Key Insights

The Mexican oil and gas industry, while historically dominated by Pemex, is undergoing significant transformation. The energy reform initiated in 2013 aimed to increase private sector participation and investment, leading to a more competitive landscape. While the initial impact was slower than anticipated due to various factors including regulatory hurdles and fluctuating global oil prices, the industry is showing signs of growth. Increased exploration and production activity, particularly in deepwater areas, is driving market expansion. However, challenges remain, including infrastructure limitations, security concerns in certain regions, and the ongoing need for technological advancements to optimize extraction and processing. Furthermore, Mexico's commitment to transitioning towards cleaner energy sources presents both opportunities and challenges for the oil and gas sector, requiring adaptation and investment in renewable energy technologies alongside traditional hydrocarbon development. The forecast period (2025-2033) is expected to see moderate growth, driven by a combination of sustained domestic demand and potential export opportunities. This growth, however, will be contingent upon favorable regulatory environments, sustained investment in infrastructure development and continued global demand for oil and gas.

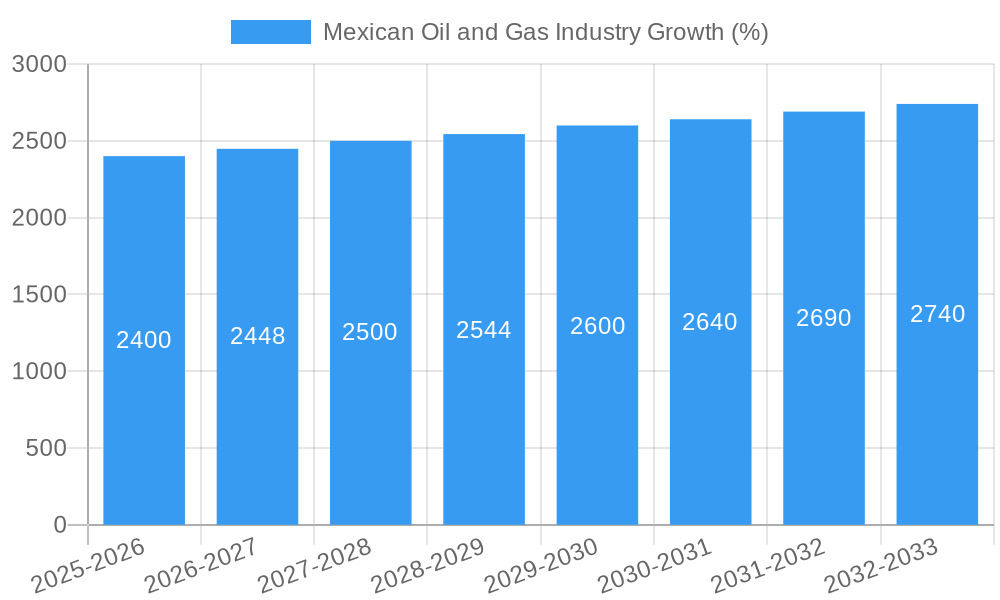

The projected Compound Annual Growth Rate (CAGR) from 2019 to 2033, while not explicitly provided, is likely to fall within the range of 2-4% considering the industry dynamics. This moderate growth reflects the balancing act between the nation's need to meet domestic energy demands, attract foreign investment, and pursue renewable energy goals. Successful navigation of these complex factors will determine the ultimate trajectory of the Mexican oil and gas industry in the coming decade. This includes effective management of environmental concerns and the development of a robust regulatory framework that fosters both growth and responsible energy practices. The base year of 2025 will be a crucial benchmark in assessing the effectiveness of current policies and the overall health of the market.

Mexican Oil and Gas Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Mexican oil and gas industry, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and policymakers seeking to understand the intricacies of this dynamic market.

Mexican Oil and Gas Industry Market Dynamics & Structure

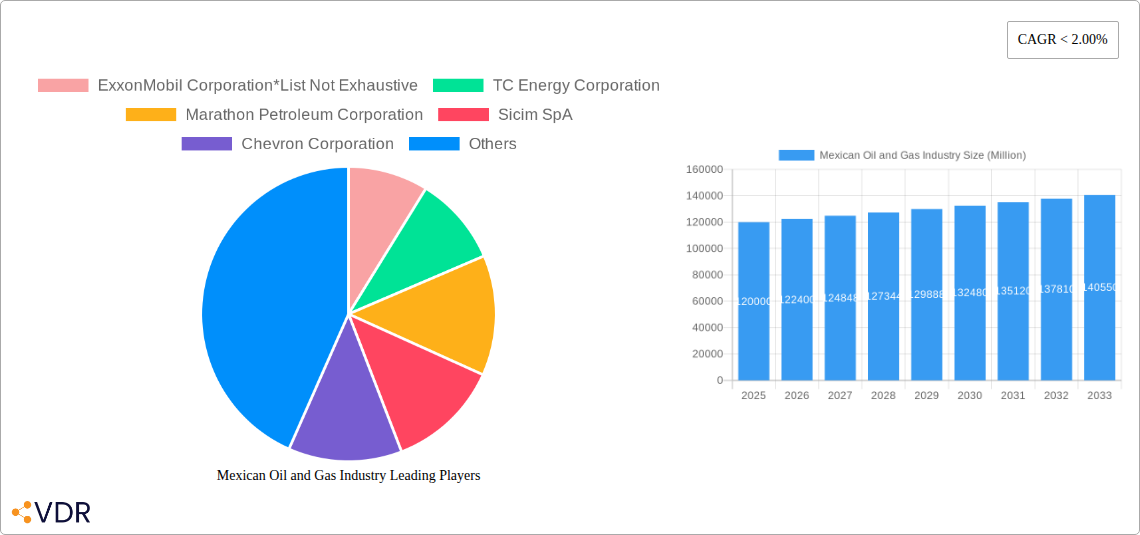

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Mexican oil and gas sector. We delve into market concentration, evaluating the market share of major players like Pemex, ExxonMobil, and Chevron, alongside smaller, emerging companies. The report also examines the impact of mergers and acquisitions (M&A) activity, providing quantitative insights into deal volumes (xx Million USD) and qualitative assessments of integration challenges. Technological innovation, driven by the need for enhanced efficiency and reduced environmental impact, is also critically examined, including barriers to adoption and the role of government incentives. The regulatory framework, including licensing, environmental regulations, and pricing policies, is analyzed for its impact on market growth and investment decisions. Finally, we assess the presence and influence of substitute products, such as renewable energy sources and their effect on market share distribution (Upstream: xx%, Midstream: xx%, Downstream: xx%).

- Market Concentration: Pemex maintains a significant market share (xx%), followed by international players (xx%).

- M&A Activity: Analysis of M&A deal volumes (xx Million USD) from 2019-2024, highlighting key drivers and implications.

- Technological Innovation: Exploration of technological advancements in upstream (e.g., enhanced oil recovery), midstream (e.g., pipeline optimization), and downstream (e.g., refinery upgrades).

- Regulatory Framework: In-depth analysis of current regulations and their influence on market dynamics.

- Competitive Substitutes: Evaluation of the competitive threat posed by renewable energy sources and other alternatives.

Mexican Oil and Gas Industry Growth Trends & Insights

This section presents a detailed analysis of the Mexican oil and gas market's historical and projected growth trajectory, leveraging extensive data analysis to determine the Compound Annual Growth Rate (CAGR). We explore market size evolution across the upstream, midstream, and downstream segments, considering both volume and value (in Million USD). The report investigates the adoption rates of new technologies, analyzing their impact on operational efficiency and environmental performance. Furthermore, we analyze shifts in consumer behavior, exploring the evolving demand for different oil and gas products (Crude Oil: xx Million barrels, Natural Gas: xx Billion cubic feet, Petrochemicals: xx Million tons). The analysis also considers external factors, including global oil price fluctuations and their effects on investment decisions.

- Market Size Evolution (2019-2033): Detailed breakdown of market size by segment (Upstream, Midstream, Downstream), with CAGR projections.

- Adoption Rates of New Technologies: Analysis of the speed and extent of technological adoption across the industry.

- Consumer Behavior Shifts: Examination of evolving demand patterns and their influence on product development and marketing strategies.

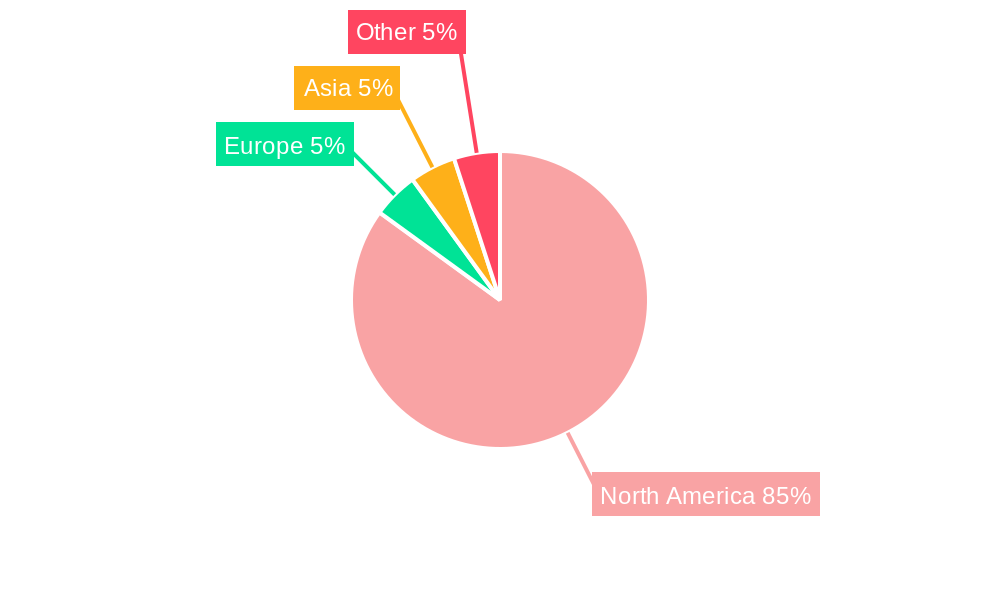

Dominant Regions, Countries, or Segments in Mexican Oil and Gas Industry

This section identifies the leading regions, countries, or segments within the Mexican oil and gas industry driving market expansion. We analyze the factors contributing to the dominance of specific regions (e.g., the Gulf of Mexico for upstream operations) or segments (e.g., petrochemicals for downstream). The analysis includes market share data, growth potential forecasts, and detailed explanations of the underlying economic, political, and infrastructural drivers of growth. Key economic policies promoting investment, access to transportation networks, and the availability of skilled labor are explored as crucial contributors to regional dominance.

- Dominant Segment: Analysis of the leading segment (e.g., Upstream, Midstream, Downstream) and factors contributing to its dominance.

- Key Regional Drivers: Examination of the factors driving growth in specific regions of Mexico.

- Market Share and Growth Potential: Detailed breakdown of market share by region/segment and projections for future growth.

Mexican Oil and Gas Industry Product Landscape

This section provides a concise overview of the product landscape within the Mexican oil and gas industry. We highlight key product innovations, focusing on their applications and performance metrics. Emphasis is placed on unique selling propositions, highlighting the advancements in refining technologies, pipeline infrastructure, and the development of new petrochemical products. The description emphasizes the technological advancements which make these products competitive in the global market.

Key Drivers, Barriers & Challenges in Mexican Oil and Gas Industry

This section identifies the key drivers and challenges influencing the growth trajectory of the Mexican oil and gas sector. Drivers may include increased domestic demand, government incentives, and technological advancements. Challenges encompass regulatory complexities, environmental concerns (e.g., carbon emissions), and competition from renewable energy sources. The analysis provides quantifiable examples of these challenges, for instance, estimating the impact of regulatory delays on project timelines and associated costs (xx Million USD).

- Key Drivers: Detailed explanation of the factors stimulating market growth (e.g., rising energy demand, infrastructure development).

- Key Challenges and Restraints: Analysis of challenges (e.g., regulatory hurdles, environmental concerns, supply chain disruptions).

Emerging Opportunities in Mexican Oil and Gas Industry

This section explores emerging opportunities in the Mexican oil and gas industry, identifying potential areas for future growth. This may include expanding into untapped markets, capitalizing on technological advancements (e.g., carbon capture and storage), or adapting to evolving consumer preferences (e.g., growing demand for cleaner energy sources).

Growth Accelerators in the Mexican Oil and Gas Industry Industry

This section discusses the key catalysts driving long-term growth in the Mexican oil and gas industry. This includes breakthroughs in exploration and production technologies, strategic partnerships to enhance efficiency, and government initiatives to promote investment and energy security.

Key Players Shaping the Mexican Oil and Gas Industry Market

- ExxonMobil Corporation

- TC Energy Corporation

- Marathon Petroleum Corporation

- Sicim SpA

- Chevron Corporation

- Saipem SpA

- Citla Energy

- TotalEnergies SE

- Royal Dutch Shell PLC

- Petroleos Mexicanos (Pemex)

- BP PLC

- Sempra Energy

Notable Milestones in Mexican Oil and Gas Industry Sector

- January 2021: Braskem Idesa partially restores operations at Etileno XXI petrochemical complex after a natural gas supply disruption.

- August 2021: Mexico's state power utility partners with TC Energy Corp. to develop a natural gas pipeline in the south.

In-Depth Mexican Oil and Gas Industry Market Outlook

The Mexican oil and gas industry is poised for significant growth over the forecast period, driven by a combination of factors including increased domestic demand, strategic partnerships, and technological advancements. The industry's future success hinges on navigating regulatory complexities, embracing sustainable practices, and adapting to global energy transitions. This presents substantial opportunities for investors and businesses to participate in the development of a more diversified and sustainable energy sector.

Mexican Oil and Gas Industry Segmentation

- 1. Upstream (Exploration and Production)

- 2. Midstream (Pipeline and LNG Terminals)

- 3. Downstre

Mexican Oil and Gas Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mexican Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Recovering Number of Air Passengers

- 3.2.2 on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries

- 3.4. Market Trends

- 3.4.1. Upstream Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 5.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 5.3. Market Analysis, Insights and Forecast - by Downstre

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 6. North America Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 6.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 6.3. Market Analysis, Insights and Forecast - by Downstre

- 6.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 7. South America Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 7.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 7.3. Market Analysis, Insights and Forecast - by Downstre

- 7.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 8. Europe Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 8.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 8.3. Market Analysis, Insights and Forecast - by Downstre

- 8.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 9. Middle East & Africa Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 9.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 9.3. Market Analysis, Insights and Forecast - by Downstre

- 9.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 10. Asia Pacific Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 10.2. Market Analysis, Insights and Forecast - by Midstream (Pipeline and LNG Terminals)

- 10.3. Market Analysis, Insights and Forecast - by Downstre

- 10.1. Market Analysis, Insights and Forecast - by Upstream (Exploration and Production)

- 11. Brazil Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of South America Mexican Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 ExxonMobil Corporation*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 TC Energy Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Marathon Petroleum Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Sicim SpA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Chevron Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Saipem SpA

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Citla Energy

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 TotalEnergies SE

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Royal Dutch Shell PLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Petroleos Mexicanos (Pemex)

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 BP PLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Sempra Energy

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 ExxonMobil Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global Mexican Oil and Gas Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: South America Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: South America Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 5: North America Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 6: North America Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 7: North America Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 8: North America Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 9: North America Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 10: North America Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 13: South America Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 14: South America Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 15: South America Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 16: South America Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 17: South America Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 18: South America Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 21: Europe Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 22: Europe Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 23: Europe Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 24: Europe Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 25: Europe Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 26: Europe Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 29: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 30: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 31: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 32: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 33: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 34: Middle East & Africa Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Upstream (Exploration and Production) 2024 & 2032

- Figure 37: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Upstream (Exploration and Production) 2024 & 2032

- Figure 38: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 39: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Midstream (Pipeline and LNG Terminals) 2024 & 2032

- Figure 40: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Downstre 2024 & 2032

- Figure 41: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Downstre 2024 & 2032

- Figure 42: Asia Pacific Mexican Oil and Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Mexican Oil and Gas Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 3: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 4: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 5: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 11: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 12: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 13: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 18: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 19: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 20: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 25: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 26: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 27: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 38: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 39: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 40: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Turkey Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Israel Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: GCC Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: North Africa Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East & Africa Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Upstream (Exploration and Production) 2019 & 2032

- Table 48: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Midstream (Pipeline and LNG Terminals) 2019 & 2032

- Table 49: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Downstre 2019 & 2032

- Table 50: Global Mexican Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific Mexican Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexican Oil and Gas Industry?

The projected CAGR is approximately < 2.00%.

2. Which companies are prominent players in the Mexican Oil and Gas Industry?

Key companies in the market include ExxonMobil Corporation*List Not Exhaustive, TC Energy Corporation, Marathon Petroleum Corporation, Sicim SpA, Chevron Corporation, Saipem SpA, Citla Energy, TotalEnergies SE, Royal Dutch Shell PLC, Petroleos Mexicanos (Pemex), BP PLC, Sempra Energy.

3. What are the main segments of the Mexican Oil and Gas Industry?

The market segments include Upstream (Exploration and Production), Midstream (Pipeline and LNG Terminals), Downstre.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Recovering Number of Air Passengers. on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population.

6. What are the notable trends driving market growth?

Upstream Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries.

8. Can you provide examples of recent developments in the market?

In January 2021, Braskem Idesa announced that it had partially restored the operations at Etileno XXI polyethylene petrochemical complex, which was shut down in December 2020 due to natural gas supply cut by Cengas, a major natural gas system operator of Mexico. Braskem further stated that it had restarted operations in an experimental business model, complying with all the safety standards to reduce the impact on Mexico's plastics industry supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexican Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexican Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexican Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Mexican Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence