Key Insights

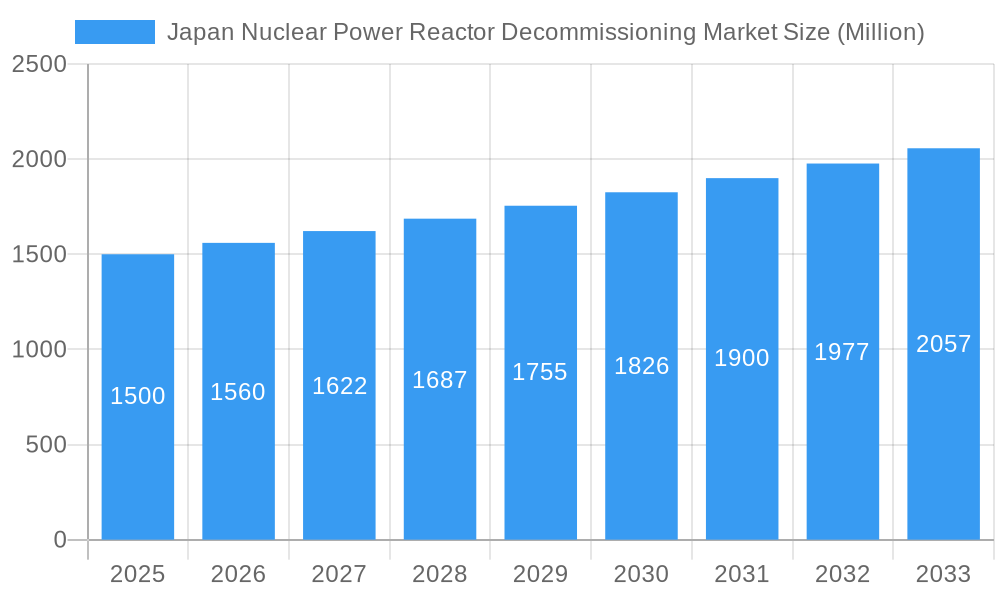

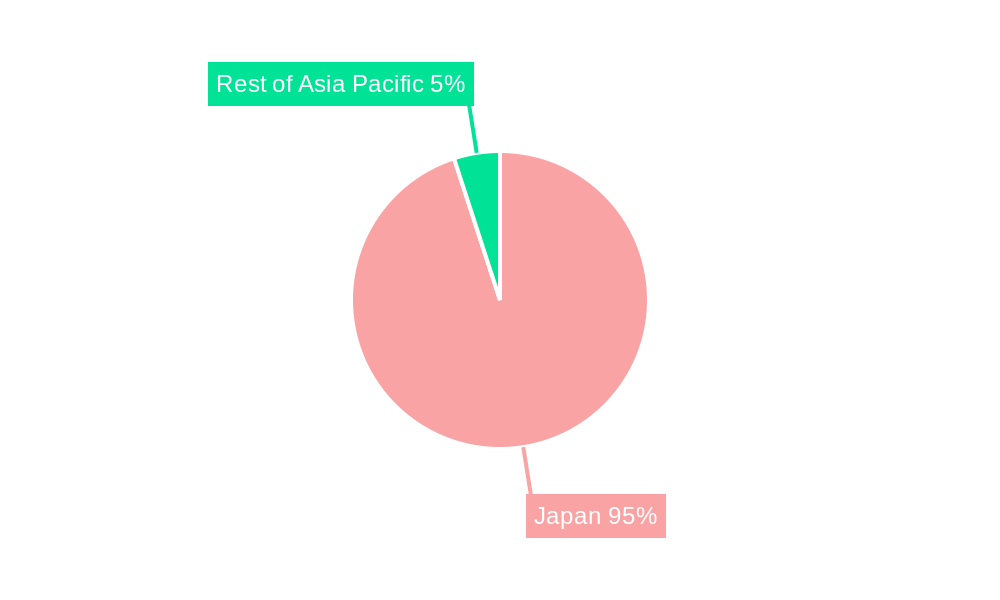

The Japan Nuclear Power Reactor Decommissioning market is experiencing substantial growth, propelled by the aging infrastructure of existing nuclear facilities and the escalating demand for secure and effective decommissioning solutions. The market is projected to reach a size of 396.1 million by 2033, with a Compound Annual Growth Rate (CAGR) of 8.5% from the base year 2025. Key growth drivers include heightened safety awareness following the Fukushima Daiichi accident, government mandates for nuclear power phase-out, and increasingly stringent safety regulations, all necessitating significant investment in decommissioning projects. This trend fosters opportunities for specialized firms providing dismantling, waste management, and site remediation services. Technological progress in robotics, AI-driven monitoring, and advanced waste processing is further enhancing efficiency and cost-effectiveness. The market is segmented by reactor type, application, and capacity, with each segment influenced by unique decommissioning challenges and growth dynamics. Leading entities such as Japan Atomic Power Co, GE-Hitachi Nuclear Energy Ltd, and Toshiba Corp are actively participating, leveraging their expertise. The Asia-Pacific region, predominantly Japan, is the central hub due to its high concentration of aging nuclear power plants.

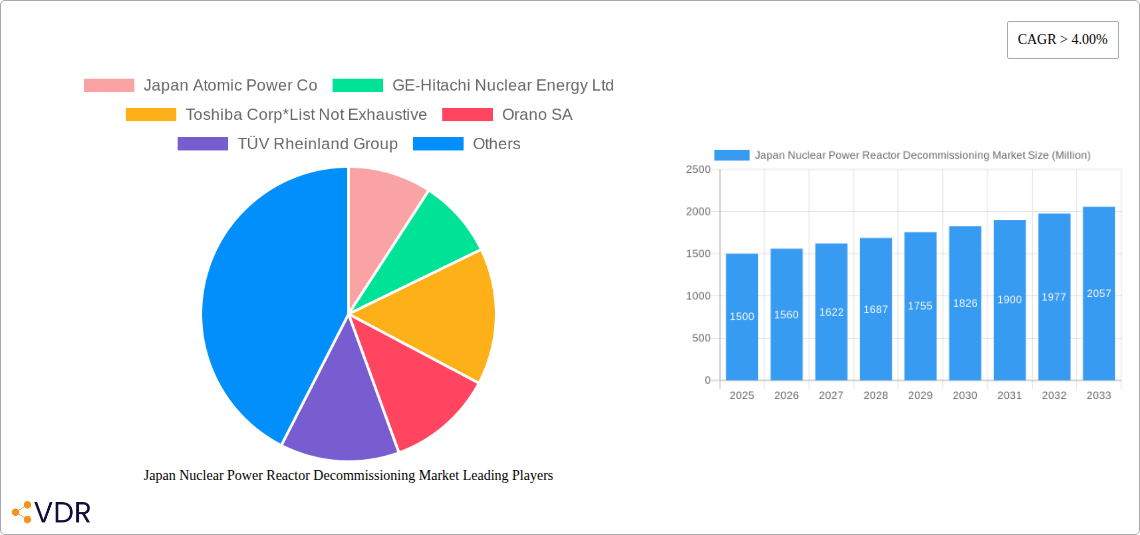

Japan Nuclear Power Reactor Decommissioning Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued market expansion as more reactors reach their end-of-life. Challenges include the inherent complexity and significant financial requirements of decommissioning, alongside regulatory complexities and the demand for specialized expertise. Despite these hurdles, sustained government support and ongoing technological advancements position the Japan Nuclear Power Reactor Decommissioning market for sustained growth. The increasing emphasis on environmental sustainability and waste reduction will also drive innovation and investment in eco-friendly decommissioning technologies.

Japan Nuclear Power Reactor Decommissioning Market Company Market Share

Japan Nuclear Power Reactor Decommissioning Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Japan Nuclear Power Reactor Decommissioning market, offering invaluable insights for industry professionals, investors, and policymakers. With a focus on market dynamics, growth trends, and key players, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report segments the market by reactor type (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas-cooled Reactor, Liquid Metal Fast Breeder Reactor, Other Reactor Types), application (Commercial Power Reactor, Prototype Power Reactor, Research Reactor), and capacity (Below 100 MW, 100-1000 MW, Above 1000 MW). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Japan Nuclear Power Reactor Decommissioning Market Market Dynamics & Structure

The Japanese nuclear power reactor decommissioning market is characterized by a relatively concentrated landscape, with key players like Japan Atomic Power Co, GE-Hitachi Nuclear Energy Ltd, Toshiba Corp, Orano SA, TÜV Rheinland Group, Snc-Lavalin Group Inc (Atkins), and Tokyo Electric Power Company Holdings Inc. Market share distribution is currently estimated at xx% for the top three players, indicating consolidation. Technological innovation, particularly in robotics, AI-driven inspection, and waste management, are crucial drivers. Stringent regulatory frameworks from the Japanese government significantly influence market operations. While limited, competitive substitutes exist in the form of alternative energy sources, but their impact remains minimal due to Japan's current energy mix. The decommissioning process involves diverse end-users, including power companies, government agencies, and specialized contractors. M&A activity has been moderate, with approximately xx deals recorded during the historical period (2019-2024), signaling ongoing industry consolidation and strategic expansion.

- Market Concentration: High, with top three players holding xx% market share.

- Technological Innovation: Robotics, AI, advanced waste management driving growth.

- Regulatory Framework: Stringent government regulations shaping market practices.

- Competitive Substitutes: Limited, primarily alternative energy sources.

- M&A Activity: xx deals during 2019-2024, reflecting industry consolidation.

- Innovation Barriers: High capital investment, complex regulatory approvals.

Japan Nuclear Power Reactor Decommissioning Market Growth Trends & Insights

The Japanese nuclear reactor decommissioning market has experienced significant growth driven by the aging nuclear power plant infrastructure and the Fukushima Daiichi disaster aftermath. The market size expanded from xx Million in 2019 to xx Million in 2024. This growth is attributed to the increasing number of reactors requiring decommissioning and ongoing technological advancements in decommissioning technologies. The adoption rate of advanced decommissioning techniques is gradually increasing, driven by factors like enhanced safety and efficiency. Technological disruptions, including the introduction of robotics and AI-powered solutions, are accelerating the pace of decommissioning projects. Shifts in consumer attitudes towards nuclear energy have indirectly impacted the market, driving stricter safety regulations and increased public scrutiny. The overall market demonstrates a steady growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033).

Dominant Regions, Countries, or Segments in Japan Nuclear Power Reactor Decommissioning Market

The Fukushima region remains the dominant segment, fueled by the ongoing decommissioning of the Fukushima Daiichi nuclear power plant, representing a significant portion (xx%) of the overall market. Within reactor types, Boiling Water Reactors (BWRs) constitute a large portion of the decommissioning projects, owing to their prevalence in Japan’s nuclear power generation capacity. The Commercial Power Reactor segment dominates due to the large number of commercial plants requiring decommissioning. In terms of capacity, the 100-1000 MW segment dominates, reflecting the size distribution of operational nuclear power plants in Japan.

- Key Drivers: Fukushima Daiichi decommissioning efforts, aging nuclear infrastructure.

- Dominant Segments: Fukushima region, Boiling Water Reactors, Commercial Power Reactors, 100-1000 MW capacity.

- Market Share: Fukushima region holds xx% market share, BWRs hold xx%.

Japan Nuclear Power Reactor Decommissioning Market Product Landscape

The market offers a diverse range of products and services, including specialized robotics, remote handling systems, waste treatment technologies, and decommissioning consulting services. Product innovation focuses on improving safety, efficiency, and reducing environmental impact. Key performance indicators include radiation dose reduction, waste volume minimization, and project completion time. Unique selling propositions often center on technological advancements, safety features, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Japan Nuclear Power Reactor Decommissioning Market

Key Drivers: The aging nuclear power plant infrastructure, regulatory mandates for decommissioning, and government funding for the Fukushima Daiichi cleanup are primary growth drivers. Advancements in robotics and AI are streamlining decommissioning processes.

Challenges: The high cost of decommissioning, complex regulatory procedures, skilled labor shortages, and the safe management of radioactive waste present significant hurdles. Supply chain disruptions can also delay projects. The estimated cost for the Fukushima Daiichi decommissioning alone exceeds USD 76 billion, showcasing the considerable financial challenges.

Emerging Opportunities in Japan Nuclear Power Reactor Decommissioning Market

Emerging opportunities include the development of advanced robotics and AI systems for decommissioning, innovative waste management solutions focusing on volume reduction and long-term storage, and expansion into related services such as site remediation and environmental monitoring. Untapped markets include the decommissioning of smaller research reactors and the development of specialized training programs for the workforce.

Growth Accelerators in the Japan Nuclear Power Reactor Decommissioning Market Industry

Technological breakthroughs, such as the development of more efficient and safer decommissioning robots and improved waste treatment technologies, are major growth catalysts. Strategic partnerships between international companies and Japanese firms are also fostering innovation and market expansion. Government initiatives and incentives further accelerate the adoption of advanced technologies.

Key Players Shaping the Japan Nuclear Power Reactor Decommissioning Market Market

- Japan Atomic Power Co

- GE-Hitachi Nuclear Energy Ltd

- Toshiba Corp

- Orano SA

- TÜV Rheinland Group

- Snc-Lavalin Group Inc (Atkins)

- Tokyo Electric Power Company Holdings Inc

Notable Milestones in Japan Nuclear Power Reactor Decommissioning Market Sector

- May 2022: Jacobs Engineering Group selected by Tokyo Electric Power Company (Tepco) for Fukushima Daiichi decommissioning support.

- January 2022: Japanese government announces plans to release treated wastewater from Fukushima Daiichi, a key step in the decommissioning process.

In-Depth Japan Nuclear Power Reactor Decommissioning Market Market Outlook

The future of the Japanese nuclear power reactor decommissioning market is promising, driven by continued government support, technological advancements, and the increasing number of reactors requiring decommissioning. Strategic partnerships and investments in research and development will further accelerate market growth. The market is poised for significant expansion, creating opportunities for both domestic and international players.

Japan Nuclear Power Reactor Decommissioning Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Boiling Water Reactor

- 1.4. High-temperature Gas-cooled Reactor

- 1.5. Liquid Metal Fast Breeder Reactor

- 1.6. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. 100-1000 MW

- 3.3. Above 1000 MW

Japan Nuclear Power Reactor Decommissioning Market Segmentation By Geography

- 1. Japan

Japan Nuclear Power Reactor Decommissioning Market Regional Market Share

Geographic Coverage of Japan Nuclear Power Reactor Decommissioning Market

Japan Nuclear Power Reactor Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Reliable Electricity4.; Increasing Government Support for Hydropower Generation

- 3.3. Market Restrains

- 3.3.1. Negative Environmental Consequences of Hydropower Projects

- 3.4. Market Trends

- 3.4.1. Commercial Power Reactor Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Boiling Water Reactor

- 5.1.4. High-temperature Gas-cooled Reactor

- 5.1.5. Liquid Metal Fast Breeder Reactor

- 5.1.6. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. 100-1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Atomic Power Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GE-Hitachi Nuclear Energy Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toshiba Corp*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orano SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TÜV Rheinland Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Snc-Lavalin Group Inc (Atkins)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tokyo Electric Power Company Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Japan Atomic Power Co

List of Figures

- Figure 1: Japan Nuclear Power Reactor Decommissioning Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan Nuclear Power Reactor Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 2: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 4: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 6: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 8: Japan Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Nuclear Power Reactor Decommissioning Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Japan Nuclear Power Reactor Decommissioning Market?

Key companies in the market include Japan Atomic Power Co, GE-Hitachi Nuclear Energy Ltd, Toshiba Corp*List Not Exhaustive, Orano SA, TÜV Rheinland Group, Snc-Lavalin Group Inc (Atkins), Tokyo Electric Power Company Holdings Inc.

3. What are the main segments of the Japan Nuclear Power Reactor Decommissioning Market?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 396.1 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Reliable Electricity4.; Increasing Government Support for Hydropower Generation.

6. What are the notable trends driving market growth?

Commercial Power Reactor Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Negative Environmental Consequences of Hydropower Projects.

8. Can you provide examples of recent developments in the market?

May 2022: USA-based engineering group Jacobs has been selected by Tokyo Electric Power Company (Tepco) to support decommissioning efforts at its damaged Fukushima Daiichi nuclear power plant in Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Nuclear Power Reactor Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Nuclear Power Reactor Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Nuclear Power Reactor Decommissioning Market?

To stay informed about further developments, trends, and reports in the Japan Nuclear Power Reactor Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence