Key Insights

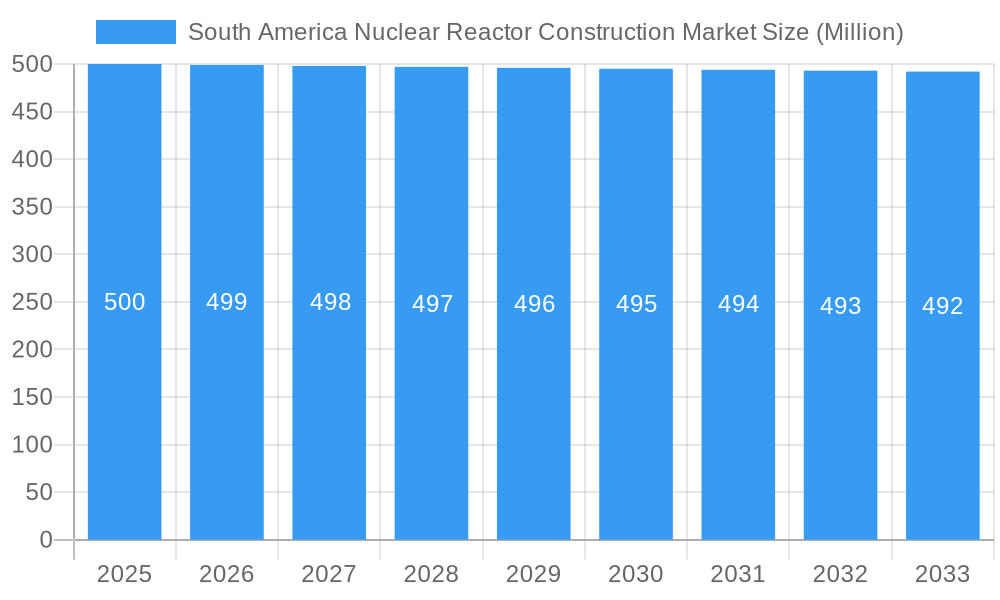

The South America nuclear reactor construction market is poised for a period of significant, albeit complex, evolution. Despite a projected modest CAGR of approximately -0.25% over the forecast period (2025-2033), indicating a slight contraction, the market's underlying value is substantial, estimated at $500 million in 2025. This projected decline, while seemingly negative, should be interpreted within the context of the industry's cyclical nature and the substantial existing infrastructure. The primary drivers for continued activity, even with a slight dip, are the ongoing needs for energy security, the drive towards lower-carbon electricity generation, and the potential for life extension and refurbishment projects on existing nuclear facilities. Furthermore, advancements in small modular reactor (SMR) technology could introduce new avenues for growth in the longer term, though their widespread adoption in this region within the immediate forecast period remains a key consideration. The market's resilience will likely be tested by evolving regulatory frameworks, public perception of nuclear energy, and the competitive landscape of other energy sources.

South America Nuclear Reactor Construction Market Market Size (In Million)

The regional landscape of the South America nuclear reactor construction market is distinctly shaped by Brazil and Argentina, which are expected to dominate activity. Brazil, with its established nuclear program and ongoing discussions surrounding new projects, is a critical player. Argentina, also possessing nuclear capabilities, will contribute to regional dynamics. The "Rest of South America" segment, while currently less active in large-scale construction, presents a latent opportunity as countries explore diversification of their energy portfolios. Key restraints will include the significant capital expenditure required for nuclear projects, stringent safety and regulatory compliance, and the long lead times associated with construction. Supply chain complexities and the availability of skilled labor are also critical factors that will influence the pace and success of any new construction or significant upgrade projects. Companies like SNC-Lavalin Inc and China National Nuclear Corporation are likely to play pivotal roles in shaping the market through their expertise and potential investments.

South America Nuclear Reactor Construction Market Company Market Share

South America Nuclear Reactor Construction Market Report - Future Outlook & Opportunities (2019-2033)

This comprehensive report offers an in-depth analysis of the South America Nuclear Reactor Construction Market, providing critical insights into its dynamics, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving landscape of nuclear power development in the region.

South America Nuclear Reactor Construction Market Market Dynamics & Structure

The South America nuclear reactor construction market is characterized by a moderate level of concentration, with a few dominant players actively shaping its trajectory. Technological innovation remains a key driver, particularly in enhancing reactor safety, efficiency, and waste management solutions. Governments across South America are increasingly focusing on robust regulatory frameworks to ensure public safety and environmental compliance, which, while adding to project timelines, fosters long-term trust and sustainability. Competitive product substitutes, primarily renewable energy sources like solar and wind, present a dynamic challenge, necessitating continuous advancements in nuclear technology to maintain its competitive edge in the energy mix. End-user demographics are evolving, with a growing demand for stable, baseload power to support industrialization and economic growth. Mergers and acquisitions (M&A) are also an emerging trend, as companies seek to consolidate expertise, expand their regional presence, and secure project pipelines. The market share of leading companies is estimated to be around 60-70% combined, reflecting a degree of consolidation. Innovation barriers include the substantial capital investment required for research and development, stringent safety regulations, and the need for specialized expertise.

South America Nuclear Reactor Construction Market Growth Trends & Insights

The South America Nuclear Reactor Construction Market is poised for significant growth, driven by the region's escalating energy demands and a strategic push towards decarbonization. The market size is projected to expand from an estimated USD 5,500 Million in 2025 to USD 12,000 Million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 10.5% during the forecast period. This robust growth is underpinned by several key trends. Firstly, the increasing reliance on stable, baseload power to fuel industrial expansion and meet the energy needs of a growing population is a primary catalyst. Countries are actively seeking reliable energy sources that can complement intermittent renewables. Secondly, a heightened global awareness of climate change and the commitment to reducing carbon emissions are driving renewed interest in nuclear energy as a low-carbon alternative to fossil fuels. This sentiment is translating into policy support and investment in new nuclear projects.

The adoption rates of nuclear power are expected to accelerate, particularly in countries with established nuclear programs and ambitious energy expansion plans. Technological advancements in Small Modular Reactors (SMRs) and Generation IV reactors are also anticipated to play a crucial role. These innovations promise enhanced safety, improved efficiency, and greater flexibility, making nuclear power more accessible and cost-effective for a wider range of applications and smaller grids. The integration of advanced digital technologies, such as AI and IoT, in reactor design, construction, and operation will further optimize performance and reduce operational risks. Consumer behavior, while historically nuanced regarding nuclear energy, is gradually shifting as the benefits of reliable, low-carbon energy become more apparent, coupled with increased transparency and robust safety standards. The market penetration of nuclear power in South America, currently at a modest level, is set to increase as new projects come online and existing facilities are upgraded or expanded. The strategic importance of energy security and independence further bolsters the demand for nuclear power solutions in the region.

Dominant Regions, Countries, or Segments in South America Nuclear Reactor Construction Market

Brazil is unequivocally the dominant region within the South America Nuclear Reactor Construction Market, commanding a substantial market share estimated at 45% of the total regional market. This dominance is driven by a confluence of strategic factors, including a long-standing commitment to nuclear energy as part of its energy diversification strategy, significant investments in existing nuclear infrastructure, and ambitious plans for future expansion. The country's primary nuclear facility, Angra Nuclear Power Plant, has been a cornerstone of its energy supply, and ongoing discussions and feasibility studies for additional reactors underscore Brazil's continued reliance on nuclear power. Economic policies in Brazil have historically supported the development of large-scale infrastructure projects, and nuclear power construction falls squarely within this purview. The sheer scale of Brazil's energy needs, fueled by its large population and robust industrial sector, further amplifies the demand for reliable baseload power, a role nuclear energy is ideally positioned to fulfill.

Argentina stands as the second-largest market, with an estimated 25% market share. The country has a well-established nuclear program, operating multiple reactors and possessing indigenous capabilities in fuel cycle technology and nuclear engineering. Government initiatives aimed at modernizing its nuclear fleet and exploring new reactor technologies contribute to its sustained presence in the market. The "Rest of South America" segment, encompassing countries like Chile, Colombia, and Peru, collectively holds the remaining 30% of the market. While these countries may not have extensive existing nuclear power generation, several are actively exploring the potential of nuclear energy. Factors driving their interest include the need for diversified and secure energy sources to meet growing demand, ambitious climate change mitigation goals, and the potential to leverage advanced technologies like SMRs for smaller, localized energy needs. For example, Chile is evaluating the feasibility of nuclear power to complement its significant renewable energy portfolio. Colombia is also exploring nuclear energy options to reduce its reliance on hydropower and thermal power. Peru has expressed interest in nuclear technology for research and potentially for future power generation. The overall growth potential in these emerging markets is significant, contingent on favorable economic conditions, political will, and the successful navigation of regulatory and public acceptance hurdles.

South America Nuclear Reactor Construction Market Product Landscape

The product landscape within the South America Nuclear Reactor Construction Market is centered on the design, engineering, procurement, and construction of nuclear power plants. Innovations are focused on enhancing safety features, such as passive safety systems and advanced containment structures, to meet stringent global standards. Reactor designs are evolving to improve fuel efficiency and reduce radioactive waste generation, with a growing interest in advanced reactor concepts like Small Modular Reactors (SMRs) for their flexibility and potential cost advantages. Performance metrics are rigorously defined by reliability, capacity factor, and a low cost of electricity generation over the plant's lifespan. Unique selling propositions of leading construction firms often lie in their proven track record, expertise in managing complex megaprojects, and their ability to integrate cutting-edge technologies.

Key Drivers, Barriers & Challenges in South America Nuclear Reactor Construction Market

Key Drivers:

- Growing Energy Demand: South America's expanding economies and populations necessitate a stable and reliable energy supply to meet increasing electricity needs.

- Decarbonization Goals: The global imperative to reduce carbon emissions positions nuclear power as a vital low-carbon baseload energy source.

- Energy Security & Independence: Diversifying energy portfolios with nuclear power reduces reliance on volatile fossil fuel markets and enhances national energy independence.

- Technological Advancements: Innovations in reactor design, including SMRs, offer increased safety, efficiency, and cost-effectiveness, making nuclear power more attractive.

- Government Support & Policy: Favorable government policies, regulatory frameworks, and long-term energy strategies are crucial for project initiation and success.

Key Barriers & Challenges:

- High Capital Costs & Long Lead Times: The immense upfront investment and multi-year construction timelines for nuclear power plants pose significant financial and planning challenges.

- Regulatory Hurdles & Public Perception: Stringent safety regulations and public concerns regarding nuclear safety and waste disposal can lead to project delays and increased costs.

- Skilled Workforce Shortages: A lack of specialized engineers, technicians, and construction personnel can impede project execution.

- Supply Chain Complexities: Sourcing specialized components and materials for nuclear construction can be challenging and time-consuming, impacting project timelines and costs.

- Competition from Renewables: The decreasing cost of renewable energy sources like solar and wind presents a significant competitive pressure. The market currently faces an estimated USD 3,000 Million in potential project delays due to these factors.

Emerging Opportunities in South America Nuclear Reactor Construction Market

Emerging opportunities in the South America Nuclear Reactor Construction Market are largely driven by the potential adoption of Small Modular Reactors (SMRs). These innovative, smaller-scale reactors offer greater flexibility in deployment, reduced upfront costs, and enhanced safety features, making them attractive for regions or industries with specific energy needs. There is also an untapped market for the refurbishment and life extension of existing nuclear power plants, ensuring continued reliable energy generation. Furthermore, exploring the use of nuclear technology for non-power applications, such as desalination or hydrogen production, presents a novel avenue for growth. The increasing focus on grid modernization and the need for stable baseload power to complement variable renewable sources creates a fertile ground for nuclear solutions.

Growth Accelerators in the South America Nuclear Reactor Construction Market Industry

Several key catalysts are accelerating growth in the South America Nuclear Reactor Construction Market. Technological breakthroughs in passive safety systems and advanced fuel cycles are enhancing the inherent safety and economic viability of nuclear power. Strategic partnerships between international nuclear technology providers and local South American engineering firms are fostering knowledge transfer and building regional expertise, thereby streamlining project execution. Government initiatives, including the development of clear regulatory pathways and financial incentives, are crucial in de-risking investments and encouraging the private sector to participate in nuclear projects. Furthermore, the growing emphasis on energy security and the long-term commitment to climate change mitigation are creating a sustained demand for low-carbon baseload power.

Key Players Shaping the South America Nuclear Reactor Construction Market Market

- SNC-Lavalin Inc

- China National Nuclear Corporation

Notable Milestones in South America Nuclear Reactor Construction Market Sector

- 2019: Initiation of feasibility studies for new reactor projects in various South American nations.

- 2020: Release of updated national energy plans in Brazil and Argentina, emphasizing the role of nuclear power.

- 2021: Announcement of research collaborations for advanced reactor technologies in Argentina.

- 2022: Discussions for potential SMR deployment in Chile gain momentum.

- 2023: Progress in regulatory framework updates for nuclear safety and security across several key countries.

- 2024: China National Nuclear Corporation secures a significant contract for a planned nuclear project in the region.

In-Depth South America Nuclear Reactor Construction Market Market Outlook

The South America Nuclear Reactor Construction Market is set for a period of robust expansion, fueled by an increasing regional commitment to sustainable and reliable energy solutions. The market's future potential is significantly bolstered by the ongoing development and potential deployment of Small Modular Reactors (SMRs), which offer a more adaptable and cost-effective approach to nuclear power generation. Strategic opportunities lie in leveraging existing infrastructure, fostering domestic expertise through international collaborations, and actively engaging in public education campaigns to address safety concerns. The convergence of energy security imperatives and ambitious climate targets will continue to drive demand, positioning the South American nuclear reactor construction sector for sustained growth and innovation in the coming years.

South America Nuclear Reactor Construction Market Segmentation

-

1. Geography

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Nuclear Reactor Construction Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Nuclear Reactor Construction Market Regional Market Share

Geographic Coverage of South America Nuclear Reactor Construction Market

South America Nuclear Reactor Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactor to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Brazil

- 5.1.2. Argentina

- 5.1.3. Rest of South America

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Brazil South America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Brazil

- 6.1.2. Argentina

- 6.1.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Argentina South America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Brazil

- 7.1.2. Argentina

- 7.1.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Rest of South America South America Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Brazil

- 8.1.2. Argentina

- 8.1.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 SNC-Lavalin Inc *List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 China National Nuclear Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.1 SNC-Lavalin Inc *List Not Exhaustive

List of Figures

- Figure 1: South America Nuclear Reactor Construction Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Nuclear Reactor Construction Market Share (%) by Company 2025

List of Tables

- Table 1: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 2: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Nuclear Reactor Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Nuclear Reactor Construction Market?

The projected CAGR is approximately 1.8%.

2. Which companies are prominent players in the South America Nuclear Reactor Construction Market?

Key companies in the market include SNC-Lavalin Inc *List Not Exhaustive, China National Nuclear Corporation.

3. What are the main segments of the South America Nuclear Reactor Construction Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Pressurized Water Reactor to dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Nuclear Reactor Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Nuclear Reactor Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Nuclear Reactor Construction Market?

To stay informed about further developments, trends, and reports in the South America Nuclear Reactor Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence