Key Insights

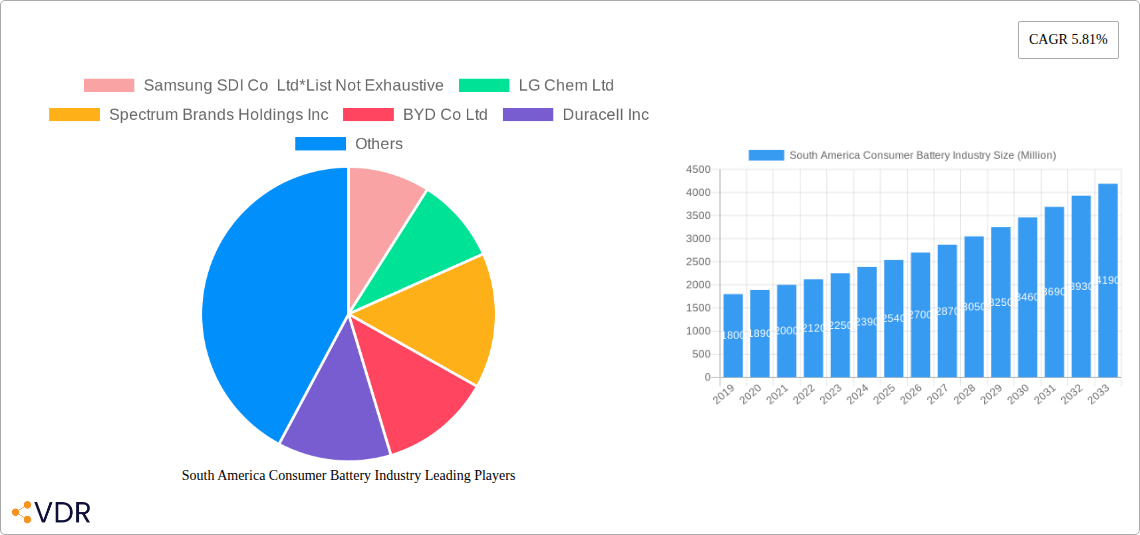

The South America consumer battery market is poised for significant expansion, projected to reach a valuation of approximately $2,500 million by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.81%, indicating sustained demand and evolving market dynamics. A primary driver for this expansion is the increasing adoption of portable electronic devices, ranging from smartphones and laptops to wireless peripherals and power tools, across the region's growing middle class. Furthermore, the burgeoning demand for energy-efficient and longer-lasting battery solutions, particularly Lithium-ion batteries, is reshaping consumer preferences and product development. Investments in renewable energy storage solutions, while nascent in the consumer segment, also contribute to an overall positive market outlook, fostering innovation and driving the adoption of advanced battery technologies.

South America Consumer Battery Industry Market Size (In Billion)

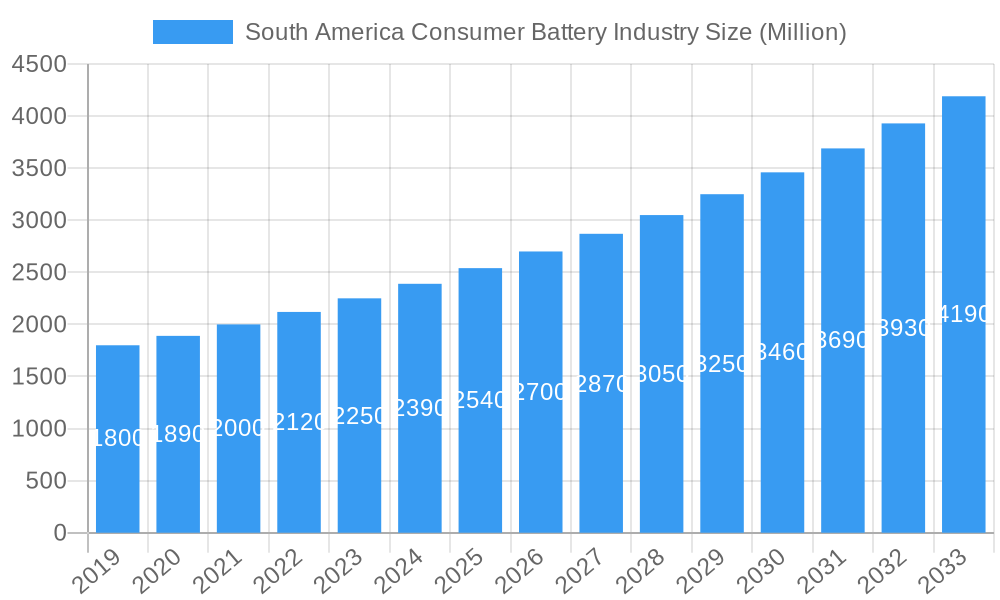

The market is characterized by a diverse range of battery types, with Lithium-ion batteries leading the charge due to their superior energy density and rechargeability, making them ideal for modern consumer electronics. However, traditional Zinc-carbon and Alkaline batteries continue to hold a substantial share, catering to low-drain devices and budget-conscious consumers. Key players like Samsung SDI Co. Ltd., LG Chem Ltd., BYD Co. Ltd., Panasonic Corporation, and Energizer Holdings Inc. are actively competing, introducing innovative products and expanding their distribution networks to capture market share in countries like Brazil, Argentina, and Colombia. Restraints such as fluctuating raw material prices and the growing environmental concerns associated with battery disposal are being addressed through advancements in battery recycling and the development of more sustainable battery chemistries, suggesting a dynamic and adaptive market landscape for consumer batteries in South America.

South America Consumer Battery Industry Company Market Share

South America Consumer Battery Industry: Market Dynamics, Growth Trends, and Key Player Analysis 2019-2033

This comprehensive report offers an in-depth analysis of the South America Consumer Battery Industry, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, growth accelerators, and a detailed profile of leading market players. The study encompasses a detailed examination from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. All quantitative values are presented in Million units.

South America Consumer Battery Industry Market Dynamics & Structure

The South America consumer battery market is characterized by a moderately concentrated landscape, with a few major global players dominating market share, alongside a growing presence of regional manufacturers. Technological innovation is primarily driven by the demand for higher energy density, longer lifespan, and enhanced safety in batteries, especially within the burgeoning lithium-ion segment. Regulatory frameworks are evolving, with increasing attention on environmental compliance, battery recycling, and the standardization of battery types to ensure consumer safety and facilitate market integration. Competitive product substitutes, such as rechargeable batteries and alternative power sources for low-drain devices, are steadily gaining traction, influencing the market dynamics for traditional disposable batteries. End-user demographics reveal a growing middle class with increasing disposable income, a rising adoption of portable electronic devices, and a greater awareness of sustainable energy solutions. Mergers and acquisitions (M&A) activity is moderate, often involving strategic partnerships or smaller acquisition of local entities to expand distribution networks and market penetration.

- Market Concentration: Dominated by established multinational corporations; estimated to be around 60-70% controlled by the top 5-7 players.

- Technological Innovation Drivers: Demand for improved performance in portable electronics, electric vehicles (for broader consumer adoption impact), and smart home devices.

- Regulatory Frameworks: Focus on hazardous material reduction, battery disposal protocols, and potential import/export regulations affecting component sourcing.

- Competitive Product Substitutes: Rechargeable battery market share projected to reach 35% of the total consumer battery market by 2028.

- End-User Demographics: Growing demand from urban centers and emerging economies within South America.

- M&A Trends: Strategic alliances for R&D and distribution; limited outright acquisitions of major players.

South America Consumer Battery Industry Growth Trends & Insights

The South America Consumer Battery Industry is poised for robust growth, driven by escalating demand for portable electronic devices, the increasing adoption of smart home technologies, and a growing consumer awareness regarding the benefits of advanced battery chemistries like lithium-ion. The market size evolution is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period (2025-2033). Adoption rates for high-performance batteries, particularly lithium-ion variants, are surging as consumers prioritize longevity and efficiency for their electronic gadgets, from smartphones and laptops to digital cameras and gaming consoles. Technological disruptions are primarily centered around improving energy density, reducing charging times, and enhancing battery safety profiles. Innovations in battery management systems are also playing a crucial role in extending battery life and optimizing performance. Consumer behavior shifts are evident, with a discernible move towards rechargeable solutions due to cost savings and environmental considerations over the long term, although the convenience of disposable batteries still holds significant sway in certain segments. The penetration of specialized batteries for medical devices and remote-controlled vehicles is also contributing to market expansion. The increasing urbanization across South American nations, coupled with improved digital infrastructure, further fuels the demand for reliable and efficient power sources for a wide array of consumer electronics. The projected market size for consumer batteries in South America is estimated to reach approximately 3,800 Million units by 2028, a significant increase from 2,950 Million units in 2023. This growth trajectory is underpinned by sustained economic development within key South American countries, leading to increased disposable incomes and a greater propensity to invest in consumer electronics that rely heavily on dependable battery power. The penetration of the lithium-ion segment is anticipated to surpass 45% of the total market value by the end of the forecast period, reflecting a strong consumer preference for advanced battery technology.

Dominant Regions, Countries, or Segments in South America Consumer Battery Industry

Within the South America Consumer Battery Industry, Lithium-ion Batteries are emerging as the dominant segment, spearheading market growth and technological advancement. This dominance is propelled by several converging factors, including the ubiquitous demand for high-performance portable electronics, the burgeoning adoption of electric mobility solutions (even at the micro-mobility level), and the increasing integration of smart technologies in households. Brazil, as the largest economy in South America, stands out as the leading country driving this demand, followed closely by Argentina and Colombia. The economic policies in these nations, which encourage the manufacturing and adoption of electronic goods, coupled with significant investments in digital infrastructure, create a fertile ground for the consumer battery market. The market share of lithium-ion batteries is projected to reach over 45% by 2028, eclipsing traditional alkaline and zinc-carbon batteries.

- Dominant Segment: Lithium-ion Batteries

- Key Drivers:

- Explosive Growth in Portable Electronics: Smartphones, laptops, tablets, and wearable devices all heavily rely on lithium-ion technology for their compact size and high energy density.

- Rise of Smart Home Devices: Connected devices, smart speakers, and home security systems are increasingly powered by rechargeable lithium-ion batteries.

- Electric Mobility Expansion: While not solely consumer batteries, the growth of e-scooters, e-bikes, and smaller electric vehicles indirectly boosts the demand for lithium-ion battery components and manufacturing expertise.

- Technological Advancements: Continuous improvements in energy density, charging speeds, and safety features make lithium-ion batteries increasingly attractive.

- Environmental Concerns: Growing consumer preference for rechargeable and longer-lasting batteries aligns with sustainability goals.

- Market Share & Growth Potential: Lithium-ion batteries are expected to command a market share of approximately 45% by 2028, with a projected CAGR of 7.2% during the forecast period.

- Key Drivers:

- Leading Countries:

- Brazil: Largest market due to its economic size, growing middle class, and significant penetration of consumer electronics.

- Argentina: Strong demand for portable devices and increasing adoption of smart home solutions.

- Colombia: Rapidly expanding consumer electronics market and supportive government initiatives for technology adoption.

- Underlying Factors:

- Economic Policies: Favorable trade agreements and incentives for electronics manufacturing and import.

- Infrastructure Development: Expansion of reliable power grids and internet connectivity supports the use of electronic devices.

- Consumer Purchasing Power: Rising disposable incomes enable consumers to purchase and upgrade electronic devices more frequently.

While lithium-ion batteries lead, alkaline batteries continue to hold a significant share due to their affordability and widespread use in low-drain devices like remote controls and clocks. Zinc-carbon batteries, though declining, still find niche applications in very low-cost, low-drain devices in less developed regions.

South America Consumer Battery Industry Product Landscape

The South America Consumer Battery Industry product landscape is characterized by a dynamic interplay of established battery chemistries and emerging technological advancements. Lithium-ion batteries are at the forefront, offering superior energy density and longer lifecycles for demanding applications such as smartphones, laptops, and portable gaming devices. Innovations in this segment focus on increasing charge cycles, improving safety features through advanced battery management systems, and exploring next-generation chemistries like solid-state batteries. Alkaline batteries remain a staple for general-purpose devices like remote controls, flashlights, and toys, benefiting from their cost-effectiveness and widespread availability. Manufacturers are also focusing on creating more environmentally friendly alkaline formulations. Other battery types, including button cells and specialized batteries for medical devices and hearing aids, cater to niche but growing markets requiring high reliability and specific performance metrics. The trend towards rechargeable solutions is evident across most battery types, driven by both economic and environmental considerations.

Key Drivers, Barriers & Challenges in South America Consumer Battery Industry

The South America Consumer Battery Industry is propelled by several key drivers. The escalating demand for portable electronic devices, a growing middle class with increased disposable income, and the rising adoption of smart home technologies are significant growth catalysts. Furthermore, advancements in battery technology, leading to improved performance and longer lifespans, coupled with a growing consumer awareness of environmental sustainability, are encouraging the adoption of more advanced and rechargeable battery solutions.

However, the industry faces notable barriers and challenges. Supply chain disruptions, particularly concerning the sourcing of raw materials like lithium and cobalt, can impact production volumes and costs. Regulatory hurdles related to battery disposal and recycling infrastructure development are also significant concerns. Intense competition from both global and local manufacturers, often leading to price pressures, and the reliance on imported technologies can hinder domestic innovation. The relatively lower purchasing power in some regions compared to developed markets can also limit the adoption of premium, high-cost batteries.

Emerging Opportunities in South America Consumer Battery Industry

Emerging opportunities within the South America Consumer Battery Industry are abundant. The untapped potential in rural and semi-urban areas for consumer electronics presents a significant growth avenue, particularly for affordable and reliable battery solutions. The increasing demand for eco-friendly and sustainable battery options offers a niche for manufacturers focusing on recyclable materials and ethical sourcing. Furthermore, the growing prevalence of portable medical devices and diagnostic tools creates a demand for specialized, high-reliability batteries. The development of local manufacturing capabilities and R&D centers for battery technology could unlock significant economic growth and reduce reliance on imports.

Growth Accelerators in the South America Consumer Battery Industry Industry

Several catalysts are accelerating the growth of the South America Consumer Battery Industry. Technological breakthroughs in battery chemistry, leading to higher energy density, faster charging, and enhanced safety, are continuously expanding the capabilities of consumer electronics. Strategic partnerships between global battery manufacturers and local South American distributors are crucial for expanding market reach and understanding regional consumer needs. Market expansion strategies, including the development of tailored product offerings for specific South American demographics and the establishment of robust after-sales service networks, are also key growth accelerators. The increasing investment in research and development within the region, focusing on localized solutions and sustainable practices, will further fuel long-term expansion.

Key Players Shaping the South America Consumer Battery Industry Market

- Samsung SDI Co Ltd

- LG Chem Ltd

- Spectrum Brands Holdings Inc

- BYD Co Ltd

- Duracell Inc

- Panasonic Corporation

- PolyPlus

- Energizer Holdings inc

- Sony Corporation

- Varta AG

Notable Milestones in South America Consumer Battery Industry Sector

- 2023: Samsung SDI establishes a new battery production facility in Brazil, signaling a significant investment in localized manufacturing and supply chain enhancement within South America.

- 2023: LG Chem partners with local distributors across key South American markets, including Brazil, Argentina, and Colombia, to expand its distribution network and improve market penetration for its consumer battery products.

- 2024: BYD launches a line of eco-friendly consumer batteries in select South American countries, focusing on sustainable materials and enhanced recyclability, aligning with growing environmental consciousness among consumers.

In-Depth South America Consumer Battery Industry Market Outlook

The South America Consumer Battery Industry is on a trajectory of sustained growth, driven by a confluence of technological advancements, evolving consumer preferences, and expanding market reach. The increasing adoption of portable electronics, coupled with the burgeoning smart home ecosystem, will continue to fuel demand for high-performance batteries. Growth accelerators include ongoing innovations in lithium-ion technology, leading to more efficient and safer battery solutions, and strategic collaborations that enhance distribution networks and local market understanding. The industry's future potential is further bolstered by a growing awareness of sustainability, creating opportunities for manufacturers focusing on eco-friendly and rechargeable battery options. The strategic development of regional manufacturing capabilities and R&D centers will play a pivotal role in shaping a resilient and dynamic South American consumer battery market.

South America Consumer Battery Industry Segmentation

-

1. Types

- 1.1. Lithium-ion Batteries

- 1.2. Zinc-carbon batteries

- 1.3. Alkaline Batteries

- 1.4. Other Types of Batteries

South America Consumer Battery Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Consumer Battery Industry Regional Market Share

Geographic Coverage of South America Consumer Battery Industry

South America Consumer Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Cheap and Alternative Pumps

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Lithium-ion Batteries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Consumer Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Lithium-ion Batteries

- 5.1.2. Zinc-carbon batteries

- 5.1.3. Alkaline Batteries

- 5.1.4. Other Types of Batteries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung SDI Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG Chem Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spectrum Brands Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BYD Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Duracell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Panasonic Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PolyPlus

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Energizer Holdings inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sony Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Varta AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Samsung SDI Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: South America Consumer Battery Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Consumer Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Consumer Battery Industry Revenue Million Forecast, by Types 2020 & 2033

- Table 2: South America Consumer Battery Industry Volume K Tons Forecast, by Types 2020 & 2033

- Table 3: South America Consumer Battery Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Consumer Battery Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: South America Consumer Battery Industry Revenue Million Forecast, by Types 2020 & 2033

- Table 6: South America Consumer Battery Industry Volume K Tons Forecast, by Types 2020 & 2033

- Table 7: South America Consumer Battery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: South America Consumer Battery Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: Brazil South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Brazil South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: Argentina South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Argentina South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Chile South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Chile South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Colombia South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Peru South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Venezuela South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Venezuela South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Ecuador South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ecuador South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Bolivia South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Bolivia South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Paraguay South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Paraguay South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Uruguay South America Consumer Battery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Uruguay South America Consumer Battery Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Consumer Battery Industry?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the South America Consumer Battery Industry?

Key companies in the market include Samsung SDI Co Ltd*List Not Exhaustive, LG Chem Ltd, Spectrum Brands Holdings Inc, BYD Co Ltd, Duracell Inc, Panasonic Corporation, PolyPlus, Energizer Holdings inc , Sony Corporation , Varta AG.

3. What are the main segments of the South America Consumer Battery Industry?

The market segments include Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors.

6. What are the notable trends driving market growth?

Increasing Demand for Lithium-ion Batteries.

7. Are there any restraints impacting market growth?

4.; Availability of Cheap and Alternative Pumps.

8. Can you provide examples of recent developments in the market?

Samsung SDI establishes a new battery production facility in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Consumer Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Consumer Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Consumer Battery Industry?

To stay informed about further developments, trends, and reports in the South America Consumer Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence