Key Insights

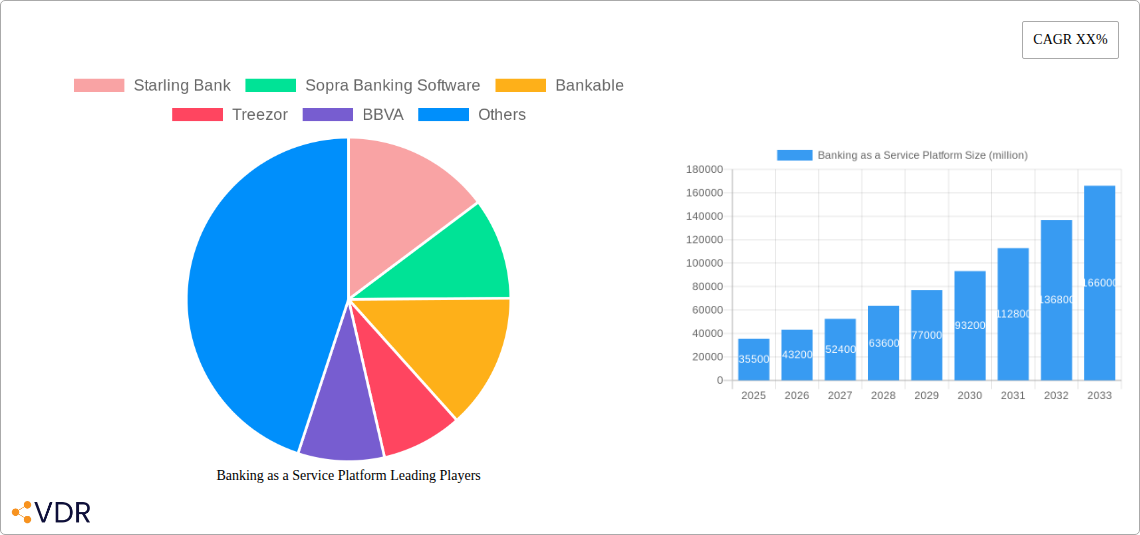

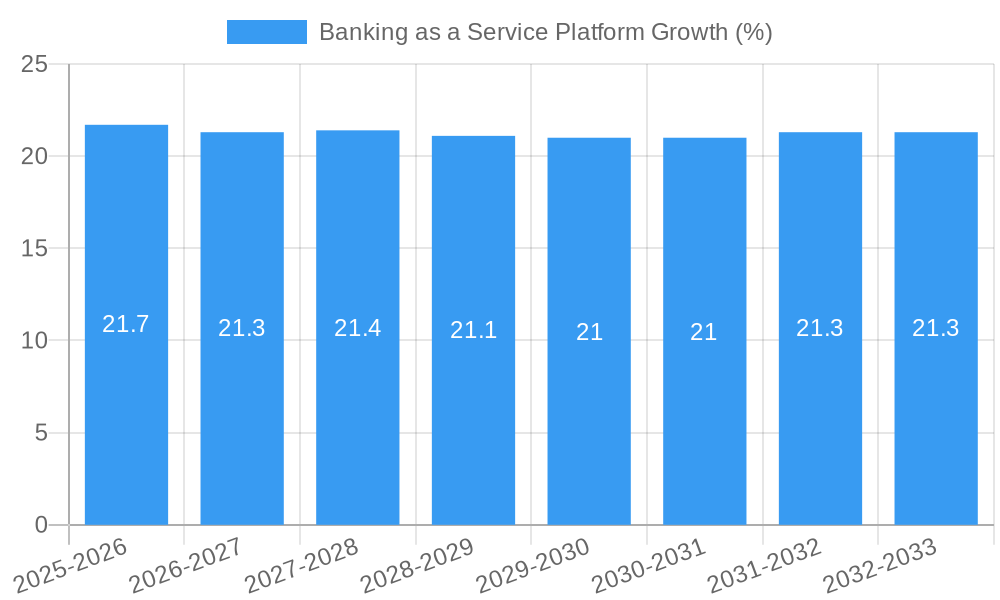

The global Banking as a Service (BaaS) Platform market is poised for significant expansion, projected to reach an estimated USD 35,500 million by 2025 and is expected to witness a robust Compound Annual Growth Rate (CAGR) of 21.5% between 2025 and 2033. This growth trajectory is fueled by a confluence of factors, primarily the escalating demand for embedded finance solutions across diverse industries and the persistent drive towards digital transformation within the financial sector. As businesses increasingly seek to integrate financial services seamlessly into their existing platforms and customer journeys, BaaS providers are becoming indispensable partners, offering flexible APIs and white-label solutions that accelerate innovation and enhance customer engagement. The market's dynamism is further propelled by a surge in fintech adoption and a growing willingness among traditional financial institutions to collaborate with third-party providers to offer specialized banking functionalities without the extensive regulatory burden and infrastructure costs associated with building them from scratch.

Key growth drivers include the burgeoning adoption of BaaS in sectors like e-commerce for streamlined payment processing, in the manufacturing industry for supply chain finance solutions, and in healthcare for facilitating secure patient payment portals. The IT and Telecommunication sector is also a significant contributor, leveraging BaaS for innovative digital wallet and payment solutions. While the market benefits from substantial investment and a clear demand for agile financial infrastructure, certain restraints, such as evolving regulatory landscapes and data security concerns, need continuous attention from market players. The competitive landscape is characterized by a blend of established banks offering BaaS capabilities, specialized fintech companies, and software providers, all vying to capture market share through differentiated offerings, advanced technology, and strategic partnerships. Innovations in areas such as open banking APIs, real-time payment processing, and customizable banking solutions will continue to shape market dynamics and present opportunities for sustained growth.

Banking as a Service Platform Market Report: Unlocking the Future of Embedded Finance

This comprehensive report delves into the dynamic and rapidly expanding Banking as a Service (BaaS) Platform market. We provide an in-depth analysis of market trends, growth trajectories, key players, and future opportunities, essential for strategists, financial institutions, fintech innovators, and technology providers navigating the evolving landscape of embedded finance. The report leverages a robust study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, incorporating historical data from 2019–2024. All quantitative data is presented in millions of units.

Banking as a Service Platform Market Dynamics & Structure

The Banking as a Service (BaaS) Platform market is characterized by a blend of concentrated and fragmented dynamics, driven by significant technological innovation and evolving regulatory frameworks. Major players are investing heavily in API development and cloud infrastructure, facilitating seamless integration of financial services into non-financial applications. This has led to increased competition from specialized BaaS providers and a surge in M&A activity as established financial institutions seek to acquire or partner with agile fintech firms. Competitive product substitutes, while emerging, primarily focus on niche functionalities rather than comprehensive BaaS solutions. End-user demographics are broadening, encompassing a wide range of industries seeking to embed financial capabilities to enhance customer experience and create new revenue streams.

- Market Concentration: A moderate level of concentration exists, with leading BaaS providers holding significant market share, but with a growing number of new entrants and specialized players.

- Technological Innovation Drivers: Open APIs, cloud computing, AI/ML for fraud detection and personalization, and blockchain technology are key innovation drivers.

- Regulatory Frameworks: Evolving regulations around data privacy, KYC/AML, and open banking are shaping market entry and operational strategies.

- Competitive Product Substitutes: While not direct substitutes, embedded finance solutions from neo-banks and payment gateways present indirect competition.

- End-User Demographics: Primarily B2B, with a strong focus on fintechs, SaaS companies, e-commerce platforms, and traditional enterprises.

- M&A Trends: Significant M&A activity is observed, with deal volumes in the hundreds of millions of dollars, driven by the desire for market expansion and technological capabilities.

Banking as a Service Platform Growth Trends & Insights

The Banking as a Service (BaaS) Platform market is experiencing exponential growth, driven by a paradigm shift in how financial services are delivered and consumed. The market size is projected to reach $XX billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This rapid expansion is fueled by increasing adoption rates across diverse industry verticals, spurred by the demand for seamless, integrated financial experiences. Technological disruptions, such as the maturation of open banking standards and the rise of cloud-native architectures, have significantly lowered the barrier to entry for embedding financial services. Consumer behavior is a critical catalyst, with a growing preference for convenient, on-demand financial solutions accessible within their preferred digital ecosystems. This has pushed businesses across sectors like Retail, IT and Telecommunication, and Healthcare to explore BaaS solutions to enhance customer loyalty and unlock new revenue streams. The market penetration of BaaS is still in its nascent stages in many regions, presenting substantial untapped potential. For instance, the Banking as a Service Platform segment itself is outgrowing Banking as a Service APIs and ancillary Services, indicating a maturation towards end-to-end platform solutions. The accessibility and scalability offered by BaaS platforms enable businesses to offer services such as embedded payments, lending, and insurance without the need for extensive in-house financial infrastructure, thereby fostering innovation and accelerating digital transformation. The overall evolution points towards a future where financial services are no longer a standalone offering but an integral, invisible component of daily digital interactions.

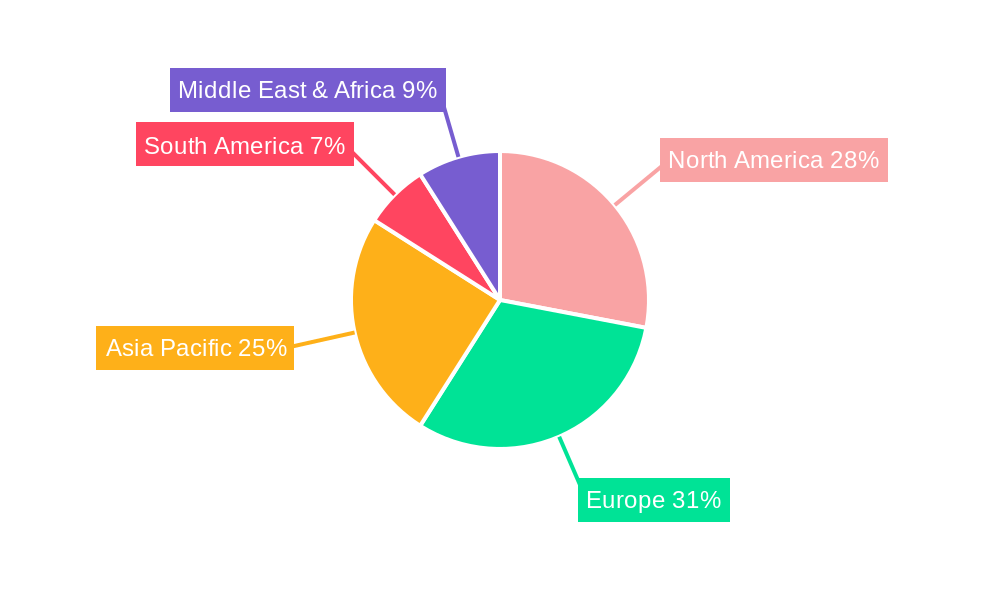

Dominant Regions, Countries, or Segments in Banking as a Service Platform

The Banking as a Service Platform segment is unequivocally the dominant force driving market growth within the broader BaaS ecosystem. This dominance stems from the increasing demand for comprehensive, end-to-end solutions that offer a holistic approach to embedding financial services, rather than just isolated APIs or specific services. The IT and Telecommunication sector, closely followed by Retail, are currently the leading applications leveraging BaaS platforms due to their extensive digital customer bases and inherent need for seamless payment and financial transaction integrations. Geographically, North America and Europe currently lead the market. North America benefits from a mature fintech ecosystem, strong regulatory support for open banking initiatives, and significant venture capital investment, enabling companies like Unit Finance and Railsbank to scale rapidly. Europe, with its PSD2 regulations, has fostered a conducive environment for BaaS adoption, with countries like the UK and Germany at the forefront.

- Dominant Segment: Banking as a Service Platforms, representing a significant majority of the market value, driven by demand for integrated solutions.

- Leading Applications:

- IT and Telecommunication: High adoption due to the need for subscription management, in-app purchases, and digital wallet integration. Market share estimated at XX%.

- Retail: Significant growth driven by embedded payments, buy-now-pay-later (BNPL) solutions, and loyalty programs. Market share estimated at XX%.

- Healthcare: Emerging adoption for streamlined patient payments, insurance claims processing, and healthcare financing.

- Dominant Regions:

- North America: Leading market due to robust fintech innovation, regulatory push, and substantial investment. Expected market share: XX%.

- Europe: Strong growth driven by PSD2 and a well-established open banking framework. Expected market share: XX%.

- Key Drivers for Dominance:

- Economic Policies: Favorable regulations and incentives promoting financial innovation.

- Infrastructure: Advanced digital infrastructure and widespread internet penetration.

- Consumer Behavior: Growing demand for digital-first, convenient financial experiences.

- Technological Advancement: Proliferation of APIs and cloud computing enabling scalable BaaS solutions.

Banking as a Service Platform Product Landscape

The Banking as a Service (BaaS) Platform product landscape is characterized by a rich tapestry of innovative solutions designed to democratize access to financial functionalities. Companies are offering modular and white-label platforms that allow businesses to seamlessly integrate services such as account opening, payment processing, card issuance, and lending directly into their own applications and workflows. Unique selling propositions often revolve around speed of integration, cost-effectiveness, regulatory compliance, and the ability to offer highly personalized financial experiences. Technological advancements include sophisticated API gateways, robust security protocols, and AI-driven analytics for risk management and customer insights. For example, platforms like Thought Machine are providing core banking technology that can be offered as a service, while others like TrueLayer focus on facilitating secure access to banking data for enriched applications.

Key Drivers, Barriers & Challenges in Banking as a Service Platform

The Banking as a Service (BaaS) Platform market is propelled by several key drivers. The increasing demand for seamless embedded finance experiences, the growing adoption of digital transformation across industries, and supportive regulatory frameworks like open banking are significant catalysts. Technological advancements in API standardization and cloud infrastructure further accelerate adoption.

- Key Drivers:

- Embedded Finance Demand: Businesses seeking to offer financial services within their existing customer journeys.

- Digital Transformation: Accelerated by the pandemic, driving the need for agile financial solutions.

- Open Banking Regulations: Mandating data sharing and fostering innovation.

- Fintech Innovation: Continuous development of new financial products and services.

Conversely, the market faces several barriers and challenges. Regulatory compliance, particularly across different jurisdictions, remains a complex hurdle. Ensuring robust cybersecurity and data privacy is paramount, with significant investments required. High upfront integration costs for some businesses and a lack of technical expertise can also impede adoption.

- Key Barriers & Challenges:

- Regulatory Complexity: Navigating diverse and evolving compliance requirements.

- Cybersecurity & Data Privacy: Protecting sensitive financial data from breaches.

- Integration Costs & Expertise: Significant upfront investment and technical know-how needed.

- Market Fragmentation: A crowded market with numerous providers, leading to choice paralysis.

- Scalability Concerns: Ensuring platforms can handle growing transaction volumes and user bases.

Emerging Opportunities in Banking as a Service Platform

Emerging opportunities in the Banking as a Service (BaaS) Platform sector are plentiful, driven by evolving consumer expectations and technological advancements. The burgeoning demand for personalized financial products, particularly in areas like embedded lending for small businesses and flexible payment options in the Retail sector, presents a significant growth avenue. Furthermore, the integration of BaaS into emerging technologies like the Metaverse and Web3 offers novel possibilities for digital asset management and decentralized finance. The untapped potential in emerging economies, where digital adoption is accelerating, also represents a vast opportunity for BaaS providers to leapfrog traditional banking infrastructure.

- Personalized Financial Products: Tailored lending, insurance, and investment solutions embedded within consumer journeys.

- Web3 and Metaverse Integration: Facilitating digital asset management and decentralized financial interactions.

- Emerging Markets: Offering accessible and scalable financial services in regions with limited traditional banking penetration.

- Industry-Specific Solutions: Developing specialized BaaS offerings for verticals like Healthcare and Energy.

Growth Accelerators in the Banking as a Service Platform Industry

The Banking as a Service (BaaS) Platform industry's long-term growth is being significantly accelerated by several key factors. Continuous technological breakthroughs, such as the advancement of AI and machine learning for enhanced risk assessment and fraud detection, are making BaaS solutions more robust and attractive. Strategic partnerships between traditional financial institutions and agile fintech companies are fostering innovation and expanding market reach, creating a more interconnected financial ecosystem. Market expansion strategies, including geographical diversification and the development of specialized BaaS offerings for niche industries, are further fueling this growth trajectory.

Key Players Shaping the Banking as a Service Platform Market

- Starling Bank

- Sopra Banking Software

- Bankable

- Treezor

- BBVA

- ClearBank

- TrueLayer

- Unit Finance

- Railsbank

- Yapily

- FintechOs

- Thought Machine

- Upvest

- Solarisbank

- Green Dot Corporation

- Q2 Software, Inc.

Notable Milestones in Banking as a Service Platform Sector

- 2019/Q1: Railsbank secures significant Series B funding, enabling expansion and product development.

- 2020/Q3: Solarisbank receives regulatory approval and expands its European reach.

- 2021/Q2: TrueLayer raises substantial investment to bolster its open banking infrastructure.

- 2022/Q4: BBVA launches its BaaS offering, signaling increased interest from traditional banks.

- 2023/Q1: Starling Bank continues to grow its marketplace offering, integrating more third-party financial services.

- 2023/Q3: Sopra Banking Software announces strategic partnerships to enhance its BaaS capabilities.

- 2024/Q1: Unit Finance introduces new API capabilities for embedded lending solutions.

In-Depth Banking as a Service Platform Market Outlook

The outlook for the Banking as a Service (BaaS) Platform market is exceptionally promising, driven by the relentless pursuit of embedded finance and the democratization of financial services. Growth accelerators, including advancements in AI for hyper-personalization and strategic collaborations between fintechs and established institutions, are poised to unlock significant future market potential. The continuous evolution of regulatory landscapes, while sometimes challenging, ultimately fosters a more secure and innovative environment for BaaS adoption. Strategic opportunities lie in expanding into underserved markets, developing specialized solutions for burgeoning industries like Healthcare and Energy, and leveraging emerging technologies to redefine financial interactions. The market is set for sustained high growth, with an estimated market size of $XX billion by 2033.

Banking as a Service Platform Segmentation

-

1. Application

- 1.1. Education

- 1.2. Manufacturing

- 1.3. Healthcare

- 1.4. IT and Telecommunication

- 1.5. Energy

- 1.6. Retail

- 1.7. Transportation

- 1.8. Others

-

2. Types

- 2.1. Banking as a Service Platform

- 2.2. Banking as a Service APls

- 2.3. Services

Banking as a Service Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Banking as a Service Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Banking as a Service Platform Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Education

- 5.1.2. Manufacturing

- 5.1.3. Healthcare

- 5.1.4. IT and Telecommunication

- 5.1.5. Energy

- 5.1.6. Retail

- 5.1.7. Transportation

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Banking as a Service Platform

- 5.2.2. Banking as a Service APls

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Banking as a Service Platform Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Education

- 6.1.2. Manufacturing

- 6.1.3. Healthcare

- 6.1.4. IT and Telecommunication

- 6.1.5. Energy

- 6.1.6. Retail

- 6.1.7. Transportation

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Banking as a Service Platform

- 6.2.2. Banking as a Service APls

- 6.2.3. Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Banking as a Service Platform Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Education

- 7.1.2. Manufacturing

- 7.1.3. Healthcare

- 7.1.4. IT and Telecommunication

- 7.1.5. Energy

- 7.1.6. Retail

- 7.1.7. Transportation

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Banking as a Service Platform

- 7.2.2. Banking as a Service APls

- 7.2.3. Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Banking as a Service Platform Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Education

- 8.1.2. Manufacturing

- 8.1.3. Healthcare

- 8.1.4. IT and Telecommunication

- 8.1.5. Energy

- 8.1.6. Retail

- 8.1.7. Transportation

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Banking as a Service Platform

- 8.2.2. Banking as a Service APls

- 8.2.3. Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Banking as a Service Platform Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Education

- 9.1.2. Manufacturing

- 9.1.3. Healthcare

- 9.1.4. IT and Telecommunication

- 9.1.5. Energy

- 9.1.6. Retail

- 9.1.7. Transportation

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Banking as a Service Platform

- 9.2.2. Banking as a Service APls

- 9.2.3. Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Banking as a Service Platform Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Education

- 10.1.2. Manufacturing

- 10.1.3. Healthcare

- 10.1.4. IT and Telecommunication

- 10.1.5. Energy

- 10.1.6. Retail

- 10.1.7. Transportation

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Banking as a Service Platform

- 10.2.2. Banking as a Service APls

- 10.2.3. Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Starling Bank

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sopra Banking Software

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bankable

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Treezor

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BBVA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ClearBank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TrueLayer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Unit Finance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Railsbank

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yapily

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FintechOs

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Thought Machine

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Upvest

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Solarisbank

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Green Dot Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Q2 Software

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Inc.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Starling Bank

List of Figures

- Figure 1: Global Banking as a Service Platform Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Banking as a Service Platform Revenue (million), by Application 2024 & 2032

- Figure 3: North America Banking as a Service Platform Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Banking as a Service Platform Revenue (million), by Types 2024 & 2032

- Figure 5: North America Banking as a Service Platform Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Banking as a Service Platform Revenue (million), by Country 2024 & 2032

- Figure 7: North America Banking as a Service Platform Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Banking as a Service Platform Revenue (million), by Application 2024 & 2032

- Figure 9: South America Banking as a Service Platform Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Banking as a Service Platform Revenue (million), by Types 2024 & 2032

- Figure 11: South America Banking as a Service Platform Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Banking as a Service Platform Revenue (million), by Country 2024 & 2032

- Figure 13: South America Banking as a Service Platform Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Banking as a Service Platform Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Banking as a Service Platform Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Banking as a Service Platform Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Banking as a Service Platform Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Banking as a Service Platform Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Banking as a Service Platform Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Banking as a Service Platform Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Banking as a Service Platform Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Banking as a Service Platform Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Banking as a Service Platform Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Banking as a Service Platform Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Banking as a Service Platform Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Banking as a Service Platform Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Banking as a Service Platform Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Banking as a Service Platform Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Banking as a Service Platform Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Banking as a Service Platform Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Banking as a Service Platform Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Banking as a Service Platform Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Banking as a Service Platform Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Banking as a Service Platform Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Banking as a Service Platform Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Banking as a Service Platform Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Banking as a Service Platform Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Banking as a Service Platform Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Banking as a Service Platform Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Banking as a Service Platform Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Banking as a Service Platform Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Banking as a Service Platform Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Banking as a Service Platform Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Banking as a Service Platform Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Banking as a Service Platform Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Banking as a Service Platform Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Banking as a Service Platform Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Banking as a Service Platform Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Banking as a Service Platform Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Banking as a Service Platform Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Banking as a Service Platform Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking as a Service Platform?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Banking as a Service Platform?

Key companies in the market include Starling Bank, Sopra Banking Software, Bankable, Treezor, BBVA, ClearBank, TrueLayer, Unit Finance, Railsbank, Yapily, FintechOs, Thought Machine, Upvest, Solarisbank, Green Dot Corporation, Q2 Software, Inc..

3. What are the main segments of the Banking as a Service Platform?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Banking as a Service Platform," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Banking as a Service Platform report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Banking as a Service Platform?

To stay informed about further developments, trends, and reports in the Banking as a Service Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence