Key Insights

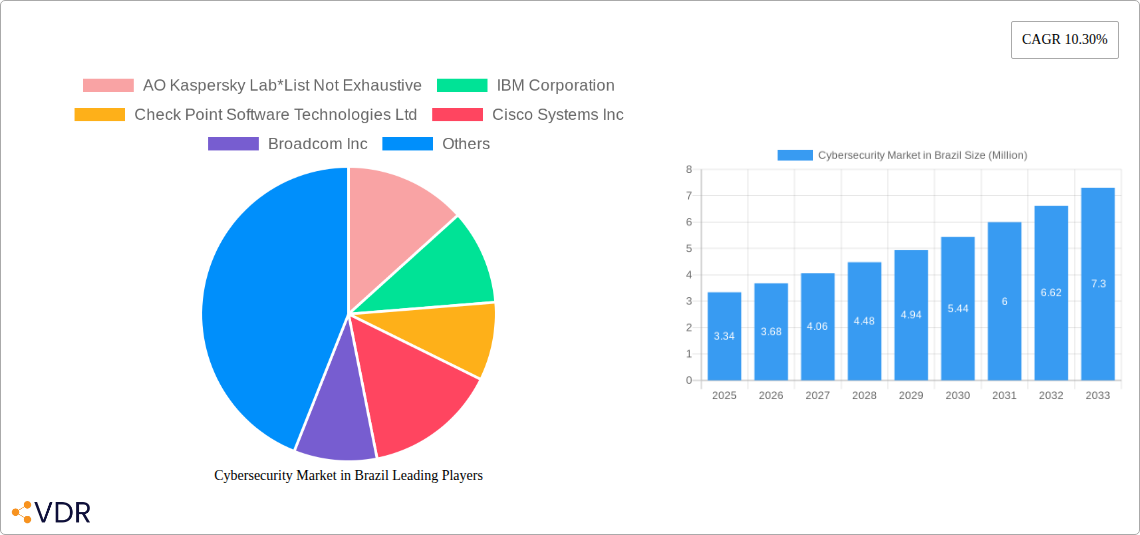

The Brazilian cybersecurity market is poised for robust expansion, driven by an increasing digital footprint and a heightened awareness of cyber threats across various sectors. With a projected market size of approximately USD 3.34 million in 2025 and a compelling Compound Annual Growth Rate (CAGR) of 10.30%, the market is set to experience substantial growth throughout the forecast period of 2025-2033. Key drivers fueling this expansion include the escalating adoption of cloud technologies, the imperative for stringent data protection regulations, and the growing sophistication of cyberattacks, particularly targeting critical infrastructure and sensitive financial data. The BFSI, Healthcare, and Government & Defense sectors are emerging as significant contributors to market demand, owing to the high value of the data they manage and the increasing regulatory scrutiny they face. Furthermore, the pervasive shift towards remote work and the proliferation of connected devices have expanded the attack surface, necessitating enhanced cybersecurity measures across the board.

Cybersecurity Market in Brazil Market Size (In Million)

The market's growth trajectory is further supported by a dynamic landscape of evolving cyber threats and the continuous innovation in security solutions. Cloud security solutions are expected to witness significant uptake as organizations increasingly migrate their operations to cloud environments. Identity and Access Management (IAM) will also play a crucial role in securing digital assets and user credentials. While the market presents immense opportunities, certain restraints such as the shortage of skilled cybersecurity professionals and the cost of implementing advanced security solutions might pose challenges. However, these are being progressively addressed through government initiatives, educational programs, and the rise of managed security service providers (MSSPs). Brazil’s burgeoning digital economy, coupled with proactive government policies aimed at fostering a secure digital ecosystem, positions it as a key growth region within the global cybersecurity landscape, presenting lucrative opportunities for both domestic and international players.

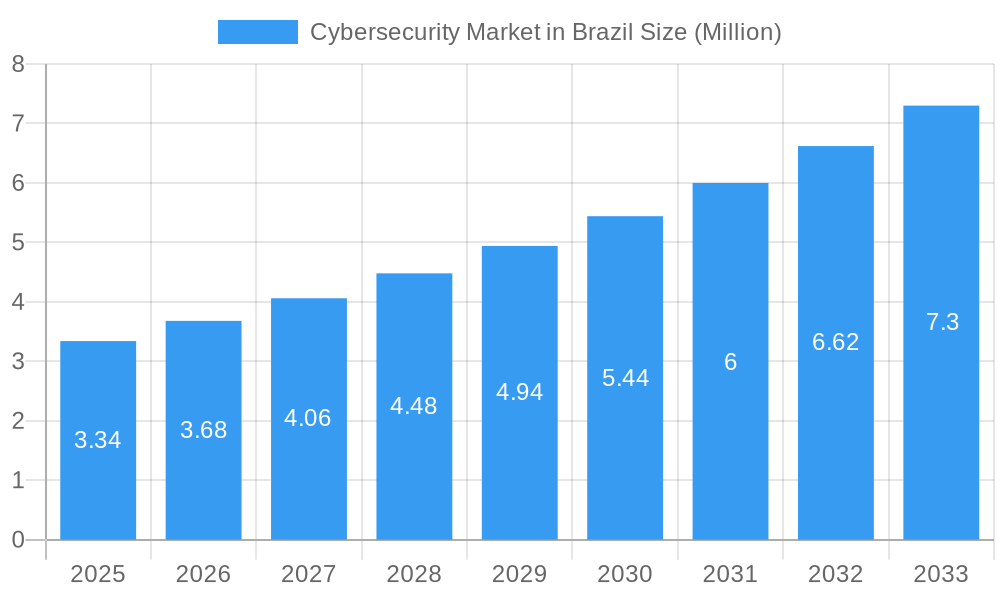

Cybersecurity Market in Brazil Company Market Share

Unlocking Brazil's Digital Frontier: A Comprehensive Cybersecurity Market Report

This in-depth report delves into the dynamic and rapidly expanding Cybersecurity Market in Brazil, providing actionable insights for stakeholders navigating this critical sector. With the increasing digitalization across all industries, robust cybersecurity solutions are no longer a luxury but a necessity. This report offers a panoramic view of the market's evolution, key players, emerging trends, and future trajectory, equipping you with the knowledge to capitalize on opportunities and mitigate risks. Our analysis encompasses the parent market and granular insights into child markets, offering a holistic understanding of Brazil's cybersecurity landscape. The study period spans from 2019–2033, with a detailed base year of 2025 and a forecast period from 2025–2033, building upon historical data from 2019–2024. All market values are presented in Million Units.

Cybersecurity Market in Brazil Market Dynamics & Structure

The Cybersecurity Market in Brazil is characterized by a moderate to high level of market concentration, driven by a few prominent global players and a growing number of specialized local providers. Technological innovation is a primary driver, with advancements in AI-powered threat detection, cloud security, and data protection solutions constantly reshaping the competitive landscape. Regulatory frameworks, while evolving, are increasingly emphasizing data privacy and security, pushing organizations to adopt more stringent cybersecurity measures. Competitive product substitutes are emerging, particularly in areas like endpoint security and threat intelligence, forcing established vendors to innovate continuously. End-user demographics showcase a growing demand across all sectors, with BFSI and IT & Telecommunication sectors leading in adoption. Mergers and acquisitions (M&A) trends are moderately active, indicating consolidation and strategic partnerships aimed at expanding service portfolios and market reach. Barriers to innovation include the high cost of advanced security technologies and the scarcity of skilled cybersecurity professionals.

- Market Concentration: Dominated by a mix of global cybersecurity giants and emerging local specialists.

- Technological Innovation: Fueled by AI, machine learning for threat intelligence, and advanced cloud security solutions.

- Regulatory Frameworks: Increasing focus on data protection (LGPD) and critical infrastructure security.

- Competitive Landscape: Intense competition driving product differentiation and service innovation.

- M&A Trends: Strategic acquisitions to enhance capabilities and market presence.

Cybersecurity Market in Brazil Growth Trends & Insights

The Cybersecurity Market in Brazil is poised for significant growth, driven by a confluence of factors including escalating cyber threats, stringent data privacy regulations, and the accelerated digital transformation across industries. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025–2033). Adoption rates for advanced security solutions, such as cloud security and identity and access management (IAM), are rapidly increasing as organizations recognize the critical need to protect their digital assets. Technological disruptions, including the rise of IoT, AI-driven attacks, and the growing sophistication of ransomware, are pushing demand for proactive and adaptive security measures. Consumer behavior shifts towards increased online activities and the growing reliance on digital services are also contributing to the heightened awareness and demand for robust cybersecurity. The market penetration of comprehensive cybersecurity solutions is expected to rise significantly as businesses of all sizes prioritize cyber resilience to safeguard their operations and reputation.

Dominant Regions, Countries, or Segments in Cybersecurity Market in Brazil

The Cybersecurity Market in Brazil is heavily influenced by several key segments and end-user industries. Cloud Security stands out as a dominant offering, driven by the widespread adoption of cloud infrastructure across Brazilian businesses seeking scalability and flexibility. This segment is projected to witness a CAGR of 14.2% from 2025 to 2033, reflecting the ongoing migration to cloud platforms and the inherent security challenges associated with them. The IT and Telecommunication sector consistently leads in cybersecurity spending, investing heavily in network security and infrastructure protection to safeguard vast amounts of data and ensure uninterrupted services. This sector accounts for an estimated 28% of the total market spend in 2025. Following closely is the BFSI (Banking, Financial Services, and Insurance) sector, which prioritizes data security and identity access management due to the sensitive nature of financial transactions and customer information; its market share is projected at 25% in 2025. The Government & Defense sector is also a significant contributor, driven by national security concerns and the need to protect critical infrastructure, exhibiting substantial growth driven by strategic investments in advanced defense technologies and secure communication networks.

- Dominant Offering: Cloud Security, characterized by rapid adoption due to digital transformation initiatives.

- Market Share (2025): Projected to be around 30% of the total market value.

- Key Drivers: Scalability, cost-effectiveness, and the increasing use of hybrid and multi-cloud environments.

- Leading End User: IT and Telecommunication, demanding robust solutions for network and data protection.

- Market Size (2025): Estimated at $1,800 Million.

- Growth Potential: Driven by 5G deployment and increasing network complexity.

- Second Largest End User: BFSI, with a strong focus on data security and regulatory compliance.

- Market Size (2025): Estimated at $1,650 Million.

- Key Investments: Identity and Access Management, fraud detection, and compliance solutions.

- Growing Segment: Government & Defense, with increasing investments in national security and critical infrastructure protection.

- Market Size (2025): Estimated at $1,200 Million.

- Drivers: Geopolitical factors and the need for advanced threat intelligence.

- Deployment Trends: While cloud deployment is ascendant, on-premise solutions remain crucial for highly regulated industries and critical infrastructure, demonstrating a bifurcated adoption strategy.

Cybersecurity Market in Brazil Product Landscape

The Cybersecurity Market in Brazil is characterized by a dynamic product landscape featuring continuous innovation and diversification. Vendors are increasingly offering integrated security platforms that combine multiple security functionalities, such as cloud security suites, advanced endpoint detection and response (EDR) solutions, and sophisticated data loss prevention (DLP) tools. AI and machine learning are being embedded into an array of products, enhancing threat detection accuracy and automating response mechanisms. Unique selling propositions often revolve around real-time threat intelligence, proactive vulnerability management, and tailored solutions for specific industry needs, such as specialized security for healthcare data or financial transactions. Performance metrics such as detection rates, response times, and compliance adherence are key differentiators for product success in this competitive market.

Key Drivers, Barriers & Challenges in Cybersecurity Market in Brazil

Key Drivers: The Cybersecurity Market in Brazil is propelled by a surge in sophisticated cyber threats, including ransomware and phishing attacks, which have become a major concern for businesses of all sizes. The implementation of Brazil's General Data Protection Law (LGPD) is a significant regulatory driver, mandating stricter data protection and privacy measures. Rapid digital transformation across industries, including the adoption of cloud computing and remote work, expands the attack surface, necessitating enhanced security solutions. Furthermore, the increasing interconnectivity of critical infrastructure amplifies the need for robust defense mechanisms.

- Escalating Cyber Threats: Sophisticated and persistent attacks necessitate advanced security measures.

- Regulatory Compliance: LGPD enforcement drives investment in data protection and privacy solutions.

- Digital Transformation: Cloud adoption, IoT, and remote work create new vulnerabilities.

- Critical Infrastructure Protection: Growing need to secure essential services against cyber disruptions.

Barriers & Challenges: A significant barrier is the shortage of skilled cybersecurity professionals, creating a talent gap that hinders effective implementation and management of security solutions. The high cost of advanced cybersecurity technologies can be prohibitive for small and medium-sized enterprises (SMEs), limiting their ability to adopt comprehensive protection. Supply chain vulnerabilities, especially in relation to software and hardware components, pose an ongoing risk. Additionally, evolving threat landscapes require constant adaptation, making it challenging for organizations to stay ahead of emerging attack vectors. Competitive pressures also lead to pricing challenges, impacting profit margins for vendors.

- Talent Shortage: Lack of skilled cybersecurity professionals impedes effective defense.

- Cost of Advanced Solutions: High investment required for comprehensive security can be a barrier for SMEs.

- Supply Chain Vulnerabilities: Risks associated with the security of software and hardware components.

- Evolving Threat Landscape: The need for continuous adaptation to new and emerging cyberattack methods.

- Regulatory Complexity: Navigating and complying with evolving data privacy and security regulations.

Emerging Opportunities in Cybersecurity Market in Brazil

Emerging opportunities in the Cybersecurity Market in Brazil lie in the growing demand for specialized solutions for emerging technologies such as the Internet of Things (IoT) and operational technology (OT) security, particularly within the manufacturing and energy sectors. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in cybersecurity presents opportunities for vendors offering AI-driven threat detection, predictive analytics, and automated response systems. Furthermore, there is a significant untapped market for cybersecurity awareness training and managed security services targeted at SMEs, which often lack dedicated IT security resources. The evolving landscape of remote work also presents opportunities for advanced endpoint security and secure access solutions.

- IoT and OT Security: Protecting connected devices and industrial control systems.

- AI/ML-Powered Solutions: Advanced threat detection, anomaly identification, and automated response.

- SME-Focused Services: Affordable and accessible cybersecurity solutions for small and medium businesses.

- Remote Work Security: Enhanced endpoint protection and secure access solutions.

Growth Accelerators in the Cybersecurity Market in Brazil Industry

Several catalysts are accelerating the growth of the Cybersecurity Market in Brazil. Technological breakthroughs in areas like zero-trust architecture and extended detection and response (XDR) are enabling more sophisticated and proactive security postures. Strategic partnerships between cybersecurity firms and cloud service providers are expanding market reach and offering integrated solutions. The increasing number of high-profile data breaches and ransomware attacks serves as a potent market accelerator, heightening awareness and urgency among businesses to invest in comprehensive cybersecurity. Furthermore, government initiatives promoting digital transformation and data security are also playing a crucial role in fostering market expansion.

Key Players Shaping the Cybersecurity Market in Brazil Market

- AO Kaspersky Lab

- IBM Corporation

- Check Point Software Technologies Ltd

- Cisco Systems Inc

- Broadcom Inc

- Microsoft Corporation

- Northrop Grumman

- NortonLifeLock Inc

- Dell Technologies Inc

- Palo Alto Networks Inc

Notable Milestones in Cybersecurity Market in Brazil Sector

- August 2022: Microsoft Corporation announced the launch of Microsoft Defender Threat Intelligence and Microsoft Defender External Attack Surface Management. These offerings provide real-time data from Microsoft security signals for monitoring threat agent activity and discovering unknown internet-accessible resources, enhancing organizational security visibility.

- July 2022: Microsoft Brazil partnered with the Center for Public Leadership (CLP) to provide digital leadership and transformation training to 44 public sector managers across Brazil. This initiative aims to accelerate the digital transformation of the public sector, with cybersecurity being a key focus area.

In-Depth Cybersecurity Market in Brazil Market Outlook

The Cybersecurity Market in Brazil is set for sustained and robust growth, driven by an increasingly threat-prone digital landscape and proactive regulatory environments. Future market potential is significantly boosted by the ongoing digital transformation initiatives across all sectors, from BFSI to manufacturing and healthcare. Strategic opportunities lie in providing advanced, cloud-native security solutions, and specialized services for IoT and OT environments. The increasing demand for managed security services and cybersecurity awareness programs for SMEs will also contribute to market expansion. As Brazil continues to embrace innovation and digitalization, the imperative for strong cybersecurity will only intensify, making this a prime sector for investment and development.

Cybersecurity Market in Brazil Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

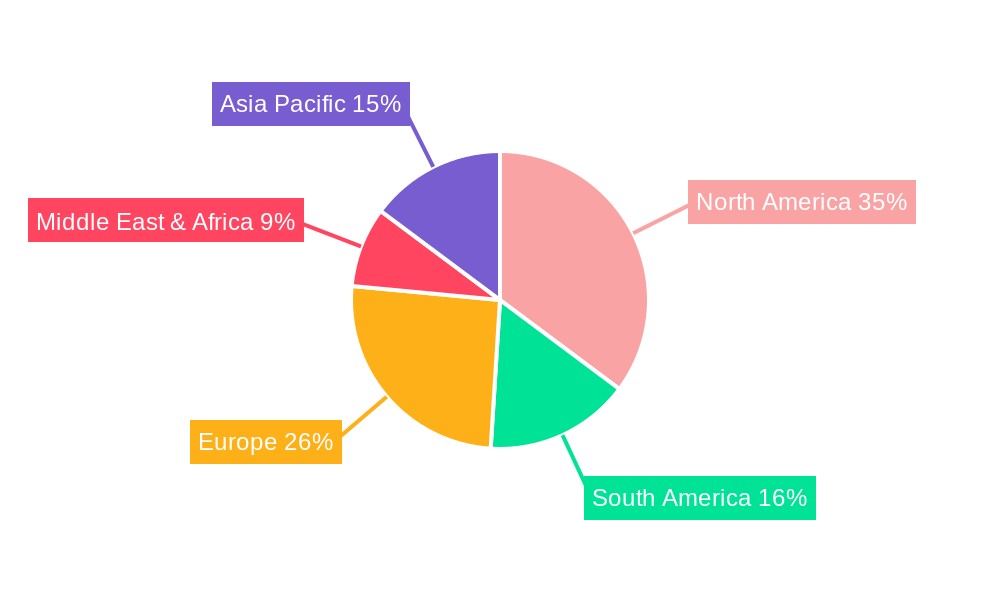

Cybersecurity Market in Brazil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cybersecurity Market in Brazil Regional Market Share

Geographic Coverage of Cybersecurity Market in Brazil

Cybersecurity Market in Brazil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of IoT Devices to Boost the Market; Economic Growth Through Emerging E-commerce Platforms

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Cybersecurity Professionals

- 3.4. Market Trends

- 3.4.1. Increasing Use of IoT Devices to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cybersecurity Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Cybersecurity Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Security Type

- 6.1.1.1. Cloud Security

- 6.1.1.2. Data Security

- 6.1.1.3. Identity Access Management

- 6.1.1.4. Network Security

- 6.1.1.5. Consumer Security

- 6.1.1.6. Infrastructure Protection

- 6.1.1.7. Other Types

- 6.1.2. Services

- 6.1.1. Security Type

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Manufacturing

- 6.3.4. Government & Defense

- 6.3.5. IT and Telecommunication

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. South America Cybersecurity Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Security Type

- 7.1.1.1. Cloud Security

- 7.1.1.2. Data Security

- 7.1.1.3. Identity Access Management

- 7.1.1.4. Network Security

- 7.1.1.5. Consumer Security

- 7.1.1.6. Infrastructure Protection

- 7.1.1.7. Other Types

- 7.1.2. Services

- 7.1.1. Security Type

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Manufacturing

- 7.3.4. Government & Defense

- 7.3.5. IT and Telecommunication

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Europe Cybersecurity Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Security Type

- 8.1.1.1. Cloud Security

- 8.1.1.2. Data Security

- 8.1.1.3. Identity Access Management

- 8.1.1.4. Network Security

- 8.1.1.5. Consumer Security

- 8.1.1.6. Infrastructure Protection

- 8.1.1.7. Other Types

- 8.1.2. Services

- 8.1.1. Security Type

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Manufacturing

- 8.3.4. Government & Defense

- 8.3.5. IT and Telecommunication

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Middle East & Africa Cybersecurity Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Security Type

- 9.1.1.1. Cloud Security

- 9.1.1.2. Data Security

- 9.1.1.3. Identity Access Management

- 9.1.1.4. Network Security

- 9.1.1.5. Consumer Security

- 9.1.1.6. Infrastructure Protection

- 9.1.1.7. Other Types

- 9.1.2. Services

- 9.1.1. Security Type

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Manufacturing

- 9.3.4. Government & Defense

- 9.3.5. IT and Telecommunication

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Asia Pacific Cybersecurity Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Security Type

- 10.1.1.1. Cloud Security

- 10.1.1.2. Data Security

- 10.1.1.3. Identity Access Management

- 10.1.1.4. Network Security

- 10.1.1.5. Consumer Security

- 10.1.1.6. Infrastructure Protection

- 10.1.1.7. Other Types

- 10.1.2. Services

- 10.1.1. Security Type

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. BFSI

- 10.3.2. Healthcare

- 10.3.3. Manufacturing

- 10.3.4. Government & Defense

- 10.3.5. IT and Telecommunication

- 10.3.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AO Kaspersky Lab*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Check Point Software Technologies Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Broadcom Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northrop Grumman

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NortonLifeLock Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dell Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Palo Alto Networks Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AO Kaspersky Lab*List Not Exhaustive

List of Figures

- Figure 1: Global Cybersecurity Market in Brazil Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cybersecurity Market in Brazil Revenue (Million), by Offering 2025 & 2033

- Figure 3: North America Cybersecurity Market in Brazil Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Cybersecurity Market in Brazil Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Cybersecurity Market in Brazil Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Cybersecurity Market in Brazil Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Cybersecurity Market in Brazil Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Cybersecurity Market in Brazil Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cybersecurity Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Cybersecurity Market in Brazil Revenue (Million), by Offering 2025 & 2033

- Figure 11: South America Cybersecurity Market in Brazil Revenue Share (%), by Offering 2025 & 2033

- Figure 12: South America Cybersecurity Market in Brazil Revenue (Million), by Deployment 2025 & 2033

- Figure 13: South America Cybersecurity Market in Brazil Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: South America Cybersecurity Market in Brazil Revenue (Million), by End User 2025 & 2033

- Figure 15: South America Cybersecurity Market in Brazil Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America Cybersecurity Market in Brazil Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Cybersecurity Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cybersecurity Market in Brazil Revenue (Million), by Offering 2025 & 2033

- Figure 19: Europe Cybersecurity Market in Brazil Revenue Share (%), by Offering 2025 & 2033

- Figure 20: Europe Cybersecurity Market in Brazil Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Europe Cybersecurity Market in Brazil Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Europe Cybersecurity Market in Brazil Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe Cybersecurity Market in Brazil Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe Cybersecurity Market in Brazil Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cybersecurity Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Cybersecurity Market in Brazil Revenue (Million), by Offering 2025 & 2033

- Figure 27: Middle East & Africa Cybersecurity Market in Brazil Revenue Share (%), by Offering 2025 & 2033

- Figure 28: Middle East & Africa Cybersecurity Market in Brazil Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Middle East & Africa Cybersecurity Market in Brazil Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Middle East & Africa Cybersecurity Market in Brazil Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa Cybersecurity Market in Brazil Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa Cybersecurity Market in Brazil Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Cybersecurity Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Cybersecurity Market in Brazil Revenue (Million), by Offering 2025 & 2033

- Figure 35: Asia Pacific Cybersecurity Market in Brazil Revenue Share (%), by Offering 2025 & 2033

- Figure 36: Asia Pacific Cybersecurity Market in Brazil Revenue (Million), by Deployment 2025 & 2033

- Figure 37: Asia Pacific Cybersecurity Market in Brazil Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Asia Pacific Cybersecurity Market in Brazil Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific Cybersecurity Market in Brazil Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific Cybersecurity Market in Brazil Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Cybersecurity Market in Brazil Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Cybersecurity Market in Brazil Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Offering 2020 & 2033

- Table 6: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Global Cybersecurity Market in Brazil Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Offering 2020 & 2033

- Table 13: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Cybersecurity Market in Brazil Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Offering 2020 & 2033

- Table 20: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Deployment 2020 & 2033

- Table 21: Global Cybersecurity Market in Brazil Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Offering 2020 & 2033

- Table 33: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Deployment 2020 & 2033

- Table 34: Global Cybersecurity Market in Brazil Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Offering 2020 & 2033

- Table 43: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Deployment 2020 & 2033

- Table 44: Global Cybersecurity Market in Brazil Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global Cybersecurity Market in Brazil Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Cybersecurity Market in Brazil Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cybersecurity Market in Brazil?

The projected CAGR is approximately 10.30%.

2. Which companies are prominent players in the Cybersecurity Market in Brazil?

Key companies in the market include AO Kaspersky Lab*List Not Exhaustive, IBM Corporation, Check Point Software Technologies Ltd, Cisco Systems Inc, Broadcom Inc, Microsoft Corporation, Northrop Grumman, NortonLifeLock Inc, Dell Technologies Inc, Palo Alto Networks Inc.

3. What are the main segments of the Cybersecurity Market in Brazil?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of IoT Devices to Boost the Market; Economic Growth Through Emerging E-commerce Platforms.

6. What are the notable trends driving market growth?

Increasing Use of IoT Devices to Boost the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Cybersecurity Professionals.

8. Can you provide examples of recent developments in the market?

August 2022: Microsoft Corporation announced Microsoft Defender Threat Intelligence and Microsoft Defender External Attack Surface Management as the company's new security offerings for monitoring threat agent activity. The Microsoft Defender Threat Intelligence provides direct access to real-time data generated by Microsoft security signals, with the existing platforms like the Microsoft Defender product family and Microsoft Sentinel. Microsoft Defender External Attack Surface Management allows security teams to discover unmatched and unknown resources visible and accessible on the internet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cybersecurity Market in Brazil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cybersecurity Market in Brazil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cybersecurity Market in Brazil?

To stay informed about further developments, trends, and reports in the Cybersecurity Market in Brazil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence