Key Insights

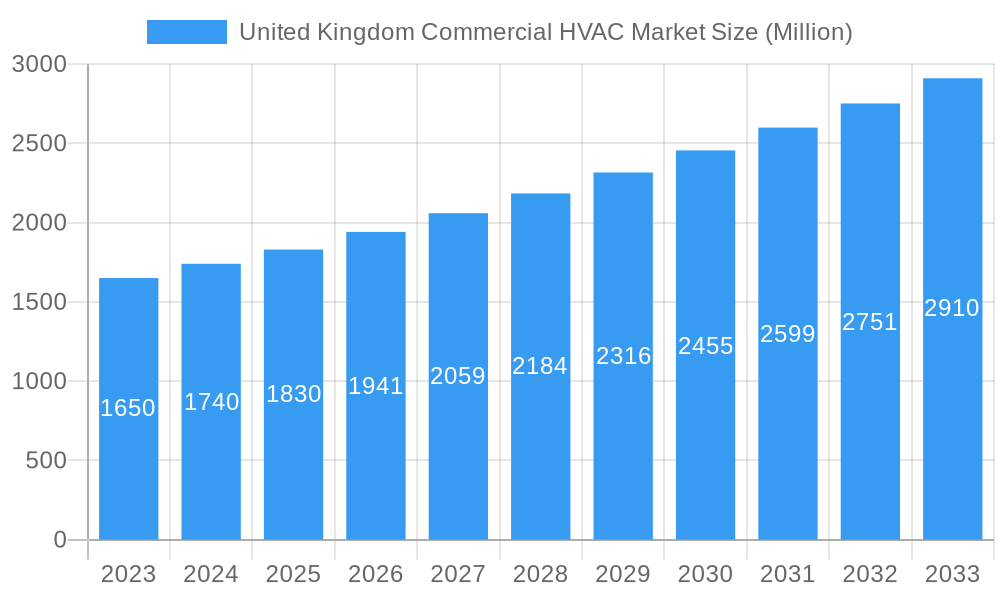

The United Kingdom's Commercial HVAC (Heating, Ventilation, and Air Conditioning) market is poised for significant expansion, driven by a growing emphasis on energy efficiency, sustainability, and occupant comfort across various commercial sectors. With an estimated market size of £1,830 million in 2025, the sector is projected to witness a healthy Compound Annual Growth Rate (CAGR) of 6.14% through 2033. This growth trajectory is primarily fueled by stringent government regulations promoting reduced carbon emissions and the increasing adoption of smart technologies that optimize energy consumption in buildings. The hospitality sector, in particular, is a key contributor, with hotels and restaurants investing heavily in advanced HVAC systems to enhance guest experiences and operational efficiency. Similarly, commercial and public buildings are undergoing retrofitting and new construction projects that prioritize modern, eco-friendly HVAC solutions, including sophisticated heating, air conditioning, and ventilation equipment.

United Kingdom Commercial HVAC Market Market Size (In Billion)

The market's evolution is further shaped by emerging trends such as the integration of IoT (Internet of Things) for remote monitoring and predictive maintenance, alongside a rising demand for highly efficient and environmentally friendly refrigerants. While the market exhibits strong growth potential, certain restraints such as the high initial investment cost for cutting-edge HVAC systems and the need for skilled labor for installation and maintenance could pose challenges. However, the long-term benefits in terms of reduced operational costs and environmental impact are expected to outweigh these concerns, encouraging sustained investment. Key players like Johnson Controls, Daikin, and Carrier Corporation are actively innovating to offer solutions that meet these evolving demands, driving competition and pushing the boundaries of technological advancement in the UK Commercial HVAC landscape.

United Kingdom Commercial HVAC Market Company Market Share

United Kingdom Commercial HVAC Market Analysis Report: Comprehensive Industry Outlook 2019-2033

Uncover the intricate dynamics and future trajectory of the United Kingdom's commercial HVAC market. This in-depth report provides strategic insights into market growth, key players, emerging trends, and regulatory impacts, equipping industry professionals with the knowledge to navigate this evolving sector. Analyze parent and child market segments, including HVAC Equipment (Heating Equipment, Air Conditioning/Ventilation Equipment) and HVAC Services, alongside critical End User Industries such as Hospitality, Commercial Buildings, and Public Buildings. All values are presented in Million units.

United Kingdom Commercial HVAC Market Market Dynamics & Structure

The United Kingdom commercial HVAC market exhibits a moderately concentrated structure, with a few dominant global players like Johnson Controls International PLC, Midea Group Co Ltd, Daikin Industries Ltd, Robert Bosch GmbH, and Carrier Corporation, alongside key regional contributors. Technological innovation remains a primary driver, fueled by the urgent need for energy efficiency and reduced carbon emissions in line with stringent UK environmental regulations. The adoption of smart HVAC systems, IoT integration for predictive maintenance, and the increasing demand for variable refrigerant flow (VRF) systems are reshaping product development. Regulatory frameworks, particularly those focusing on Building Performance, Minimum Energy Efficiency Standards (MEES), and the phased introduction of the Green Homes Grant and subsequent initiatives, are pivotal in shaping demand for advanced and compliant HVAC solutions. Competitive product substitutes are emerging, with advancements in heat pump technology and the integration of renewable energy sources posing challenges to traditional boiler systems. End-user demographics are evolving, with a growing emphasis on occupant comfort, indoor air quality (IAQ), and operational cost savings across all commercial sectors. Mergers and Acquisitions (M&A) trends are observed, aimed at consolidating market share, expanding product portfolios, and acquiring specialized technological capabilities. For instance, M&A activity in the past three years (2021-2023) saw approximately 3-5 significant deals focused on sustainable HVAC technologies and service providers, reflecting a strategic push towards greener solutions. Innovation barriers include the high upfront cost of advanced systems and the need for skilled labor for installation and maintenance.

United Kingdom Commercial HVAC Market Growth Trends & Insights

The United Kingdom commercial HVAC market is poised for significant expansion, driven by a confluence of technological advancements, evolving regulatory landscapes, and a growing consciousness towards sustainability. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% to 6.0% from the base year of 2025 through to 2033. This growth is underpinned by an increasing adoption rate of energy-efficient HVAC equipment, particularly heat pumps and advanced ventilation systems, as businesses strive to meet Net Zero targets. Technological disruptions are a key feature, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) in HVAC controls enabling predictive maintenance, optimizing energy consumption, and enhancing system performance. Internet of Things (IoT) devices are becoming ubiquitous, facilitating remote monitoring and control, and contributing to the rise of smart buildings. Consumer behavior shifts are evident, with a heightened awareness of the importance of indoor air quality (IAQ) post-pandemic, leading to increased demand for sophisticated air purification and ventilation solutions. Furthermore, the push for decarbonization is a major catalyst, encouraging the replacement of fossil fuel-based heating systems with electric alternatives. Market penetration of high-efficiency air conditioning and ventilation equipment is expected to rise, moving from an estimated 45% in the base year 2025 to over 65% by 2033. Investment in retrofitting existing commercial buildings to improve energy efficiency is also a substantial growth driver, contributing to the demand for a wide range of HVAC components and services. The perceived long-term cost savings associated with energy-efficient systems are increasingly outweighing initial investment concerns for end-users, thereby accelerating market penetration. The government’s commitment to a green economy, evidenced by various grants and incentives, further propels the adoption of sustainable HVAC technologies, solidifying the market's growth trajectory.

Dominant Regions, Countries, or Segments in United Kingdom Commercial HVAC Market

Within the United Kingdom commercial HVAC market, the Commercial Buildings end-user industry stands out as the dominant segment driving market growth. This dominance is fueled by a multifaceted interplay of economic policies, infrastructure development, and evolving tenant demands. The proliferation of new commercial construction projects, coupled with the imperative to retrofit older structures to meet stringent energy efficiency standards, creates a continuous and substantial demand for HVAC solutions. The market share of the Commercial Buildings segment is estimated to be around 50-55% of the overall market value in the forecast period.

Key drivers for this dominance include:

- Economic Policies and Incentives: Government initiatives, such as tax incentives for energy-efficient upgrades and stricter building regulations, directly encourage investment in advanced HVAC systems for commercial properties. The drive towards Net Zero emissions further mandates the adoption of low-carbon heating and cooling solutions.

- Infrastructure Development: Ongoing urban regeneration projects and the development of new business districts across major cities like London, Manchester, and Birmingham necessitate the installation of state-of-the-art HVAC systems in offices, retail spaces, and mixed-use developments.

- Tenant Demand and Occupant Well-being: Businesses are increasingly prioritizing employee comfort and productivity, recognizing the direct link between a well-maintained indoor environment and workforce performance. This translates into a demand for sophisticated HVAC systems that ensure optimal temperature, humidity, and superior indoor air quality (IAQ). The integration of smart building technologies, including advanced HVAC controls, is also a key factor in attracting and retaining tenants.

- Energy Efficiency Mandates: The UK's commitment to reducing carbon footprints has led to stringent energy performance regulations for commercial buildings. This necessitates the upgrade or replacement of older, less efficient HVAC units with modern, energy-saving alternatives.

- Growth Potential: The sheer volume and diversity of commercial spaces, from large corporate offices to smaller retail outlets, offer immense growth potential. The ongoing trend of hybrid working models also influences building design and HVAC requirements, often necessitating more personalized climate control within office spaces.

Among the Type of Component, HVAC Equipment, specifically Air Conditioning / Ventilation Equipment, represents a significant growth area within the Commercial Buildings segment. The increasing focus on IAQ and the need for effective cooling solutions in a warming climate contribute to its strong performance.

United Kingdom Commercial HVAC Market Product Landscape

The United Kingdom commercial HVAC market is characterized by a dynamic product landscape driven by a relentless pursuit of efficiency, sustainability, and intelligent control. Recent product innovations include the introduction of next-generation air-to-air heat pumps with redesigned indoor and outdoor units for enhanced user experience, ease of installation, and improved energy performance. There is a notable trend towards integrating IoT capabilities for remote monitoring, diagnostics, and predictive maintenance, allowing for proactive issue resolution and optimized operational efficiency. The application of variable refrigerant flow (VRF) systems continues to gain traction, offering granular control over temperature in different zones of a building, thereby reducing energy wastage. Furthermore, the development of low-GWP (Global Warming Potential) refrigerants is a key area of focus, aligning with environmental regulations and promoting a more sustainable product offering. Performance metrics are increasingly centered around energy efficiency ratings (e.g., SEER, EER), noise reduction, and advanced filtration systems to improve indoor air quality.

Key Drivers, Barriers & Challenges in United Kingdom Commercial HVAC Market

Key Drivers:

- Government Regulations and Net Zero Targets: Stringent energy efficiency standards and the UK's commitment to achieving Net Zero emissions are powerful drivers for adopting low-carbon HVAC technologies.

- Technological Advancements: The integration of AI, IoT, and advanced heat pump technology is enhancing system efficiency, intelligence, and occupant comfort.

- Growing Awareness of Indoor Air Quality (IAQ): Post-pandemic, there is increased demand for HVAC solutions that ensure healthy and safe indoor environments.

- Rising Energy Costs: The persistent increase in energy prices incentivizes the adoption of energy-efficient HVAC systems for long-term operational cost savings.

Barriers & Challenges:

- High Upfront Investment Costs: Advanced and sustainable HVAC systems often come with a higher initial purchase price, posing a barrier for some businesses.

- Availability of Skilled Labor: A shortage of trained professionals for the installation, maintenance, and servicing of complex HVAC systems can hinder adoption and effective operation.

- Supply Chain Disruptions: Global supply chain issues can lead to extended lead times and increased costs for key components.

- Complexity of Retrofitting: Integrating new HVAC systems into older buildings can be complex and costly, requiring significant structural and electrical modifications.

- Evolving Regulatory Landscape: While a driver, the continuous evolution of regulations can create uncertainty and require ongoing adaptation from manufacturers and end-users.

Emerging Opportunities in United Kingdom Commercial HVAC Market

Emerging opportunities within the UK commercial HVAC market are largely centered around the growing demand for sustainable and intelligent building solutions. The substantial market for retrofitting existing commercial buildings with energy-efficient HVAC systems presents a significant untapped area. The increasing adoption of smart building technologies, including integrated HVAC controls and IoT-enabled diagnostics, offers avenues for service providers and technology developers. Furthermore, the focus on enhancing indoor air quality (IAQ) is creating opportunities for specialized filtration, purification, and ventilation systems, particularly in healthcare, education, and office environments. The development and adoption of hydrogen-ready boilers and advanced heat pump technologies for district heating networks also represent significant future growth potential.

Growth Accelerators in the United Kingdom Commercial HVAC Market Industry

The long-term growth of the United Kingdom commercial HVAC market is being significantly accelerated by several key catalysts. The continuous push for decarbonization, driven by ambitious government targets and increasing corporate social responsibility, is a primary growth accelerator, fostering innovation in heat pump technology and renewable energy integration. Strategic partnerships between HVAC manufacturers, energy service companies (ESCOs), and technology providers are crucial for developing comprehensive and integrated solutions. The expansion of smart building ecosystems, where HVAC systems are integral to the overall building management, is also a significant growth catalyst, driving demand for interconnected and intelligent climate control. Furthermore, increased investment in the healthcare and data center sectors, both of which have stringent HVAC requirements, will continue to fuel market expansion.

Key Players Shaping the United Kingdom Commercial HVAC Market Market

- Johnson Controls International PLC

- Midea Group Co Ltd

- Daikin Industries Ltd

- Robert Bosch GmbH

- Carrier Corporation

- LG Electronics Inc

- Lennox International Inc

- BDR Thermea Group

- Panasonic Corporation

- Danfoss A/

Notable Milestones in United Kingdom Commercial HVAC Market Sector

- March 2024: Daikin Industries Ltd announced the launch of the next generation ‘All Seasons’ Perfera home air-to-air heat pump, also referred to as air conditioning. The indoor and outdoor units of the Perfera system have been fully redesigned to enhance the user experience, making them both easy to install and easy to use.

- October 2023: Panasonic developed a new central heat pump system, the Interior 1.5 Ton Central Heat Pump, for residential space heating and cooling. The new product comes in two versions: the Interior Low-Carbon Hybrid Heating System with an outdoor heat pump unit and an indoor-cased A-coil, and the Interios All-electric Central Heat Pump System, which is an all-electric system featuring an outdoor heat pump unit and an all-electric air handler.

In-Depth United Kingdom Commercial HVAC Market Market Outlook

The United Kingdom commercial HVAC market is characterized by a robust outlook driven by sustained demand for energy-efficient and environmentally responsible climate control solutions. Growth accelerators, including government mandates for decarbonization and increasing consumer demand for healthy indoor environments, will continue to shape market dynamics. The ongoing technological evolution, particularly in heat pump technology and smart building integration, will unlock new avenues for innovation and market penetration. Strategic investments in research and development, coupled with an emphasis on sustainable product lifecycles, will be crucial for manufacturers. The market's future potential lies in its ability to adapt to evolving building standards, embrace digital transformation, and cater to the diverse needs of commercial end-users seeking cost-effective, efficient, and sustainable HVAC solutions.

United Kingdom Commercial HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning /Ventillation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End User Industry

- 2.1. Hospitality

- 2.2. Commercial Buildings

- 2.3. Public Buildings

- 2.4. Others

United Kingdom Commercial HVAC Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Commercial HVAC Market Regional Market Share

Geographic Coverage of United Kingdom Commercial HVAC Market

United Kingdom Commercial HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices

- 3.3. Market Restrains

- 3.3.1. Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices

- 3.4. Market Trends

- 3.4.1. Heating Equipment is Expected to Grow with Significant CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Commercial HVAC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning /Ventillation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Hospitality

- 5.2.2. Commercial Buildings

- 5.2.3. Public Buildings

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midea Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Robert Bosch GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carrier Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Electronics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lennox International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDR Thermea Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss A/

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: United Kingdom Commercial HVAC Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Commercial HVAC Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 2: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 3: United Kingdom Commercial HVAC Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 4: United Kingdom Commercial HVAC Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 5: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 8: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 9: United Kingdom Commercial HVAC Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 10: United Kingdom Commercial HVAC Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 11: United Kingdom Commercial HVAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Commercial HVAC Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Commercial HVAC Market?

The projected CAGR is approximately 6.14%.

2. Which companies are prominent players in the United Kingdom Commercial HVAC Market?

Key companies in the market include Johnson Controls International PLC, Midea Group Co Ltd, Daikin Industries Ltd, Robert Bosch GmbH, Carrier Corporation, LG Electronics Inc, Lennox International Inc, BDR Thermea Group, Panasonic Corporation, Danfoss A/.

3. What are the main segments of the United Kingdom Commercial HVAC Market?

The market segments include Type of Component, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices.

6. What are the notable trends driving market growth?

Heating Equipment is Expected to Grow with Significant CAGR.

7. Are there any restraints impacting market growth?

Growing Commercial Construction in Major Emerging Economies; Increasing Demand For Energy Efficient Devices.

8. Can you provide examples of recent developments in the market?

March 2024 - Daikin Industries Ltd announced the launch of the next generation ‘All Seasons’ Perfera home air-to-air heat pump, also referred to as air conditioning. The indoor and outdoor units of the Perfera system have been fully redesigned to enhance the user experience, making them both easy to install and easy to use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Commercial HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Commercial HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Commercial HVAC Market?

To stay informed about further developments, trends, and reports in the United Kingdom Commercial HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence