Key Insights

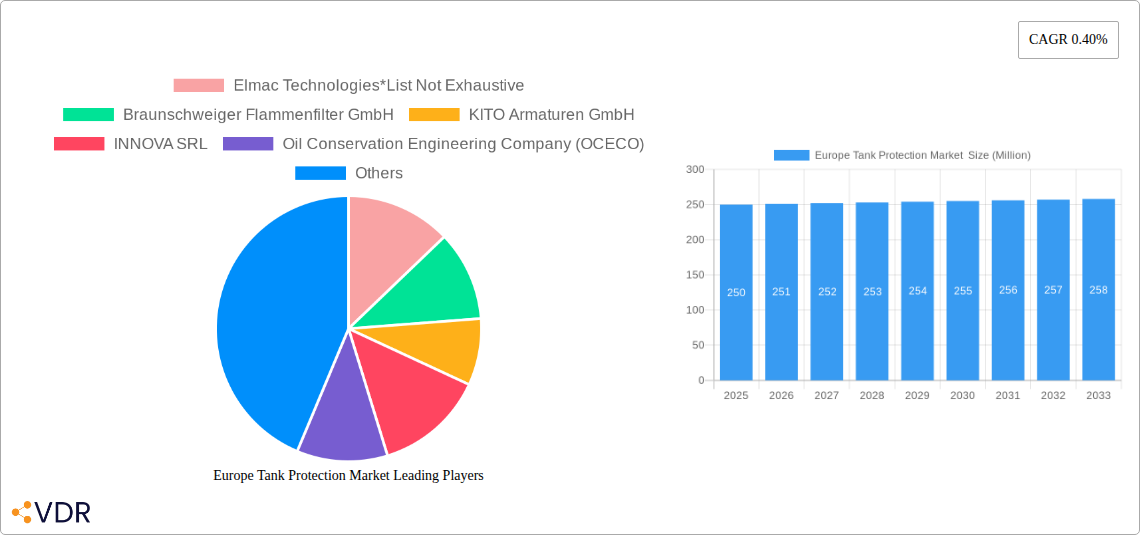

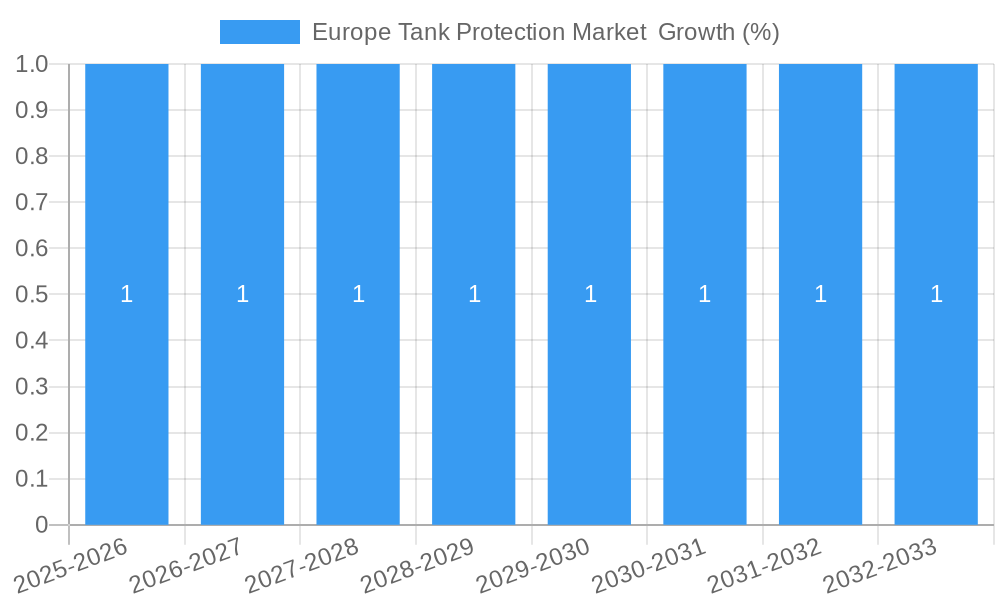

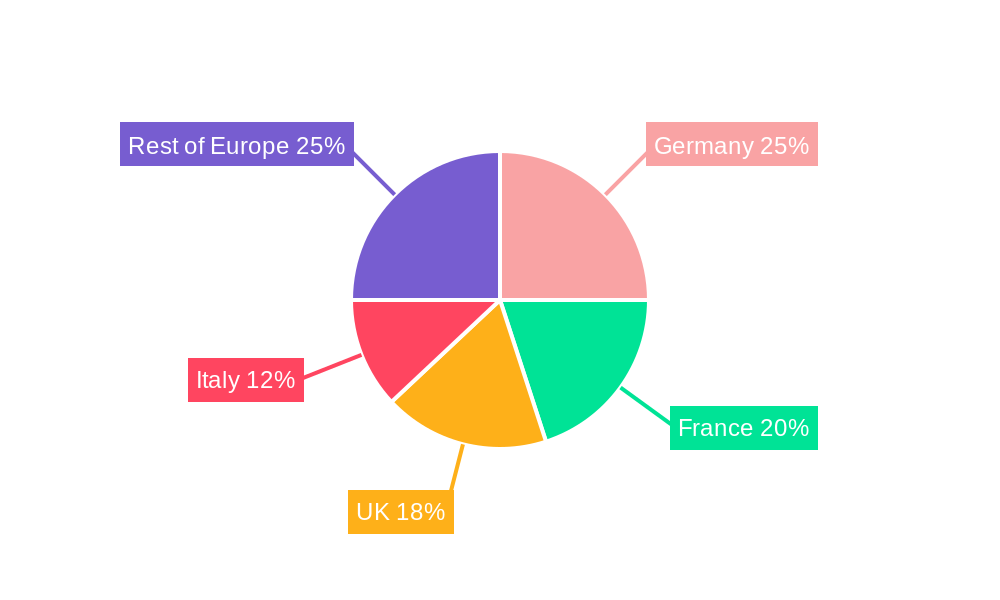

The Europe tank protection market, valued at approximately €250 million in 2025, is projected to experience moderate growth, with a Compound Annual Growth Rate (CAGR) of 0.40% from 2025 to 2033. This relatively low CAGR reflects a mature market with existing infrastructure and established players. However, several factors are shaping market dynamics. The oil & gas sector, particularly upstream and downstream operations, remains the primary driver, with new project orders contributing significantly to market demand. Replacement orders for aging equipment in existing projects also represent a substantial portion of the market. Valves, vents, and flame arrestors are the key equipment segments driving growth, reflecting a focus on safety and regulatory compliance. Increasing environmental regulations and stringent safety standards are pushing the adoption of advanced tank protection technologies. Germany, France, and the United Kingdom are the major markets within Europe, accounting for a significant share of overall market revenue. Competition is relatively intense, with both established multinational corporations like Emerson Electric Co. and specialized regional players like Braunschweiger Flammenfilter GmbH vying for market share.

Despite the moderate growth, opportunities exist for innovation. The development and adoption of technologically advanced, more efficient, and environmentally friendly tank protection solutions will attract significant investments. The market is likely to see an increase in the demand for integrated solutions that combine various protection mechanisms for improved safety and operational efficiency. This trend will be driven by increasing awareness of environmental risks associated with tank failures and stricter regulatory norms related to emissions and safety standards. Further research into sustainable materials and manufacturing processes could also influence the market trajectory and sustainability considerations will be increasingly crucial in determining market positioning. Furthermore, focusing on providing tailored solutions to specific industry segments will allow companies to penetrate this competitive market effectively.

This in-depth report provides a comprehensive analysis of the Europe Tank Protection Market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The market is segmented by Oil & Gas sector (Upstream, Midstream, Downstream), application (New Projects, Existing Projects), and equipment (Valves, Vents, Flame Arrestors). The market size is valued in million units.

Europe Tank Protection Market Dynamics & Structure

The European tank protection market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, driven by the need for enhanced safety and efficiency, is a major driver. Stringent regulatory frameworks, aiming to minimize environmental risks and ensure operational safety, significantly influence market growth. Competitive pressure from substitute technologies and the evolving end-user demographics (increasing focus on sustainability) also play crucial roles. The M&A landscape has seen xx deals in the last five years, with a focus on consolidation and expansion of geographical reach.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on advanced materials, automated systems, and remote monitoring technologies.

- Regulatory Landscape: Stringent safety and environmental regulations driving adoption of advanced solutions.

- Competitive Substitutes: Limited substitutes; competition primarily focused on product features and pricing.

- End-User Demographics: Shift towards larger, integrated oil and gas companies with heightened safety concerns.

- M&A Activity: xx deals completed in the past 5 years, indicating consolidation and expansion trends.

Europe Tank Protection Market Growth Trends & Insights

The Europe Tank Protection Market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. This growth is primarily driven by increasing investments in the oil and gas sector, particularly in existing infrastructure upgrades. Technological advancements, such as the adoption of smart sensors and remote monitoring systems, are further boosting market adoption. Consumer behavior shifts towards safer and more environmentally friendly solutions contribute positively to the growth.

Dominant Regions, Countries, or Segments in Europe Tank Protection Market

Germany, the UK, and Norway are the leading countries in the Europe Tank Protection Market. The Upstream sector is currently the largest segment, driven by extensive exploration and production activities. However, the Downstream segment is expected to witness faster growth in the coming years due to increasing investments in refinery upgrades and expansion. New project orders represent a larger market segment compared to replacement orders currently but replacement orders are projected to grow significantly as aging infrastructure needs upgrades.

- Key Drivers:

- Strong Oil & Gas infrastructure in Germany, UK, and Norway.

- Stringent environmental regulations driving upgrades and replacements.

- Government investments and incentives for oil and gas infrastructure development.

- Dominant Segments: Upstream sector (currently largest), with the Downstream sector showing rapid growth potential. New Project orders currently dominate but Replacement orders showing strong future growth.

- Market Share: Germany holds the largest market share (xx%), followed by the UK (xx%) and Norway (xx%).

Europe Tank Protection Market Product Landscape

The market offers a range of tank protection equipment, including valves, vents, and flame arrestors, each designed to meet specific safety and operational requirements. Recent innovations focus on improving performance metrics such as pressure resistance, leak detection capabilities, and operational efficiency. The unique selling propositions primarily center around enhanced safety features, reduced maintenance needs, and improved environmental compliance. Technological advancements have led to the development of smart, digitally enabled systems capable of providing real-time data on tank status and performance.

Key Drivers, Barriers & Challenges in Europe Tank Protection Market

Key Drivers: Rising oil and gas production, increasing demand for enhanced safety measures, and stringent regulatory compliance requirements are the primary drivers. Technological advancements offering improved safety and efficiency further propel market growth. Government initiatives aimed at upgrading aging infrastructure also contribute positively.

Key Challenges: Supply chain disruptions, particularly concerning the availability of raw materials, pose a significant challenge. High initial investment costs for advanced equipment and complex regulatory processes may hinder market expansion. Intense competition among market players also creates pricing pressures.

Emerging Opportunities in Europe Tank Protection Market

The increasing focus on renewable energy sources presents opportunities to offer specialized tank protection solutions for storage of biofuels and hydrogen. Furthermore, the market presents significant scope for developing innovative, data-driven solutions such as AI-powered predictive maintenance systems and remote monitoring capabilities. Expansion into emerging markets within Europe and exploring new applications for existing technologies can also drive growth.

Growth Accelerators in the Europe Tank Protection Market Industry

Long-term growth will be fueled by continuous technological advancements, resulting in more robust and efficient tank protection systems. Strategic partnerships between equipment manufacturers and engineering firms will play a crucial role in facilitating market penetration. Expanding into new geographical areas and servicing niche markets will further enhance market growth.

Key Players Shaping the Europe Tank Protection Market Market

- Elmac Technologies

- Braunschweiger Flammenfilter GmbH

- KITO Armaturen GmbH

- INNOVA SRL

- Oil Conservation Engineering Company (OCECO)

- BS&B Innovations Limited

- Emerson Electric Co

- Flammer GmbH

- 3B Controls Ltd

- Motherwell Tank Protection

Notable Milestones in Europe Tank Protection Market Sector

- September 2022: The German government's takeover of Rosneft's German operations highlighted the vulnerability of energy supply chains and the need for enhanced security measures, including improved tank protection.

- June 2022: Wood's 10-year agreement with Chevron underscored the importance of reliable engineering and project services for the oil and gas industry, indicating a rising demand for sophisticated tank protection solutions.

In-Depth Europe Tank Protection Market Market Outlook

The Europe Tank Protection Market is poised for sustained growth, driven by the factors discussed above. The increasing demand for enhanced safety, coupled with technological innovations and strategic partnerships, will create significant opportunities for market players. Focusing on sustainable solutions and expanding into new applications will be key to unlocking the market's full potential in the coming years.

Europe Tank Protection Market Segmentation

-

1. Oil & Gas - Sector

- 1.1. Upstream

- 1.2. Downstream

- 1.3. Midstream

-

2. Application

- 2.1. New Project (New Orders)

- 2.2. Existing Project (Replacement Orders)

-

3. Equipment

- 3.1. Valves

- 3.2. Vents

- 3.3. Flame Arrestors

Europe Tank Protection Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. Rest of Europe

Europe Tank Protection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities

- 3.3. Market Restrains

- 3.3.1. 4.; Rising adoption of cleaner alternatives

- 3.4. Market Trends

- 3.4.1. Oil and gas is major segment in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 5.1.1. Upstream

- 5.1.2. Downstream

- 5.1.3. Midstream

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. New Project (New Orders)

- 5.2.2. Existing Project (Replacement Orders)

- 5.3. Market Analysis, Insights and Forecast - by Equipment

- 5.3.1. Valves

- 5.3.2. Vents

- 5.3.3. Flame Arrestors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Italy

- 5.4.4. France

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 6. Germany Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 6.1.1. Upstream

- 6.1.2. Downstream

- 6.1.3. Midstream

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. New Project (New Orders)

- 6.2.2. Existing Project (Replacement Orders)

- 6.3. Market Analysis, Insights and Forecast - by Equipment

- 6.3.1. Valves

- 6.3.2. Vents

- 6.3.3. Flame Arrestors

- 6.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 7. United Kingdom Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 7.1.1. Upstream

- 7.1.2. Downstream

- 7.1.3. Midstream

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. New Project (New Orders)

- 7.2.2. Existing Project (Replacement Orders)

- 7.3. Market Analysis, Insights and Forecast - by Equipment

- 7.3.1. Valves

- 7.3.2. Vents

- 7.3.3. Flame Arrestors

- 7.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 8. Italy Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 8.1.1. Upstream

- 8.1.2. Downstream

- 8.1.3. Midstream

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. New Project (New Orders)

- 8.2.2. Existing Project (Replacement Orders)

- 8.3. Market Analysis, Insights and Forecast - by Equipment

- 8.3.1. Valves

- 8.3.2. Vents

- 8.3.3. Flame Arrestors

- 8.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 9. France Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 9.1.1. Upstream

- 9.1.2. Downstream

- 9.1.3. Midstream

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. New Project (New Orders)

- 9.2.2. Existing Project (Replacement Orders)

- 9.3. Market Analysis, Insights and Forecast - by Equipment

- 9.3.1. Valves

- 9.3.2. Vents

- 9.3.3. Flame Arrestors

- 9.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 10. Spain Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 10.1.1. Upstream

- 10.1.2. Downstream

- 10.1.3. Midstream

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. New Project (New Orders)

- 10.2.2. Existing Project (Replacement Orders)

- 10.3. Market Analysis, Insights and Forecast - by Equipment

- 10.3.1. Valves

- 10.3.2. Vents

- 10.3.3. Flame Arrestors

- 10.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 11. Rest of Europe Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 11.1.1. Upstream

- 11.1.2. Downstream

- 11.1.3. Midstream

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. New Project (New Orders)

- 11.2.2. Existing Project (Replacement Orders)

- 11.3. Market Analysis, Insights and Forecast - by Equipment

- 11.3.1. Valves

- 11.3.2. Vents

- 11.3.3. Flame Arrestors

- 11.1. Market Analysis, Insights and Forecast - by Oil & Gas - Sector

- 12. Germany Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Tank Protection Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Elmac Technologies*List Not Exhaustive

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Braunschweiger Flammenfilter GmbH

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 KITO Armaturen GmbH

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 INNOVA SRL

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Oil Conservation Engineering Company (OCECO)

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 BS&B Innovations Limited

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Emerson Electric Co

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Flammer GmbH

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 3B Controls Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Motherwell Tank Protection

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Elmac Technologies*List Not Exhaustive

List of Figures

- Figure 1: Europe Tank Protection Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Tank Protection Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Tank Protection Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Tank Protection Market Revenue Million Forecast, by Oil & Gas - Sector 2019 & 2032

- Table 3: Europe Tank Protection Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Tank Protection Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 5: Europe Tank Protection Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Tank Protection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Tank Protection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Tank Protection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Tank Protection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Tank Protection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Tank Protection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Tank Protection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Tank Protection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Tank Protection Market Revenue Million Forecast, by Oil & Gas - Sector 2019 & 2032

- Table 15: Europe Tank Protection Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Tank Protection Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Europe Tank Protection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Tank Protection Market Revenue Million Forecast, by Oil & Gas - Sector 2019 & 2032

- Table 19: Europe Tank Protection Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Europe Tank Protection Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 21: Europe Tank Protection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Tank Protection Market Revenue Million Forecast, by Oil & Gas - Sector 2019 & 2032

- Table 23: Europe Tank Protection Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Tank Protection Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 25: Europe Tank Protection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Tank Protection Market Revenue Million Forecast, by Oil & Gas - Sector 2019 & 2032

- Table 27: Europe Tank Protection Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Europe Tank Protection Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 29: Europe Tank Protection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Tank Protection Market Revenue Million Forecast, by Oil & Gas - Sector 2019 & 2032

- Table 31: Europe Tank Protection Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Tank Protection Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 33: Europe Tank Protection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Tank Protection Market Revenue Million Forecast, by Oil & Gas - Sector 2019 & 2032

- Table 35: Europe Tank Protection Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Europe Tank Protection Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 37: Europe Tank Protection Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Tank Protection Market ?

The projected CAGR is approximately 0.40%.

2. Which companies are prominent players in the Europe Tank Protection Market ?

Key companies in the market include Elmac Technologies*List Not Exhaustive, Braunschweiger Flammenfilter GmbH, KITO Armaturen GmbH, INNOVA SRL, Oil Conservation Engineering Company (OCECO), BS&B Innovations Limited, Emerson Electric Co, Flammer GmbH, 3B Controls Ltd, Motherwell Tank Protection.

3. What are the main segments of the Europe Tank Protection Market ?

The market segments include Oil & Gas - Sector, Application, Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities.

6. What are the notable trends driving market growth?

Oil and gas is major segment in the market.

7. Are there any restraints impacting market growth?

4.; Rising adoption of cleaner alternatives.

8. Can you provide examples of recent developments in the market?

In September 2022, the government of Germany announced that Berlin had taken control of Russian oil firm Rosneft's German operations in order to protect energy supplies disrupted by Moscow's full-scale invasion of Ukraine. Rosneft's German companies, which account for around 12% of the country's oil refining capacity, have been placed under the trusteeship of the Federal Network Agency. The move covers the companies Rosneft Deutschland GmbH (RDG) and RN Refining & Marketing GmbH (RNRM) and, thereby, their corresponding stakes in three refineries: PCK Schwedt, MiRo, and Bayernoil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Tank Protection Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Tank Protection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Tank Protection Market ?

To stay informed about further developments, trends, and reports in the Europe Tank Protection Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence