Key Insights

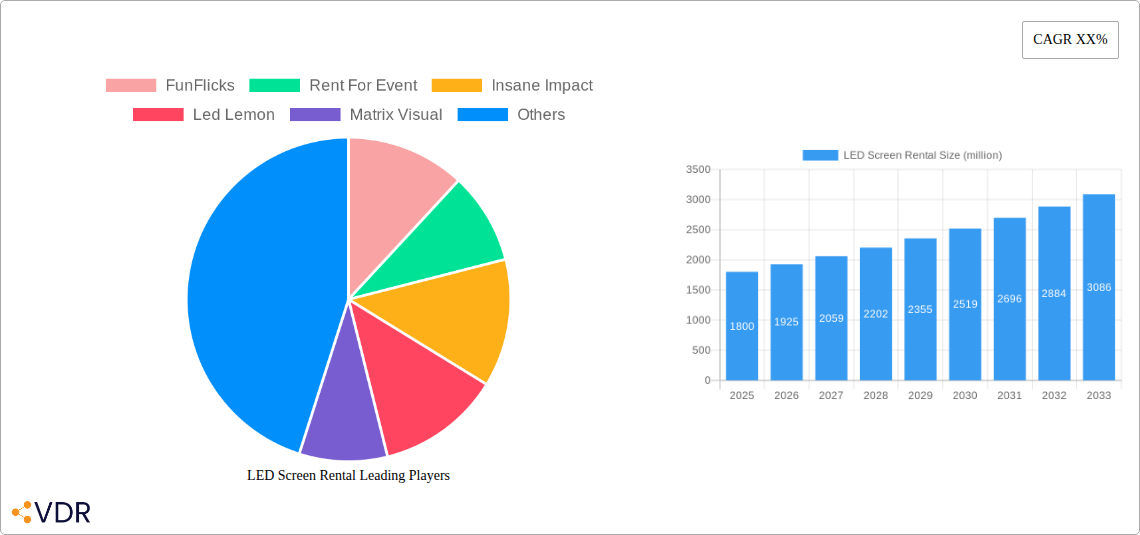

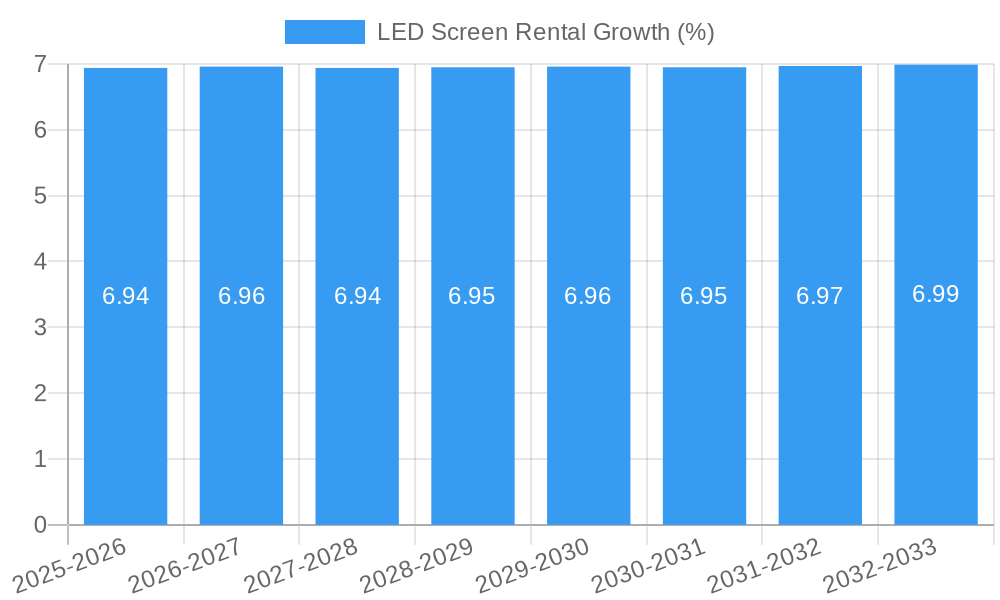

The global LED screen rental market is poised for substantial growth, driven by an increasing demand for dynamic visual experiences across a multitude of applications. With an estimated market size of $1.8 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033, this sector is set to expand significantly. Key drivers include the rising popularity of large-scale events such as sports meetings, concerts, and trade shows, where high-impact LED displays are crucial for audience engagement and sponsorship visibility. The versatility of LED screens, offering unparalleled brightness, resolution, and flexibility in size and shape, makes them indispensable for both indoor and outdoor settings. Furthermore, advancements in LED technology, leading to more energy-efficient and cost-effective solutions, are accelerating adoption. The integration of LED screens into meeting spaces for enhanced presentations and virtual collaborations is also contributing to market expansion.

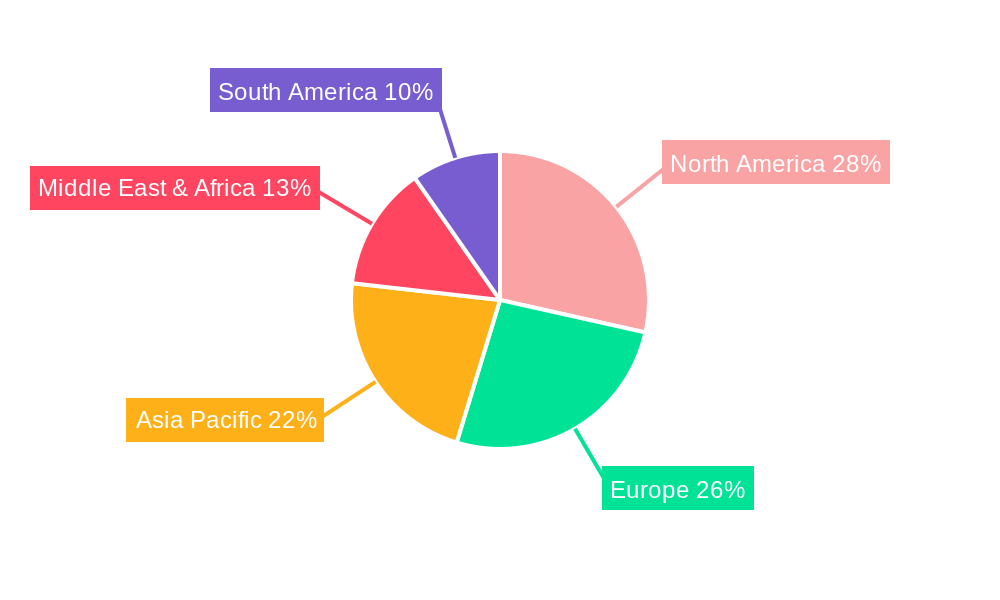

The market segmentation reveals a healthy balance between various applications and screen types. Speaking engagements and meetings, while perhaps smaller in individual scale, represent a consistent and growing demand for professional visual aids. Trade shows and concerts are major contributors, leveraging LED screens for brand promotion and immersive entertainment. Sports meetings represent a significant segment due to the need for large, high-resolution displays for live action and replays. In terms of screen types, outdoor LED screens are expected to see robust demand due to their durability and suitability for public events, while indoor LED screens cater to a wide array of corporate and entertainment venues. Mobile LED screens offer unique advertising and event solutions. Geographically, North America and Europe are leading markets, attributed to advanced event infrastructure and strong corporate spending. However, the Asia Pacific region is expected to exhibit the fastest growth, fueled by rapid economic development, increasing MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism, and a burgeoning entertainment industry. Challenges, such as the initial capital investment for high-end equipment and the need for skilled technical support, are being mitigated by the increasing availability of rental services and technological innovations.

This in-depth report provides a thorough analysis of the global LED Screen Rental market, offering critical insights into its dynamics, growth trajectory, and future potential. Covering the historical period of 2019–2024 and projecting forward to 2033, with a base and estimated year of 2025, this report is an essential resource for industry professionals, investors, and stakeholders. We meticulously examine market segmentation, regional dominance, technological advancements, and competitive landscapes, providing actionable intelligence for strategic decision-making.

LED Screen Rental Market Dynamics & Structure

The global LED Screen Rental market exhibits a moderately fragmented structure, with a blend of large, established players and a growing number of niche providers. Technological innovation serves as a primary driver, with continuous advancements in LED display technology, such as increased brightness, resolution, energy efficiency, and modularity, significantly enhancing product offerings. Regulatory frameworks are generally supportive, focusing on safety standards and electromagnetic compatibility, though variations exist across different regions. Competitive product substitutes, primarily large format projectors and traditional display technologies, are gradually losing ground to the superior visual impact and versatility of LED screens. End-user demographics are diverse, encompassing event organizers, corporate clients, entertainment venues, and advertising agencies, each with specific needs and preferences. Mergers and acquisitions (M&A) activity is present, driven by the desire for market consolidation, expanded service portfolios, and enhanced technological capabilities. For instance, recent M&A activities have seen companies like PRG and Creative Technology expanding their global reach and service offerings. Barriers to innovation include the high capital expenditure required for cutting-edge display technology and the need for specialized technical expertise in installation and operation.

- Market Concentration: Moderately fragmented, with key players holding significant, but not dominant, market shares.

- Technological Innovation Drivers: Mini-LED, micro-LED, higher refresh rates, advanced pixel pitch, and integrated content management systems.

- Regulatory Frameworks: Primarily focused on safety, electrical compliance, and local event permitting.

- Competitive Substitutes: High-lumen projectors, traditional video walls, and digital signage solutions.

- End-User Demographics: Event production companies, corporate event planners, entertainment promoters, and advertising agencies.

- M&A Trends: Driven by market expansion, technology acquisition, and service diversification, with an estimated XX M&A deals in the historical period, and a projected XX deals in the forecast period.

LED Screen Rental Growth Trends & Insights

The LED Screen Rental market has witnessed robust growth, fueled by increasing demand for immersive visual experiences across a multitude of applications. The market size evolution has been significant, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025–2033). Adoption rates are steadily increasing, as businesses and event organizers recognize the superior impact and flexibility offered by LED screen rentals compared to static displays or traditional projection systems. Technological disruptions, such as the advent of high-resolution fine-pitch LEDs and transparent LED screens, are further expanding the application scope and appeal of these rental solutions. Consumer behavior shifts are evident, with a growing preference for dynamic, engaging, and visually stunning presentations at events, conferences, and public gatherings. The ease of deployment, scalability, and customization offered by LED screen rentals are key factors driving this trend. The market penetration of LED screen rentals is expected to continue its upward trajectory, driven by decreasing rental costs and a broader availability of rental providers.

- Market Size Evolution: From an estimated XX million units in 2024, projected to reach XX million units by 2033.

- Adoption Rates: Experiencing a surge across corporate events, concerts, and sporting events due to enhanced visual impact.

- Technological Disruptions: Fine-pitch LEDs enabling unprecedented detail, and curved/flexible LED screens opening new creative possibilities.

- Consumer Behavior Shifts: Increased demand for interactive and immersive visual experiences at events.

- Market Penetration: Expected to grow from XX% in 2024 to XX% by 2033, indicating a widening adoption base.

- Key Market Growth Enablers: Declining average rental costs and increased accessibility of advanced LED technology.

Dominant Regions, Countries, or Segments in LED Screen Rental

The North America region consistently emerges as a dominant force in the global LED Screen Rental market, driven by a mature events industry, significant corporate spending on conferences and trade shows, and a strong appetite for cutting-edge entertainment and sporting events. Within North America, the United States leads the charge due to its large market size, advanced technological infrastructure, and the presence of major event organizers and corporate clients. The Application segment of Trade Shows and Concerts are particularly instrumental in driving market growth in this region. Trade shows benefit from the ability of LED screens to create impactful brand displays, product showcases, and engaging exhibitor booths, attracting significant investment from businesses. Similarly, the vibrant concert and live music scene relies heavily on large-scale LED screens for elaborate stage designs, real-time visuals, and enhanced audience engagement, contributing substantially to rental demand.

- Dominant Region: North America, with a significant market share estimated at XX% in 2025.

- Leading Country: United States, accounting for an estimated XX% of the North American market.

- Key Driving Application Segment:

- Trade Shows: Enabling impactful branding, product demonstrations, and interactive exhibitor experiences. Market share in this segment estimated at XX million units in 2025.

- Concerts: Facilitating immersive stage visuals, artist performances, and enhanced audience connectivity. Market share in this segment estimated at XX million units in 2025.

- Dominance Factors: High concentration of corporate headquarters, well-established event infrastructure, and high consumer disposable income for entertainment.

- Growth Potential: Continued investment in live events, technological adoption by businesses, and expansion of outdoor festivals.

- Infrastructure Advantages: Availability of skilled technicians, robust logistics networks, and advanced venue facilities.

LED Screen Rental Product Landscape

The LED Screen Rental product landscape is characterized by continuous innovation and a diverse range of offerings tailored to specific application needs. Key product innovations include the development of ultra-fine pixel pitch screens, enabling seamless, high-definition visuals previously unattainable. Transparent LED screens are gaining traction for architectural installations and retail displays, offering unique aesthetic possibilities. Mobile LED screens, mounted on trailers or vehicles, provide on-the-go advertising and event solutions. Performance metrics such as brightness (nits), refresh rate (Hz), pixel pitch (mm), and durability are critical differentiators. Companies are focusing on developing modular systems for easy assembly and customization, alongside integrated software solutions for content management and playback.

Key Drivers, Barriers & Challenges in LED Screen Rental

Key Drivers:

- Technological Advancements: Continuous improvements in LED resolution, brightness, and efficiency.

- Demand for Immersive Experiences: Growing desire for engaging and visually stunning events across all sectors.

- Cost-Effectiveness of Rentals: Offering access to high-end technology without significant capital investment.

- Versatility and Scalability: Adaptable to various event sizes, types, and locations.

- Digital Transformation: Increased reliance on digital media for communication and marketing.

Barriers & Challenges:

- High Initial Investment: For rental companies to acquire the latest LED technology.

- Logistical Complexity: Transportation, installation, and dismantling of large LED screens.

- Technical Expertise Required: Skilled personnel for operation and maintenance.

- Competition: Intense competition among rental providers driving down rental rates.

- Weather Dependencies: For outdoor LED screen rentals, impacting scheduling and deployment. Estimated impact of weather-related disruptions leading to XX% of cancelled events in the historical period.

Emerging Opportunities in LED Screen Rental

Emerging opportunities in the LED Screen Rental market are driven by evolving consumer preferences and new technological applications. The increasing demand for interactive and experiential marketing presents a significant avenue for growth, with LED screens capable of integrating touch capabilities and augmented reality. Untapped markets in developing economies, with growing event and entertainment sectors, offer substantial potential. The rise of virtual and hybrid events also creates opportunities for innovative LED screen integration, facilitating seamless audience participation across physical and digital platforms. The use of LED screens in art installations and immersive digital exhibitions is another rapidly expanding niche, appealing to a different demographic and broadening the market's scope.

Growth Accelerators in the LED Screen Rental Industry

Growth accelerators in the LED Screen Rental industry are primarily fueled by ongoing technological breakthroughs and strategic market expansion initiatives. The continuous refinement of LED technology, particularly in areas like energy efficiency and pixel density, makes these solutions more attractive and accessible. Strategic partnerships between rental companies, event organizers, and technology providers are crucial for co-creating innovative solutions and expanding market reach. Furthermore, the increasing adoption of LED screens in emerging applications, such as augmented reality experiences and interactive retail displays, is driving new revenue streams and market growth. The global expansion of live events and entertainment venues further bolsters demand for rental services.

Key Players Shaping the LED Screen Rental Market

- FunFlicks

- Rent For Event

- Insane Impact

- Led Lemon

- Matrix Visual

- Ultimate Outdoor Entertainment

- PixelFLEX

- SofloStudio

- Lightmedia

- Creative Technology

- Everbright Media

- Kvantled

- Refresh

- Shivam Video

- Big Screen Media

- Enigmax

- Mobile Pro

- Uniview

- Karana Audio Visual

- Ledtop Visual Ltd

- Audio Video LA

- AB AV Rentals

- Leyard Vteam

- PRG

- ColossoVision

- Great Wall Events

- Dynamo LED

- Pure AV

- Sifi Entertainment

- SYNC Productions

Notable Milestones in LED Screen Rental Sector

- 2019: Increased adoption of fine-pitch LED screens for indoor corporate events and trade shows.

- 2020: Rise of hybrid event solutions, with LED screens playing a crucial role in facilitating in-person and virtual audience engagement.

- 2021: Significant advancements in transparent LED technology, opening new architectural and retail display opportunities.

- 2022: Growing demand for outdoor LED screens for festivals, sporting events, and public gatherings post-pandemic.

- 2023: Integration of AI and advanced content management systems for dynamic and responsive LED screen content.

- 2024: Enhanced focus on sustainability and energy efficiency in LED display rental solutions.

In-Depth LED Screen Rental Market Outlook

- 2019: Increased adoption of fine-pitch LED screens for indoor corporate events and trade shows.

- 2020: Rise of hybrid event solutions, with LED screens playing a crucial role in facilitating in-person and virtual audience engagement.

- 2021: Significant advancements in transparent LED technology, opening new architectural and retail display opportunities.

- 2022: Growing demand for outdoor LED screens for festivals, sporting events, and public gatherings post-pandemic.

- 2023: Integration of AI and advanced content management systems for dynamic and responsive LED screen content.

- 2024: Enhanced focus on sustainability and energy efficiency in LED display rental solutions.

In-Depth LED Screen Rental Market Outlook

The LED Screen Rental market is poised for continued robust growth, driven by sustained demand for immersive visual experiences and ongoing technological innovation. Strategic opportunities lie in expanding service offerings to include integrated solutions for hybrid events, interactive displays, and augmented reality applications. The growing event industry in emerging economies presents a significant untapped market. Companies that prioritize technological advancement, customer-centric solutions, and operational efficiency will be best positioned to capitalize on the expanding opportunities in this dynamic sector, ensuring a projected market value of XX million units by 2033.

LED Screen Rental Segmentation

-

1. Application

- 1.1. Speaking Engagements

- 1.2. Meeting

- 1.3. Trade Show

- 1.4. Concert

- 1.5. Sports Meeting

- 1.6. Other

-

2. Types

- 2.1. Outdoor LED Screen

- 2.2. Indoor LED Screen

- 2.3. Mobile LED Screen

- 2.4. Other

LED Screen Rental Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LED Screen Rental REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LED Screen Rental Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Speaking Engagements

- 5.1.2. Meeting

- 5.1.3. Trade Show

- 5.1.4. Concert

- 5.1.5. Sports Meeting

- 5.1.6. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Outdoor LED Screen

- 5.2.2. Indoor LED Screen

- 5.2.3. Mobile LED Screen

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LED Screen Rental Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Speaking Engagements

- 6.1.2. Meeting

- 6.1.3. Trade Show

- 6.1.4. Concert

- 6.1.5. Sports Meeting

- 6.1.6. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Outdoor LED Screen

- 6.2.2. Indoor LED Screen

- 6.2.3. Mobile LED Screen

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America LED Screen Rental Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Speaking Engagements

- 7.1.2. Meeting

- 7.1.3. Trade Show

- 7.1.4. Concert

- 7.1.5. Sports Meeting

- 7.1.6. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Outdoor LED Screen

- 7.2.2. Indoor LED Screen

- 7.2.3. Mobile LED Screen

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe LED Screen Rental Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Speaking Engagements

- 8.1.2. Meeting

- 8.1.3. Trade Show

- 8.1.4. Concert

- 8.1.5. Sports Meeting

- 8.1.6. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Outdoor LED Screen

- 8.2.2. Indoor LED Screen

- 8.2.3. Mobile LED Screen

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa LED Screen Rental Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Speaking Engagements

- 9.1.2. Meeting

- 9.1.3. Trade Show

- 9.1.4. Concert

- 9.1.5. Sports Meeting

- 9.1.6. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Outdoor LED Screen

- 9.2.2. Indoor LED Screen

- 9.2.3. Mobile LED Screen

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific LED Screen Rental Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Speaking Engagements

- 10.1.2. Meeting

- 10.1.3. Trade Show

- 10.1.4. Concert

- 10.1.5. Sports Meeting

- 10.1.6. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Outdoor LED Screen

- 10.2.2. Indoor LED Screen

- 10.2.3. Mobile LED Screen

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 FunFlicks

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rent For Event

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Insane Impact

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Led Lemon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Matrix Visual

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ultimate Outdoor Entertainment

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PixelFLEX

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SofloStudio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lightmedia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Creative Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Everbright Media

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kvantled

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Refresh

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shivam Video

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Big Screen Media

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Enigmax

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Mobile Pro

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Uniview

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Karana Audio Visual

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ledtop Visual Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Audio Video LA

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 AB AV Rentals

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Leyard Vteam

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 PRG

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 ColossoVision

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Great Wall Events

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Dynamo LED

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Pure AV

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Sifi Entertainment

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 SYNC Productions

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 FunFlicks

List of Figures

- Figure 1: Global LED Screen Rental Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America LED Screen Rental Revenue (million), by Application 2024 & 2032

- Figure 3: North America LED Screen Rental Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America LED Screen Rental Revenue (million), by Types 2024 & 2032

- Figure 5: North America LED Screen Rental Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America LED Screen Rental Revenue (million), by Country 2024 & 2032

- Figure 7: North America LED Screen Rental Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America LED Screen Rental Revenue (million), by Application 2024 & 2032

- Figure 9: South America LED Screen Rental Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America LED Screen Rental Revenue (million), by Types 2024 & 2032

- Figure 11: South America LED Screen Rental Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America LED Screen Rental Revenue (million), by Country 2024 & 2032

- Figure 13: South America LED Screen Rental Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe LED Screen Rental Revenue (million), by Application 2024 & 2032

- Figure 15: Europe LED Screen Rental Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe LED Screen Rental Revenue (million), by Types 2024 & 2032

- Figure 17: Europe LED Screen Rental Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe LED Screen Rental Revenue (million), by Country 2024 & 2032

- Figure 19: Europe LED Screen Rental Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa LED Screen Rental Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa LED Screen Rental Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa LED Screen Rental Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa LED Screen Rental Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa LED Screen Rental Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa LED Screen Rental Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific LED Screen Rental Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific LED Screen Rental Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific LED Screen Rental Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific LED Screen Rental Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific LED Screen Rental Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific LED Screen Rental Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LED Screen Rental Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global LED Screen Rental Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global LED Screen Rental Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global LED Screen Rental Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global LED Screen Rental Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global LED Screen Rental Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global LED Screen Rental Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global LED Screen Rental Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global LED Screen Rental Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global LED Screen Rental Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global LED Screen Rental Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global LED Screen Rental Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global LED Screen Rental Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global LED Screen Rental Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global LED Screen Rental Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global LED Screen Rental Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global LED Screen Rental Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global LED Screen Rental Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global LED Screen Rental Revenue million Forecast, by Country 2019 & 2032

- Table 41: China LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific LED Screen Rental Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Screen Rental?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the LED Screen Rental?

Key companies in the market include FunFlicks, Rent For Event, Insane Impact, Led Lemon, Matrix Visual, Ultimate Outdoor Entertainment, PixelFLEX, SofloStudio, Lightmedia, Creative Technology, Everbright Media, Kvantled, Refresh, Shivam Video, Big Screen Media, Enigmax, Mobile Pro, Uniview, Karana Audio Visual, Ledtop Visual Ltd, Audio Video LA, AB AV Rentals, Leyard Vteam, PRG, ColossoVision, Great Wall Events, Dynamo LED, Pure AV, Sifi Entertainment, SYNC Productions.

3. What are the main segments of the LED Screen Rental?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Screen Rental," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Screen Rental report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Screen Rental?

To stay informed about further developments, trends, and reports in the LED Screen Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence