Key Insights

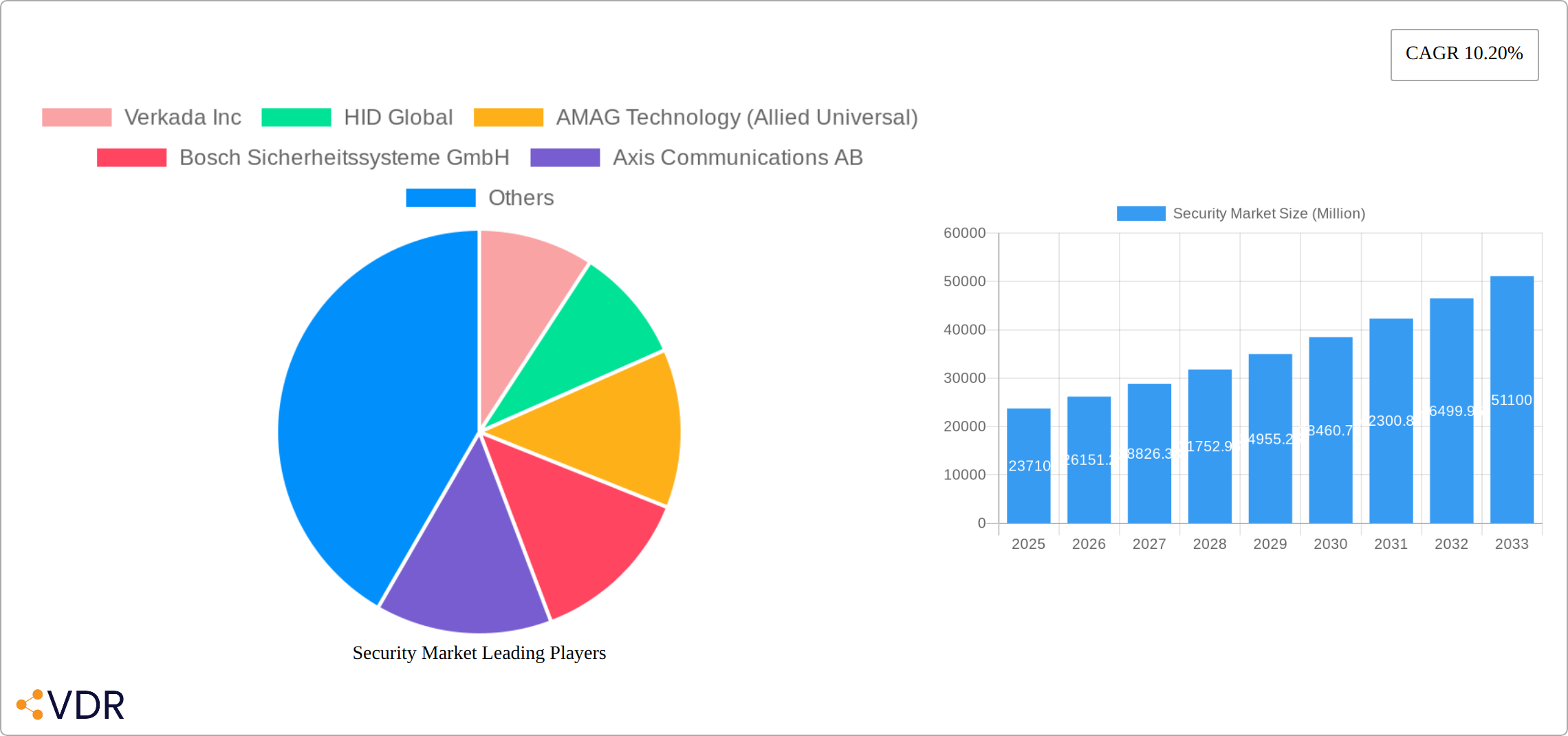

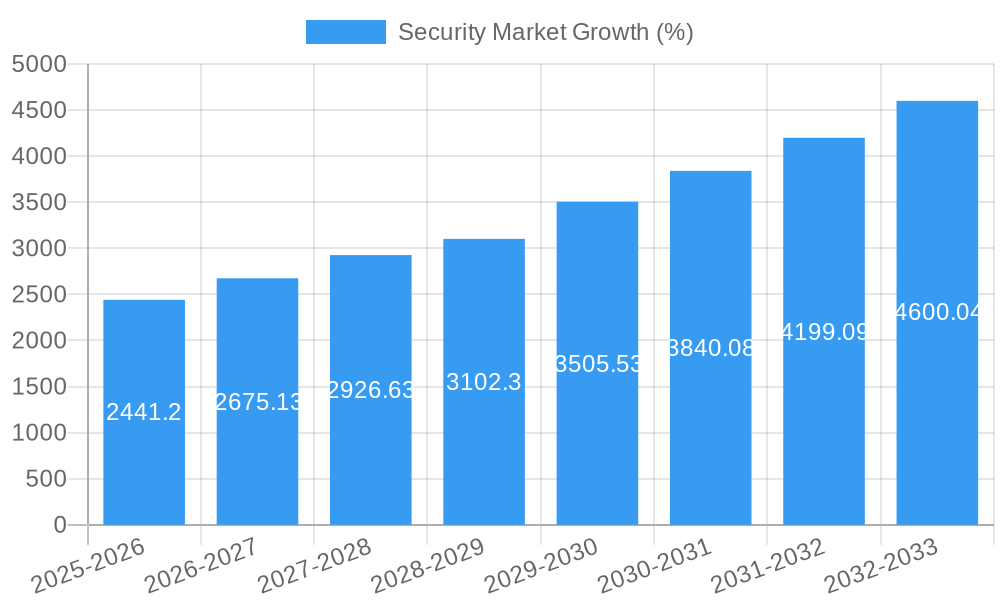

The global security market, valued at $23.71 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.20% from 2025 to 2033. This expansion is fueled by several key factors. Increasing cyber threats across various sectors, from finance to healthcare, are driving demand for sophisticated cybersecurity solutions. Simultaneously, rising concerns about physical security, particularly in public spaces and commercial buildings, are boosting investment in surveillance systems, access control technologies, and integrated security platforms. The adoption of advanced technologies like AI-powered video analytics, cloud-based security management, and IoT-integrated security solutions is further accelerating market growth. Competition among major players such as Verkada Inc, HID Global, and Honeywell International Inc. is fostering innovation and driving down costs, making security solutions more accessible to a wider range of businesses and consumers.

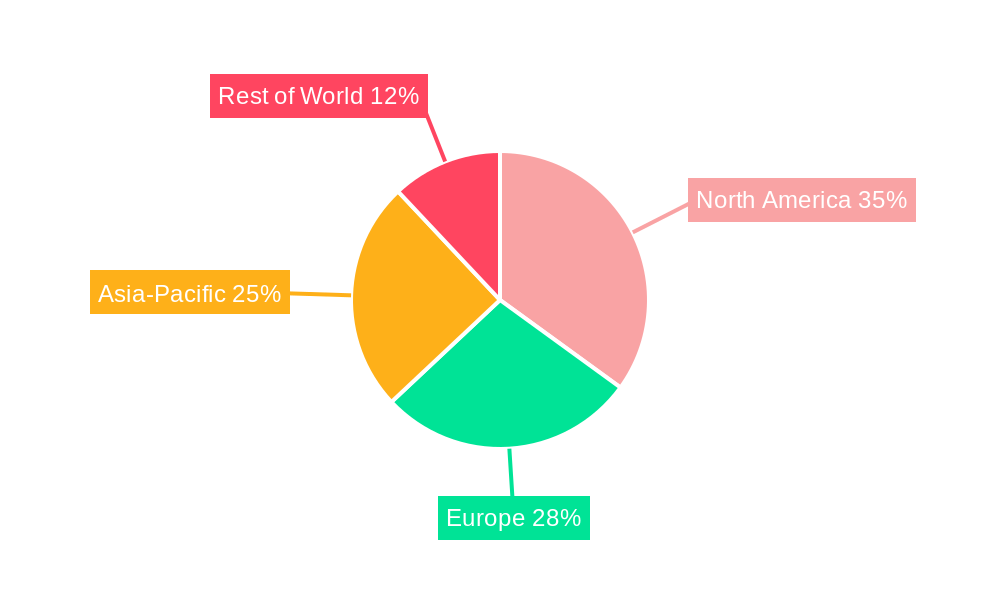

The market segmentation is likely diversified, encompassing various security solutions such as video surveillance, access control, intrusion detection, cybersecurity, and perimeter security. Regional variations in market penetration are expected, with North America and Europe likely holding significant market shares due to higher technological adoption rates and robust regulatory frameworks. However, growth opportunities are emerging in developing economies, driven by rising urbanization and increasing disposable incomes. While factors like high initial investment costs and the complexity of implementing integrated security systems could pose challenges, the overall market outlook remains positive, driven by the continuous need to protect assets, information, and people from evolving security threats. The forecast period of 2025-2033 promises significant expansion, presenting attractive investment prospects for players across the security value chain.

Security Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Security Market, encompassing market dynamics, growth trends, regional dominance, product landscapes, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and strategists seeking to understand and navigate this rapidly evolving sector. The report covers both parent markets (e.g., Cybersecurity, Physical Security) and child markets (e.g., Smart Locks, Access Control Systems) for a complete perspective. Market values are presented in millions of units.

Security Market Dynamics & Structure

The Security Market is characterized by a moderately concentrated landscape, with key players holding significant market shares but facing increasing competition from innovative startups and niche players. Technological advancements, particularly in AI and IoT, are driving significant innovation, while evolving regulatory frameworks (e.g., GDPR, CCPA) and cybersecurity threats are shaping market practices. The market experiences considerable M&A activity as established players seek to expand their portfolios and emerging companies attract acquisitions. Substitute products, including traditional security solutions, exert competitive pressure but are increasingly challenged by smart and integrated security systems.

- Market Concentration: The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation Drivers: AI, IoT, cloud computing, and blockchain technology are major drivers.

- Regulatory Frameworks: GDPR, CCPA, and other data privacy regulations significantly impact market practices.

- Competitive Product Substitutes: Traditional security systems (e.g., basic CCTV, mechanical locks) are facing challenges from smart solutions.

- End-User Demographics: The market comprises diverse end-users, including residential, commercial, government, and industrial sectors.

- M&A Trends: The number of M&A deals within the security sector increased by xx% from 2023 to 2024, driven by the desire for expansion and technological integration. (Value: xx Million)

Security Market Growth Trends & Insights

The Security Market exhibits robust growth, driven by increasing cybersecurity threats, the rising adoption of smart security solutions, and the expanding global digital footprint. The market size experienced a CAGR of xx% from 2019 to 2024, and a projected CAGR of xx% is anticipated from 2025 to 2033, reaching a market value of xx Million by 2033. This expansion is fueled by growing consumer awareness about security risks, technological disruptions including the integration of AI and advanced analytics for threat detection and response, and a shift towards proactive security measures. Market penetration rates are expected to grow significantly across various segments, particularly in the smart home and smart city sectors. The market's trajectory is further shaped by shifts in consumer preferences for convenient, integrated, and intelligent security solutions.

Dominant Regions, Countries, or Segments in Security Market

North America currently dominates the Security Market, driven by high technological adoption rates, robust investment in cybersecurity infrastructure, and stringent regulatory frameworks. However, significant growth potential is observed in the Asia-Pacific region, particularly in countries like China and India, owing to rapid urbanization, rising disposable incomes, and increasing government initiatives for infrastructure development. The physical security segment holds a larger share currently, but the cybersecurity sector is expected to witness the fastest growth due to escalating cyberattacks and data breaches.

- North America: High technology adoption, robust investment, strong regulatory environment.

- Asia-Pacific: Rapid urbanization, rising disposable income, government infrastructure investments.

- Europe: Stringent data privacy regulations drive demand for compliant solutions.

- Segments: Physical Security (xx Million, 2024), Cybersecurity (xx Million, 2024)

Security Market Product Landscape

The security market is a dynamic landscape encompassing a wide array of products and solutions designed to protect assets and individuals from a variety of threats. This ranges from traditional security systems like surveillance cameras and access control systems to highly sophisticated, AI-powered threat detection platforms and cloud-based security management systems. Product innovation is relentless, focusing on seamless integration between different systems, intuitive user interfaces, advanced analytics capabilities providing actionable insights, and robust, constantly evolving security features to counter emerging threats. Successful products often highlight ease of use, scalability to meet evolving needs, cost-effectiveness, and real-time threat monitoring capabilities. Key advancements consistently pushing the boundaries of the industry include biometric authentication for enhanced access control, predictive analytics to anticipate potential threats, and automated incident response mechanisms to minimize damage and downtime.

Key Drivers, Barriers & Challenges in Security Market

Key Drivers:

- Increasing cybersecurity threats and data breaches.

- Growing adoption of IoT devices and smart technologies.

- Stringent government regulations and compliance requirements.

- Rising investments in security infrastructure by businesses and governments.

Challenges & Restraints:

- High initial investment costs for advanced security systems can deter adoption in some markets.

- Integration complexities can hinder the seamless operation of multi-vendor security solutions.

- Skill gaps in cybersecurity professionals can limit the effectiveness of security measures.

- Regulatory changes can pose challenges to market players in adapting to new requirements.

Emerging Opportunities in Security Market

- Integrated Security Solutions: A growing demand exists for comprehensive security solutions that seamlessly integrate physical security measures (e.g., surveillance, access control) with cybersecurity defenses to create a unified and robust security posture.

- AI and Machine Learning: The adoption of AI and machine learning for predictive threat analysis is rapidly expanding, enabling proactive security measures and reducing reliance on reactive responses.

- Smart City and Smart Home Security: Significant untapped potential exists in the smart city and smart home security markets, fueled by the increasing number of connected devices and the need for comprehensive security solutions in these environments.

- Managed Security Services (MSS) and Security-as-a-Service (SaaS): The demand for managed security services and SaaS offerings is increasing, driven by the need for flexible, scalable, and cost-effective security solutions.

- Cybersecurity Mesh: The adoption of a distributed security architecture, known as a cybersecurity mesh, offers improved flexibility and scalability, especially relevant in hybrid and multi-cloud environments.

Growth Accelerators in the Security Market Industry

Technological advancements in AI, IoT, and cloud computing are significantly accelerating the growth of the Security Market. Strategic partnerships between technology providers and security solution integrators are fostering innovation and expanding market reach. Moreover, government initiatives promoting cybersecurity awareness and infrastructure development are creating favorable market conditions for growth. Market expansion strategies focusing on underserved regions and emerging markets are also driving long-term growth.

Key Players Shaping the Security Market Market

- Verkada Inc

- HID Global

- AMAG Technology (Allied Universal)

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- Honeywell International Inc

- Johnson Controls

- ADT Inc

- Securitas Technology

- Assa Abloy Group

- Genetec Inc

- Palo Alto Networks

- Fortinet Inc

- IBM Corporation

- Cisco Systems Inc

Notable Milestones in Security Market Sector

- August 2024: Alfred International launched its patented Alfred ML2 Smart Mortise Lock with Z-Wave Long Range, enhancing the smart lock market segment with improved range and security features.

- May 2024: Palo Alto Networks partnered with IBM to deliver AI-driven security solutions, combining Palo Alto's security expertise with IBM's AI capabilities for enhanced threat detection and response.

- [Add more recent milestones here, e.g., new product launches, partnerships, acquisitions]

In-Depth Security Market Market Outlook

The Security Market is poised for continued robust growth, driven by the convergence of technological advancements, evolving security threats, and expanding global digital infrastructure. Strategic opportunities lie in developing innovative solutions leveraging AI, IoT, and cloud technologies to address the increasing complexity of security challenges. Focus on integrating physical and cybersecurity measures, coupled with a strong emphasis on user experience and data privacy compliance, will be crucial for success in this dynamic market.

Security Market Segmentation

-

1. Security Type

-

1.1. Physical Security

- 1.1.1. Access Control

- 1.1.2. Video Surveillance

- 1.1.3. Intrusion Detection

- 1.1.4. Perimeter Security

-

1.2. Cyber Security

- 1.2.1. Network Security

- 1.2.2. End Point Security

- 1.2.3. Application Security

- 1.2.4. Cloud Security

- 1.2.5. Information Security

-

1.1. Physical Security

-

2. End-user Vertical

- 2.1. Government and Public Sector

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Residential

- 2.5. Healthcare

- 2.6. Education

- 2.7. Critical Infrastructure

-

3. Solution Type

- 3.1. Hardware

- 3.2. Software

- 3.3. Services

-

4. Deployment Type

- 4.1. On-premise

- 4.2. Cloud-based

Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Cyber Threats; Growth in IoT Devices

- 3.3. Market Restrains

- 3.3.1. Increasing Cyber Threats; Growth in IoT Devices

- 3.4. Market Trends

- 3.4.1. Commercial Sector Witnessing Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 5.1.1. Physical Security

- 5.1.1.1. Access Control

- 5.1.1.2. Video Surveillance

- 5.1.1.3. Intrusion Detection

- 5.1.1.4. Perimeter Security

- 5.1.2. Cyber Security

- 5.1.2.1. Network Security

- 5.1.2.2. End Point Security

- 5.1.2.3. Application Security

- 5.1.2.4. Cloud Security

- 5.1.2.5. Information Security

- 5.1.1. Physical Security

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Government and Public Sector

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Residential

- 5.2.5. Healthcare

- 5.2.6. Education

- 5.2.7. Critical Infrastructure

- 5.3. Market Analysis, Insights and Forecast - by Solution Type

- 5.3.1. Hardware

- 5.3.2. Software

- 5.3.3. Services

- 5.4. Market Analysis, Insights and Forecast - by Deployment Type

- 5.4.1. On-premise

- 5.4.2. Cloud-based

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 6. North America Security Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 6.1.1. Physical Security

- 6.1.1.1. Access Control

- 6.1.1.2. Video Surveillance

- 6.1.1.3. Intrusion Detection

- 6.1.1.4. Perimeter Security

- 6.1.2. Cyber Security

- 6.1.2.1. Network Security

- 6.1.2.2. End Point Security

- 6.1.2.3. Application Security

- 6.1.2.4. Cloud Security

- 6.1.2.5. Information Security

- 6.1.1. Physical Security

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Government and Public Sector

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.2.4. Residential

- 6.2.5. Healthcare

- 6.2.6. Education

- 6.2.7. Critical Infrastructure

- 6.3. Market Analysis, Insights and Forecast - by Solution Type

- 6.3.1. Hardware

- 6.3.2. Software

- 6.3.3. Services

- 6.4. Market Analysis, Insights and Forecast - by Deployment Type

- 6.4.1. On-premise

- 6.4.2. Cloud-based

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 7. Europe Security Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 7.1.1. Physical Security

- 7.1.1.1. Access Control

- 7.1.1.2. Video Surveillance

- 7.1.1.3. Intrusion Detection

- 7.1.1.4. Perimeter Security

- 7.1.2. Cyber Security

- 7.1.2.1. Network Security

- 7.1.2.2. End Point Security

- 7.1.2.3. Application Security

- 7.1.2.4. Cloud Security

- 7.1.2.5. Information Security

- 7.1.1. Physical Security

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Government and Public Sector

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.2.4. Residential

- 7.2.5. Healthcare

- 7.2.6. Education

- 7.2.7. Critical Infrastructure

- 7.3. Market Analysis, Insights and Forecast - by Solution Type

- 7.3.1. Hardware

- 7.3.2. Software

- 7.3.3. Services

- 7.4. Market Analysis, Insights and Forecast - by Deployment Type

- 7.4.1. On-premise

- 7.4.2. Cloud-based

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 8. Asia Security Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 8.1.1. Physical Security

- 8.1.1.1. Access Control

- 8.1.1.2. Video Surveillance

- 8.1.1.3. Intrusion Detection

- 8.1.1.4. Perimeter Security

- 8.1.2. Cyber Security

- 8.1.2.1. Network Security

- 8.1.2.2. End Point Security

- 8.1.2.3. Application Security

- 8.1.2.4. Cloud Security

- 8.1.2.5. Information Security

- 8.1.1. Physical Security

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Government and Public Sector

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.2.4. Residential

- 8.2.5. Healthcare

- 8.2.6. Education

- 8.2.7. Critical Infrastructure

- 8.3. Market Analysis, Insights and Forecast - by Solution Type

- 8.3.1. Hardware

- 8.3.2. Software

- 8.3.3. Services

- 8.4. Market Analysis, Insights and Forecast - by Deployment Type

- 8.4.1. On-premise

- 8.4.2. Cloud-based

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 9. Australia and New Zealand Security Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 9.1.1. Physical Security

- 9.1.1.1. Access Control

- 9.1.1.2. Video Surveillance

- 9.1.1.3. Intrusion Detection

- 9.1.1.4. Perimeter Security

- 9.1.2. Cyber Security

- 9.1.2.1. Network Security

- 9.1.2.2. End Point Security

- 9.1.2.3. Application Security

- 9.1.2.4. Cloud Security

- 9.1.2.5. Information Security

- 9.1.1. Physical Security

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Government and Public Sector

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.2.4. Residential

- 9.2.5. Healthcare

- 9.2.6. Education

- 9.2.7. Critical Infrastructure

- 9.3. Market Analysis, Insights and Forecast - by Solution Type

- 9.3.1. Hardware

- 9.3.2. Software

- 9.3.3. Services

- 9.4. Market Analysis, Insights and Forecast - by Deployment Type

- 9.4.1. On-premise

- 9.4.2. Cloud-based

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 10. Latin America Security Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Security Type

- 10.1.1. Physical Security

- 10.1.1.1. Access Control

- 10.1.1.2. Video Surveillance

- 10.1.1.3. Intrusion Detection

- 10.1.1.4. Perimeter Security

- 10.1.2. Cyber Security

- 10.1.2.1. Network Security

- 10.1.2.2. End Point Security

- 10.1.2.3. Application Security

- 10.1.2.4. Cloud Security

- 10.1.2.5. Information Security

- 10.1.1. Physical Security

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Government and Public Sector

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.2.4. Residential

- 10.2.5. Healthcare

- 10.2.6. Education

- 10.2.7. Critical Infrastructure

- 10.3. Market Analysis, Insights and Forecast - by Solution Type

- 10.3.1. Hardware

- 10.3.2. Software

- 10.3.3. Services

- 10.4. Market Analysis, Insights and Forecast - by Deployment Type

- 10.4.1. On-premise

- 10.4.2. Cloud-based

- 10.1. Market Analysis, Insights and Forecast - by Security Type

- 11. Middle East and Africa Security Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Security Type

- 11.1.1. Physical Security

- 11.1.1.1. Access Control

- 11.1.1.2. Video Surveillance

- 11.1.1.3. Intrusion Detection

- 11.1.1.4. Perimeter Security

- 11.1.2. Cyber Security

- 11.1.2.1. Network Security

- 11.1.2.2. End Point Security

- 11.1.2.3. Application Security

- 11.1.2.4. Cloud Security

- 11.1.2.5. Information Security

- 11.1.1. Physical Security

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Government and Public Sector

- 11.2.2. Commercial

- 11.2.3. Industrial

- 11.2.4. Residential

- 11.2.5. Healthcare

- 11.2.6. Education

- 11.2.7. Critical Infrastructure

- 11.3. Market Analysis, Insights and Forecast - by Solution Type

- 11.3.1. Hardware

- 11.3.2. Software

- 11.3.3. Services

- 11.4. Market Analysis, Insights and Forecast - by Deployment Type

- 11.4.1. On-premise

- 11.4.2. Cloud-based

- 11.1. Market Analysis, Insights and Forecast - by Security Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Verkada Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 HID Global

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 AMAG Technology (Allied Universal)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bosch Sicherheitssysteme GmbH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Axis Communications AB

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Honeywell International Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Johnson Controls

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ADT Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Securitas Technology

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Assa Abloy Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Genetec Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Palo Alto Networks

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Fortinet Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 IBM Corporation

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Cisco Systems Inc

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Verkada Inc

List of Figures

- Figure 1: Global Security Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Security Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Security Market Revenue (Million), by Security Type 2024 & 2032

- Figure 4: North America Security Market Volume (Billion), by Security Type 2024 & 2032

- Figure 5: North America Security Market Revenue Share (%), by Security Type 2024 & 2032

- Figure 6: North America Security Market Volume Share (%), by Security Type 2024 & 2032

- Figure 7: North America Security Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 8: North America Security Market Volume (Billion), by End-user Vertical 2024 & 2032

- Figure 9: North America Security Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 10: North America Security Market Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 11: North America Security Market Revenue (Million), by Solution Type 2024 & 2032

- Figure 12: North America Security Market Volume (Billion), by Solution Type 2024 & 2032

- Figure 13: North America Security Market Revenue Share (%), by Solution Type 2024 & 2032

- Figure 14: North America Security Market Volume Share (%), by Solution Type 2024 & 2032

- Figure 15: North America Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 16: North America Security Market Volume (Billion), by Deployment Type 2024 & 2032

- Figure 17: North America Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 18: North America Security Market Volume Share (%), by Deployment Type 2024 & 2032

- Figure 19: North America Security Market Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Security Market Volume (Billion), by Country 2024 & 2032

- Figure 21: North America Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Security Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Europe Security Market Revenue (Million), by Security Type 2024 & 2032

- Figure 24: Europe Security Market Volume (Billion), by Security Type 2024 & 2032

- Figure 25: Europe Security Market Revenue Share (%), by Security Type 2024 & 2032

- Figure 26: Europe Security Market Volume Share (%), by Security Type 2024 & 2032

- Figure 27: Europe Security Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 28: Europe Security Market Volume (Billion), by End-user Vertical 2024 & 2032

- Figure 29: Europe Security Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 30: Europe Security Market Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 31: Europe Security Market Revenue (Million), by Solution Type 2024 & 2032

- Figure 32: Europe Security Market Volume (Billion), by Solution Type 2024 & 2032

- Figure 33: Europe Security Market Revenue Share (%), by Solution Type 2024 & 2032

- Figure 34: Europe Security Market Volume Share (%), by Solution Type 2024 & 2032

- Figure 35: Europe Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 36: Europe Security Market Volume (Billion), by Deployment Type 2024 & 2032

- Figure 37: Europe Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 38: Europe Security Market Volume Share (%), by Deployment Type 2024 & 2032

- Figure 39: Europe Security Market Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Security Market Volume (Billion), by Country 2024 & 2032

- Figure 41: Europe Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Security Market Volume Share (%), by Country 2024 & 2032

- Figure 43: Asia Security Market Revenue (Million), by Security Type 2024 & 2032

- Figure 44: Asia Security Market Volume (Billion), by Security Type 2024 & 2032

- Figure 45: Asia Security Market Revenue Share (%), by Security Type 2024 & 2032

- Figure 46: Asia Security Market Volume Share (%), by Security Type 2024 & 2032

- Figure 47: Asia Security Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 48: Asia Security Market Volume (Billion), by End-user Vertical 2024 & 2032

- Figure 49: Asia Security Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 50: Asia Security Market Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 51: Asia Security Market Revenue (Million), by Solution Type 2024 & 2032

- Figure 52: Asia Security Market Volume (Billion), by Solution Type 2024 & 2032

- Figure 53: Asia Security Market Revenue Share (%), by Solution Type 2024 & 2032

- Figure 54: Asia Security Market Volume Share (%), by Solution Type 2024 & 2032

- Figure 55: Asia Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 56: Asia Security Market Volume (Billion), by Deployment Type 2024 & 2032

- Figure 57: Asia Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 58: Asia Security Market Volume Share (%), by Deployment Type 2024 & 2032

- Figure 59: Asia Security Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Asia Security Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Asia Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Security Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Australia and New Zealand Security Market Revenue (Million), by Security Type 2024 & 2032

- Figure 64: Australia and New Zealand Security Market Volume (Billion), by Security Type 2024 & 2032

- Figure 65: Australia and New Zealand Security Market Revenue Share (%), by Security Type 2024 & 2032

- Figure 66: Australia and New Zealand Security Market Volume Share (%), by Security Type 2024 & 2032

- Figure 67: Australia and New Zealand Security Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 68: Australia and New Zealand Security Market Volume (Billion), by End-user Vertical 2024 & 2032

- Figure 69: Australia and New Zealand Security Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 70: Australia and New Zealand Security Market Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 71: Australia and New Zealand Security Market Revenue (Million), by Solution Type 2024 & 2032

- Figure 72: Australia and New Zealand Security Market Volume (Billion), by Solution Type 2024 & 2032

- Figure 73: Australia and New Zealand Security Market Revenue Share (%), by Solution Type 2024 & 2032

- Figure 74: Australia and New Zealand Security Market Volume Share (%), by Solution Type 2024 & 2032

- Figure 75: Australia and New Zealand Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 76: Australia and New Zealand Security Market Volume (Billion), by Deployment Type 2024 & 2032

- Figure 77: Australia and New Zealand Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 78: Australia and New Zealand Security Market Volume Share (%), by Deployment Type 2024 & 2032

- Figure 79: Australia and New Zealand Security Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Australia and New Zealand Security Market Volume (Billion), by Country 2024 & 2032

- Figure 81: Australia and New Zealand Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Australia and New Zealand Security Market Volume Share (%), by Country 2024 & 2032

- Figure 83: Latin America Security Market Revenue (Million), by Security Type 2024 & 2032

- Figure 84: Latin America Security Market Volume (Billion), by Security Type 2024 & 2032

- Figure 85: Latin America Security Market Revenue Share (%), by Security Type 2024 & 2032

- Figure 86: Latin America Security Market Volume Share (%), by Security Type 2024 & 2032

- Figure 87: Latin America Security Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 88: Latin America Security Market Volume (Billion), by End-user Vertical 2024 & 2032

- Figure 89: Latin America Security Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 90: Latin America Security Market Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 91: Latin America Security Market Revenue (Million), by Solution Type 2024 & 2032

- Figure 92: Latin America Security Market Volume (Billion), by Solution Type 2024 & 2032

- Figure 93: Latin America Security Market Revenue Share (%), by Solution Type 2024 & 2032

- Figure 94: Latin America Security Market Volume Share (%), by Solution Type 2024 & 2032

- Figure 95: Latin America Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 96: Latin America Security Market Volume (Billion), by Deployment Type 2024 & 2032

- Figure 97: Latin America Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 98: Latin America Security Market Volume Share (%), by Deployment Type 2024 & 2032

- Figure 99: Latin America Security Market Revenue (Million), by Country 2024 & 2032

- Figure 100: Latin America Security Market Volume (Billion), by Country 2024 & 2032

- Figure 101: Latin America Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 102: Latin America Security Market Volume Share (%), by Country 2024 & 2032

- Figure 103: Middle East and Africa Security Market Revenue (Million), by Security Type 2024 & 2032

- Figure 104: Middle East and Africa Security Market Volume (Billion), by Security Type 2024 & 2032

- Figure 105: Middle East and Africa Security Market Revenue Share (%), by Security Type 2024 & 2032

- Figure 106: Middle East and Africa Security Market Volume Share (%), by Security Type 2024 & 2032

- Figure 107: Middle East and Africa Security Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 108: Middle East and Africa Security Market Volume (Billion), by End-user Vertical 2024 & 2032

- Figure 109: Middle East and Africa Security Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 110: Middle East and Africa Security Market Volume Share (%), by End-user Vertical 2024 & 2032

- Figure 111: Middle East and Africa Security Market Revenue (Million), by Solution Type 2024 & 2032

- Figure 112: Middle East and Africa Security Market Volume (Billion), by Solution Type 2024 & 2032

- Figure 113: Middle East and Africa Security Market Revenue Share (%), by Solution Type 2024 & 2032

- Figure 114: Middle East and Africa Security Market Volume Share (%), by Solution Type 2024 & 2032

- Figure 115: Middle East and Africa Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 116: Middle East and Africa Security Market Volume (Billion), by Deployment Type 2024 & 2032

- Figure 117: Middle East and Africa Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 118: Middle East and Africa Security Market Volume Share (%), by Deployment Type 2024 & 2032

- Figure 119: Middle East and Africa Security Market Revenue (Million), by Country 2024 & 2032

- Figure 120: Middle East and Africa Security Market Volume (Billion), by Country 2024 & 2032

- Figure 121: Middle East and Africa Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 122: Middle East and Africa Security Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Security Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 4: Global Security Market Volume Billion Forecast, by Security Type 2019 & 2032

- Table 5: Global Security Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Global Security Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 7: Global Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 8: Global Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 9: Global Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 10: Global Security Market Volume Billion Forecast, by Deployment Type 2019 & 2032

- Table 11: Global Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Global Security Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Global Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 14: Global Security Market Volume Billion Forecast, by Security Type 2019 & 2032

- Table 15: Global Security Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 16: Global Security Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 18: Global Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 19: Global Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 20: Global Security Market Volume Billion Forecast, by Deployment Type 2019 & 2032

- Table 21: Global Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Security Market Volume Billion Forecast, by Country 2019 & 2032

- Table 23: Global Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 24: Global Security Market Volume Billion Forecast, by Security Type 2019 & 2032

- Table 25: Global Security Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Global Security Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 27: Global Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 28: Global Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 29: Global Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 30: Global Security Market Volume Billion Forecast, by Deployment Type 2019 & 2032

- Table 31: Global Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Security Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 34: Global Security Market Volume Billion Forecast, by Security Type 2019 & 2032

- Table 35: Global Security Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 36: Global Security Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 37: Global Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 38: Global Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 39: Global Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 40: Global Security Market Volume Billion Forecast, by Deployment Type 2019 & 2032

- Table 41: Global Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Security Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Global Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 44: Global Security Market Volume Billion Forecast, by Security Type 2019 & 2032

- Table 45: Global Security Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 46: Global Security Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 47: Global Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 48: Global Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 49: Global Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 50: Global Security Market Volume Billion Forecast, by Deployment Type 2019 & 2032

- Table 51: Global Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Security Market Volume Billion Forecast, by Country 2019 & 2032

- Table 53: Global Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 54: Global Security Market Volume Billion Forecast, by Security Type 2019 & 2032

- Table 55: Global Security Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 56: Global Security Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 57: Global Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 58: Global Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 59: Global Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 60: Global Security Market Volume Billion Forecast, by Deployment Type 2019 & 2032

- Table 61: Global Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Security Market Volume Billion Forecast, by Country 2019 & 2032

- Table 63: Global Security Market Revenue Million Forecast, by Security Type 2019 & 2032

- Table 64: Global Security Market Volume Billion Forecast, by Security Type 2019 & 2032

- Table 65: Global Security Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 66: Global Security Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 67: Global Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 68: Global Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 69: Global Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 70: Global Security Market Volume Billion Forecast, by Deployment Type 2019 & 2032

- Table 71: Global Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global Security Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Security Market?

Key companies in the market include Verkada Inc, HID Global, AMAG Technology (Allied Universal), Bosch Sicherheitssysteme GmbH, Axis Communications AB, Honeywell International Inc, Johnson Controls, ADT Inc, Securitas Technology, Assa Abloy Group, Genetec Inc, Palo Alto Networks, Fortinet Inc, IBM Corporation, Cisco Systems Inc.

3. What are the main segments of the Security Market?

The market segments include Security Type, End-user Vertical, Solution Type, Deployment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Cyber Threats; Growth in IoT Devices.

6. What are the notable trends driving market growth?

Commercial Sector Witnessing Demand.

7. Are there any restraints impacting market growth?

Increasing Cyber Threats; Growth in IoT Devices.

8. Can you provide examples of recent developments in the market?

August 2024: Alfred International, a subsidiary of GHT Door Hardware specializing in smart and connected locks, launched its patented Alfred ML2 Smart Mortise Lock with Z-Wave Long Range in the United States. The ML2, as per the company's claims, merges cutting-edge technology with a modern keypad and a unique design. This patented drive mechanism enables dealers to retrofit the ML2 into properties that previously used older mortise-style locks. Now available in the United States, the ML2 caters to property managers and homeowners who wish to upgrade to a smart mortise lock. This upgrade can be done without entirely replacing or re-keying the existing lock, thus sidestepping common installation challenges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security Market?

To stay informed about further developments, trends, and reports in the Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence