Key Insights

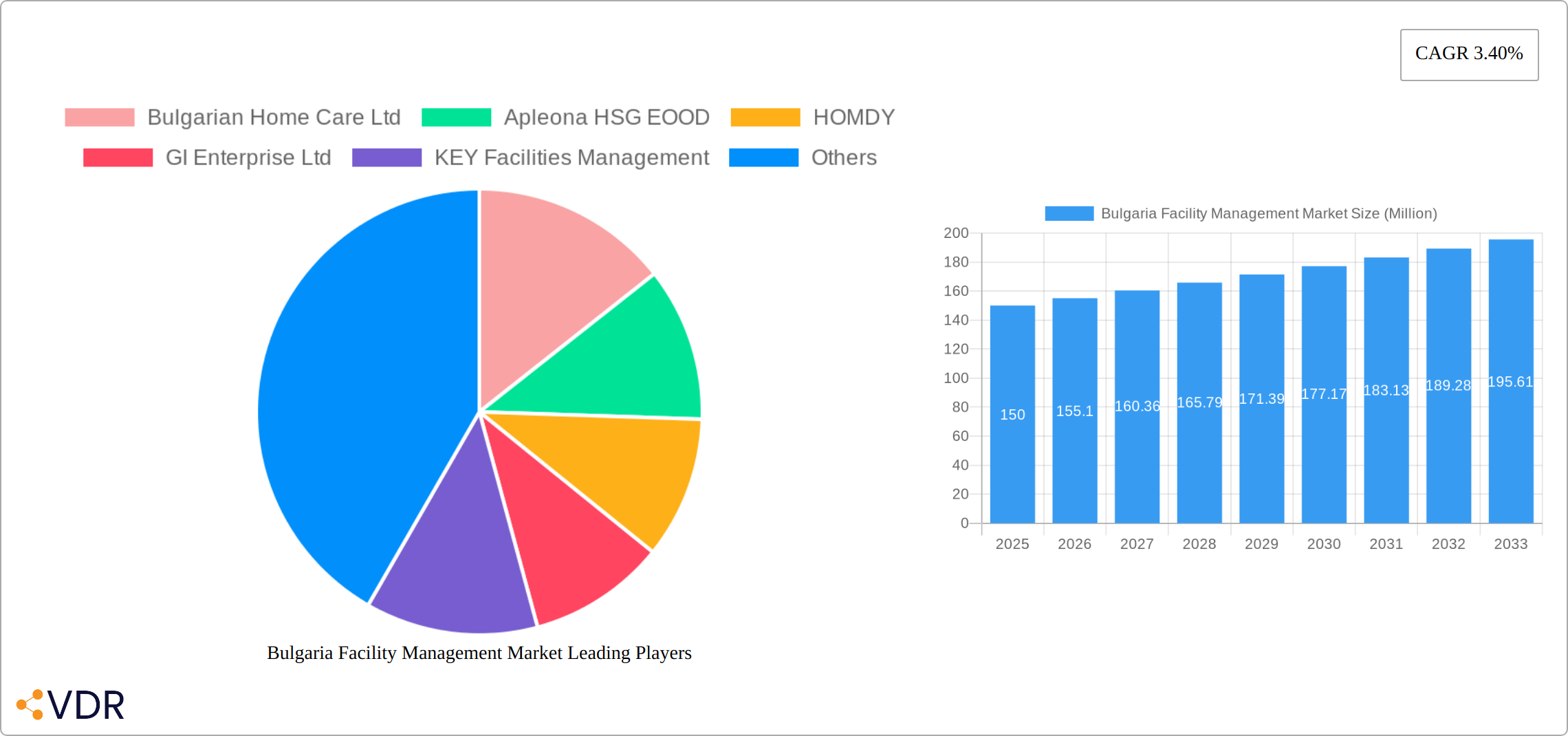

The Bulgarian facility management market, valued at approximately €150 million in 2025, is projected to experience steady growth, driven by increasing urbanization, a burgeoning commercial sector, and rising awareness of the benefits of outsourced facility services. A Compound Annual Growth Rate (CAGR) of 3.40% is anticipated from 2025 to 2033, indicating a market size exceeding €200 million by the end of the forecast period. Key drivers include the growing need for efficient operational management in commercial buildings, the expansion of the industrial sector requiring specialized maintenance services, and the increasing adoption of sustainable facility practices. The market is segmented by facility management type (in-house vs. outsourced), offering type (hard FM encompassing technical services and soft FM focusing on administrative and support services), and end-user sectors (commercial, institutional, public/infrastructure, industrial, and others). While the dominance of outsourced facility management is expected to continue, a notable trend is the increasing adoption of integrated facility management solutions, providing comprehensive services across various aspects of building operations. Growth is also propelled by the rising demand for smart building technologies and data-driven facility management strategies. This trend is expected to further accelerate market growth, especially within the commercial and institutional sectors. Leading companies like Apleona HSG EOOD, KEY Facilities Management, and Global Facility Services Ltd. are well-positioned to benefit from this expansion, leveraging their experience and expertise to meet the evolving needs of clients.

The competitive landscape is characterized by a mix of both large multinational corporations and smaller local players. While established players focus on maintaining their market share and expanding their service offerings, emerging companies are targeting niche markets and offering specialized services. However, potential restraints include economic fluctuations within Bulgaria, the availability of skilled labor, and the regulatory environment impacting the industry. The ongoing impact of global events, such as supply chain disruptions, could also potentially influence growth, but the overall outlook for the Bulgarian facility management market remains positive, with considerable opportunities for growth across all market segments. This positive outlook is strengthened by the nation's ongoing infrastructural development and its increasing alignment with modern facility management practices prevalent in the broader European market.

Bulgaria Facility Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Bulgaria Facility Management Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market is segmented by facility management type (in-house vs. outsourced), offering type (hard FM vs. soft FM), and end-user (commercial, institutional, public/infrastructure, industrial, others). The report features detailed analysis of key players, including Bulgarian Home Care Ltd, Apleona HSG EOOD, HOMDY, GI Enterprise Ltd, KEY Facilities Management, Global Facility Services Ltd, OKIN Facility, Landmark Property Management Jsc, First Facility Bulgaria EOOD, and Mundus Services AD. The total market size is projected to reach xx Million by 2033.

Bulgaria Facility Management Market Dynamics & Structure

The Bulgarian facility management market is characterized by a moderately concentrated structure, with a few large players and numerous smaller firms. Technological innovation, driven by the adoption of smart building technologies and digital solutions, is a key driver of growth. The regulatory framework, while evolving, is generally supportive of market expansion. The market faces competition from in-house facility management teams and also experiences substitution pressures from new technological solutions. End-user demographics show a shift towards more sophisticated demands for sustainability, efficiency and cost optimization. M&A activity has been moderate in recent years with xx deals recorded between 2019-2024, representing a xx% increase compared to the previous five-year period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Adoption of smart building technologies, IoT, and AI is driving efficiency gains and creating new service offerings.

- Regulatory Framework: Supportive but evolving, with increasing focus on sustainability and energy efficiency.

- Competitive Substitutes: In-house teams, specialized service providers, and technological solutions pose competitive threats.

- End-User Demographics: Growing demand for integrated and sustainable facility management solutions from commercial and institutional sectors.

- M&A Activity: xx deals recorded between 2019-2024, indicating moderate consolidation.

Bulgaria Facility Management Market Growth Trends & Insights

The Bulgarian facility management market demonstrated robust growth, achieving a Compound Annual Growth Rate (CAGR) of X% during 2019-2024, primarily fueled by increased outsourcing from commercial and industrial entities. While market penetration of outsourced facility management remains relatively low compared to Western European counterparts, this presents significant untapped potential. Technological advancements, such as the Internet of Things (IoT) and Artificial Intelligence (AI), are revolutionizing the sector, enhancing operational efficiency and spawning innovative service offerings. A growing preference for integrated, data-driven solutions emphasizing transparency and cost control further shapes market demand. This positive trajectory is projected to continue, with a forecasted CAGR of Y% from 2025 to 2033, driven by the expanding commercial real estate sector, government investments in infrastructure modernization, and a heightened awareness of sustainable building practices. The market is anticipated to reach Z Million by 2033.

Dominant Regions, Countries, or Segments in Bulgaria Facility Management Market

The Sofia region commands a dominant position in the Bulgarian facility management market, capturing X% of total market revenue in 2024. This prominence stems from the concentration of commercial and institutional buildings within the capital. Growth is propelled by a thriving commercial real estate sector, escalating demand for outsourced services, and substantial government investments in infrastructure projects. The Outsourced Facility Management segment holds the largest market share, reflecting a preference for cost optimization and specialized expertise. Within service offerings, Hard FM currently surpasses Soft FM, a testament to the prevalent demand for traditional facility services such as maintenance and repairs. However, the Soft FM segment is expected to experience significant growth in the coming years driven by an increasing focus on employee well-being and workplace experience.

- Key Drivers in Sofia: High concentration of commercial and institutional buildings, substantial foreign direct investment, and ongoing infrastructural development initiatives.

- Market Share Distribution: Sofia maintains an X% market share, with promising expansion opportunities in other key cities such as Plovdiv and Varna.

- Outsourced Facility Management: Represents the fastest-growing segment, primarily driven by the pursuit of efficiency and cost-effectiveness.

- Hard FM Dominance: Maintains a leading market share due to consistent demand for core services such as preventative and reactive maintenance, and repairs.

- Commercial Sector Leadership: The commercial sector remains the leading end-user segment, characterized by higher adoption rates of outsourced facility management services.

Bulgaria Facility Management Market Product Landscape

The market features a range of services, from traditional hard FM (maintenance, repairs, cleaning) to integrated soft FM solutions (catering, security, landscaping). Technological advancements are enabling the integration of IoT, AI, and predictive analytics into facility management systems, enhancing efficiency and reducing operational costs. Unique selling propositions frequently center on integrated solutions, sustainable practices, and data-driven insights. New products focus on predictive maintenance and proactive issue resolution to reduce downtime and enhance resource optimization.

Key Drivers, Barriers & Challenges in Bulgaria Facility Management Market

Key Drivers: The market is propelled by the increasing demand for outsourced facility management services; a growing awareness of sustainability and environmental responsibility; advancements in technologies such as IoT, AI, and predictive maintenance; and government initiatives aimed at promoting energy efficiency and sustainable building practices.

Challenges: Significant challenges include a limited skilled workforce, competition from established international players, cost pressures exerted by clients, and inconsistencies in the regulatory framework across various regions. Furthermore, macroeconomic factors such as supply chain disruptions significantly impact costs and project timelines. The cumulative effect of these challenges is estimated to reduce projected market growth by X%.

Emerging Opportunities in Bulgaria Facility Management Market

Significant growth opportunities abound in the Bulgarian facility management market. These include untapped markets in smaller cities across the country, the increasing demand for comprehensive, sustainable solutions, opportunities within the burgeoning renewable energy sector, and the widespread adoption of smart building technologies. Specialized niche offerings catering to specific sectors, such as healthcare and data centers, present additional avenues for market expansion. The focus on integrated facility management solutions encompassing both Hard and Soft FM services will be a key driver of growth.

Growth Accelerators in the Bulgaria Facility Management Market Industry

Technological advancements in areas such as IoT, AI, and predictive maintenance significantly boost efficiency and drive market expansion. Strategic partnerships between facility management companies and technology providers create synergies, offering comprehensive solutions to clients. Market expansion strategies focusing on untapped regional markets (e.g. rural areas) and niche services create further growth opportunities.

Key Players Shaping the Bulgaria Facility Management Market Market

- Bulgarian Home Care Ltd

- Apleona HSG EOOD

- HOMDY

- GI Enterprise Ltd

- KEY Facilities Management

- Global Facility Services Ltd

- OKIN Facility

- Landmark Property Management Jsc

- First Facility Bulgaria EOOD

- Mundus Services AD

Notable Milestones in Bulgaria Facility Management Market Sector

- January 2021: First Facility Bulgaria EOOD secured the facility management contract for Synergy Tower, Sofia – a 50,000 sq.m. LEED-certified green building. This landmark achievement underscores the growing adoption of sustainable practices and a clear preference for technologically advanced facilities within the market.

- [Add other relevant milestones here with dates and brief descriptions. Include quantifiable achievements whenever possible (e.g., contract values, number of buildings managed, etc.)]

In-Depth Bulgaria Facility Management Market Market Outlook

The Bulgarian facility management market is poised for sustained growth, driven by the convergence of technological advancements, rising demand for outsourced services, and government initiatives. Opportunities lie in the expansion of smart building technologies, adoption of sustainable practices, and focus on emerging sectors such as renewable energy. Strategic partnerships and investments in workforce development will be crucial for realizing the market's full potential. The market shows robust future potential, especially within smart building integrations and the adoption of advanced technologies.

Bulgaria Facility Management Market Segmentation

-

1. Type of Facility Management Type

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Mangement

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

Bulgaria Facility Management Market Segmentation By Geography

- 1. Bulgaria

Bulgaria Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of FM; Increasing Investments on Infrastructure Developments

- 3.3. Market Restrains

- 3.3.1. Diminishing Profit Margins and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. Maintenance of Building Installations Segment to hold significant share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bulgaria Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management Type

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Mangement

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Bulgaria

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bulgarian Home Care Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apleona HSG EOOD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HOMDY

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GI Enterprise Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KEY Facilities Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Global Facility Services Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OKIN Facility

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Landmark Property Management Jsc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 First Facility Bulgaria EOOD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mundus Services AD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bulgarian Home Care Ltd

List of Figures

- Figure 1: Bulgaria Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bulgaria Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Bulgaria Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bulgaria Facility Management Market Revenue Million Forecast, by Type of Facility Management Type 2019 & 2032

- Table 3: Bulgaria Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: Bulgaria Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Bulgaria Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Bulgaria Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Bulgaria Facility Management Market Revenue Million Forecast, by Type of Facility Management Type 2019 & 2032

- Table 8: Bulgaria Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 9: Bulgaria Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Bulgaria Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bulgaria Facility Management Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Bulgaria Facility Management Market?

Key companies in the market include Bulgarian Home Care Ltd, Apleona HSG EOOD, HOMDY, GI Enterprise Ltd, KEY Facilities Management, Global Facility Services Ltd, OKIN Facility, Landmark Property Management Jsc, First Facility Bulgaria EOOD, Mundus Services AD.

3. What are the main segments of the Bulgaria Facility Management Market?

The market segments include Type of Facility Management Type, Offering Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of FM; Increasing Investments on Infrastructure Developments.

6. What are the notable trends driving market growth?

Maintenance of Building Installations Segment to hold significant share in the market.

7. Are there any restraints impacting market growth?

Diminishing Profit Margins and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

January 2021 - First Facility Bulgaria EOOD takes over facility management for Synergy Tower, Sofia. Synergy Tower is a multifunctional office building with a TBA of approx. 50 000 sq.m. It is a sustainable next-generation green building that meets the latest technological and architectural trends and follows all LEED certifications requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bulgaria Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bulgaria Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bulgaria Facility Management Market?

To stay informed about further developments, trends, and reports in the Bulgaria Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence