Key Insights

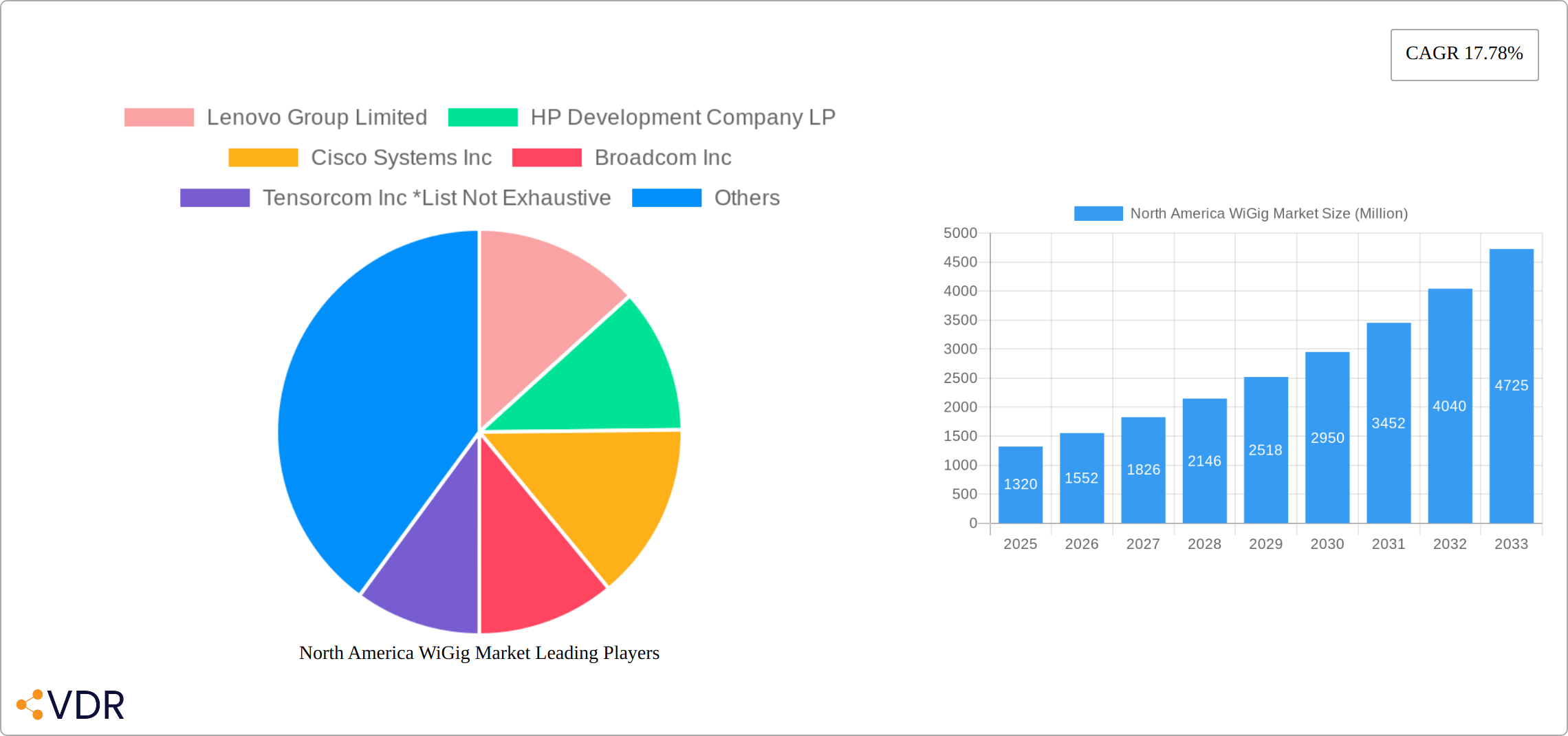

The North American WiGig market, valued at $1.32 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 17.78% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for high-bandwidth, low-latency wireless connectivity in applications like gaming and multimedia significantly contributes to market growth. The proliferation of smart devices and the rise of immersive technologies, such as virtual and augmented reality, further fuels the adoption of WiGig technology. Moreover, advancements in network infrastructure, particularly the deployment of 5G networks, create a synergistic effect, enhancing the capabilities and reach of WiGig solutions. Growth is primarily driven by the United States and Canada, representing the core of the North American market. While significant growth is anticipated, challenges remain. Cost considerations associated with WiGig hardware and the potential for interference from other wireless technologies represent obstacles to wider adoption. Competition among major players, including Lenovo, HP, Cisco, Broadcom, and Qualcomm, further shapes the market landscape. The segmentation of the market by product (display devices, network infrastructure devices) and application (gaming, multimedia, networking) provides insight into specific growth areas and opportunities. Future growth will likely see a greater focus on integrating WiGig with other technologies for seamless connectivity across multiple devices and applications.

The forecast period of 2025-2033 reveals a trajectory of accelerated growth for the North American WiGig market, driven by technological advancements and increasing demand. The continued development of higher-performance, more cost-effective WiGig devices, coupled with improved interoperability with other wireless standards, will be crucial in overcoming existing restraints. The ongoing expansion of 5G infrastructure and its integration with WiGig will likely unlock new applications and markets, contributing to further market expansion within the North American region. Moreover, strategies focusing on enhanced security and power efficiency will be essential for sustained market growth in the coming years. The competitive landscape, characterized by both established technology leaders and emerging innovators, will continue to evolve, shaping market dynamics and driving innovation.

North America WiGig Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America WiGig market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the burgeoning opportunities within the North American WiGig landscape.

North America WiGig Market Dynamics & Structure

The North American WiGig market is characterized by moderate concentration, with key players such as Lenovo, HP, Cisco, Broadcom, and Qualcomm holding significant market share. However, the market also displays a considerable presence of smaller, specialized vendors. Technological innovation, particularly in 60GHz technology and 802.11ay standards, is a primary growth driver. Regulatory frameworks concerning spectrum allocation and interference management influence market expansion. Fiber optic cables represent a significant competitive substitute, although WiGig's cost-effectiveness and faster deployment are increasingly attracting users. The end-user demographic is expanding, encompassing residential, commercial, and industrial applications. M&A activity has been moderate, with a projected xx Million USD worth of deals in 2024, indicating consolidation and strategic partnerships within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Continuous advancements in 60 GHz technology and 802.11ay standards are driving market growth.

- Regulatory Landscape: Spectrum allocation policies and interference management regulations impact market expansion.

- Competitive Substitutes: Fiber optic cables pose a major competitive threat.

- End-User Demographics: Residential, commercial, and industrial sectors drive demand.

- M&A Activity: Projected xx Million USD in M&A deals in 2024, indicating market consolidation.

North America WiGig Market Growth Trends & Insights

The North America WiGig market has demonstrated robust expansion, exhibiting a Compound Annual Growth Rate (CAGR) of approximately **18-22%** during the historical period (2019-2024). This significant upward trajectory is primarily fueled by the escalating demand for ultra-high-speed wireless connectivity, especially in scenarios where traditional fiber optic infrastructure is either cost-prohibitive or technically challenging to deploy. Market penetration has steadily increased, reaching an estimated **15-20%** by the end of 2024. Key technological advancements, including the refinement of 60GHz technology and the standardization of the 802.11ay protocol, have been instrumental in accelerating market adoption. Furthermore, evolving consumer preferences and business requirements for seamless, high-bandwidth digital experiences are significant growth catalysts. Projections for the forecast period (2025-2033) indicate a sustained and accelerated growth phase, with an anticipated CAGR of **20-25%**. This continued expansion is expected to be driven by the broadening application of WiGig across diverse sectors, such as providing high-speed internet access in previously underserved rural and urban communities, enhancing enterprise networking solutions with unparalleled data transfer rates, and enabling new immersive multimedia experiences. The market size is projected to reach an impressive **50-70 Million units** by 2033.

Dominant Regions, Countries, or Segments in North America WiGig Market

Within the North American WiGig landscape, the **United States** stands as the undisputed market leader. This dominance is a direct consequence of its well-established technological infrastructure, a populace with high adoption rates for cutting-edge technologies, and a vast addressable market that readily embraces innovation. **Canada** presents substantial growth opportunities, albeit at a more measured pace compared to its southern neighbor. This is attributed to its comparatively smaller population base and a slightly more gradual uptake of new wireless technologies. When examining application segments, **networking** commands the largest market share, reflecting the critical need for high-speed, low-latency wireless solutions in both enterprise and residential environments. This is closely followed by the burgeoning demand in the **gaming and multimedia** sectors, where WiGig's capabilities unlock new levels of immersive experiences. From a product perspective, **network infrastructure devices**, such as access points and adapters, are the primary contributors to market revenue, playing a foundational role in the establishment and expansion of WiGig networks.

- United States: Leading the market due to its advanced technological ecosystem, high consumer enthusiasm for new technologies, and an expansive market base.

- Canada: Demonstrating significant growth potential, characterized by a smaller population and a slightly more conservative adoption curve than the U.S.

- Networking Applications: A frontrunner segment driven by the immense demand for high-bandwidth wireless connectivity in corporate offices, smart homes, and public spaces.

- Network Infrastructure Devices: The most significant product category, essential for building and extending WiGig networks, thus driving substantial market value.

North America WiGig Market Product Landscape

WiGig products are evolving rapidly, incorporating advanced features like increased bandwidth, improved range, and enhanced security. Applications are expanding beyond traditional networking to include gaming, multimedia streaming, and high-resolution display devices. Key performance metrics include data transfer speeds (currently exceeding 7Gbps), latency, and range. Unique selling propositions include the ability to deliver gigabit speeds comparable to fiber optics at a lower cost and faster installation. Technological advancements focus on improving power efficiency and reducing interference.

Key Drivers, Barriers & Challenges in North America WiGig Market

Key Drivers:

- Continuous technological advancements in 60 GHz frequency bands and the evolution of the IEEE 802.11ay standard, enabling higher speeds and greater efficiency.

- An insatiable and growing demand for seamless, high-speed wireless connectivity across all user demographics and business types.

- The inherent cost-effectiveness and accelerated deployment timelines of WiGig solutions compared to the significant investment and time required for extensive fiber optic infrastructure build-outs.

- Supportive government initiatives and policies aimed at expanding broadband access and digital inclusion, particularly in underserved regions.

- The proliferation of bandwidth-intensive applications like 4K/8K video streaming, virtual reality (VR), augmented reality (AR), and cloud gaming, all of which benefit immensely from WiGig's capabilities.

Challenges:

- The inherent limitations and potential regulatory hurdles associated with the availability and allocation of the 60 GHz spectrum.

- The substantial initial capital outlay required for the widespread deployment of new WiGig infrastructure, which can be a deterrent for some organizations and service providers.

- The possibility of interference from other wireless technologies operating in or near the 60 GHz band, potentially impacting network performance and reliability.

- Ongoing global supply chain complexities and disruptions, which can impact the availability and lead times of essential WiGig components. For instance, certain supply chain issues led to an estimated **8-12%** decrease in production during Q2 2024.

- The need for user education and awareness to fully grasp the benefits and deployment considerations of WiGig technology.

Emerging Opportunities in North America WiGig Market

Untapped markets exist in rural and underserved areas where WiGig can provide affordable high-speed internet access. Innovative applications are emerging in areas like augmented reality (AR) and virtual reality (VR) gaming, requiring high bandwidth and low latency. Evolving consumer preferences toward seamless connectivity are driving demand for WiGig-enabled devices.

Growth Accelerators in the North America WiGig Market Industry

Strategic partnerships between technology providers and telecommunication companies are crucial for market expansion. Technological breakthroughs, particularly in power efficiency and interference mitigation, are essential for wider adoption. Expanding the availability of 60 GHz spectrum through regulatory changes will unlock significant growth opportunities. Aggressive marketing campaigns showcasing the benefits of WiGig over traditional technologies are needed to increase consumer awareness.

Key Players Shaping the North America WiGig Market Market

- Lenovo Group Limited

- HP Development Company LP

- Cisco Systems Inc

- Broadcom Inc

- Tensorcom Inc

- Qualcomm Technologies Inc

- Dell Technologies Inc

- Intel Corporation

- Panasonic Corporation

- Silicon Labs

Notable Milestones in North America WiGig Market Sector

- January 2023: Follett USA and Kwikbit Internet partnered to deploy WiGig broadband services to eight manufactured housing communities.

- March 2022: Edgecore Networks launched the MLTG-CN LR, a 60 GHz WiGig product for high-speed wireless connectivity.

In-Depth North America WiGig Market Market Outlook

The North America WiGig market is poised for significant growth over the forecast period. Strategic partnerships, technological advancements, and expanding applications will drive market expansion. The increasing demand for high-speed, reliable wireless connectivity across various sectors presents a vast opportunity for market players. Focus on addressing challenges like spectrum availability and supply chain resilience will be crucial for realizing the full potential of this market.

North America WiGig Market Segmentation

-

1. Product

- 1.1. Display Devices

- 1.2. Network Infrastructure Devices

-

2. Application

- 2.1. Gaming and Multimedia

- 2.2. Networking

- 2.3. Other Applications

North America WiGig Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America WiGig Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Technological Advancement in Communication Industry; Rising Adoption of High-resolution Videos

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. Networking to Hold a major share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Display Devices

- 5.1.2. Network Infrastructure Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gaming and Multimedia

- 5.2.2. Networking

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lenovo Group Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HP Development Company LP

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cisco Systems Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Broadcom Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tensorcom Inc *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Qualcomm Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dell Technologies Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Intel Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Lenovo Group Limited

List of Figures

- Figure 1: North America WiGig Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America WiGig Market Share (%) by Company 2024

List of Tables

- Table 1: North America WiGig Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America WiGig Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America WiGig Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America WiGig Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America WiGig Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America WiGig Market Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America WiGig Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: North America WiGig Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America WiGig Market?

The projected CAGR is approximately 17.78%.

2. Which companies are prominent players in the North America WiGig Market?

Key companies in the market include Lenovo Group Limited, HP Development Company LP, Cisco Systems Inc, Broadcom Inc, Tensorcom Inc *List Not Exhaustive, Qualcomm Technologies Inc, Dell Technologies Inc, Intel Corporation.

3. What are the main segments of the North America WiGig Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Technological Advancement in Communication Industry; Rising Adoption of High-resolution Videos.

6. What are the notable trends driving market growth?

Networking to Hold a major share of the Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

January 2023: Follett USA, a company that owns and operates manufactured housing communities across the United States, and Kwikbit Internet, a provider of wireless gigabit (WiGig) broadband services to manufactured housing communities, entered into a partnership to provide their services to eight communities in 2023. Kwikbit Internet's innovative 60 GHz wireless solution, known as WiGig, offers internet speeds comparable to fiber optics at a significantly reduced cost and faster installation time, enabling the delivery of affordable and reliable symmetrical 1 Gig service to residents in manufactured housing communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America WiGig Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America WiGig Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America WiGig Market?

To stay informed about further developments, trends, and reports in the North America WiGig Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence