Key Insights

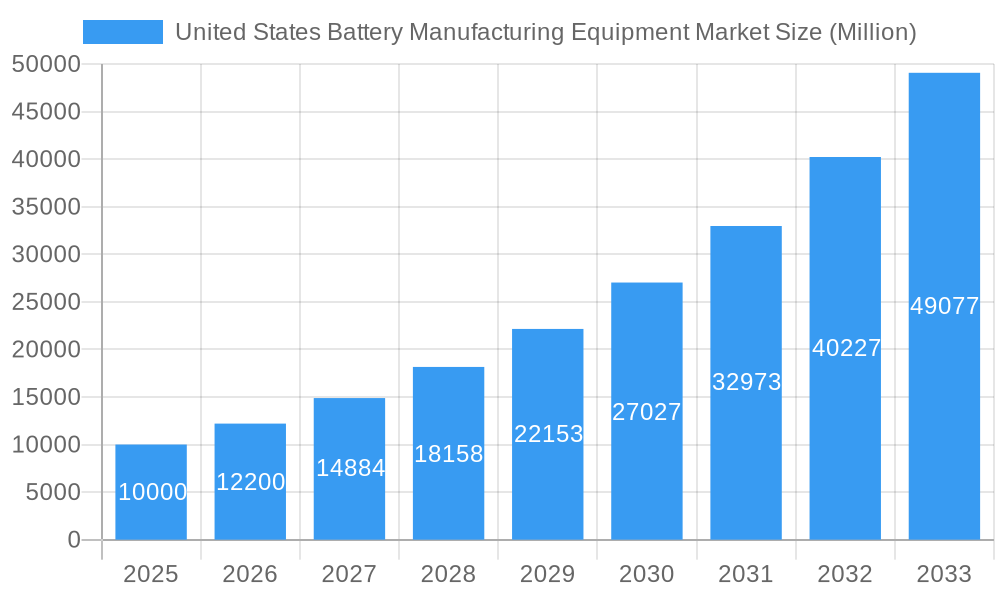

The United States battery manufacturing equipment market is projected for substantial growth, reaching an estimated $9.77 billion by 2025 and maintaining a Compound Annual Growth Rate (CAGR) of 27.61% through 2033. This expansion is primarily driven by the escalating demand for electric vehicles (EVs) and the rapid development of renewable energy storage systems. Government incentives and a focus on domestic battery production are significantly boosting investments in advanced manufacturing. Key factors include the increasing sophistication and energy density requirements of battery chemistries, necessitating advanced equipment for processes such as coating, drying, calendaring, and electrode stacking. The integration of automation and AI is crucial for enhancing efficiency, precision, and safety throughout the production lifecycle.

United States Battery Manufacturing Equipment Market Market Size (In Billion)

The market is segmented by equipment type, with Electrode Stacking and Formation & Testing Machines expected to lead demand due to their critical impact on battery performance and safety. The automotive sector is the primary end-user, propelled by the global shift towards electric mobility. Industrial applications, including grid-scale energy storage, also contribute significantly to market growth. While the outlook is strongly positive, challenges may arise from the high initial investment for advanced manufacturing equipment and supply chain vulnerabilities for essential raw materials. Nevertheless, robust government support and continuous technological innovation in battery technology are anticipated to outweigh these constraints, positioning the U.S. as a key center for battery manufacturing equipment.

United States Battery Manufacturing Equipment Market Company Market Share

This report offers a comprehensive analysis of the United States battery manufacturing equipment market, a vital sector supporting the nation's energy transition. We delve into market dynamics, growth trends, dominant segments, product offerings, and key stakeholders shaping this evolving industry. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study provides in-depth insights into market size evolution, technological advancements, and investment prospects in battery production equipment, specifically for lithium-ion battery manufacturing, EV battery production, and energy storage solutions.

This report utilizes high-impact keywords such as battery manufacturing machines, electrode coating equipment, battery assembly machines, battery testing equipment, and gigafactory equipment to ensure broad reach among industry professionals, investors, and policymakers. We examine the broader energy storage equipment market and its sub-segment, battery manufacturing equipment, to provide a holistic ecosystem perspective. All quantitative data is presented in billion units for clarity.

United States Battery Manufacturing Equipment Market Market Dynamics & Structure

The United States battery manufacturing equipment market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and significant end-user demand, particularly from the burgeoning automotive battery manufacturing sector. Market concentration is gradually increasing with the establishment of large-scale domestic battery production facilities. Key drivers include the urgent need for a secure domestic supply chain for lithium-ion battery components and the drive towards electrification of transportation. Regulatory incentives and federal funding play a crucial role in accelerating investment in advanced battery making machines. Competitive product substitutes are minimal, given the specialized nature of battery manufacturing equipment. However, innovation barriers exist in developing highly precise and efficient machinery for next-generation battery chemistries. M&A trends are expected to intensify as companies seek to gain market share and technological expertise in specialized areas like electrode calendering equipment and battery formation equipment.

- Market Concentration: Increasing with investments in large-scale battery plants.

- Technological Innovation: Driven by demand for higher energy density, faster charging, and improved safety in batteries.

- Regulatory Frameworks: Favorable policies and incentives supporting domestic battery manufacturing are key.

- Competitive Product Substitutes: Limited due to high specialization and capital investment.

- End-User Demographics: Predominantly automotive OEMs and battery cell manufacturers.

- M&A Trends: Expected to rise as companies consolidate expertise and expand capabilities in battery electrode manufacturing equipment.

United States Battery Manufacturing Equipment Market Growth Trends & Insights

The United States battery manufacturing equipment market is poised for substantial growth, driven by the accelerating adoption of electric vehicles (EVs) and the expanding need for grid-scale energy storage solutions. Market size evolution is directly correlated with the strategic initiatives to onshore battery production, aiming to reduce reliance on foreign supply chains. Adoption rates for advanced battery production lines are surging as manufacturers invest in cutting-edge technology to meet increasing demand and regulatory mandates. Technological disruptions, such as the development of solid-state battery manufacturing equipment and enhanced automation in battery assembly processes, are poised to redefine the market landscape. Consumer behavior shifts, including a growing preference for sustainable products and increased awareness of energy independence, further fuel the demand for domestically produced batteries and, consequently, the equipment required to manufacture them. The CAGR for this market is projected to be robust, reflecting sustained investment in domestic gigafactory equipment and specialty battery manufacturing machinery.

Dominant Regions, Countries, or Segments in United States Battery Manufacturing Equipment Market

Within the United States, the Automotive end-user segment is the primary driver of growth in the battery manufacturing equipment market. The relentless pursuit of electrification by major automotive OEMs necessitates massive investments in EV battery manufacturing capacity, leading to a surge in demand for comprehensive battery production machinery. Consequently, regions with a strong automotive manufacturing presence and supportive state-level incentives are emerging as dominant hubs.

Dominant Segment (End User): Automotive

- Key Drivers:

- Accelerated EV adoption targets by federal and state governments.

- Significant investments by automotive manufacturers in domestic battery production.

- Government incentives and tax credits for EV and battery manufacturing.

- The need for localized supply chains to reduce logistical costs and geopolitical risks.

- Market Share: The automotive segment accounts for a substantial majority of the demand for battery manufacturing equipment, driven by the sheer volume of battery cells required for electric vehicles.

- Growth Potential: This segment offers the highest growth potential due to ongoing and planned expansions of battery gigafactories across the nation.

- Key Drivers:

Dominant Segment (Machine Type): Electrode Stacking Machines and Assembly & Handling Machines

- Key Drivers:

- These machines are at the core of battery cell production, directly impacting efficiency and throughput.

- Advancements in automation and precision are critical for high-quality battery manufacturing.

- The complexity of stacking and assembling battery components requires sophisticated and reliable equipment.

- Market Share: High demand for these critical components of the battery production line.

- Growth Potential: Continuous innovation in speed, accuracy, and adaptability for various battery chemistries will drive demand.

- Key Drivers:

Dominant Regions/Countries: States with established automotive industries and strong government support for battery manufacturing, such as Michigan, Georgia, and the Carolinas, are expected to lead in the adoption of advanced battery making equipment.

United States Battery Manufacturing Equipment Market Product Landscape

The product landscape of the United States battery manufacturing equipment market is defined by continuous innovation focused on enhancing efficiency, precision, and scalability. Manufacturers are developing advanced electrode coating and drying equipment with superior uniformity and solvent recovery capabilities. Innovations in battery calendering machines aim for tighter tolerances and higher throughput, crucial for consistent electrode performance. Specialized battery slitting machines are engineered for increased accuracy and reduced material waste. The development of highly automated battery assembly and handling machines, including sophisticated pick-and-place systems and robotic integration, is transforming production lines. Furthermore, cutting-edge battery formation and testing machines are incorporating AI and advanced analytics to accelerate the formation process and ensure stringent quality control, vital for the industrial battery and automotive battery sectors.

Key Drivers, Barriers & Challenges in United States Battery Manufacturing Equipment Market

Key Drivers: The United States battery manufacturing equipment market is propelled by strong government initiatives, including the Inflation Reduction Act, which offers significant tax credits for domestic battery production and component manufacturing. The escalating demand for electric vehicles, coupled with ambitious climate targets, creates an insatiable need for battery cells, directly translating to demand for manufacturing equipment. Furthermore, strategic partnerships between battery manufacturers and automotive giants are accelerating investment in advanced battery production technology.

Barriers & Challenges: The primary challenges include the high capital investment required for establishing advanced battery manufacturing facilities and procuring sophisticated battery making machinery. Supply chain disruptions for critical raw materials and specialized components can also impact production timelines and costs. Intense global competition, particularly from established players in Asia, presents a continuous pressure on domestic manufacturers to innovate and optimize costs. Navigating complex regulatory landscapes and ensuring adherence to evolving safety and environmental standards adds another layer of challenge for equipment providers and manufacturers alike.

Emerging Opportunities in United States Battery Manufacturing Equipment Market

Emerging opportunities in the United States battery manufacturing equipment market lie in the development of specialized machinery for next-generation battery technologies, such as solid-state batteries and advanced lithium-ion chemistries like silicon anodes and high-nickel cathodes. The growing demand for battery recycling equipment and technologies presents a significant untapped market. Furthermore, there is a substantial opportunity in providing integrated solutions and automation software that enhance the overall efficiency and data analytics capabilities of battery manufacturing plants, driving the adoption of smart battery production lines.

Growth Accelerators in the United States Battery Manufacturing Equipment Market Industry

Long-term growth in the United States battery manufacturing equipment industry is being accelerated by breakthroughs in material science that enable the development of more energy-dense and safer batteries, thus driving demand for new equipment designs. Strategic partnerships between equipment manufacturers and battery producers are crucial for co-developing tailored solutions and de-risking new technology adoption. Government incentives and policies aimed at fostering a robust domestic battery ecosystem, including investments in research and development and workforce training, are vital catalysts. The expansion of existing battery production facilities and the construction of new gigafactories across the country are direct growth accelerators for battery making equipment suppliers.

Key Players Shaping the United States Battery Manufacturing Equipment Market Market

- Xiamen Lith Machine Limited

- Xiamen Acey New Energy Technology Co Ltd

- Hitachi Ltd

- Schuler AG

- IPG Photonics Corporation

- Durr AG

- Xiamen Tmax Battery Equipments Limited

Notable Milestones in United States Battery Manufacturing Equipment Market Sector

- December 2022: General Motors and LG Energy Solution announced an additional USD 275 million investment in their joint venture battery plant in Tennessee, aiming to increase production by over 40%. This builds upon the USD 2.3 billion announced in April 2021 for the 2.8 million-square-foot facility. Production is slated to commence in late 2023.

- November 2022: Hyundai Motor Group and SK On signed a Memorandum of Understanding (MOU) for a new EV battery manufacturing facility. Operations are targeted to begin in 2025, with an estimated investment of USD 4-5 billion expected to create over 3,500 jobs in Georgia's Bartow County.

In-Depth United States Battery Manufacturing Equipment Market Market Outlook

The United States battery manufacturing equipment market is set for a period of sustained expansion, driven by the critical need for domestic battery production capacity to support the EV revolution and grid modernization efforts. Growth accelerators such as ongoing technological advancements in battery chemistry and manufacturing processes, coupled with robust government support through favorable policies and investments, are creating a fertile ground for innovation and capital deployment. Strategic alliances between equipment providers and battery manufacturers will be instrumental in streamlining the adoption of new technologies and ensuring scalable production. The outlook is highly positive, with significant opportunities for market players to contribute to a secure and sustainable energy future for the United States.

United States Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

United States Battery Manufacturing Equipment Market Segmentation By Geography

- 1. United States

United States Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of United States Battery Manufacturing Equipment Market

United States Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen Lith Machine Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IPG Photonics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiamen Tmax Battery Equipments Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Xiamen Lith Machine Limited

List of Figures

- Figure 1: United States Battery Manufacturing Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 2: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 3: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 8: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 9: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Battery Manufacturing Equipment Market?

The projected CAGR is approximately 27.61%.

2. Which companies are prominent players in the United States Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen Lith Machine Limited, Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive, Hitachi Ltd, Schuler AG, IPG Photonics Corporation, Durr AG, Xiamen Tmax Battery Equipments Limited.

3. What are the main segments of the United States Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

In December 2022, General Motors and LG Energy Solution will spend an additional USD 275 million in their joint venture battery plant in Tennessee to increase production by more than 40%. The joint venture, Ultium Cells LLC, announced that the new investment is in addition to the USD 2.3 billion announced in April 2021 to build the 2.8 million-square-foot facility. Production at the plant is expected to begin in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the United States Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence