Key Insights

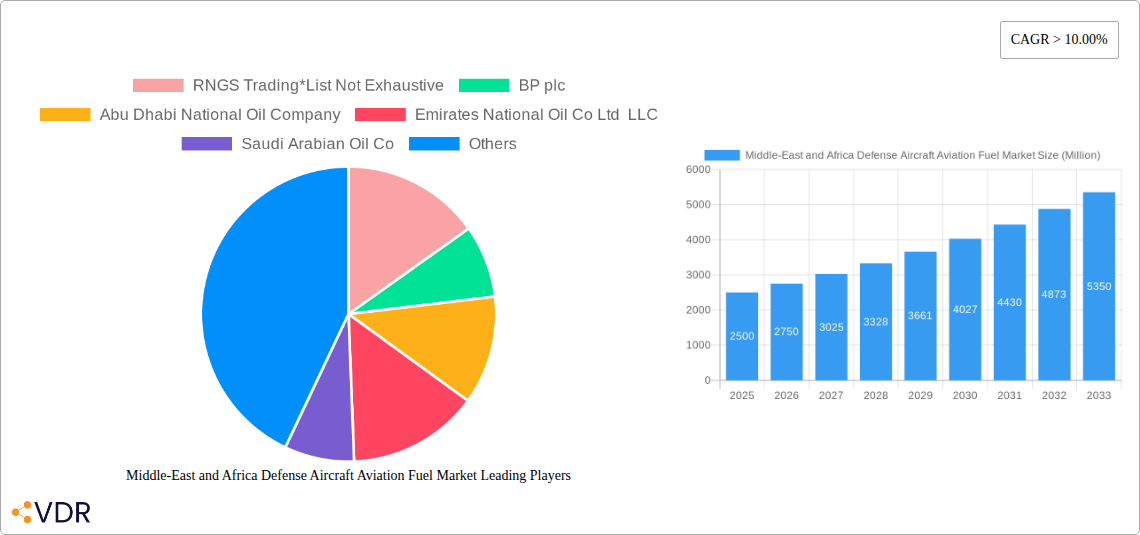

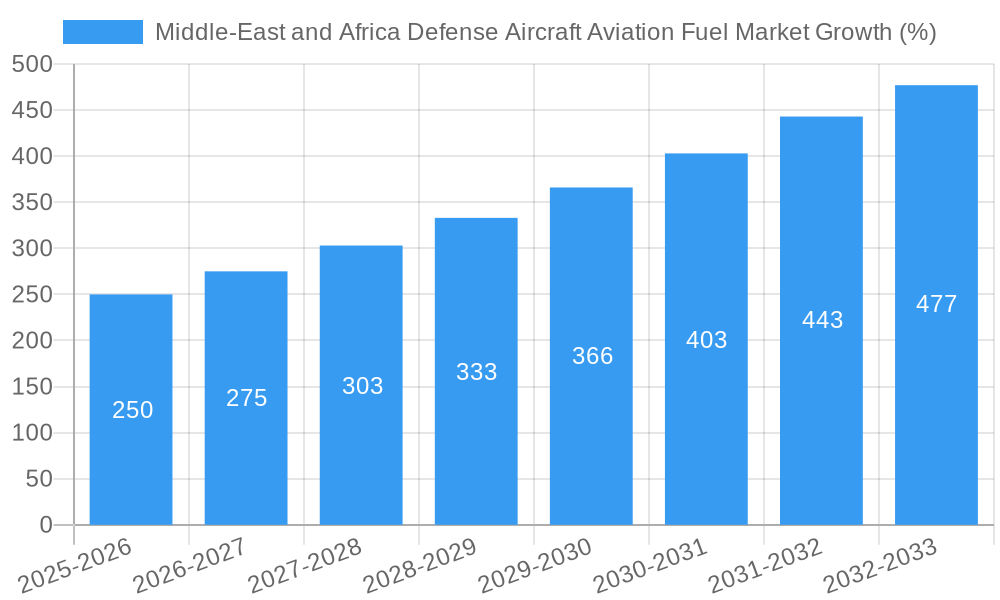

The Middle East and Africa Defense Aircraft Aviation Fuel market is experiencing robust growth, driven by increasing military activities, modernization of air forces, and expanding regional defense budgets. The market, valued at approximately $2.5 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 10% from 2025 to 2033. This expansion is fueled by several key factors: the ongoing geopolitical instability across several regions, necessitating increased military preparedness; the growing adoption of advanced military aircraft, requiring specialized and high-performance fuels; and the continuous investment in infrastructure development to support increased air traffic. The market is segmented primarily by fuel type, with Aviation Turbine Fuel (ATF) currently dominating, though the nascent but rapidly growing Aviation Biofuel segment is attracting significant attention due to environmental concerns and government initiatives promoting sustainable aviation. Key players, including BP plc, Abu Dhabi National Oil Company, and Saudi Arabian Oil Co, are strategically positioning themselves to capitalize on this market expansion, investing in infrastructure and technological advancements to meet the evolving demands. The African sub-Saharan region, specifically countries like South Africa, Kenya, and Tanzania, are showing notable growth potential, driven by rising defense spending and modernization efforts.

However, challenges remain. Price volatility in crude oil significantly impacts ATF prices, creating uncertainty for both suppliers and defense forces. Furthermore, logistical constraints in certain regions, coupled with security concerns, present hurdles to efficient fuel distribution and supply chain management. The market’s future growth hinges on the successful navigation of these challenges, alongside continued investment in sustainable aviation fuel solutions to mitigate the environmental impact of military air operations. The forecast period of 2025-2033 anticipates substantial market expansion, with significant opportunities for industry players to leverage technological advancements and strategic partnerships to gain a competitive edge.

Middle East & Africa Defense Aircraft Aviation Fuel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa Defense Aircraft Aviation Fuel market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by fuel type: Aviation Turbine Fuel (ATF) and Aviation Biofuel. The total market size is projected to reach xx Million by 2033.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Middle East and Africa defense aircraft aviation fuel market. Market concentration is currently moderate, with a few major players holding significant market share. However, the market is expected to witness increased competition in the forecast period.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: The adoption of sustainable aviation fuels (SAFs) is driving innovation, albeit facing challenges in terms of infrastructure and cost.

- Regulatory Frameworks: Varying regulatory landscapes across different countries in the region impact fuel sourcing, pricing, and distribution.

- Competitive Product Substitutes: Limited direct substitutes exist, but efficiency improvements in aircraft engines can reduce fuel consumption.

- End-User Demographics: The primary end-users are national defense forces, with significant influence from government procurement policies.

- M&A Trends: The number of M&A deals in the sector has remained relatively stable in recent years, with approximately xx deals recorded between 2019 and 2024.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Growth Trends & Insights

The Middle East and Africa defense aircraft aviation fuel market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), driven by increasing defense budgets, modernization of air forces, and rising geopolitical tensions in the region. The market is characterized by fluctuating fuel prices, which significantly impact market growth. Adoption of biofuels is expected to increase gradually, however, it will remain a niche segment due to higher cost and limited availability. Market penetration of biofuels is projected to reach xx% by 2033. Technological disruptions, such as the development of more fuel-efficient aircraft engines, are expected to moderate overall fuel consumption growth.

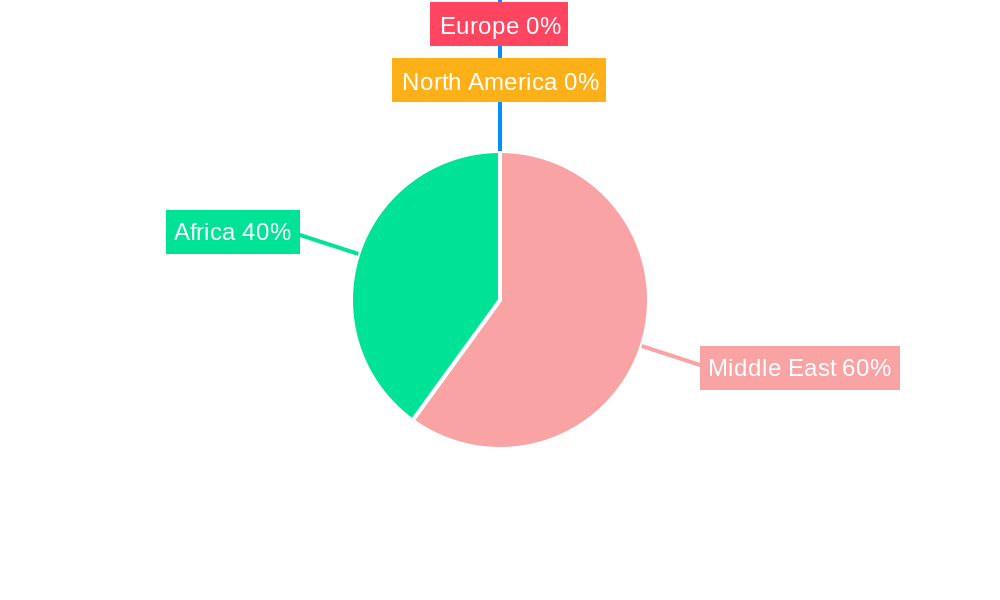

Dominant Regions, Countries, or Segments in Middle-East and Africa Defense Aircraft Aviation Fuel Market

The Middle East region dominates the market, driven by the presence of large defense forces, extensive air operations, and significant investments in military aviation. Within the Middle East, the UAE, Saudi Arabia, and Egypt are major consumers of defense aircraft aviation fuel.

- Key Drivers in the Middle East: High defense expenditure, strategic geopolitical location, and modernization of air forces are key factors driving market growth in the region.

- Key Drivers in Africa: Increased military activity in certain regions and growing defense budgets in some countries are contributing to market growth, albeit at a slower rate compared to the Middle East.

- Fuel Type Dominance: Aviation Turbine Fuel (ATF) accounts for the vast majority (xx%) of the market share due to its established dominance and cost-effectiveness compared to biofuels. Aviation biofuel adoption is currently limited due to various constraints, including supply chain, cost, and infrastructure.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Product Landscape

The market primarily consists of Aviation Turbine Fuel (ATF) with a gradual introduction of Aviation Biofuel. Product innovation focuses on improving fuel efficiency, reducing emissions, and enhancing performance under extreme climatic conditions. Key selling propositions include reliability, consistent quality, and compliance with international aviation standards.

Key Drivers, Barriers & Challenges in Middle-East and Africa Defense Aircraft Aviation Fuel Market

Key Drivers:

- Increased defense spending in several Middle Eastern and African countries.

- Modernization of air forces leading to increased aircraft operations.

- Geopolitical instability and regional conflicts.

Key Challenges:

- Fluctuating crude oil prices impacting fuel costs.

- Supply chain vulnerabilities and logistical challenges.

- Limited infrastructure for biofuel production and distribution.

- Stringent regulatory requirements for fuel quality and safety.

Emerging Opportunities in Middle-East and Africa Defense Aircraft Aviation Fuel Market

- Growing demand for sustainable aviation fuels (SAFs) presents opportunities for biofuel producers and suppliers.

- Expanding partnerships between fuel suppliers and defense companies.

- Technological advancements in fuel additives and blending techniques.

Growth Accelerators in the Middle-East and Africa Defense Aircraft Aviation Fuel Market Industry

Long-term growth will be fueled by continued investment in military aviation, technological advancements in fuel efficiency, and the growing adoption of biofuels, albeit at a slower pace. Strategic partnerships and collaborations between defense forces, fuel suppliers, and technology companies will accelerate market growth.

Key Players Shaping the Middle-East and Africa Defense Aircraft Aviation Fuel Market Market

- RNGS Trading

- BP plc

- Abu Dhabi National Oil Company

- Emirates National Oil Co Ltd LLC

- Saudi Arabian Oil Co

- World Fuel Services Corp

Notable Milestones in Middle-East and Africa Defense Aircraft Aviation Fuel Market Sector

- March 2022: U.S. Central Command's announcement to sell F-15 Eagle fighter jets to Egypt increased demand for aviation fuel in the region.

- February 2023: The UAE's agreement to export L-15 advanced trainer jets from China signifies potential long-term growth in aviation fuel demand.

In-Depth Middle-East and Africa Defense Aircraft Aviation Fuel Market Market Outlook

The future of the Middle East and Africa defense aircraft aviation fuel market appears promising, driven by several factors including increasing defense spending, ongoing military modernization programs, and the growing adoption of more fuel-efficient aircraft. Strategic partnerships and investments in sustainable aviation fuels present lucrative opportunities for market players, despite challenges posed by fluctuating oil prices and regional geopolitical complexities. The market is expected to witness sustained growth, albeit with potential fluctuations linked to global economic conditions and regional security dynamics.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Aviation Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

-

2. Geography

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Rest of Middle-East and Africa

Middle-East and Africa Defense Aircraft Aviation Fuel Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Rest of Middle East and Africa

Middle-East and Africa Defense Aircraft Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Production4.; Rising Upstream Oil and Gas Investments

- 3.3. Market Restrains

- 3.3.1. 4.; Plans to Diversify the Power Generation Mix by Adoption of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Aviation Turbine Fuel (ATF) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Aviation Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. Rest of Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. United Arab Emirates Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Aviation Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates

- 6.2.2. Saudi Arabia

- 6.2.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Saudi Arabia Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Aviation Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates

- 7.2.2. Saudi Arabia

- 7.2.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Rest of Middle East and Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Aviation Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates

- 8.2.2. Saudi Arabia

- 8.2.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. South Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 RNGS Trading*List Not Exhaustive

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 BP plc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Abu Dhabi National Oil Company

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Emirates National Oil Co Ltd LLC

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Saudi Arabian Oil Co

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 World Fuel Services Corp

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 RNGS Trading*List Not Exhaustive

List of Figures

- Figure 1: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Defense Aircraft Aviation Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 3: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 19: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

Key companies in the market include RNGS Trading*List Not Exhaustive, BP plc, Abu Dhabi National Oil Company, Emirates National Oil Co Ltd LLC, Saudi Arabian Oil Co, World Fuel Services Corp.

3. What are the main segments of the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

The market segments include Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Production4.; Rising Upstream Oil and Gas Investments.

6. What are the notable trends driving market growth?

Aviation Turbine Fuel (ATF) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Plans to Diversify the Power Generation Mix by Adoption of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

March 2022: U.S. Central Command informed the Senate Armed Services Committee that the United States would sell F-15 Eagle fighter jets to Egypt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Defense Aircraft Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Defense Aircraft Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Defense Aircraft Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence