Key Insights

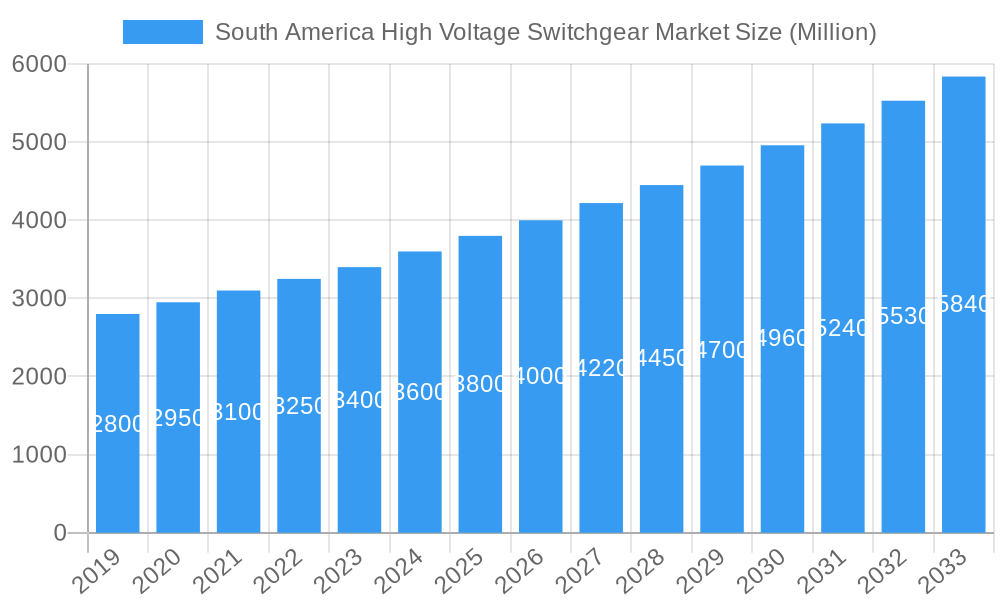

The South America High Voltage Switchgear Market is poised for robust expansion, projecting a market size of approximately $3,800 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This significant growth is primarily fueled by substantial investments in upgrading and expanding transmission and distribution networks across the region. Key drivers include the ongoing development of renewable energy projects, particularly solar and wind farms, which necessitate advanced switchgear for grid integration and stability. Furthermore, increasing urbanization and industrialization in countries like Brazil, Argentina, and Colombia are creating a sustained demand for reliable and efficient electrical infrastructure. The market is segmented into Air-insulated, Gas-insulated, and Other Types of switchgear, with Gas-insulated switchgear likely to witness higher adoption due to its superior performance, compactness, and environmental benefits in diverse South American climates.

South America High Voltage Switchgear Market Market Size (In Billion)

The competitive landscape features established global players such as ABB Ltd, Siemens AG, and General Electric Company, alongside strong regional contenders like Larson & Turbo Limited. These companies are focused on innovating and offering solutions that cater to the specific needs of South American utilities, commercial sectors, and industrial facilities. Key trends include the integration of smart grid technologies and digitalization, enhancing grid management, fault detection, and overall operational efficiency. However, the market also faces restraints such as the high initial cost of advanced switchgear, particularly in economies experiencing currency fluctuations, and the need for skilled labor to install and maintain these sophisticated systems. Despite these challenges, the overarching demand for enhanced grid reliability and capacity, coupled with supportive government policies for infrastructure development and renewable energy, paints a very optimistic outlook for the South America High Voltage Switchgear Market.

South America High Voltage Switchgear Market Company Market Share

This in-depth report provides a detailed examination of the South America High Voltage Switchgear Market, encompassing market dynamics, growth trends, regional analysis, product landscape, key drivers, emerging opportunities, and competitive intelligence. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers a robust understanding of current market conditions and future projections. We delve into critical segments including Type (Air-insulated, Gas-insulated, Other Types) and End User (Transmission & Distribution Utilities, Commercial & Residential, Industrial), and analyze geographical impact across Brazil, Argentina, Colombia, and the Rest of South America. This report is essential for stakeholders seeking strategic insights into this vital infrastructure market.

South America High Voltage Switchgear Market Market Dynamics & Structure

The South America High Voltage Switchgear Market is characterized by a moderately concentrated structure, with a few dominant players like Siemens AG, ABB Ltd, and Schneider Electric SE holding significant market share. Technological innovation, particularly in the realm of advanced insulation techniques and smart grid integration, is a key driver. Regulatory frameworks, such as evolving safety standards and grid modernization initiatives across countries like Brazil and Argentina, play a crucial role in shaping market entry and product development. Competitive product substitutes, while limited in the high-voltage segment, primarily revolve around advancements in existing technologies and alternative grid management solutions. End-user demographics are shifting, with increasing demand from industrial expansion and renewable energy integration projects. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their regional footprint and technological capabilities. For instance, anticipated M&A activities within the study period are estimated to impact market share by approximately 10-15%. Barriers to innovation include the high capital investment required for R&D and the stringent testing and certification processes inherent in the high-voltage sector.

- Market Concentration: Moderately concentrated with key players holding substantial market share.

- Technological Innovation Drivers: Smart grid integration, advanced insulation, GIS technology advancements.

- Regulatory Frameworks: Evolving safety standards, grid modernization policies, renewable energy mandates.

- Competitive Product Substitutes: Advancements in existing technologies, alternative grid management solutions.

- End-User Demographics: Growing demand from industrial expansion, renewable energy projects, and T&D infrastructure upgrades.

- M&A Trends: Strategic acquisitions for market expansion and technology enhancement.

- Innovation Barriers: High R&D investment, stringent certification processes.

South America High Voltage Switchgear Market Growth Trends & Insights

The South America High Voltage Switchgear Market is poised for significant growth, driven by the continuous need for robust and modernized electrical infrastructure across the continent. The market size is projected to expand from an estimated XX million units in 2025 to an anticipated XX million units by 2033, demonstrating a healthy Compound Annual Growth Rate (CAGR) of approximately X.XX%. This expansion is underpinned by increasing investments in transmission and distribution networks to accommodate growing energy demand and integrate a larger share of renewable energy sources. Adoption rates for advanced switchgear technologies, such as Gas-Insulated Switchgear (GIS), are rising due to their superior performance, reduced footprint, and enhanced safety features, especially in densely populated urban areas and challenging environmental conditions. Technological disruptions, including the advent of digital substations and the integration of IoT sensors for real-time monitoring and predictive maintenance, are transforming operational efficiencies and reliability. Consumer behavior shifts are observed, with utilities and industrial clients prioritizing solutions that offer long-term cost savings, improved grid stability, and compliance with environmental regulations. Market penetration of sophisticated switchgear solutions is expected to accelerate as governments and private entities prioritize infrastructure development to fuel economic growth and ensure energy security. The forecast period will witness a pronounced trend towards smart and resilient grid solutions, directly impacting the demand for high-voltage switchgear that can support these evolving needs. The growing emphasis on electrification across various sectors, from transportation to industrial processes, further fuels the underlying demand for enhanced electrical transmission and distribution capabilities.

Dominant Regions, Countries, or Segments in South America High Voltage Switchgear Market

Within the South America High Voltage Switchgear Market, the Transmission & Distribution Utilities segment is the dominant force, commanding a significant market share estimated at over 60% in 2025. This dominance is attributed to the fundamental role of T&D utilities in maintaining and expanding the continent's electrical grid infrastructure. The need for reliable power supply to meet growing industrial and residential demand, coupled with the ongoing modernization of aging grids and the integration of new power generation sources, propels this segment's growth.

Brazil stands out as the leading country, projected to hold approximately 35-40% of the total South American market share. This position is bolstered by its large economy, substantial population, and significant investments in power generation and transmission projects, including a growing focus on renewable energy sources like solar and wind. Government initiatives aimed at upgrading and expanding the national grid to ensure energy security and facilitate industrial development are key drivers.

Geographically, the Rest of South America segment, encompassing countries like Chile, Peru, and Ecuador, is also exhibiting robust growth. This is fueled by increasing investments in mining operations, infrastructure development, and the expansion of renewable energy capacity in these nations. The demand for reliable and high-capacity switchgear is directly linked to the economic progress and energy needs of these developing economies.

- Dominant End User Segment: Transmission & Distribution Utilities

- Key Drivers: Grid modernization, renewable energy integration, increasing energy demand, infrastructure upgrades.

- Market Share (Estimated 2025): Over 60%

- Leading Country: Brazil

- Key Drivers: Large economy, significant power generation investments, renewable energy expansion, government infrastructure initiatives.

- Market Share (Estimated 2025): 35-40%

- High Growth Geography: Rest of South America (Chile, Peru, Ecuador, etc.)

- Key Drivers: Mining sector expansion, infrastructure development, renewable energy projects, growing industrialization.

- Growth Potential: Significant expansion expected due to ongoing development and investment.

South America High Voltage Switchgear Market Product Landscape

The product landscape of the South America High Voltage Switchgear Market is characterized by a focus on enhanced performance, reliability, and safety. Gas-insulated switchgear (GIS) is increasingly favored for its compact design, superior insulation properties, and reduced environmental impact, making it ideal for urban substations and space-constrained installations. Air-insulated switchgear (AIS) remains a prevalent choice for outdoor substations and applications where cost-effectiveness is a primary consideration. Innovations are centered on improving the lifespan of equipment, reducing maintenance requirements, and integrating digital technologies for remote monitoring and control. Key performance metrics include dielectric strength, interrupting capacity, and thermal resistance. The unique selling proposition of advanced switchgear lies in its ability to ensure grid stability and minimize downtime, crucial for industrial operations and public services.

Key Drivers, Barriers & Challenges in South America High Voltage Switchgear Market

Key Drivers:

- Infrastructure Development: Significant government and private sector investments in upgrading and expanding transmission and distribution networks across South America to meet rising energy demand and integrate renewable sources.

- Renewable Energy Integration: The growing adoption of solar, wind, and hydropower necessitates robust switchgear solutions capable of handling intermittent power flows and grid fluctuations.

- Industrial Growth: Expansion of manufacturing, mining, and other industrial sectors drives the demand for reliable and high-capacity electrical infrastructure.

- Technological Advancements: The adoption of smart grid technologies, digital substations, and advanced insulation materials enhances efficiency, reliability, and safety.

Barriers & Challenges:

- Economic Volatility: Fluctuations in regional economies and currency depreciation can impact investment decisions and project timelines, posing a significant challenge.

- Regulatory Complexities: Navigating diverse and evolving regulatory frameworks across different South American countries can be time-consuming and costly for manufacturers and project developers.

- Supply Chain Disruptions: Global supply chain issues, including the availability of raw materials and components, can lead to production delays and increased costs.

- Skilled Workforce Shortage: A lack of qualified engineers and technicians for the installation, operation, and maintenance of high-voltage switchgear can hinder market growth.

Emerging Opportunities in South America High Voltage Switchgear Market

Emerging opportunities in the South America High Voltage Switchgear Market lie in the burgeoning renewable energy sector, particularly in countries like Brazil and Chile, which are investing heavily in solar and wind power. The development of smart grid technologies, including digital substations and advanced metering infrastructure, presents a significant growth avenue. Furthermore, the modernization of aging grid infrastructure in countries like Argentina and Colombia, coupled with increasing urbanization, creates demand for efficient and reliable switchgear solutions. The development of compact and eco-friendly switchgear, such as advanced GIS, tailored for specific regional needs and environmental conditions, also represents a promising niche.

Growth Accelerators in the South America High Voltage Switchgear Market Industry

Several factors are acting as growth accelerators for the South America High Voltage Switchgear Market. The increasing government focus on energy security and the push towards decarbonization through renewable energy mandates are compelling substantial investments in grid modernization. Technological breakthroughs in areas like SF6 alternatives and advanced control systems are making switchgear more efficient, safer, and environmentally sustainable. Strategic partnerships between local utilities and international manufacturers are facilitating technology transfer and market penetration. Furthermore, the expansion of interconnected power grids across South America, aiming to optimize resource utilization and enhance regional energy trade, will drive demand for standardized and high-performance switchgear.

Key Players Shaping the South America High Voltage Switchgear Market Market

- ABB Ltd

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Larson & Turbo Limited

- General Electric Company

- Bharat Heavy Electricals Limited

Notable Milestones in South America High Voltage Switchgear Market Sector

- July 2022: Alstom signed a contract for the 700-meter double-track expansion of the VLT (tramway) system in Rio de Janeiro, which will provide an integrated terminal connection to a new Bus Rapid Transit (BRT) system and interconnection with the bus station in the city, which is expected to increase the demand of high voltage switch gears in the country.

- January 2022: Alstom secured three new contracts that will contribute to improving Argentina's transit infrastructure: track, bridges, tunnels, signal systems, vehicles, and stations which will help ensure safe, accessible, and dependable services.

In-Depth South America High Voltage Switchgear Market Market Outlook

The South America High Voltage Switchgear Market is set for a dynamic future, driven by a confluence of factors including ongoing infrastructure development, the rapid expansion of renewable energy, and the increasing demand for grid modernization. Future growth accelerators will be intrinsically linked to technological innovation, particularly in the adoption of digital substations and smart grid solutions that enhance operational efficiency and grid resilience. Strategic alliances and collaborations between global manufacturers and local stakeholders will be crucial for navigating the region's diverse market landscape. The market outlook also highlights significant opportunities in catering to the evolving energy needs of industrial sectors and urban centers, emphasizing the importance of sustainable and reliable power transmission and distribution solutions.

South America High Voltage Switchgear Market Segmentation

-

1. Type

- 1.1. Air-insulated

- 1.2. Gas-insulated

- 1.3. Other Types

-

2. End User

- 2.1. Transmission & Distribution Utilities

- 2.2. Commercial & Residential

- 2.3. Industrial

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Rest of South America

South America High Voltage Switchgear Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America High Voltage Switchgear Market Regional Market Share

Geographic Coverage of South America High Voltage Switchgear Market

South America High Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Grid Modernization4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Gas-Insulated Switchgear to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Air-insulated

- 5.1.2. Gas-insulated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Transmission & Distribution Utilities

- 5.2.2. Commercial & Residential

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Air-insulated

- 6.1.2. Gas-insulated

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Transmission & Distribution Utilities

- 6.2.2. Commercial & Residential

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Air-insulated

- 7.1.2. Gas-insulated

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Transmission & Distribution Utilities

- 7.2.2. Commercial & Residential

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia South America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Air-insulated

- 8.1.2. Gas-insulated

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Transmission & Distribution Utilities

- 8.2.2. Commercial & Residential

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Air-insulated

- 9.1.2. Gas-insulated

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Transmission & Distribution Utilities

- 9.2.2. Commercial & Residential

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toshiba International Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Electric Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Schneider Electric SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Larson & Turbo Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 General Electric Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bharat Heavy Electricals Limited*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: South America High Voltage Switchgear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America High Voltage Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: South America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South America High Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: South America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: South America High Voltage Switchgear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: South America High Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: South America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South America High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: South America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: South America High Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: South America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: South America High Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: South America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: South America High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: South America High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: South America High Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: South America High Voltage Switchgear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: South America High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America High Voltage Switchgear Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the South America High Voltage Switchgear Market?

Key companies in the market include ABB Ltd, Toshiba International Corporation, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Larson & Turbo Limited, General Electric Company, Bharat Heavy Electricals Limited*List Not Exhaustive.

3. What are the main segments of the South America High Voltage Switchgear Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Grid Modernization4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Gas-Insulated Switchgear to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

July 2022: Alstom signed a contract for the 700-meter double-track expansion of the VLT (tramway) system in Rio de Janeiro, which will provide an integrated terminal connection to a new Bus Rapid Transit (BRT) system and interconnection with the bus station in the city, which is expected to increase the demand of high voltage switch gears in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America High Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America High Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America High Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the South America High Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence