Key Insights

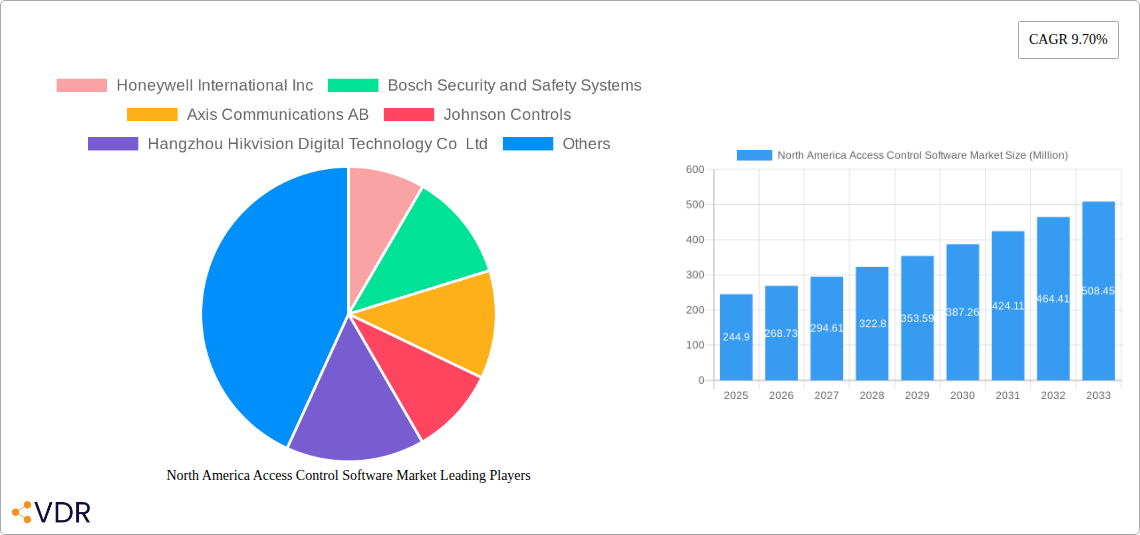

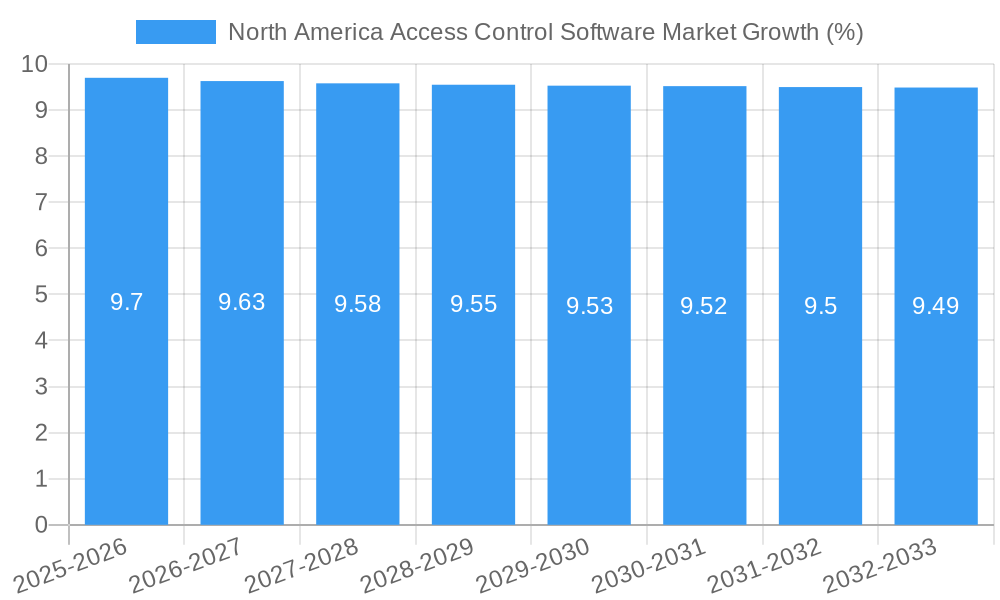

The North America Access Control Software Market is poised for robust expansion, driven by escalating concerns for physical security and the increasing adoption of advanced authentication technologies across diverse sectors. With a current market size of approximately USD 244.90 million and a projected Compound Annual Growth Rate (CAGR) of 9.70% from 2019 to 2033, the market is expected to witness significant value creation. Key drivers include the growing demand for sophisticated security solutions in commercial buildings, residential complexes, and industrial facilities, alongside the imperative for stringent regulatory compliance in government and defense sectors. The proliferation of cloud-based access control systems, offering enhanced scalability, flexibility, and remote management capabilities, is a prominent trend shaping market dynamics. These solutions are particularly appealing to SMEs and large enterprises alike, providing cost-effective and efficient security management. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) for anomaly detection and predictive security is emerging as a crucial differentiator, enhancing threat intelligence and response mechanisms.

The market's growth is further propelled by technological advancements in biometric authentication, including facial recognition, fingerprint scanning, and iris recognition, which offer superior security and user convenience compared to traditional key cards. These innovations are increasingly being embedded in access control software, creating a more seamless and secure user experience. While the market exhibits strong upward momentum, certain restraints such as the high initial investment cost for advanced systems and the persistent threat of cyberattacks targeting access control infrastructure warrant careful consideration. However, the ongoing digital transformation across industries and the heightened awareness of data security are expected to outweigh these challenges, fostering sustained growth. Leading players like Honeywell International Inc., Bosch Security and Safety Systems, and Johnson Controls are actively investing in research and development to offer integrated and intelligent access control solutions, further stimulating market innovation and adoption across North America, including the United States, Canada, and Mexico.

This in-depth report offers a detailed examination of the North America Access Control Software market, providing critical insights into its current landscape, historical performance, and projected trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this analysis is essential for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive challenges in the access control software sector. We meticulously analyze key segments, including on-premise and cloud-based solutions, the needs of SMEs and large enterprises, and the diverse requirements of commercial, residential, government, industrial, transportation and logistics, military and defense, and other end-user industries.

North America Access Control Software Market Market Dynamics & Structure

The North America Access Control Software market is characterized by a moderately concentrated structure, with key players like Honeywell International Inc., Bosch Security and Safety Systems, Axis Communications AB, Johnson Controls, and Hangzhou Hikvision Digital Technology Co Ltd holding significant influence. Technological innovation serves as a primary driver, with advancements in AI, IoT integration, and biometric authentication continuously shaping product offerings and user experiences. Regulatory frameworks, particularly those pertaining to data privacy and security, play a crucial role in dictating software development and deployment strategies, impacting the adoption of cloud-based solutions. Competitive product substitutes, such as traditional key systems and basic card readers, are steadily being displaced by sophisticated software-driven access control systems. End-user demographics are shifting towards a greater demand for integrated security solutions and remote management capabilities. Mergers and acquisitions (M&A) trends indicate a consolidation phase, as larger entities acquire smaller innovative firms to expand their portfolios and market reach. For instance, the last few years have seen significant M&A activity as companies seek to enhance their cloud offerings and expand into new vertical markets. Barriers to innovation include the high cost of R&D for cutting-edge features and the challenge of ensuring seamless integration with existing security infrastructure.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized vendors.

- Technological Innovation Drivers: AI-powered analytics, IoT device integration, advanced biometric solutions (facial recognition, fingerprint), and cloud computing.

- Regulatory Frameworks: Evolving data privacy laws (e.g., GDPR, CCPA), cybersecurity mandates, and industry-specific compliance requirements.

- Competitive Product Substitutes: Traditional mechanical locks, basic RFID cards, and manual access logs.

- End-User Demographics: Increasing demand for mobile credentials, touchless access, and unified security platforms.

- M&A Trends: Strategic acquisitions to bolster cloud capabilities, expand vertical market penetration, and acquire specialized technologies.

North America Access Control Software Market Growth Trends & Insights

The North America Access Control Software market is projected for robust growth, driven by escalating security concerns and the pervasive adoption of smart technologies across industries. The market size is expected to witness a substantial increase from approximately $5,500 million units in 2025 to an estimated $12,000 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. Adoption rates of advanced access control solutions are accelerating, particularly among small and medium-sized enterprises (SMEs) that are increasingly recognizing the benefits of scalable and cost-effective cloud-based systems. Technological disruptions, such as the widespread integration of IoT devices and the rise of artificial intelligence for predictive security analytics, are reshaping the market landscape. Consumer behavior shifts are evident in the growing preference for user-friendly interfaces, mobile-first access credentials, and integrated smart home and building management systems. The market penetration of cloud-based access control is steadily increasing, offering enhanced flexibility, remote management, and lower upfront investment compared to traditional on-premise solutions. This trend is further fueled by the increasing sophistication of cyber threats, necessitating more dynamic and adaptable security measures. The continuous development of AI algorithms for anomaly detection and automated threat response is also a significant factor contributing to market expansion.

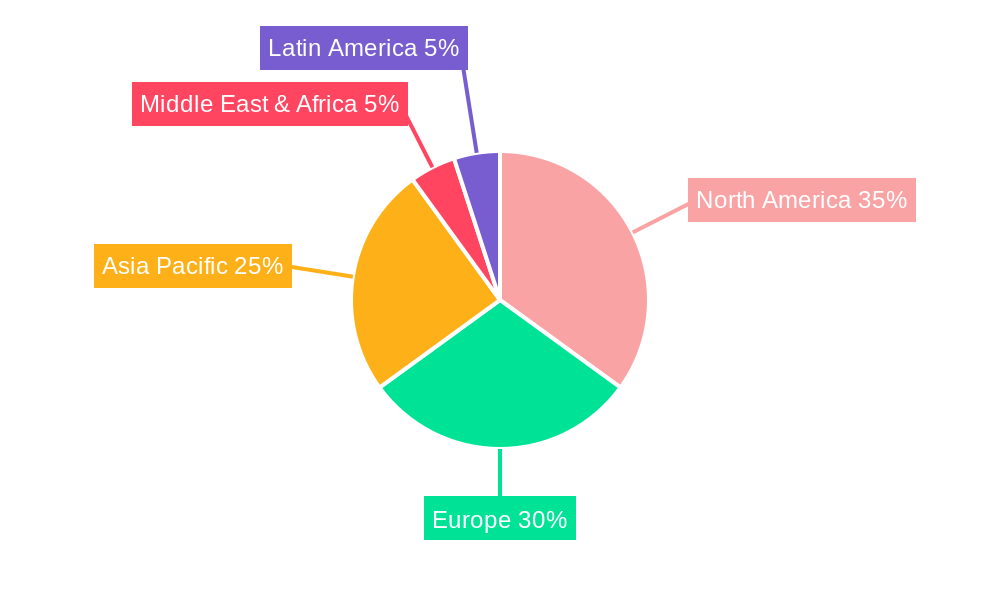

Dominant Regions, Countries, or Segments in North America Access Control Software Market

The Commercial end-user industry segment is currently the dominant force in the North America Access Control Software market, consistently demonstrating the highest market share and projected growth potential. This dominance is fueled by the diverse and evolving security needs of businesses across various sectors, including office buildings, retail spaces, hospitality, and healthcare facilities. The increasing adoption of sophisticated access control solutions in these environments is driven by a confluence of factors, including the imperative to protect valuable assets, ensure employee safety, comply with stringent regulations, and streamline operational efficiency. The commercial sector's proactive approach to investing in advanced security technologies, coupled with the growing demand for integrated building management systems, positions it as the primary growth engine for the access control software market.

- Commercial Sector Dominance:

- Key Drivers: High-value assets, employee safety mandates, regulatory compliance (e.g., HIPAA in healthcare, PCI DSS in retail), need for visitor management, and desire for operational efficiency.

- Market Share: Consistently holds the largest share, estimated at over 35% of the total market revenue.

- Growth Potential: Continued expansion driven by smart building initiatives, workplace safety enhancements, and the increasing adoption of IoT in commercial spaces.

The United States stands out as the leading country within the North American market, accounting for a substantial portion of the market revenue and adoption of advanced access control technologies.

- United States Leadership:

- Key Drivers: High concentration of large enterprises, robust technological infrastructure, significant government investment in security, and a mature market for smart building solutions.

- Market Share: Estimated to represent over 70% of the total North American market.

- Growth Potential: Sustained growth fueled by ongoing smart city development, critical infrastructure protection initiatives, and the strong cybersecurity awareness among businesses.

The Cloud-based segment is rapidly gaining traction and is expected to exhibit the highest growth rate, gradually challenging the established dominance of On-premise solutions.

- Cloud-based Growth:

- Key Drivers: Scalability, cost-effectiveness, remote management capabilities, easier updates and maintenance, and enhanced accessibility.

- Market Share: Growing rapidly, projected to surpass 50% of the market within the next five years.

- Growth Potential: Driven by the increasing preference of SMEs for flexible and subscription-based security solutions.

North America Access Control Software Market Product Landscape

The North America Access Control Software market is witnessing a wave of innovative product introductions focused on enhanced security, user convenience, and seamless integration. Key product innovations include AI-powered facial recognition systems offering contactless entry, mobile credentialing solutions enabling access via smartphones, and advanced biometric readers for multi-factor authentication. These products are increasingly incorporating features like web-based management portals for centralized control, versatile authentication methods to cater to diverse user needs, and specialized applications for sectors like healthcare and finance. The performance metrics of these new offerings emphasize faster processing speeds, higher accuracy rates for biometric identification, and robust encryption protocols to ensure data security. Unique selling propositions often lie in the software's ability to integrate with existing CCTV, alarm, and HR systems, providing a unified security ecosystem.

Key Drivers, Barriers & Challenges in North America Access Control Software Market

Key Drivers:

- Rising Security Threats: The escalating concern over physical and digital security breaches across all sectors is a primary catalyst, driving demand for advanced access control solutions.

- Technological Advancements: Innovations in AI, IoT, cloud computing, and biometrics are making access control systems more sophisticated, user-friendly, and effective.

- Smart Building Initiatives: The widespread adoption of smart buildings and the desire for integrated building management systems are boosting the demand for software-driven access control.

- Regulatory Compliance: Stringent government regulations and industry-specific compliance mandates are compelling organizations to invest in robust access control systems to protect sensitive data and physical assets.

Barriers & Challenges:

- High Initial Investment Costs: For some sophisticated on-premise solutions, the initial capital expenditure can be a significant barrier, especially for SMEs.

- Integration Complexity: Ensuring seamless integration of new access control software with existing legacy systems can be a complex and time-consuming process.

- Data Privacy Concerns: While cloud-based solutions offer benefits, concerns about data privacy and potential breaches in cloud environments can hinder adoption for some organizations.

- Cybersecurity Vulnerabilities: As access control systems become more networked, they are increasingly susceptible to cyberattacks, requiring continuous vigilance and robust security measures.

- Skilled Workforce Shortage: A lack of adequately trained IT and security professionals capable of implementing, managing, and maintaining advanced access control systems can pose a challenge.

Emerging Opportunities in North America Access Control Software Market

Emerging opportunities in the North America Access Control Software market are concentrated in the expansion of integrated security platforms that combine access control with video surveillance, intrusion detection, and building automation. The growing demand for touchless authentication methods, driven by hygiene concerns and convenience, presents a significant avenue for growth, particularly for advanced biometric solutions like facial recognition and iris scanning. Furthermore, the increasing adoption of access control in the residential sector, especially in multi-unit dwellings and smart homes, represents an untapped market segment. The development of AI-powered predictive analytics within access control software, capable of identifying and mitigating potential threats before they occur, offers substantial value proposition for proactive security management.

Growth Accelerators in the North America Access Control Software Market Industry

Several catalysts are accelerating long-term growth in the North America Access Control Software market. The pervasive adoption of IoT devices across industries is creating a vast ecosystem for integrated access control solutions, enabling enhanced monitoring and management. Strategic partnerships between software providers, hardware manufacturers, and cybersecurity firms are fostering the development of more comprehensive and secure access control ecosystems. Market expansion strategies, including the penetration into emerging verticals like educational institutions and small to medium-sized businesses with tailored cloud-based offerings, are also driving growth. Furthermore, the continuous drive for digitalization across all sectors ensures that security solutions, including access control, remain a high priority investment.

Key Players Shaping the North America Access Control Software Market Market

- Honeywell International Inc.

- Bosch Security and Safety Systems

- Axis Communications AB

- Johnson Controls

- Hangzhou Hikvision Digital Technology Co Ltd

- Veridium

- Fujitsu

- Thales Group

- M2SYS Technologies

- Aware Inc

- IDEMIA

- IdentiSys Inc

- Genetec Inc

- Securitas Technology

Notable Milestones in North America Access Control Software Market Sector

- February 2024: Hikvision, a leading North American access control solutions provider, introduced its latest line of professional access control products, including the DS-K2700X series access controller, the DS-K1109 series reader, and the DS-K1T805/-K1T502 series, emphasizing web management, versatile authentication, and integrated security solutions.

- November 2023: Verkada, a US-based firm, expanded its offerings with the launch of AC12, a compact, one-door controller designed for easy deployment using a single PoE cable, simplifying access control for standalone doors.

In-Depth North America Access Control Software Market Market Outlook

The future outlook for the North America Access Control Software market is exceptionally bright, propelled by continued technological innovation and an unwavering demand for enhanced security. The increasing convergence of physical and cybersecurity, coupled with the proliferation of smart devices, creates fertile ground for integrated access control solutions. Strategic investments in AI and machine learning for predictive analytics will further refine threat detection and response capabilities. The ongoing shift towards cloud-based platforms will democratize access control, making advanced security accessible to a wider range of organizations, particularly SMEs. Furthermore, the growing emphasis on user experience and mobile-first solutions will continue to shape product development, ensuring the market remains dynamic and responsive to evolving end-user needs and preferences.

North America Access Control Software Market Segmentation

-

1. Type

- 1.1. On-premise

- 1.2. Cloud-based

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Residential

- 3.3. Government

- 3.4. Industrial

- 3.5. Transportation and Logistics

- 3.6. Military and Defense

- 3.7. Other End-user Industries

North America Access Control Software Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Access Control Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing adoption of IoT access Controls; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Growing adoption of IoT access Controls; Technological Advancements

- 3.4. Market Trends

- 3.4.1. Commercial to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Access Control Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. On-premise

- 5.1.2. Cloud-based

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Government

- 5.3.4. Industrial

- 5.3.5. Transportation and Logistics

- 5.3.6. Military and Defense

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security and Safety Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axis Communications AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Controls

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veridium

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujitsu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thales Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M2SYS Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IDEMIA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 IdentiSys Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Genetec Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Securitas Technology*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Access Control Software Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Access Control Software Market Share (%) by Company 2024

List of Tables

- Table 1: North America Access Control Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Access Control Software Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: North America Access Control Software Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Access Control Software Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: North America Access Control Software Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 6: North America Access Control Software Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 7: North America Access Control Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: North America Access Control Software Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 9: North America Access Control Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Access Control Software Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: North America Access Control Software Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Access Control Software Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: North America Access Control Software Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 14: North America Access Control Software Market Volume Million Forecast, by Organization Size 2019 & 2032

- Table 15: North America Access Control Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: North America Access Control Software Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 17: North America Access Control Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: North America Access Control Software Market Volume Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Access Control Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United States North America Access Control Software Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada North America Access Control Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada North America Access Control Software Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Mexico North America Access Control Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico North America Access Control Software Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Access Control Software Market?

The projected CAGR is approximately 9.70%.

2. Which companies are prominent players in the North America Access Control Software Market?

Key companies in the market include Honeywell International Inc, Bosch Security and Safety Systems, Axis Communications AB, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, Veridium, Fujitsu, Thales Group, M2SYS Technologies, Aware Inc, IDEMIA, IdentiSys Inc, Genetec Inc, Securitas Technology*List Not Exhaustive.

3. What are the main segments of the North America Access Control Software Market?

The market segments include Type, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 244.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing adoption of IoT access Controls; Technological Advancements.

6. What are the notable trends driving market growth?

Commercial to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing adoption of IoT access Controls; Technological Advancements.

8. Can you provide examples of recent developments in the market?

February 2024: Hikvision, a leading North American access control solutions provider, introduced its latest line of professional access control products. The flagship offerings in this lineup include the DS-K2700X series access controller, the DS-K1109 series reader, and the DS-K1T805/-K1T502 series, all showcased in the company's recent product launch event. Hikvision highlights that these new products boast enhanced features, focusing on web management, versatile authentication, specialized access applications, and integrated security solutions.November 2023: Verkada, a US-based firm, expanded its offerings with the launch of AC12. This compact, one-door controller is designed for easy deployment. It operates on a single PoE cable and is conveniently sized to be placed directly above or beside an entryway. With the AC12, Verkada is simplifying access control for standalone doors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Access Control Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Access Control Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Access Control Software Market?

To stay informed about further developments, trends, and reports in the North America Access Control Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence