Key Insights

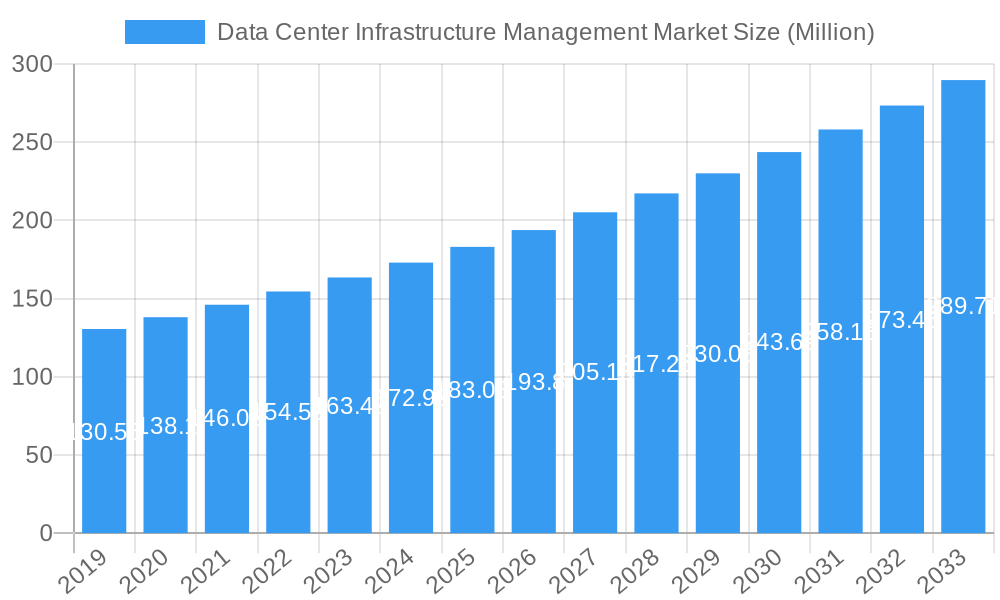

The global Data Center Infrastructure Management (DCIM) market is experiencing robust growth, projected to reach $213.24 million with a Compound Annual Growth Rate (CAGR) of 6.17% between 2019 and 2033. This expansion is fueled by several critical drivers, including the escalating demand for data, the increasing complexity of data center operations, and the imperative for enhanced energy efficiency and cost optimization. Organizations are increasingly adopting DCIM solutions to gain granular visibility into their infrastructure, enabling proactive management of power, cooling, and space. The growing adoption of cloud computing and the surge in IoT devices are further amplifying the need for efficient data center management, positioning DCIM as an indispensable tool for maintaining operational continuity and performance. The market is segmented by data center type, with Enterprise Data Centers forming a significant portion due to their critical role in business operations, followed by Large Data Centers and Small- and Medium-sized Data Centers. Deployment types are also diverse, with a notable shift towards on-premise solutions for enhanced control and security, while colocation is gaining traction for its scalability and cost-effectiveness.

Data Center Infrastructure Management Market Market Size (In Million)

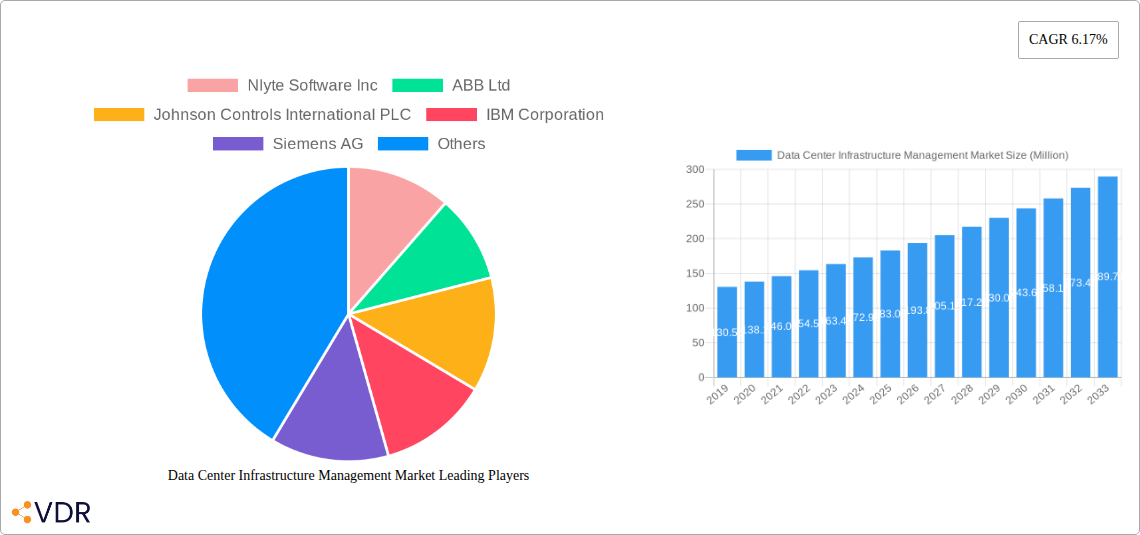

Key trends shaping the DCIM market include the integration of AI and machine learning for predictive analytics and automated operations, the rising focus on sustainability and green IT practices, and the increasing demand for robust security features. These advancements allow for more intelligent resource allocation, optimized energy consumption, and improved data center resilience. However, the market faces certain restraints, such as the high initial investment cost of DCIM solutions and the perceived complexity of implementation for some organizations. Skills gaps in data center management and integration challenges with existing legacy systems also present hurdles. Despite these challenges, the significant benefits offered by DCIM in terms of operational efficiency, cost savings, and improved uptime are driving widespread adoption across North America, Europe, and the Asia Pacific, with the latter expected to witness substantial growth due to rapid digitalization. Leading companies like Nlyte Software Inc, ABB Ltd, Johnson Controls International PLC, IBM Corporation, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, FNT GmbH, and Vertiv Group Corp are actively innovating and expanding their offerings to cater to the evolving demands of the DCIM landscape.

Data Center Infrastructure Management Market Company Market Share

This comprehensive report delves into the global Data Center Infrastructure Management (DCIM) market, exploring its intricate dynamics, growth trajectories, and future potential. As digital transformation accelerates, the demand for robust, efficient, and scalable data center operations has never been higher. This study provides in-depth analysis of market segmentation, key players, industry developments, and emerging trends, offering invaluable insights for stakeholders seeking to navigate this evolving landscape.

Data Center Infrastructure Management Market Market Dynamics & Structure

The Data Center Infrastructure Management market is characterized by a moderate to high concentration, driven by a handful of established vendors alongside a growing number of innovative solution providers. Technological innovation is a primary driver, with advancements in AI, IoT, and automation continuously enhancing DCIM capabilities for predictive maintenance, energy optimization, and resource allocation. Regulatory frameworks, particularly those focused on energy efficiency and data security, also shape market strategies and product development. While direct competitive product substitutes for comprehensive DCIM solutions are limited, integrated IT management tools and specialized monitoring software present indirect competition. End-user demographics are shifting, with an increasing adoption by small and medium-sized enterprises alongside continued dominance by large enterprises and colocation providers. Mergers and acquisitions (M&A) remain a significant trend, with companies strategically acquiring technologies and market share to strengthen their portfolios. For instance, over the historical period (2019-2024), an estimated 15-20 M&A deals have been observed, averaging a deal value of XX Million USD. Innovation barriers include the complexity of integrating diverse IT and physical infrastructure components and the significant upfront investment required for comprehensive DCIM deployment.

- Market Concentration: Moderate to High, with key vendors holding significant market share.

- Technological Innovation Drivers: AI, IoT, Machine Learning, Automation, Edge Computing integration.

- Regulatory Frameworks: Energy efficiency standards (e.g., LEED), data privacy regulations (e.g., GDPR), critical infrastructure protection mandates.

- Competitive Substitutes: Specialized monitoring tools, unified communication platforms, cloud-native management solutions.

- End-User Demographics: Growing adoption by SMBs, continued demand from hyperscalers, enterprises, and colocation facilities.

- M&A Trends: Strategic acquisitions for technology enhancement, market penetration, and portfolio expansion.

Data Center Infrastructure Management Market Growth Trends & Insights

The Data Center Infrastructure Management market is poised for robust growth, driven by the relentless expansion of digital services and the increasing criticality of data centers as the backbone of modern economies. The market size is projected to expand from USD 3,500 Million in 2024 to an estimated USD 7,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period (2025-2033). Adoption rates are accelerating across various enterprise segments as organizations recognize the tangible benefits of DCIM in improving operational efficiency, reducing costs, and enhancing data center reliability. Technological disruptions, such as the proliferation of edge data centers and the increasing adoption of hybrid and multi-cloud strategies, are creating new demands for flexible and integrated DCIM solutions. Consumer behavior shifts, characterized by a growing preference for data-intensive applications and services, are directly fueling the need for more powerful and efficiently managed data center infrastructure. The market penetration of DCIM solutions, which stood at approximately 45% in 2024, is expected to climb steadily as more organizations realize the ROI and strategic advantages of these platforms. Furthermore, the evolving landscape of IT infrastructure, including the rise of converged and hyperconverged systems, necessitates advanced management capabilities that DCIM provides. The increasing complexity of data center environments, with a higher density of IT equipment and greater power and cooling demands, further underscores the importance of sophisticated DCIM tools. The shift towards more sustainable data center operations also plays a crucial role, with DCIM solutions enabling significant energy savings and environmental impact reduction.

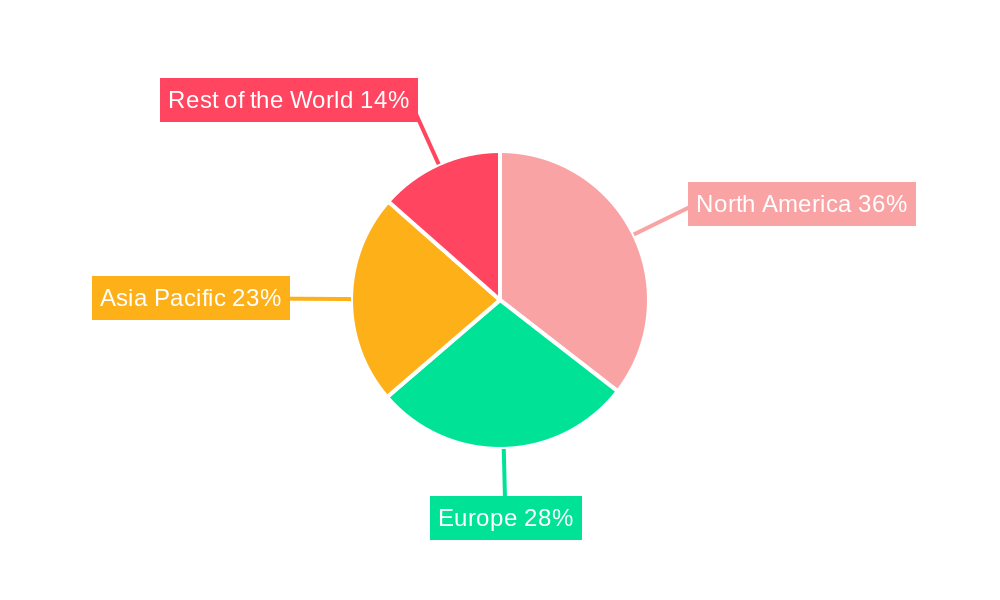

Dominant Regions, Countries, or Segments in Data Center Infrastructure Management Market

North America currently dominates the Data Center Infrastructure Management market, driven by its mature IT ecosystem, significant investments in hyperscale data centers, and the presence of major technology players. The United States, in particular, accounts for a substantial portion of the regional market share, fueled by ongoing digital transformation initiatives across various industries and a strong emphasis on technological innovation. Among the segments, Large Data Centers are exhibiting the most significant growth and market penetration, owing to their complex infrastructure requirements and the substantial operational cost savings achievable through effective DCIM implementation. These facilities, often operated by hyperscalers and large enterprises, benefit immensely from DCIM's capabilities in managing power, cooling, space, and asset lifecycle efficiently.

The Colocation deployment type is another key growth driver, as colocation providers increasingly adopt DCIM to offer enhanced services to their tenants, improve resource utilization, and optimize energy consumption. This segment's growth is intrinsically linked to the rising demand for outsourced data center services.

- Leading Region: North America (primarily the United States).

- Dominant Data Center Type: Large Data Centers.

- Dominant Deployment Type: Colocation.

Key drivers for dominance in North America include:

- High IT Spending: Robust investment in digital infrastructure and cloud services.

- Technological Advancement: Early adoption and development of cutting-edge DCIM technologies.

- Presence of Hyperscalers: Home to major cloud providers with extensive data center footprints.

- Stringent Energy Efficiency Regulations: Driving demand for solutions that optimize power consumption.

- Growing Colocation Market: Increasing reliance on third-party data center providers.

In the Small- and Medium-sized Data Centers segment, while adoption is growing, the market share is relatively smaller due to budget constraints and less complex infrastructure needs. However, the increasing availability of cloud-based and modular DCIM solutions is making these platforms more accessible to this segment. Enterprise Data Centers continue to be a significant market, with organizations focusing on improving agility, security, and cost-effectiveness through DCIM.

Data Center Infrastructure Management Market Product Landscape

The Data Center Infrastructure Management product landscape is characterized by increasingly sophisticated and integrated solutions designed to provide end-to-end visibility and control over physical and virtual data center assets. Innovations focus on leveraging AI and machine learning for predictive analytics, enabling proactive issue resolution and optimized resource allocation. Key features include advanced asset management, real-time environmental monitoring, intelligent power distribution management, capacity planning tools, and workflow automation for IT and facilities teams. The performance metrics of these solutions are measured by their ability to reduce downtime, improve energy efficiency by up to 20%, enhance IT asset utilization, and streamline operational processes, ultimately contributing to a lower total cost of ownership for data center operations.

Key Drivers, Barriers & Challenges in Data Center Infrastructure Management Market

Key Drivers:

- Exponential Data Growth: The ever-increasing volume of data generated by digital services necessitates robust infrastructure management.

- Demand for Energy Efficiency: Growing environmental concerns and rising energy costs drive the need for optimized power consumption.

- Cost Optimization: DCIM solutions enable significant reductions in operational expenditures through efficient resource utilization and predictive maintenance.

- Improved Reliability and Uptime: Proactive monitoring and management minimize downtime, ensuring business continuity.

- Scalability and Agility: DCIM facilitates seamless expansion and adaptation of data center infrastructure to meet evolving business demands.

Barriers & Challenges:

- High Implementation Costs: The initial investment in DCIM software and hardware can be substantial, particularly for smaller organizations.

- Integration Complexity: Integrating DCIM with existing disparate IT and physical infrastructure systems can be challenging and time-consuming.

- Lack of Skilled Personnel: A shortage of trained professionals to deploy, manage, and interpret DCIM data can hinder adoption.

- Data Security Concerns: Protecting sensitive data managed by DCIM platforms is paramount and requires robust security measures.

- Resistance to Change: Organizational inertia and reluctance to adopt new management methodologies can slow down implementation.

Emerging Opportunities in Data Center Infrastructure Management Market

Emerging opportunities in the Data Center Infrastructure Management market lie in the growing demand for AI-driven predictive analytics for proactive fault detection and capacity planning. The expansion of edge computing presents a significant opportunity for modular and scalable DCIM solutions tailored for distributed data center environments. Furthermore, the increasing focus on sustainability and green data centers is creating a demand for DCIM tools that can effectively monitor and optimize energy consumption and carbon footprint. The integration of DCIM with IoT devices for real-time environmental monitoring and the development of blockchain-based solutions for enhanced data integrity and security also represent promising avenues for growth. The rise of Software-Defined Data Centers (SDDCs) also opens up opportunities for DCIM to provide a unified management layer for both physical and virtual resources.

Growth Accelerators in the Data Center Infrastructure Management Market Industry

Several key accelerators are propelling the growth of the Data Center Infrastructure Management market. The relentless expansion of cloud computing and the increasing adoption of hybrid and multi-cloud strategies are creating a complex IT landscape that demands sophisticated management capabilities, which DCIM provides. Technological advancements, particularly in Artificial Intelligence (AI) and Machine Learning (ML), are enabling more intelligent and predictive DCIM solutions, leading to enhanced operational efficiency and reduced downtime. Strategic partnerships between DCIM vendors and IT infrastructure providers, as well as collaborations with colocation facility operators, are expanding market reach and offering more integrated solutions. Furthermore, the growing emphasis on sustainability and energy efficiency by regulatory bodies and enterprises alike is driving the demand for DCIM solutions that can optimize power consumption and reduce the environmental impact of data centers. The increasing adoption of automation in data center operations, from provisioning to maintenance, further fuels the need for comprehensive management platforms like DCIM.

Key Players Shaping the Data Center Infrastructure Management Market Market

- Nlyte Software Inc

- ABB Ltd

- Johnson Controls International PLC

- IBM Corporation

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- FNT GmbH

- Vertiv Group Corp

- Itracs Corporation Inc (CommScope Inc)

Notable Milestones in Data Center Infrastructure Management Market Sector

- May 2022: Siemens implemented integrated data center management software in the Baltic region's largest and most energy-efficient data center. Greenergy Data Centers benefited from building management software (BMS), energy and power management software (EPMS), and White Space Cooling Optimization (WSCO) to reduce energy consumption, maintain thermal protection, and manage the reliable functioning of essential infrastructure.

- January 2022: Delta's UPS and Data Centre solutions allied with DATABOX, a renowned provider of IT channels. Through this collaboration, DATABOX will provide Delta's energy-efficient Uninterruptible Power Supplies and Data Centre Infrastructure Solutions to IT resellers and system integrators throughout Portugal.

In-Depth Data Center Infrastructure Management Market Market Outlook

The Data Center Infrastructure Management market is set for sustained and significant growth, fueled by the indispensable role of data centers in the digital economy. The continuous surge in data generation, coupled with the imperative for energy efficiency and cost optimization, will drive deeper penetration of DCIM solutions across all enterprise segments. Advancements in AI and IoT will further empower these platforms with predictive capabilities, transforming data center operations from reactive to proactive. Emerging trends such as edge computing and the proliferation of hybrid cloud environments will necessitate more adaptable and granular DCIM solutions. Strategic partnerships and ongoing M&A activities are expected to consolidate the market and foster innovation, leading to more integrated and comprehensive offerings that address the complex challenges of modern data center management. The future outlook for DCIM is exceptionally positive, promising enhanced operational resilience, reduced environmental impact, and significant cost savings for data center operators globally.

Data Center Infrastructure Management Market Segmentation

-

1. Data Center Type

- 1.1. Small- and Medium-sized Data Centers

- 1.2. Large Data Centers

- 1.3. Enterprise Data Centers

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Colocation

Data Center Infrastructure Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Data Center Infrastructure Management Market Regional Market Share

Geographic Coverage of Data Center Infrastructure Management Market

Data Center Infrastructure Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Manage Energy Consumption Across Data Centers; Increase in the Number of Data Centers

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Small and Medium Sized Data Centers is Expected to hold Significant Growth rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Data Center Type

- 5.1.1. Small- and Medium-sized Data Centers

- 5.1.2. Large Data Centers

- 5.1.3. Enterprise Data Centers

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Colocation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Data Center Type

- 6. North America Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Data Center Type

- 6.1.1. Small- and Medium-sized Data Centers

- 6.1.2. Large Data Centers

- 6.1.3. Enterprise Data Centers

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. On-premise

- 6.2.2. Colocation

- 6.1. Market Analysis, Insights and Forecast - by Data Center Type

- 7. Europe Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Data Center Type

- 7.1.1. Small- and Medium-sized Data Centers

- 7.1.2. Large Data Centers

- 7.1.3. Enterprise Data Centers

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. On-premise

- 7.2.2. Colocation

- 7.1. Market Analysis, Insights and Forecast - by Data Center Type

- 8. Asia Pacific Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Data Center Type

- 8.1.1. Small- and Medium-sized Data Centers

- 8.1.2. Large Data Centers

- 8.1.3. Enterprise Data Centers

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. On-premise

- 8.2.2. Colocation

- 8.1. Market Analysis, Insights and Forecast - by Data Center Type

- 9. Rest of the World Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Data Center Type

- 9.1.1. Small- and Medium-sized Data Centers

- 9.1.2. Large Data Centers

- 9.1.3. Enterprise Data Centers

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. On-premise

- 9.2.2. Colocation

- 9.1. Market Analysis, Insights and Forecast - by Data Center Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nlyte Software Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Johnson Controls International PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IBM Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schneider Electric SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Eaton Corporation PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 FNT GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vertiv Group Corp

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Itracs Corporation Inc (CommScope Inc)*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nlyte Software Inc

List of Figures

- Figure 1: Global Data Center Infrastructure Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2025 & 2033

- Figure 3: North America Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 4: North America Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 5: North America Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 6: North America Data Center Infrastructure Management Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Data Center Infrastructure Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2025 & 2033

- Figure 9: Europe Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 10: Europe Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 11: Europe Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 12: Europe Data Center Infrastructure Management Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Data Center Infrastructure Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2025 & 2033

- Figure 15: Asia Pacific Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 16: Asia Pacific Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 17: Asia Pacific Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 18: Asia Pacific Data Center Infrastructure Management Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Data Center Infrastructure Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2025 & 2033

- Figure 21: Rest of the World Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 22: Rest of the World Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 23: Rest of the World Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 24: Rest of the World Data Center Infrastructure Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Data Center Infrastructure Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2020 & 2033

- Table 2: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 3: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2020 & 2033

- Table 5: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 6: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2020 & 2033

- Table 8: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 9: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2020 & 2033

- Table 11: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 12: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2020 & 2033

- Table 14: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 15: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Infrastructure Management Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the Data Center Infrastructure Management Market?

Key companies in the market include Nlyte Software Inc, ABB Ltd, Johnson Controls International PLC, IBM Corporation, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, FNT GmbH, Vertiv Group Corp, Itracs Corporation Inc (CommScope Inc)*List Not Exhaustive.

3. What are the main segments of the Data Center Infrastructure Management Market?

The market segments include Data Center Type, Deployment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Manage Energy Consumption Across Data Centers; Increase in the Number of Data Centers.

6. What are the notable trends driving market growth?

Small and Medium Sized Data Centers is Expected to hold Significant Growth rate.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

May 2022 - Siemens has implemented integrated data center management software in the Baltic region's largest and most energy-efficient data center. Greenergy Data Centers benefit from building management software (BMS), energy and power management software (EPMS), and White Space Cooling Optimization (WSCO) to reduce energy consumption, maintain thermal protection, and manage the reliable functioning of essential infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Infrastructure Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Infrastructure Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Infrastructure Management Market?

To stay informed about further developments, trends, and reports in the Data Center Infrastructure Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence