Key Insights

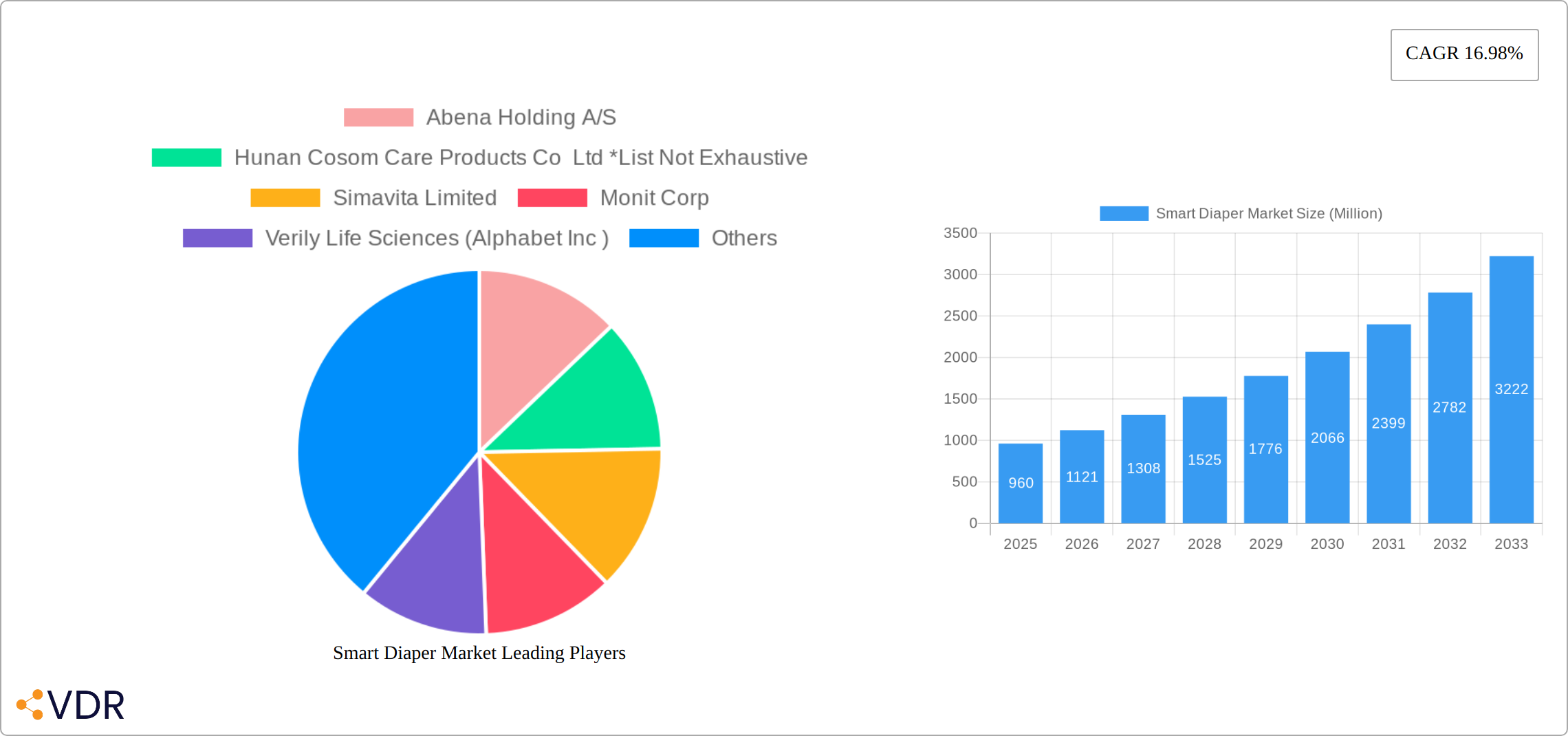

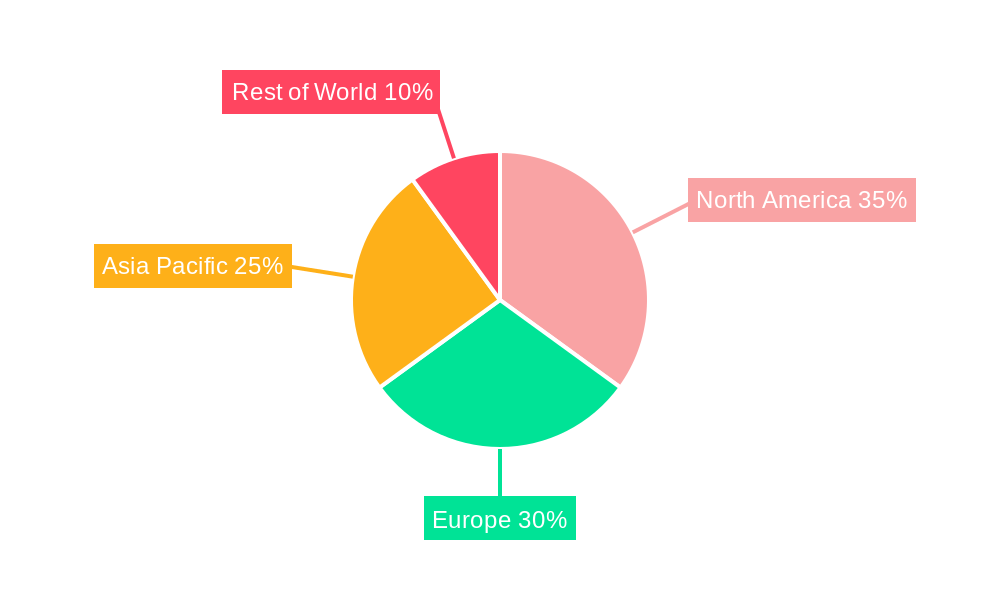

The smart diaper market, valued at $0.96 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 16.98% from 2025 to 2033. This expansion is fueled by several key factors. Increasing awareness among parents regarding infant health and hygiene, coupled with technological advancements in sensor technology and data analytics, are creating significant demand for smart diapers. The ability to monitor a baby's hydration levels, bowel movements, and potential health issues remotely provides parents with invaluable peace of mind and allows for proactive healthcare interventions. The market is segmented by end-user industry, encompassing both baby and adult diapers, with the baby segment currently holding a larger market share due to higher adoption rates and parental concerns. Furthermore, the integration of smart diaper technology with connected healthcare ecosystems, facilitating remote monitoring and data sharing with physicians, is accelerating market growth. Competitive landscape analysis reveals several key players, including Abena Holding A/S, Hunan Cosom Care Products Co Ltd, Simavita Limited, Monit Corp, Verily Life Sciences (Alphabet Inc), Smardii, Sinopulsar Technology Inc, and Pixie Scientific, constantly innovating to improve product features and expand market reach. Growth is expected across all major regions, with North America and Europe likely leading initially due to higher disposable incomes and technological adoption rates, followed by a strong surge in the Asia-Pacific region driven by rising birth rates and increasing awareness. Challenges to overcome include the relatively high cost of smart diapers compared to traditional options and potential concerns about data privacy and security.

The forecast period of 2025-2033 anticipates continued market expansion, driven by ongoing technological refinements, increasing affordability, and the introduction of new features such as improved sensor accuracy and enhanced data analysis capabilities. Furthermore, the potential for integration with smart home systems and personalized healthcare platforms will likely further accelerate market growth. The adult segment of the smart diaper market is expected to see substantial growth driven by an aging global population and the increasing need for remote monitoring of elderly individuals’ health. However, regulatory hurdles and consumer acceptance related to data privacy and the cost of the technology may present challenges for sustained expansion. Strategic partnerships between diaper manufacturers, technology companies, and healthcare providers will be crucial for overcoming these challenges and realizing the full potential of this rapidly evolving market.

Smart Diaper Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global smart diaper market, encompassing both the baby and adult segments, from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand the market dynamics, growth drivers, and future opportunities within this rapidly evolving sector. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects the market forecast until 2033. Market values are presented in million units.

Smart Diaper Market Dynamics & Structure

The smart diaper market is characterized by moderate concentration, with key players like Abena Holding A/S, Hunan Cosom Care Products Co Ltd, Simavita Limited, Monit Corp, Verily Life Sciences (Alphabet Inc), Smardii, Sinopulsar Technology Inc, and Pixie Scientific vying for market share. However, the market is witnessing significant technological innovation, driven by advancements in sensor technology, AI, and connectivity. Regulatory frameworks concerning data privacy and safety standards are also increasingly influencing market development. Competitive pressures arise from traditional diaper manufacturers expanding into the smart diaper segment, along with emerging players introducing innovative solutions. The market is further shaped by evolving end-user demographics, with increased disposable incomes and a growing elderly population fueling demand. Mergers and acquisitions (M&A) activity within the sector remains relatively moderate, with xx deals recorded in the past five years, representing a xx% market share consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Rapid advancements in sensor technology, AI, and IoT are key drivers.

- Regulatory Landscape: Increasingly stringent data privacy and safety regulations are shaping market strategies.

- Competitive Landscape: Intense competition from both established and emerging players.

- End-User Demographics: Aging population and rising disposable incomes are key demand drivers.

- M&A Activity: xx deals recorded in the past 5 years, resulting in xx% market share consolidation.

Smart Diaper Market Growth Trends & Insights

The global smart diaper market demonstrated substantial growth between 2019 and 2024, exhibiting a compound annual growth rate (CAGR) of xx%. This upward trajectory is projected to continue throughout the forecast period (2025-2033), although at a slightly moderated pace. Market analysts predict a market size of xx million units by 2033, achieving a CAGR of xx%. Several key factors underpin this expansion. Firstly, rising consumer awareness of the numerous benefits offered by smart diapers is driving adoption, particularly within developed economies. Secondly, continuous technological advancements are resulting in improved product features, functionalities, and overall user experience. This aligns with a broader consumer shift towards convenient and technologically advanced products, mirroring the increasing popularity of smart home technology. The entry of new players introducing innovative products and business models further disrupts the market and fuels its growth. While developed regions already boast relatively high market penetration (estimated at xx% in 2025), emerging markets represent a significant, largely untapped opportunity for future expansion and substantial growth potential.

Dominant Regions, Countries, or Segments in Smart Diaper Market

North America currently dominates the smart diaper market, holding the largest market share (xx%) in 2025, driven by factors including high disposable incomes, early adoption of smart technologies, and a robust healthcare infrastructure. Within North America, the United States is the leading market, with high demand for technologically advanced baby care products and a sizeable elderly population. Europe follows as a significant market, with increasing demand for smart diapers among both the baby and adult segments, although the adoption rate remains slightly lower than North America due to price sensitivity and varied regulatory frameworks. The Asia-Pacific region displays substantial growth potential, with rapidly expanding economies and a burgeoning young population contributing to a rapidly increasing market size.

- North America: High disposable income, early tech adoption, strong healthcare infrastructure.

- Europe: Growing adoption, price sensitivity, varied regulations.

- Asia-Pacific: Rapidly expanding economies, young population, high growth potential.

- Baby Segment: Strong growth due to higher consumer spending on infant care.

- Adult Segment: Growing steadily due to increasing elderly population and demand for incontinence solutions.

Smart Diaper Market Product Landscape

Modern smart diaper products integrate sophisticated features such as embedded sensors that monitor a range of crucial parameters including wetness levels, temperature, and even bowel movements. This data is typically transmitted wirelessly to a dedicated mobile application, providing caregivers with invaluable real-time insights into the baby's or adult's health and well-being. Beyond the core sensing capabilities, these diapers often incorporate enhanced comfort and absorbency features. The market offers a variety of options, encompassing both disposable and reusable diapers. Key differentiators among competing products include the level of sophistication of the sensor technology, the robustness of data analytics capabilities, the user-friendliness of the accompanying app, and the overall price point. Ongoing technological advancements are focused on miniaturizing sensors for enhanced comfort, improving data accuracy and reliability, and enabling seamless integration with existing smart home ecosystems.

Key Drivers, Barriers & Challenges in Smart Diaper Market

Key Drivers:

- Increasing consumer awareness and demand for advanced baby and adult care solutions.

- Technological advancements leading to enhanced product features and functionalities.

- Growing elderly population, leading to an increased need for adult incontinence products.

- Rising disposable incomes in developing countries.

Challenges & Restraints:

- High initial cost of smart diapers compared to traditional options, limiting market penetration.

- Concerns regarding data privacy and security related to the collection and transmission of sensitive health information.

- Potential for technical malfunctions and inaccurate sensor readings.

- Stringent regulatory frameworks governing the development and marketing of medical devices. These hurdles add significant costs and timelines to product development and market entry.

Emerging Opportunities in Smart Diaper Market

- Expansion into underserved markets in developing countries with increasing disposable incomes.

- Development of smart diapers with integrated health monitoring capabilities beyond basic wetness detection.

- Creation of subscription models for diaper delivery and data services to enhance customer convenience and recurring revenue streams.

- Integration of smart diapers with other smart home devices and platforms to create holistic health monitoring systems.

Growth Accelerators in the Smart Diaper Market Industry

Technological innovation serves as a primary driver of market growth. Advancements in sensor technology, artificial intelligence (AI), and improved connectivity continuously enhance product functionality and consumer appeal. Strategic partnerships are also playing a crucial role, with collaborations between diaper manufacturers, technology companies, and healthcare providers facilitating the seamless integration of smart diaper solutions into existing healthcare systems and workflows. Expanding into untapped markets in developing economies and exploring innovative applications, such as early disease detection through analysis of diaper contents, represent key expansion strategies that are poised to fuel long-term market growth and solidify the position of smart diapers as a valuable healthcare tool.

Key Players Shaping the Smart Diaper Market Market

- Abena Holding A/S

- Hunan Cosom Care Products Co Ltd

- Simavita Limited

- Monit Corp

- Verily Life Sciences (Alphabet Inc)

- Smardii

- Sinopulsar Technology Inc

- Pixie Scientific

Notable Milestones in Smart Diaper Market Sector

- March 2023: Development of a low-cost, innovative smart diaper sensor at Penn State, funded by NIH and NSF.

- January 2023: Chillax introduces Giraffe AI and Thermo AI smart baby monitors at CES, highlighting AI-driven health monitoring capabilities.

In-Depth Smart Diaper Market Market Outlook

The smart diaper market is poised for sustained growth, driven by continuous technological innovation, expanding market penetration, and a growing awareness of the benefits of smart healthcare solutions. Strategic partnerships, focusing on improving the affordability and accessibility of smart diapers, will play a critical role in unlocking the market's vast potential. The integration of smart diaper technology with broader healthcare ecosystems and the development of new applications present significant opportunities for long-term market expansion.

Smart Diaper Market Segmentation

-

1. End-User Industry

- 1.1. Baby

- 1.2. Adult

Smart Diaper Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Smart Diaper Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Geriatric Population in Developed Countries; High Birth Rates and Rise in Disposable Incomes in Emerging Markets

- 3.3. Market Restrains

- 3.3.1. Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth

- 3.4. Market Trends

- 3.4.1. The Rising Baby Care Will Act as a Major Driver of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Baby

- 5.1.2. Adult

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. North America Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Baby

- 6.1.2. Adult

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Europe Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Baby

- 7.1.2. Adult

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Asia Pacific Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Baby

- 8.1.2. Adult

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Rest of the World Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9.1.1. Baby

- 9.1.2. Adult

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10. North America Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Abena Holding A/S

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Hunan Cosom Care Products Co Ltd *List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Simavita Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Monit Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Verily Life Sciences (Alphabet Inc )

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Smardii

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Sinopulsar Technology Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Pixie Scientific

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.1 Abena Holding A/S

List of Figures

- Figure 1: Global Smart Diaper Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 11: North America Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 12: North America Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 15: Europe Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 16: Europe Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 19: Asia Pacific Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 20: Asia Pacific Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 23: Rest of the World Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 24: Rest of the World Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Diaper Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 3: Global Smart Diaper Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 13: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 15: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 19: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Diaper Market?

The projected CAGR is approximately 16.98%.

2. Which companies are prominent players in the Smart Diaper Market?

Key companies in the market include Abena Holding A/S, Hunan Cosom Care Products Co Ltd *List Not Exhaustive, Simavita Limited, Monit Corp, Verily Life Sciences (Alphabet Inc ), Smardii, Sinopulsar Technology Inc, Pixie Scientific.

3. What are the main segments of the Smart Diaper Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Geriatric Population in Developed Countries; High Birth Rates and Rise in Disposable Incomes in Emerging Markets.

6. What are the notable trends driving market growth?

The Rising Baby Care Will Act as a Major Driver of the Market.

7. Are there any restraints impacting market growth?

Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023 - An innovative smart diaper has been created by an international team of scientists, with funding from the National Institutes of Health (NIH) and the National Science Foundation (NSF). Developed at Penn State, this diaper utilizes a basic pencil-on-paper design, incorporating an electrode sensor array treated with a sodium chloride solution. This array can detect dampness caused by urine. The simplicity and affordability of this sensor array could potentially pave the way for wearable, self-powered health monitors. These monitors could be used not only in smart diapers but also to predict serious health issues such as cardiac arrest and pneumonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Diaper Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Diaper Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Diaper Market?

To stay informed about further developments, trends, and reports in the Smart Diaper Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence