Key Insights

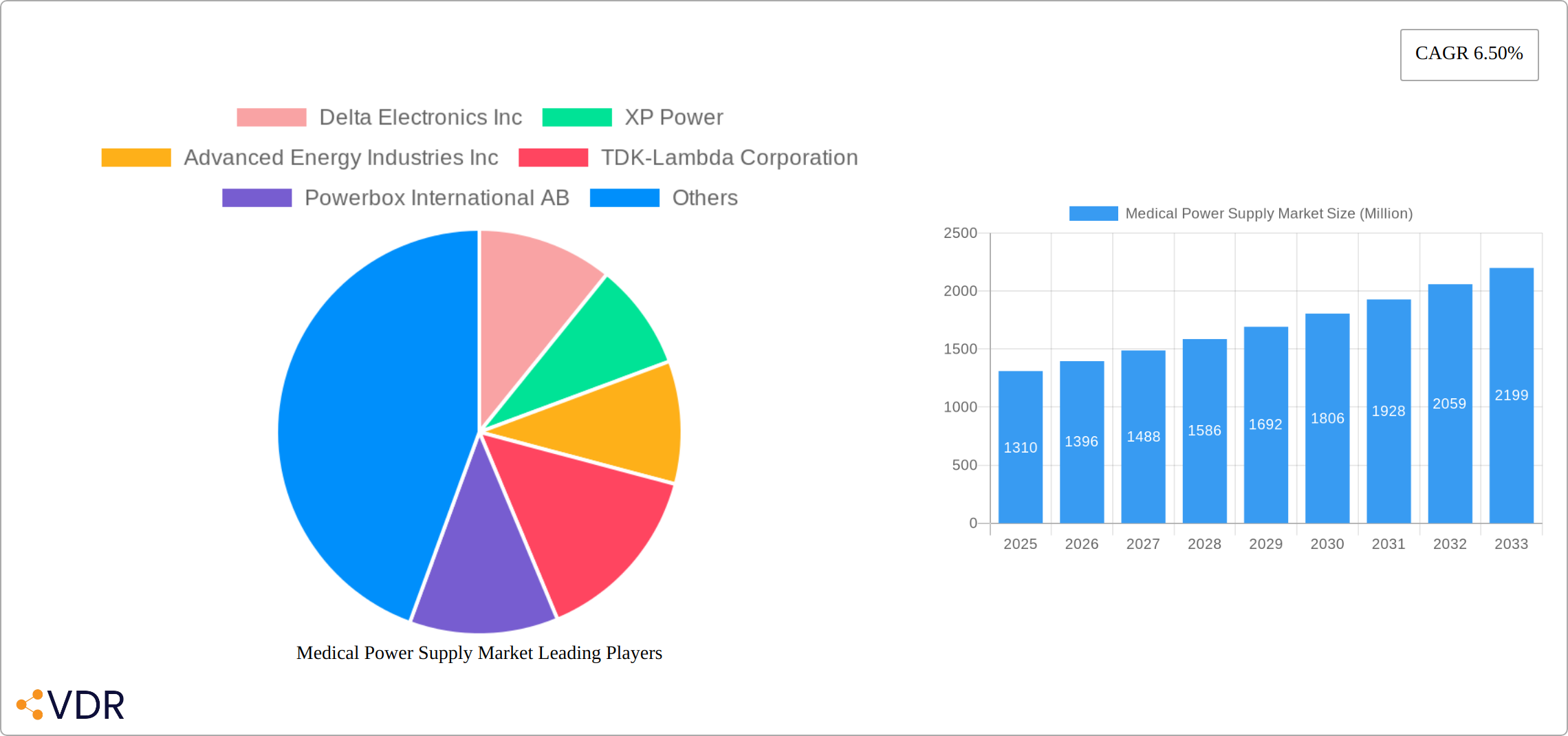

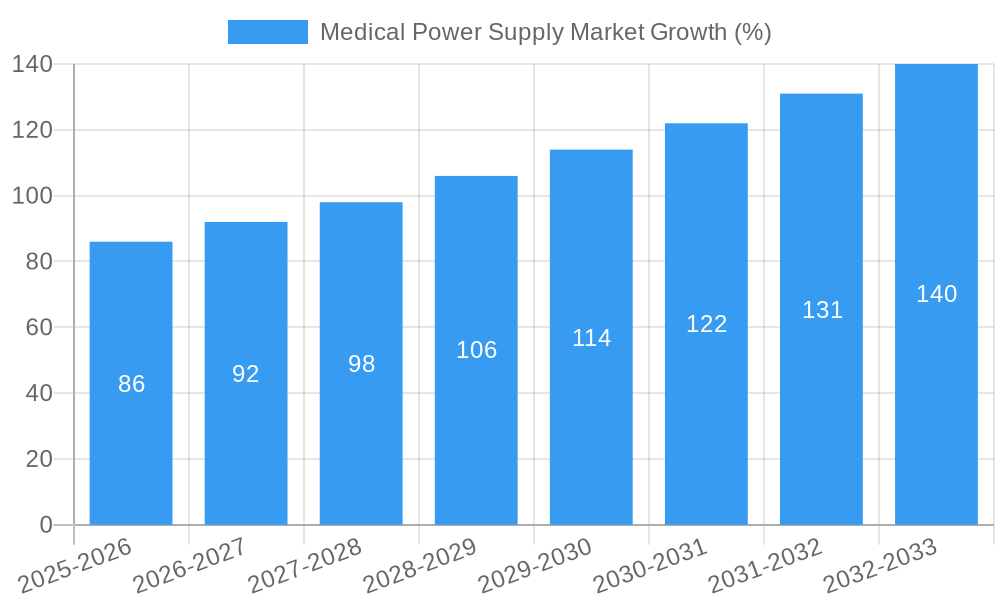

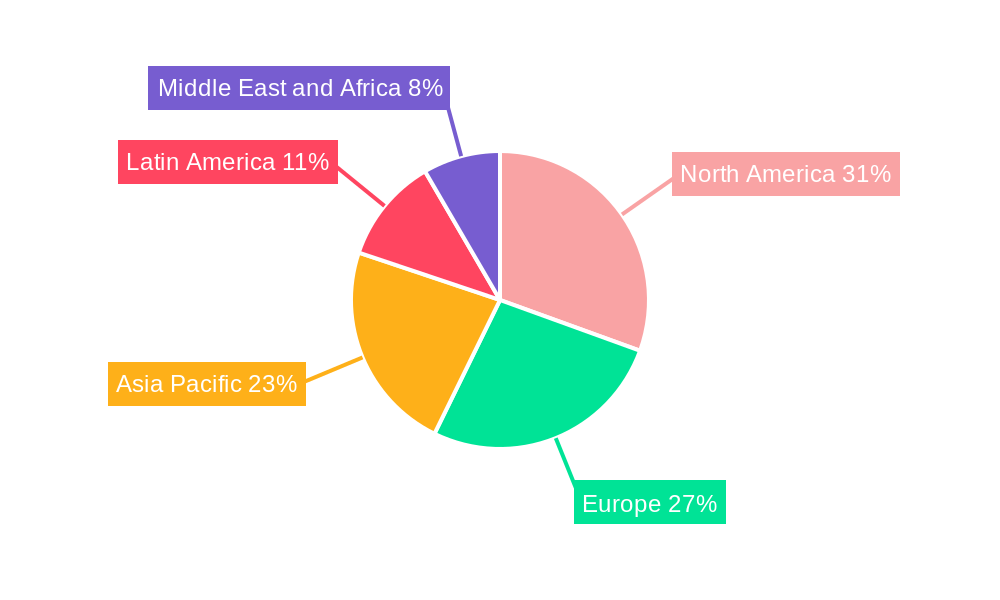

The medical power supply market, valued at $1.31 billion in 2025, is projected to experience robust growth, driven by the increasing demand for advanced medical devices and the expansion of healthcare infrastructure globally. A compound annual growth rate (CAGR) of 6.50% from 2025 to 2033 indicates a significant market expansion over the forecast period. This growth is fueled by several key factors. The rising prevalence of chronic diseases necessitates sophisticated medical equipment, thereby increasing the demand for reliable and efficient power supplies. Technological advancements, such as miniaturization and enhanced efficiency in power supplies, are also contributing to market expansion. Furthermore, the increasing adoption of minimally invasive surgical procedures and the growing popularity of home healthcare solutions are further bolstering market growth. The market is segmented by technology (AC-DC, DC-DC), type (open frame, enclosed, adapter, converters), and application (diagnostic, imaging, surgical, home medical equipment). While precise regional breakdowns are unavailable, it’s reasonable to expect North America and Europe to hold significant market shares initially, followed by rapid growth in the Asia-Pacific region due to increasing healthcare spending and technological advancements in these areas. However, regulatory hurdles and stringent safety standards could pose challenges to market expansion. Nevertheless, the overall outlook for the medical power supply market remains positive, driven by long-term trends towards improved healthcare infrastructure and technological sophistication within the medical device industry. Competitive landscape includes major players like Delta Electronics, XP Power, and Advanced Energy, who are focusing on innovation and strategic partnerships to maintain their market positions.

The continued integration of sophisticated electronics in medical devices and the trend toward portable and wireless medical technologies will fuel future growth. The demand for smaller, lighter, and more energy-efficient power supplies is a significant driver. Furthermore, increasing regulatory scrutiny related to safety and compliance will require manufacturers to invest in advanced technologies and rigorous quality control measures. This market presents a promising opportunity for companies focusing on innovative power supply solutions that meet the stringent demands of the medical sector, both in terms of performance and regulatory compliance. The ongoing development of novel medical technologies, along with rising healthcare expenditure worldwide, is expected to further stimulate market expansion in the coming years, making it a highly attractive investment prospect.

Medical Power Supply Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Medical Power Supply market, encompassing market dynamics, growth trends, regional insights, product landscapes, key players, and future outlooks. The report covers the parent market of Power Supplies and the child market of Medical Power Supplies, offering a granular understanding of this vital sector within the healthcare industry. The study period spans from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. The market size is presented in million units.

Medical Power Supply Market Dynamics & Structure

The Medical Power Supply market is characterized by a moderately concentrated landscape, with key players holding significant market share. Technological innovation, driven by the increasing demand for smaller, more efficient, and safer power supplies for advanced medical devices, is a major growth driver. Stringent regulatory frameworks, such as those related to safety and electromagnetic compatibility (EMC), shape product design and market entry. The market experiences competitive pressure from substitute technologies, and ongoing M&A activity reshapes the competitive dynamics.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Focus on miniaturization, increased efficiency (Level VI compliance), and improved safety features (2xMOPP).

- Regulatory Landscape: Compliance with IEC 60601-1, UL 60601-1, and other international safety standards is crucial.

- Competitive Substitutes: Alternative power solutions, including battery technologies, pose some level of competition.

- End-User Demographics: Growth is driven by the aging global population and increasing demand for advanced medical technologies.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024, indicating consolidation within the market.

Medical Power Supply Market Growth Trends & Insights

The Medical Power Supply market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to factors like technological advancements, increasing adoption of minimally invasive procedures, and rising demand for portable medical devices. The market is expected to continue its expansion during the forecast period (2025-2033), driven by the increasing prevalence of chronic diseases, rising healthcare expenditure, and technological advancements such as the adoption of IoT and AI in healthcare. The market penetration of advanced power supply technologies is projected to reach xx% by 2033. Consumer behavior shifts towards preference for portable and user-friendly medical equipment further fuel market growth. Technological disruptions, particularly the incorporation of GaN technology in power supplies, are expected to significantly impact the market's trajectory. The market size is projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Medical Power Supply Market

North America and Europe currently dominate the Medical Power Supply market, owing to advanced healthcare infrastructure, high adoption rates of technologically advanced medical equipment, and stringent regulatory frameworks. However, the Asia-Pacific region is poised for significant growth, driven by increasing healthcare expenditure and a growing middle class.

By Technology: AC-to-DC power supplies hold a larger market share than DC-to-DC power supplies due to their wider application in various medical devices.

By Type: Enclosed power supplies are the dominant segment due to their superior safety and protection features.

By Application: Diagnostic, Imaging, and Monitoring Equipment segment holds the largest share, followed by Surgical Equipment and Home Medical Equipment.

- North America: Strong regulatory environment and high adoption of advanced medical technologies.

- Europe: Similar to North America, characterized by a robust healthcare infrastructure.

- Asia-Pacific: Rapid growth fueled by increasing healthcare expenditure and a large, aging population.

- Key Drivers: Government initiatives supporting healthcare infrastructure development, technological advancements, and increasing adoption of minimally invasive surgeries.

Medical Power Supply Market Product Landscape

The medical power supply market is characterized by a dynamic and evolving product landscape, driven by an increasing demand for advanced, reliable, and safe power solutions for a wide array of healthcare applications. Innovations are sharply focused on miniaturization, enabling the development of smaller, more portable medical devices that enhance patient mobility and facilitate point-of-care diagnostics and treatment. Simultaneously, there's a significant push towards higher energy efficiency to reduce heat generation, extend battery life, and minimize the overall environmental footprint of medical equipment. Safety remains paramount, with power supplies increasingly designed to meet and exceed stringent regulatory standards such as 2xMOPP (Means of Patient Protection), ensuring utmost patient and operator safety, especially in critical care environments.

Key product advancements include the integration of cutting-edge technologies like Gallium Nitride (GaN) semiconductors, which allow for higher switching frequencies and improved power conversion efficiency, leading to more compact and cooler-operating power modules. The incorporation of digital control architectures is also a growing trend, offering enhanced precision, greater flexibility in configuration, and advanced monitoring capabilities. These digital solutions enable real-time performance adjustments and predictive maintenance, crucial for high-reliability medical equipment. Unique selling propositions in this market revolve around highly integrated, compact designs, broad universal input voltage ranges to accommodate global power grids, and a diverse spectrum of configurable output voltage and current options tailored to the precise needs of specialized medical devices, from sophisticated imaging systems to wearable health monitors.

Key Drivers, Barriers & Challenges in Medical Power Supply Market

Key Drivers:

- Surging Demand for Wearable and Portable Medical Devices: The continuous innovation in remote patient monitoring, telehealth, and point-of-care diagnostics is fueling a significant demand for compact, battery-powered, and highly efficient medical power supplies.

- Expansion of Minimally Invasive Surgical Procedures: These procedures rely on advanced, often portable, robotic and endoscopic equipment, necessitating robust and precise power solutions that can operate reliably within sterile environments.

- Globally Escalating Healthcare Expenditure: Increased investments in healthcare infrastructure, particularly in emerging economies, are driving the adoption of new medical technologies and equipment, thereby boosting the demand for associated power supplies.

- Evolving and Stringent Regulatory Landscape: The constant push by regulatory bodies worldwide for enhanced safety, reliability, and interoperability standards acts as a powerful catalyst for innovation in medical power supply design and manufacturing.

- Technological Advancements in Power Electronics: Breakthroughs in materials science (e.g., GaN, SiC) and digital control technologies are enabling the creation of smaller, more efficient, and higher-performing power solutions, which are crucial for next-generation medical devices.

Challenges & Restraints:

- High Capital Investment for Advanced Technologies: The research, development, and implementation of novel power supply technologies often involve substantial upfront costs, which can be a barrier to adoption for some manufacturers.

- Vulnerability to Supply Chain Volatility: Global disruptions in the supply of critical electronic components, coupled with fluctuating raw material prices, can impact production timelines, cost-effectiveness, and component availability for medical power supplies.

- Navigating Complex and Fragmented Regulatory Frameworks: Adhering to the diverse and often region-specific regulatory compliance requirements for medical devices poses a significant challenge, requiring extensive testing and documentation.

- Intensified Market Competition: The presence of both established global players and agile emerging companies leads to fierce price competition and pressure on profit margins. This competitive intensity is projected to compress profit margins by an estimated 15-20% by 2033, necessitating strategic differentiation and operational efficiencies.

- Short Product Life Cycles of Medical Devices: The rapid pace of innovation in medical technology can lead to shorter product life cycles for medical equipment, demanding agile and responsive power supply manufacturers capable of quick design iterations and scaled production.

Emerging Opportunities in Medical Power Supply Market

- Growing demand for telemedicine and remote patient monitoring systems.

- Expansion into emerging markets with growing healthcare infrastructure.

- Development of power supply solutions for next-generation medical devices incorporating AI and IoT.

- Increased focus on energy-efficient and sustainable power supply solutions.

Growth Accelerators in the Medical Power Supply Market Industry

Technological breakthroughs, such as the adoption of Gallium Nitride (GaN) technology, are significantly accelerating market growth by enabling the development of smaller, more efficient, and higher-power density power supplies. Strategic partnerships between power supply manufacturers and medical device manufacturers are facilitating the integration of advanced power solutions into next-generation medical devices. Expansion into emerging markets and the development of tailored power solutions for specialized applications are further propelling market growth.

Key Players Shaping the Medical Power Supply Market

- Delta Electronics Inc. - A leading provider of power management solutions, offering a comprehensive portfolio of medical-grade power supplies known for their reliability and efficiency.

- XP Power - Specializes in the design and manufacture of a wide range of power conversion solutions, with a strong focus on medical and industrial applications, emphasizing safety and performance.

- Advanced Energy Industries Inc. - Renowned for its high-performance power conversion products, AE serves critical applications in the medical sector, particularly in complex medical equipment and life support systems.

- TDK-Lambda Corporation - A subsidiary of TDK Corporation, TDK-Lambda offers a broad spectrum of AC-DC power supplies, DC-DC converters, and filters designed to meet the stringent requirements of medical devices.

- Powerbox International AB - Now part of Murata Power Solutions, Powerbox has a long-standing reputation for providing reliable and high-quality power solutions for demanding applications, including the medical industry.

- Spellman High Voltage Electronics Corporation - A global leader in high voltage power supply technology, Spellman provides critical components for advanced medical imaging and diagnostic equipment, such as X-ray and CT scanners.

- Globtek Inc. - Offers a wide range of medical power supplies, including wall plug-in adapters and desktop power supplies, known for their compliance with international safety standards.

- Mean Well Enterprises Co Ltd. - A prominent manufacturer of standard and customized power supplies, Mean Well provides cost-effective and reliable solutions for various medical applications.

- CUI Inc (Bel Fuse Inc) - CUI offers an extensive catalog of AC-DC power supplies and DC-DC converters, including many medical-grade options designed for safety and performance in healthcare settings.

- SL Industries Inc. - A diversified manufacturer of power systems and components, SL Industries provides power solutions that are integral to a range of medical devices, emphasizing quality and dependability.

Notable Milestones in Medical Power Supply Sector

- December 2020: CUI Inc. launched two new 120-watt ac-dc external power supply series (SDM120-U and SDM120-UD), expanding its medical power supply family. The smaller footprint and Level VI compliance enhance market competitiveness.

- April 2020: XP Power released its UCH600 series of convection-cooled, 600W AC-DC power supplies, ideal for medical and industrial applications due to its compact size and high power delivery.

- March 2020: Delta Electronics launched the MEA-065A, a compact 65W medical AC-DC adapter offering multiple output voltages, targeting portable healthcare equipment and test equipment. The low earth leakage and electric shock protection highlight its safety features.

In-Depth Medical Power Supply Market Outlook

The Medical Power Supply market is poised for continued robust growth, driven by technological advancements, increasing demand for advanced medical devices, and expansion into emerging markets. Strategic opportunities lie in developing energy-efficient and sustainable power solutions, focusing on miniaturization and integration with emerging medical technologies, such as AI and IoT. The market's future potential is significant, with substantial growth projected across all segments and regions. Companies that invest in R&D, focus on regulatory compliance, and build strong partnerships will be best positioned to capitalize on the opportunities within this dynamic market.

Medical Power Supply Market Segmentation

-

1. Technology

- 1.1. AC to DC Power Supply

- 1.2. DC to DC Power Supply

-

2. Type

- 2.1. Open Frame Power Supply

- 2.2. Enclosed Power Supply

- 2.3. Adapter Power Supply

- 2.4. Converters

-

3. Application

- 3.1. Diagnostic, Imaging, and Monitoring Equipment

- 3.2. Surgical Equipment

- 3.3. Home Medical Equipment

- 3.4. Other Applications

Medical Power Supply Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Medical Power Supply Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in Healthcare Equipment; Increasing Demand for Portable Home Care Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Compliance and Safety Standards

- 3.4. Market Trends

- 3.4.1. Diagnostic and Monitoring Equipment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. AC to DC Power Supply

- 5.1.2. DC to DC Power Supply

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Open Frame Power Supply

- 5.2.2. Enclosed Power Supply

- 5.2.3. Adapter Power Supply

- 5.2.4. Converters

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 5.3.2. Surgical Equipment

- 5.3.3. Home Medical Equipment

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. AC to DC Power Supply

- 6.1.2. DC to DC Power Supply

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Open Frame Power Supply

- 6.2.2. Enclosed Power Supply

- 6.2.3. Adapter Power Supply

- 6.2.4. Converters

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 6.3.2. Surgical Equipment

- 6.3.3. Home Medical Equipment

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. AC to DC Power Supply

- 7.1.2. DC to DC Power Supply

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Open Frame Power Supply

- 7.2.2. Enclosed Power Supply

- 7.2.3. Adapter Power Supply

- 7.2.4. Converters

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 7.3.2. Surgical Equipment

- 7.3.3. Home Medical Equipment

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. AC to DC Power Supply

- 8.1.2. DC to DC Power Supply

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Open Frame Power Supply

- 8.2.2. Enclosed Power Supply

- 8.2.3. Adapter Power Supply

- 8.2.4. Converters

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 8.3.2. Surgical Equipment

- 8.3.3. Home Medical Equipment

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. AC to DC Power Supply

- 9.1.2. DC to DC Power Supply

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Open Frame Power Supply

- 9.2.2. Enclosed Power Supply

- 9.2.3. Adapter Power Supply

- 9.2.4. Converters

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 9.3.2. Surgical Equipment

- 9.3.3. Home Medical Equipment

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. AC to DC Power Supply

- 10.1.2. DC to DC Power Supply

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Open Frame Power Supply

- 10.2.2. Enclosed Power Supply

- 10.2.3. Adapter Power Supply

- 10.2.4. Converters

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 10.3.2. Surgical Equipment

- 10.3.3. Home Medical Equipment

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Delta Electronics Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 XP Power

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Advanced Energy Industries Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 TDK-Lambda Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Powerbox International AB

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Spellman High Voltage Electronics Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Globtek Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mean Well Enterprises Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 CUI Inc (Bel Fuse Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SL Industries Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Delta Electronics Inc

List of Figures

- Figure 1: Global Medical Power Supply Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 13: North America Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 21: Europe Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 22: Europe Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 29: Asia Pacific Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 30: Asia Pacific Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 37: Latin America Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 38: Latin America Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 45: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 46: Middle East and Africa Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East and Africa Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Power Supply Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Medical Power Supply Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 21: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 33: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Power Supply Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Medical Power Supply Market?

Key companies in the market include Delta Electronics Inc, XP Power, Advanced Energy Industries Inc, TDK-Lambda Corporation, Powerbox International AB, Spellman High Voltage Electronics Corporation, Globtek Inc, Mean Well Enterprises Co Ltd, CUI Inc (Bel Fuse Inc ), SL Industries Inc.

3. What are the main segments of the Medical Power Supply Market?

The market segments include Technology, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in Healthcare Equipment; Increasing Demand for Portable Home Care Devices.

6. What are the notable trends driving market growth?

Diagnostic and Monitoring Equipment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Regulatory Compliance and Safety Standards.

8. Can you provide examples of recent developments in the market?

December 2020 - CUI Inc. announced the addition of two 120-watt ac-dc external power supply series, expanding its existing 60601 certified medical power supply family. The new series footprint is 35% smaller than its non-medical counterpart, providing a lighter and less cumbersome adapter that can power a wide range of medical and dental devices. The SDM120-U is available with a C14 inlet, and the SDM120-UD comes with a C8 inlet. Both series meet the current average efficiency and no-load power specifications mandated by the US Department of Energy (DoE) under the Level VI standard, as well as the European Union's (EU) Ecodesign 2019/1782 and CoC Tier 2 directives for external power supplies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Power Supply Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Power Supply Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Power Supply Market?

To stay informed about further developments, trends, and reports in the Medical Power Supply Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence