Key Insights

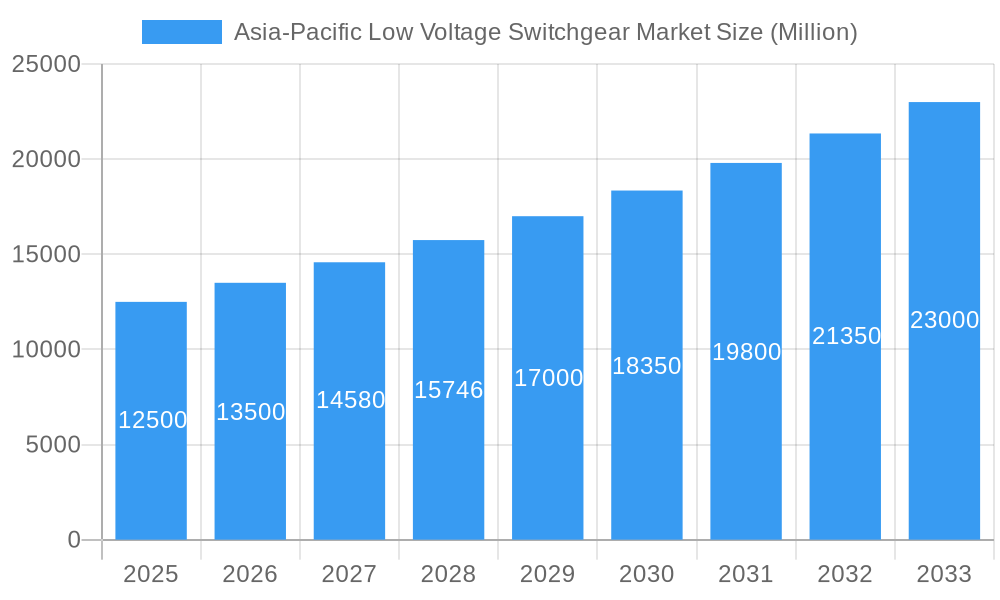

The Asia-Pacific Low Voltage Switchgear Market is poised for significant expansion, projected to reach a substantial market size with a Compound Annual Growth Rate (CAGR) exceeding 7.00%. This robust growth is primarily fueled by escalating investments in power infrastructure development across the region, driven by rapid industrialization, urbanization, and the increasing demand for electricity from both residential and commercial sectors. Key market drivers include the ongoing upgrades and modernization of existing substations and distribution networks to enhance reliability and efficiency, coupled with the burgeoning need for new installations in emerging economies. Furthermore, the growing emphasis on smart grid technologies and the integration of renewable energy sources necessitate advanced low voltage switchgear solutions, contributing to market dynamism. The market is segmented by application, with substations and distribution networks representing the largest segments, followed by general utility applications. Installation-wise, outdoor switchgear is expected to dominate due to its application in expansive power grids, though indoor installations are gaining traction in space-constrained urban environments and for specialized industrial applications.

Asia-Pacific Low Voltage Switchgear Market Market Size (In Billion)

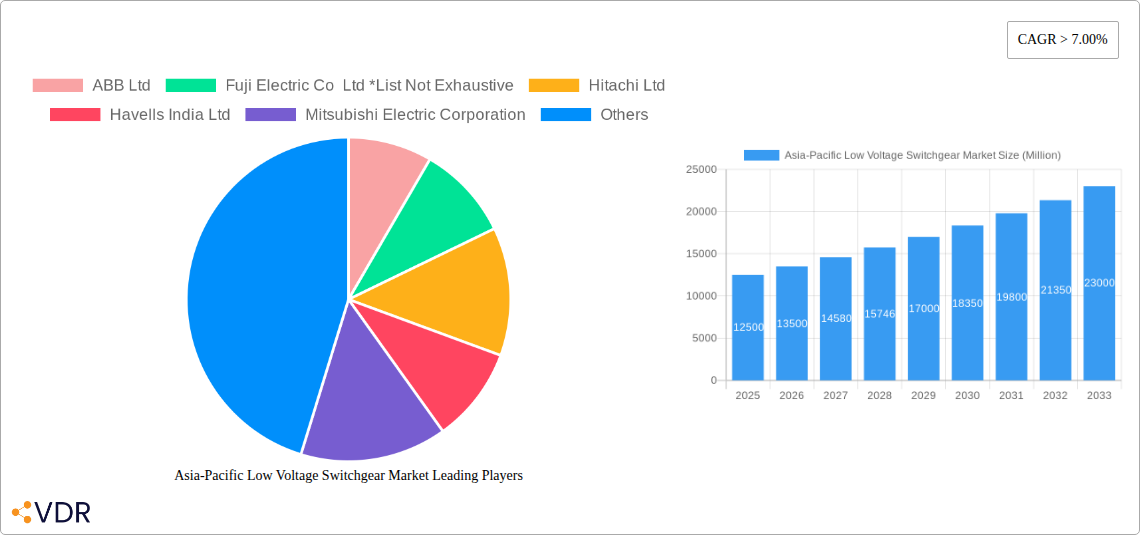

The low voltage switchgear market in Asia-Pacific is characterized by a diverse range of voltage ratings, with solutions below 250 V, 250 V - 750 V, and 750 V - 1000 V catering to various needs, from small commercial setups to large industrial complexes. Geographically, China and India are anticipated to be the leading markets, owing to their vast populations, expanding industrial bases, and substantial government initiatives aimed at improving power access and grid stability. Japan and Australia, while more mature markets, continue to drive demand through technological advancements and the replacement of aging infrastructure. The competitive landscape is populated by major global players such as Siemens AG, Schneider Electric SE, ABB Ltd, and Mitsubishi Electric Corporation, alongside prominent regional manufacturers like Fuji Electric Co. Ltd, Hitachi Ltd, Havells India Ltd, HD Hyundai Electric, and Rockwell Automation Inc. These companies are actively engaged in research and development to introduce innovative products with enhanced safety features, energy efficiency, and digital connectivity, further propelling market growth. Despite the promising outlook, challenges such as fluctuating raw material prices and the high initial cost of advanced switchgear solutions may present some restraints.

Asia-Pacific Low Voltage Switchgear Market Company Market Share

Asia-Pacific Low Voltage Switchgear Market: Comprehensive Growth Analysis & Forecast (2019-2033)

This in-depth report delivers a definitive analysis of the Asia-Pacific Low Voltage Switchgear Market, projecting significant growth driven by robust industrial expansion, increasing urbanization, and a strong emphasis on grid modernization. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, emerging opportunities, and leading players. Essential for industry professionals, manufacturers, investors, and policymakers, this report offers a granular understanding of the market's trajectory, including quantitative data in million units and qualitative analyses of influential factors.

Asia-Pacific Low Voltage Switchgear Market Market Dynamics & Structure

The Asia-Pacific Low Voltage Switchgear Market is characterized by a moderately consolidated structure, with key players like Siemens AG, Schneider Electric SE, ABB Ltd, and Mitsubishi Electric Corporation holding substantial market shares. Technological innovation remains a primary driver, with continuous advancements in smart grid integration, IoT-enabled switchgear, and enhanced safety features. Regulatory frameworks, particularly those promoting energy efficiency and grid reliability, are shaping product development and adoption. Competitive product substitutes exist, but specialized low voltage switchgear solutions offer distinct advantages for specific applications. End-user demographics are diverse, encompassing utilities, industrial facilities, commercial buildings, and residential sectors, all demanding reliable and efficient power distribution. Mergers and acquisitions (M&A) activity, though not rampant, is strategic, aimed at expanding market reach and technological capabilities. For instance, the acquisition of smaller, innovative firms by larger conglomerates can significantly impact market concentration. The market also faces innovation barriers related to high R&D costs and the need for extensive testing and certification.

- Market Concentration: Moderately consolidated, with a few dominant global players.

- Technological Innovation Drivers: Smart grid integration, IoT capabilities, advanced safety features, digitalization.

- Regulatory Frameworks: Energy efficiency standards, grid modernization initiatives, safety regulations.

- Competitive Product Substitutes: While some generic electrical components can substitute, specialized low voltage switchgear offers superior performance and integration.

- End-User Demographics: Utilities, industrial manufacturing, construction, commercial real estate, residential infrastructure.

- M&A Trends: Strategic acquisitions to enhance product portfolios and market access.

Asia-Pacific Low Voltage Switchgear Market Growth Trends & Insights

The Asia-Pacific Low Voltage Switchgear Market is poised for substantial growth, fueled by a confluence of economic, technological, and infrastructural advancements. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025-2033. This expansion is driven by the burgeoning demand for electricity across the region, necessitated by rapid industrialization, increasing urbanization, and the growing adoption of electric vehicles. The integration of smart technologies, such as IoT-enabled sensors and communication modules, is revolutionizing the adoption of low voltage switchgear, enabling enhanced monitoring, control, and predictive maintenance. Consumer behavior is shifting towards solutions that offer greater energy efficiency, reliability, and safety. Utilities are increasingly investing in upgrading their aging infrastructure to meet the rising power demands and to enhance grid resilience against disruptions.

The penetration of advanced low voltage switchgear solutions is also being accelerated by government initiatives promoting smart cities and sustainable energy development. These initiatives often include incentives for adopting energy-efficient electrical equipment and modernizing power distribution networks. In the industrial sector, the demand for sophisticated switchgear is driven by the need for precise power management and the protection of sensitive machinery. Similarly, the construction of new commercial complexes and residential buildings, especially in developing economies, presents a significant opportunity for market growth. The continuous technological disruptions, including the development of modular and compact switchgear designs, are further enhancing the market's appeal by offering cost-effectiveness and ease of installation. The adoption rates of these advanced solutions are expected to climb as awareness and understanding of their benefits grow among end-users. The market's evolution is also influenced by the increasing focus on digitalization across all industries, pushing for interconnected and intelligent electrical systems.

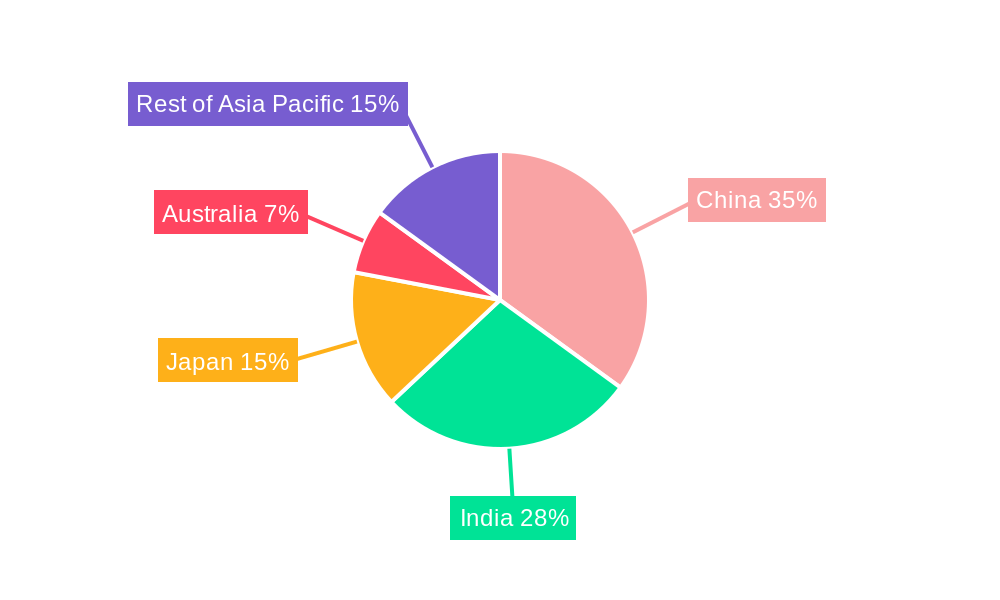

Dominant Regions, Countries, or Segments in Asia-Pacific Low Voltage Switchgear Market

China is unequivocally the dominant force within the Asia-Pacific Low Voltage Switchgear Market, driven by its massive industrial base, extensive infrastructure development projects, and significant government investment in the power sector. Its sheer market size, estimated to be the largest contributor by value and volume, is a testament to its pivotal role. The country's ongoing urbanization and the rapid expansion of its manufacturing sector create an insatiable demand for reliable low voltage switchgear solutions for substations, distribution networks, and industrial facilities. China's commitment to renewable energy integration further bolsters this demand, requiring advanced switchgear for managing intermittent power sources.

India emerges as another critical growth engine, fueled by its expanding economy, a growing population, and ambitious electrification programs. The Indian government's focus on "Make in India" initiatives and infrastructure upgrades, including smart grid development, significantly boosts the demand for low voltage switchgear. The country's burgeoning industrial and commercial sectors, coupled with significant investments in power generation and transmission, present substantial opportunities.

Key Dominance Factors and Segment Analysis:

- Geographic Dominance:

- China: Leads due to vast industrial output, infrastructure projects, and smart grid initiatives.

- India: Rapidly growing demand driven by electrification, urbanization, and industrial expansion.

- Rest of Asia-Pacific: Includes rapidly developing economies like Vietnam, Indonesia, and Thailand, contributing significantly through industrial growth and infrastructure development.

- Application Segment Dominance:

- Distribution: This segment is crucial, encompassing the widespread need for switchgear in power distribution networks to ensure efficient and safe electricity delivery to end-users. Growth is propelled by grid modernization and the expansion of distribution infrastructure in developing economies.

- Substation: Essential for power transmission and distribution, substations require robust low voltage switchgear for control and protection. Investment in new substations and upgrades of existing ones across the region fuels demand.

- Utility: The backbone of the power sector, utilities are major consumers of low voltage switchgear for their expansive networks, driven by the need for reliability and grid stability.

- Voltage Rating Segment Insights:

- 250 V - 750 V: This is a dominant voltage range, catering to a broad spectrum of industrial, commercial, and residential applications, reflecting the most common power requirements in the region.

- Less Than 250 V: Primarily for residential and small commercial applications, this segment maintains consistent demand.

- 750 V - 1000 V: Increasingly relevant for specific industrial applications and higher-power distribution needs.

- Installation Segment:

- Indoor Installation: Dominates due to its prevalence in industrial facilities, commercial buildings, and residential complexes, offering protection from environmental factors.

- Outdoor Installation: Growing demand driven by utility infrastructure development and smart grid deployments in remote and distributed areas.

Asia-Pacific Low Voltage Switchgear Market Product Landscape

The Asia-Pacific Low Voltage Switchgear Market is characterized by a dynamic product landscape driven by innovation and a focus on enhanced performance, safety, and connectivity. Manufacturers are increasingly incorporating digital technologies, such as IoT sensors and communication protocols, into their switchgear offerings. This enables real-time monitoring, remote diagnostics, and predictive maintenance capabilities, significantly improving operational efficiency for end-users. Product innovations also include advancements in miniaturization, leading to more compact and space-saving switchgear solutions suitable for densely populated urban environments. Furthermore, there is a strong emphasis on developing products with higher energy efficiency ratings and enhanced protection mechanisms to safeguard critical infrastructure and minimize energy losses. The performance metrics being targeted include improved breaking capacity, enhanced arc fault detection, and longer operational lifespans. Unique selling propositions often revolve around intelligent features, environmental sustainability, and compliance with stringent international safety standards.

Key Drivers, Barriers & Challenges in Asia-Pacific Low Voltage Switchgear Market

The Asia-Pacific Low Voltage Switchgear Market is propelled by several key drivers. Rapid industrialization across countries like China and India creates immense demand for reliable power distribution infrastructure. Government initiatives focused on expanding electricity access, modernizing grids, and promoting renewable energy integration are significant catalysts. The increasing urbanization and subsequent construction of commercial and residential buildings necessitate advanced switchgear solutions. Technological advancements, particularly in smart grid technologies and IoT integration, are driving the adoption of intelligent and connected switchgear.

Key challenges include intense price competition, especially from local manufacturers in some emerging economies, which can put pressure on profit margins for global players. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, pose a significant risk. Stringent regulatory requirements and the need for product certifications in different countries can create hurdles for market entry and expansion. Furthermore, the existing installed base of older, less efficient switchgear in some regions can slow down the adoption of newer, more advanced technologies. Cybersecurity concerns related to connected switchgear also represent a growing challenge that needs robust solutions.

Emerging Opportunities in Asia-Pacific Low Voltage Switchgear Market

Emerging opportunities in the Asia-Pacific Low Voltage Switchgear Market are largely centered around the growing demand for smart grid technologies and digitalization. The increasing focus on energy efficiency and sustainability presents a significant avenue for growth, with a rising preference for low-voltage switchgear incorporating advanced energy management features. The expansion of electric vehicle charging infrastructure across the region will also necessitate specialized switchgear solutions. Furthermore, the development of smart cities and the retrofitting of existing infrastructure with intelligent electrical systems offer substantial untapped market potential. The growing adoption of renewable energy sources, such as solar and wind power, creates a demand for advanced switchgear capable of seamlessly integrating these intermittent sources into the grid. Untapped markets in Southeast Asia and Oceania also present lucrative opportunities for expansion.

Growth Accelerators in the Asia-Pacific Low Voltage Switchgear Market Industry

Several catalysts are accelerating long-term growth in the Asia-Pacific Low Voltage Switchgear Market. Technological breakthroughs in areas like artificial intelligence (AI) for grid optimization and predictive maintenance are set to revolutionize switchgear functionality. Strategic partnerships between leading manufacturers and technology providers are crucial for developing integrated smart grid solutions. Market expansion strategies, including localization of manufacturing and distribution networks in key emerging economies, will further fuel growth. The increasing global emphasis on decarbonization and the transition to cleaner energy sources will also drive demand for advanced and efficient low voltage switchgear. Investments in smart metering and demand-side management technologies will create a synergistic effect, boosting the need for intelligent switchgear to manage distributed energy resources effectively.

Key Players Shaping the Asia-Pacific Low Voltage Switchgear Market Market

- ABB Ltd

- Fuji Electric Co Ltd

- Hitachi Ltd

- Havells India Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- HD Hyundai Electric

- Rockwell Automation Inc

- Eaton Corporation Plc

Notable Milestones in Asia-Pacific Low Voltage Switchgear Market Sector

- February 2023: Elmeasure, a prominent energy management solutions company in India, announced its participation in ELECRAMA 2023. The company is slated to unveil its groundbreaking IoT-Enabled Low Voltage Switchgear during the event.

- October 2022: LS Electric announced the completion of relocating its new plant from Hanoi to Bac Ninh, Vietnam. The new plant spans an area of 30,000 square meters, and its production facility is double the size of the existing Hanoi plant. This move is aimed at enabling LS Electric to penetrate the Southeast Asian market better. The company plans to diversify its business structure in the power system industry by introducing high-end products, including an ultra-high voltage gas insulated switchgear (GIS) and its existing low voltage switchgear market. The primary objective of this strategy is to increase the proportion of overseas sales by utilizing the new plant as its base.

In-Depth Asia-Pacific Low Voltage Switchgear Market Market Outlook

The future outlook for the Asia-Pacific Low Voltage Switchgear Market is exceptionally promising, driven by a sustained demand for electrification and modernization across the region. Growth accelerators such as smart grid technologies, increasing investments in renewable energy integration, and the burgeoning electric vehicle infrastructure will continue to shape market dynamics. Strategic partnerships and technological advancements in AI and IoT will further enhance the intelligence and efficiency of switchgear solutions. Emerging opportunities in untapped markets and the growing consumer preference for sustainable and energy-efficient products will create new avenues for expansion. The market is expected to witness significant value creation as companies focus on offering integrated solutions that go beyond basic power distribution to encompass advanced monitoring, control, and data analytics.

Asia-Pacific Low Voltage Switchgear Market Segmentation

-

1. Application

- 1.1. Substation

- 1.2. Distribution

- 1.3. Utility

-

2. Installation

- 2.1. Outdoor

- 2.2. Indoor

-

3. Voltage Rating

- 3.1. Less Than 250 V

- 3.2. 250 V - 750 V

- 3.3. 750 V - 1000 V

-

4. Geograph

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

Asia-Pacific Low Voltage Switchgear Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Low Voltage Switchgear Market Regional Market Share

Geographic Coverage of Asia-Pacific Low Voltage Switchgear Market

Asia-Pacific Low Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles and Related Investments4.; Supportive Government Policies And Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost Of Setting Up Ev Charging Stations

- 3.4. Market Trends

- 3.4.1. Distribution Segments to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Substation

- 5.1.2. Distribution

- 5.1.3. Utility

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Outdoor

- 5.2.2. Indoor

- 5.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 5.3.1. Less Than 250 V

- 5.3.2. 250 V - 750 V

- 5.3.3. 750 V - 1000 V

- 5.4. Market Analysis, Insights and Forecast - by Geograph

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Substation

- 6.1.2. Distribution

- 6.1.3. Utility

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Outdoor

- 6.2.2. Indoor

- 6.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 6.3.1. Less Than 250 V

- 6.3.2. 250 V - 750 V

- 6.3.3. 750 V - 1000 V

- 6.4. Market Analysis, Insights and Forecast - by Geograph

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Substation

- 7.1.2. Distribution

- 7.1.3. Utility

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Outdoor

- 7.2.2. Indoor

- 7.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 7.3.1. Less Than 250 V

- 7.3.2. 250 V - 750 V

- 7.3.3. 750 V - 1000 V

- 7.4. Market Analysis, Insights and Forecast - by Geograph

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Substation

- 8.1.2. Distribution

- 8.1.3. Utility

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Outdoor

- 8.2.2. Indoor

- 8.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 8.3.1. Less Than 250 V

- 8.3.2. 250 V - 750 V

- 8.3.3. 750 V - 1000 V

- 8.4. Market Analysis, Insights and Forecast - by Geograph

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia Asia-Pacific Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Substation

- 9.1.2. Distribution

- 9.1.3. Utility

- 9.2. Market Analysis, Insights and Forecast - by Installation

- 9.2.1. Outdoor

- 9.2.2. Indoor

- 9.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 9.3.1. Less Than 250 V

- 9.3.2. 250 V - 750 V

- 9.3.3. 750 V - 1000 V

- 9.4. Market Analysis, Insights and Forecast - by Geograph

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Asia Pacific Asia-Pacific Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Substation

- 10.1.2. Distribution

- 10.1.3. Utility

- 10.2. Market Analysis, Insights and Forecast - by Installation

- 10.2.1. Outdoor

- 10.2.2. Indoor

- 10.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 10.3.1. Less Than 250 V

- 10.3.2. 250 V - 750 V

- 10.3.3. 750 V - 1000 V

- 10.4. Market Analysis, Insights and Forecast - by Geograph

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fuji Electric Co Ltd *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Havells India Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi Electric Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HD Hyundai Electric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rockwell Automation Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eaton Corporation Plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Asia-Pacific Low Voltage Switchgear Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Low Voltage Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 3: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Voltage Rating 2020 & 2033

- Table 4: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Geograph 2020 & 2033

- Table 5: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 8: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Voltage Rating 2020 & 2033

- Table 9: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Geograph 2020 & 2033

- Table 10: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 13: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Voltage Rating 2020 & 2033

- Table 14: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Geograph 2020 & 2033

- Table 15: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 18: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Voltage Rating 2020 & 2033

- Table 19: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Geograph 2020 & 2033

- Table 20: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 23: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Voltage Rating 2020 & 2033

- Table 24: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Geograph 2020 & 2033

- Table 25: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 28: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Voltage Rating 2020 & 2033

- Table 29: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Geograph 2020 & 2033

- Table 30: Asia-Pacific Low Voltage Switchgear Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Low Voltage Switchgear Market?

The projected CAGR is approximately 7.71%.

2. Which companies are prominent players in the Asia-Pacific Low Voltage Switchgear Market?

Key companies in the market include ABB Ltd, Fuji Electric Co Ltd *List Not Exhaustive, Hitachi Ltd, Havells India Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, HD Hyundai Electric, Rockwell Automation Inc, Eaton Corporation Plc.

3. What are the main segments of the Asia-Pacific Low Voltage Switchgear Market?

The market segments include Application, Installation, Voltage Rating, Geograph.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles and Related Investments4.; Supportive Government Policies And Initiatives.

6. What are the notable trends driving market growth?

Distribution Segments to dominate the market.

7. Are there any restraints impacting market growth?

4.; High Cost Of Setting Up Ev Charging Stations.

8. Can you provide examples of recent developments in the market?

February 2023: Elmeasure, a prominent energy management solutions company in India, announced its participation in ELECRAMA 2023. The company is slated to unveil its groundbreaking IoT-Enabled Low Voltage Switchgear during the event.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Low Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Low Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Low Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Low Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence