Key Insights

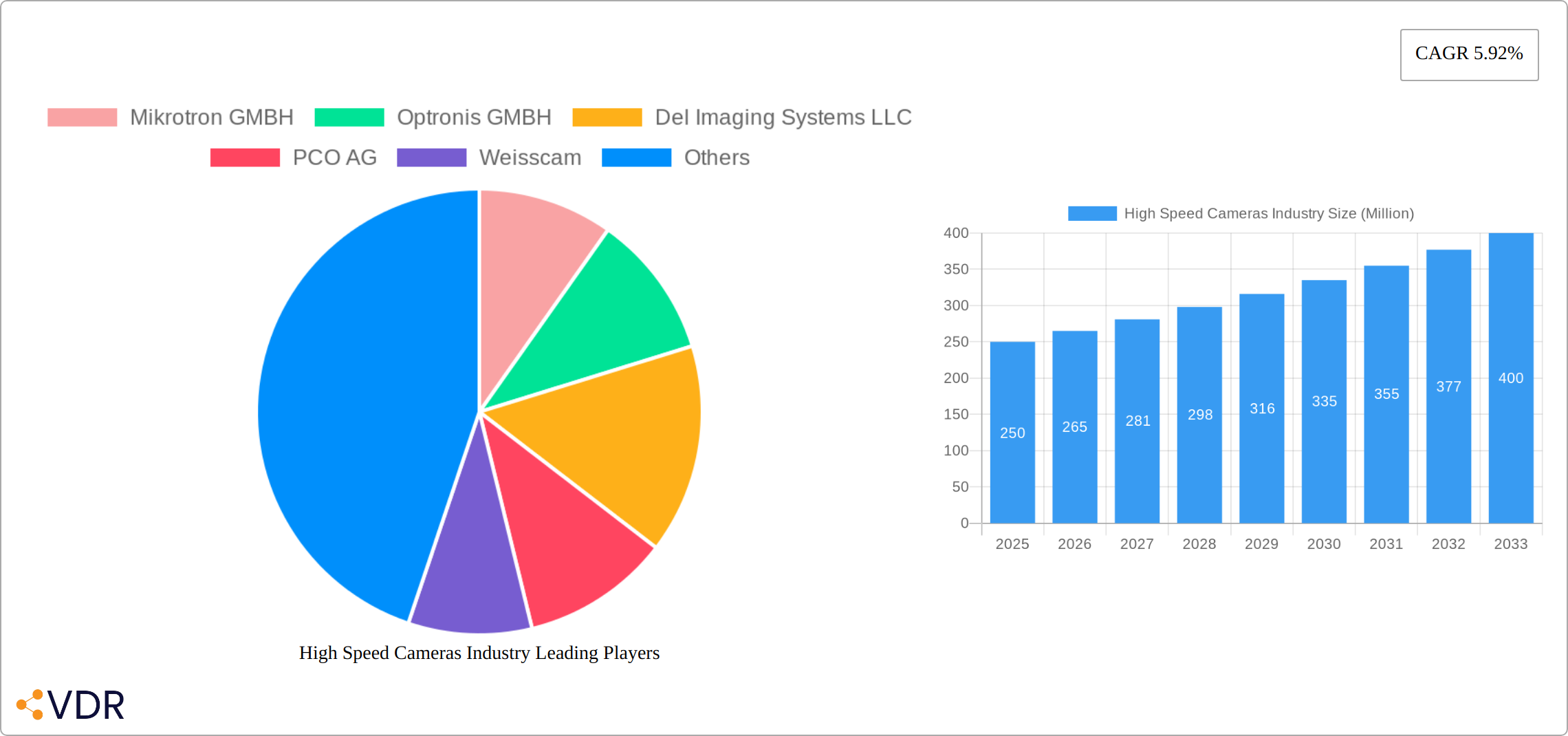

The high-speed camera market, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of 5.92% from 2025 to 2033. Several factors drive this expansion. Technological advancements leading to improved image sensors, faster frame rates, and enhanced image processing capabilities are key contributors. The increasing adoption of high-speed cameras across diverse applications, including entertainment and media (filmmaking, sports broadcasting), consumer electronics (advanced mobile cameras), research and development (scientific imaging, automotive testing), and industrial manufacturing (quality control, process optimization), fuels market growth. Furthermore, the rising demand for high-resolution imaging in military & defense, and aerospace sectors presents significant opportunities. The market is segmented by component (image sensors, lenses, batteries, memory systems), frame rate (categorized into ranges reflecting technological capabilities), and application. While the market faces restraints such as high initial investment costs and specialized technical expertise required for operation and maintenance, the overall market trajectory points towards continued expansion.

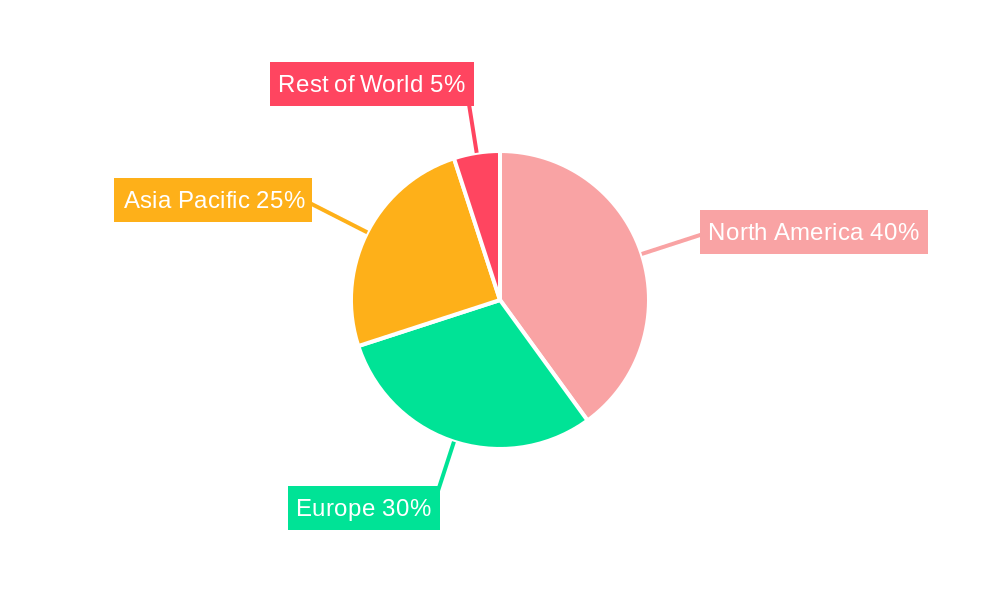

The North American market currently holds a significant share, followed by Europe and Asia Pacific. However, the Asia Pacific region is poised for substantial growth due to increasing industrialization and technological advancements in countries like China, Japan, and India. Competitive landscape is marked by established players such as Mikrotron GmbH, Optronis GmbH, and Vision Research Inc., alongside emerging companies. The ongoing innovation in sensor technology, coupled with the expanding applications in diverse sectors, ensures the high-speed camera market will remain a dynamic and lucrative space in the coming years. Strategic partnerships and mergers & acquisitions will likely play a role in shaping the future of this competitive industry.

High-Speed Cameras Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the high-speed cameras industry, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. This detailed study is crucial for industry professionals, investors, and researchers seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader imaging technology market, while the child market comprises various applications such as industrial manufacturing and scientific research.

High Speed Cameras Industry Market Dynamics & Structure

The high-speed camera market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, driven by advancements in image sensor technology and processing power, is a significant growth driver. Regulatory frameworks, particularly in industries like aerospace and defense, influence market dynamics. The market faces competition from alternative technologies, such as high-frame-rate video capture using standard cameras with enhanced processing, although high-speed cameras often provide superior resolution and capabilities for specific applications. End-user demographics are diverse, encompassing researchers, manufacturers, and entertainment professionals. M&A activity has been relatively limited (xx deals in the last 5 years), reflecting a cautious approach to consolidation in this specialized market.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share.

- Technological Innovation: Advancements in CMOS sensors, processing algorithms, and data storage are key drivers.

- Regulatory Landscape: Stringent regulations in specific sectors (e.g., aerospace) affect camera design and deployment.

- Competitive Substitutes: High-frame-rate video from standard cameras presents a competitive challenge, but at the cost of resolution and other performance factors.

- End-User Demographics: Diverse, including researchers, industrial manufacturers, sports organizations, and film production companies.

- M&A Activity: Limited in recent years, with xx major mergers and acquisitions reported since 2019.

High Speed Cameras Industry Growth Trends & Insights

The high-speed camera market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of [Insert Precise CAGR Percentage]% during the forecast period (2025-2033). Market valuation is estimated at [Insert Precise Market Value in USD] in 2025 and is anticipated to reach [Insert Precise Market Value in USD] by 2033. This expansion is fueled by a confluence of factors, including escalating adoption across diverse sectors, continuous technological advancements leading to enhanced performance and affordability, and shifting consumer preferences towards higher-quality video content. Specifically, breakthroughs in low-light sensitivity and sophisticated image processing capabilities are significantly broadening the applicability of these cameras. While developed economies currently dominate market penetration, emerging markets present substantial untapped potential, driven by accelerating industrialization and rising technological adoption rates. The increasing demand for high-speed imaging in various sectors, such as automotive, manufacturing, and research is expected to further propel market expansion.

Dominant Regions, Countries, or Segments in High Speed Cameras Industry

North America, particularly the United States, currently commands the largest market share, propelled by robust demand from sectors including aerospace, defense, and automotive manufacturing. Europe also maintains a significant market presence, driven by the concentration of leading manufacturers and prominent research institutions. Analyzing market segmentation by frame rate reveals that the "greater than 100 fps" category holds the most substantial share ( [Insert Precise Market Share Percentage]% in 2025), reflecting the burgeoning need for high-speed image capture in advanced applications. Within application segments, industrial manufacturing and research & development are key growth drivers. From a component perspective, image sensors constitute the largest portion of the market value.

- Key Regional Drivers: Robust industrial infrastructure in North America and Europe, substantial research and development investments, and continuous technological innovation.

- Country-Specific Factors: U.S. dominance is attributed to significant defense spending and advanced industrial automation; Europe and Asia boast strong research sectors fostering technological advancements.

- Leading Segments: Cameras with frame rates exceeding 100 fps dominate the market, followed by the 20,001-100 fps segment. Industrial manufacturing and research & development applications lead in application-based market share. Image sensors remain the predominant component.

High Speed Cameras Industry Product Landscape

High-speed cameras now offer a wide array of functionalities, from ultra-high frame rates (exceeding 1 million fps) to advanced features like high dynamic range (HDR) imaging and global shutter technology. These technological advancements provide superior image quality and sharper resolution even at extreme speeds. New models are incorporating larger memory buffers, enabling extended continuous recording. Many cameras integrate advanced image-processing capabilities, directly enhancing the quality and utility of recorded data. Unique selling propositions include specialized features such as thermographic capabilities and enhanced data analysis software integration.

Key Drivers, Barriers & Challenges in High Speed Cameras Industry

Key Drivers:

- Technological advancements in sensor technology, image processing, and data storage.

- Increasing demand for high-quality video content in various applications (entertainment, R&D).

- Rising industrial automation and the need for process optimization in manufacturing.

Challenges and Restraints:

- High initial investment costs for advanced cameras.

- Specialized skills are needed to operate and process the high volumes of data generated by these cameras.

- Potential supply chain disruptions affecting the availability of key components (e.g., sensors). The impact of such disruptions is difficult to quantify but could lead to xx% increase in average prices for certain high-demand models.

Emerging Opportunities in High Speed Cameras Industry

Significant growth opportunities exist in integrating high-speed cameras into diverse applications, including autonomous driving systems, medical imaging (e.g., minimally invasive surgery), sports analytics (e.g., biomechanics research), and scientific research (e.g., fluid dynamics). The development of more compact and user-friendly camera models will broaden market accessibility. Furthermore, the incorporation of AI-powered image analysis capabilities holds transformative potential, enabling automation and advanced data interpretation. Expanding into developing economies with significant growth potential in infrastructure development and manufacturing presents another compelling avenue for market expansion.

Growth Accelerators in the High Speed Cameras Industry Industry

Technological breakthroughs, particularly in sensor technology and artificial intelligence (AI) integration, are significant growth catalysts. Strategic partnerships between camera manufacturers and software providers are expanding application potential. Market expansion strategies into emerging economies, and increased application penetration in the automotive, medical, and sports industries, are important for long-term growth.

Key Players Shaping the High Speed Cameras Industry Market

- Mikrotron GMBH

- Optronis GMBH

- Del Imaging Systems LLC

- PCO AG

- Weisscam

- Photron LTD

- NAC Image Technology

- Ix-Cameras Inc

- Vision Research Inc

- Olympus Corporation

- Motion Capture Technologies

Notable Milestones in High Speed Cameras Industry Sector

- February 2022: OM Digital Solutions launched the OM System OM-1, a high-speed camera featuring a sensor capable of 120fps, expanding market reach within professional photography.

- March 2022: Photron USA introduced the Fastcam Nova R5-4K, touted as the world's fastest 4K UHD camera, demonstrating significant advancements in sensor technology and processing power.

- April 2022: Vision Research released the Phantom VEO 610, a more affordable high-speed camera model, making this technology accessible to a wider range of users.

In-Depth High Speed Cameras Industry Market Outlook

The high-speed camera market is poised for substantial and sustained growth, driven by continuous technological progress and the broadening adoption across diverse sectors. Strategic alliances focused on developing integrated solutions incorporating advanced software and AI capabilities will be instrumental in accelerating market penetration and expanding the applications of high-speed imaging. Ongoing innovation coupled with a focus on cost reduction will make high-speed camera technology more accessible to a broader range of users and industries, unlocking substantial future market potential. This includes exploring new applications and expanding into previously underserved markets.

High Speed Cameras Industry Segmentation

-

1. Component

- 1.1. Image Sensors

- 1.2. Lens

- 1.3. Battery

- 1.4. Memory Systems

-

2. Frame Rate

- 2.1. 1,000-5,000

- 2.2. 5,001-20,000

- 2.3. 20,001-100,000

- 2.4. Greater Than 100,000

-

3. Application

- 3.1. Entertainment & Media

- 3.2. Sports

- 3.3. Consumer Electronics

- 3.4. Research & Design

- 3.5. Industrial Manufacturing

- 3.6. Military & Defense

- 3.7. Aerospace

- 3.8. Other Applications

High Speed Cameras Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

High Speed Cameras Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of High Speed Camera in Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of High Speed Cameras

- 3.4. Market Trends

- 3.4.1. Intelligent Transportation Systems Initiative to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Image Sensors

- 5.1.2. Lens

- 5.1.3. Battery

- 5.1.4. Memory Systems

- 5.2. Market Analysis, Insights and Forecast - by Frame Rate

- 5.2.1. 1,000-5,000

- 5.2.2. 5,001-20,000

- 5.2.3. 20,001-100,000

- 5.2.4. Greater Than 100,000

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Entertainment & Media

- 5.3.2. Sports

- 5.3.3. Consumer Electronics

- 5.3.4. Research & Design

- 5.3.5. Industrial Manufacturing

- 5.3.6. Military & Defense

- 5.3.7. Aerospace

- 5.3.8. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Image Sensors

- 6.1.2. Lens

- 6.1.3. Battery

- 6.1.4. Memory Systems

- 6.2. Market Analysis, Insights and Forecast - by Frame Rate

- 6.2.1. 1,000-5,000

- 6.2.2. 5,001-20,000

- 6.2.3. 20,001-100,000

- 6.2.4. Greater Than 100,000

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Entertainment & Media

- 6.3.2. Sports

- 6.3.3. Consumer Electronics

- 6.3.4. Research & Design

- 6.3.5. Industrial Manufacturing

- 6.3.6. Military & Defense

- 6.3.7. Aerospace

- 6.3.8. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Image Sensors

- 7.1.2. Lens

- 7.1.3. Battery

- 7.1.4. Memory Systems

- 7.2. Market Analysis, Insights and Forecast - by Frame Rate

- 7.2.1. 1,000-5,000

- 7.2.2. 5,001-20,000

- 7.2.3. 20,001-100,000

- 7.2.4. Greater Than 100,000

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Entertainment & Media

- 7.3.2. Sports

- 7.3.3. Consumer Electronics

- 7.3.4. Research & Design

- 7.3.5. Industrial Manufacturing

- 7.3.6. Military & Defense

- 7.3.7. Aerospace

- 7.3.8. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Image Sensors

- 8.1.2. Lens

- 8.1.3. Battery

- 8.1.4. Memory Systems

- 8.2. Market Analysis, Insights and Forecast - by Frame Rate

- 8.2.1. 1,000-5,000

- 8.2.2. 5,001-20,000

- 8.2.3. 20,001-100,000

- 8.2.4. Greater Than 100,000

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Entertainment & Media

- 8.3.2. Sports

- 8.3.3. Consumer Electronics

- 8.3.4. Research & Design

- 8.3.5. Industrial Manufacturing

- 8.3.6. Military & Defense

- 8.3.7. Aerospace

- 8.3.8. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Image Sensors

- 9.1.2. Lens

- 9.1.3. Battery

- 9.1.4. Memory Systems

- 9.2. Market Analysis, Insights and Forecast - by Frame Rate

- 9.2.1. 1,000-5,000

- 9.2.2. 5,001-20,000

- 9.2.3. 20,001-100,000

- 9.2.4. Greater Than 100,000

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Entertainment & Media

- 9.3.2. Sports

- 9.3.3. Consumer Electronics

- 9.3.4. Research & Design

- 9.3.5. Industrial Manufacturing

- 9.3.6. Military & Defense

- 9.3.7. Aerospace

- 9.3.8. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. North America High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Kingdom

- 11.1.2 Germany

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World High Speed Cameras Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Latin America

- 13.1.2 Middle East

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Mikrotron GMBH

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Optronis GMBH

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Del Imaging Systems LLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 PCO AG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Weisscam

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Photron LTD

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NAC Image Technology

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Ix-Cameras Inc *List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Vision Research Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Olympus Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Motion Capture Technologies

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Mikrotron GMBH

List of Figures

- Figure 1: Global High Speed Cameras Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America High Speed Cameras Industry Revenue (Million), by Component 2024 & 2032

- Figure 11: North America High Speed Cameras Industry Revenue Share (%), by Component 2024 & 2032

- Figure 12: North America High Speed Cameras Industry Revenue (Million), by Frame Rate 2024 & 2032

- Figure 13: North America High Speed Cameras Industry Revenue Share (%), by Frame Rate 2024 & 2032

- Figure 14: North America High Speed Cameras Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America High Speed Cameras Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe High Speed Cameras Industry Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe High Speed Cameras Industry Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe High Speed Cameras Industry Revenue (Million), by Frame Rate 2024 & 2032

- Figure 21: Europe High Speed Cameras Industry Revenue Share (%), by Frame Rate 2024 & 2032

- Figure 22: Europe High Speed Cameras Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe High Speed Cameras Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High Speed Cameras Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Pacific High Speed Cameras Industry Revenue (Million), by Frame Rate 2024 & 2032

- Figure 29: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Frame Rate 2024 & 2032

- Figure 30: Asia Pacific High Speed Cameras Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World High Speed Cameras Industry Revenue (Million), by Component 2024 & 2032

- Figure 35: Rest of the World High Speed Cameras Industry Revenue Share (%), by Component 2024 & 2032

- Figure 36: Rest of the World High Speed Cameras Industry Revenue (Million), by Frame Rate 2024 & 2032

- Figure 37: Rest of the World High Speed Cameras Industry Revenue Share (%), by Frame Rate 2024 & 2032

- Figure 38: Rest of the World High Speed Cameras Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World High Speed Cameras Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World High Speed Cameras Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World High Speed Cameras Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High Speed Cameras Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global High Speed Cameras Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global High Speed Cameras Industry Revenue Million Forecast, by Frame Rate 2019 & 2032

- Table 4: Global High Speed Cameras Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global High Speed Cameras Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Latin America High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Middle East High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global High Speed Cameras Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 23: Global High Speed Cameras Industry Revenue Million Forecast, by Frame Rate 2019 & 2032

- Table 24: Global High Speed Cameras Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United States High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Canada High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global High Speed Cameras Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global High Speed Cameras Industry Revenue Million Forecast, by Frame Rate 2019 & 2032

- Table 30: Global High Speed Cameras Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Europe High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global High Speed Cameras Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 37: Global High Speed Cameras Industry Revenue Million Forecast, by Frame Rate 2019 & 2032

- Table 38: Global High Speed Cameras Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Japan High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global High Speed Cameras Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 45: Global High Speed Cameras Industry Revenue Million Forecast, by Frame Rate 2019 & 2032

- Table 46: Global High Speed Cameras Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 47: Global High Speed Cameras Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Latin America High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Middle East High Speed Cameras Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Speed Cameras Industry?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the High Speed Cameras Industry?

Key companies in the market include Mikrotron GMBH, Optronis GMBH, Del Imaging Systems LLC, PCO AG, Weisscam, Photron LTD, NAC Image Technology, Ix-Cameras Inc *List Not Exhaustive, Vision Research Inc, Olympus Corporation, Motion Capture Technologies.

3. What are the main segments of the High Speed Cameras Industry?

The market segments include Component, Frame Rate, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of High Speed Camera in Manufacturing Sector.

6. What are the notable trends driving market growth?

Intelligent Transportation Systems Initiative to Drive the Market.

7. Are there any restraints impacting market growth?

High Cost of High Speed Cameras.

8. Can you provide examples of recent developments in the market?

April 2022: The Phantom VEO 610 is Vision Study's latest "entry-level" high-speed camera. The camera has a maximum refresh speed of 218.970 fps in 320 x 12 and can record in HD 720p at 7420 pictures per second.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Speed Cameras Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Speed Cameras Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Speed Cameras Industry?

To stay informed about further developments, trends, and reports in the High Speed Cameras Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence