Key Insights

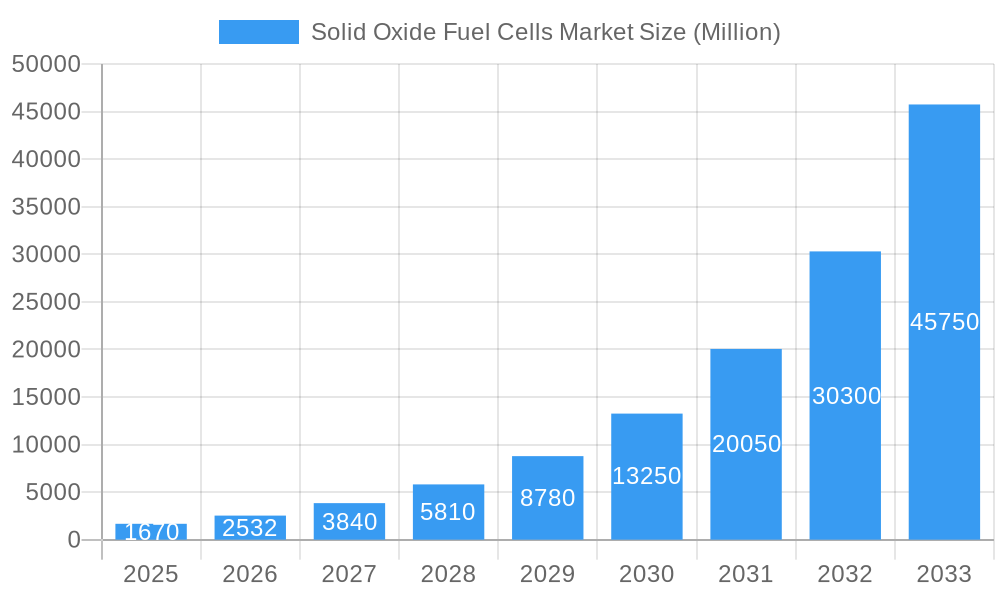

The global Solid Oxide Fuel Cells (SOFC) market is poised for explosive growth, projected to reach a substantial $1670 million value. This surge is driven by an impressive Compound Annual Growth Rate (CAGR) exceeding 49.00% throughout the forecast period of 2025-2033. The primary impetus behind this remarkable expansion stems from the urgent global need for cleaner, more efficient energy solutions, particularly in the face of escalating environmental concerns and stringent regulations. The inherent high-efficiency and low-emission characteristics of SOFC technology make it a compelling alternative to traditional power generation methods. Furthermore, advancements in material science and manufacturing processes are steadily reducing production costs and improving the durability and performance of SOFC systems, making them increasingly competitive and accessible for a wider range of applications. The growing demand for distributed power generation, backup power solutions, and integration with renewable energy sources further fuels this upward trajectory.

Solid Oxide Fuel Cells Market Market Size (In Billion)

The SOFC market is segmented into critical applications, namely Vehicular and Non-Vehicular. The Non-Vehicular segment is expected to dominate the market due to its widespread adoption in stationary power generation for commercial, industrial, and residential sectors, as well as in critical infrastructure like data centers and telecommunications. Emerging trends such as the development of hybrid SOFC systems, enhanced thermal management techniques, and the potential for SOFCs to produce hydrogen through electrolysis are creating new avenues for market penetration. While significant opportunities exist, certain restraints, such as the high initial capital investment and the need for further infrastructure development for hydrogen fuel supply, may temper the pace of adoption in some regions. However, the strong industry commitment from leading companies like Bloom Energy Corp, Ceres Power Holdings PLC, and Mitsubishi Hitachi Power Systems Ltd, coupled with ongoing research and development initiatives, is actively addressing these challenges and solidifying the promising future of the SOFC market.

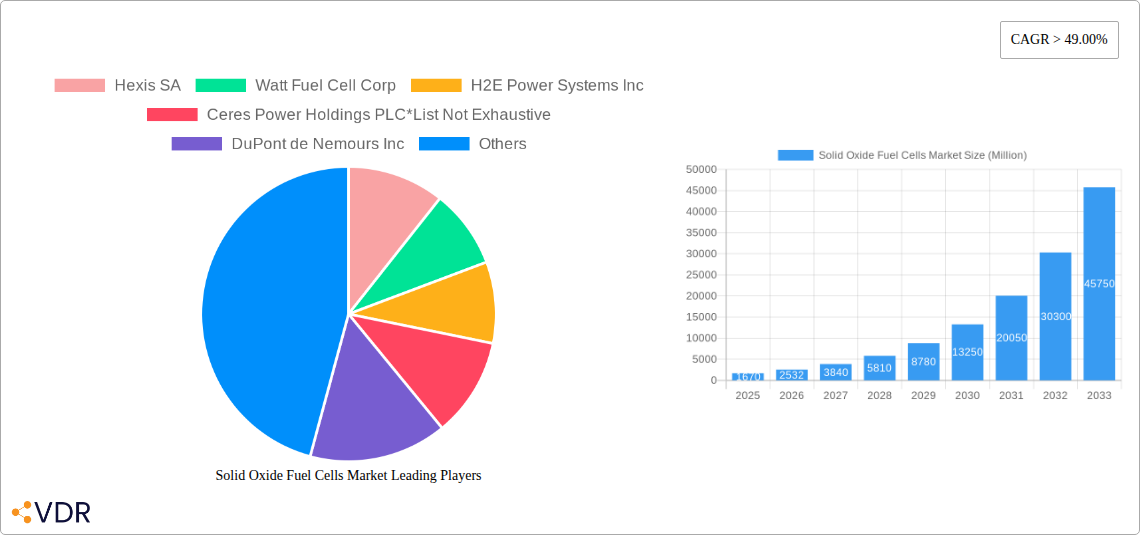

Solid Oxide Fuel Cells Market Company Market Share

Unlock the potential of the rapidly expanding Solid Oxide Fuel Cells (SOFC) market with our in-depth report. Explore critical market dynamics, growth trends, dominant regions, product innovations, key players, and emerging opportunities shaping the future of clean energy. This report offers a detailed analysis of the SOFC market, covering applications in vehicular and non-vehicular sectors, and examining parent and child market segments for a holistic view.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Solid Oxide Fuel Cells Market Market Dynamics & Structure

The Solid Oxide Fuel Cells (SOFC) market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demands. Market concentration is moderately fragmented, with a few key players dominating research and development, while a growing number of smaller entities are emerging with specialized solutions. Technological innovation is a primary driver, fueled by the continuous pursuit of higher efficiency, lower costs, and increased durability for SOFC systems. Regulatory frameworks, particularly those promoting decarbonization and renewable energy adoption, are creating a favorable environment for SOFC deployment. Competitive product substitutes, primarily other fuel cell technologies and conventional power generation methods, present ongoing challenges, necessitating continuous improvement in SOFC performance and cost-competitiveness. End-user demographics are diversifying, with increasing interest from stationary power generation, industrial applications, and even niche vehicular segments. Mergers and acquisitions (M&A) trends, though not yet as pronounced as in some mature energy markets, are anticipated to increase as companies seek to consolidate expertise, expand market reach, and secure intellectual property. Barriers to innovation include high initial capital costs, the need for robust supporting infrastructure, and the complexity of scaling up manufacturing processes.

- Market Concentration: Moderately fragmented with leading R&D players and emerging specialized firms.

- Technological Innovation Drivers: Efficiency improvements, cost reduction, durability enhancements, miniaturization.

- Regulatory Frameworks: Government incentives for clean energy, emission standards, carbon pricing mechanisms.

- Competitive Product Substitutes: PEMFC, SOEC, internal combustion engines, battery storage.

- End-User Demographics: Utilities, data centers, remote power, industrial facilities, automotive (niche).

- M&A Trends: Expected to rise for technology acquisition and market access.

- Barriers to Innovation: High upfront costs, infrastructure development, manufacturing scalability.

Solid Oxide Fuel Cells Market Growth Trends & Insights

The Solid Oxide Fuel Cells (SOFC) market is poised for significant expansion, driven by the global imperative for clean and efficient energy solutions. Market size evolution is projected to see a substantial increase from approximately $2,500 million in 2025 to an estimated $9,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 15.5%. This growth trajectory is underpinned by accelerating adoption rates across various sectors, spurred by both economic incentives and environmental consciousness. Technological disruptions are a constant feature, with ongoing advancements in materials science, electrode design, and system integration enhancing SOFC performance and reliability. Consumer behavior shifts are increasingly favoring sustainable energy options, creating a robust demand for fuel cell technologies that offer low-to-zero emissions and high energy conversion efficiency. The inherent advantages of SOFCs, such as their ability to utilize a wide range of fuels (including hydrogen, natural gas, and biogas) and their high operating temperatures that facilitate efficient heat recovery for combined heat and power (CHP) applications, are key differentiators.

The increasing demand for reliable and green power in data centers, which are experiencing exponential growth in energy consumption, presents a significant opportunity. The integration of SOFCs with uninterruptible power supply (UPS) systems and battery storage is being actively explored and funded, promising flexible and clean primary power solutions. This addresses the critical need for consistent and high-quality power in these sensitive environments, minimizing downtime and reducing their carbon footprint. Furthermore, the development of smaller, modular SOFC systems is expanding their applicability to distributed power generation, enabling greater energy independence and resilience for businesses and communities. The economic viability of SOFCs is improving as manufacturing processes mature and economies of scale are realized, making them increasingly competitive with conventional power sources. The rising cost of fossil fuels and the implementation of carbon taxes are further tilting the economic balance in favor of fuel cell technologies. The market penetration of SOFCs, while still nascent in some areas, is expected to accelerate as pilot projects demonstrate their long-term benefits and reliability, paving the way for widespread commercial deployment. The increasing focus on the hydrogen economy and the development of green hydrogen production infrastructure will also serve as a major catalyst for SOFC adoption, particularly for applications requiring high-efficiency energy conversion.

Dominant Regions, Countries, or Segments in Solid Oxide Fuel Cells Market

The Solid Oxide Fuel Cells (SOFC) market is witnessing significant growth driven by a confluence of factors in several key regions and within specific application segments. The Non-Vehicular application segment is currently the dominant force in market growth, encompassing stationary power generation, industrial applications, and distributed energy systems. This dominance is propelled by the urgent need for reliable, efficient, and low-emission power solutions for critical infrastructure and industrial processes.

Key Drivers for Non-Vehicular Dominance:

- Grid Decarbonization Efforts: Many countries are actively pursuing policies to reduce their reliance on fossil fuels for electricity generation. SOFCs, with their high efficiency and potential to run on hydrogen or natural gas with significantly reduced emissions, are well-positioned to support this transition.

- Data Center Power Demands: The insatiable energy needs of data centers, coupled with their increasing focus on sustainability, are creating a substantial market for clean and reliable backup power. SOFCs offer a compelling solution due to their high power density and ability to operate on diverse fuels. The Clean Hydrogen Partnership's investment in exploring SOFC integration with UPS systems for data centers underscores this trend.

- Industrial Process Heat and Power: Industries with high thermal energy demands can benefit immensely from the combined heat and power (CHP) capabilities of SOFCs. This dual functionality significantly boosts overall energy efficiency and reduces operational costs.

- Remote and Off-Grid Power: SOFCs are ideal for providing reliable power in remote locations where grid access is limited or unreliable. Their modularity and fuel flexibility make them suitable for diverse environments.

- Government Incentives and R&D Funding: Proactive government policies and substantial investments in research and development, particularly in regions like Europe and Asia, are accelerating the adoption and innovation of SOFC technology for stationary applications.

- Technological Maturity: While still evolving, SOFC technology for stationary applications has reached a level of maturity that allows for larger-scale deployments and demonstrated reliability.

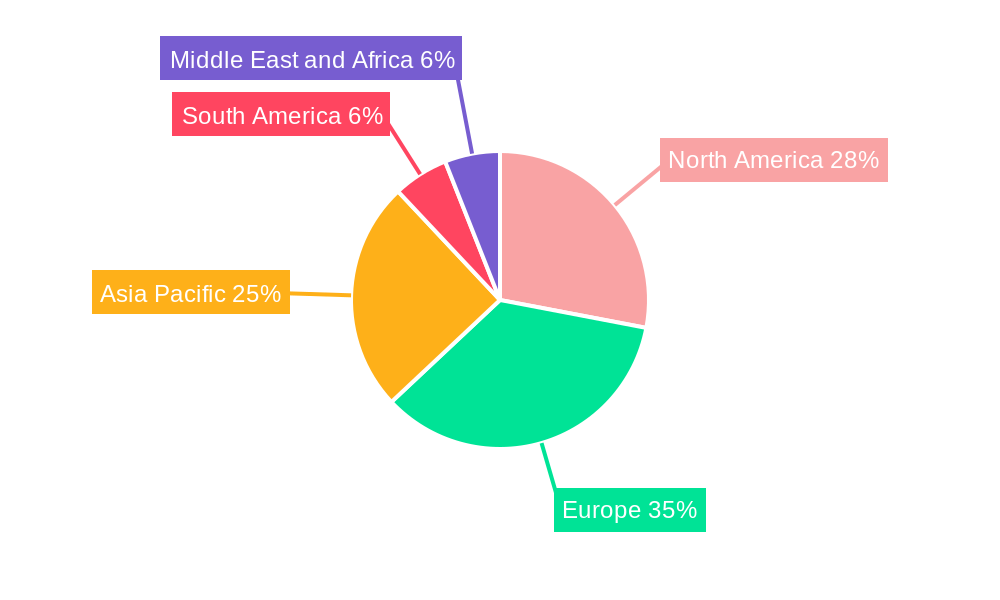

Dominant Regions:

- North America: Driven by stringent environmental regulations and a growing demand for clean energy solutions, particularly in the industrial and commercial sectors.

- Europe: Benefitting from strong government support for renewable energy, ambitious decarbonization targets, and significant R&D investments, making it a leader in SOFC adoption for stationary power.

- Asia-Pacific: Witnessing rapid growth due to increasing energy demand, government initiatives promoting clean energy, and substantial investments in technological advancements. South Korea's operationalization of its first 4.2 MW SOFC power plant signifies this region's commitment.

While the vehicular segment is still in its nascent stages for SOFCs, advancements in materials and system design are gradually paving the way for future integration in specialized transport applications. The current market, however, is overwhelmingly dominated by non-vehicular applications due to their immediate economic and environmental benefits and the existing infrastructure to support them.

Solid Oxide Fuel Cells Market Product Landscape

The Solid Oxide Fuel Cells (SOFC) market is characterized by continuous product innovation focused on enhancing efficiency, reducing costs, and expanding application versatility. Key product advancements include the development of novel ceramic electrolyte materials that operate at lower temperatures, improving durability and reducing balance-of-plant costs. Innovations in electrode materials and manufacturing techniques are leading to higher power densities and improved long-term performance. Manufacturers are offering a range of SOFC systems, from small-scale modular units for distributed power generation to larger-scale systems for industrial and utility applications. Unique selling propositions often revolve around fuel flexibility (hydrogen, natural gas, biogas, syngas), high electrical efficiency, and the ability to provide combined heat and power (CHP) for enhanced overall energy utilization. Technological advancements are enabling SOFCs to be integrated with existing power grids and energy storage systems, offering hybrid solutions for increased grid stability and reliability.

Key Drivers, Barriers & Challenges in Solid Oxide Fuel Cells Market

Key Drivers:

- Global Push for Decarbonization: Stringent environmental regulations and a collective desire to reduce greenhouse gas emissions are paramount drivers for SOFC adoption.

- High Energy Efficiency: SOFCs offer superior electrical efficiencies compared to traditional power generation methods, especially when utilizing combined heat and power (CHP).

- Fuel Flexibility: The ability to operate on a wide range of fuels, including renewable sources like biogas and hydrogen, makes SOFCs adaptable to diverse energy landscapes.

- Technological Advancements: Ongoing research and development in materials science and engineering are leading to improved performance, durability, and cost-effectiveness.

- Growing Demand for Reliable Power: Critical infrastructure like data centers require robust and clean power solutions, for which SOFCs are increasingly viable.

Key Barriers & Challenges:

- High Initial Capital Costs: The upfront investment for SOFC systems remains a significant barrier to widespread adoption, though costs are decreasing.

- Long Start-up Times: Traditional SOFCs have high operating temperatures, leading to longer start-up times compared to some competing technologies.

- Material Degradation: Long-term material durability under operating conditions is a continuous area of research and improvement.

- Supply Chain Development: Establishing robust and cost-effective supply chains for specialized materials and components is crucial for scalability.

- Competition from Established Technologies: SOFCs face competition from mature and lower-cost conventional energy sources and other fuel cell technologies.

- Regulatory and Permitting Complexities: Navigating evolving regulations and obtaining necessary permits can sometimes slow down deployment.

Emerging Opportunities in Solid Oxide Fuel Cells Market

Emerging opportunities in the Solid Oxide Fuel Cells (SOFC) market lie in the expansion into niche yet high-growth areas. The increasing focus on microgrids and distributed energy systems presents a significant avenue for SOFC deployment, offering resilient and clean power solutions for communities and industrial complexes. The integration of SOFCs with renewable energy sources like solar and wind power is another promising area, enabling highly efficient and reliable energy storage and conversion. Furthermore, advancements in SOFC technology are opening doors for applications in specialized transportation, such as long-haul trucking and marine vessels, where high energy density and fuel flexibility are critical. The development of SOFC-based systems for direct carbon capture and utilization (CCU) is also an exciting frontier, addressing environmental concerns while creating value from waste CO2. The growing emphasis on circular economy principles is also creating opportunities for SOFCs that can utilize waste streams as fuel.

Growth Accelerators in the Solid Oxide Fuel Cells Market Industry

Several key catalysts are accelerating the growth of the Solid Oxide Fuel Cells (SOFC) industry. Technological breakthroughs, particularly in materials science leading to lower operating temperatures and increased power density, are making SOFCs more competitive and applicable to a wider range of uses. Strategic partnerships between SOFC developers, energy companies, and end-users are crucial for co-development, pilot projects, and market penetration, fostering wider adoption and trust in the technology. Market expansion strategies, including the development of standardized modular systems and robust service networks, are essential for scaling up deployment and reducing installation complexities. The increasing global commitment to net-zero emissions and the development of hydrogen infrastructure further serve as powerful growth accelerators, creating a supportive ecosystem for SOFC technologies. Investments in research and development from both public and private sectors are continuously pushing the boundaries of SOFC capabilities, promising further innovation and market growth.

Key Players Shaping the Solid Oxide Fuel Cells Market Market

- Hexis SA

- Watt Fuel Cell Corp

- H2E Power Systems Inc

- Ceres Power Holdings PLC

- DuPont de Nemours Inc

- Sunfire GmbH

- Mitsubishi Hitachi Power Systems Ltd

- Elcogen AS

- Bloom Energy Corp

- Convion Ltd

Notable Milestones in Solid Oxide Fuel Cells Market Sector

- June 2022: South Korea's first SOFC power plant of 4.2 MW capacity came into operation in Donghae, expected to energize close to 14,000 households annually. The project involved an investment of approximately USD 19.6 billion and is managed by Korea East-West Power Company (EWP).

- January 2022: The Clean Hydrogen Partnership announced an investment of USD 2.65 million to fund a project exploring the integration of SOFCs with uninterruptible power supply (UPS) and lithium-ion batteries for data centers, as well as considering natural gas SOFCs for standby power requirements.

In-Depth Solid Oxide Fuel Cells Market Market Outlook

The Solid Oxide Fuel Cells (SOFC) market is poised for sustained and robust growth, driven by an increasing global demand for clean, efficient, and reliable energy solutions. Future market potential is immense, with advancements in materials science and manufacturing techniques continually driving down costs and improving performance, making SOFCs increasingly competitive against conventional power sources. Strategic opportunities lie in further developing and scaling applications in grid stabilization, industrial process heat, and specialized transportation. The ongoing expansion of the hydrogen economy will serve as a significant tailwind, enabling SOFCs to play a pivotal role in the decarbonization of various sectors. Continued government support, through incentives and favorable regulations, will be crucial in accelerating adoption rates and fostering innovation. The market's trajectory indicates a strong shift towards distributed generation and a greater emphasis on energy independence, areas where SOFC technology is exceptionally well-suited.

Solid Oxide Fuel Cells Market Segmentation

-

1. Application

- 1.1. Vehicular

- 1.2. Non-Vehicular

Solid Oxide Fuel Cells Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Solid Oxide Fuel Cells Market Regional Market Share

Geographic Coverage of Solid Oxide Fuel Cells Market

Solid Oxide Fuel Cells Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 49.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Cheap and Alternative Pumps

- 3.4. Market Trends

- 3.4.1. Non-Vehicular segment expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solid Oxide Fuel Cells Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Vehicular

- 5.1.2. Non-Vehicular

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Solid Oxide Fuel Cells Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Vehicular

- 6.1.2. Non-Vehicular

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Solid Oxide Fuel Cells Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Vehicular

- 7.1.2. Non-Vehicular

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Solid Oxide Fuel Cells Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Vehicular

- 8.1.2. Non-Vehicular

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Solid Oxide Fuel Cells Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Vehicular

- 9.1.2. Non-Vehicular

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Solid Oxide Fuel Cells Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Vehicular

- 10.1.2. Non-Vehicular

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hexis SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Watt Fuel Cell Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 H2E Power Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ceres Power Holdings PLC*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DuPont de Nemours Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sunfire GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Hitachi Power Systems Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Elcogen AS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bloom Energy Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Convion Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hexis SA

List of Figures

- Figure 1: Global Solid Oxide Fuel Cells Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Solid Oxide Fuel Cells Market Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: North America Solid Oxide Fuel Cells Market Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Solid Oxide Fuel Cells Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 5: North America Solid Oxide Fuel Cells Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Solid Oxide Fuel Cells Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Solid Oxide Fuel Cells Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Solid Oxide Fuel Cells Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 9: North America Solid Oxide Fuel Cells Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Solid Oxide Fuel Cells Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Solid Oxide Fuel Cells Market Revenue (Million), by Application 2025 & 2033

- Figure 12: Europe Solid Oxide Fuel Cells Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 13: Europe Solid Oxide Fuel Cells Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Solid Oxide Fuel Cells Market Volume Share (%), by Application 2025 & 2033

- Figure 15: Europe Solid Oxide Fuel Cells Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Solid Oxide Fuel Cells Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 17: Europe Solid Oxide Fuel Cells Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Solid Oxide Fuel Cells Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Solid Oxide Fuel Cells Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Asia Pacific Solid Oxide Fuel Cells Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 21: Asia Pacific Solid Oxide Fuel Cells Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Solid Oxide Fuel Cells Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Asia Pacific Solid Oxide Fuel Cells Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Solid Oxide Fuel Cells Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 25: Asia Pacific Solid Oxide Fuel Cells Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Solid Oxide Fuel Cells Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Solid Oxide Fuel Cells Market Revenue (Million), by Application 2025 & 2033

- Figure 28: South America Solid Oxide Fuel Cells Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 29: South America Solid Oxide Fuel Cells Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Solid Oxide Fuel Cells Market Volume Share (%), by Application 2025 & 2033

- Figure 31: South America Solid Oxide Fuel Cells Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Solid Oxide Fuel Cells Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 33: South America Solid Oxide Fuel Cells Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Solid Oxide Fuel Cells Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Solid Oxide Fuel Cells Market Revenue (Million), by Application 2025 & 2033

- Figure 36: Middle East and Africa Solid Oxide Fuel Cells Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 37: Middle East and Africa Solid Oxide Fuel Cells Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Solid Oxide Fuel Cells Market Volume Share (%), by Application 2025 & 2033

- Figure 39: Middle East and Africa Solid Oxide Fuel Cells Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Solid Oxide Fuel Cells Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 41: Middle East and Africa Solid Oxide Fuel Cells Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Solid Oxide Fuel Cells Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 3: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 7: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 9: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 11: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 15: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 19: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 21: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 23: Global Solid Oxide Fuel Cells Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Solid Oxide Fuel Cells Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solid Oxide Fuel Cells Market?

The projected CAGR is approximately > 49.00%.

2. Which companies are prominent players in the Solid Oxide Fuel Cells Market?

Key companies in the market include Hexis SA, Watt Fuel Cell Corp, H2E Power Systems Inc, Ceres Power Holdings PLC*List Not Exhaustive, DuPont de Nemours Inc, Sunfire GmbH, Mitsubishi Hitachi Power Systems Ltd, Elcogen AS, Bloom Energy Corp, Convion Ltd.

3. What are the main segments of the Solid Oxide Fuel Cells Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1670 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors.

6. What are the notable trends driving market growth?

Non-Vehicular segment expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Availability of Cheap and Alternative Pumps.

8. Can you provide examples of recent developments in the market?

In June 2022, South Korea's first SOFC power plant of 4.2 MW capacity power plant came into operation, which is expected to energize close to 14,000 households annually in the country. The power plant located in the eastern port city of Donghae was built with an investment of approx. USD 19.6 billion is operationalized by a state-owned generation company, Korea East-West power company (EWP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solid Oxide Fuel Cells Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solid Oxide Fuel Cells Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solid Oxide Fuel Cells Market?

To stay informed about further developments, trends, and reports in the Solid Oxide Fuel Cells Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence