Key Insights

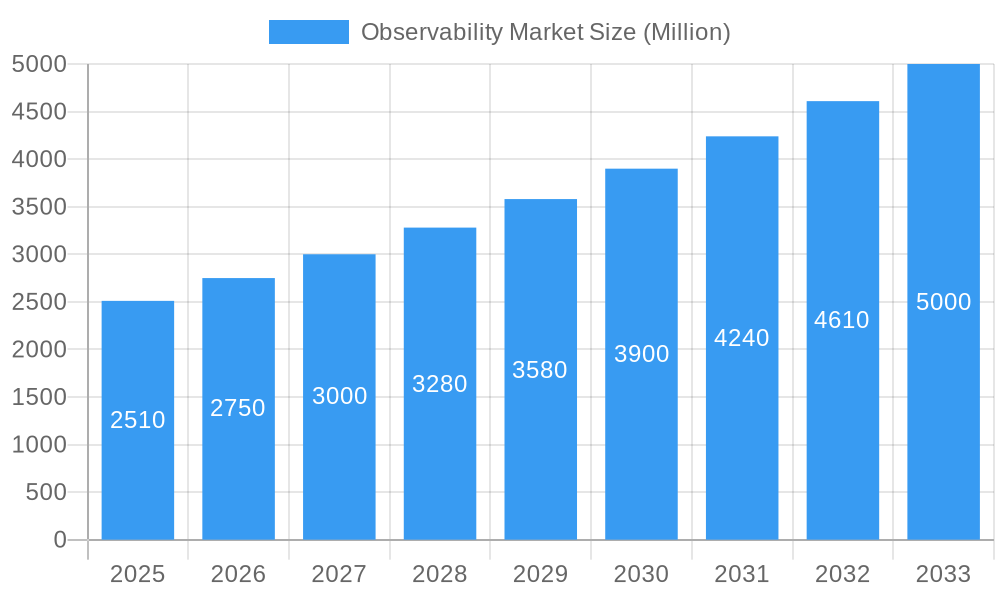

The Observability Market is poised for significant expansion, projected to reach USD 2.51 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.73% expected to drive sustained growth through 2033. This burgeoning market is fueled by the increasing complexity of modern IT infrastructures, the proliferation of cloud-native applications, and the critical need for real-time insights into system performance and user experience. Enterprises across various sectors are recognizing observability as a strategic imperative for proactive issue detection, faster root cause analysis, and optimized resource utilization, ultimately leading to improved operational efficiency and enhanced customer satisfaction. Key drivers include the surging adoption of microservices architectures, the growing demand for AI-powered anomaly detection, and the imperative to meet stringent regulatory compliance requirements. The market's expansion is also propelled by the continuous innovation in observability solutions, offering more comprehensive telemetry data collection, advanced analytics, and intuitive visualization tools to manage distributed systems effectively.

Observability Market Market Size (In Billion)

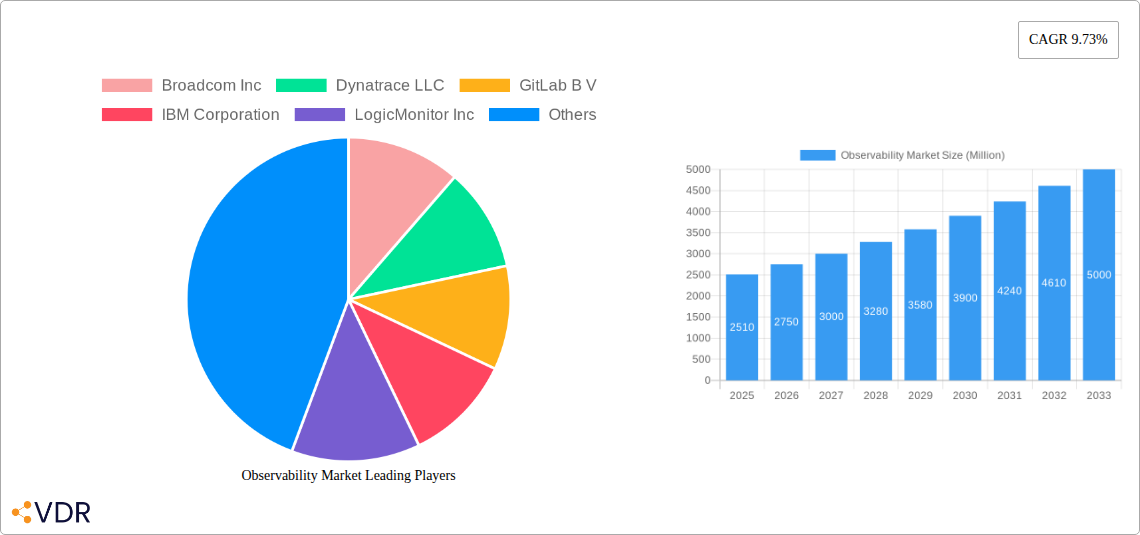

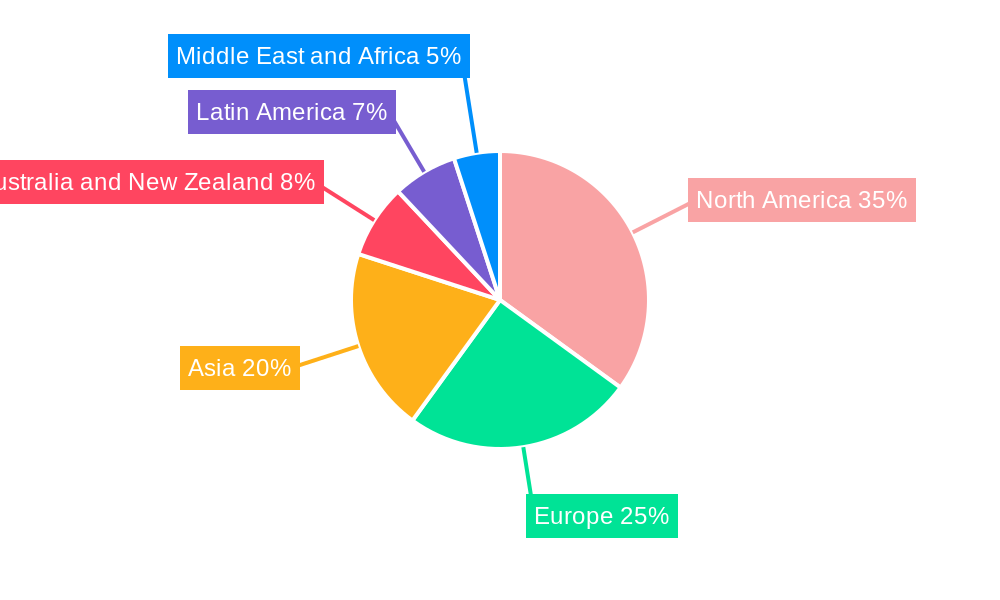

The market segmentation reveals a dynamic landscape with diverse opportunities. The Solution segment is expected to dominate, encompassing advanced tooling for logs, metrics, and traces, while Services will play a crucial role in implementation, support, and consulting. Cloud deployment is rapidly gaining traction, reflecting the broader industry shift towards cloud environments, though On-Premises solutions will retain relevance for organizations with specific security or regulatory mandates. Small and Medium-sized Enterprises (SMEs) are increasingly adopting observability solutions to democratize access to critical IT insights, complementing the continued investment by Large Enterprises. Geographically, North America is anticipated to lead the market, driven by its early adoption of advanced technologies and a mature digital economy. However, the Asia region is projected to exhibit the fastest growth, fueled by rapid digital transformation initiatives and a burgeoning IT sector. Key players like Broadcom Inc., Dynatrace LLC, GitLab B.V., IBM Corporation, Microsoft Corporation, and Splunk Inc. are at the forefront of this innovation, offering comprehensive platforms and solutions to meet the evolving demands of the observability landscape.

Observability Market Company Market Share

Here is a comprehensive and SEO-optimized report description for the Observability Market, integrating high-traffic keywords and structured for maximum visibility and engagement:

Observability Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth market research report provides a granular analysis of the global Observability Market, encompassing a detailed examination of its dynamics, growth trajectory, and future potential. Covering the historical period of 2019–2024 and projecting through 2033, with a base and estimated year of 2025, this report is an essential resource for stakeholders seeking to understand the intricate workings and evolving landscape of this critical technology sector. We delve into parent and child markets, offering a holistic view that uncovers hidden growth avenues and competitive advantages. The report utilizes quantitative data and qualitative insights to empower strategic decision-making.

Observability Market Market Dynamics & Structure

The Observability Market is characterized by a dynamic and evolving structure, driven by rapid technological innovation and increasing enterprise demand for comprehensive system insights. Market concentration is influenced by a blend of established technology giants and agile specialized vendors. Key drivers include the relentless pursuit of improved application performance, enhanced user experience, and proactive issue resolution. Regulatory frameworks, while nascent in some regions, are beginning to influence data privacy and security aspects of observability solutions. Competitive product substitutes, such as traditional monitoring tools, are increasingly being superseded by integrated observability platforms. End-user demographics are shifting towards a greater reliance on cloud-native architectures and microservices, necessitating advanced observability capabilities. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring innovative startups to bolster their portfolios.

- Market Concentration: A mix of large enterprise players and specialized SaaS providers, with increasing M&A activity.

- Technological Innovation Drivers: Cloud-native adoption, AI/ML for anomaly detection, hybrid and multi-cloud environments, edge computing.

- Regulatory Frameworks: Data privacy (GDPR, CCPA), compliance mandates for critical infrastructure.

- Competitive Product Substitutes: Traditional Application Performance Monitoring (APM), Infrastructure Monitoring, Log Management tools.

- End-User Demographics: Growing demand from SMEs and Large Enterprises across diverse verticals.

- M&A Trends: Strategic acquisitions to expand feature sets, gain market share, and acquire talent.

Observability Market Growth Trends & Insights

The Observability Market is experiencing robust growth, fueled by the digital transformation initiatives sweeping across industries. The market size is projected to see a significant upward trend, with adoption rates accelerating as organizations recognize the imperative of real-time, end-to-end visibility. Technological disruptions, including the rise of AI-powered analytics and the increasing complexity of distributed systems, are not only driving demand but also reshaping the very nature of observability solutions. Consumer behavior shifts are paramount; businesses now expect seamless digital experiences, making proactive problem identification and resolution a critical competitive differentiator. The convergence of logs, metrics, and traces into unified observability platforms is a key trend, enabling deeper insights and faster mean-time-to-resolution (MTTR). The increasing adoption of DevOps and SRE practices further solidifies the need for comprehensive observability.

Leveraging advanced analytical methodologies, this report quantifies market evolution with metrics such as Compound Annual Growth Rate (CAGR) and market penetration across various segments. We analyze the impact of emerging technologies like edge observability and the growing importance of security observability. The shift from reactive monitoring to proactive and predictive insights is a defining characteristic of current and future market growth. We explore how the increasing volume and velocity of data generated by modern applications necessitate scalable and intelligent observability solutions. The report highlights how organizations are investing in observability to gain a competitive edge, reduce operational costs, and improve customer satisfaction. The evolving landscape of cloud architectures, microservices, and serverless computing presents both challenges and significant opportunities for observability vendors.

Dominant Regions, Countries, or Segments in Observability Market

The North America region currently dominates the Observability Market, driven by a mature technology ecosystem, high adoption of cloud services, and the presence of leading technology companies. The United States, in particular, serves as a significant growth hub, owing to substantial investments in digital infrastructure and a strong emphasis on IT and Telecom, BFSI, and Retail and E-commerce sectors.

Dominant Segment (Type): Solutions

- Key Drivers: Demand for integrated platforms encompassing logs, metrics, traces, and user experience monitoring.

- Market Share Potential: High, as organizations prioritize comprehensive data analysis.

- Growth Potential: Driven by AI/ML enhancements and automation capabilities.

Dominant Segment (Deployment): Cloud

- Key Drivers: Scalability, flexibility, and cost-efficiency of cloud-based observability solutions.

- Market Share Potential: Continually increasing, aligning with the broader cloud migration trend.

- Growth Potential: Accelerated by the proliferation of SaaS observability platforms.

Dominant Segment (End-user Vertical): IT and Telecom

- Key Drivers: Criticality of uptime, complexity of networks and services, and the need for real-time performance monitoring.

- Market Share Potential: Substantial, representing early adopters and continuous demand.

- Growth Potential: Fueled by 5G deployment, IoT expansion, and digital service innovation.

Other significant contributors to market growth include Europe, with its strong regulatory focus and increasing enterprise adoption, and Asia Pacific, which is rapidly expanding its digital infrastructure and witnessing a surge in cloud adoption. The BFSI and Retail and E-commerce verticals globally are also key drivers, demanding robust observability for secure and seamless transactions and customer experiences.

Observability Market Product Landscape

The product landscape of the Observability Market is characterized by sophisticated, integrated platforms designed to provide end-to-end visibility across complex IT infrastructures. Innovations focus on leveraging Artificial Intelligence (AI) and Machine Learning (ML) for automated anomaly detection, root cause analysis, and predictive insights. Key product developments include unified platforms that seamlessly ingest and correlate data from logs, metrics, and traces, offering a holistic view of application performance and user experience. Unique selling propositions revolve around enhanced data correlation, intelligent alerting, and customizable dashboards that empower IT teams to proactively manage their systems and accelerate troubleshooting. Technological advancements are also addressing the challenges of distributed systems, microservices, and hybrid cloud environments.

Key Drivers, Barriers & Challenges in Observability Market

Key Drivers: The Observability Market is propelled by several key forces. The escalating complexity of modern IT environments, including cloud-native architectures, microservices, and IoT devices, necessitates advanced visibility solutions. The increasing demand for exceptional digital customer experiences drives organizations to adopt observability for proactive issue resolution and performance optimization. Furthermore, the growing adoption of DevOps and Site Reliability Engineering (SRE) practices places a premium on real-time data and actionable insights. The imperative to reduce downtime and operational costs also acts as a significant catalyst.

Barriers & Challenges: Despite its robust growth, the market faces several challenges. The sheer volume and velocity of data generated by complex systems can lead to data management and storage complexities. The shortage of skilled professionals with expertise in observability tools and data analysis presents a significant barrier. Integrating disparate data sources from various tools and platforms can also be a complex and time-consuming endeavor. Moreover, the evolving threat landscape and the need for integrated security observability add another layer of complexity, requiring continuous adaptation and investment in advanced solutions.

Emerging Opportunities in Observability Market

Emerging opportunities in the Observability Market lie in the increasing demand for specialized observability solutions tailored to specific industry needs, such as IoT observability and edge computing observability. The convergence of observability with security operations (SecOps) presents a significant avenue for growth, leading to integrated security and operational intelligence platforms. Furthermore, the development of more intelligent, AI-driven anomaly detection and predictive maintenance capabilities will unlock new value for enterprises. The growing adoption of serverless architectures and edge deployments creates a fertile ground for vendors to offer specialized observability tools.

Growth Accelerators in the Observability Market Industry

Several key factors are acting as growth accelerators for the Observability Market. The widespread adoption of cloud-native technologies, including containers and Kubernetes, directly fuels the need for sophisticated observability solutions to manage these dynamic environments. Strategic partnerships between observability vendors and cloud providers, as well as other technology companies, are expanding market reach and integration capabilities. The ongoing digital transformation across all industry verticals, pushing for greater automation and data-driven decision-making, is a consistent accelerator. Additionally, the increasing focus on customer experience management necessitates continuous investment in tools that provide deep insights into user journeys and application performance.

Key Players Shaping the Observability Market Market

- Broadcom Inc

- Dynatrace LLC

- GitLab B V

- IBM Corporation

- LogicMonitor Inc

- Microsoft Corporation

- Monte Carlo Corporation

- Riverbed Technology

- ScienceLogic Inc

- Splunk Inc

Notable Milestones in Observability Market Sector

- June 2024: SUSE announced its acquisition of StackState, aiming to embed observability capabilities into its Rancher platform for managing Kubernetes clusters. This move, announced at SUSECon, signifies an effort to enhance enterprise IT teams' ability to manage complex containerized environments through integrated observability.

- May 2024: Cisco unveiled a new virtual appliance for its AppDynamics On-Premises application observability offering. This innovation empowers customers with a self-hosted solution leveraging AI-powered intelligence for anomaly detection, root cause analysis, application security, and SAP monitoring.

In-Depth Observability Market Market Outlook

The future outlook for the Observability Market is exceptionally promising, driven by a confluence of technological advancements and evolving business imperatives. The sustained growth of cloud computing, the proliferation of microservices, and the increasing adoption of AI/ML are creating a fertile ground for innovation and market expansion. Organizations are increasingly recognizing observability not just as a tool for troubleshooting but as a strategic enabler for digital transformation, operational excellence, and superior customer experiences. The market is expected to witness further consolidation, with strategic partnerships and mergers playing a crucial role in shaping the competitive landscape. The ongoing development of unified observability platforms, capable of correlating data from diverse sources and providing predictive insights, will be a key differentiator and growth accelerator.

Observability Market Segmentation

-

1. Type

- 1.1. Solution

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-Premises

-

3. Enterprises

- 3.1. SMEs

- 3.2. Large Enterprises

-

4. End-user Vertical

- 4.1. IT and Telecom

- 4.2. Retail and E-commerce

- 4.3. Manufacturing

- 4.4. BFSI

- 4.5. Government and Defense

- 4.6. Other End-user Verticals

Observability Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Observability Market Regional Market Share

Geographic Coverage of Observability Market

Observability Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automation Among Enterprises; Shifting Workloads of Enterprises towards Cloud Environment

- 3.3. Market Restrains

- 3.3.1. Increasing Automation Among Enterprises; Shifting Workloads of Enterprises towards Cloud Environment

- 3.4. Market Trends

- 3.4.1. BFSI to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Observability Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solution

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-Premises

- 5.3. Market Analysis, Insights and Forecast - by Enterprises

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. IT and Telecom

- 5.4.2. Retail and E-commerce

- 5.4.3. Manufacturing

- 5.4.4. BFSI

- 5.4.5. Government and Defense

- 5.4.6. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Observability Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solution

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-Premises

- 6.3. Market Analysis, Insights and Forecast - by Enterprises

- 6.3.1. SMEs

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.4.1. IT and Telecom

- 6.4.2. Retail and E-commerce

- 6.4.3. Manufacturing

- 6.4.4. BFSI

- 6.4.5. Government and Defense

- 6.4.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Observability Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solution

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-Premises

- 7.3. Market Analysis, Insights and Forecast - by Enterprises

- 7.3.1. SMEs

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.4.1. IT and Telecom

- 7.4.2. Retail and E-commerce

- 7.4.3. Manufacturing

- 7.4.4. BFSI

- 7.4.5. Government and Defense

- 7.4.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Observability Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solution

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-Premises

- 8.3. Market Analysis, Insights and Forecast - by Enterprises

- 8.3.1. SMEs

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.4.1. IT and Telecom

- 8.4.2. Retail and E-commerce

- 8.4.3. Manufacturing

- 8.4.4. BFSI

- 8.4.5. Government and Defense

- 8.4.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Observability Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solution

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-Premises

- 9.3. Market Analysis, Insights and Forecast - by Enterprises

- 9.3.1. SMEs

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.4.1. IT and Telecom

- 9.4.2. Retail and E-commerce

- 9.4.3. Manufacturing

- 9.4.4. BFSI

- 9.4.5. Government and Defense

- 9.4.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Observability Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solution

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-Premises

- 10.3. Market Analysis, Insights and Forecast - by Enterprises

- 10.3.1. SMEs

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.4.1. IT and Telecom

- 10.4.2. Retail and E-commerce

- 10.4.3. Manufacturing

- 10.4.4. BFSI

- 10.4.5. Government and Defense

- 10.4.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Observability Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solution

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. Cloud

- 11.2.2. On-Premises

- 11.3. Market Analysis, Insights and Forecast - by Enterprises

- 11.3.1. SMEs

- 11.3.2. Large Enterprises

- 11.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.4.1. IT and Telecom

- 11.4.2. Retail and E-commerce

- 11.4.3. Manufacturing

- 11.4.4. BFSI

- 11.4.5. Government and Defense

- 11.4.6. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Broadcom Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Dynatrace LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GitLab B V

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 IBM Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 LogicMonitor Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Monte Carlo Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Riverbed Technology

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ScienceLogic Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Splunk Inc *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Broadcom Inc

List of Figures

- Figure 1: Global Observability Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Observability Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Observability Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Observability Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Observability Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Observability Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Observability Market Revenue (Million), by Deployment 2025 & 2033

- Figure 8: North America Observability Market Volume (Billion), by Deployment 2025 & 2033

- Figure 9: North America Observability Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: North America Observability Market Volume Share (%), by Deployment 2025 & 2033

- Figure 11: North America Observability Market Revenue (Million), by Enterprises 2025 & 2033

- Figure 12: North America Observability Market Volume (Billion), by Enterprises 2025 & 2033

- Figure 13: North America Observability Market Revenue Share (%), by Enterprises 2025 & 2033

- Figure 14: North America Observability Market Volume Share (%), by Enterprises 2025 & 2033

- Figure 15: North America Observability Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 16: North America Observability Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 17: North America Observability Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: North America Observability Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 19: North America Observability Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Observability Market Volume (Billion), by Country 2025 & 2033

- Figure 21: North America Observability Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Observability Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Observability Market Revenue (Million), by Type 2025 & 2033

- Figure 24: Europe Observability Market Volume (Billion), by Type 2025 & 2033

- Figure 25: Europe Observability Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe Observability Market Volume Share (%), by Type 2025 & 2033

- Figure 27: Europe Observability Market Revenue (Million), by Deployment 2025 & 2033

- Figure 28: Europe Observability Market Volume (Billion), by Deployment 2025 & 2033

- Figure 29: Europe Observability Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Europe Observability Market Volume Share (%), by Deployment 2025 & 2033

- Figure 31: Europe Observability Market Revenue (Million), by Enterprises 2025 & 2033

- Figure 32: Europe Observability Market Volume (Billion), by Enterprises 2025 & 2033

- Figure 33: Europe Observability Market Revenue Share (%), by Enterprises 2025 & 2033

- Figure 34: Europe Observability Market Volume Share (%), by Enterprises 2025 & 2033

- Figure 35: Europe Observability Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 36: Europe Observability Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 37: Europe Observability Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 38: Europe Observability Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 39: Europe Observability Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Observability Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Europe Observability Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Observability Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Observability Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Asia Observability Market Volume (Billion), by Type 2025 & 2033

- Figure 45: Asia Observability Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Observability Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Asia Observability Market Revenue (Million), by Deployment 2025 & 2033

- Figure 48: Asia Observability Market Volume (Billion), by Deployment 2025 & 2033

- Figure 49: Asia Observability Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 50: Asia Observability Market Volume Share (%), by Deployment 2025 & 2033

- Figure 51: Asia Observability Market Revenue (Million), by Enterprises 2025 & 2033

- Figure 52: Asia Observability Market Volume (Billion), by Enterprises 2025 & 2033

- Figure 53: Asia Observability Market Revenue Share (%), by Enterprises 2025 & 2033

- Figure 54: Asia Observability Market Volume Share (%), by Enterprises 2025 & 2033

- Figure 55: Asia Observability Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Asia Observability Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 57: Asia Observability Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Asia Observability Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Asia Observability Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Observability Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Observability Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Observability Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Australia and New Zealand Observability Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Australia and New Zealand Observability Market Volume (Billion), by Type 2025 & 2033

- Figure 65: Australia and New Zealand Observability Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Australia and New Zealand Observability Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Australia and New Zealand Observability Market Revenue (Million), by Deployment 2025 & 2033

- Figure 68: Australia and New Zealand Observability Market Volume (Billion), by Deployment 2025 & 2033

- Figure 69: Australia and New Zealand Observability Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 70: Australia and New Zealand Observability Market Volume Share (%), by Deployment 2025 & 2033

- Figure 71: Australia and New Zealand Observability Market Revenue (Million), by Enterprises 2025 & 2033

- Figure 72: Australia and New Zealand Observability Market Volume (Billion), by Enterprises 2025 & 2033

- Figure 73: Australia and New Zealand Observability Market Revenue Share (%), by Enterprises 2025 & 2033

- Figure 74: Australia and New Zealand Observability Market Volume Share (%), by Enterprises 2025 & 2033

- Figure 75: Australia and New Zealand Observability Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 76: Australia and New Zealand Observability Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 77: Australia and New Zealand Observability Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 78: Australia and New Zealand Observability Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 79: Australia and New Zealand Observability Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Australia and New Zealand Observability Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Australia and New Zealand Observability Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia and New Zealand Observability Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Latin America Observability Market Revenue (Million), by Type 2025 & 2033

- Figure 84: Latin America Observability Market Volume (Billion), by Type 2025 & 2033

- Figure 85: Latin America Observability Market Revenue Share (%), by Type 2025 & 2033

- Figure 86: Latin America Observability Market Volume Share (%), by Type 2025 & 2033

- Figure 87: Latin America Observability Market Revenue (Million), by Deployment 2025 & 2033

- Figure 88: Latin America Observability Market Volume (Billion), by Deployment 2025 & 2033

- Figure 89: Latin America Observability Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 90: Latin America Observability Market Volume Share (%), by Deployment 2025 & 2033

- Figure 91: Latin America Observability Market Revenue (Million), by Enterprises 2025 & 2033

- Figure 92: Latin America Observability Market Volume (Billion), by Enterprises 2025 & 2033

- Figure 93: Latin America Observability Market Revenue Share (%), by Enterprises 2025 & 2033

- Figure 94: Latin America Observability Market Volume Share (%), by Enterprises 2025 & 2033

- Figure 95: Latin America Observability Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 96: Latin America Observability Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 97: Latin America Observability Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 98: Latin America Observability Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 99: Latin America Observability Market Revenue (Million), by Country 2025 & 2033

- Figure 100: Latin America Observability Market Volume (Billion), by Country 2025 & 2033

- Figure 101: Latin America Observability Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: Latin America Observability Market Volume Share (%), by Country 2025 & 2033

- Figure 103: Middle East and Africa Observability Market Revenue (Million), by Type 2025 & 2033

- Figure 104: Middle East and Africa Observability Market Volume (Billion), by Type 2025 & 2033

- Figure 105: Middle East and Africa Observability Market Revenue Share (%), by Type 2025 & 2033

- Figure 106: Middle East and Africa Observability Market Volume Share (%), by Type 2025 & 2033

- Figure 107: Middle East and Africa Observability Market Revenue (Million), by Deployment 2025 & 2033

- Figure 108: Middle East and Africa Observability Market Volume (Billion), by Deployment 2025 & 2033

- Figure 109: Middle East and Africa Observability Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 110: Middle East and Africa Observability Market Volume Share (%), by Deployment 2025 & 2033

- Figure 111: Middle East and Africa Observability Market Revenue (Million), by Enterprises 2025 & 2033

- Figure 112: Middle East and Africa Observability Market Volume (Billion), by Enterprises 2025 & 2033

- Figure 113: Middle East and Africa Observability Market Revenue Share (%), by Enterprises 2025 & 2033

- Figure 114: Middle East and Africa Observability Market Volume Share (%), by Enterprises 2025 & 2033

- Figure 115: Middle East and Africa Observability Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 116: Middle East and Africa Observability Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 117: Middle East and Africa Observability Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 118: Middle East and Africa Observability Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 119: Middle East and Africa Observability Market Revenue (Million), by Country 2025 & 2033

- Figure 120: Middle East and Africa Observability Market Volume (Billion), by Country 2025 & 2033

- Figure 121: Middle East and Africa Observability Market Revenue Share (%), by Country 2025 & 2033

- Figure 122: Middle East and Africa Observability Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Observability Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Observability Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Observability Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Global Observability Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 5: Global Observability Market Revenue Million Forecast, by Enterprises 2020 & 2033

- Table 6: Global Observability Market Volume Billion Forecast, by Enterprises 2020 & 2033

- Table 7: Global Observability Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Observability Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Observability Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Observability Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Observability Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Observability Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Global Observability Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Observability Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 15: Global Observability Market Revenue Million Forecast, by Enterprises 2020 & 2033

- Table 16: Global Observability Market Volume Billion Forecast, by Enterprises 2020 & 2033

- Table 17: Global Observability Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Observability Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 19: Global Observability Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Observability Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Observability Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Observability Market Volume Billion Forecast, by Type 2020 & 2033

- Table 23: Global Observability Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 24: Global Observability Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 25: Global Observability Market Revenue Million Forecast, by Enterprises 2020 & 2033

- Table 26: Global Observability Market Volume Billion Forecast, by Enterprises 2020 & 2033

- Table 27: Global Observability Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Observability Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Observability Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Observability Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Observability Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Observability Market Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Observability Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 34: Global Observability Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 35: Global Observability Market Revenue Million Forecast, by Enterprises 2020 & 2033

- Table 36: Global Observability Market Volume Billion Forecast, by Enterprises 2020 & 2033

- Table 37: Global Observability Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 38: Global Observability Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 39: Global Observability Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Observability Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Observability Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Observability Market Volume Billion Forecast, by Type 2020 & 2033

- Table 43: Global Observability Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 44: Global Observability Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 45: Global Observability Market Revenue Million Forecast, by Enterprises 2020 & 2033

- Table 46: Global Observability Market Volume Billion Forecast, by Enterprises 2020 & 2033

- Table 47: Global Observability Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 48: Global Observability Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 49: Global Observability Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Observability Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Global Observability Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Observability Market Volume Billion Forecast, by Type 2020 & 2033

- Table 53: Global Observability Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 54: Global Observability Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 55: Global Observability Market Revenue Million Forecast, by Enterprises 2020 & 2033

- Table 56: Global Observability Market Volume Billion Forecast, by Enterprises 2020 & 2033

- Table 57: Global Observability Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 58: Global Observability Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 59: Global Observability Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Observability Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Global Observability Market Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Global Observability Market Volume Billion Forecast, by Type 2020 & 2033

- Table 63: Global Observability Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 64: Global Observability Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 65: Global Observability Market Revenue Million Forecast, by Enterprises 2020 & 2033

- Table 66: Global Observability Market Volume Billion Forecast, by Enterprises 2020 & 2033

- Table 67: Global Observability Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 68: Global Observability Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 69: Global Observability Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Observability Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Observability Market?

The projected CAGR is approximately 9.73%.

2. Which companies are prominent players in the Observability Market?

Key companies in the market include Broadcom Inc, Dynatrace LLC, GitLab B V, IBM Corporation, LogicMonitor Inc, Microsoft Corporation, Monte Carlo Corporation, Riverbed Technology, ScienceLogic Inc, Splunk Inc *List Not Exhaustive.

3. What are the main segments of the Observability Market?

The market segments include Type, Deployment, Enterprises, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation Among Enterprises; Shifting Workloads of Enterprises towards Cloud Environment.

6. What are the notable trends driving market growth?

BFSI to Hold Significant Share.

7. Are there any restraints impacting market growth?

Increasing Automation Among Enterprises; Shifting Workloads of Enterprises towards Cloud Environment.

8. Can you provide examples of recent developments in the market?

June 2024: SUSE announced it has acquired StackState as part of a plan to embed observability capabilities into its Rancher platform for managing Kubernetes clusters. Announced at SUSECon event, the StackState observability platform will be embedded into the Rancher Prime version of the platform for enterprise IT teams.May 2024: Cisco announced a new virtual appliance for its AppDynamics On-Premises application observability offering, enabling customers to use a self-hosted observability solution built on AI-powered intelligence for anomaly detection and root cause analysis, application security, and SAP monitoring.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Observability Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Observability Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Observability Market?

To stay informed about further developments, trends, and reports in the Observability Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence