Key Insights

The United Kingdom's nuclear power sector is set for substantial growth, driven by net-zero emission targets and enhanced energy security. The market, valued at $54.8 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is powered by investments in new reactor builds, including advanced modular reactors (AMRs) and small modular reactors (SMRs), offering improved safety, efficiency, and cost-effectiveness. The demand for clean, baseload power to supplement intermittent renewables, coupled with government commitment, positions nuclear energy as a cornerstone of the UK's future energy strategy. Key players like Aecom, Orano Group, and SNC-Lavalin Group are integral to project development, engineering, procurement, and construction, fostering a dynamic industry ecosystem. Innovation in high-temperature gas-cooled reactors and liquid metal fast breeder reactors highlights a long-term vision for advanced nuclear technology.

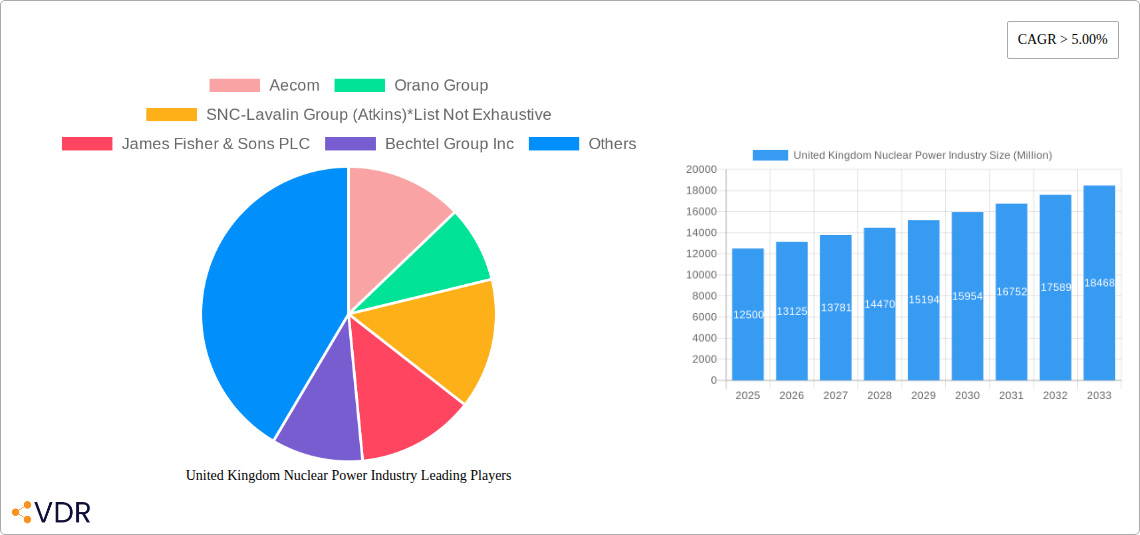

United Kingdom Nuclear Power Industry Market Size (In Billion)

The UK nuclear power market is shifting towards modern, efficient reactor designs. While current pressurized water reactors (PWRs) and boiling water reactors (BWRs) remain crucial, next-generation reactor deployment is a growing focus. The 100-1000 MW reactor capacity segment is expected to be particularly active, supporting both commercial power generation and industrial needs. Challenges include significant upfront capital for new builds, evolving regulatory frameworks, and public perception. However, decarbonization and energy independence remain strong market drivers. The integration of research and prototype power reactors further underscores the UK's dedication to advancing nuclear science and technology for future commercial applications.

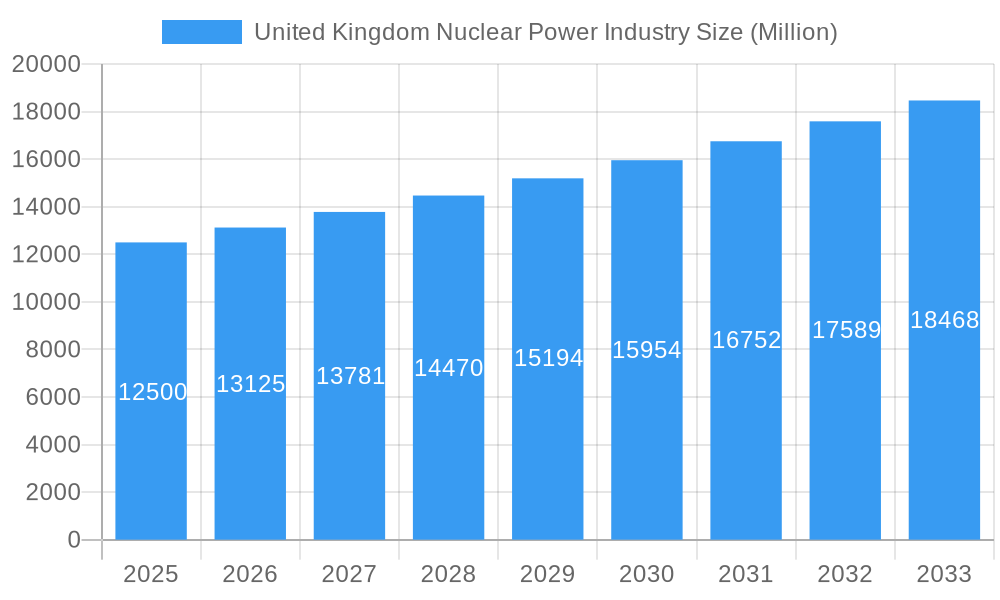

United Kingdom Nuclear Power Industry Company Market Share

Here's a compelling, SEO-optimized report description for the United Kingdom Nuclear Power Industry, incorporating high-traffic keywords, parent and child market structures, and all specified details:

United Kingdom Nuclear Power Industry Market Dynamics & Structure

The United Kingdom's nuclear power industry is a dynamic and strategically vital sector, characterized by a mature yet evolving market structure. Driven by ambitious net-zero targets and energy security imperatives, the market exhibits a moderate concentration, with established players and significant government influence shaping its trajectory. Technological innovation is a key driver, particularly in advanced reactor designs like Small Modular Reactors (SMRs), aimed at enhancing efficiency and reducing costs. The regulatory framework, overseen by bodies like the Office for Nuclear Regulation (ONR), is stringent, focusing on safety, security, and environmental protection. Competitive product substitutes, primarily renewable energy sources and fossil fuels, present ongoing market pressures, necessitating continuous investment in nuclear's advantages of low-carbon, baseload power. End-user demographics are shifting, with increasing demand for reliable, decarbonized electricity from both industrial and residential sectors. Mergers and acquisitions (M&A) trends are subtle but strategic, often focusing on specialized capabilities in decommissioning, waste management, and new build projects.

- Market Concentration: Moderate, with key players and significant government involvement.

- Technological Innovation Drivers: SMR development, advanced fuel cycles, and life extension technologies.

- Regulatory Frameworks: Stringent safety, security, and environmental standards.

- Competitive Product Substitutes: Renewable energy, natural gas.

- End-User Demographics: Growing demand for secure, low-carbon electricity.

- M&A Trends: Strategic acquisitions for specialized expertise and project consolidation.

United Kingdom Nuclear Power Industry Growth Trends & Insights

The United Kingdom nuclear power industry is poised for significant growth, underpinned by a robust demand for low-carbon energy and a strategic national imperative to enhance energy independence. The market size is projected to expand considerably over the forecast period (2025–2033), driven by the construction of new nuclear power plants and the potential deployment of SMRs. Adoption rates for nuclear energy are anticipated to increase as the urgency to decarbonize the economy intensifies, making nuclear a crucial component of the UK's energy mix alongside renewables. Technological disruptions are actively shaping this growth, with advancements in reactor design, fuel efficiency, and waste management solutions enhancing the sector's attractiveness. Consumer behavior shifts, particularly a growing public acceptance of nuclear power as a reliable and clean energy source, are further bolstering market sentiment and supporting investment. The industry is navigating a complex landscape, balancing the long-term benefits of nuclear power against upfront capital costs and public perception challenges.

[Insert Placeholder for XXX] will provide an in-depth analysis of market size evolution from a historical baseline of 2019 and projected figures up to 2033. This includes detailed CAGR calculations for the forecast period, demonstrating the compound annual growth rate of the sector. Market penetration metrics will illustrate the increasing share of nuclear power within the UK's overall energy supply. Adoption rates for new nuclear technologies, such as SMRs, will be a key focus, alongside an examination of how technological disruptions in areas like fusion energy research might influence future market dynamics. The report will delve into evolving consumer preferences, analyzing public opinion surveys and their impact on policy and investment decisions. Furthermore, it will explore how the drive towards electrification of transport and heating influences the baseload power requirements that nuclear energy is uniquely positioned to meet.

Dominant Regions, Countries, or Segments in United Kingdom Nuclear Power Industry

The United Kingdom nuclear power industry's dominance is intricately linked to specific segments and regional developments, reflecting the nation's commitment to nuclear energy's baseload capabilities. Among Reactor Types, the Pressurized Water Reactor (PWR) remains a dominant force, powering existing large-scale facilities and forming the basis for future new build projects due to its proven technology and operational efficiency. In terms of Application, Commercial Power Reactors represent the largest and most impactful segment, directly contributing to the national grid and fulfilling the substantial electricity demands of the UK's economy. Regarding Capacity, the Above 1000 MW segment historically dominates due to the significant output of established nuclear power plants, providing essential baseload power. However, the emerging Below 100 MW capacity segment, driven by the exploration of SMRs, is rapidly gaining traction and is expected to shape future market dynamics significantly.

- Reactor Type Dominance: Pressurized Water Reactor (PWR) - established operational expertise and future development pipeline.

- Application Dominance: Commercial Power Reactor - critical for national energy supply and carbon reduction targets.

- Capacity Dominance: Above 1000 MW - provides substantial baseload power, essential for grid stability.

- Emerging Capacity Segment: Below 100 MW (SMRs) - poised for substantial future growth and diversification.

United Kingdom Nuclear Power Industry Product Landscape

The United Kingdom nuclear power industry's product landscape is characterized by a focus on reliable, large-scale nuclear reactor technologies and an increasing emphasis on innovative Small Modular Reactors (SMRs). Existing Commercial Power Reactors, predominantly Pressurized Water Reactors (PWRs), are designed for long operational lifespans, offering consistent baseload electricity generation with high capacity factors. Recent advancements focus on life extension programs and enhanced safety features for these established units. The emerging SMR segment is introducing a new generation of reactors, including High-temperature Gas-cooled Reactors (HTGRs) and advanced PWR designs, promising greater flexibility, enhanced safety, and modular construction benefits. These innovations aim to cater to diverse applications, from grid-scale power to industrial heat and hydrogen production. The overarching product strategy is to leverage nuclear's low-carbon credentials while addressing cost competitiveness and deployment speed.

Key Drivers, Barriers & Challenges in United Kingdom Nuclear Power Industry

Key Drivers:

- Net-Zero Targets: The UK government's commitment to achieving net-zero emissions by 2050 mandates a significant decarbonization of its energy sector, with nuclear power playing a crucial role in providing low-carbon baseload electricity.

- Energy Security: Reducing reliance on imported fossil fuels and diversifying the energy mix to enhance national energy independence.

- Technological Advancements: Development and potential deployment of Small Modular Reactors (SMRs) offering improved economics, flexibility, and faster deployment times.

- Grid Stability: Nuclear power's ability to provide consistent, dispatchable power is essential for balancing intermittent renewable sources.

Barriers & Challenges:

- High Upfront Capital Costs: The substantial investment required for new nuclear power plant construction remains a significant financial hurdle.

- Regulatory Hurdles and Permitting: Stringent safety and security regulations, coupled with lengthy consenting processes, can delay project timelines.

- Public Perception and Acceptance: Historical concerns regarding nuclear safety and waste disposal continue to influence public opinion and require ongoing engagement.

- Supply Chain Capacity: Ensuring a robust and skilled domestic supply chain for the complex components and services required for nuclear projects.

- Waste Management and Decommissioning: Long-term solutions for the safe storage and disposal of nuclear waste, and the eventual decommissioning of old facilities, pose significant technical and financial challenges.

Emerging Opportunities in United Kingdom Nuclear Power Industry

Emerging opportunities within the UK nuclear power industry are largely centered on the transformative potential of Small Modular Reactors (SMRs). The government's strategic focus on SMR development presents a significant avenue for innovation and deployment, offering a more flexible and potentially cost-effective alternative to large-scale plants. These smaller reactors open up possibilities for localized energy generation, supplying power to industrial clusters, remote communities, and even critical infrastructure. Furthermore, the increasing demand for low-carbon hydrogen production presents a compelling application for nuclear heat, creating new market segments. The ongoing need for decommissioning and advanced waste management solutions also offers lucrative opportunities for specialized companies.

Growth Accelerators in the United Kingdom Nuclear Power Industry Industry

The primary catalysts propelling long-term growth in the UK nuclear power industry include significant government backing through policy initiatives and financial support, particularly for SMR development. Strategic partnerships between established nuclear operators, technology developers, and the supply chain are fostering innovation and de-risking new projects. Market expansion strategies are evolving, with a growing interest in leveraging nuclear technology for industrial heat applications and green hydrogen production, diversifying its role beyond electricity generation. The ongoing commitment to decarbonization and energy security ensures nuclear power remains a vital part of the UK's future energy landscape, driving continuous investment and development.

Key Players Shaping the United Kingdom Nuclear Power Industry Market

- Aecom

- Orano Group

- SNC-Lavalin Group (Atkins)

- James Fisher & Sons PLC

- Bechtel Group Inc

- Fluor Corporation

- Babcock International Group PLC

- Studsvik AB

Notable Milestones in United Kingdom Nuclear Power Industry Sector

- November 2022: Rolls-Royce's nuclear power division identified four abandoned sites across Britain for the construction of a new fleet of microreactors, owned by the Nuclear Decommissioning Authority.

- October 2022: The Welsh government and the British Nuclear Decommissioning Authority (NDA) agreed to collaborate on establishing a small-scale nuclear power facility in Trawsfynydd, North Wales. This collaboration aims to facilitate information sharing, align decommissioning plans, and support socio-economic development for the project.

In-Depth United Kingdom Nuclear Power Industry Market Outlook

The outlook for the United Kingdom nuclear power industry is marked by a strong emphasis on innovation and strategic expansion, driven by the urgent need for reliable, low-carbon energy. The anticipated widespread adoption of Small Modular Reactors (SMRs) is a key growth accelerator, promising to unlock new deployment opportunities and enhance energy security across diverse applications. Government support, coupled with a robust domestic and international supply chain, will be crucial in realizing this potential. The industry is well-positioned to contribute significantly to the UK's net-zero ambitions, while also exploring new revenue streams through industrial heat and green hydrogen production, solidifying nuclear power's integral role in the nation's sustainable energy future.

United Kingdom Nuclear Power Industry Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Boiling Water Reactor

- 1.4. High-temperature Gas-cooled Reactor

- 1.5. Liquid Metal Fast Breeder Reactor

- 1.6. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. 100-1000 MW

- 3.3. Above 1000 MW

United Kingdom Nuclear Power Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Nuclear Power Industry Regional Market Share

Geographic Coverage of United Kingdom Nuclear Power Industry

United Kingdom Nuclear Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Commercial Power Reactor Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Nuclear Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Boiling Water Reactor

- 5.1.4. High-temperature Gas-cooled Reactor

- 5.1.5. Liquid Metal Fast Breeder Reactor

- 5.1.6. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. 100-1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aecom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orano Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SNC-Lavalin Group (Atkins)*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 James Fisher & Sons PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bechtel Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fluor Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Babcock International Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Studsvik AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Aecom

List of Figures

- Figure 1: United Kingdom Nuclear Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Nuclear Power Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: United Kingdom Nuclear Power Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Nuclear Power Industry?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the United Kingdom Nuclear Power Industry?

Key companies in the market include Aecom, Orano Group, SNC-Lavalin Group (Atkins)*List Not Exhaustive, James Fisher & Sons PLC, Bechtel Group Inc, Fluor Corporation, Babcock International Group PLC, Studsvik AB.

3. What are the main segments of the United Kingdom Nuclear Power Industry?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Commercial Power Reactor Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In November 2022, The nuclear power division of Rolls-Royce selected four abandoned sites in Britain to construct a new fleet of microreactors. The Nuclear Decommissioning Authority, which manages some of Britain's first nuclear facilities, owns the four locations in England and Wales.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Nuclear Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Nuclear Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Nuclear Power Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Nuclear Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence