimized network performance, and the development of satellite-based 5G services, which promise to bridge the digital divide and unlock new applications. However, the market also faces certain restraints, including the high cost of satellite airtime compared to terrestrial alternatives in some regions, regulatory hurdles and spectrum availability challenges in certain geographies, and the ongoing threat of cybersecurity risks, which necessitate robust security protocols. Despite these challenges, the overall outlook for the Portable Satellite Communication market remains highly positive, driven by the inherent need for resilient and widespread connectivity.

This report offers an in-depth analysis of the global Portable Satellite Communication industry, providing crucial insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and competitive strategies. Covering a study period from 2019 to 2033, with a base year of 2025, this research is essential for industry stakeholders seeking to understand market evolution, capitalize on growth avenues, and navigate the competitive terrain. The report delves into the parent and child markets, offering granular analysis to maximize strategic decision-making and investment opportunities within the satellite communication ecosystem. With a focus on high-traffic keywords, this report is optimized for maximum search engine visibility and engagement with industry professionals.

Portable Satellite Communication Industry Market Dynamics & Structure

The Portable Satellite Communication industry exhibits a moderately consolidated market structure, characterized by significant technological innovation and a dynamic competitive landscape. Key players are heavily investing in advanced satellite constellations and terminal miniaturization, driven by the escalating demand for seamless connectivity in remote and underserved regions. Regulatory frameworks, particularly concerning spectrum allocation and international roaming, play a pivotal role in shaping market access and operational feasibility. Competitive product substitutes, such as terrestrial mobile networks, continue to exert pressure, but the unique reliability and global coverage of satellite solutions ensure their sustained relevance, especially for mission-critical applications. End-user demographics are expanding beyond traditional government and military sectors to encompass a growing enterprise and consumer base, fueled by the increasing need for disaster resilience and remote operational capabilities. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate market share, acquire complementary technologies, and enhance their service offerings. For instance, recent M&A activities in the broader satellite industry have aimed at integrating ground infrastructure with space assets. Innovation barriers primarily revolve around high development costs for satellite technology and the need for robust interoperability standards across diverse user devices.

- Market Concentration: Moderately consolidated, with key players dominating specific service segments.

- Technological Innovation Drivers: Miniaturization of terminals, LEO/MEO satellite deployment, enhanced data throughput, and integration with IoT solutions.

- Regulatory Frameworks: Spectrum licensing, national security considerations, and inter-satellite linking regulations.

- Competitive Product Substitutes: Advanced terrestrial mobile networks (5G/6G), fixed wireless access.

- End-User Demographics: Diversifying from government/military to enterprise (logistics, energy), maritime, aviation, and eventually consumer markets.

- M&A Trends: Strategic acquisitions to enhance service portfolios, secure technological capabilities, and expand geographical reach. Estimated M&A deal volume in the broader satellite services sector has seen an upward trend, with specific figures not readily available for portable satellite communication alone.

Portable Satellite Communication Industry Growth Trends & Insights

The Portable Satellite Communication industry is on a robust growth trajectory, propelled by an insatiable demand for ubiquitous and reliable connectivity across the globe. The market size is estimated to experience a significant expansion from approximately \$5,800 Million units in 2024 to over \$12,500 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is underpinned by increasing adoption rates in traditionally underserved regions, where terrestrial infrastructure remains scarce or non-existent. Technological disruptions, including the proliferation of Low Earth Orbit (LEO) satellite constellations, are revolutionizing service delivery by offering lower latency and higher bandwidth, making portable satellite solutions more competitive and appealing for a wider range of applications. Consumer behavior shifts are also playing a crucial role, with a growing preference for connected experiences extending to remote locations, adventure tourism, and emergency preparedness. The integration of satellite communication with IoT devices is further unlocking new use cases and driving market penetration. For instance, the ability to provide real-time data from remote assets in the maritime or enterprise sectors significantly enhances operational efficiency and safety. The increasing demand for reliable data services over voice services is a notable trend, reflecting the evolving needs of businesses and individuals. The global market penetration of portable satellite communication devices, while still nascent in some consumer segments, is steadily increasing, particularly in professional and industrial applications. The ongoing development of more compact, energy-efficient, and cost-effective satellite terminals is further accelerating this adoption curve. The shift towards integrated service platforms, offering seamless voice, data, and messaging capabilities, is also a key growth driver.

Dominant Regions, Countries, or Segments in Portable Satellite Communication Industry

The Government end-user industry is a dominant force in the Portable Satellite Communication market, significantly driving global growth. This dominance stems from the inherent need for secure, resilient, and globally accessible communication solutions for national security, defense operations, emergency response, and critical infrastructure management. Governments worldwide invest heavily in portable satellite communication to ensure operational continuity in situations where terrestrial networks fail or are non-existent, such as in disaster zones, remote military deployments, and border surveillance. The Asia-Pacific region, particularly driven by initiatives in countries like India and its neighbors, is emerging as a key growth engine within this segment. India's commitment to establishing mobile satellite service (MSS) terminals on over one lakh motorized and fishing boats across 13 coastal states, as initiated by NewSpace India Ltd, exemplifies the substantial government-led investments in maritime communication and surveillance. This vast deployment underscores the strategic importance of satellite connectivity for coastal monitoring and maritime security.

- Government Sector Dominance: Essential for defense, emergency services, disaster relief, and maintaining communication in remote or conflict zones.

- Regional Growth in Asia-Pacific: Fueled by government initiatives for maritime security, disaster preparedness, and digital inclusion in remote areas.

- Maritime Segment Growth: Driven by increasing demand for Vessel Traffic Services (VTS), crew welfare, and operational efficiency in the shipping industry.

- Enterprise Sector Expansion: Growing adoption for remote operations in oil and gas, mining, and agriculture, where reliable connectivity is crucial for data acquisition and remote management.

- Aviation Sector Integration: Increasing use for cockpit communication, passenger Wi-Fi, and flight tracking, enhancing safety and passenger experience.

Portable Satellite Communication Industry Product Landscape

The product landscape of the Portable Satellite Communication industry is characterized by continuous innovation aimed at enhancing portability, performance, and user experience. Devices range from compact satellite phones and ruggedized terminals for enterprise use to integrated modules for IoT applications and specialized equipment for government and military operations. Key product innovations include advancements in antenna technology for improved signal acquisition, power efficiency for extended battery life, and data processing capabilities for real-time analytics. Applications span critical voice and data communication, asset tracking, remote sensing, and the deployment of mobile command centers. Performance metrics such as data throughput, latency, and signal reliability are constantly being optimized to meet the demanding requirements of diverse end-users. Unique selling propositions often lie in the ability to provide "always-on" connectivity in any location, ruggedized designs for harsh environments, and secure communication protocols. Technological advancements are also focused on seamless integration with existing terrestrial networks for hybrid connectivity solutions.

Key Drivers, Barriers & Challenges in Portable Satellite Communication Industry

Key Drivers:

- Growing demand for connectivity in remote and underserved areas: Essential for economic development, disaster relief, and public safety.

- Increasing adoption by enterprise and industrial sectors: For remote operations, asset tracking, and real-time data management in industries like energy, mining, and logistics.

- Government and defense requirements: For secure and resilient communication in critical missions, surveillance, and emergency response.

- Technological advancements: Miniaturization of terminals, development of LEO constellations, and improved data speeds enhance usability and affordability.

- Global events and natural disasters: Highlighting the critical need for reliable communication when terrestrial infrastructure fails.

Barriers & Challenges:

- High initial cost of equipment and service subscriptions: Can be a deterrent for smaller businesses and individual users.

- Regulatory hurdles and spectrum licensing complexities: Varying by country, can impede market entry and service expansion.

- Competition from improving terrestrial mobile networks: Especially in areas with developing 5G infrastructure.

- Power consumption and battery life limitations: For highly mobile and remote applications.

- Supply chain disruptions: Can impact the availability of critical components and finished products. The impact of supply chain issues can lead to extended lead times, increasing costs by an estimated 10-20% for certain components.

Emerging Opportunities in Portable Satellite Communication Industry

Emerging opportunities in the Portable Satellite Communication industry lie in the burgeoning demand for enhanced IoT connectivity in remote locations, enabling advanced data collection and control for industries such as precision agriculture, environmental monitoring, and remote asset management. The expansion of direct-to-device satellite connectivity for smartphones presents a significant untapped market, promising to democratize satellite communication access for a broader consumer base. Furthermore, the increasing focus on resilient and secure communication for critical infrastructure, including smart grids and transportation networks, presents substantial growth potential. The development of integrated satellite-cellular solutions, offering seamless fallback and seamless connectivity, is another key area for innovation and market expansion.

Growth Accelerators in the Portable Satellite Communication Industry Industry

The Portable Satellite Communication industry is poised for accelerated growth driven by several key catalysts. Technological breakthroughs in LEO satellite constellations are significantly reducing latency and increasing bandwidth, making satellite services more competitive with terrestrial alternatives and opening new application frontiers. Strategic partnerships between satellite operators, technology providers, and vertical industry players are crucial for developing tailored solutions and expanding market reach. For example, collaborations aimed at integrating satellite backhaul with rural mobile networks are rapidly increasing connectivity in previously underserved regions. Market expansion strategies, including the development of more affordable service plans and user-friendly devices, are poised to attract a wider customer base. The increasing government investment in space-based communication infrastructure globally acts as a significant impetus for sustained growth.

Key Players Shaping the Portable Satellite Communication Industry Market

- ViaSat UK Limited

- Iridium Communications Inc

- ORBCOMM Europe Holding BV

- Intelsat S A

- Inmarsat PLC

- Ericsson Inc

- Globalstar Inc

- Thuraya Telecommunications Company

- EchoStar Mobile Limited

Notable Milestones in Portable Satellite Communication Industry Sector

- June 2023: NewSpace India Ltd (ISRO) initiated the setup of mobile satellite service (MSS) terminals on at least one lakh motorized and fishing boats across 13 Indian coastal states to enhance maritime communication and monitoring capabilities.

- December 2022: Nelco, a Tata Group member, applied for the Global Mobile Personal Communication by Satellite (GMPCS) license in India, indicating significant interest and growth potential in a newly developing market. This follows licenses granted to SpaceX, OneWeb, and Reliance Jio Infocomm.

- August 2022: Vodafone PNG and Kacific partnered to deliver Mobile Backhaul services via satellite to rural areas in Papua New Guinea, aiming to expand Vodafone's voice and 3G/4G data network and support the country's digital transformation.

In-Depth Portable Satellite Communication Industry Market Outlook

- June 2023: NewSpace India Ltd (ISRO) initiated the setup of mobile satellite service (MSS) terminals on at least one lakh motorized and fishing boats across 13 Indian coastal states to enhance maritime communication and monitoring capabilities.

- December 2022: Nelco, a Tata Group member, applied for the Global Mobile Personal Communication by Satellite (GMPCS) license in India, indicating significant interest and growth potential in a newly developing market. This follows licenses granted to SpaceX, OneWeb, and Reliance Jio Infocomm.

- August 2022: Vodafone PNG and Kacific partnered to deliver Mobile Backhaul services via satellite to rural areas in Papua New Guinea, aiming to expand Vodafone's voice and 3G/4G data network and support the country's digital transformation.

In-Depth Portable Satellite Communication Industry Market Outlook

The future outlook for the Portable Satellite Communication industry is exceptionally promising, driven by continued technological advancements and expanding market penetration. Growth accelerators such as the ongoing deployment of advanced LEO satellite constellations will further reduce latency and increase data speeds, making satellite services more viable for a broader range of high-demand applications, including real-time data streaming and high-definition video conferencing. Strategic alliances and partnerships will be instrumental in driving innovation and creating integrated connectivity solutions that bridge the gap between satellite and terrestrial networks. The increasing focus on direct-to-device satellite connectivity for smartphones is poised to unlock mass-market adoption, transforming how individuals access communication in remote areas. Furthermore, the persistent global need for resilient and secure communication in critical sectors like defense, emergency response, and utilities will continue to fuel substantial investments and sustained demand, ensuring a dynamic and expanding market.

Portable Satellite Communication Industry Segmentation

-

1. Service

- 1.1. Voice

- 1.2. Data

-

2. End-User Industry

- 2.1. Maritime

- 2.2. Enterprise

- 2.3. Aviation

- 2.4. Government

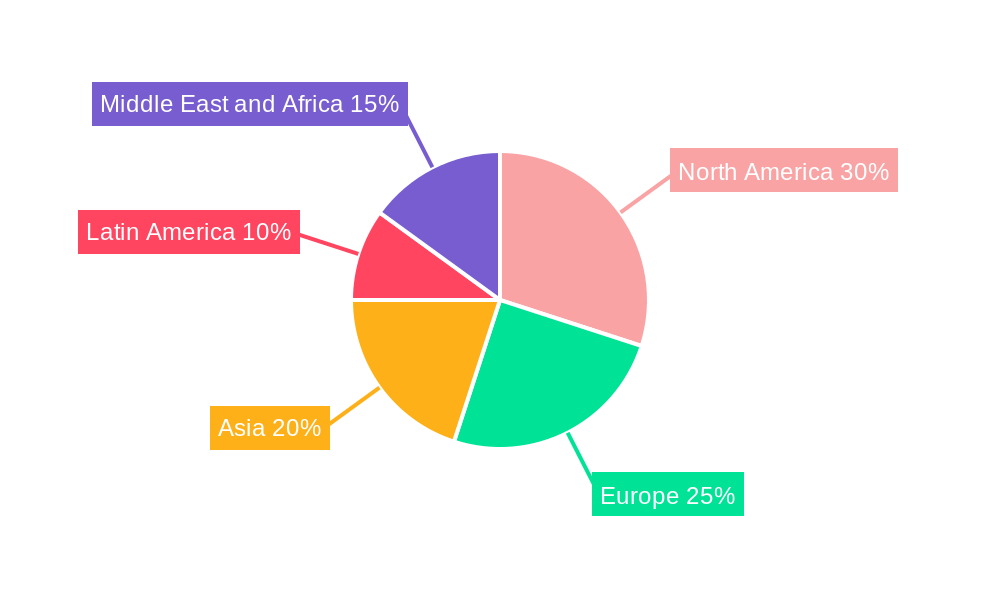

Portable Satellite Communication Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Portable Satellite Communication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Integration Demands for Satellite and Terrestrial Mobile Technology; Growing Interest from Government and Military

- 3.3. Market Restrains

- 3.3.1. Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology

- 3.4. Market Trends

- 3.4.1. Voice Service Segment is expected to register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Voice

- 5.1.2. Data

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Maritime

- 5.2.2. Enterprise

- 5.2.3. Aviation

- 5.2.4. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Voice

- 6.1.2. Data

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Maritime

- 6.2.2. Enterprise

- 6.2.3. Aviation

- 6.2.4. Government

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Voice

- 7.1.2. Data

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Maritime

- 7.2.2. Enterprise

- 7.2.3. Aviation

- 7.2.4. Government

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Voice

- 8.1.2. Data

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Maritime

- 8.2.2. Enterprise

- 8.2.3. Aviation

- 8.2.4. Government

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Voice

- 9.1.2. Data

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Maritime

- 9.2.2. Enterprise

- 9.2.3. Aviation

- 9.2.4. Government

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Voice

- 10.1.2. Data

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Maritime

- 10.2.2. Enterprise

- 10.2.3. Aviation

- 10.2.4. Government

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. North America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Portable Satellite Communication Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 ViaSat UK Limited

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Iridium Communications Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 ORBCOMM Europe Holding BV

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Intelsat S A

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Inmarsat PLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Ericsson Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Globalstar Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Thuraya Telecommunications Company

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 EchoStar Mobile Limited

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 ViaSat UK Limited

List of Figures

- Figure 1: Global Portable Satellite Communication Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Portable Satellite Communication Industry Revenue (Million), by Service 2024 & 2032

- Figure 15: North America Portable Satellite Communication Industry Revenue Share (%), by Service 2024 & 2032

- Figure 16: North America Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 17: North America Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 18: North America Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Portable Satellite Communication Industry Revenue (Million), by Service 2024 & 2032

- Figure 21: Europe Portable Satellite Communication Industry Revenue Share (%), by Service 2024 & 2032

- Figure 22: Europe Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 23: Europe Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 24: Europe Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Portable Satellite Communication Industry Revenue (Million), by Service 2024 & 2032

- Figure 27: Asia Portable Satellite Communication Industry Revenue Share (%), by Service 2024 & 2032

- Figure 28: Asia Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 29: Asia Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 30: Asia Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Portable Satellite Communication Industry Revenue (Million), by Service 2024 & 2032

- Figure 33: Latin America Portable Satellite Communication Industry Revenue Share (%), by Service 2024 & 2032

- Figure 34: Latin America Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 35: Latin America Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 36: Latin America Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by Service 2024 & 2032

- Figure 39: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by Service 2024 & 2032

- Figure 40: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 41: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 42: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Portable Satellite Communication Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Portable Satellite Communication Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Portable Satellite Communication Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 51: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 52: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 54: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 55: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 57: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 58: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 60: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 61: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 63: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 64: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Satellite Communication Industry?

The projected CAGR is approximately 7.11%.

2. Which companies are prominent players in the Portable Satellite Communication Industry?

Key companies in the market include ViaSat UK Limited, Iridium Communications Inc, ORBCOMM Europe Holding BV, Intelsat S A, Inmarsat PLC, Ericsson Inc, Globalstar Inc, Thuraya Telecommunications Company, EchoStar Mobile Limited.

3. What are the main segments of the Portable Satellite Communication Industry?

The market segments include Service, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Integration Demands for Satellite and Terrestrial Mobile Technology; Growing Interest from Government and Military.

6. What are the notable trends driving market growth?

Voice Service Segment is expected to register a Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology.

8. Can you provide examples of recent developments in the market?

June 2023: To establish better communication with vessels in the sea and monitor Indian waters more efficiently, NewSpace India Ltd, the commercial arm of the Indian Space Research Organisation (ISRO), is setting up mobile satellite service (MSS) terminals on at least one lakh motorized and fishing boats across 13 coastal states. In order to set up maritime ship communication and support systems for monitoring, control, and surveillance in marine fishing vessels, NewSpace India has initiated a selection of private contractors that would supply, install, and commission MSS terminals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portable Satellite Communication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portable Satellite Communication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portable Satellite Communication Industry?

To stay informed about further developments, trends, and reports in the Portable Satellite Communication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence