Key Insights

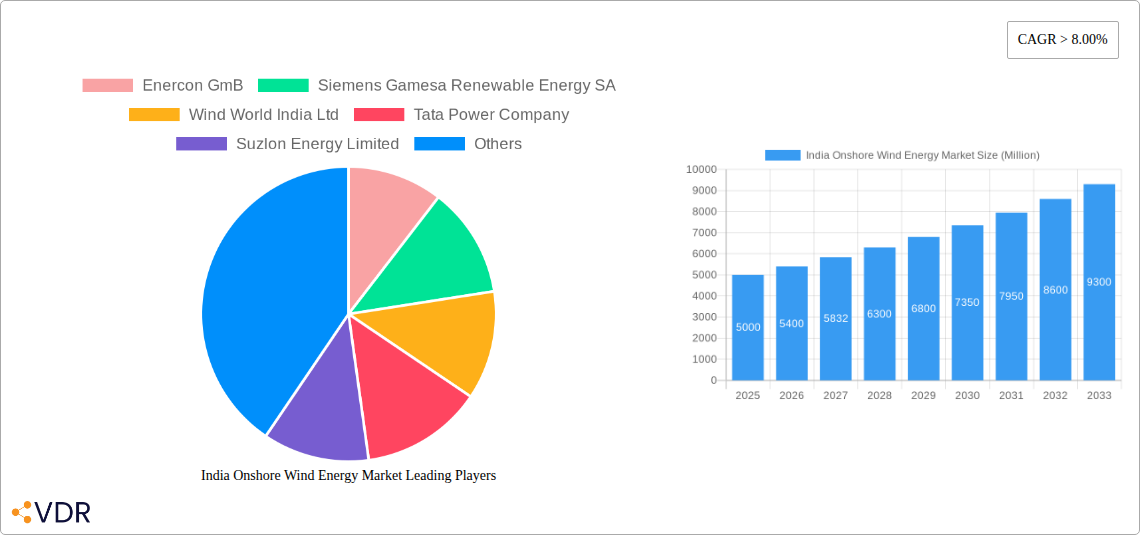

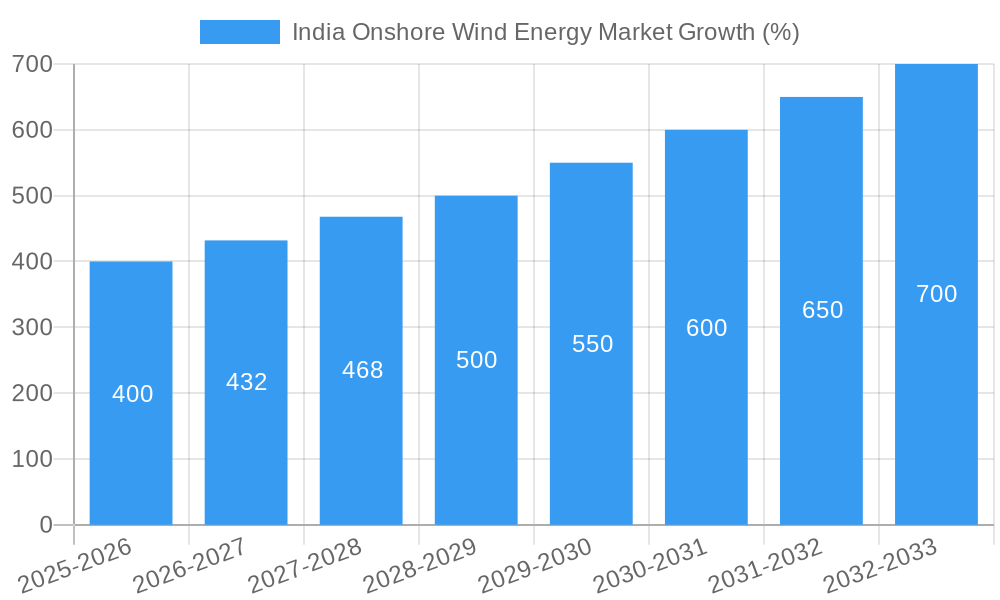

The India onshore wind energy market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is fueled by several key drivers. Government initiatives promoting renewable energy, coupled with increasing electricity demand and a commitment to reducing carbon emissions, are creating a favorable environment for investment. Furthermore, advancements in turbine technology, particularly larger turbines (over 3 MW), are leading to increased energy generation efficiency and lower costs per unit of electricity. While land acquisition and grid infrastructure limitations pose challenges, the overall market outlook remains positive. The market is segmented by turbine capacity, with the 2-3 MW segment currently holding a larger share (55%) but the >3 MW segment expected to gain momentum due to its efficiency advantages. Key players like Suzlon Energy, Tata Power, and Siemens Gamesa are actively shaping the market landscape through technological advancements and project development. The Asia-Pacific region, particularly India, is a significant contributor to global wind energy growth, and India's substantial renewable energy targets are attracting significant foreign direct investment.

The market's sustained growth trajectory is expected to continue through the forecast period, driven by supportive government policies such as the National Wind-Solar Hybrid Policy, and further technological advancements. The focus on improving grid infrastructure and streamlined permitting processes should alleviate current bottlenecks. The increasing competitiveness of onshore wind energy compared to fossil fuels, along with corporate sustainability initiatives, further enhances market prospects. While challenges remain, the inherent potential of India's wind resources and the strong government push towards renewable energy integration position the onshore wind energy sector for considerable expansion. The consistent presence of major international and domestic players indicates a healthy and competitive market dynamic conducive to long-term growth.

This comprehensive report provides an in-depth analysis of the India onshore wind energy market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly expanding sector. The report examines the parent market of Renewable Energy and its child market of Onshore Wind Energy in India.

India Onshore Wind Energy Market Dynamics & Structure

This section delves into the intricate structure of India's onshore wind energy market, examining its concentration, technological advancements, regulatory landscape, competitive dynamics, and end-user trends. The analysis incorporates quantitative data, such as market share percentages and M&A deal volumes, alongside qualitative insights into innovation barriers and market forces.

- Market Concentration: The market exhibits a moderately concentrated structure, with major players like Suzlon Energy, Inox Wind, and Tata Power holding significant market share. However, the entry of international players and the emergence of smaller, specialized firms are increasing competition. The market share of the top 5 players is estimated at xx%.

- Technological Innovation: Technological advancements in turbine design (e.g., higher capacity turbines), smart grids, and energy storage solutions are driving market growth. However, challenges remain in adopting cutting-edge technologies due to high initial investment costs and technological complexities.

- Regulatory Framework: Government policies and incentives, such as the National Renewable Energy Policy and various state-level regulations, are pivotal in shaping market growth. However, regulatory inconsistencies and bureaucratic delays can hinder progress.

- Competitive Landscape: The market is characterized by intense competition among both domestic and international players. The competitive landscape involves pricing strategies, technological differentiation, and project acquisition strategies. The market is seeing increased M&A activity with xx number of deals recorded in the last 5 years.

- End-User Demographics: The primary end-users are utility companies, independent power producers (IPPs), and industrial consumers seeking renewable energy solutions. Growing energy demands and environmental concerns are driving adoption.

- M&A Trends: Mergers and acquisitions are frequently observed as companies seek expansion and consolidation within the market. This has resulted in xx million USD of investment through M&A activity in the past five years.

India Onshore Wind Energy Market Growth Trends & Insights

This section utilizes detailed market data to analyze the growth trajectory of the India onshore wind energy market. This analysis includes market size evolution, adoption rates, technological disruption impacts, and shifts in consumer behavior. The analysis will focus on the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

The market exhibited a CAGR of xx% during the historical period (2019-2024), driven by supportive government policies, increasing energy demand, and decreasing turbine costs. The market size in 2024 was approximately xx million units. The forecast period (2025-2033) is expected to witness a CAGR of xx%, reaching an estimated xx million units by 2033. This growth will be fueled by continued government support, technological advancements, and growing private sector investment. Market penetration of renewable energy sources increased from xx% to xx% between 2019 and 2024, further indicating the increasing significance of the onshore wind sector.

Dominant Regions, Countries, or Segments in India Onshore Wind Energy Market

This section identifies the leading regions, states, and segments within the Indian onshore wind energy market driving its growth. Focus is given to the “By Turbine Capacity” segment, with a breakdown of 2-3 MW (55%) and >3 MW (45%) capacities.

- Dominant Segment: 2-3 MW Turbine Capacity: This segment holds the largest market share (55%) due to its cost-effectiveness and suitability for various project sites. However, the >3 MW segment is expected to witness faster growth due to technological advancements and economies of scale.

- Key Growth Drivers:

- Government Policies and Incentives: Favorable policies, tax benefits, and feed-in tariffs are stimulating investment and development.

- Abundant Wind Resources: India possesses significant wind resources, particularly in states like Tamil Nadu, Gujarat, and Karnataka, which provide ample locations for wind farms.

- Falling Turbine Costs: Technological advancements have led to reduced turbine costs, making onshore wind power increasingly competitive.

- Improved Grid Infrastructure: Investments in grid infrastructure are enhancing the reliability and efficiency of wind power integration.

The states of Tamil Nadu and Gujarat are currently leading in onshore wind power capacity, accounting for approximately xx% of the total installed capacity. However, other states are rapidly expanding their capacity, indicating a geographically diverse growth pattern.

India Onshore Wind Energy Market Product Landscape

The Indian onshore wind energy market features a diverse range of wind turbines, ranging from smaller 2-3 MW capacities to larger >3 MW models. Key product innovations include advanced blade designs for increased efficiency and durability, as well as improved control systems for optimized energy output and grid integration. The focus is shifting towards larger turbines for enhanced energy generation and cost reduction per unit of energy. The adoption of smart grid technologies and energy storage solutions is further augmenting the competitiveness and reliability of onshore wind power.

Key Drivers, Barriers & Challenges in India Onshore Wind Energy Market

Key Drivers:

- Government support: Ambitious renewable energy targets and supportive policies are accelerating market growth.

- Decreasing costs: Advances in technology and economies of scale are making wind energy increasingly cost-competitive.

- Growing energy demand: India's rapidly expanding economy requires more power generation capacity, creating opportunities for wind energy.

Key Challenges:

- Land Acquisition: Securing land for large-scale wind farms can be a complex and time-consuming process. This often contributes to project delays and increased costs.

- Grid Integration: Integrating large amounts of intermittent wind power into the national grid poses technical challenges requiring grid modernization and investment in smart grid technologies. This challenge is estimated to delay project completion by an average of xx months.

- Supply Chain Constraints: The reliance on imported components for wind turbines can create supply chain vulnerabilities and price volatility.

Emerging Opportunities in India Onshore Wind Energy Market

The Indian onshore wind energy market presents various emerging opportunities, including:

- Hybrid Projects: Combining wind energy with solar power (hybridized) increases efficiency and reduces reliance on intermittent sources.

- Offshore Wind: While still nascent, India's vast coastline offers significant potential for offshore wind power development. The government's target of 30,000 MW of offshore wind capacity by 2030 represents a substantial untapped market.

- Energy Storage Solutions: Integrating battery storage or other energy storage systems with wind turbines enhances grid stability and improves power output predictability.

Growth Accelerators in the India Onshore Wind Energy Market Industry

Long-term growth in the Indian onshore wind energy market will be driven by sustained government support, continued technological innovation, strategic partnerships between domestic and international players, and expansion into new geographical areas with favorable wind resources. The proactive development of grid infrastructure to accommodate increased wind power integration will also be crucial.

Key Players Shaping the India Onshore Wind Energy Market Market

- Enercon GmB

- Siemens Gamesa Renewable Energy SA

- Wind World India Ltd

- Tata Power Company

- Suzlon Energy Limited

- Envision Group

- Inox Wind limited

- Vestas Wind Systems AS

- General Electric Company

Notable Milestones in India Onshore Wind Energy Market Sector

- October 2022: Suzlon Group secured a 144.9 MW wind power project order from the Aditya Birla Group, showcasing strong market demand.

- May 2022: The Indian government announced plans for 30,000 MW of offshore wind capacity, signifying a major expansion opportunity.

- October 2021: GE Renewable Energy secured an 810 MW onshore wind turbine order from JSW Energy Ltd, highlighting the significant investments being made in the sector.

In-Depth India Onshore Wind Energy Market Market Outlook

The Indian onshore wind energy market is poised for substantial growth over the next decade, driven by supportive government policies, technological advancements, and increasing private sector investment. The focus on larger turbine capacities, the exploration of offshore wind potential, and integration with other renewable energy sources and energy storage solutions will further fuel market expansion. Strategic partnerships and investments in grid infrastructure will be crucial for unlocking the full potential of this rapidly growing sector. The market is expected to attract significant foreign investment, further driving its growth and innovation.

India Onshore Wind Energy Market Segmentation

- 1. Onshore

- 2. Offshore

India Onshore Wind Energy Market Segmentation By Geography

- 1. India

India Onshore Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Onshore Wind Energy is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. China India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. India India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Onshore Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Enercon GmB

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens Gamesa Renewable Energy SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Wind World India Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tata Power Company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Suzlon Energy Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Envision Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Inox Wind limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vestas Wind Systems AS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 General Electric Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Enercon GmB

List of Figures

- Figure 1: India Onshore Wind Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Onshore Wind Energy Market Share (%) by Company 2024

List of Tables

- Table 1: India Onshore Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 3: India Onshore Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 4: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2019 & 2032

- Table 5: India Onshore Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 6: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2019 & 2032

- Table 7: India Onshore Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 9: India Onshore Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

- Table 11: China India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 13: Japan India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 15: India India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 17: South Korea India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 19: Taiwan India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 21: Australia India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific India Onshore Wind Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific India Onshore Wind Energy Market Volume (Gigawatte) Forecast, by Application 2019 & 2032

- Table 25: India Onshore Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 26: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Onshore 2019 & 2032

- Table 27: India Onshore Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 28: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Offshore 2019 & 2032

- Table 29: India Onshore Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: India Onshore Wind Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Onshore Wind Energy Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India Onshore Wind Energy Market?

Key companies in the market include Enercon GmB, Siemens Gamesa Renewable Energy SA, Wind World India Ltd, Tata Power Company, Suzlon Energy Limited, Envision Group, Inox Wind limited, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the India Onshore Wind Energy Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Onshore Wind Energy is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

October 2022: Suzlon Group secured new order to develop 144.9 MW wind power projects located at sites in Gujarat and Madhya Pradesh for the Aditya Birla Group. As a part of the contract, the company will install around 69 units of wind turbine generators (Wind Turbines) with a Hybrid Lattice Tubular (HLT) tower with a rated capacity of 2.1 MW each. It is expected to commence operations by the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatte.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Onshore Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Onshore Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Onshore Wind Energy Market?

To stay informed about further developments, trends, and reports in the India Onshore Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence