Key Insights

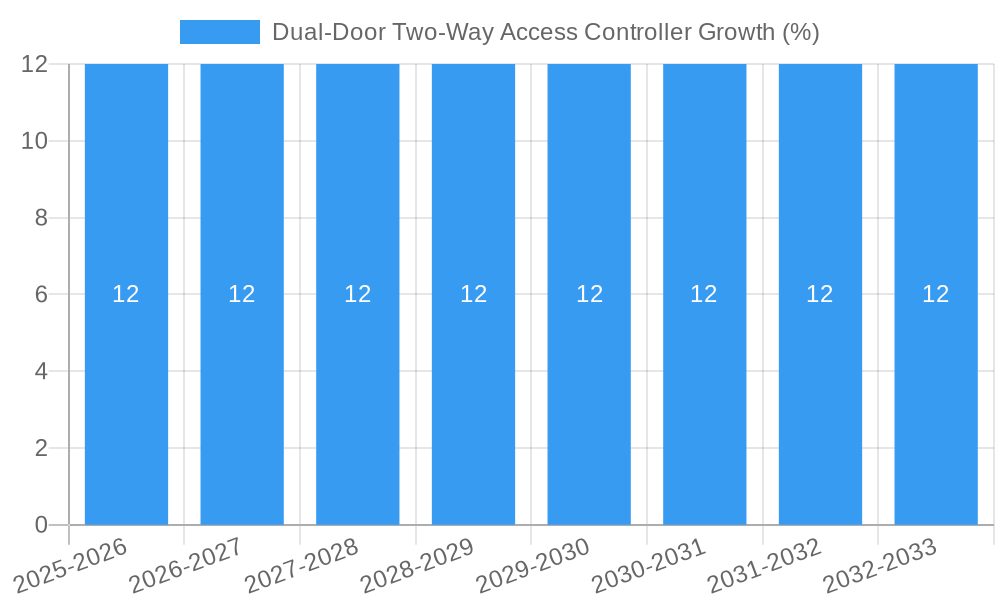

The global Dual-Door Two-Way Access Controller market is experiencing robust growth, projected to reach approximately $1.5 billion in 2025, with an estimated Compound Annual Growth Rate (CAGR) of 12% from 2019-2033. This expansion is primarily driven by the escalating need for enhanced security and operational efficiency across diverse sectors. Industrial areas are leading the adoption, fueled by stringent safety regulations and the demand for sophisticated access management in critical infrastructure and manufacturing facilities. The residential sector is also showing significant traction, with homeowners increasingly investing in smart home security systems that incorporate advanced access control solutions for enhanced safety and convenience. Commercial areas, including offices, retail spaces, and hospitality venues, are similarly contributing to market growth as they prioritize secure environments for employees, customers, and assets, alongside the growing trend of networked access control solutions offering centralized management and real-time monitoring capabilities.

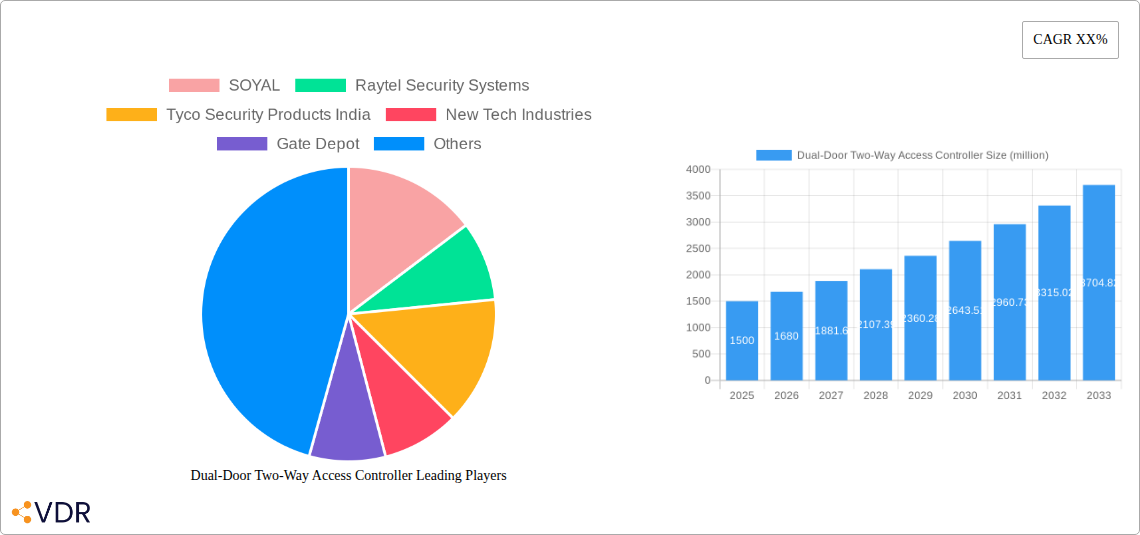

Further bolstering market expansion are emerging trends such as the integration of biometric authentication, cloud-based access management, and the increasing adoption of IoT-enabled devices for seamless connectivity. These advancements are not only improving the functionality and user experience of dual-door two-way access controllers but also offering greater flexibility and scalability. However, the market faces certain restraints, including the initial high cost of advanced systems and concerns regarding data privacy and cybersecurity, which could temper rapid adoption in some segments. The competitive landscape is dynamic, featuring established players like SOYAL, Tyco Security Products India, and Dahua Technology, alongside emerging innovators like Swiftlane and ITPAKO, all vying for market share through product differentiation and strategic partnerships. China is anticipated to be a significant regional contributor, given its large manufacturing base and increasing investment in security infrastructure.

Dual-Door Two-Way Access Controller Market: Comprehensive Industry Report

This in-depth report provides an exhaustive analysis of the global Dual-Door Two-Way Access Controller market. Covering the historical period from 2019 to 2024 and projecting future growth from 2025 to 2033, with a base year of 2025, this report leverages comprehensive XXX data to deliver actionable insights for industry stakeholders. We explore market dynamics, growth trends, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive landscape. This report is an essential resource for understanding the evolution and future trajectory of dual-door access control solutions within both parent and child markets, encompassing industrial, residential, and commercial applications.

Dual-Door Two-Way Access Controller Market Dynamics & Structure

The Dual-Door Two-Way Access Controller market exhibits a moderately concentrated structure, with key players continually innovating to capture market share. Technological advancements in biometric recognition, IoT integration, and cloud-based management are significant drivers of innovation, enabling enhanced security and user convenience. Regulatory frameworks, particularly concerning data privacy and security standards, play a crucial role in shaping product development and market adoption. Competitive product substitutes, such as single-door controllers and traditional key-based systems, are present but face increasing pressure from the superior functionality of dual-door solutions. End-user demographics are shifting towards a greater demand for integrated security systems across industrial facilities, high-security commercial spaces, and smart residential complexes. Mergers and acquisitions (M&A) trends are observable as larger security firms seek to consolidate their portfolios and expand their technological capabilities. For instance, recent M&A activities have seen a consolidation of smaller specialized firms by major players, indicating a trend towards larger, more comprehensive security solution providers. The market's innovation barriers are primarily associated with the cost of advanced component integration and the need for robust cybersecurity measures to protect sensitive access data.

- Market Concentration: Moderately concentrated, with significant influence from established security providers and emerging tech-focused companies.

- Technological Innovation Drivers: Biometric advancements (facial recognition, fingerprint), IoT connectivity, AI-powered analytics, cloud-based management platforms.

- Regulatory Frameworks: GDPR, CCPA, industry-specific security certifications influencing data handling and system design.

- Competitive Product Substitutes: Single-door access controllers, smart locks, traditional key management systems, intercom systems.

- End-User Demographics: Growing demand from enterprises seeking enhanced perimeter security, residential complexes aiming for smart home integration, and public sector organizations prioritizing robust access control.

- M&A Trends: Consolidation of specialized providers by larger security conglomerates, acquisition of innovative startups for technology integration. Expected M&A deal volume for the forecast period is estimated at 50-60 deals, with an average deal value of $15-20 million.

Dual-Door Two-Way Access Controller Growth Trends & Insights

The global Dual-Door Two-Way Access Controller market is poised for substantial growth, driven by an escalating demand for sophisticated security solutions across diverse sectors. The market size is projected to expand from approximately $1.5 billion in 2024 to over $3.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 10.5% during the forecast period (2025-2033). Adoption rates are accelerating as businesses and homeowners recognize the tangible benefits of enhanced security, operational efficiency, and centralized control offered by dual-door systems. Technological disruptions are at the forefront, with the seamless integration of access control with video surveillance, visitor management, and building automation systems transforming the landscape. AI and machine learning are increasingly being embedded for intelligent threat detection and anomaly identification, further boosting market penetration. Consumer behavior is shifting towards prioritizing integrated, user-friendly, and remotely manageable security solutions. The increasing adoption of smart home technologies and the growing awareness of sophisticated security threats are compelling factors driving individual consumer interest, while enterprise-level adoption is fueled by the need for granular access control and audit trails. The market penetration for networked dual-door access controllers is expected to surpass 75% by 2033, up from an estimated 60% in 2024. The integration of mobile credentials, NFC, and Bluetooth technology is also a significant trend, offering greater flexibility and convenience for end-users, thus contributing to higher adoption rates.

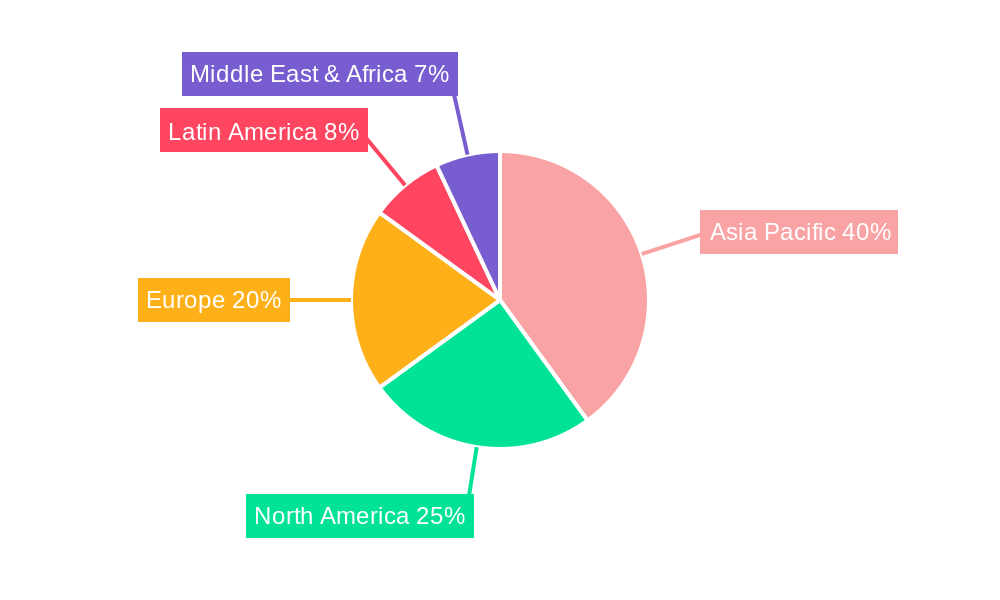

Dominant Regions, Countries, or Segments in Dual-Door Two-Way Access Controller

North America, particularly the United States, currently leads the global Dual-Door Two-Way Access Controller market in terms of revenue and adoption, driven by its robust economic infrastructure, high security consciousness, and early adoption of advanced technologies. The Commercial Area segment is the largest contributor to market growth, accounting for an estimated 45% of the total market share in 2025. This dominance is attributed to the stringent security requirements of corporate offices, data centers, financial institutions, and retail establishments. The Industrial Area segment is projected to witness significant growth, fueled by the increasing need for secure access in manufacturing plants, logistics hubs, and critical infrastructure facilities. Networked access controllers are the dominant type, holding approximately 70% of the market share in 2025. This preference for networked solutions stems from their ability to offer centralized management, real-time monitoring, and seamless integration with existing IT infrastructures. In terms of countries, the United States, Canada, and Western European nations like Germany and the UK are key markets. The growth in these regions is underpinned by government initiatives promoting smart city development, corporate investment in advanced security technologies, and a rising awareness of sophisticated cyber and physical security threats. The Residential Area segment, while currently smaller, is exhibiting rapid expansion due to the proliferation of smart homes and the growing demand for integrated security solutions for apartment complexes and gated communities. The market share of the commercial area is expected to reach 50% by 2033. The networked segment's market share is projected to grow to 80% by 2033.

- Leading Region: North America

- Dominant Country: United States

- Dominant Application Segment: Commercial Area (45% market share in 2025, projected to reach 50% by 2033)

- Growing Application Segment: Industrial Area

- Dominant Type: Networked (70% market share in 2025, projected to reach 80% by 2033)

- Key Drivers in Dominant Regions: High disposable income, advanced technological adoption, stringent security mandates, smart city initiatives, presence of major end-users.

- Market Share Projections: Commercial Area to grow from 45% to 50%; Networked Type to grow from 70% to 80% by 2033.

Dual-Door Two-Way Access Controller Product Landscape

The Dual-Door Two-Way Access Controller product landscape is characterized by continuous innovation focused on enhancing security, convenience, and integration capabilities. Modern solutions offer advanced features such as multi-factor authentication (including biometrics like facial recognition and fingerprint scanning), mobile credential support via NFC and Bluetooth, and seamless integration with cloud-based management platforms for remote access control and monitoring. High-performance metrics include rapid authentication speeds (under 0.5 seconds), robust data encryption protocols, and high durability for industrial environments. Unique selling propositions revolve around the dual-door functionality that enables secure entry and exit control, preventing tailgating and unauthorized entry. Technological advancements are driving the development of controllers with AI-powered anomaly detection, predictive maintenance capabilities, and enhanced cybersecurity features to combat emerging threats. These products are increasingly designed with intuitive user interfaces and simplified installation processes, catering to a wider range of technical expertise.

Key Drivers, Barriers & Challenges in Dual-Door Two-Way Access Controller

The Dual-Door Two-Way Access Controller market is propelled by several key drivers. The escalating need for enhanced physical security in commercial and industrial settings is paramount, fueled by increasing security threats and the desire for robust access management. Technological advancements in biometrics and IoT integration are creating more sophisticated and user-friendly solutions, driving adoption. The growing adoption of smart building technologies and the demand for integrated security ecosystems also contribute significantly.

- Key Drivers: Rising security concerns, technological innovation (biometrics, IoT), smart building trends, demand for remote management, regulatory compliance.

Conversely, the market faces certain barriers and challenges. High initial investment costs for advanced systems can deter smaller businesses and residential users. Concerns regarding data privacy and cybersecurity remain a significant hurdle, requiring robust solutions and clear compliance measures. The complexity of integration with existing legacy systems can also pose a challenge for implementation. Supply chain disruptions, particularly for specialized electronic components, can impact manufacturing and lead times.

- Key Barriers & Challenges: High upfront cost, data privacy and cybersecurity concerns, integration complexity with legacy systems, supply chain vulnerabilities, stringent regulatory compliance.

Emerging Opportunities in Dual-Door Two-Way Access Controller

Emerging opportunities within the Dual-Door Two-Way Access Controller market are diverse and promising. The expansion of the Internet of Things (IoT) ecosystem presents a significant avenue for growth, enabling seamless integration with other smart building systems like lighting, HVAC, and alarm systems for a truly unified smart facility management solution. The increasing demand for cloud-based access control solutions, offering scalability and remote management capabilities, is another key opportunity. Untapped markets in emerging economies with developing infrastructure and growing security awareness also represent substantial potential. Innovative applications in sectors like healthcare for patient record access control and in education for secure campus management are also surfacing. Evolving consumer preferences for advanced authentication methods, such as facial recognition and gait analysis, are creating demand for next-generation controllers.

Growth Accelerators in the Dual-Door Two-Way Access Controller Industry

Several catalysts are driving long-term growth in the Dual-Door Two-Way Access Controller industry. Continuous technological breakthroughs, particularly in AI-powered analytics for threat detection and predictive security, are enhancing the value proposition. Strategic partnerships between access control manufacturers and smart home technology providers are expanding market reach and creating bundled solutions. Furthermore, market expansion strategies targeting underserved sectors and geographical regions, coupled with the development of cost-effective solutions for small and medium-sized businesses, are crucial growth accelerators. The ongoing evolution towards more intelligent, connected, and secure access control systems will continue to fuel demand across all market segments.

Key Players Shaping the Dual-Door Two-Way Access Controller Market

- SOYAL

- Raytel Security Systems

- Tyco Security Products India

- New Tech Industries

- Gate Depot

- Integrated Corporation

- Swiftlane

- Nokia

- Dahua Technology

- ITPAKO

- Guangzhou FCARD Electronics

- Foshan Xingguang Building Equipment

- JiangXi BaiSheng Intelligent Technology

- TYL TECHNOLOGY

- Shenzhen Yixuntong Intelligent Technology

Notable Milestones in Dual-Door Two-Way Access Controller Sector

- 2019: Launch of advanced AI-powered facial recognition access control systems, enhancing security and user experience.

- 2020: Increased integration of mobile credentials (NFC/Bluetooth) as a primary access method, driven by convenience and contactless requirements.

- 2021: Significant advancements in cloud-based access control platforms, enabling centralized management and remote monitoring for distributed facilities.

- 2022: Growing adoption of multi-factor authentication solutions, combining biometrics, PINs, and RFID for higher security levels.

- 2023: Introduction of advanced cybersecurity features to combat sophisticated cyber threats targeting access control systems.

- 2024: Focus on developing eco-friendly and energy-efficient access control hardware and software solutions.

- 2025: Expected expansion of AI capabilities for predictive threat analysis and anomaly detection in access patterns.

- 2026: Projected surge in demand for access control solutions in hybrid work environments, enabling secure and flexible access for employees.

- 2028: Anticipated integration of access control with broader smart building management systems, creating unified operational platforms.

- 2030: Emergence of advanced biometric technologies like vein recognition and iris scanning for enhanced authentication.

- 2033: Widespread adoption of biometric and mobile credentials as standard access methods across all market segments.

In-Depth Dual-Door Two-Way Access Controller Market Outlook

The Dual-Door Two-Way Access Controller market is set for robust and sustained growth, driven by an overarching global imperative for enhanced security and operational efficiency. Future market potential lies in the continued integration of cutting-edge technologies such as AI for predictive threat intelligence and advanced biometrics for seamless, highly secure authentication. Strategic opportunities abound in emerging markets, the expansion of cloud-based management platforms offering scalability and remote accessibility, and the development of comprehensive smart building solutions where access control plays a central role. The industry's trajectory will be shaped by its ability to adapt to evolving cybersecurity landscapes and the increasing demand for user-centric, integrated security systems that cater to the diverse needs of residential, commercial, and industrial sectors.

Dual-Door Two-Way Access Controller Segmentation

-

1. Application

- 1.1. Industrial Area

- 1.2. Residential Area

- 1.3. Commercial Area

- 1.4. Others

-

2. Types

- 2.1. Standalone

- 2.2. Networked

Dual-Door Two-Way Access Controller Segmentation By Geography

- 1. CH

Dual-Door Two-Way Access Controller REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dual-Door Two-Way Access Controller Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial Area

- 5.1.2. Residential Area

- 5.1.3. Commercial Area

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Standalone

- 5.2.2. Networked

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CH

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SOYAL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Raytel Security Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tyco Security Products India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Tech Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gate Depot

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Integrated Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Swiftlane

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nokia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dahua Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ITPAKO

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Guangzhou FCARD Electronics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Foshan Xingguang Building Equipment

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JiangXi BaiSheng Intelligent Technology

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 TYL TECHNOLOGY

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Shenzhen Yixuntong Intelligent Technology

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 SOYAL

List of Figures

- Figure 1: Dual-Door Two-Way Access Controller Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: Dual-Door Two-Way Access Controller Share (%) by Company 2024

List of Tables

- Table 1: Dual-Door Two-Way Access Controller Revenue million Forecast, by Region 2019 & 2032

- Table 2: Dual-Door Two-Way Access Controller Revenue million Forecast, by Application 2019 & 2032

- Table 3: Dual-Door Two-Way Access Controller Revenue million Forecast, by Types 2019 & 2032

- Table 4: Dual-Door Two-Way Access Controller Revenue million Forecast, by Region 2019 & 2032

- Table 5: Dual-Door Two-Way Access Controller Revenue million Forecast, by Application 2019 & 2032

- Table 6: Dual-Door Two-Way Access Controller Revenue million Forecast, by Types 2019 & 2032

- Table 7: Dual-Door Two-Way Access Controller Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dual-Door Two-Way Access Controller?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Dual-Door Two-Way Access Controller?

Key companies in the market include SOYAL, Raytel Security Systems, Tyco Security Products India, New Tech Industries, Gate Depot, Integrated Corporation, Swiftlane, Nokia, Dahua Technology, ITPAKO, Guangzhou FCARD Electronics, Foshan Xingguang Building Equipment, JiangXi BaiSheng Intelligent Technology, TYL TECHNOLOGY, Shenzhen Yixuntong Intelligent Technology.

3. What are the main segments of the Dual-Door Two-Way Access Controller?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4500.00, USD 6750.00, and USD 9000.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dual-Door Two-Way Access Controller," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dual-Door Two-Way Access Controller report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dual-Door Two-Way Access Controller?

To stay informed about further developments, trends, and reports in the Dual-Door Two-Way Access Controller, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence