Key Insights

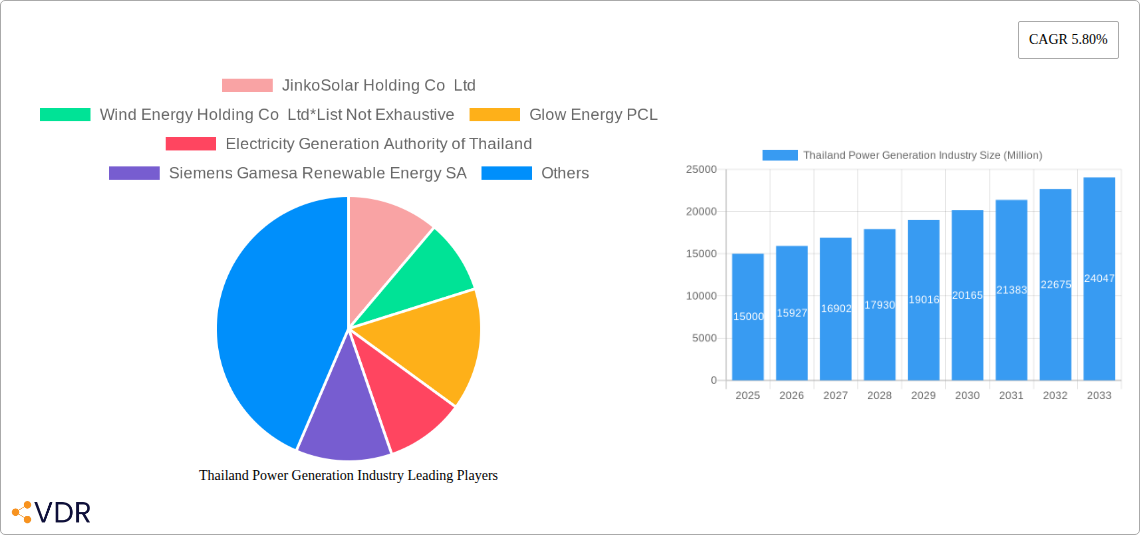

The Thailand power generation market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Thailand's increasing energy demands fueled by economic growth and rising population necessitate significant investments in power generation capacity. Secondly, the government's strong commitment to renewable energy sources, such as solar and wind power, is fostering substantial market opportunities for companies like JinkoSolar, Wind Energy Holding, and Vestas Wind Systems. This shift is further amplified by the country's efforts to reduce carbon emissions and enhance energy security. However, challenges remain, including potential grid infrastructure limitations and regulatory hurdles that could impact the pace of renewable energy integration. The conventional power generation segment, dominated by companies like Glow Energy and Electricity Generation Authority of Thailand, is also expected to witness growth, albeit at a potentially slower rate compared to the renewable energy sector, as the nation continues to rely on a mix of energy sources to meet its energy needs. The market segmentation will likely see a significant shift towards renewables over the forecast period.

The competitive landscape is characterized by a mix of both domestic and international players. Established players like Siemens Gamesa, Schneider Electric, and General Electric are leveraging their technological expertise and global presence to gain market share. Meanwhile, local companies such as BCPG and SIAM SOLAR are capitalizing on their understanding of the local market and regulatory environment. The success of companies within the Thailand power generation market will depend heavily on their ability to adapt to evolving government policies, invest in innovative technologies, and effectively manage operational and logistical challenges. The market's future trajectory will hinge on the successful implementation of renewable energy projects, infrastructure upgrades, and continuous policy support for sustainable energy development. A deeper analysis of specific regional trends within Thailand would further refine the market outlook.

Thailand Power Generation Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Thailand power generation industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both conventional and renewable energy segments, this report is essential for industry professionals, investors, and policymakers seeking to understand this rapidly evolving market. The study period spans 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Thailand Power Generation Industry Market Dynamics & Structure

The Thailand power generation market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing demand driven by economic growth. Market concentration is moderate, with both state-owned entities and private players holding significant shares. The renewable energy segment, particularly solar and wind, is experiencing robust growth, fueled by government policies promoting sustainable energy. Mergers and acquisitions (M&A) activity is expected to increase as companies seek to expand their market share and gain access to new technologies. Competition is intensifying with the entry of international players, driving innovation and price competitiveness.

- Market Concentration: Moderate, with EGAT holding a significant share in conventional power generation. Private sector participation is high in renewables. Market share data will be presented in the full report.

- Technological Innovation: Driven by the need to reduce reliance on fossil fuels and improve energy efficiency. Key areas of innovation include solar PV technology, wind turbine advancements, and energy storage solutions.

- Regulatory Framework: The Thai government is actively promoting renewable energy through feed-in tariffs, renewable portfolio standards (RPS), and other supportive policies. Regulatory changes are expected to further shape market dynamics.

- Competitive Product Substitutes: Natural gas remains a significant competitor to renewable energy sources, but increasing costs and environmental concerns are driving shifts towards renewables.

- End-User Demographics: The industrial sector is a major consumer of electricity, with growing demand from residential and commercial sectors.

- M&A Trends: A rising number of M&A deals are anticipated in the renewable energy space, particularly involving wind and solar power projects. xx Million USD worth of deals were observed in the historical period.

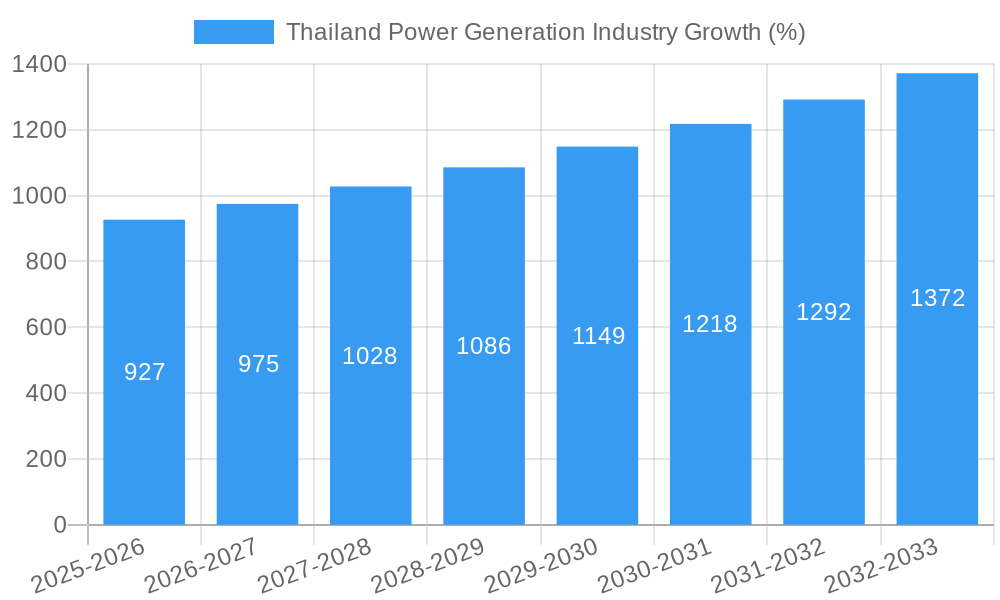

Thailand Power Generation Industry Growth Trends & Insights

The Thailand power generation market is projected to experience robust growth over the forecast period, driven by increasing energy demand, economic expansion, and government support for renewable energy. The market size is estimated at xx Million USD in 2025, with a compound annual growth rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several factors, including the rising adoption of renewable energy technologies, improvements in energy efficiency, and infrastructure development. The shift towards a cleaner energy mix and technological advancements will continue to shape market developments, leading to a substantial increase in the capacity of renewable power generation. The report provides detailed insights into these factors, including a comprehensive analysis of consumer behavior and technology adoption trends, and a breakdown of market size by various segments.

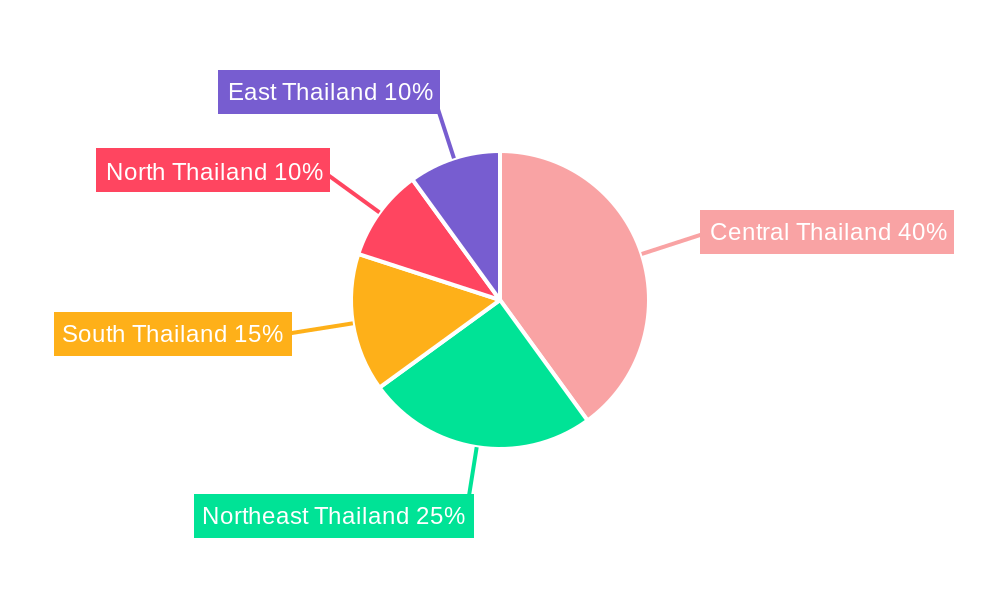

Dominant Regions, Countries, or Segments in Thailand Power Generation Industry

The renewable energy segment is poised for significant growth, driven by government policies promoting clean energy. This segment is expected to witness faster growth compared to the conventional segment. Specific regions such as the eastern seaboard, with its industrial clusters, exhibit higher demand.

- Key Drivers:

- Government incentives and supportive policies for renewable energy.

- Increasing demand for electricity across all sectors.

- Investment in renewable energy infrastructure.

- Technological advancements leading to cost reductions in renewable energy technologies.

- Dominance Factors: The Central region, due to its high population density and industrial activity, is expected to dominate in conventional power, while regions with abundant wind and solar resources will lead the renewable sector's expansion.

Thailand Power Generation Industry Product Landscape

The product landscape is marked by a diverse range of technologies, including conventional power plants (coal, gas, hydro) and a growing selection of renewable energy solutions (solar PV, wind, biomass). Technological advancements are focused on improving efficiency, reducing costs, and enhancing grid integration. Solar PV is experiencing rapid innovation in terms of cell efficiency and cost reduction, while wind turbine technology is evolving toward larger capacities and improved performance in diverse wind conditions.

Key Drivers, Barriers & Challenges in Thailand Power Generation Industry

Key Drivers:

- Government policies promoting renewable energy adoption.

- Increasing electricity demand from industrial and commercial sectors.

- Technological advancements reducing the cost of renewable energy.

Challenges & Restraints:

- High upfront capital costs associated with renewable energy projects.

- Limited grid infrastructure in some regions.

- Intermittency of renewable energy sources.

- Dependence on imported components for some renewable technologies (e.g., solar panels).

Emerging Opportunities in Thailand Power Generation Industry

- Energy Storage: The increasing adoption of intermittent renewable sources presents an opportunity for energy storage solutions, enhancing grid stability and reliability.

- Smart Grid Technologies: Investment in smart grid infrastructure can facilitate better integration of renewable energy and improve grid management.

- Hybrid Power Plants: Combining different renewable energy sources or renewable and conventional sources in hybrid plants could optimize energy production and minimize intermittency challenges.

Growth Accelerators in the Thailand Power Generation Industry

Strategic partnerships between domestic and international companies are accelerating technology transfer and investment in renewable energy projects. Government initiatives to streamline permitting processes and promote private sector participation will also further expedite growth.

Key Players Shaping the Thailand Power Generation Industry Market

- JinkoSolar Holding Co Ltd

- Wind Energy Holding Co Ltd

- Glow Energy PCL

- Electricity Generation Authority of Thailand

- Siemens Gamesa Renewable Energy SA

- Schneider Electric SE

- SGS SA

- BCPG PCL

- SIAM SOLAR

- Vestas Wind Systems AS

- General Electric Company

Notable Milestones in Thailand Power Generation Industry Sector

- May 2023: Mae Hing Son province launched a solar power plant and battery energy storage project (3 MW solar, 4 MW battery storage). This highlights the growing adoption of renewable energy and storage solutions.

- May 2023: Acciona Energia and Blue Circle signed a 25-year PPA for five wind farms (total capacity of 436 MW). This signifies significant investment in wind energy and long-term commitment to renewable power.

In-Depth Thailand Power Generation Industry Market Outlook

The Thai power generation market is poised for significant growth in the coming years, driven by robust economic expansion, government support for renewable energy, and ongoing technological advancements. Strategic partnerships, infrastructure development, and innovative solutions will further enhance market potential. The focus on sustainable energy and increasing energy efficiency will shape future market dynamics, presenting attractive opportunities for investors and industry players.

Thailand Power Generation Industry Segmentation

-

1. Power Generation

- 1.1. Conventional

- 1.2. Renewables

- 2. Power Transmission and Distribution

Thailand Power Generation Industry Segmentation By Geography

- 1. Thailand

Thailand Power Generation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities

- 3.4. Market Trends

- 3.4.1. Renewable Power Generation to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Power Generation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Conventional

- 5.1.2. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JinkoSolar Holding Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wind Energy Holding Co Ltd*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Glow Energy PCL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electricity Generation Authority of Thailand

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SGS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BCPG PCL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SIAM SOLAR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vestas Wind Systems AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 General Electric Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Thailand Power Generation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Power Generation Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Power Generation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Power Generation Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 3: Thailand Power Generation Industry Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 4: Thailand Power Generation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Power Generation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Power Generation Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 7: Thailand Power Generation Industry Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 8: Thailand Power Generation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Power Generation Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Thailand Power Generation Industry?

Key companies in the market include JinkoSolar Holding Co Ltd, Wind Energy Holding Co Ltd*List Not Exhaustive, Glow Energy PCL, Electricity Generation Authority of Thailand, Siemens Gamesa Renewable Energy SA, Schneider Electric SE, SGS SA, BCPG PCL, SIAM SOLAR, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the Thailand Power Generation Industry?

The market segments include Power Generation, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure.

6. What are the notable trends driving market growth?

Renewable Power Generation to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities.

8. Can you provide examples of recent developments in the market?

May 2023: Mae Hing Son province launched a solar power plant and battery energy storage project. The Electricity Generating Authority of Thailand (EGAT) held a commercial operation date (COD) ceremony for a 3 MW solar power plant and 4 MW battery energy storage system project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Power Generation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Power Generation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Power Generation Industry?

To stay informed about further developments, trends, and reports in the Thailand Power Generation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence