Key Insights

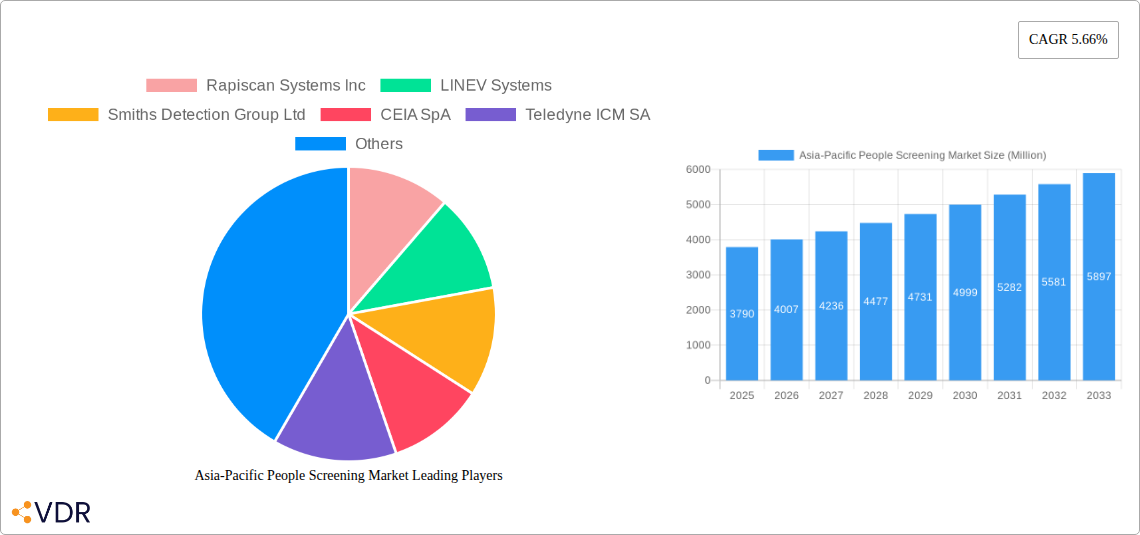

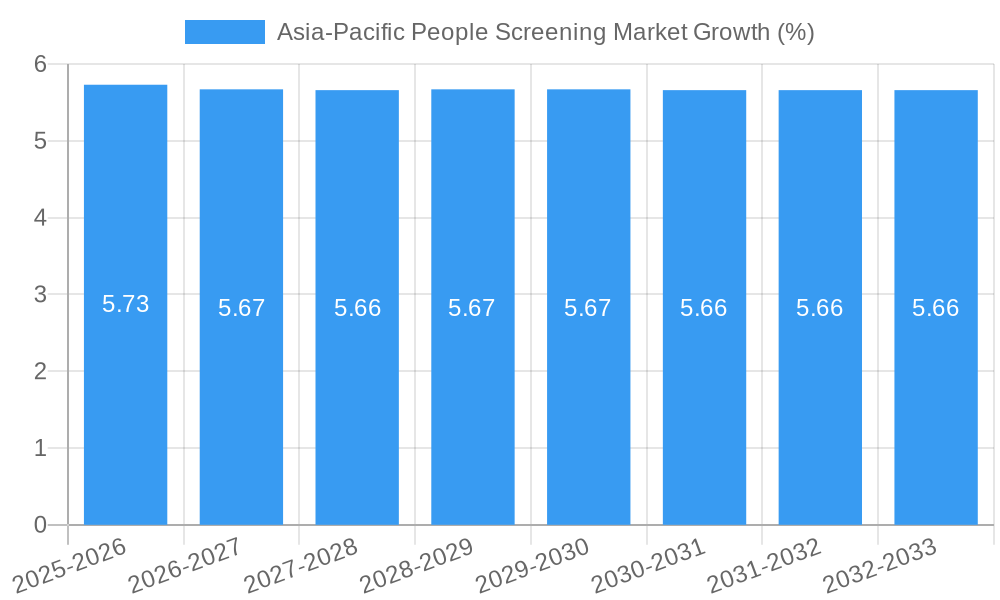

The Asia-Pacific People Screening Market is poised for significant expansion, projected to reach approximately USD 4,390 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 5.66% from its estimated base of USD 3,790 million in 2025. This growth trajectory is fueled by escalating concerns for public safety and security across diverse end-user industries, including corporate buildings, government facilities, and transportation hubs. The increasing adoption of advanced technologies such as millimeter wave scanners, X-ray systems, and biometric solutions is instrumental in enhancing threat detection capabilities and streamlining security protocols. Furthermore, the rising threat of terrorism, coupled with the need for efficient crowd management and access control in densely populated urban centers, is creating sustained demand for sophisticated people screening solutions. The market's expansion is also being propelled by government initiatives aimed at bolstering national security infrastructure and the private sector's commitment to safeguarding assets and personnel.

The market's dynamism is further shaped by emerging trends like the integration of artificial intelligence (AI) and machine learning (ML) for improved threat identification and reduced false positives, alongside the development of non-intrusive screening technologies that enhance passenger experience. While the market exhibits strong growth potential, certain restraints may influence its pace. These include the high initial investment cost associated with advanced screening systems and potential privacy concerns surrounding data collection and surveillance. However, the continuous innovation in hardware and software, coupled with a growing awareness of the critical role of effective security measures, is expected to outweigh these challenges. The Asia-Pacific region, with its rapidly developing economies and increasing focus on security, presents a fertile ground for the sustained growth and adoption of cutting-edge people screening technologies, leading to a more secure environment across various sectors.

Asia-Pacific People Screening Market: Comprehensive Outlook 2019-2033

This in-depth report provides an exhaustive analysis of the Asia-Pacific People Screening Market, covering its dynamics, growth trends, competitive landscape, and future outlook from 2019 to 2033. Gain critical insights into market size, technological advancements, and regional dominance, essential for strategic decision-making in the rapidly evolving security sector. The Asia-Pacific People Screening Market is segmented by Technology into X-ray Systems, Metal Detectors, Body Scanners, Biometric Systems, Millimeter Wave Whole Body Scanners, and Other Technologies. The End-user Industry segmentation includes Corporate Buildings, Warehouse and Logistics, Commercial Spaces, Transportation, Government Buildings, Law Enforcement, and Other End-User Industries. The study period encompasses 2019–2033, with the base year and estimated year at 2025, and the forecast period from 2025–2033, covering the historical period of 2019–2024. The report presents all values in Million units.

Asia-Pacific People Screening Market Market Dynamics & Structure

The Asia-Pacific People Screening Market exhibits a moderately concentrated structure, driven by substantial investments in advanced security technologies and increasing global security concerns. Key drivers of technological innovation include the persistent threat of terrorism, rising crime rates, and the growing adoption of smart city initiatives across the region. Regulatory frameworks, often stringent for critical infrastructure and public spaces, are pivotal in shaping market demand and product development. Competitive product substitutes, ranging from traditional metal detectors to sophisticated millimeter wave scanners, necessitate continuous innovation and cost-effectiveness from market players. End-user demographics are diverse, with significant demand originating from transportation hubs, government facilities, and increasingly, corporate and commercial spaces seeking to enhance employee and visitor safety. Merger and acquisition (M&A) trends, while not dominant, indicate a strategic consolidation among key players to expand product portfolios and geographical reach. For instance, in 2023, the market saw approximately xx M&A deals, reflecting an effort to gain market share and acquire innovative technologies. Innovation barriers include high research and development costs, lengthy product approval cycles, and the need for extensive training and maintenance of sophisticated screening systems. The market is poised for significant growth, with an estimated market share of xx% attributed to Millimeter Wave Whole Body Scanners by 2025, highlighting a shift towards non-invasive and advanced screening methods.

Asia-Pacific People Screening Market Growth Trends & Insights

The Asia-Pacific People Screening Market is on an upward trajectory, fueled by escalating security mandates and a growing awareness of the need for robust screening solutions across various sectors. The market size is projected to expand from an estimated xx Million units in 2025 to xx Million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of xx%. Adoption rates for advanced screening technologies, such as biometric systems and millimeter wave whole body scanners, are accelerating, driven by their superior detection capabilities and reduced false alarm rates. Technological disruptions, including the integration of artificial intelligence (AI) for threat detection and the development of portable and discreet screening devices, are reshaping the competitive landscape. Consumer behavior is shifting towards prioritizing security and safety, leading to increased demand for integrated security solutions. For example, the transportation sector, a major consumer, is seeing a xx% year-over-year increase in investment in advanced screening technologies to improve passenger throughput and security. The market penetration of full-body scanners in airports is expected to reach xx% by 2027, a significant increase from xx% in 2023. Evolving consumer preferences are also pushing for non-intrusive screening methods, thereby driving the adoption of millimeter wave and AI-powered biometric solutions. Furthermore, the rise of smart city projects across countries like Singapore, South Korea, and Japan is creating a substantial demand for integrated people screening systems for public spaces, contributing to the overall market expansion. The increasing focus on data privacy and the ethical use of biometric data are also influencing the development of more secure and transparent screening protocols, further shaping market growth.

Dominant Regions, Countries, or Segments in Asia-Pacific People Screening Market

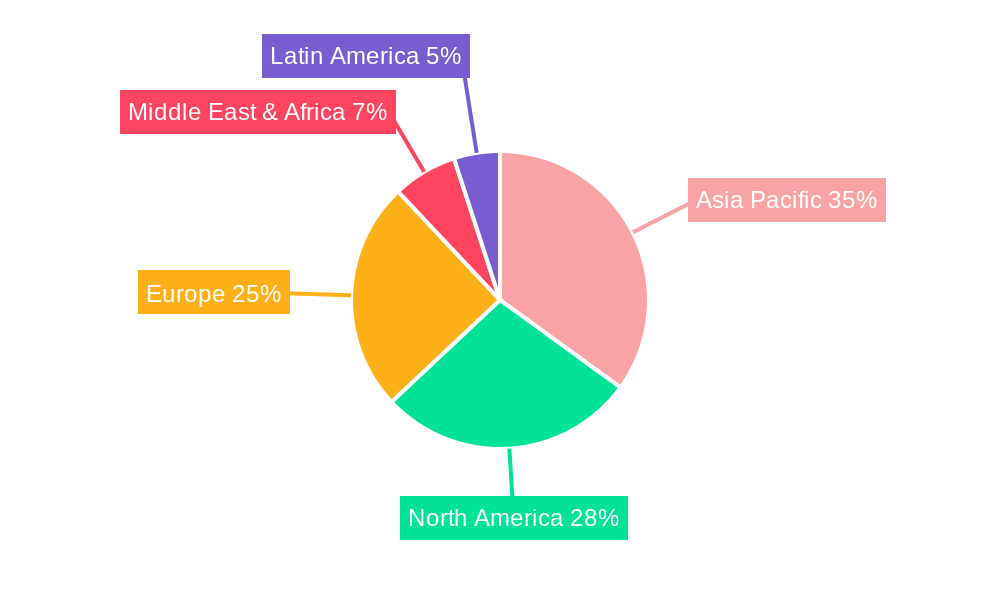

The Asia-Pacific People Screening Market is significantly influenced by the Transportation end-user industry and the Millimeter Wave Whole Body Scanner technology segment. Within this vast region, countries like China, Japan, South Korea, and India are emerging as dominant forces, driven by their large populations, burgeoning economies, and proactive stances on national security. China, in particular, leads in terms of market size and technological adoption, fueled by extensive government investments in smart city infrastructure and advanced security systems for its airports, railway stations, and public venues. Japan and South Korea are notable for their high adoption of sophisticated biometric systems and AI-integrated screening technologies, driven by a strong emphasis on technological innovation and public safety. India’s market is experiencing rapid growth, especially in the transportation sector, with significant deployments of body scanners and metal detectors in airports and railway stations, underscored by recent trials of full-body scanners.

- Key Drivers in Dominant Countries:

- Economic Policies: Favorable government policies promoting security upgrades and technological integration.

- Infrastructure Development: Rapid expansion of transportation networks, corporate buildings, and public spaces requiring enhanced security.

- Technological Adoption: High receptiveness to adopting cutting-edge security solutions.

- Security Threats: Proactive measures to counter potential security risks and maintain public order.

The Transportation segment, encompassing airports, railways, and ports, represents the largest end-user industry, accounting for approximately xx% of the market share in 2025. This dominance is attributed to the critical need for efficient and secure passenger screening to manage high volumes of travelers. The Millimeter Wave Whole Body Scanner technology segment is also a significant growth driver, projected to capture xx% of the technology market by 2025 due to its non-invasive nature and advanced detection capabilities for concealed items. The increasing focus on aviation security post-pandemic and the ongoing modernization of transportation hubs across the region are further solidifying the dominance of these segments. Furthermore, the increasing use of Biometric Systems for access control and identification in various end-user industries, such as government buildings and corporate facilities, is also contributing to the overall market growth, with an expected xx% market share in 2025. The Corporate Buildings segment is also witnessing a surge in demand for advanced people screening solutions, driven by the need to secure workplaces against internal and external threats.

Asia-Pacific People Screening Market Product Landscape

The Asia-Pacific People Screening Market is characterized by continuous product innovation focused on enhancing detection accuracy, speed, and user experience. Leading companies are developing advanced X-ray systems with improved image resolution and AI-driven analysis for faster threat identification. Metal detectors are evolving to offer greater sensitivity, discriminative capabilities to reduce nuisance alarms, and ergonomic designs. Body scanners, particularly millimeter wave whole body scanners, are at the forefront, offering non-invasive screening that can detect a wide range of threats, including explosives, liquids, and non-metallic weapons. Biometric systems are integrating facial recognition, fingerprint scanning, and iris recognition for seamless and secure identity verification. Innovations include AI-powered analytics that can predict potential threats based on behavioral patterns, and the development of portable and modular screening solutions for flexible deployment. Unique selling propositions often lie in the integration of multiple screening technologies for a comprehensive security approach, compliance with international security standards, and customized solutions tailored to specific client needs and environments.

Key Drivers, Barriers & Challenges in Asia-Pacific People Screening Market

Key Drivers: The Asia-Pacific People Screening Market is propelled by several key drivers: increasing global security concerns and a rise in terrorism threats globally and regionally; governmental initiatives and mandates for enhanced public safety; rapid urbanization and infrastructure development requiring robust security measures; and technological advancements leading to more efficient and effective screening solutions. The growing adoption of smart city projects across various nations further stimulates demand for integrated security systems. Economic growth and increased disposable income also contribute to higher spending on security infrastructure in both public and private sectors.

Barriers & Challenges: Despite robust growth, the market faces significant barriers and challenges. High initial investment costs for advanced screening technologies can be a restraint, particularly for small and medium-sized enterprises. Stringent regulatory compliance and the need for frequent technology upgrades to meet evolving security standards pose ongoing challenges. Supply chain disruptions and the availability of skilled personnel for installation, operation, and maintenance of sophisticated systems can also impact market growth. Furthermore, public perception and privacy concerns associated with certain screening technologies, such as body scanners, can create resistance and necessitate careful implementation strategies. The competitive pressure among manufacturers also leads to price wars, impacting profit margins.

Emerging Opportunities in Asia-Pacific People Screening Market

Emerging opportunities in the Asia-Pacific People Screening Market lie in the expanding adoption of these technologies in non-traditional sectors. The healthcare industry presents a significant untapped market, with the need for patient identification and security in hospitals and clinics. The entertainment and retail sectors are increasingly investing in security solutions for large venues and shopping malls to prevent theft and ensure patron safety. The rise of remote work and hybrid models is also driving demand for advanced security systems in corporate offices for access control and employee screening. Furthermore, the development of AI-powered, non-intrusive screening solutions that can analyze human behavior and detect anomalies in real-time offers a substantial opportunity for innovation and market penetration. The increasing focus on border security and the need for efficient cargo screening also present a growing area for market expansion.

Growth Accelerators in the Asia-Pacific People Screening Market Industry

Several catalysts are accelerating the long-term growth of the Asia-Pacific People Screening Market. Technological breakthroughs in sensor technology, artificial intelligence, and data analytics are leading to the development of more sophisticated and accurate screening systems. Strategic partnerships between technology providers, system integrators, and end-users are crucial for tailoring solutions to specific needs and expanding market reach. Market expansion strategies, including geographical diversification and the penetration of emerging economies within the Asia-Pacific region, are also key growth accelerators. Increased government spending on national security and public safety infrastructure, driven by evolving geopolitical landscapes and a proactive approach to threat mitigation, further fuels market expansion. The development of integrated security platforms that combine people screening with other security measures, such as surveillance and access control, is also a significant growth driver.

Key Players Shaping the Asia-Pacific People Screening Market Market

- Rapiscan Systems Inc

- LINEV Systems

- Smiths Detection Group Ltd

- CEIA SpA

- Teledyne ICM SA

- Thruvision Ltd

- Evovl Technologies

- Rohde & Schwarz

- Vehant Technologies

- Nuctech Company Limited

Notable Milestones in Asia-Pacific People Screening Market Sector

- April 2024: Major airports in India, such as those in Delhi, Mumbai, and Bengaluru, trialed full-body scanners to streamline passenger movement. Initially slated for installation at airports with over 10 million annual passengers, the rollout faced delays due to equipment import holdups. Despite this setback, Delhi and Bengaluru airports are leading the charge, with Delhi targeting a complete installation by the FY 2024 second half, while Bengaluru is in the trial phase. These scanners are anticipated to slash passenger screening times by half, potentially reducing the 30-second manual frisking process to 15 seconds.

- January 2024: Liberty Defense secured a contract to deploy its HEXWAVE security portal at an international airport in the Philippines, marking its debut in the Asia-Pacific airport market. According to the agreement, the screening will be conducted at the terminal's forecourt, screening people as they enter.

In-Depth Asia-Pacific People Screening Market Market Outlook

The Asia-Pacific People Screening Market is poised for sustained and robust growth, driven by an unwavering commitment to enhancing public safety and security across diverse sectors. The ongoing digital transformation and the integration of smart technologies are creating new avenues for advanced screening solutions, particularly those leveraging AI and machine learning for predictive threat assessment. Growth accelerators will continue to be fueled by significant government investments in security infrastructure, especially within the transportation and government buildings segments. Emerging opportunities in the healthcare and retail sectors, coupled with the development of non-intrusive and user-friendly screening technologies, will further diversify market applications. Strategic collaborations and continuous innovation in product development will be crucial for players to maintain a competitive edge. The market's future outlook is characterized by a strong emphasis on intelligent, integrated, and efficient security solutions that cater to the evolving needs of a dynamic and rapidly developing region.

Asia-Pacific People Screening Market Segmentation

-

1. Technology

- 1.1. X-ray Systems

- 1.2. Metal Detectors

- 1.3. Body Scanners

- 1.4. Biometric Systems

- 1.5. Millimeter Wave Whole Body Scanner

- 1.6. Other Technologies

-

2. End-user Industry

- 2.1. Corporate Buildings

- 2.2. Warehouse and Logistics

- 2.3. Commercial Spaces

- 2.4. Transpor

- 2.5. Government Buildings

- 2.6. Law Enforcements

- 2.7. Other End-User Industries

Asia-Pacific People Screening Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific People Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Terror Activities in the Region; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1. Upsurge in Terror Activities in the Region; Increasing Government Initiatives for Smart Cities

- 3.4. Market Trends

- 3.4.1. Warehouse and Logistics End-user Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific People Screening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. X-ray Systems

- 5.1.2. Metal Detectors

- 5.1.3. Body Scanners

- 5.1.4. Biometric Systems

- 5.1.5. Millimeter Wave Whole Body Scanner

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Corporate Buildings

- 5.2.2. Warehouse and Logistics

- 5.2.3. Commercial Spaces

- 5.2.4. Transpor

- 5.2.5. Government Buildings

- 5.2.6. Law Enforcements

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rapiscan Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LINEV Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Smiths Detection Group Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CEIA SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teledyne ICM SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thruvision Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evovl Technologies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rohde & Schwarz

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vehant Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nuctech Company Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rapiscan Systems Inc

List of Figures

- Figure 1: Asia-Pacific People Screening Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific People Screening Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific People Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific People Screening Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific People Screening Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Asia-Pacific People Screening Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 5: Asia-Pacific People Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Asia-Pacific People Screening Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Asia-Pacific People Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific People Screening Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific People Screening Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 10: Asia-Pacific People Screening Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 11: Asia-Pacific People Screening Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Asia-Pacific People Screening Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Asia-Pacific People Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Asia-Pacific People Screening Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: China Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: New Zealand Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: New Zealand Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Malaysia Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Singapore Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Thailand Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Thailand Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Vietnam Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Vietnam Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Philippines Asia-Pacific People Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Philippines Asia-Pacific People Screening Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific People Screening Market?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Asia-Pacific People Screening Market?

Key companies in the market include Rapiscan Systems Inc, LINEV Systems, Smiths Detection Group Ltd, CEIA SpA, Teledyne ICM SA, Thruvision Ltd, Evovl Technologies, Rohde & Schwarz, Vehant Technologies, Nuctech Company Limited*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific People Screening Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Terror Activities in the Region; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

Warehouse and Logistics End-user Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Upsurge in Terror Activities in the Region; Increasing Government Initiatives for Smart Cities.

8. Can you provide examples of recent developments in the market?

April 2024: Major airports in India, such as those in Delhi, Mumbai, and Bengaluru, trialed full-body scanners to streamline passenger movement. Initially slated for installation at airports with over 10 million annual passengers, the rollout faced delays due to equipment import holdups. Despite this setback, Delhi and Bengaluru airports are leading the charge, with Delhi targeting a complete installation by the FY 2024 second half, while Bengaluru is in the trial phase. These scanners are anticipated to slash passenger screening times by half, potentially reducing the 30-second manual frisking process to 15 seconds.January 2024: Liberty Defense secured a contract to deploy its HEXWAVE security portal at an international airport in the Philippines, marking its debut in the Asia-Pacific airport market. According to the agreement, the screening will be conducted at the terminal's forecourt, screening people as they enter.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific People Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific People Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific People Screening Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific People Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence