Key Insights

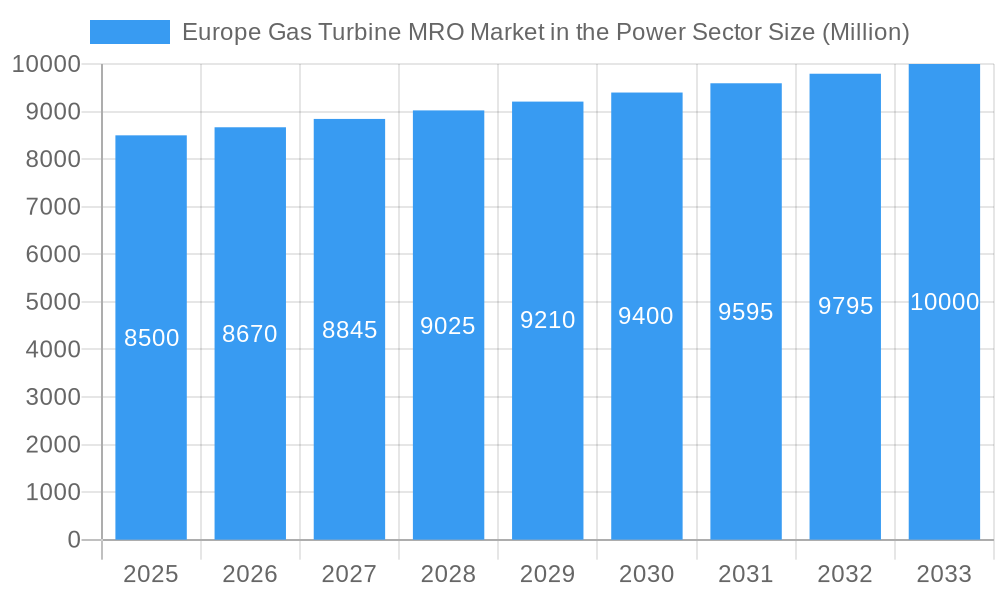

The Europe Gas Turbine Maintenance, Repair, and Overhaul (MRO) market in the power sector is projected for significant expansion. Anticipated to reach a market size of 29.5 billion, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.1% from the 2025 base year through 2033. This growth is propelled by the escalating demand for reliable and efficient power generation across Europe, driven by evolving energy landscapes and the imperative to maintain critical existing infrastructure. The region's commitment to energy security and the continued reliance on gas-fired power plants for baseload and transitional power underscore the persistent need for robust MRO services. Key growth drivers include aging gas turbine fleets, stringent environmental regulations mandating performance upgrades and emission controls, and the pursuit of extended operational lifespans. Leading companies such as Siemens AG, General Electric Company, and Mitsubishi Heavy Industries Ltd are at the forefront, investing in advanced MRO technologies and expanding service networks to meet evolving power utility demands.

Europe Gas Turbine MRO Market in the Power Sector Market Size (In Billion)

Market dynamics are further shaped by distinct trends and restraints. A prominent trend is the increasing adoption of digital solutions and predictive maintenance strategies, utilizing AI and IoT to minimize downtime and optimize operational efficiency. This shift towards condition-based monitoring and proactive servicing is crucial for cost optimization and ensuring the longevity of valuable gas turbine assets. Furthermore, the market's segmentation between Maintenance, Repair, and Overhaul services highlights the comprehensive needs of the sector. While Original Equipment Manufacturers (OEMs) maintain a significant market share, Independent Service Providers are gaining traction by offering competitive pricing and specialized expertise, fostering a dynamic competitive environment. However, the market faces restraints such as the high capital investment required for advanced MRO facilities and potential volatility in natural gas prices, which can indirectly influence power generation output and, consequently, MRO demand. The ongoing energy transition towards renewable sources, while a long-term consideration, presents a complex interplay with the sustained demand for gas turbine MRO in the interim.

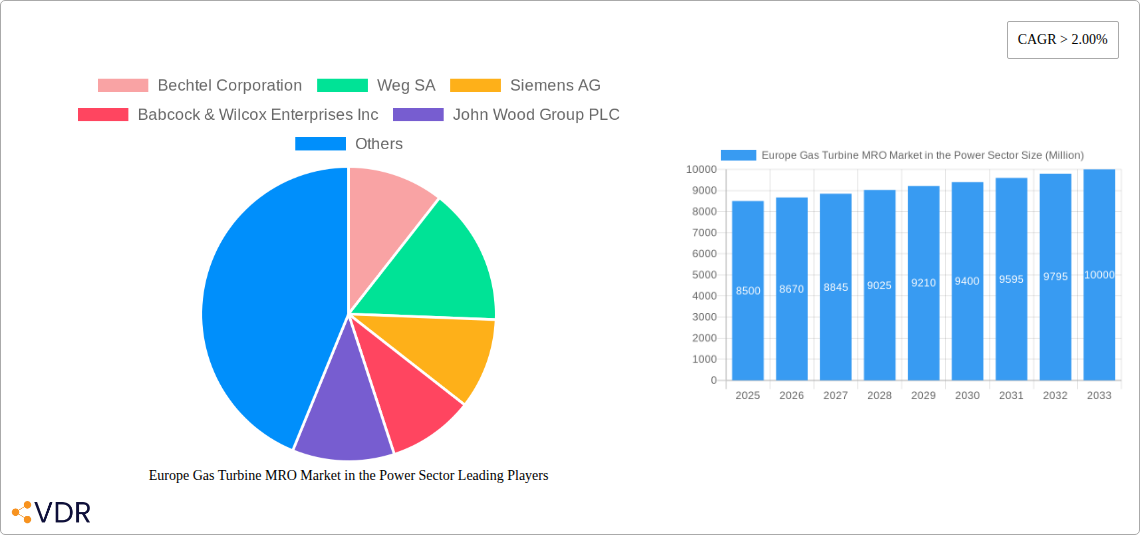

Europe Gas Turbine MRO Market in the Power Sector Company Market Share

This report delivers an in-depth analysis of the Europe Gas Turbine MRO Market in the Power Sector, a critical segment within the broader energy infrastructure landscape. We explore the intricate dynamics, growth trajectories, and future potential of gas turbine maintenance, repair, and overhaul (MRO) services essential for powering Europe's electricity generation. Our study encompasses the forecast period from 2025 to 2033, with 2025 serving as the base year, offering detailed market size projections. Leveraging advanced analytical methodologies, this report provides unparalleled insights into market size evolution, technological disruptions, and the competitive landscape for gas turbine aftermarket services across Europe. This comprehensive report is designed to equip industry professionals, investors, and policymakers with the strategic intelligence needed to navigate and capitalize on the evolving power sector MRO market.

Europe Gas Turbine MRO Market in the Power Sector Market Dynamics & Structure

The Europe Gas Turbine MRO Market in the Power Sector exhibits a moderately concentrated structure, with a significant portion of the market share held by Original Equipment Manufacturers (OEMs) like Siemens AG, General Electric Company, and Mitsubishi Heavy Industries Ltd. These players benefit from proprietary knowledge and established service networks, driving a substantial portion of the gas turbine maintenance revenue. However, the rise of independent service providers and the increasing capability of in-house maintenance teams are gradually diversifying the competitive landscape, introducing price competition and specialized service offerings. Technological innovation remains a key driver, particularly in the realm of advanced diagnostics, predictive maintenance solutions, and the development of more fuel-efficient and environmentally compliant turbine components. Regulatory frameworks, including stringent emissions standards and energy transition policies, are indirectly influencing MRO demand by promoting the adoption of newer, cleaner turbine technologies and mandating higher operational efficiency. Competitive product substitutes, such as renewable energy sources, are a long-term consideration, but the immediate need for reliable baseload and peak load power ensures the continued relevance of gas turbines and their associated MRO services. End-user demographics are shifting towards a greater demand for flexible and responsive power generation, necessitating optimized gas turbine repair and overhaul schedules. Mergers and acquisitions (M&A) are expected to continue, driven by the pursuit of scale, technological integration, and expanded service portfolios.

- Market Concentration: Dominated by a few key OEMs, but with growing influence of independent service providers.

- Technological Innovation: Focus on digital solutions, predictive analytics, and component upgrades for efficiency and emissions reduction.

- Regulatory Frameworks: Emission control mandates and energy security policies are shaping MRO requirements.

- Competitive Substitutes: Long-term threat from renewables, but short-to-medium term reliance on gas turbines for grid stability.

- End-User Demographics: Demand for flexible, reliable, and environmentally compliant power generation.

- M&A Trends: Strategic consolidation to enhance service capabilities and market reach.

Europe Gas Turbine MRO Market in the Power Sector Growth Trends & Insights

The Europe Gas Turbine MRO Market in the Power Sector is poised for steady growth, driven by the imperative to maintain and optimize existing gas turbine fleets for continued reliable electricity generation. The market size is projected to expand significantly over the forecast period, fueled by an aging installed base requiring regular overhaul services and component replacements. Adoption rates for advanced MRO technologies, such as remote monitoring and AI-driven diagnostics, are accelerating as power operators seek to minimize downtime and enhance operational efficiency. Technological disruptions are not entirely replacing traditional MRO but are augmenting it, enabling more proactive and precise interventions. This shift from reactive to predictive maintenance is a major trend reshaping consumer behavior, with operators increasingly investing in service agreements that offer long-term reliability and cost predictability. The CAGR for the gas turbine aftermarket services in Europe is estimated to be in the range of 3.5% to 4.5%, reflecting a mature yet robust market. Market penetration of digital MRO solutions is expected to increase from approximately 40% in 2025 to over 65% by 2033, indicating a significant transformation in how gas turbine repair and maintenance are conducted. Furthermore, the ongoing transition towards cleaner energy sources is creating a sustained demand for efficient gas turbines, particularly in regions where renewable energy intermittency requires reliable backup power. This necessitates ongoing investment in the upkeep of these critical assets. The increasing complexity of modern gas turbines also demands specialized expertise and advanced tooling, further driving the need for professional MRO services. The market's growth is also influenced by geopolitical factors and energy security concerns, which underscore the importance of maintaining domestic power generation capabilities. The long-term operational viability of existing gas turbine infrastructure relies heavily on effective gas turbine MRO, ensuring both performance and compliance with evolving environmental regulations.

Dominant Regions, Countries, or Segments in Europe Gas Turbine MRO Market in the Power Sector

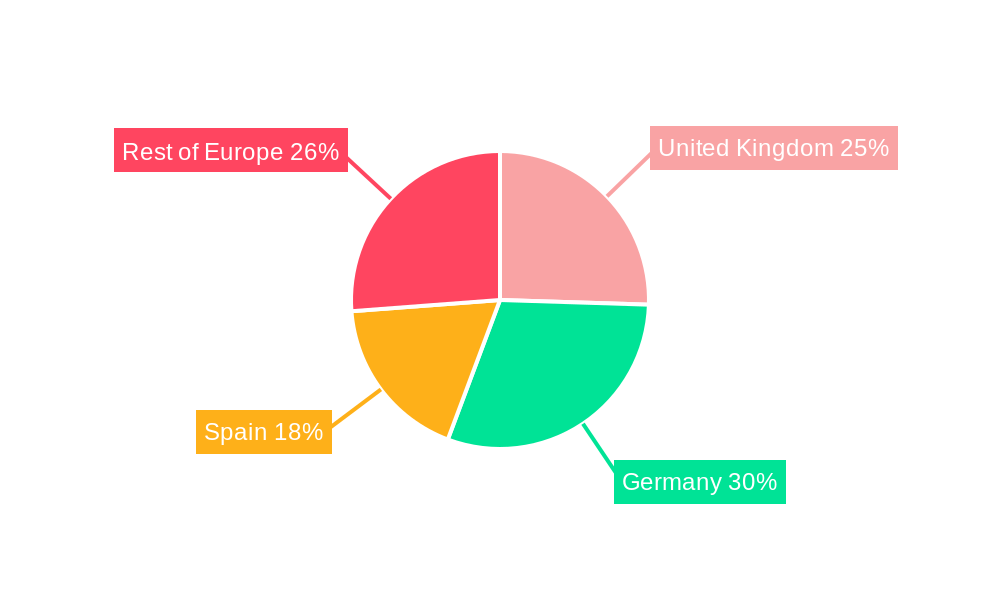

The Europe Gas Turbine MRO Market in the Power Sector is currently dominated by Western European countries, particularly Germany, the United Kingdom, France, and Italy. These nations possess a substantial installed base of gas turbine power generation capacity, driven by historical investments in fossil fuel-based electricity generation and their critical role in ensuring grid stability. Germany, with its significant industrial base and strong emphasis on energy security, leads in terms of overall MRO expenditure, closely followed by the United Kingdom and France.

Within the segment analysis, Maintenance services constitute the largest share of the market, accounting for an estimated 55% of the total MRO revenue. This is due to the regular and scheduled nature of routine checks, minor repairs, and preventative actions required to keep gas turbines operating optimally. Repair services follow, representing approximately 30% of the market, encompassing more complex interventions and component rectifications. Overhaul services, while less frequent, represent the most significant revenue-generating activities per event, accounting for the remaining 15% of the market, and are crucial for extending the lifespan of major turbine components and ensuring peak performance.

In terms of Provider Type, OEMs continue to hold a dominant position, capturing an estimated 60% of the market share. Their deep understanding of their own turbine models, proprietary technologies, and extensive service networks provide them with a competitive edge. However, Independent Service Providers are steadily gaining traction, estimated to hold around 30% of the market. They offer competitive pricing, specialized expertise, and greater flexibility, catering to a growing segment of power operators seeking cost-effective MRO solutions. In-house maintenance capabilities, while still a smaller segment at approximately 10%, are also seeing increased investment by some larger utilities seeking greater control over their maintenance operations and a reduction in third-party dependency.

Key drivers for dominance in these regions and segments include:

- Economic Policies: Government incentives for energy infrastructure modernization and grid stability initiatives.

- Infrastructure: High density of existing gas-fired power plants requiring ongoing MRO.

- Technological Adoption: Higher willingness to invest in advanced MRO solutions and predictive maintenance.

- Regulatory Compliance: Strict environmental regulations necessitate efficient and well-maintained turbines.

- Energy Security Concerns: The need for reliable domestic power sources drives investment in maintaining existing assets.

Europe Gas Turbine MRO Market in the Power Sector Product Landscape

The Europe Gas Turbine MRO Market in the Power Sector is characterized by a sophisticated product landscape focused on enhancing the performance, reliability, and longevity of gas turbine components. Innovations in gas turbine maintenance revolve around advanced diagnostic tools, such as borescope inspections with high-resolution imaging, ultrasonic testing, and eddy current testing, enabling early detection of potential issues. Repair technologies are increasingly sophisticated, employing techniques like plasma spraying, laser cladding, and advanced welding processes to restore worn or damaged components, thereby reducing the need for costly replacements. Overhaul services benefit from the development of modular component designs and standardized procedures, streamlining the complex process of disassembling, inspecting, and reassembling entire turbine sections. Performance metrics are continuously being pushed, with MRO providers focusing on restoring turbines to their original factory specifications or even improving efficiency through upgrades. Unique selling propositions often lie in the speed of turnaround times, the expertise of specialized engineers, and the warranty offered on repaired or refurbished components. Technological advancements are also geared towards improving environmental compliance, with MRO solutions designed to optimize combustion for reduced emissions and enhance the efficiency of emission control systems.

Key Drivers, Barriers & Challenges in Europe Gas Turbine MRO Market in the Power Sector

Key Drivers: The Europe Gas Turbine MRO Market in the Power Sector is propelled by several key drivers. Firstly, the aging installed base of gas turbines necessitates continuous maintenance and repair to ensure operational reliability and prevent unexpected outages. Secondly, stringent environmental regulations, including emissions standards (e.g., Industrial Emissions Directive), are driving demand for MRO services that optimize turbine performance for cleaner operation. Thirdly, the increasing global focus on energy security and the need for flexible power generation to balance intermittent renewable sources makes well-maintained gas turbines crucial for grid stability. Finally, advancements in digital MRO technologies, such as AI-powered predictive analytics and remote monitoring, are enabling more efficient and cost-effective maintenance strategies, acting as a significant growth accelerator.

Barriers & Challenges: Despite the robust growth potential, the market faces several barriers and challenges. The high cost of specialized MRO services and replacement parts can be a significant deterrent for some operators, especially in periods of economic uncertainty. The increasing complexity of newer gas turbine models requires highly skilled technicians and specialized training, creating a potential skills gap. Supply chain disruptions, particularly for critical components and raw materials, can lead to extended lead times and increased costs. Furthermore, the long-term transition to renewable energy sources, while creating demand for flexible gas power, also presents a strategic challenge to the sustained growth of gas turbine MRO in the distant future. Competition from a growing number of independent service providers, while beneficial for customers, also puts pressure on pricing and profit margins for established players. Regulatory uncertainties regarding future energy policies and the role of natural gas in the energy mix can also create hesitations in long-term investment decisions for MRO services.

Emerging Opportunities in Europe Gas Turbine MRO Market in the Power Sector

Emerging opportunities in the Europe Gas Turbine MRO Market in the Power Sector lie in the increasing demand for advanced digital solutions and specialized services. The widespread adoption of Industry 4.0 technologies offers significant potential for predictive maintenance, remote diagnostics, and the optimization of MRO workflows, leading to reduced downtime and operational costs. There is a growing niche for MRO providers specializing in the refurbishment and extension of the lifespan of older, but still critical, gas turbine models as a more cost-effective alternative to new installations. Furthermore, the focus on decarbonization and the potential for co-firing or transitioning gas turbines to hydrogen or other sustainable fuels presents a long-term opportunity for MRO providers to develop new expertise and service offerings in the realm of alternative fuels. The growing emphasis on circular economy principles also opens avenues for innovative component recycling and remanufacturing processes.

Growth Accelerators in the Europe Gas Turbine MRO Market in the Power Sector Industry

Several catalysts are accelerating growth in the Europe Gas Turbine MRO Market in the Power Sector. The ongoing retirement of older, less efficient coal-fired power plants, coupled with the need for reliable backup power to complement the increasing penetration of renewable energy sources, is ensuring a sustained role for gas turbines. Technological breakthroughs in areas like additive manufacturing (3D printing) are revolutionizing component repair and the production of spare parts, leading to reduced lead times and costs. Strategic partnerships between MRO providers and technology companies are fostering the development and deployment of cutting-edge digital solutions, enhancing service offerings and customer value. Market expansion strategies by key players, including geographical diversification and the broadening of service portfolios, are also contributing to sustained growth.

Key Players Shaping the Europe Gas Turbine MRO Market in the Power Sector Market

- Bechtel Corporation

- Weg SA

- Siemens AG

- Babcock & Wilcox Enterprises Inc

- John Wood Group PLC

- Sulzer AG

- General Electric Company

- Flour Corporation

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Europe Gas Turbine MRO Market in the Power Sector Sector

- February 2022: Ansaldo Energia signed a 20-year agreement for gas turbine maintenance in the 1518.5 MW gas power plant owned by Cairo Electricity Production Company. The Power plant is equipped with four AE 94-2 gas turbines built at the Ansaldo Energia site in Genoa. This significant long-term contract underscores the demand for reliable gas turbine overhaul and maintenance services for large-scale power generation facilities.

- January 2022: Wartsila won an EPC contract from A2A Gencogas to build a 110 MW flexible power plant in Cassano d'Adda, Italy. The scope of the contract includes the complete engineering, procurement, and construction services for setting up a gas-fired plant with 6 Wartsila 50SG gas-fueled internal combustion engines in collaboration with Cefla. The equipment delivery is scheduled to take place in autumn 2022, and the plant is expected to be completed by 2023. This development highlights the continued investment in new gas-fired power generation capacity, which will in turn drive future demand for gas turbine MRO as these plants enter their operational life.

In-Depth Europe Gas Turbine MRO Market in the Power Sector Market Outlook

The future market outlook for the Europe Gas Turbine MRO Market in the Power Sector remains positive, driven by the enduring need for reliable and flexible power generation. Growth accelerators such as the ongoing integration of renewable energy, necessitating robust gas turbine backup, and the advancement of digital MRO solutions will continue to shape the market. Strategic opportunities are abundant for companies that can offer specialized services, embrace technological innovation, and adapt to evolving environmental regulations. The market's trajectory points towards increased efficiency, predictive capabilities, and potentially the integration of alternative fuels, ensuring the continued relevance of gas turbine aftermarket services in Europe's evolving energy landscape.

Europe Gas Turbine MRO Market in the Power Sector Segmentation

-

1. Service Type

- 1.1. Maintenance

- 1.2. Repair

- 1.3. Overhaul

-

2. Provider Type

- 2.1. OEMs

- 2.2. Independent Service Providers

- 2.3. In-house

Europe Gas Turbine MRO Market in the Power Sector Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. Rest of Europe

Europe Gas Turbine MRO Market in the Power Sector Regional Market Share

Geographic Coverage of Europe Gas Turbine MRO Market in the Power Sector

Europe Gas Turbine MRO Market in the Power Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. Maintenance Sector to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Maintenance

- 5.1.2. Repair

- 5.1.3. Overhaul

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. OEMs

- 5.2.2. Independent Service Providers

- 5.2.3. In-house

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United Kingdom Europe Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Maintenance

- 6.1.2. Repair

- 6.1.3. Overhaul

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. OEMs

- 6.2.2. Independent Service Providers

- 6.2.3. In-house

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Germany Europe Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Maintenance

- 7.1.2. Repair

- 7.1.3. Overhaul

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. OEMs

- 7.2.2. Independent Service Providers

- 7.2.3. In-house

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Spain Europe Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Maintenance

- 8.1.2. Repair

- 8.1.3. Overhaul

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. OEMs

- 8.2.2. Independent Service Providers

- 8.2.3. In-house

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Europe Europe Gas Turbine MRO Market in the Power Sector Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Maintenance

- 9.1.2. Repair

- 9.1.3. Overhaul

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. OEMs

- 9.2.2. Independent Service Providers

- 9.2.3. In-house

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bechtel Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Weg SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siemens AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Babcock & Wilcox Enterprises Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 John Wood Group PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sulzer AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 General Electric Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Flour Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi Heavy Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Bechtel Corporation

List of Figures

- Figure 1: Europe Gas Turbine MRO Market in the Power Sector Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Gas Turbine MRO Market in the Power Sector Share (%) by Company 2025

List of Tables

- Table 1: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Provider Type 2020 & 2033

- Table 3: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Provider Type 2020 & 2033

- Table 6: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Provider Type 2020 & 2033

- Table 9: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Provider Type 2020 & 2033

- Table 12: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Service Type 2020 & 2033

- Table 14: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Provider Type 2020 & 2033

- Table 15: Europe Gas Turbine MRO Market in the Power Sector Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Gas Turbine MRO Market in the Power Sector?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Europe Gas Turbine MRO Market in the Power Sector?

Key companies in the market include Bechtel Corporation, Weg SA, Siemens AG, Babcock & Wilcox Enterprises Inc, John Wood Group PLC, Sulzer AG, General Electric Company, Flour Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Europe Gas Turbine MRO Market in the Power Sector?

The market segments include Service Type, Provider Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

Maintenance Sector to Grow Significantly.

7. Are there any restraints impacting market growth?

4.; Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

February 2022: Ansaldo Energia signed a 20-year agreement for gas turbine maintenance in the 1518.5 MW gas power plant owned by Cairo Electricity Production Company. The Power plant is equipped with four AE 94-2 gas turbines built at the Ansaldo Energia site in Genoa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Gas Turbine MRO Market in the Power Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Gas Turbine MRO Market in the Power Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Gas Turbine MRO Market in the Power Sector?

To stay informed about further developments, trends, and reports in the Europe Gas Turbine MRO Market in the Power Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence