Key Insights

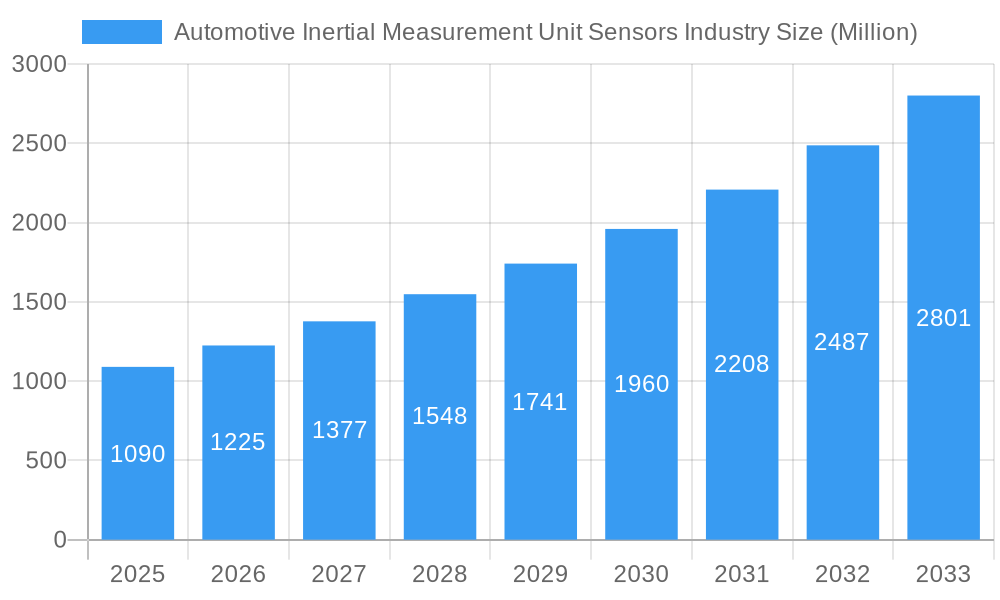

The Automotive Inertial Measurement Unit (IMU) Sensors market is poised for substantial growth, projected to reach a valuation of USD 1.09 billion with a robust Compound Annual Growth Rate (CAGR) of 11.31% from 2025 to 2033. This significant expansion is primarily fueled by the escalating demand for advanced driver-assistance systems (ADAS), autonomous driving technologies, and sophisticated vehicle dynamics control systems. As vehicles become more intelligent and capable of sensing their environment, the need for accurate and reliable IMU sensors to interpret motion, orientation, and acceleration data becomes paramount. The automotive sector is rapidly integrating these sensors for applications ranging from electronic stability control and anti-lock braking systems to sophisticated navigation and parking assistance features. Furthermore, the increasing complexity of modern vehicle architectures and the drive towards enhanced safety standards are compelling automakers to equip vehicles with more comprehensive IMU solutions, thereby acting as strong market drivers.

Automotive Inertial Measurement Unit Sensors Industry Market Size (In Billion)

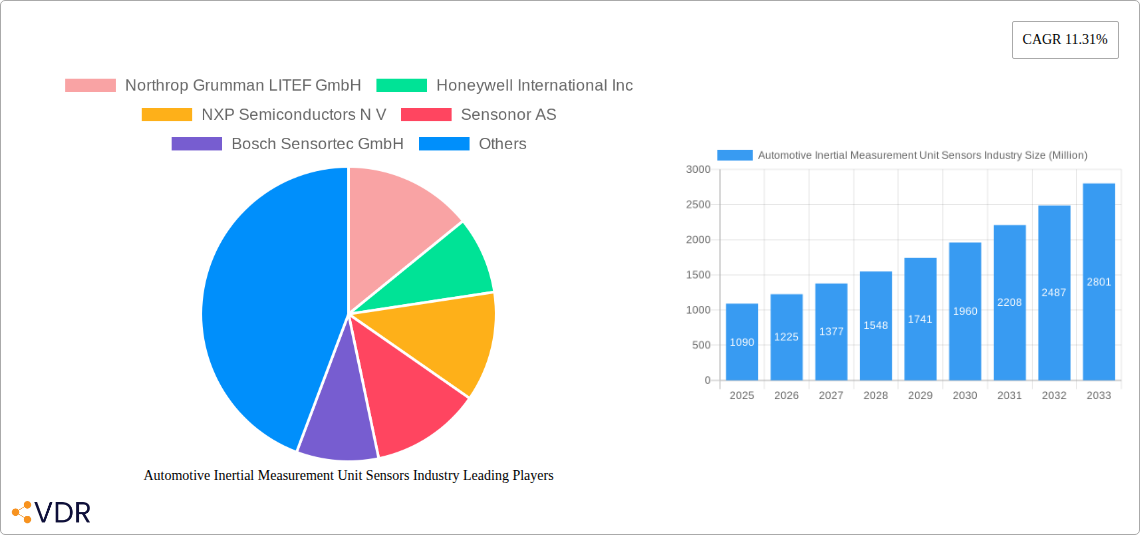

The market's upward trajectory will also be propelled by emerging trends such as the miniaturization of IMU sensors, improved accuracy and performance through advanced MEMS technology, and the integration of artificial intelligence and machine learning algorithms to enhance sensor data interpretation. Innovations in sensor fusion, combining IMU data with inputs from other sensors like GPS and cameras, will unlock new levels of automotive functionality and safety. While the market is characterized by intense competition among established players like Bosch Sensortec, NXP Semiconductors, and Honeywell International Inc., and emerging innovators, the primary restraint might stem from the high cost of advanced IMU integration, especially in entry-level vehicle segments, and the ongoing need for standardization and regulatory frameworks to ensure interoperability and safety across diverse automotive platforms. However, as production volumes increase and technological advancements drive down costs, the adoption of IMUs across a broader spectrum of vehicles is expected to accelerate, solidifying its indispensable role in the future of mobility.

Automotive Inertial Measurement Unit Sensors Industry Company Market Share

Unlock deep insights into the rapidly evolving Automotive Inertial Measurement Unit (IMU) Sensors market. This indispensable report provides a data-driven analysis of market dynamics, growth trends, regional dominance, and the competitive landscape. Covering the historical period of 2019–2024 and forecasting to 2033, with a base and estimated year of 2025, this report is crucial for stakeholders seeking to navigate the complexities of automotive sensors, MEMS technology, and advanced navigation systems. Explore parent and child market segments, understand key drivers, identify emerging opportunities, and gain a competitive edge.

Automotive Inertial Measurement Unit Sensors Industry Market Dynamics & Structure

The Automotive IMU Sensors market is characterized by a moderate to high concentration, with key players continuously investing in research and development to gain a competitive advantage. Technological innovation is the primary driver, fueled by the increasing demand for advanced driver-assistance systems (ADAS), autonomous driving, and enhanced vehicle safety features. Regulatory frameworks, particularly those pertaining to vehicle safety and emissions, are also shaping market trends, often mandating the integration of IMUs for various functionalities. Competitive product substitutes exist, primarily in the form of standalone GPS modules or simpler motion sensors, but their capabilities often fall short of the precision and robustness offered by IMUs. End-user demographics are shifting towards a greater demand for connected and intelligent vehicles, influencing the adoption of sophisticated sensor technologies. Merger and acquisition (M&A) activities, while not consistently high, are strategically driven by companies seeking to expand their product portfolios, acquire new technologies, or secure market share.

- Market Concentration: Dominated by a few key global players with significant R&D capabilities.

- Technological Innovation Drivers: ADAS, autonomous driving, vehicle stability control, enhanced navigation, and safety systems.

- Regulatory Frameworks: Safety standards, emissions control, and mandated ADAS features.

- Competitive Product Substitutes: Standalone GPS, accelerometers, gyroscopes (often integrated within IMUs).

- End-User Demographics: Growing preference for smart, connected, and autonomous vehicles.

- M&A Trends: Strategic acquisitions for technology integration and market expansion.

Automotive Inertial Measurement Unit Sensors Industry Growth Trends & Insights

The Automotive IMU Sensors market is poised for substantial growth, driven by the accelerating adoption of advanced automotive technologies. Market size evolution is directly correlated with the increasing integration of IMUs across various vehicle platforms, from premium segments to mass-market models. Adoption rates are projected to surge as automakers prioritize enhanced safety features, sophisticated infotainment systems, and the foundational elements of autonomous driving. Technological disruptions, such as the miniaturization and cost reduction of MEMS-based IMUs, are democratizing access to these critical components. Consumer behavior shifts towards a demand for more personalized, safer, and convenient driving experiences are further fueling market expansion. The market penetration of IMUs is expected to grow significantly, becoming a standard component in most new vehicle generations. The CAGR is projected to be strong over the forecast period, reflecting the transformative impact of IMUs on automotive functionality and safety.

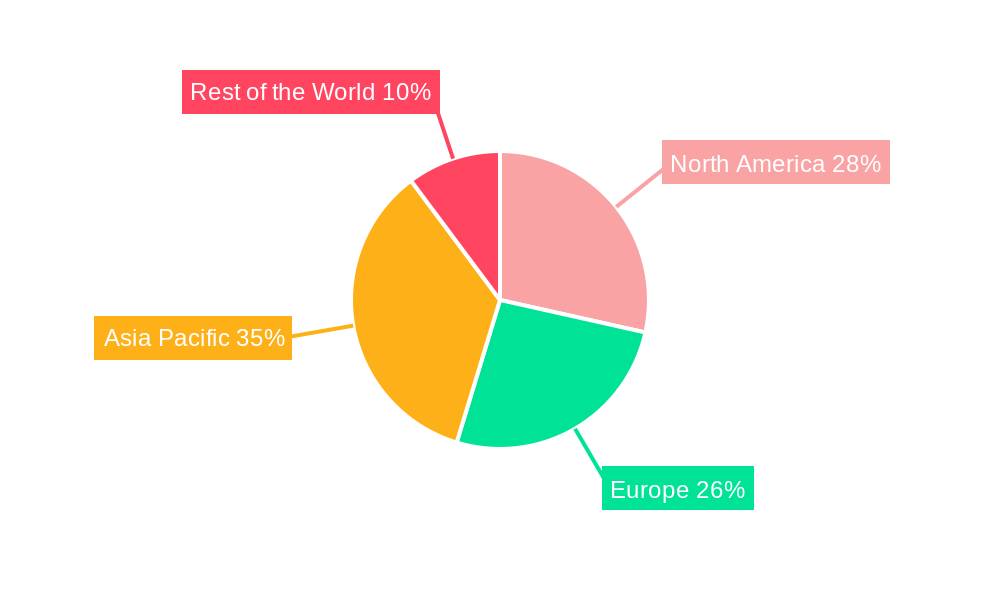

Dominant Regions, Countries, or Segments in Automotive Inertial Measurement Unit Sensors Industry

The Automotive end-user industry is the dominant segment driving growth in the Automotive IMU Sensors market. This dominance is propelled by several factors, including substantial investments in vehicle electrification, autonomous driving research, and the implementation of advanced safety features globally. Asia-Pacific, particularly China, leads in terms of both production and consumption, owing to its massive automotive manufacturing base and rapid adoption of new technologies. The presence of major automotive manufacturers and a burgeoning supplier ecosystem within this region further bolsters its leadership. North America and Europe follow closely, driven by stringent safety regulations and a strong focus on innovation in ADAS and self-driving technologies.

- Dominant End-User Industry: Automotive.

- Key Regional Dominance: Asia-Pacific (especially China), followed by North America and Europe.

- Drivers of Dominance (Asia-Pacific):

- Largest automotive manufacturing hub.

- High adoption rate of ADAS and connected car technologies.

- Government initiatives supporting the automotive sector and technological advancements.

- Presence of key sensor manufacturers and automotive OEMs.

- Drivers of Dominance (North America & Europe):

- Strict safety regulations and mandated ADAS features.

- Significant investment in autonomous driving research and development.

- Consumer demand for premium safety and convenience features.

- Technological advancements and a mature automotive ecosystem.

Automotive Inertial Measurement Unit Sensors Industry Product Landscape

The product landscape of Automotive IMU Sensors is characterized by continuous innovation, with a focus on higher accuracy, smaller footprints, improved temperature stability, and reduced power consumption. Key product innovations include 6-axis and 9-axis IMUs, integrating accelerometers, gyroscopes, and magnetometers for comprehensive motion tracking. Applications span across critical automotive functions such as electronic stability control (ESC), anti-lock braking systems (ABS), airbag deployment systems, advanced navigation, and the sophisticated sensor fusion required for ADAS and autonomous driving. Performance metrics are continually being enhanced, with manufacturers striving for higher resolution, lower noise, and greater resistance to shock and vibration to meet the demanding automotive environment.

Key Drivers, Barriers & Challenges in Automotive Inertial Measurement Unit Sensors Industry

Key Drivers: The Automotive IMU Sensors market is propelled by the relentless pursuit of enhanced vehicle safety, the rapid development and deployment of Advanced Driver-Assistance Systems (ADAS), and the burgeoning field of autonomous driving. The increasing integration of navigation systems, vehicle stability control, and the demand for improved passenger comfort and user experience are significant catalysts. Furthermore, government regulations mandating safety features are directly contributing to market growth.

Barriers & Challenges: Key challenges include the stringent qualification and validation processes required for automotive components, which can extend development timelines. High development costs associated with advanced sensor technology and the need for robust supply chains capable of meeting automotive quality standards are also significant hurdles. Additionally, competitive pricing pressures and the potential for technological obsolescence due to rapid innovation present ongoing challenges. Supply chain disruptions, as seen in recent global events, can impact availability and cost.

Emerging Opportunities in Automotive Inertial Measurement Unit Sensors Industry

Emerging opportunities lie in the expansion of IMU applications beyond traditional safety and navigation. The increasing adoption of in-cabin monitoring systems for driver fatigue detection and occupant sensing presents a significant growth avenue. Furthermore, the development of highly integrated IMUs for electric vehicle (EV) battery management and performance optimization offers new frontiers. The integration of IMUs in vehicle-to-everything (V2X) communication systems to enhance situational awareness and predictive capabilities is another promising area. Tapping into the aftermarket for advanced driver assistance upgrades and specialized automotive diagnostics also represents untapped market potential.

Growth Accelerators in the Automotive Inertial Measurement Unit Sensors Industry Industry

The long-term growth of the Automotive IMU Sensors industry is significantly accelerated by breakthroughs in MEMS technology, leading to more cost-effective, smaller, and higher-performing sensors. Strategic partnerships between semiconductor manufacturers, automotive OEMs, and Tier-1 suppliers are crucial for co-development and faster market penetration of innovative solutions. The global push towards smart cities and connected infrastructure will necessitate more sophisticated vehicle-to-infrastructure communication, where accurate IMU data plays a vital role. Continuous advancements in sensor fusion algorithms and artificial intelligence further amplify the capabilities and value proposition of IMUs, driving their adoption across a wider spectrum of automotive applications.

Key Players Shaping the Automotive Inertial Measurement Unit Sensors Market

- Northrop Grumman

- LITEF GmbH

- Honeywell International Inc

- NXP Semiconductors N V

- Sensonor AS

- Bosch Sensortec GmbH

- STMicroelectronics N V

- MEMSIC Inc

- Xsens Technologies B V

- Silicon Sensing Systems Limited

- TDK Corporation

- Murata Manufacturing Co Ltd

- Analog Devices Inc

Notable Milestones in Automotive Inertial Measurement Unit Sensors Industry Sector

- February 2022: SBG Systems announced the Pulse-40 MEMS-based Inertial Navigation Systems, offering unmatched performance in harsh conditions in a miniaturized size for applications where precision and robustness matter in all states.

- December 2021: TDK Corporation introduced the InvenSense IAM-20680HT high-temperature automotive monolithic 6-Axis Motion Tracking sensor platform solution for non-safety automotive applications, which includes the IAM-20680HT IMU MEMS sensor and the DK-20680HT developer kit.

In-Depth Automotive Inertial Measurement Unit Sensors Industry Market Outlook

The future market outlook for Automotive IMU Sensors is exceptionally bright, driven by the unabated demand for sophisticated automotive technologies. Growth accelerators such as ongoing advancements in MEMS technology, fostering smaller, more powerful, and cost-effective sensors, will continue to propel market expansion. Strategic collaborations between key industry players will streamline innovation and accelerate the integration of IMUs into next-generation vehicles. The evolving landscape of connected and autonomous mobility, coupled with increasing regulatory support for safety features, creates a fertile ground for sustained market growth. Investors and industry participants can anticipate significant opportunities in developing advanced sensor fusion solutions, specialized IMUs for emerging EV architectures, and integrated systems for V2X communications.

Automotive Inertial Measurement Unit Sensors Industry Segmentation

-

1. End-user Industry

- 1.1. Consumer

- 1.2. Automotive

- 1.3. Medical

- 1.4. Aerospace & Defense

- 1.5. Industrial

- 1.6. Others End-user Industries

Automotive Inertial Measurement Unit Sensors Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Automotive Inertial Measurement Unit Sensors Industry Regional Market Share

Geographic Coverage of Automotive Inertial Measurement Unit Sensors Industry

Automotive Inertial Measurement Unit Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Number of Emerging Applications (IoT Devices

- 3.2.2 Robotic Cars

- 3.2.3 etc.); Increasing Adoption of Low-cost MEMS-based IMUs

- 3.3. Market Restrains

- 3.3.1. Keeping Pace with the Changing Consumer Demand

- 3.4. Market Trends

- 3.4.1. Automotive Sector is to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Inertial Measurement Unit Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Consumer

- 5.1.2. Automotive

- 5.1.3. Medical

- 5.1.4. Aerospace & Defense

- 5.1.5. Industrial

- 5.1.6. Others End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Automotive Inertial Measurement Unit Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Consumer

- 6.1.2. Automotive

- 6.1.3. Medical

- 6.1.4. Aerospace & Defense

- 6.1.5. Industrial

- 6.1.6. Others End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Automotive Inertial Measurement Unit Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Consumer

- 7.1.2. Automotive

- 7.1.3. Medical

- 7.1.4. Aerospace & Defense

- 7.1.5. Industrial

- 7.1.6. Others End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Automotive Inertial Measurement Unit Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Consumer

- 8.1.2. Automotive

- 8.1.3. Medical

- 8.1.4. Aerospace & Defense

- 8.1.5. Industrial

- 8.1.6. Others End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Rest of the World Automotive Inertial Measurement Unit Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Consumer

- 9.1.2. Automotive

- 9.1.3. Medical

- 9.1.4. Aerospace & Defense

- 9.1.5. Industrial

- 9.1.6. Others End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Northrop Grumman LITEF GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sensonor AS

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bosch Sensortec GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STMicroelectronics N V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MEMSIC Inc *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Xsens Technologies B V

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Silicon Sensing Systems Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TDK Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Murata Manufacturing Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Analog Devices Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Northrop Grumman LITEF GmbH

List of Figures

- Figure 1: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Rest of the World Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Rest of the World Automotive Inertial Measurement Unit Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Automotive Inertial Measurement Unit Sensors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Automotive Inertial Measurement Unit Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Inertial Measurement Unit Sensors Industry?

The projected CAGR is approximately 11.31%.

2. Which companies are prominent players in the Automotive Inertial Measurement Unit Sensors Industry?

Key companies in the market include Northrop Grumman LITEF GmbH, Honeywell International Inc, NXP Semiconductors N V, Sensonor AS, Bosch Sensortec GmbH, STMicroelectronics N V, MEMSIC Inc *List Not Exhaustive, Xsens Technologies B V, Silicon Sensing Systems Limited, TDK Corporation, Murata Manufacturing Co Ltd, Analog Devices Inc.

3. What are the main segments of the Automotive Inertial Measurement Unit Sensors Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Emerging Applications (IoT Devices. Robotic Cars. etc.); Increasing Adoption of Low-cost MEMS-based IMUs.

6. What are the notable trends driving market growth?

Automotive Sector is to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Keeping Pace with the Changing Consumer Demand.

8. Can you provide examples of recent developments in the market?

February 2022 - SBG Systems announced the Pulse-40 MEMS-based Inertial Navigation Systems. It offers unmatched performance in harsh conditions in a miniaturized size for applications where precision and robustness matter in all states.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Inertial Measurement Unit Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Inertial Measurement Unit Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Inertial Measurement Unit Sensors Industry?

To stay informed about further developments, trends, and reports in the Automotive Inertial Measurement Unit Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence