Key Insights

The China Hydrogen and Fuel Cells Industry is set for significant expansion, with a projected market size of \$25.00 billion by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of over 11.20%. This growth is largely fueled by substantial government backing for decarbonization objectives, notably the "dual carbon" goals, which are stimulating considerable investment in hydrogen as a clean energy solution. The increasing demand for zero-emission transportation, including fuel cell electric vehicles (FCEVs) for both commercial and passenger use, is a primary catalyst. Additionally, the expanding application of fuel cell technology in stationary power systems, such as backup power for critical infrastructure like telecommunications and data centers, and for distributed power generation in industrial zones, is contributing to market advancement. Continuous technological innovation in fuel cell components, particularly in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), is enhancing efficiency and reducing costs, thereby increasing their competitiveness against conventional energy sources. The integration of hydrogen fuel cells into novel energy systems for industrial processes, promoting a circular economy by leveraging waste heat and by-product hydrogen, also presents a significant growth avenue.

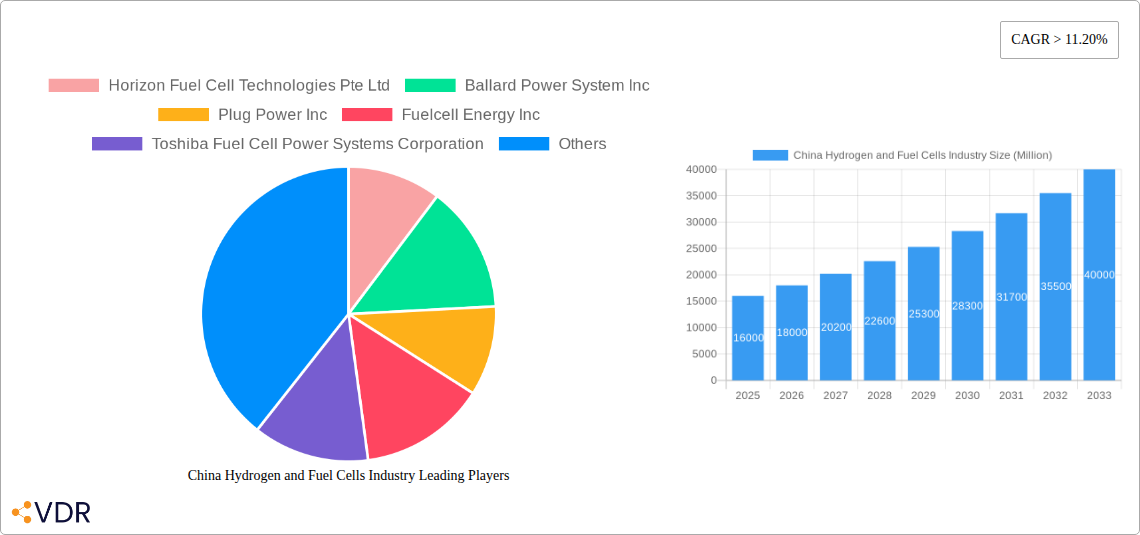

China Hydrogen and Fuel Cells Industry Market Size (In Billion)

Several factors are influencing the trajectory of China's hydrogen and fuel cell market. Key applications such as portable devices and stationary power solutions are gaining momentum, while the transportation sector, encompassing both road and rail, is a focal point for large-scale implementation. The continued dominance of PEMFC technology is anticipated due to its versatility across applications, from vehicles to portable power, owing to its rapid response times and compact design. However, SOFCs are emerging as a strong contender for stationary power generation due to their high efficiency and fuel flexibility. Leading companies including Horizon Fuel Cell Technologies Pte Ltd, Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, and Toshiba Fuel Cell Power Systems Corporation are actively investing in research and development, scaling production, and forming strategic alliances within China to capitalize on this lucrative market. While rapid growth is evident, persistent challenges such as the high cost of green hydrogen production, the necessity for extensive hydrogen refueling infrastructure development, and the establishment of comprehensive safety standards and regulations remain critical areas requiring ongoing attention and investment to ensure sustained and widespread adoption.

China Hydrogen and Fuel Cells Industry Company Market Share

China Hydrogen and Fuel Cells Industry: Market Analysis and Forecast (2025–2033)

This comprehensive report offers an in-depth analysis of the dynamic China Hydrogen and Fuel Cells Industry. Covering the forecast period from 2025 to 2033, with 2025 as the base year, and an estimated market size of \$12.94 billion, this research provides critical insights into market dynamics, growth trends, regional significance, product offerings, key drivers, challenges, emerging opportunities, growth accelerators, and the competitive landscape. Focused on high-impact keywords and a granular segmentation of market areas, this report serves as an indispensable resource for industry professionals aiming to navigate and leverage the substantial potential of China's clean energy future. All quantitative data is presented in billions for clarity and ease of comparison.

China Hydrogen and Fuel Cells Industry Market Dynamics & Structure

The China Hydrogen and Fuel Cells Industry is characterized by a dynamic and evolving market structure. Market concentration is moderately fragmented, with a growing number of domestic and international players vying for market share. Technological innovation is the primary driver, fueled by substantial government investment in research and development and the pursuit of carbon neutrality goals. Regulatory frameworks are increasingly supportive, with national and provincial policies actively promoting the adoption of hydrogen fuel cell technologies through subsidies, tax incentives, and infrastructure development plans. Competitive product substitutes, primarily advanced battery electric vehicles and traditional internal combustion engines, are present but are facing increasing pressure from the superior performance and environmental benefits of hydrogen fuel cells in specific applications. End-user demographics are shifting towards environmentally conscious consumers and industries seeking sustainable energy solutions. Mergers and acquisitions (M&A) trends are on the rise as larger companies seek to consolidate their positions, acquire critical technologies, or expand their market reach.

- Market Concentration: Moderately fragmented with increasing consolidation.

- Technological Innovation Drivers: Government R&D funding, pursuit of carbon neutrality targets, advancements in PEMFC and SOFC technologies.

- Regulatory Frameworks: Favorable government policies, subsidies, tax incentives, and infrastructure support.

- Competitive Product Substitutes: Battery electric vehicles (BEVs), internal combustion engine (ICE) vehicles, and grid-based electricity.

- End-User Demographics: Government fleets, commercial transportation, industrial applications, and increasingly, consumer adoption in specific segments.

- M&A Trends: Growing number of strategic partnerships and acquisitions to gain technological edge and market access.

China Hydrogen and Fuel Cells Industry Growth Trends & Insights

The China Hydrogen and Fuel Cells Industry is poised for exponential growth, driven by a confluence of factors including ambitious national decarbonization targets, significant government incentives, and rapid technological advancements. The market size is expected to expand at a robust Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market value of $xx Billion by 2033. Adoption rates are accelerating across various applications, particularly in the transportation sector, with commercial vehicles, buses, and logistics fleets leading the charge. Technological disruptions are continuously reshaping the industry, with ongoing improvements in fuel cell efficiency, durability, and cost-effectiveness, especially for Polymer Electrolyte Membrane Fuel Cells (PEMFC) and Solid Oxide Fuel Cells (SOFC). Consumer behavior is shifting, with a growing awareness of environmental sustainability influencing purchasing decisions, though cost remains a critical factor for mass adoption. The integration of hydrogen fuel cell systems into the energy grid for stationary power generation and backup power solutions is also gaining traction, presenting a significant growth avenue. The historical period from 2019 to 2024 saw initial policy support and pilot projects laying the groundwork for this anticipated boom. The base year of 2025 marks a critical inflection point where widespread deployment is expected to accelerate. The forecast period of 2025–2033 will witness sustained and intensified market expansion, driven by infrastructure build-out and increasing commercial viability. The market penetration of hydrogen fuel cell technology is projected to move from niche applications to broader societal integration.

Dominant Regions, Countries, or Segments in China Hydrogen and Fuel Cells Industry

Within the China Hydrogen and Fuel Cells Industry, several regions and segments are emerging as dominant growth drivers. Transportation stands out as the leading application segment, propelled by national policies aimed at decarbonizing the mobility sector. China's commitment to zero-emission vehicles, particularly for heavy-duty trucks, buses, and logistics fleets, creates a massive demand for hydrogen fuel cells.

- Leading Application Segment: Transportation

- Key Drivers:

- Government mandates for zero-emission vehicle adoption.

- Development of extensive hydrogen refueling infrastructure in key urban and logistics hubs.

- Cost reduction in fuel cell stacks and hydrogen production.

- Improved performance and longer range compared to battery electric vehicles for commercial applications.

- Market Share & Growth Potential: The transportation segment is projected to capture over xx% of the total market share by 2033, with an estimated market size of $xx Billion. Growth is anticipated to be driven by fleet renewals and the expansion of hydrogen-powered public transport systems.

- Key Drivers:

The Polymer Electrolyte Membrane Fuel Cell (PEMFC) technology is the dominant fuel cell technology segment, accounting for approximately xx% of the market. Its lightweight nature, quick startup time, and suitability for mobile applications make it the preferred choice for the transportation sector.

- Dominant Fuel Cell Technology: Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- Key Drivers:

- Maturity and scalability of PEMFC technology.

- Cost competitiveness driven by mass production.

- High power density suitable for vehicles.

- Ongoing advancements in membrane and catalyst materials.

- Market Share & Growth Potential: PEMFC is expected to maintain its dominance, with its market share growing at a CAGR of xx% during the forecast period. Its application in fuel cell electric vehicles (FCEVs) will continue to be the primary growth engine.

- Key Drivers:

Regionally, Eastern China, encompassing major industrial and economic hubs like Shanghai, Jiangsu, and Zhejiang, is leading the market development. These regions benefit from strong government support, established industrial bases for manufacturing, and a higher concentration of pilot projects and early adopters.

- Dominant Region: Eastern China

- Key Drivers:

- Concentration of hydrogen production facilities and refueling stations.

- Presence of leading fuel cell manufacturers and research institutions.

- Strong demand from urban transportation and industrial sectors.

- Proactive provincial and municipal policies supporting hydrogen energy.

- Market Share & Growth Potential: Eastern China is estimated to hold xx% of the market share, with significant investment pouring into developing comprehensive hydrogen ecosystems.

- Key Drivers:

While other applications like Stationary power generation (e.g., backup power for data centers, uninterruptible power supply) are also growing, and Portable applications (e.g., consumer electronics, portable generators) are in early stages of development, the transportation sector and PEMFC technology are currently the primary forces shaping the industry's trajectory.

China Hydrogen and Fuel Cells Industry Product Landscape

The China Hydrogen and Fuel Cells Industry product landscape is characterized by continuous innovation and diversification across various applications. Fuel cell systems, primarily PEMFC and SOFC, are being integrated into a wide range of products, from passenger cars and commercial vehicles to buses, trains, and even ships. Innovations are focused on enhancing power output, improving energy efficiency, extending operational lifespan, and reducing manufacturing costs. Notable product advancements include lightweight and compact fuel cell stacks for mobility, high-efficiency SOFC systems for stationary power generation, and integrated hydrogen storage solutions. Performance metrics such as power density, operating temperature, and fuel utilization are consistently being optimized to meet the stringent demands of diverse end-users. Companies like Ballard Power System Inc. are known for their advanced PEMFC stacks, while others are developing proprietary SOFC solutions for industrial applications. The focus remains on delivering reliable, sustainable, and cost-effective hydrogen energy solutions that can displace fossil fuels across multiple sectors.

Key Drivers, Barriers & Challenges in China Hydrogen and Fuel Cells Industry

Key Drivers: The primary forces propelling the China Hydrogen and Fuel Cells Industry are robust government support and ambitious decarbonization targets. National policies, including subsidies, tax incentives, and preferential procurement, are crucial in driving demand and investment. Technological advancements in fuel cell efficiency and cost reduction are making hydrogen a more viable alternative. The increasing focus on energy security and the desire to reduce reliance on imported fossil fuels are also significant motivators. Furthermore, the growing environmental awareness among consumers and businesses is creating a push for cleaner energy solutions. The development of a comprehensive hydrogen ecosystem, including production, storage, and distribution infrastructure, acts as a critical enabler.

Barriers & Challenges: Despite the strong growth potential, the industry faces significant challenges. The high initial cost of fuel cell systems and hydrogen production remains a major barrier to widespread adoption. The lack of a comprehensive and widespread hydrogen refueling infrastructure limits the practical application of hydrogen vehicles. Safety concerns associated with hydrogen storage and handling, though often manageable with proper protocols, can still be a deterrent for some. Supply chain bottlenecks for critical components, such as platinum-group metal catalysts, can also impact production volumes and costs. Regulatory inconsistencies and the need for standardized safety regulations across different regions pose further hurdles. Intense competition from established battery electric vehicle technology also presents a challenge.

Emerging Opportunities in China Hydrogen and Fuel Cells Industry

Emerging opportunities in the China Hydrogen and Fuel Cells Industry lie in several key areas. The expansion of hydrogen refueling infrastructure beyond major cities into secondary and tertiary markets presents a significant untapped market. The development of integrated hydrogen energy solutions for industrial parks, offering both power generation and heat, is another promising avenue. The increasing demand for clean energy in heavy-duty transportation, including mining trucks and long-haul logistics, offers substantial growth potential. Furthermore, the exploration of green hydrogen production through renewable energy sources is gaining momentum, creating opportunities for renewable energy developers and electrolyzer manufacturers. The potential for hydrogen fuel cells in maritime and aviation applications, though nascent, represents a future growth frontier. Innovations in hydrogen storage technologies, such as solid-state storage, could also unlock new opportunities.

Growth Accelerators in the China Hydrogen and Fuel Cells Industry Industry

Several catalysts are accelerating the growth of the China Hydrogen and Fuel Cells Industry. Technological breakthroughs in reducing the cost of fuel cell stacks, particularly for PEMFCs, are making them more competitive. Strategic partnerships between fuel cell manufacturers, automotive companies, and energy providers are facilitating market penetration and scaling up production. Government-led initiatives and the establishment of hydrogen industrial parks are fostering collaboration and accelerating infrastructure development. The increasing adoption of hydrogen by large corporations for their fleet decarbonization strategies is creating significant demand and driving market expansion. The continued investment in R&D for advanced materials and manufacturing processes is further enhancing the performance and reducing the cost of hydrogen fuel cell systems, thereby acting as a crucial growth accelerator.

Key Players Shaping the China Hydrogen and Fuel Cells Industry Market

- Horizon Fuel Cell Technologies Pte Ltd

- Ballard Power System Inc

- Plug Power Inc

- Fuelcell Energy Inc

- Toshiba Fuel Cell Power Systems Corporation

Notable Milestones in China Hydrogen and Fuel Cells Industry Sector

- 2019: Release of the "Guideline for the Development of Hydrogen Energy Industry" by the National Development and Reform Commission, signaling strong government backing.

- 2020: Launch of pilot cities for hydrogen fuel cell vehicle promotion and application by the Ministry of Science and Technology, accelerating adoption.

- 2021: Significant investment and policy announcements from various provincial governments to support hydrogen infrastructure development and fuel cell production.

- 2022: Introduction of new energy vehicle (NEV) subsidies that include fuel cell vehicles, further incentivizing adoption.

- 2023: Major breakthroughs in domestic PEMFC stack technology, achieving higher power density and improved durability.

- 2024: Expansion of hydrogen refueling station networks in key economic zones and increased deployment of fuel cell buses and trucks in pilot cities.

In-Depth China Hydrogen and Fuel Cells Industry Market Outlook

The outlook for the China Hydrogen and Fuel Cells Industry is exceptionally strong, driven by aggressive national policies and a clear commitment to achieving carbon neutrality. Growth accelerators such as continuous technological innovation in fuel cell efficiency and cost reduction, coupled with substantial investments in hydrogen production and infrastructure, are creating a robust ecosystem. Strategic partnerships and collaborations among industry stakeholders are further bolstering market expansion and accelerating the deployment of hydrogen solutions. The increasing market penetration in transportation, particularly for commercial vehicles, and the burgeoning interest in stationary power applications signal sustained long-term growth. The industry is on the cusp of a transformative period, with significant potential for market leadership and global influence in the clean energy transition.

China Hydrogen and Fuel Cells Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

China Hydrogen and Fuel Cells Industry Segmentation By Geography

- 1. China

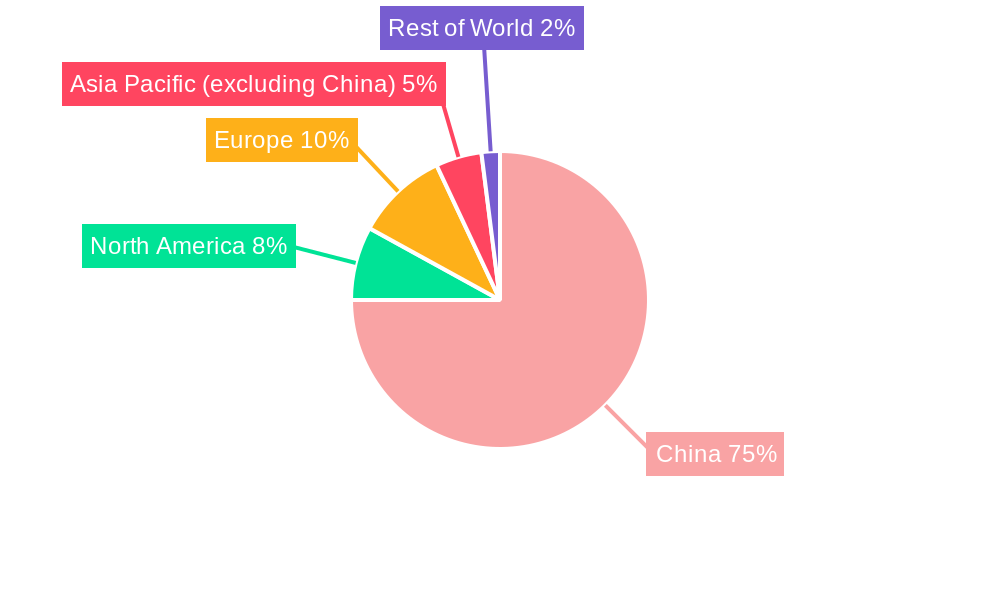

China Hydrogen and Fuel Cells Industry Regional Market Share

Geographic Coverage of China Hydrogen and Fuel Cells Industry

China Hydrogen and Fuel Cells Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Trend of Renewable Power Generation

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Hydrogen and Fuel Cells Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Horizon Fuel Cell Technologies Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ballard Power System Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plug Power Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuelcell Energy Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toshiba Fuel Cell Power Systems Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Horizon Fuel Cell Technologies Pte Ltd

List of Figures

- Figure 1: China Hydrogen and Fuel Cells Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Hydrogen and Fuel Cells Industry Share (%) by Company 2025

List of Tables

- Table 1: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 6: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Hydrogen and Fuel Cells Industry?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the China Hydrogen and Fuel Cells Industry?

Key companies in the market include Horizon Fuel Cell Technologies Pte Ltd, Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Toshiba Fuel Cell Power Systems Corporation.

3. What are the main segments of the China Hydrogen and Fuel Cells Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.94 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator.

6. What are the notable trends driving market growth?

Transportation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Trend of Renewable Power Generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Hydrogen and Fuel Cells Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Hydrogen and Fuel Cells Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Hydrogen and Fuel Cells Industry?

To stay informed about further developments, trends, and reports in the China Hydrogen and Fuel Cells Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence