Key Insights

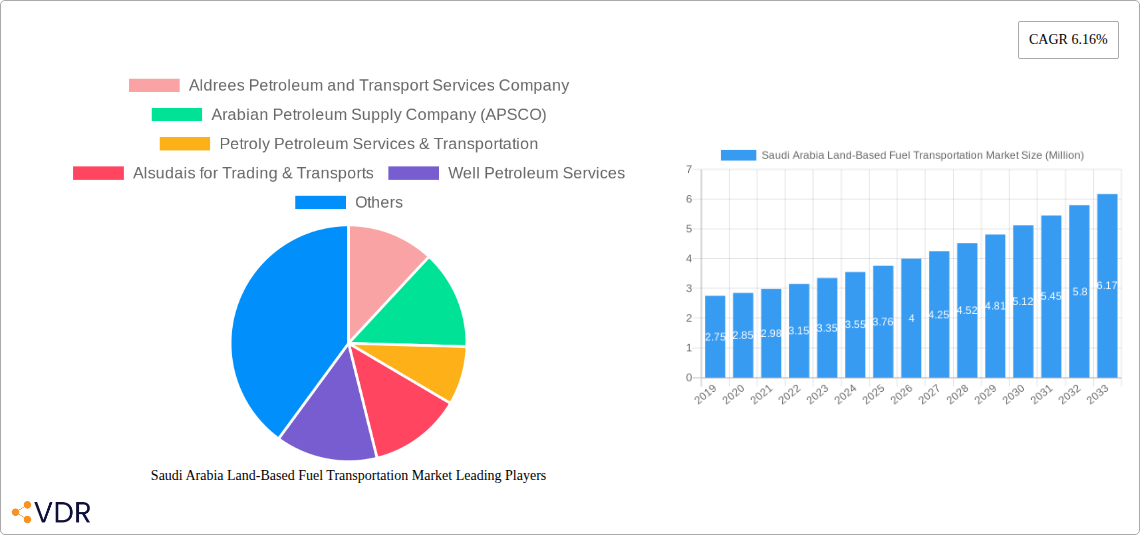

The Saudi Arabia Land-Based Fuel Transportation Market is experiencing robust growth, projected to reach approximately $3.76 million in value. This expansion is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 6.16%, indicating a dynamic and evolving sector. The market is driven by several key factors, including the increasing demand for petroleum products across various industries, the continuous development of infrastructure projects, and the government's strategic initiatives to boost the energy sector and diversify the economy. These forces collectively fuel the need for efficient and reliable land-based transportation of fuels, from refined products like Octane 91 and 95 to industrial staples like Diesel and specialized fuels such as Jet-A1. The market is segmented not only by fuel type but also by the diverse needs of consumers and industries that rely on timely fuel delivery.

Saudi Arabia Land-Based Fuel Transportation Market Market Size (In Million)

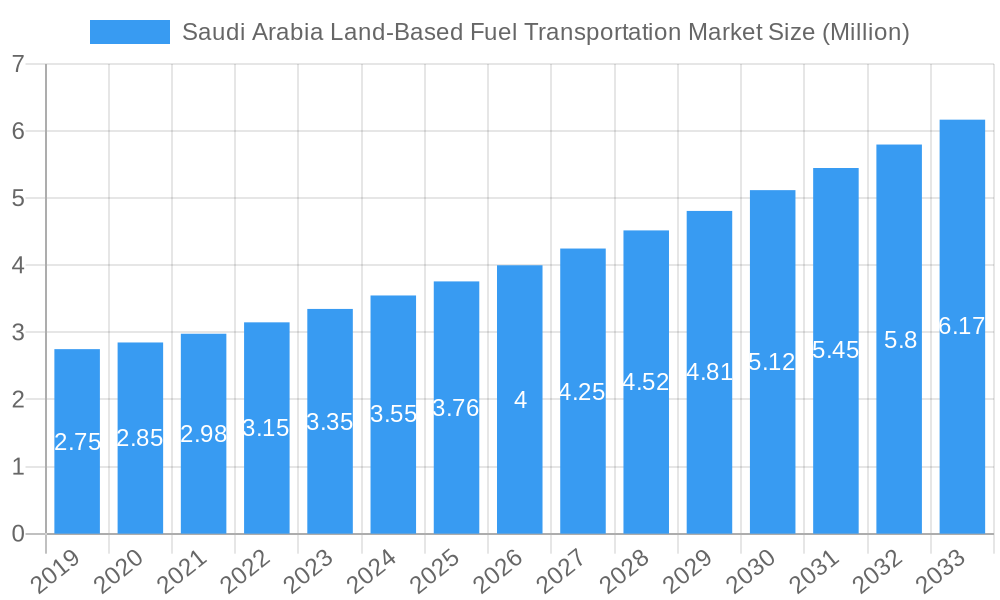

Further analysis reveals that key trends shaping the Saudi Arabia Land-Based Fuel Transportation Market include the adoption of advanced logistics and tracking technologies to enhance efficiency and safety, the increasing focus on sustainable transportation solutions and greener fuel options, and a growing demand for specialized transportation services catering to remote or challenging locations. While the market presents significant opportunities, it also faces certain restraints. These may include stringent regulatory compliance requirements, fluctuations in global oil prices impacting demand and operational costs, and the logistical complexities associated with vast geographical areas and diverse terrain. Nevertheless, the presence of prominent companies like Aldrees Petroleum and Transport Services Company and Arabian Petroleum Supply Company (APSCO) signifies a competitive landscape with established players actively contributing to the market's development and innovation.

Saudi Arabia Land-Based Fuel Transportation Market Company Market Share

Saudi Arabia Land-Based Fuel Transportation Market: Comprehensive Outlook 2019–2033

This in-depth report provides a comprehensive analysis of the Saudi Arabia Land-Based Fuel Transportation Market, offering critical insights for stakeholders aiming to navigate this dynamic sector. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report delves into market size, growth drivers, challenges, and future opportunities. With a focus on high-traffic keywords such as Saudi Arabia fuel logistics, oil transportation Saudi Arabia, petroleum transport services KSA, diesel transport market Saudi Arabia, and aviation fuel logistics, this report is optimized for maximum search engine visibility. We meticulously analyze parent and child market segments, including Fuel Type (Octane 91, Octane 95, Diesel, Jet-A1, Other Fuel Types), and explore the competitive landscape featuring key players like Aldrees Petroleum and Transport Services Company, Arabian Petroleum Supply Company (APSCO), and others.

Saudi Arabia Land-Based Fuel Transportation Market Market Dynamics & Structure

The Saudi Arabia Land-Based Fuel Transportation Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, alongside a growing number of smaller, specialized logistics providers. Technological innovation is a key driver, particularly in enhancing fleet efficiency, safety, and environmental compliance. Advanced tracking systems, route optimization software, and the integration of AI for predictive maintenance are becoming standard. The regulatory framework, guided by entities like the Ministry of Energy and the Saudi Standards, Metrology and Quality Organization (SASO), emphasizes safety standards, environmental regulations, and licensing requirements for fuel transportation. Competitive product substitutes are limited for bulk fuel transportation, with road tankers being the primary mode. However, intermodal solutions and alternative fuel sources present nascent competitive pressures. End-user demographics are diverse, ranging from large industrial consumers like Saudi Aramco and petrochemical companies to retail fuel stations and aviation fuel providers. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger companies seeking to expand their operational footprint and service offerings. For instance, in 2023, the M&A deal volume in the broader Middle East logistics sector reached an estimated $8,500 million, indicating a robust appetite for strategic acquisitions within the region's fuel transportation sub-sector. Innovation barriers include the high capital expenditure required for modern fleets and the stringent safety compliance protocols.

Saudi Arabia Land-Based Fuel Transportation Market Growth Trends & Insights

The Saudi Arabia Land-Based Fuel Transportation Market is poised for substantial growth, driven by the Kingdom's ambitious economic diversification initiatives and its pivotal role in the global energy landscape. Market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period, expanding from an estimated $6,500 million in 2025 to $9,100 million by 2033. Adoption rates for advanced logistics technologies are accelerating as companies prioritize operational efficiency and safety. The increasing demand for refined petroleum products, coupled with the expansion of the aviation sector and the growing automotive fleet, directly fuels the need for robust land-based fuel transportation. Technological disruptions, such as the adoption of more fuel-efficient vehicles and the potential integration of alternative fuel delivery methods in the long term, are reshaping operational paradigms. Consumer behavior shifts are observed in the demand for faster, more reliable, and environmentally conscious fuel delivery services, particularly from major industrial clients and fuel station networks. Market penetration for specialized fuel logistics services is deepening, moving beyond basic transportation to encompass value-added services like inventory management and emergency response. The overall market penetration for sophisticated fuel transportation solutions is estimated to increase from 65% in 2025 to over 78% by 2033, reflecting the growing sophistication of the industry. The sheer volume of crude oil and refined products handled by Saudi Arabia necessitates a continuously evolving and expanding fuel transportation infrastructure.

Dominant Regions, Countries, or Segments in Saudi Arabia Land-Based Fuel Transportation Market

Within the Saudi Arabia Land-Based Fuel Transportation Market, the Diesel segment emerges as a dominant force, driven by its widespread application across various critical industries and its significant share in the nation's energy consumption. This segment is projected to account for an estimated 35% of the total market value in 2025, with a forecast CAGR of 6.2% for the period 2025-2033. Key drivers underpinning Diesel's dominance include its extensive use in heavy-duty transportation, construction machinery, industrial generators, and agriculture, all sectors experiencing substantial investment and growth under Saudi Vision 2030. Infrastructure development projects across the Kingdom, such as NEOM and the Red Sea Project, rely heavily on diesel-powered equipment and transportation, creating a consistent and high demand for diesel fuel logistics. Furthermore, the retail fuel station network, which primarily serves passenger vehicles and light commercial vehicles, also heavily depends on diesel for a significant portion of its fuel sales. The geographical distribution of demand is concentrated in major industrial hubs and urban centers, with the Eastern Province, Riyadh, and Jeddah regions exhibiting the highest market share in terms of fuel consumption and, consequently, transportation volume. The Kingdom's commitment to developing its industrial base and expanding its transportation networks further solidifies Diesel's leading position. While other segments like Octane 91 and Octane 95 cater to the automotive sector, and Jet-A1 serves the burgeoning aviation industry, the sheer breadth of diesel application across commercial and industrial sectors positions it as the primary growth engine for the land-based fuel transportation market. The market share for diesel fuel transportation is estimated to remain above 30% throughout the forecast period, with continued expansion driven by industrial needs.

Saudi Arabia Land-Based Fuel Transportation Market Product Landscape

The product landscape of the Saudi Arabia Land-Based Fuel Transportation Market is defined by highly specialized and robust equipment designed for the safe and efficient delivery of various fuel types. These include advanced tank trucks equipped with state-of-the-art safety features such as spill containment systems, grounding mechanisms, and fire suppression equipment. Innovations focus on optimizing tank design for maximum payload capacity and reduced fuel consumption during transit, along with the integration of real-time monitoring systems for temperature, pressure, and location. Performance metrics are rigorously measured by delivery uptime, adherence to safety protocols, and fuel efficiency. Unique selling propositions lie in the reliability, capacity, and compliance of these transportation assets. Technological advancements are continuously integrated to meet evolving environmental regulations and enhance operational security.

Key Drivers, Barriers & Challenges in Saudi Arabia Land-Based Fuel Transportation Market

Key Drivers:

- Vision 2030 Initiatives: The ambitious economic diversification and infrastructure development plans, such as NEOM and gigaprojects, are creating massive demand for fuel across various sectors.

- Growing Energy Demand: Saudi Arabia's status as a leading energy producer and exporter, coupled with increasing domestic consumption, fuels the need for efficient transportation.

- Industrial Expansion: The growth of petrochemical, manufacturing, and mining industries directly translates to higher fuel requirements.

- Technological Advancements: Adoption of advanced fleet management, safety systems, and efficient logistics software enhances operational capabilities.

- Strategic Location: Saudi Arabia's geographical position serves as a vital hub for regional energy distribution.

Key Barriers & Challenges:

- Stringent Safety Regulations: Compliance with rigorous safety and environmental standards necessitates significant investment in fleet upgrades and training, posing a capital expenditure challenge.

- Infrastructure Limitations: While improving, some remote areas might present logistical challenges due to underdeveloped road networks, impacting delivery times and costs.

- Skilled Labor Shortage: A consistent demand for trained and certified drivers and logistics personnel can lead to recruitment challenges.

- Fluctuating Fuel Prices: Volatility in global and domestic fuel prices can impact operational costs and profitability for transportation companies.

- Supply Chain Disruptions: Geopolitical events or unforeseen circumstances can disrupt the supply chain of fuel, impacting transportation volumes.

Emerging Opportunities in Saudi Arabia Land-Based Fuel Transportation Market

Emerging opportunities within the Saudi Arabia Land-Based Fuel Transportation Market are manifold. The increasing focus on environmental sustainability presents a significant avenue for the development and adoption of alternative fuel delivery vehicles, such as those powered by natural gas or electricity, as the Kingdom transitions towards cleaner energy sources. The expansion of specialized fuel logistics services, including last-mile delivery to remote construction sites and emergency fuel supply for critical infrastructure, offers untapped potential. Furthermore, the growing e-commerce sector and the demand for efficient supply chains for consumer goods will indirectly boost the need for reliable fuel transportation to power the logistics network. Investment in smart logistics solutions that leverage IoT, AI, and big data for route optimization, predictive maintenance, and enhanced fleet management will become increasingly crucial.

Growth Accelerators in the Saudi Arabia Land-Based Fuel Transportation Market Industry

Several catalysts are accelerating the long-term growth of the Saudi Arabia Land-Based Fuel Transportation Market. Technological breakthroughs in vehicle efficiency and safety systems are enabling greater operational capacity and reduced environmental impact. Strategic partnerships between fuel suppliers, logistics providers, and technology companies are fostering innovation and expanding service offerings. Market expansion strategies, including diversification into related services like bulk liquid storage and handling, are also contributing to growth. The ongoing digitalization of the logistics sector, with increased adoption of integrated supply chain platforms, is streamlining operations and enhancing overall efficiency. Government incentives and policy support for the logistics industry further bolster investment and development.

Key Players Shaping the Saudi Arabia Land-Based Fuel Transportation Market Market

- Aldrees Petroleum and Transport Services Company

- Arabian Petroleum Supply Company (APSCO)

- Petroly Petroleum Services & Transportation

- Alsudais for Trading & Transports

- Well Petroleum Services

- Alayed Group

- M S Al-meshri & Bros Co

- Abed Abdulrahman Al Sobhi & Sons Ltd Co

- Al-deyabi Group

- Flsarabia (Fuel Logistics Services EST)

Notable Milestones in Saudi Arabia Land-Based Fuel Transportation Market Sector

- August 2024: Saudi Arabia significantly bolstered its oil infrastructure with the arrival of a state-of-the-art fleet of 100 oil tank trucks produced by CSCTRUCK Limited, to be operated by Saudi Aramco, aligning logistics with global oil market demands.

- July 2024: Circle K and Alsulaiman Group signed an MOU, sponsored by the Ministry of Energy, to establish a network of Circle K-branded fuel stations across Saudi Arabia, aligning with Vision 2030 goals for service sector elevation.

- March 2024: Oman Oil Marketing Company (OOMCO) unveiled a strategy to expand its retail service stations, including its 30 stations in Saudi Arabia, identifying it as a pivotal growth market and creating opportunities for fuel transportation.

In-Depth Saudi Arabia Land-Based Fuel Transportation Market Market Outlook

The future outlook for the Saudi Arabia Land-Based Fuel Transportation Market is exceptionally promising, driven by the nation's unwavering commitment to its Vision 2030 blueprint for economic diversification and growth. The continuous expansion of industrial sectors, coupled with significant infrastructure development projects, will sustain robust demand for fuel logistics. Opportunities in adopting greener transportation technologies and enhancing digital logistics capabilities will define the competitive landscape. Strategic investments in fleet modernization, alongside a focus on operational efficiency and safety, will be paramount for sustained success. The market is set to witness increased consolidation and specialization, with companies that can offer integrated, technology-driven solutions being best positioned for future growth.

Saudi Arabia Land-Based Fuel Transportation Market Segmentation

-

1. Fuel Type

- 1.1. Octane 91

- 1.2. Octane 95

- 1.3. Diesel

- 1.4. Jet-A1

- 1.5. Other Fuel Types

Saudi Arabia Land-Based Fuel Transportation Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Land-Based Fuel Transportation Market Regional Market Share

Geographic Coverage of Saudi Arabia Land-Based Fuel Transportation Market

Saudi Arabia Land-Based Fuel Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure

- 3.4. Market Trends

- 3.4.1. Octane 91 Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Land-Based Fuel Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Octane 91

- 5.1.2. Octane 95

- 5.1.3. Diesel

- 5.1.4. Jet-A1

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aldrees Petroleum and Transport Services Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arabian Petroleum Supply Company (APSCO)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Petroly Petroleum Services & Transportation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alsudais for Trading & Transports

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Well Petroleum Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alayed Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 M S Al-meshri & Bros Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abed Abdulrahman Al Sobhi & Sons Ltd Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-deyabi Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Flsarabia (Fuel Logistics Services EST)*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aldrees Petroleum and Transport Services Company

List of Figures

- Figure 1: Saudi Arabia Land-Based Fuel Transportation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Land-Based Fuel Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 2: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 6: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 7: Saudi Arabia Land-Based Fuel Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Land-Based Fuel Transportation Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Land-Based Fuel Transportation Market?

The projected CAGR is approximately 6.16%.

2. Which companies are prominent players in the Saudi Arabia Land-Based Fuel Transportation Market?

Key companies in the market include Aldrees Petroleum and Transport Services Company, Arabian Petroleum Supply Company (APSCO), Petroly Petroleum Services & Transportation, Alsudais for Trading & Transports, Well Petroleum Services, Alayed Group, M S Al-meshri & Bros Co, Abed Abdulrahman Al Sobhi & Sons Ltd Co, Al-deyabi Group, Flsarabia (Fuel Logistics Services EST)*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi.

3. What are the main segments of the Saudi Arabia Land-Based Fuel Transportation Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.76 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure.

6. What are the notable trends driving market growth?

Octane 91 Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

4.; Population Growth and Urbanization4.; Rising Expansion of Transportation Infrastructure.

8. Can you provide examples of recent developments in the market?

August 2024: Saudi Arabia took a significant step forward in bolstering its oil infrastructure with the arrival of a state-of-the-art fleet of oil tank trucks produced by CSCTRUCK Limited. Officially welcomed at a ceremony at Jeddah Port, this new fleet comprises 100 advanced oil tank trucks. Saudi Arabian Oil Company (Aramco) will operate these trucks as it diligently aligns its logistics and transportation network with the surging demands of the global oil market.July 2024: Circle K and Alsulaiman Group, under the sponsorship of the Ministry of Energy - Saudi Arabia, signed an MOU to set up a network of Circle K-branded fuel stations across the country. This agreement is key in the ministry's vision to elevate the services and fuel station sectors by welcoming leading global corporations to invest. This initiative aligns with policy enhancements, strategic development initiatives, and transformation plans, all aimed at realizing the objectives of Saudi Vision 2030.March 2024: Oman Oil Marketing Company (OOMCO) unveiled its strategy to bolster its network of retail service stations in Oman, Saudi Arabia, and Tanzania, all identified as pivotal growth markets. Currently, OOMCO boasts a total of 277 service stations spread across these three nations: 235 in Oman, 30 in Saudi Arabia, and 12 in Tanzania. Such strategic investments are poised to create lucrative opportunities for players in the land-based fuel transportation market in Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Land-Based Fuel Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Land-Based Fuel Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Land-Based Fuel Transportation Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Land-Based Fuel Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence