Key Insights

The Southeast Asia Power Transmission and Distribution (T&D) market is poised for significant expansion, projected to reach $7.1 billion by 2024, with a compelling Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This robust growth is underpinned by the region's accelerating economic development, increasing urbanization, and the escalating demand for dependable and stable electricity. Governments are actively prioritizing T&D infrastructure modernization to foster industrial growth and broaden energy access. Key market drivers include the imperative to upgrade aging grid systems, facilitate the integration of renewable energy sources, and bolster grid resilience against climate-related events. This landscape presents considerable opportunities for manufacturers and service providers in the T&D sector.

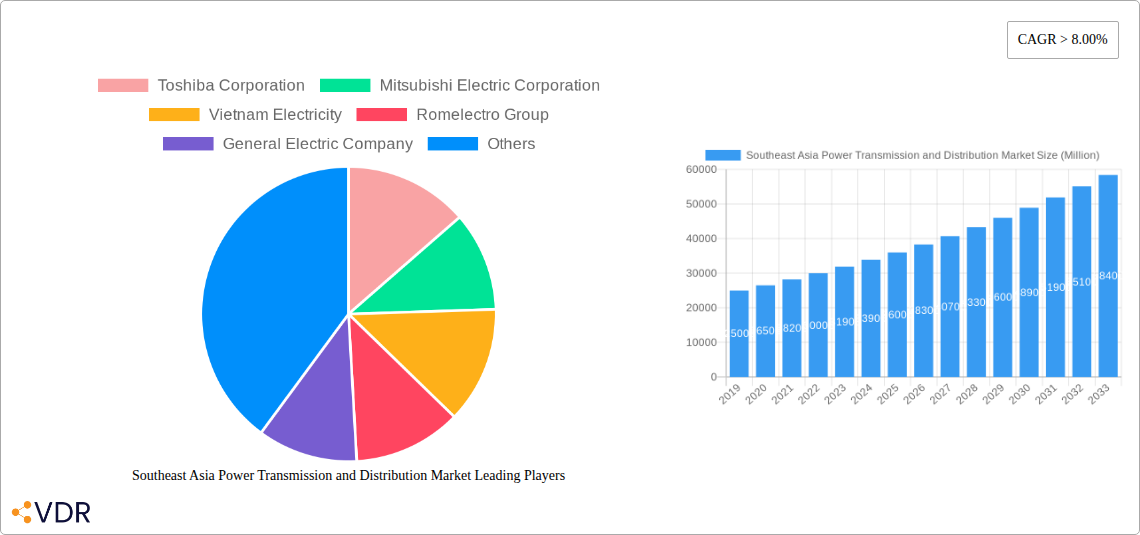

Southeast Asia Power Transmission and Distribution Market Market Size (In Billion)

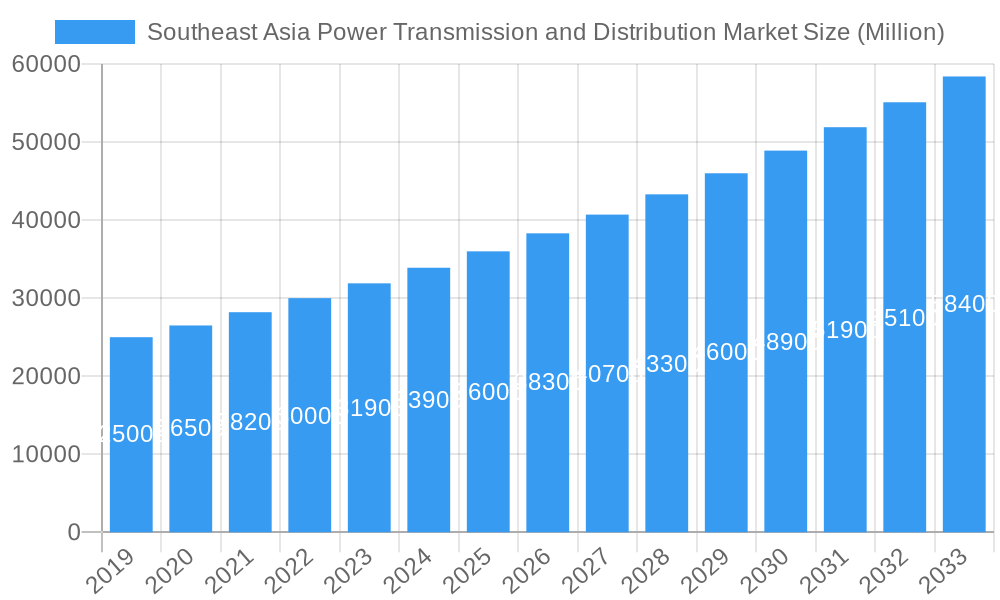

The market's evolution is significantly influenced by the digital transformation of power grids, marked by the widespread adoption of smart grid technologies, advanced metering infrastructure, and IoT-based monitoring solutions. Furthermore, substantial investments are being directed towards expanding transmission and distribution networks to cater to the burgeoning energy requirements of growing populations and industrial hubs across key economies such as Vietnam, Indonesia, Malaysia, and Thailand. While considerable capital investment and navigating complex regulatory frameworks present challenges, the continuous inflow of foreign direct investment and strategic collaborations among industry leaders, including Toshiba Corporation, Mitsubishi Electric Corporation, and General Electric Company, alongside prominent regional players like Vietnam Electricity and Romelectro Group, are instrumental in surmounting these obstacles and driving market advancement. Enhancing grid stability and minimizing transmission losses remain paramount objectives for all stakeholders.

Southeast Asia Power Transmission and Distribution Market Company Market Share

Southeast Asia Power Transmission and Distribution Market Report: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a detailed analysis of the Southeast Asia Power Transmission and Distribution Market, offering critical insights into its current landscape, growth trajectories, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this study is an indispensable resource for industry professionals, investors, and policymakers seeking to understand the dynamics of this rapidly evolving sector. With a focus on key market segments, regional dominance, technological advancements, and competitive strategies, this report equips stakeholders with the actionable intelligence needed to navigate and capitalize on opportunities within the region's power infrastructure development.

Southeast Asia Power Transmission and Distribution Market Market Dynamics & Structure

The Southeast Asia power transmission and distribution market is characterized by a moderately concentrated structure, with key global players and regional utilities actively shaping its evolution. Technological innovation is a primary driver, fueled by the region's increasing demand for reliable and sustainable energy. Investments in smart grid technologies, high-voltage direct current (HVDC) transmission lines, and advanced distribution automation systems are on the rise, aimed at improving grid efficiency and stability. Regulatory frameworks are becoming more conducive, with governments implementing policies to encourage private sector participation and attract foreign investment. However, challenges persist, including the need for significant capital expenditure, the integration of renewable energy sources, and the impact of climate change on existing infrastructure. Competitive product substitutes are limited in the core transmission and distribution equipment, but innovation in grid management software and energy storage solutions presents evolving alternatives. End-user demographics are diverse, ranging from rapidly urbanizing populations demanding increased power access to industrial sectors requiring stable and high-quality electricity. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their market reach, acquire new technologies, and achieve economies of scale. The market is witnessing strategic consolidations and partnerships to address the vast infrastructure needs of the region.

- Market Concentration: Dominated by a mix of global conglomerates and national utilities, with increasing regional collaboration.

- Technological Innovation Drivers: Smart grid implementation, renewable energy integration, and demand for greater grid resilience are key catalysts.

- Regulatory Frameworks: Supportive government policies, incentives for renewable energy, and evolving grid codes are influencing market dynamics.

- Competitive Product Substitutes: Emerging energy storage solutions and advanced grid management software are creating new competitive landscapes.

- End-User Demographics: Rapid urbanization, industrial growth, and a rising middle class are driving demand for electricity access and reliability.

- M&A Trends: Strategic acquisitions and joint ventures aimed at market expansion and technological synergy are becoming more prevalent.

Southeast Asia Power Transmission and Distribution Market Growth Trends & Insights

The Southeast Asia power transmission and distribution market is poised for robust growth, propelled by a confluence of factors including surging electricity demand, ongoing industrialization, and a strong push towards renewable energy integration. The market size is projected to witness a significant expansion from approximately USD 15,800 Million in 2025 to an estimated USD 22,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 5.8%. This growth is underpinned by substantial investments in upgrading and expanding existing grid infrastructure, alongside the development of new transmission and distribution networks to support burgeoning economies. Adoption rates of advanced technologies such as smart meters, digital substations, and automated fault detection systems are accelerating, driven by the need for improved operational efficiency, reduced transmission losses, and enhanced grid reliability. Technological disruptions, particularly in the realm of flexible AC transmission systems (FACTS) and HVDC, are enabling the efficient transfer of power over longer distances and the integration of remote renewable energy sources. Consumer behavior is shifting towards a greater demand for uninterrupted power supply and a preference for cleaner energy options, further stimulating investment in grid modernization and distributed generation capabilities. The increasing penetration of electric vehicles (EVs) and the digitalization of industries are also creating new load patterns that necessitate more sophisticated and responsive power grids. Regional governments are actively promoting private sector investment and implementing supportive policies to attract foreign capital, thereby accelerating the pace of infrastructure development. The growing awareness of climate change and the need for sustainable energy solutions are also contributing to a paradigm shift, encouraging the adoption of smart, resilient, and environmentally friendly power transmission and distribution systems. Market penetration of smart grid technologies is expected to rise significantly as utilities prioritize modernization efforts to meet future energy demands and operational challenges. The evolving energy landscape in Southeast Asia, characterized by diverse energy mixes and ambitious renewable energy targets, makes the transmission and distribution sector a critical enabler of energy security and sustainable development for the region. The projected growth is indicative of a sustained commitment to building a robust and modern power infrastructure that can support economic progress and improve the quality of life for millions.

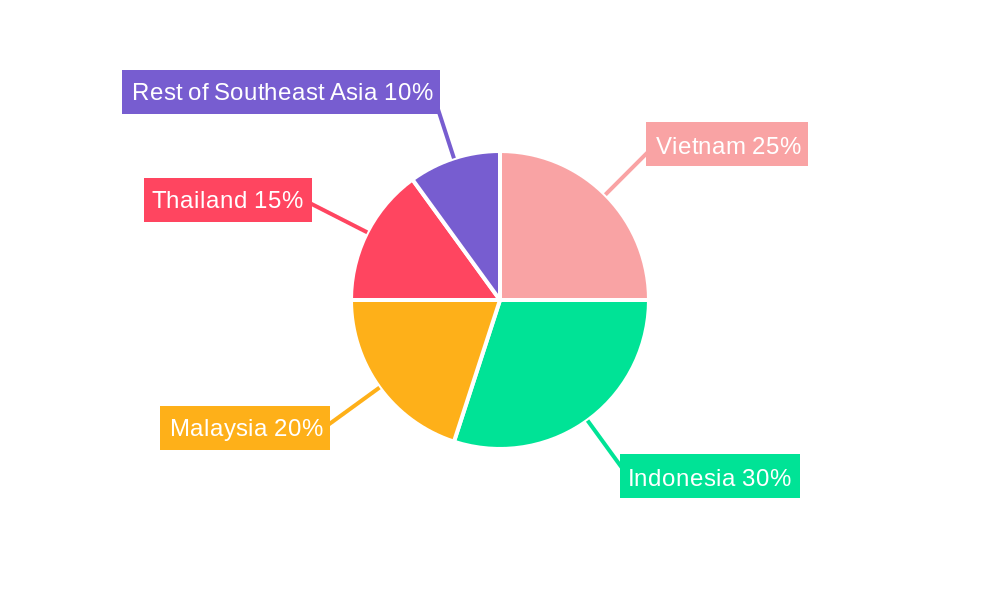

Dominant Regions, Countries, or Segments in Southeast Asia Power Transmission and Distribution Market

The Southeast Asia power transmission and distribution market is experiencing significant growth and development across its various segments and geographies. However, Distribution emerges as a dominant segment, driven by the imperative to expand electricity access to a growing population and the need for enhanced grid reliability at the consumer level. The Indonesia market, in particular, stands out as a leading country due to its vast archipelago and the ongoing efforts to electrify remote areas and connect islands, creating substantial demand for distribution infrastructure.

Key drivers of dominance in the Distribution segment and within Indonesia include:

- Expanding Electricity Access: Indonesia's large and dispersed population necessitates extensive investment in low and medium-voltage distribution networks to reach underserved communities. This translates to a continuous demand for poles, cables, transformers, and substations.

- Urbanization and Industrial Growth: Rapid urbanization across Southeast Asia, especially in Indonesia, Malaysia, and Vietnam, leads to increased electricity consumption from residential, commercial, and industrial consumers. This surge requires upgrades and expansions of existing distribution networks to handle higher load densities.

- Integration of Distributed Generation: The rise of rooftop solar and other forms of distributed energy resources requires sophisticated distribution grids capable of managing two-way power flow and ensuring grid stability. This is a growing trend in countries like Thailand and Vietnam.

- Aging Infrastructure Modernization: Many older transmission and distribution networks across the region are in need of upgrades to meet modern energy demands and improve efficiency. This modernization effort is a significant contributor to market growth.

- Government Initiatives and Investments: Governments in countries like Indonesia are actively prioritizing grid modernization and expansion, allocating significant budgets towards these projects to ensure energy security and support economic development. For instance, the Indonesian government's commitment to improving electricity access has spurred considerable investment in its distribution network.

- Technological Advancements in Distribution: The adoption of smart meters, automated distribution systems, and advanced analytics is enhancing the efficiency and reliability of the distribution network, creating a demand for these new technologies.

While the Transmission segment is also crucial, particularly with large-scale interconnector projects and the growing need to transport power from renewable energy sources, the sheer volume and continuous nature of upgrades and expansions required at the distribution level give it a leading edge in terms of immediate market value and volume. Vietnam and Thailand also show strong growth in both transmission and distribution, driven by their respective economic development plans and energy transition goals. Malaysia, with its more developed infrastructure, is focusing on smart grid upgrades and enhancing the resilience of its existing network. The "Rest of Southeast Asia" category encompasses countries with nascent but rapidly growing power sectors, presenting significant future potential.

Southeast Asia Power Transmission and Distribution Market Product Landscape

The Southeast Asia power transmission and distribution market is characterized by a landscape of robust and evolving product offerings. Core products include high-voltage power transformers, switchgear, circuit breakers, transmission towers, and various types of power cables, essential for ensuring the efficient and reliable flow of electricity. Innovations are increasingly focused on enhancing grid resilience, efficiency, and the integration of renewable energy sources. This includes the development of advanced composite insulators, smart grid enabled substation automation systems, and high-performance HVDC cables designed for long-distance power transmission. Performance metrics are paramount, with manufacturers emphasizing reduced energy losses, increased operational lifespan, enhanced safety features, and improved fault detection capabilities. Unique selling propositions often revolve around the ability of these products to withstand the region's diverse climatic conditions, including high humidity and temperatures, as well as their compliance with international and local standards. Technological advancements are geared towards digitalization and automation, leading to the introduction of intelligent sensors, predictive maintenance capabilities, and advanced monitoring systems.

Key Drivers, Barriers & Challenges in Southeast Asia Power Transmission and Distribution Market

Key Drivers:

The Southeast Asia power transmission and distribution market is propelled by several powerful drivers. Firstly, the burgeoning economic growth and rapid industrialization across the region are leading to a surge in electricity demand, necessitating significant expansion and modernization of power grids. Secondly, governments are increasingly prioritizing energy security and reliability, investing heavily in upgrading aging infrastructure and building new transmission and distribution networks. The global push towards renewable energy integration is a major catalyst, driving demand for advanced grid technologies that can accommodate intermittent power sources. Finally, technological advancements, such as smart grid solutions and HVDC technology, are offering more efficient and sustainable ways to manage and deliver electricity.

Barriers & Challenges:

Despite the strong growth trajectory, the market faces notable barriers and challenges. The substantial capital investment required for large-scale infrastructure projects is a significant hurdle, often requiring innovative financing models and private sector participation. Navigating complex and varied regulatory frameworks across different Southeast Asian nations can also pose challenges for market players. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of critical components. Furthermore, the integration of a high proportion of renewable energy sources presents technical challenges related to grid stability and management. Competitive pressures, particularly from global manufacturers, can impact pricing and market share.

Emerging Opportunities in Southeast Asia Power Transmission and Distribution Market

Emerging opportunities in the Southeast Asia power transmission and distribution market are abundant and diverse. The increasing focus on decarbonization and the adoption of renewable energy sources, such as solar and wind, presents a significant opportunity for the deployment of smart grid technologies and energy storage solutions to ensure grid stability and reliability. The development of cross-border interconnector projects, like the proposed Australia-Asia PowerLink, highlights the potential for regional power trading and the establishment of robust international power grids. Furthermore, the ongoing digital transformation of industries and the rise of electric mobility are creating new demand patterns that necessitate advanced distribution network management systems and charging infrastructure. Untapped rural electrification projects in less developed areas of the region also offer substantial growth potential.

Growth Accelerators in the Southeast Asia Power Transmission and Distribution Market Industry

The long-term growth of the Southeast Asia power transmission and distribution market is significantly accelerated by several key factors. Technological breakthroughs in areas like advanced conductor materials and energy-efficient transformers are reducing transmission losses and improving overall grid performance. Strategic partnerships and joint ventures between global technology providers and local utilities are fostering knowledge transfer and facilitating the deployment of state-of-the-art solutions. Government initiatives aimed at promoting clean energy and creating a more competitive market environment also act as powerful accelerators. The increasing adoption of digital technologies for grid management, such as AI-powered predictive maintenance and advanced analytics, is enhancing operational efficiency and reliability, further driving investment and market expansion. The continuous push for greater grid resilience against natural disasters and cyber threats also necessitates ongoing investment in advanced and robust transmission and distribution infrastructure.

Key Players Shaping the Southeast Asia Power Transmission and Distribution Market Market

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Vietnam Electricity

- Romelectro Group

- General Electric Company

Notable Milestones in Southeast Asia Power Transmission and Distribution Market Sector

- March 2022: The SunCable led 'Australia-Asia PowerLink' HVDC project received a significant boost as Australian billionaires Mike Cannon-Brookes and Andrew Forrest invested a further USD 152 million into the undersea cable link construction meant to deliver solar-generated power from Australia to Singapore. According to Sun Cable, the solar energy developer in Australia, the USD 152 million will accelerate the construction of Australia-Asia PowerLink (AA PowerLink).

- 2021: The Indonesian government awarded the subsea permit to the Australia-Asia PowerLink (AAPowerLink) HVDC project, a proposed high voltage direct current (HVDC) power cable between Darwin, in Northern Australia, and Singapore, and recommended the project route through Indonesian waters. The proposed Australia Singapore Power Link includes a 17-20 GWp solar park in Tennant Creek, a 36-42 GWh battery storage facility, and a 4,200 km long power transmission line to supply power to Singapore.

In-Depth Southeast Asia Power Transmission and Distribution Market Market Outlook

The outlook for the Southeast Asia power transmission and distribution market remains exceptionally positive, fueled by sustained economic development and a resolute commitment to sustainable energy solutions. Growth accelerators such as smart grid advancements, the increasing adoption of renewable energy, and strategic cross-border infrastructure projects are set to drive significant market expansion. The demand for robust and resilient power grids capable of integrating diverse energy sources and meeting the needs of a rapidly growing and urbanizing population will continue to spur investments in both transmission and distribution infrastructure. Opportunities abound in the modernization of existing grids, the development of new high-capacity transmission lines, and the widespread deployment of digital technologies for enhanced grid management. The region's proactive approach to energy transition, coupled with supportive government policies and a growing influx of foreign investment, positions Southeast Asia as a key global hub for power infrastructure development in the coming years.

Southeast Asia Power Transmission and Distribution Market Segmentation

-

1. Type

- 1.1. Transmission

- 1.2. Distribution

-

2. Geography

- 2.1. Vietnam

- 2.2. Indonesia

- 2.3. Malaysia

- 2.4. Thailand

- 2.5. Rest of Southeast Asia

Southeast Asia Power Transmission and Distribution Market Segmentation By Geography

- 1. Vietnam

- 2. Indonesia

- 3. Malaysia

- 4. Thailand

- 5. Rest of Southeast Asia

Southeast Asia Power Transmission and Distribution Market Regional Market Share

Geographic Coverage of Southeast Asia Power Transmission and Distribution Market

Southeast Asia Power Transmission and Distribution Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Hydropower Generation4.; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Transmission Type Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transmission

- 5.1.2. Distribution

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Vietnam

- 5.2.2. Indonesia

- 5.2.3. Malaysia

- 5.2.4. Thailand

- 5.2.5. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.3.2. Indonesia

- 5.3.3. Malaysia

- 5.3.4. Thailand

- 5.3.5. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Vietnam Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transmission

- 6.1.2. Distribution

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Vietnam

- 6.2.2. Indonesia

- 6.2.3. Malaysia

- 6.2.4. Thailand

- 6.2.5. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Indonesia Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transmission

- 7.1.2. Distribution

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Vietnam

- 7.2.2. Indonesia

- 7.2.3. Malaysia

- 7.2.4. Thailand

- 7.2.5. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Malaysia Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transmission

- 8.1.2. Distribution

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Vietnam

- 8.2.2. Indonesia

- 8.2.3. Malaysia

- 8.2.4. Thailand

- 8.2.5. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Thailand Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Transmission

- 9.1.2. Distribution

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Vietnam

- 9.2.2. Indonesia

- 9.2.3. Malaysia

- 9.2.4. Thailand

- 9.2.5. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Southeast Asia Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Transmission

- 10.1.2. Distribution

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Vietnam

- 10.2.2. Indonesia

- 10.2.3. Malaysia

- 10.2.4. Thailand

- 10.2.5. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Toshiba Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsubishi Electric Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vietnam Electricity

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Romelectro Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Electric Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Toshiba Corporation

List of Figures

- Figure 1: Southeast Asia Power Transmission and Distribution Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Power Transmission and Distribution Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 5: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 11: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2020 & 2033

- Table 15: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 17: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 35: Southeast Asia Power Transmission and Distribution Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Power Transmission and Distribution Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Southeast Asia Power Transmission and Distribution Market?

Key companies in the market include Toshiba Corporation, Mitsubishi Electric Corporation, Vietnam Electricity, Romelectro Group, General Electric Company.

3. What are the main segments of the Southeast Asia Power Transmission and Distribution Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Hydropower Generation4.; Favorable Government Policies.

6. What are the notable trends driving market growth?

Transmission Type Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In March 2022, the SunCable led 'Australia-Asia PowerLink' HVDC project, received a significant boost as Australian billionaires Mike Cannon-Brookes and Andrew Forrest invested a further USD 152 million into the undersea cable link construction meant to deliver solar-generated power from Australia to Singapore. According to Sun Cable, the solar energy developer in Australia, the USD 152 million will accelerate the construction of Australia-Asia PowerLink (AA PowerLink).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Power Transmission and Distribution Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Power Transmission and Distribution Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Power Transmission and Distribution Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Power Transmission and Distribution Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence