Key Insights

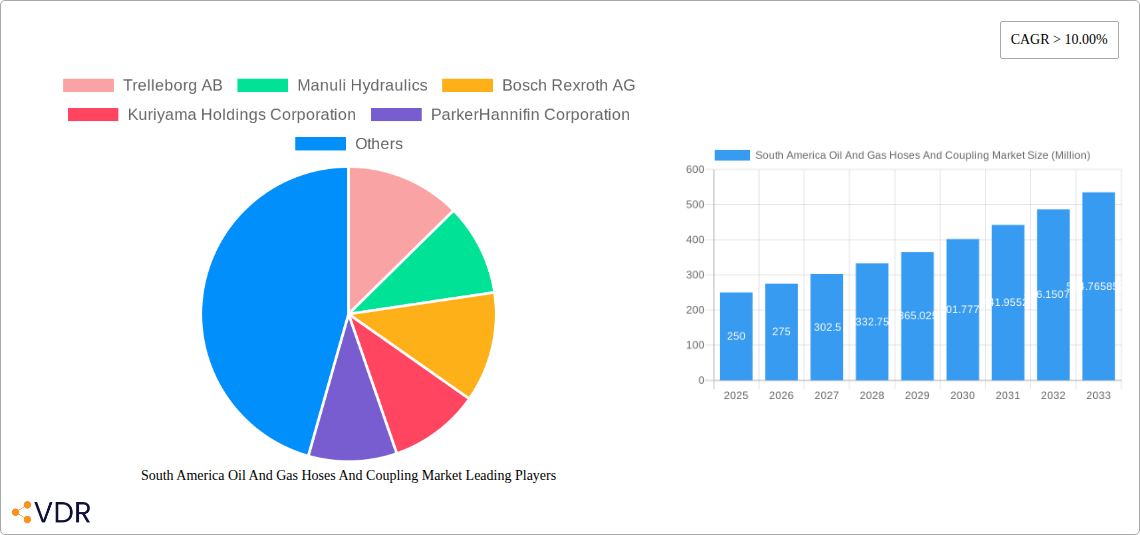

The South American oil and gas hoses and coupling market is experiencing robust growth, driven by increasing oil and gas exploration and production activities across the region, particularly in Brazil and Argentina. The market's compound annual growth rate (CAGR) exceeding 10% from 2019 to 2024 indicates significant expansion. This growth is fueled by rising demand for efficient and reliable equipment in upstream, midstream, and downstream operations. Upstream activities, such as drilling and well completion, are major contributors, demanding specialized hoses and couplings capable of withstanding harsh conditions. Midstream operations, focusing on transportation and storage, also contribute significantly to market demand, requiring durable and leak-proof connections. Finally, the downstream sector, encompassing refining and processing, necessitates hoses and couplings designed to handle various fluids and pressures. While specific market size figures for 2025 are unavailable, extrapolating from the 10%+ CAGR and considering the ongoing investments in South American oil and gas infrastructure, a conservative estimate places the 2025 market value at approximately $250 million. This figure is expected to continue its upward trajectory, driven by ongoing exploration and expansion in both conventional and unconventional resources. Challenges such as price volatility in the oil and gas sector and potential regulatory changes could act as restraints, but the overall growth outlook remains positive.

South America Oil And Gas Hoses And Coupling Market Market Size (In Million)

The market is segmented by application (upstream, midstream, and downstream), mirroring the operational phases of the oil and gas industry. Key players such as Trelleborg AB, Manuli Hydraulics, and Parker Hannifin Corporation dominate the landscape, leveraging their technological expertise and global reach to cater to this growing market. Regional variations exist, with Brazil and Argentina representing the largest market segments in South America. Future market growth will be influenced by government policies encouraging investment in oil and gas exploration, the successful development of new oil and gas fields, and the adoption of advanced materials and technologies in hose and coupling manufacturing. Increased focus on safety and environmental regulations will also play a crucial role in shaping market trends over the forecast period (2025-2033).

South America Oil And Gas Hoses And Coupling Market Company Market Share

South America Oil & Gas Hoses and Coupling Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South America Oil & Gas Hoses and Coupling market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the historical period (2019-2024), base year (2025), and forecasts the market's trajectory until 2033. This report delves into market dynamics, growth trends, regional performance, product landscapes, and key players shaping this crucial sector of the South American oil and gas industry. The market is segmented by application (Upstream, Midstream, Downstream), providing granular understanding of specific growth drivers and challenges within each segment. The report also examines the impact of recent events on market dynamics, including the hose-related production interruption experienced by Enauta in Brazil. Market size is presented in million units.

South America Oil And Gas Hoses And Coupling Market Market Dynamics & Structure

The South American oil and gas hoses and coupling market is characterized by a moderately concentrated landscape with several major international and regional players competing for market share. Technological innovation, primarily focused on enhancing hose durability, flexibility, and resistance to extreme pressure and temperatures, is a key driver. Stringent regulatory frameworks concerning safety and environmental protection significantly influence product design and manufacturing processes. The market also faces competition from substitute materials and technologies, although their market penetration remains limited. End-user demographics are shaped by the distribution of oil and gas activities across different countries in South America, with Brazil and Colombia currently dominating the market. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with a recorded xx M&A deals in the past five years, indicating a focus on organic growth among key players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Driven by the need for improved durability, flexibility, and resistance to extreme conditions.

- Regulatory Framework: Stringent safety and environmental regulations impact product standards.

- Competitive Substitutes: Limited impact from substitute materials so far.

- End-User Demographics: Concentrated in Brazil and Colombia, reflecting the distribution of oil & gas operations.

- M&A Trends: Relatively low M&A activity in recent years (xx deals in the past 5 years).

South America Oil And Gas Hoses And Coupling Market Growth Trends & Insights

The South American oil and gas hoses and coupling market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is attributed to increased oil and gas exploration and production activities, particularly in offshore and deepwater projects, coupled with infrastructural investments across the region. Adoption rates have steadily increased with improvements in product technology and reliability, and technological disruptions, such as the introduction of more robust and lighter materials, are driving market expansion. Consumer behavior shifts are mirroring the global trend towards prioritizing efficiency, sustainability, and safety in oil and gas operations. We project a CAGR of xx% during the forecast period (2025-2033), leading to a market size of xx million units by 2033. Market penetration is expected to increase significantly in less developed areas as oil and gas exploration expands.

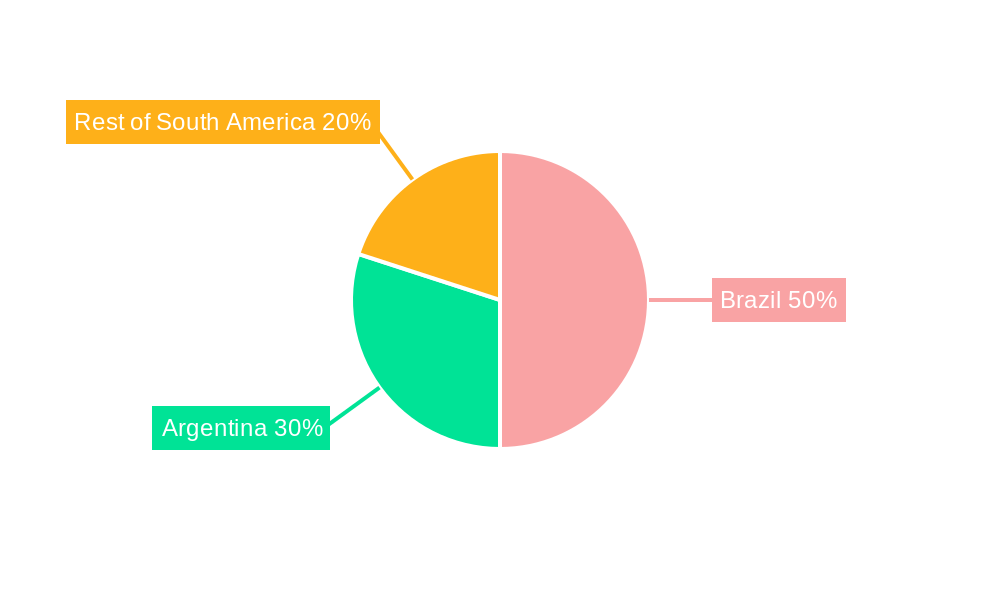

Dominant Regions, Countries, or Segments in South America Oil And Gas Hoses And Coupling Market

Brazil holds the dominant position in the South American oil and gas hoses and coupling market, accounting for approximately xx% of the total market share in 2024. This dominance stems from its substantial oil and gas reserves, robust exploration and production activities, and significant investments in offshore projects. Colombia and Argentina follow as key contributors, driven by their own domestic oil and gas production.

- Key Drivers in Brazil:

- Large oil and gas reserves and ongoing exploration activities (particularly offshore)

- Government support for energy infrastructure development

- Significant investments in deepwater and pre-salt exploration and production

- Key Drivers in Colombia:

- Growing domestic oil and gas production

- Investments in pipeline and refinery infrastructure

- Key Drivers in Argentina:

- Renewed focus on domestic energy production

- Government initiatives promoting energy independence

- Segment Dominance: The Upstream segment constitutes the largest portion (xx%) of the market, reflecting the significant demand for hoses and couplings in exploration and production activities.

South America Oil And Gas Hoses And Coupling Market Product Landscape

The market offers a diverse range of hoses and couplings, tailored to meet the specific demands of different applications and operating conditions. Innovations focus on enhanced durability, improved resistance to corrosion and high temperatures, and lighter-weight designs to reduce handling challenges and increase efficiency. Unique selling propositions include enhanced safety features, improved flow rates, and extended service life. Technological advancements include the adoption of advanced materials like high-performance polymers and specialized alloys to withstand harsh environments and improve overall performance.

Key Drivers, Barriers & Challenges in South America Oil And Gas Hoses And Coupling Market

Key Drivers: Increased exploration and production activities in both onshore and offshore fields; rising investments in oil and gas infrastructure; growing demand for improved safety and efficiency in oil and gas operations; stringent environmental regulations driving the adoption of eco-friendly products; and technological advancements improving hose and coupling performance.

Key Challenges: Fluctuations in oil and gas prices; geopolitical instability; potential supply chain disruptions; infrastructure limitations in certain regions; and the need for continuous innovation to meet evolving industry requirements. Supply chain disruptions have led to xx% increase in costs in the last year, creating a significant challenge for market players.

Emerging Opportunities in South America Oil And Gas Hoses And Coupling Market

Emerging opportunities lie in the expansion of oil and gas activities into new and remote areas, requiring highly durable and reliable hoses and couplings. Innovative applications, particularly in deepwater and unconventional drilling operations, will drive demand for specialized products. The growing focus on sustainable practices presents opportunities for eco-friendly materials and designs. Finally, the development of new technologies in areas such as leak detection and predictive maintenance will significantly influence market growth.

Growth Accelerators in the South America Oil And Gas Hoses And Coupling Market Industry

The long-term growth of the South American oil and gas hoses and coupling market will be significantly accelerated by strategic partnerships between hose manufacturers and oil and gas companies. Technological breakthroughs leading to improved product performance, durability, and safety will also significantly contribute. This will further enhance the efficiency of oil and gas operations, and government policies supporting the growth of the oil and gas industry will provide a strong foundation for continued expansion.

Key Players Shaping the South America Oil And Gas Hoses And Coupling Market Market

- Trelleborg AB

- Manuli Hydraulics

- Bosch Rexroth AG

- Kuriyama Holdings Corporation

- ParkerHannifin Corporation

- Continental AG

- W W Grainger Inc

- Gates Corporation

- Jason Industrial Inc

- Eaton Corporation Plc

- List Not Exhaustive

Notable Milestones in South America Oil And Gas Hoses And Coupling Market Sector

- September 2022: Enauta's production interruption at the Atlanta field highlights the critical role of reliable hoses and couplings in maintaining operational efficiency. This incident underscored the need for high-quality, durable products capable of withstanding the demanding conditions of offshore operations.

In-Depth South America Oil And Gas Hoses And Coupling Market Market Outlook

The South American oil and gas hoses and coupling market is poised for continued growth, driven by sustained investment in exploration and production, and the increasing demand for robust and reliable equipment. Strategic partnerships, technological innovations, and the expansion of oil and gas activities into new regions offer significant opportunities for market players. The focus on enhanced safety, efficiency, and sustainability will continue shaping product development and market dynamics. This presents a promising outlook for companies that can effectively adapt to evolving industry demands and technological advancements.

South America Oil And Gas Hoses And Coupling Market Segmentation

-

1. Application

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Oil And Gas Hoses And Coupling Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Oil And Gas Hoses And Coupling Market Regional Market Share

Geographic Coverage of South America Oil And Gas Hoses And Coupling Market

South America Oil And Gas Hoses And Coupling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Midstream is Expected to Become a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Brazil South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Argentina South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Colombia South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of South America South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Trelleborg AB

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Manuli Hydraulics

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bosch Rexroth AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kuriyama Holdings Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ParkerHannifin Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 W W Grainger Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gates Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Jason Industrial Inc *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Eaton Corporation Plc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Trelleborg AB

List of Figures

- Figure 1: South America Oil And Gas Hoses And Coupling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Oil And Gas Hoses And Coupling Market Share (%) by Company 2025

List of Tables

- Table 1: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 5: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 17: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 26: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 27: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 29: South America Oil And Gas Hoses And Coupling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Oil And Gas Hoses And Coupling Market?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the South America Oil And Gas Hoses And Coupling Market?

Key companies in the market include Trelleborg AB, Manuli Hydraulics, Bosch Rexroth AG, Kuriyama Holdings Corporation, ParkerHannifin Corporation, Continental AG, W W Grainger Inc, Gates Corporation, Jason Industrial Inc *List Not Exhaustive, Eaton Corporation Plc.

3. What are the main segments of the South America Oil And Gas Hoses And Coupling Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Midstream is Expected to Become a Significant Segment.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2022: Enauta, a Brazilian oil and gas company, resumed production through well 7-ATL-2HP-RJS at the Atlanta field in the Santos Basin offshore Brazil. Enauta resumed output from the field in August following a planned downtime. However, on August 26, it announced that a hose problem had preventively interrupted production in the field.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Oil And Gas Hoses And Coupling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Oil And Gas Hoses And Coupling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Oil And Gas Hoses And Coupling Market?

To stay informed about further developments, trends, and reports in the South America Oil And Gas Hoses And Coupling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence