Key Insights

The Mexico Combined Heat and Power (CHP) market is projected for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. In the base year of 2025, the market size was valued at approximately $32.02 billion. This growth is fueled by escalating energy demands, a strong commitment to energy efficiency, and the imperative to reduce carbon footprints. Key growth drivers include government incentives for cleaner energy, the economic advantages of generating electricity and heat concurrently, and the increasing need for dependable and cost-efficient energy in industrial and commercial settings. The industrial and utilities sector is expected to lead market consumption due to its high energy requirements and the inherent benefits of CHP systems. Residential and commercial sectors will also experience substantial adoption as awareness of economic and environmental advantages increases. Natural gas is anticipated to remain the primary fuel source, offering a cleaner and cost-effective alternative to traditional fuels, although advancements in other fuel technologies will diversify the market.

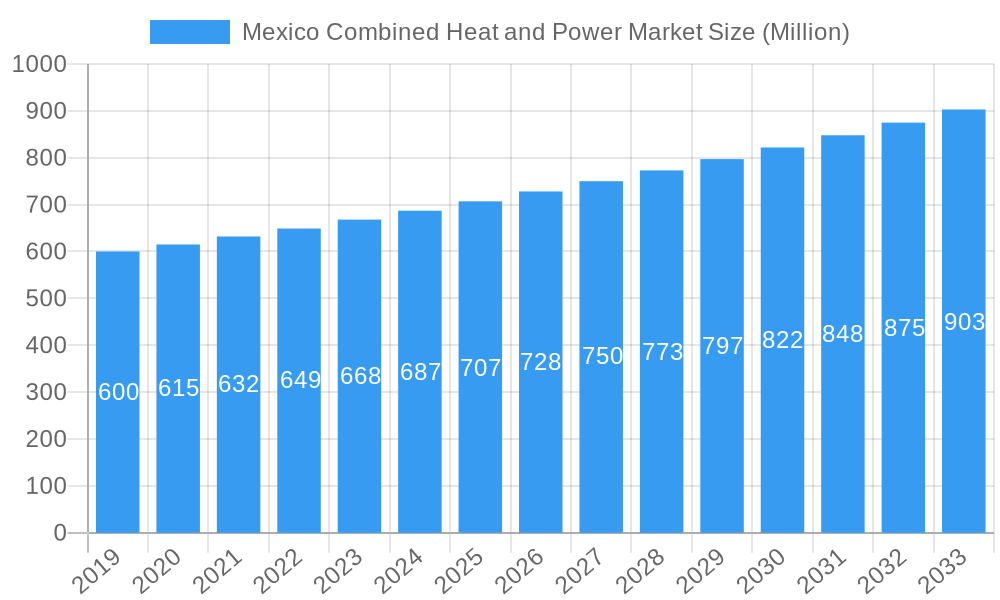

Mexico Combined Heat and Power Market Market Size (In Billion)

The market's development is supported by prominent global and regional players, including Siemens AG, General Electric Company, and Mitsubishi Electric Corporation, alongside local companies like Santos CMI. These entities are actively investing in technological advancements and market expansion to meet the evolving demands of the Mexican market. Emerging trends such as the deployment of smaller, modular CHP units for decentralized power generation and the integration of advanced digital technologies for performance optimization are defining the market's future. Potential restraints include the substantial initial capital investment for CHP system installation and the dynamic nature of regulatory frameworks. Nevertheless, the inherent advantages of energy security, cost savings, and environmental sustainability are expected to drive sustained market growth, positioning Mexico as a crucial market for CHP solutions.

Mexico Combined Heat and Power Market Company Market Share

This comprehensive report offers an in-depth analysis of the Mexico Combined Heat and Power (CHP) Market, detailing its dynamics, growth trajectory, regional influences, product innovations, and the key stakeholders driving its future. Designed for SEO optimization and industry relevance, this report incorporates high-volume keywords to enhance visibility for professionals seeking critical insights into the Mexican CHP landscape. An examination of parent and child markets provides a holistic understanding of this expanding sector, with all monetary values presented in billions.

Mexico Combined Heat and Power Market Market Dynamics & Structure

The Mexico Combined Heat and Power (CHP) Market exhibits a moderate to high concentration, with established global players like Siemens AG, General Electric Company, and MAN Energy Solutions holding significant influence. Technological innovation is a primary driver, fueled by the increasing demand for energy efficiency and reduced emissions in both industrial and residential applications. Capstone Turbine Corporation is a notable innovator in micro-CHP solutions. Regulatory frameworks, primarily driven by government initiatives to decarbonize the energy sector and promote distributed generation, are fostering market growth. The Mexican Ministry of Energy (SENER) plays a crucial role in shaping these policies. Competitive product substitutes include traditional power generation methods and renewable energy sources, though CHP’s dual-output advantage offers a unique proposition. End-user demographics are shifting, with growing awareness and adoption among commercial and industrial sectors seeking cost savings and operational reliability. Mergers and acquisitions (M&A) activity, while not as robust as in mature markets, is present, with strategic alliances and small-scale acquisitions by companies like ABB Ltd and Viessmann Werke GmbH & Co KG aimed at expanding their regional presence and technological portfolios. Innovation barriers include high initial capital expenditure and the need for robust grid infrastructure integration.

Mexico Combined Heat and Power Market Growth Trends & Insights

The Mexico Combined Heat and Power (CHP) Market is poised for substantial expansion, driven by a confluence of economic imperatives, technological advancements, and supportive government policies. Over the study period of 2019–2033, the market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5%, reaching an estimated market size of $1,850 Million in 2025 and projecting a future market value of $2,900 Million by 2033. This growth is underpinned by an increasing adoption rate across various applications, from large-scale industrial processes requiring significant thermal energy to the burgeoning demand for efficient heating and cooling solutions in the residential and commercial sectors. Technological disruptions are primarily centered around the development of more efficient and smaller-scale CHP units, making them accessible to a wider range of end-users. Innovations in fuel flexibility, particularly the enhanced utilization of natural gas, along with advancements in waste-to-energy CHP systems, are key differentiators. Consumer behavior shifts are evident, with an increasing preference for energy independence, cost optimization, and environmental responsibility influencing purchasing decisions. The market penetration of CHP systems is gradually increasing, particularly in regions with high industrial activity and a growing demand for sustainable energy solutions. The base year of 2025 signifies a pivotal point, with established adoption trends and emerging opportunities setting the stage for accelerated growth throughout the forecast period. Furthermore, the integration of smart grid technologies and the development of advanced control systems for CHP units are enhancing their operational efficiency and responsiveness to grid demands. The ongoing push for decentralized energy generation further bolsters the relevance and demand for CHP solutions. The inherent economic benefits of CHP, such as reduced energy bills and improved operational uptime, are significant drivers for its adoption in competitive industries.

Dominant Regions, Countries, or Segments in Mexico Combined Heat and Power Market

Within the Mexico Combined Heat and Power (CHP) Market, the Industrial & Utilities segment, particularly the Natural Gas fuel type, emerges as the dominant force driving growth and market penetration. This dominance is fueled by several interconnected factors, including the sheer energy demand from heavy industries such as manufacturing, petrochemicals, and food processing, which require substantial and consistent thermal energy for their operations. These industries are increasingly recognizing the significant operational cost savings and improved energy security that CHP systems offer. The availability and relatively stable pricing of natural gas in Mexico further solidify its position as the preferred fuel source, making it economically attractive for large-scale CHP installations.

Industrial & Utilities Application: This segment accounts for an estimated 70% of the total market share in 2025. Key sub-sectors driving this include:

- Manufacturing: Textile, automotive, and chemical manufacturing plants are prime adopters.

- Petrochemicals: Continuous heat and steam requirements make CHP ideal.

- Food & Beverage: Critical for process heating, cooling, and sterilization.

- Utilities: Cogeneration plants supplying both electricity and heat to local grids.

Natural Gas Fuel Type: Accounting for approximately 85% of the fuel mix in the CHP market.

- Abundant Supply: Mexico possesses significant domestic natural gas reserves.

- Environmental Benefits: Cleaner burning compared to coal and oil, aligning with emission reduction goals.

- Cost-Effectiveness: Historically, a more economical fuel option for large-scale energy generation.

The Commercial segment is experiencing robust growth, driven by demand from hospitals, hotels, and large commercial complexes seeking efficient heating, cooling, and electricity. The Residential segment, while smaller in terms of individual unit capacity, is showing promise due to increasing interest in smart home technologies and energy-efficient building designs, particularly in new constructions.

Geographically, states with a strong industrial base such as Nuevo León, State of Mexico, and Jalisco are leading the adoption of CHP technologies. Economic policies promoting industrial development, coupled with investments in energy infrastructure, create a conducive environment for CHP deployment in these regions. Growth potential in these dominant regions is further amplified by ongoing modernization efforts in industrial facilities and a growing awareness of the environmental benefits associated with reduced energy waste through CHP.

Mexico Combined Heat and Power Market Product Landscape

The product landscape of the Mexico Combined Heat and Power (CHP) Market is characterized by ongoing innovation focused on enhancing efficiency, reducing emissions, and expanding application versatility. Key product developments include advancements in gas turbine and engine technologies for larger industrial applications, offering higher power output and improved thermal recovery rates. For the commercial and residential sectors, there's a notable surge in the development of compact, modular, and highly efficient micro-CHP units. These systems, often powered by natural gas or biofuels, are designed for ease of installation and integration into existing building infrastructure, delivering simultaneous electricity and heat with exceptional energy efficiency. Mitsubishi Electric Corporation is contributing with advanced control systems for optimized CHP operation. ABB Ltd's offerings focus on integrated solutions for energy management and grid connection.

Key Drivers, Barriers & Challenges in Mexico Combined Heat and Power Market

Key Drivers:

- Energy Efficiency Mandates: Government initiatives and corporate sustainability goals are pushing for more efficient energy utilization, making CHP an attractive solution.

- Cost Savings: Reduced operational expenses through lower electricity and thermal energy bills for end-users are a primary economic driver.

- Energy Security & Reliability: CHP systems provide a degree of energy independence, crucial for critical infrastructure and industrial operations.

- Environmental Regulations: Increasing focus on reducing greenhouse gas emissions and improving air quality favors cleaner energy generation technologies like natural gas-based CHP.

- Technological Advancements: Development of more efficient, reliable, and cost-effective CHP systems is expanding market accessibility.

Barriers & Challenges:

- High Upfront Capital Investment: The initial cost of installing CHP systems can be substantial, posing a barrier for smaller businesses and residential consumers.

- Regulatory Complexities: Navigating permits, grid connection standards, and varying local regulations can be challenging.

- Limited Awareness & Expertise: A lack of widespread understanding of CHP benefits and insufficient skilled labor for installation and maintenance can hinder adoption.

- Competition from Traditional Energy Sources: Established and often cheaper conventional energy sources can be a significant competitive hurdle.

- Infrastructure Limitations: In some regions, inadequate grid infrastructure for distributed generation can pose integration challenges.

Emerging Opportunities in Mexico Combined Heat and Power Market

Emerging opportunities in the Mexico Combined Heat and Power (CHP) Market lie in the expansion of its application into sectors such as district heating and cooling networks, particularly in urban areas experiencing growth. The increasing adoption of electric vehicles presents a synergistic opportunity, where CHP plants can provide reliable electricity for charging infrastructure while also supplying heat for associated buildings. Furthermore, the integration of waste-to-energy CHP solutions offers a dual benefit of waste management and energy generation, aligning with circular economy principles. The development of advanced control systems and digital solutions for remote monitoring and optimization of CHP assets also represents a significant growth avenue, enhancing operational efficiency and predictive maintenance.

Growth Accelerators in the Mexico Combined Heat and Power Market Industry

The Mexico Combined Heat and Power (CHP) Market's long-term growth is being accelerated by significant technological breakthroughs in engine efficiency and heat recovery systems, making CHP systems more economically viable across a broader spectrum of applications. Strategic partnerships between technology providers like MAN Energy Solutions and energy developers are crucial for deploying larger-scale projects. Market expansion strategies, including government incentives for renewable and efficient energy adoption, are playing a vital role. The increasing global focus on decarbonization and the pursuit of energy independence by nations are further bolstering the demand for CHP as a reliable and efficient bridge technology, especially as countries transition towards fully renewable energy portfolios.

Key Players Shaping the Mexico Combined Heat and Power Market Market

- ABB Ltd

- Santos CMI

- MAN Energy Solutions

- Iberdrola SA

- Viessmann Werke GmbH & Co KG

- Mitsubishi Electric Corporation

- Siemens AG

- Caterpillar Inc

- General Electric Company

- Capstone Turbine Corporation

Notable Milestones in Mexico Combined Heat and Power Market Sector

- 2019: Increased focus on energy efficiency regulations by the Mexican government, encouraging distributed generation adoption.

- 2020: Capstone Turbine Corporation announces expansion of its distributor network in Mexico, facilitating access to micro-CHP solutions.

- 2021: Siemens AG secures contracts for upgrading industrial power generation facilities, incorporating CHP principles for enhanced efficiency.

- 2022: Iberdrola SA explores investment opportunities in distributed energy projects, including potential CHP integration in industrial parks.

- 2023: MAN Energy Solutions showcases its latest generation of efficient gas engines suitable for industrial CHP applications in Mexico.

- 2024: Viessmann Werke GmbH & Co KG reports growing interest in its commercial-scale CHP units for buildings and facilities in Mexico.

- 2024: General Electric Company participates in discussions regarding grid modernization and the role of CHP in enhancing grid stability in Mexico.

- 2025 (Estimated): Significant increase in project announcements for industrial CHP installations driven by improved economic feasibility.

- 2026 (Projected): Emergence of pilot projects for district heating and cooling utilizing CHP technology in rapidly developing urban areas.

- 2028 (Projected): Accelerated adoption of natural gas-based CHP due to supportive policy frameworks and declining natural gas prices.

In-Depth Mexico Combined Heat and Power Market Market Outlook

The outlook for the Mexico Combined Heat and Power (CHP) Market is exceptionally positive, driven by a strong interplay of economic incentives, technological maturation, and a clear policy direction towards energy efficiency and sustainability. Growth accelerators, including continued investment in industrial modernization, smart city initiatives, and the inherent cost-saving benefits of CHP, will propel market expansion. Strategic partnerships and the introduction of innovative, smaller-scale CHP solutions are poised to unlock new market segments and drive adoption rates. As Mexico continues its energy transition journey, CHP will play a pivotal role as a reliable, efficient, and environmentally conscious energy solution, offering significant potential for growth and profitability for stakeholders across the value chain.

Mexico Combined Heat and Power Market Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Industrial & Utilities

- 1.3. Commercial

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Coal

- 2.3. Oil

- 2.4. Other Fuel Types

Mexico Combined Heat and Power Market Segmentation By Geography

- 1. Mexico

Mexico Combined Heat and Power Market Regional Market Share

Geographic Coverage of Mexico Combined Heat and Power Market

Mexico Combined Heat and Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Policies and Incentives; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. Industrial & Utilities Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Combined Heat and Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Industrial & Utilities

- 5.1.3. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Coal

- 5.2.3. Oil

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Santos CMI

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MAN Energy Solutions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Iberdrola SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Viessmann Werke GmbH & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Caterpillar Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Capstone Turbine Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Mexico Combined Heat and Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Combined Heat and Power Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Combined Heat and Power Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Mexico Combined Heat and Power Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 3: Mexico Combined Heat and Power Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: Mexico Combined Heat and Power Market Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 5: Mexico Combined Heat and Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Mexico Combined Heat and Power Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Mexico Combined Heat and Power Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Mexico Combined Heat and Power Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 9: Mexico Combined Heat and Power Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: Mexico Combined Heat and Power Market Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 11: Mexico Combined Heat and Power Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Mexico Combined Heat and Power Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Combined Heat and Power Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Mexico Combined Heat and Power Market?

Key companies in the market include ABB Ltd, Santos CMI, MAN Energy Solutions, Iberdrola SA, Viessmann Werke GmbH & Co KG, Mitsubishi Electric Corporation, Siemens AG, Caterpillar Inc, General Electric Company, Capstone Turbine Corporation.

3. What are the main segments of the Mexico Combined Heat and Power Market?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Policies and Incentives; Environmental Concerns.

6. What are the notable trends driving market growth?

Industrial & Utilities Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Combined Heat and Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Combined Heat and Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Combined Heat and Power Market?

To stay informed about further developments, trends, and reports in the Mexico Combined Heat and Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence