Key Insights

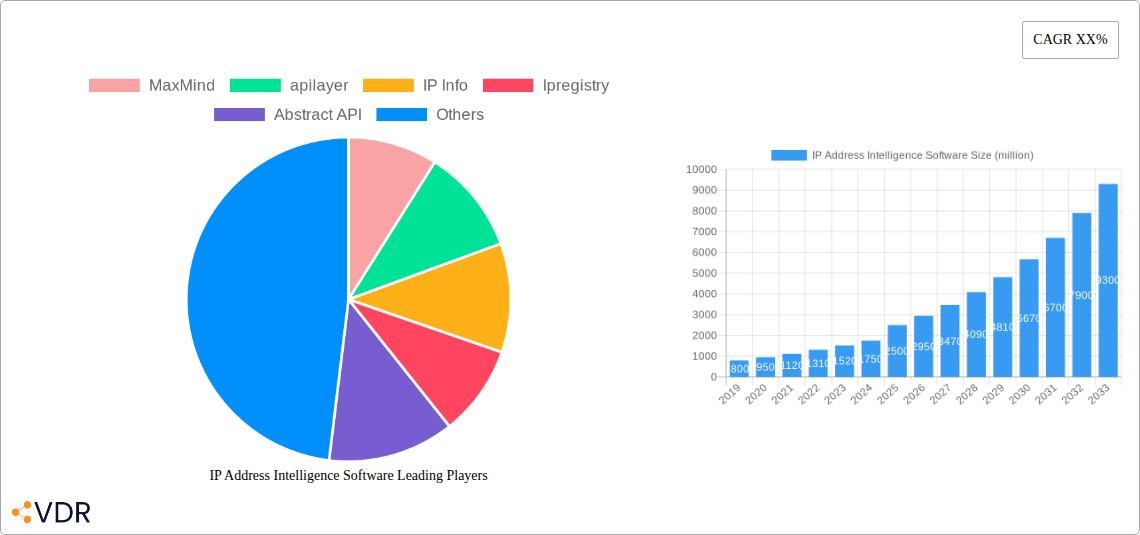

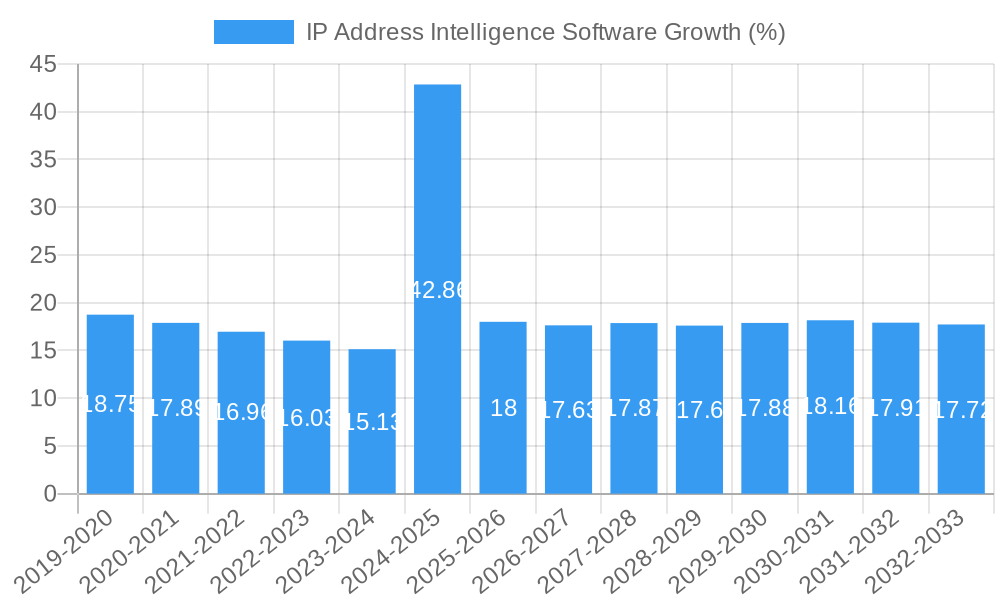

The global IP Address Intelligence Software market is poised for significant expansion, projected to reach an estimated market size of approximately $2,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 18% throughout the forecast period of 2025-2033. This robust growth is propelled by an increasing need for granular insights into user location, identity, and online behavior, crucial for a myriad of business functions including fraud detection, cybersecurity, targeted marketing, and content localization. The escalating volume of online transactions and digital interactions, coupled with the rising sophistication of cyber threats, directly fuels the demand for advanced IP intelligence solutions. Large enterprises, in particular, are a dominant force in this market, leveraging these tools for sophisticated risk management and personalized customer experiences. Simultaneously, Small and Medium-sized Enterprises (SMEs) are increasingly adopting these solutions, driven by the accessibility and scalability offered by cloud-based platforms, which simplify integration and reduce upfront investment. The shift towards cloud-based solutions is a defining trend, offering enhanced flexibility, real-time data updates, and cost-effectiveness compared to traditional on-premises deployments.

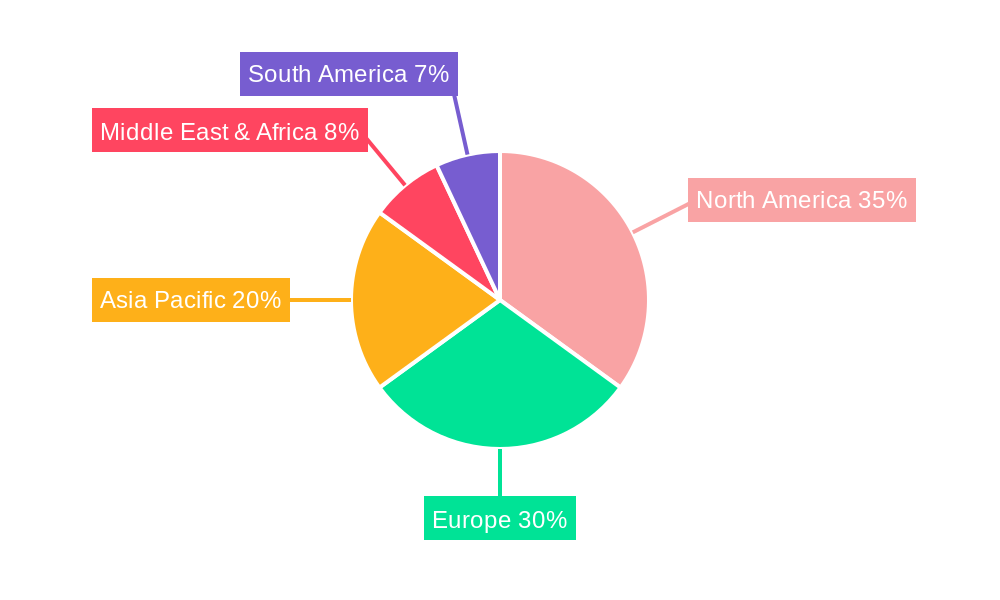

The IP Address Intelligence Software market is characterized by dynamic growth influenced by key drivers such as the burgeoning e-commerce sector, the imperative for robust fraud prevention in financial services, and the growing adoption of data-driven marketing strategies. However, certain restraints, including data privacy concerns and regulatory compliance challenges in different regions, can temper this growth. The market is segmented by application, with large enterprises and SMEs representing key consumer bases, and by deployment type, where cloud-based solutions are increasingly dominating over on-premises alternatives. Geographically, North America and Europe are expected to remain the leading markets, driven by their advanced digital infrastructures and high adoption rates of advanced technologies. Asia Pacific is anticipated to witness the fastest growth due to rapid digital transformation, a growing internet user base, and increasing investments in cybersecurity. The competitive landscape is diverse, featuring established players and emerging innovators, all striving to offer more accurate, comprehensive, and actionable IP intelligence.

IP Address Intelligence Software Market Dynamics & Structure

The IP Address Intelligence Software market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing demand for granular data insights. While the market exhibits moderate concentration, with key players like MaxMind, apilayer, IP Info, Ipregistry, and Abstract API holding significant share, a steady stream of new entrants is fostering a competitive environment. Technological innovation, particularly in AI and machine learning for enhanced accuracy and predictive capabilities, is a primary driver. Regulatory frameworks, such as data privacy laws (e.g., GDPR, CCPA), are shaping product development and mandating compliance. Competitive product substitutes, including VPNs and proxy services, influence demand by offering alternative anonymity solutions. End-user demographics span across Large Enterprises seeking robust security and marketing intelligence, and SMEs requiring cost-effective solutions for fraud prevention and geo-targeting. Mergers and Acquisitions (M&A) trends are moderately active, with recent deals (estimated volume of 30 deals in the historical period) aimed at consolidating market share, acquiring new technologies, and expanding service portfolios.

- Market Concentration: Moderate, with leading players holding approximately 55% of the market share.

- Technological Innovation Drivers: AI/ML for accuracy, real-time data processing, enhanced threat detection.

- Regulatory Frameworks: GDPR, CCPA, and similar data privacy laws influencing data handling and consent mechanisms.

- Competitive Product Substitutes: VPNs, proxy services, anonymizers.

- End-User Demographics: Large Enterprises (60% adoption), SMEs (40% adoption).

- M&A Trends: Active, with an estimated 30 M&A deals in the historical period (2019-2024).

IP Address Intelligence Software Growth Trends & Insights

The IP Address Intelligence Software market is poised for robust expansion, driven by an escalating need for precise location data, enhanced cybersecurity measures, and sophisticated digital marketing strategies. The market size, which stood at an estimated $1.2 billion in the base year of 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period of 2025–2033. This substantial growth trajectory is fueled by increasing internet penetration globally and the proliferation of connected devices, generating vast amounts of IP-related data. Adoption rates are consistently high across various industries, with a notable surge in demand from e-commerce, financial services, and online gaming sectors, all seeking to mitigate fraud and personalize user experiences. Technological disruptions, including advancements in IPv6 adoption and the integration of AI/ML algorithms for more accurate IP geolocation and threat profiling, are significantly reshaping the market. Consumer behavior shifts, such as a growing preference for personalized online experiences and a heightened awareness of digital security, are directly contributing to the increased reliance on IP address intelligence solutions. The penetration of cloud-based solutions, now accounting for over 70% of the market, further accelerates adoption by offering scalability and ease of integration. These evolving dynamics underscore a market ripe with opportunity, driven by both technological innovation and evolving end-user requirements.

Dominant Regions, Countries, or Segments in IP Address Intelligence Software

The IP Address Intelligence Software market is experiencing significant growth acceleration driven by various regional and segment-specific factors. North America, particularly the United States, currently dominates the market, accounting for an estimated 35% of the global market share in 2025. This dominance is attributed to a mature digital infrastructure, a high concentration of large enterprises investing heavily in cybersecurity and data analytics, and a proactive regulatory environment that encourages data-driven decision-making. The presence of major technology hubs and a strong emphasis on innovation further solidify North America's leadership.

Key Drivers for North American Dominance:

- High Adoption by Large Enterprises: Leading financial institutions, e-commerce giants, and technology companies in the U.S. are major adopters, utilizing IP intelligence for fraud detection, compliance, and targeted marketing. Their investment in advanced solutions drives market demand.

- Robust Cybersecurity Investment: The heightened threat landscape in North America has led to substantial investments in cybersecurity solutions, with IP address intelligence being a critical component for identifying malicious actors and protecting networks.

- Technological Innovation Hubs: Silicon Valley and other tech epicenters foster continuous innovation, leading to the development of cutting-edge IP intelligence technologies and services.

- Favorable Regulatory Environment: While data privacy is a concern, the regulatory framework in the U.S. has generally been conducive to data utilization for business purposes, provided compliance is maintained.

Within the Application segment, Large Enterprises are the primary growth drivers, representing approximately 60% of the market share in 2025. Their complex operational needs, extensive online presence, and high-value data necessitate sophisticated IP intelligence solutions for risk management, personalization, and compliance.

In terms of Types, Cloud-Based solutions are overwhelmingly dominant, capturing an estimated 75% of the market share in 2025. The scalability, flexibility, and cost-effectiveness of cloud platforms make them ideal for businesses of all sizes, enabling rapid deployment and seamless integration with existing IT infrastructures.

The Asia-Pacific region is emerging as a high-growth frontier, with countries like China, India, and South Korea exhibiting rapid adoption rates. This growth is propelled by a burgeoning digital economy, increasing internet penetration, and a rising number of SMEs adopting IP intelligence for fraud prevention and market expansion. While currently holding a smaller market share (estimated 20%), its CAGR is projected to be higher than North America's during the forecast period.

IP Address Intelligence Software Product Landscape

The IP Address Intelligence Software product landscape is characterized by continuous innovation in accuracy, speed, and feature sets. Leading solutions offer real-time IP geolocation with remarkable precision, identifying country, region, city, ISP, and even proxy or VPN usage. Advanced functionalities include risk scoring for fraud detection, bot detection capabilities, and enriched data points like domain information and email deliverability insights. Unique selling propositions often revolve around proprietary algorithms for enhanced data accuracy, comprehensive API offerings for seamless integration, and specialized data sets catering to niche industries. Technological advancements are focusing on leveraging machine learning to predict IP behavior and identify emerging threats with greater efficacy.

Key Drivers, Barriers & Challenges in IP Address Intelligence Software

The IP Address Intelligence Software market is propelled by several key drivers. The escalating global threat of cybercrime and sophisticated fraud schemes necessitates robust IP intelligence for identification and mitigation. The increasing demand for personalized user experiences and targeted marketing campaigns relies heavily on accurate geo-location and user profiling derived from IP data. Furthermore, regulatory compliance, particularly concerning data privacy and combating illicit online activities, mandates the use of IP intelligence tools.

- Technological Drivers: AI/ML for enhanced accuracy, real-time data processing, integration capabilities.

- Economic Drivers: Growing e-commerce, digital advertising, and fintech sectors.

- Policy-Driven Factors: Data privacy regulations, anti-fraud initiatives, Know Your Customer (KYC) requirements.

However, the market faces significant barriers and challenges. The increasing accuracy of VPNs and proxy services can obfuscate IP origins, posing a challenge to data providers. The global adoption of IPv6, while increasing the pool of IP addresses, also presents complexities in data management and attribution. Maintaining data accuracy and freshness in a rapidly evolving IP landscape is an ongoing hurdle, with data latency being a critical concern. Furthermore, the cost of acquiring and maintaining extensive IP databases can be substantial, impacting pricing models.

- Supply Chain Issues: Not directly applicable to software, but data source reliability can be a concern.

- Regulatory Hurdles: Navigating differing data privacy laws across jurisdictions, consent management complexities.

- Competitive Pressures: Intense competition among established players and emerging startups, pricing wars.

- Technical Challenges: IPv6 transition complexity, maintaining real-time data accuracy, obfuscation techniques.

Emerging Opportunities in IP Address Intelligence Software

Emerging opportunities within the IP Address Intelligence Software sector lie in several key areas. The burgeoning Internet of Things (IoT) ecosystem presents a vast, largely untapped market for IP intelligence, enabling device tracking, anomaly detection, and security for connected devices. The growing adoption of AI and machine learning in cybersecurity offers avenues for developing predictive threat intelligence solutions based on IP behavior patterns. Furthermore, the demand for hyper-personalization in digital marketing and content delivery creates opportunities for more granular and context-aware IP data services. The development of blockchain-based solutions for secure and transparent IP data management also represents an innovative frontier.

Growth Accelerators in the IP Address Intelligence Software Industry

Several factors are acting as significant growth accelerators for the IP Address Intelligence Software industry. The continuous evolution of cyber threats, including sophisticated ransomware attacks and nation-state sponsored cyber espionage, is compelling organizations to invest more heavily in advanced IP intelligence for proactive defense. The global expansion of e-commerce and digital services, particularly in emerging economies, is creating a surge in demand for fraud prevention and user verification tools, directly benefiting IP intelligence providers. Strategic partnerships between IP intelligence vendors and cybersecurity firms, cloud providers, and data analytics platforms are expanding market reach and enhancing service offerings. Moreover, the ongoing transition to IPv6, despite its complexities, will eventually lead to a much larger IP address space, increasing the scope and importance of IP intelligence.

Key Players Shaping the IP Address Intelligence Software Market

- MaxMind

- apilayer

- IP Info

- Ipregistry

- Abstract API

- IP Tracker

- BigDataCloud

- DB-IP

- Digital Element

- Webdevmedia

- Fastah

- Geoplugin

- Geo Targetly

- Hexasoft Development

- ipapi

- ipdata

- IP Find

- WhoisXML API

- Ipinfodb

- IPligence

- ipwhois.io

- KeyCDN

- Foundry

- Neustar

- PointPin

- Whoisxmlapi

Notable Milestones in IP Address Intelligence Software Sector

- 2019: Increased adoption of AI/ML for enhanced IP geolocation accuracy by multiple vendors.

- 2020: Significant growth in demand for fraud detection solutions driven by the e-commerce boom.

- 2021: Major cloud providers begin offering integrated IP intelligence services.

- 2022: Focus on privacy-preserving IP data solutions due to evolving data protection regulations.

- 2023: Advancements in real-time threat intelligence feeds powered by IP analysis.

- 2024: Increased M&A activity as companies seek to consolidate market position and expand capabilities.

In-Depth IP Address Intelligence Software Market Outlook

The IP Address Intelligence Software market is set for a period of sustained high growth, projected to reach an estimated $3.5 billion by 2033. Key accelerators include the relentless innovation in cybersecurity, demanding more sophisticated IP-based threat detection and prevention. The global digital transformation further fuels this demand as businesses of all sizes rely on accurate IP data for fraud mitigation, regulatory compliance, and enhanced customer experiences. Strategic alliances between IP intelligence providers and other technology enablers will unlock new market segments and functionalities. The ongoing global adoption of IPv6, while presenting short-term integration challenges, will ultimately expand the scope and value of comprehensive IP address intelligence. This forward outlook signifies a market ripe with strategic opportunities for innovation and expansion.

IP Address Intelligence Software Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Types

- 2.1. Cloud Based

- 2.2. On Premises

IP Address Intelligence Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

IP Address Intelligence Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IP Address Intelligence Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud Based

- 5.2.2. On Premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America IP Address Intelligence Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud Based

- 6.2.2. On Premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America IP Address Intelligence Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud Based

- 7.2.2. On Premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe IP Address Intelligence Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud Based

- 8.2.2. On Premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa IP Address Intelligence Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud Based

- 9.2.2. On Premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific IP Address Intelligence Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud Based

- 10.2.2. On Premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 MaxMind

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 apilayer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IP Info

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ipregistry

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abstract API

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IP Tracker

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BigDataCloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DB-IP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Digital Element

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Webdevmedia

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fastah

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Geoplugin

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Geo Targetly

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hexasoft Development

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ipapi

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ipdata

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 IP Find

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 WhoisXML API

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ipinfodb

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 IPligence

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 ipwhois.io

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 KeyCDN

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Foundry

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Neustar

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 PointPin

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Whoisxmlapi

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.1 MaxMind

List of Figures

- Figure 1: Global IP Address Intelligence Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America IP Address Intelligence Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America IP Address Intelligence Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America IP Address Intelligence Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America IP Address Intelligence Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America IP Address Intelligence Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America IP Address Intelligence Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America IP Address Intelligence Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America IP Address Intelligence Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America IP Address Intelligence Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America IP Address Intelligence Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America IP Address Intelligence Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America IP Address Intelligence Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe IP Address Intelligence Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe IP Address Intelligence Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe IP Address Intelligence Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe IP Address Intelligence Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe IP Address Intelligence Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe IP Address Intelligence Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa IP Address Intelligence Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa IP Address Intelligence Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa IP Address Intelligence Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa IP Address Intelligence Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa IP Address Intelligence Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa IP Address Intelligence Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific IP Address Intelligence Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific IP Address Intelligence Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific IP Address Intelligence Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific IP Address Intelligence Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific IP Address Intelligence Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific IP Address Intelligence Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global IP Address Intelligence Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global IP Address Intelligence Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global IP Address Intelligence Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global IP Address Intelligence Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global IP Address Intelligence Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global IP Address Intelligence Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global IP Address Intelligence Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global IP Address Intelligence Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global IP Address Intelligence Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global IP Address Intelligence Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global IP Address Intelligence Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global IP Address Intelligence Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global IP Address Intelligence Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global IP Address Intelligence Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global IP Address Intelligence Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global IP Address Intelligence Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global IP Address Intelligence Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global IP Address Intelligence Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global IP Address Intelligence Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific IP Address Intelligence Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IP Address Intelligence Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the IP Address Intelligence Software?

Key companies in the market include MaxMind, apilayer, IP Info, Ipregistry, Abstract API, IP Tracker, BigDataCloud, DB-IP, Digital Element, Webdevmedia, Fastah, Geoplugin, Geo Targetly, Hexasoft Development, ipapi, ipdata, IP Find, WhoisXML API, Ipinfodb, IPligence, ipwhois.io, KeyCDN, Foundry, Neustar, PointPin, Whoisxmlapi.

3. What are the main segments of the IP Address Intelligence Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IP Address Intelligence Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IP Address Intelligence Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IP Address Intelligence Software?

To stay informed about further developments, trends, and reports in the IP Address Intelligence Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence