Key Insights

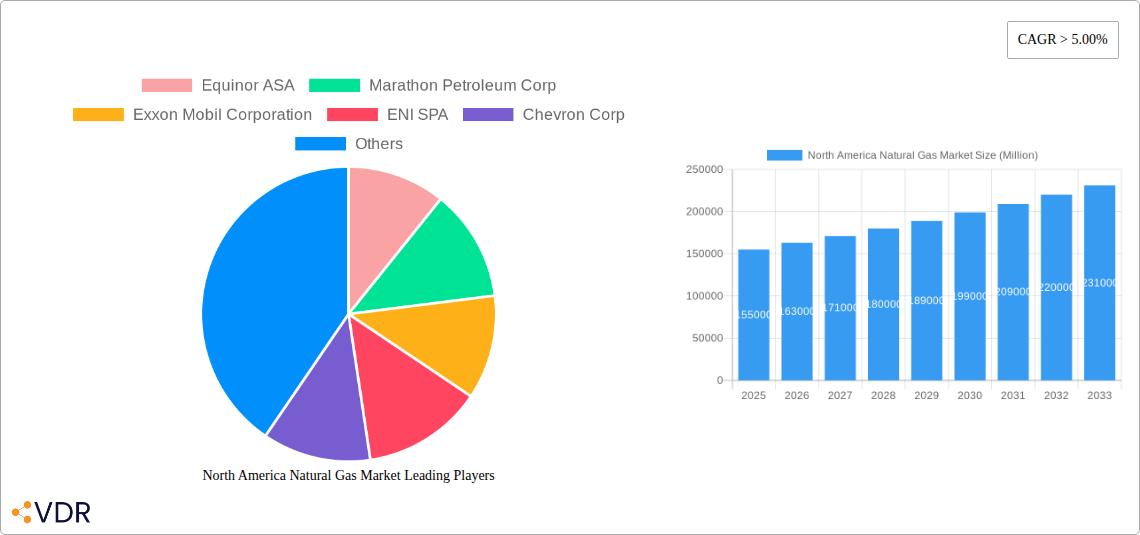

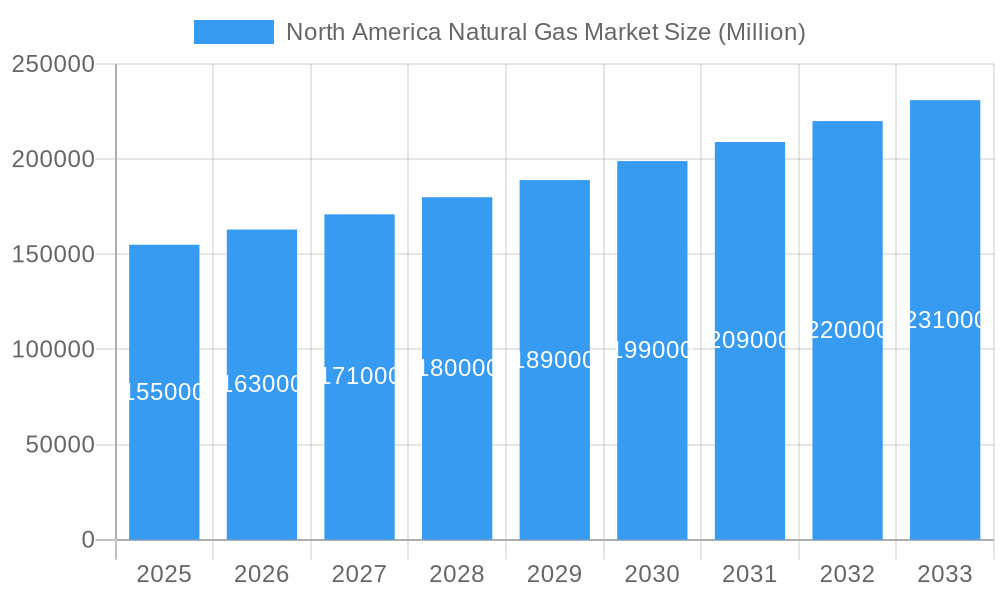

The North America natural gas market is poised for robust expansion, projected to exceed \$150 billion by 2025 with a compound annual growth rate (CAGR) surpassing 5.00%. This significant growth is propelled by a confluence of factors, including the increasing demand for cleaner energy alternatives, particularly in the power generation and industrial sectors, as nations strive to reduce their carbon footprints. Unconventional gas sources, such as shale gas, have become increasingly vital, offering substantial reserves that bolster supply security and contribute to price competitiveness. The automotive sector is also emerging as a key growth driver, with a growing adoption of natural gas vehicles (NGVs) driven by lower fuel costs and stricter emission regulations. Furthermore, household consumption, while a smaller segment, continues to exhibit steady growth due to its cost-effectiveness and convenience for heating and cooking. The market's dynamism is evident in the strategic investments and expansions undertaken by major players like Equinor ASA, Marathon Petroleum Corp, Exxon Mobil Corporation, ENI SPA, Chevron Corp, BP PLC, Total SA, and Royal Dutch Shell, who are actively shaping the future of natural gas supply and distribution across the region.

North America Natural Gas Market Market Size (In Billion)

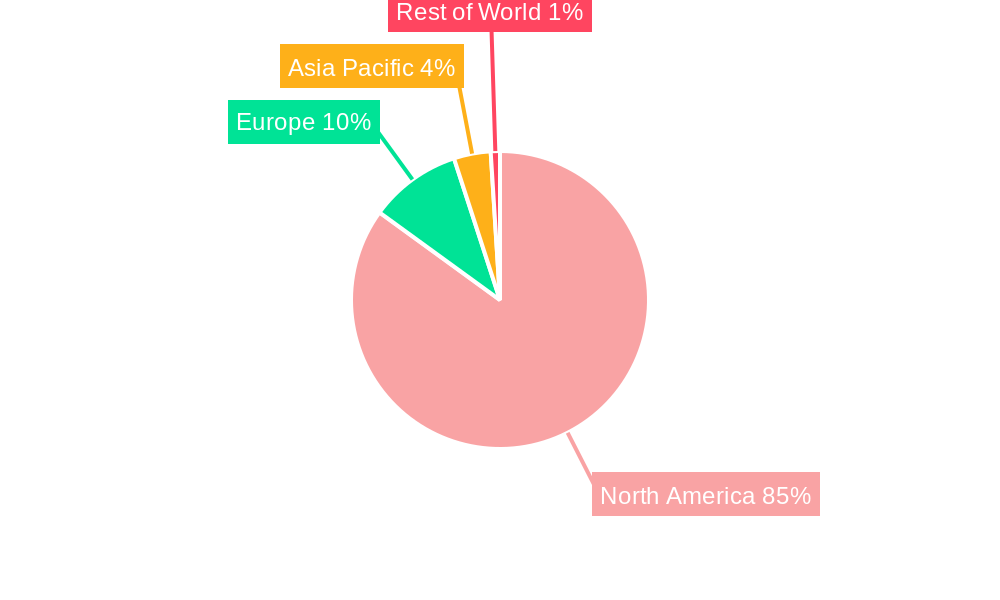

North America, encompassing Canada, the USA, and Mexico, stands as the dominant region for natural gas consumption and production, driven by extensive reserves and well-developed infrastructure. The United States, in particular, leads the market, leveraging its abundant shale gas resources to become a net exporter of natural gas. Mexico's growing industrial base and its increasing reliance on natural gas imports from the US also contribute to the regional dominance. Key trends shaping the market include advancements in extraction technologies, the development of liquefied natural gas (LNG) export terminals, and the ongoing integration of natural gas into broader energy transition strategies. However, challenges such as price volatility, potential environmental concerns related to methane emissions, and the increasing competition from renewable energy sources like solar and wind power, could temper growth in certain segments. Nevertheless, the intrinsic advantages of natural gas, including its versatility and relatively lower emissions compared to other fossil fuels, ensure its continued relevance and growth trajectory in the North American energy landscape through 2033.

North America Natural Gas Market Company Market Share

North America Natural Gas Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a panoramic view of the North America Natural Gas Market, encompassing its dynamics, growth trajectories, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, and a detailed analysis of prominent players. With a study period from 2019 to 2033, including a base and estimated year of 2025 and a forecast period from 2025–2033, this report offers critical intelligence for stakeholders navigating this vital energy sector. Values are presented in Million Units.

North America Natural Gas Market Market Dynamics & Structure

The North America Natural Gas Market exhibits a moderately concentrated structure, with major players like Equinor ASA, Marathon Petroleum Corp, Exxon Mobil Corporation, ENI SPA, Chevron Corp, BP PLC, Total SA, and Royal Dutch Shell dominating production and distribution. Technological innovation, particularly in extraction techniques like hydraulic fracturing and horizontal drilling, has been a pivotal driver, unlocking vast unconventional gas reserves. Regulatory frameworks, including environmental standards and pipeline infrastructure policies, significantly shape market access and operational costs. The competitive landscape is influenced by the availability of substitute fuels, such as coal and renewable energy sources, though natural gas's cleaner combustion profile and versatility offer a competitive edge. End-user demographics are increasingly shifting towards cleaner energy alternatives, driving demand for natural gas in power generation and industrial processes seeking to decarbonize. Mergers and acquisitions (M&A) activity remains a key strategy for market consolidation and vertical integration, with significant deal volumes recorded to enhance operational efficiencies and expand market reach.

- Market Concentration: Dominated by a few large integrated energy companies.

- Technological Innovation: Advancements in extraction technologies (e.g., fracking) are critical.

- Regulatory Frameworks: Environmental regulations and infrastructure policies are key determinants.

- Competitive Substitutes: Coal and renewables pose competition, but natural gas offers a cleaner alternative.

- End-User Demographics: Growing demand for cleaner energy solutions.

- M&A Trends: Ongoing consolidation and integration to gain market share and efficiency.

North America Natural Gas Market Growth Trends & Insights

The North America Natural Gas Market is poised for significant evolution, driven by robust demand and technological advancements. The market size is projected to witness a compound annual growth rate (CAGR) of XX% during the forecast period. Adoption rates for natural gas in key applications, particularly power generation and industrial fuel, are on an upward trajectory, supported by its cost-effectiveness and lower emissions compared to coal. Technological disruptions, including the increasing efficiency of gas-fired power plants and the development of advanced liquefied natural gas (LNG) technologies, are further catalyzing growth. Consumer behavior shifts, influenced by environmental concerns and the need for reliable energy, are also playing a crucial role, with many industries and households opting for natural gas as a transitional fuel towards a lower-carbon future. The market penetration of natural gas in various sectors is expected to increase, further solidifying its position as a cornerstone of North America's energy mix. The ongoing development of export terminals, particularly for LNG, is also a key factor in market expansion, connecting North American supply with global demand.

Dominant Regions, Countries, or Segments in North America Natural Gas Market

The USA stands out as the dominant country in the North America Natural Gas Market, driven by its immense reserves of unconventional gas and extensive infrastructure for extraction, transportation, and utilization. The power generation and industrial fuel segments are the primary growth engines within the US market, benefiting from supportive economic policies and a strong industrial base. Canada and Mexico are also significant contributors, with Canada holding substantial conventional and unconventional gas resources, and Mexico increasingly relying on natural gas imports for its growing energy needs.

- USA Dominance: Driven by abundant unconventional gas reserves and advanced infrastructure.

- Market Share: Holds over XX% of the North American natural gas production.

- Growth Potential: Significant opportunities in LNG exports and industrial decarbonization initiatives.

- Power Generation Segment: Continues to be a major consumer, benefiting from the retirement of coal-fired plants and the need for baseload power.

- Key Drivers: Cost-effectiveness, lower emissions profile, and grid stability.

- Industrial Fuel Segment: Experiences robust demand from manufacturing, chemical, and petrochemical industries.

- Key Drivers: Reliable supply, price stability, and operational efficiency.

- Unconventional Gas: Represents the vast majority of new production, largely due to technological advancements.

- Impact: Significantly lowered natural gas prices and increased supply security.

- Infrastructure Development: Extensive pipeline networks in the US and ongoing investments in Mexico are critical for market growth.

- Notable Projects: Sempra Infrastructure's initiatives in Mexico highlight regional collaboration and infrastructure expansion.

North America Natural Gas Market Product Landscape

The North America Natural Gas Market product landscape is characterized by continuous innovation focused on enhancing efficiency, reducing emissions, and expanding applications. Advancements in extraction technologies have boosted the supply of high-quality natural gas. The development of more efficient gas turbines for power generation and cleaner-burning engines for the automotive sector are key innovations. In the household sector, improved heating systems and smart appliances are increasing efficiency. For industrial fuel, advancements include catalytic converters and advanced combustion techniques that minimize environmental impact. The increasing focus on hydrogen blending with natural gas also represents a significant technological frontier, offering a pathway to further decarbonize gas utilization.

Key Drivers, Barriers & Challenges in North America Natural Gas Market

The North America Natural Gas Market is propelled by several key drivers. The abundance of unconventional gas reserves, unlocked by technological advancements, provides a significant supply advantage. Its role as a cleaner-burning fossil fuel compared to coal makes it a crucial transitional energy source in global decarbonization efforts. Robust demand from the power generation and industrial fuel sectors, coupled with supportive government policies and infrastructure development, further fuels market growth.

However, the market faces notable barriers and challenges. Stringent environmental regulations concerning methane emissions and hydraulic fracturing can increase operational costs and complexity. The growing adoption of renewable energy sources, such as solar and wind power, presents a long-term competitive challenge. Furthermore, price volatility, influenced by global supply and demand dynamics, can impact investment decisions and consumer demand. Supply chain disruptions and the need for continuous infrastructure upgrades also pose challenges to sustained growth.

Emerging Opportunities in North America Natural Gas Market

Emerging opportunities within the North America Natural Gas Market are diverse and promising. The increasing global demand for Liquefied Natural Gas (LNG) presents a significant export opportunity for North American producers, particularly the USA and Canada. The potential for widespread adoption of natural gas as a fuel for heavy-duty transportation, including trucking and shipping, offers a substantial untapped market. Furthermore, the development of carbon capture, utilization, and storage (CCUS) technologies associated with natural gas power generation can mitigate environmental concerns and extend its role in a low-carbon future. Innovations in biomethane and synthetic natural gas production also offer pathways to create a more sustainable gas supply.

Growth Accelerators in the North America Natural Gas Market Industry

Several catalysts are accelerating the growth of the North America Natural Gas Market. Technological breakthroughs in enhanced oil and gas recovery techniques continue to improve extraction efficiency and reduce costs, ensuring a competitive supply. Strategic partnerships and joint ventures between exploration and production companies, midstream operators, and downstream consumers are fostering greater market integration and infrastructure development. Aggressive market expansion strategies, including the development of new export terminals and pipeline networks, are crucial for reaching new demand centers, both domestically and internationally. The increasing focus on energy security and affordability also positions natural gas as a preferred choice for many economies.

Key Players Shaping the North America Natural Gas Market Market

- Equinor ASA

- Marathon Petroleum Corp

- Exxon Mobil Corporation

- ENI SPA

- Chevron Corp

- BP PLC

- Total SA

- Royal Dutch Shell

Notable Milestones in North America Natural Gas Market Sector

- July 2022: Sempra Infrastructure signed an agreement with Mexico's Federal Electricity Commission to advance the joint development of critical energy infrastructure projects in Mexico, including the rerouting of the Guaymas-El Oro pipeline in Sonora, the proposed Vista Pacífico LNG project in Topolobampo, Sinaloa, and the potential development of a liquefied natural gas (LNG) terminal in Salina Cruz, Oaxaca.

In-Depth North America Natural Gas Market Market Outlook

The North America Natural Gas Market outlook remains robust, driven by its indispensable role in energy security and its contribution to cleaner energy transitions. Growth accelerators, including ongoing technological innovations in extraction and utilization, strategic investments in LNG export infrastructure, and increasing demand from developing economies, are set to propel market expansion. The market's ability to provide reliable and relatively affordable energy will ensure its continued relevance as a foundational element of the North American energy mix. Strategic opportunities lie in further developing lower-carbon solutions such as hydrogen blending and CCUS, solidifying natural gas's position as a versatile and adaptable energy source for decades to come.

North America Natural Gas Market Segmentation

-

1. Source

- 1.1. Conventional Gas

- 1.2. Unconventional gas

-

2. Application

- 2.1. Automotive

- 2.2. Power generation

- 2.3. Household

- 2.4. Industrial Fuel

-

3. Countries

- 3.1. Canada

- 3.2. USA

- 3.3. Mexico

North America Natural Gas Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Natural Gas Market Regional Market Share

Geographic Coverage of North America Natural Gas Market

North America Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Power generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Natural Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Conventional Gas

- 5.1.2. Unconventional gas

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Power generation

- 5.2.3. Household

- 5.2.4. Industrial Fuel

- 5.3. Market Analysis, Insights and Forecast - by Countries

- 5.3.1. Canada

- 5.3.2. USA

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marathon Petroleum Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENI SPA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BP PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Total SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: North America Natural Gas Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Natural Gas Market Share (%) by Company 2025

List of Tables

- Table 1: North America Natural Gas Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: North America Natural Gas Market Volume Tonnes Forecast, by Source 2020 & 2033

- Table 3: North America Natural Gas Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: North America Natural Gas Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 5: North America Natural Gas Market Revenue undefined Forecast, by Countries 2020 & 2033

- Table 6: North America Natural Gas Market Volume Tonnes Forecast, by Countries 2020 & 2033

- Table 7: North America Natural Gas Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: North America Natural Gas Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 9: North America Natural Gas Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 10: North America Natural Gas Market Volume Tonnes Forecast, by Source 2020 & 2033

- Table 11: North America Natural Gas Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: North America Natural Gas Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 13: North America Natural Gas Market Revenue undefined Forecast, by Countries 2020 & 2033

- Table 14: North America Natural Gas Market Volume Tonnes Forecast, by Countries 2020 & 2033

- Table 15: North America Natural Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Natural Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 17: United States North America Natural Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States North America Natural Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Natural Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Natural Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Natural Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Natural Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Natural Gas Market?

The projected CAGR is approximately 6.15%.

2. Which companies are prominent players in the North America Natural Gas Market?

Key companies in the market include Equinor ASA, Marathon Petroleum Corp, Exxon Mobil Corporation, ENI SPA, Chevron Corp, BP PLC, Total SA, Royal Dutch Shell.

3. What are the main segments of the North America Natural Gas Market?

The market segments include Source, Application, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Power generation to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

In July 2022, Sempra Infrastructure signed an agreement with Mexico's Federal Electricity Commission to advance the joint development of critical energy infrastructure projects in Mexico, including the rerouting of the Guaymas-El Oro pipeline in Sonora, the proposed Vista Pacífico LNG project in Topolobampo, Sinaloa, and the potential development of a liquefied natural gas (LNG) terminal in Salina Cruz, Oaxaca.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Natural Gas Market?

To stay informed about further developments, trends, and reports in the North America Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence