Key Insights

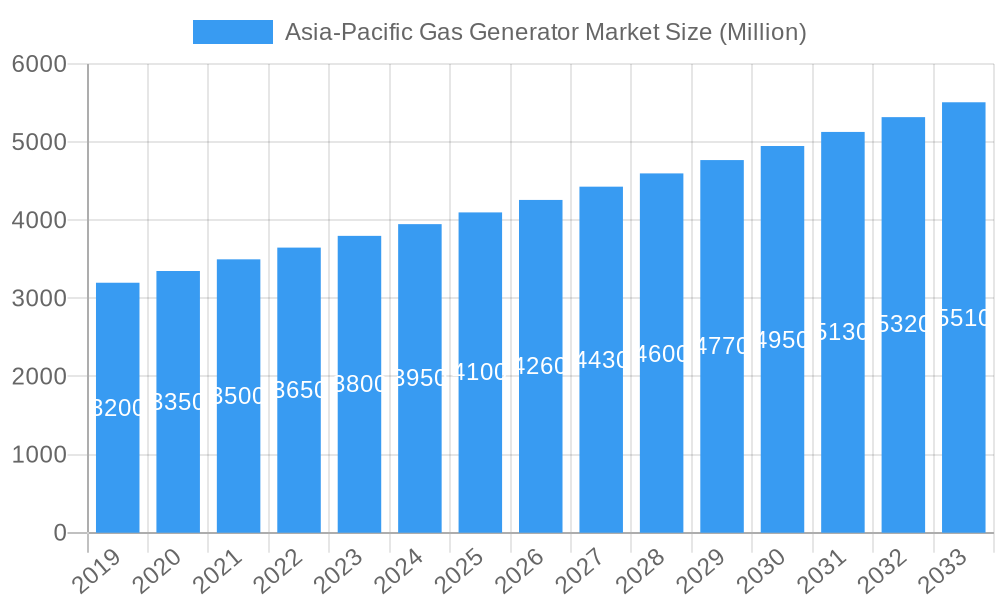

The Asia-Pacific gas generator market is projected to expand significantly, reaching an estimated market size of $3.1 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 4.5%. This expansion is fueled by increasing demand for dependable power solutions in the region's developing economies. Key growth drivers include the necessity for backup power in residential and commercial sectors amidst grid instability, and the expanding industrial base requiring uninterrupted operational power. The shift towards natural gas as a more economical and environmentally friendly alternative to diesel also supports regional sustainability objectives. Technological advancements enhancing fuel efficiency and reducing emissions further accelerate market adoption.

Asia-Pacific Gas Generator Market Market Size (In Billion)

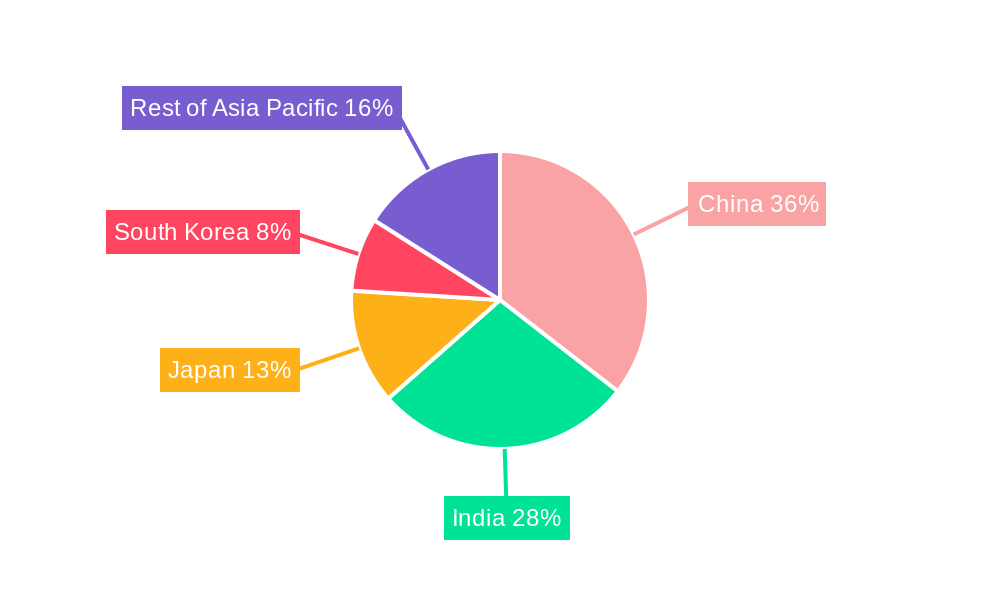

Market segmentation indicates varied demand. The 75-375 kVA capacity segment is anticipated to lead, serving a wide range of commercial and small-to-medium industrial needs. The residential sector's demand is also rising, driven by increasing disposable incomes and the preference for continuous power. China and India are expected to be the dominant markets, driven by their large populations, rapid industrialization, and infrastructure development. South Korea and Japan, established markets, will contribute through innovation and demand for advanced units. Emerging opportunities are present in the Rest of Asia-Pacific, including Southeast Asian nations, as their economies grow and power infrastructure requirements escalate.

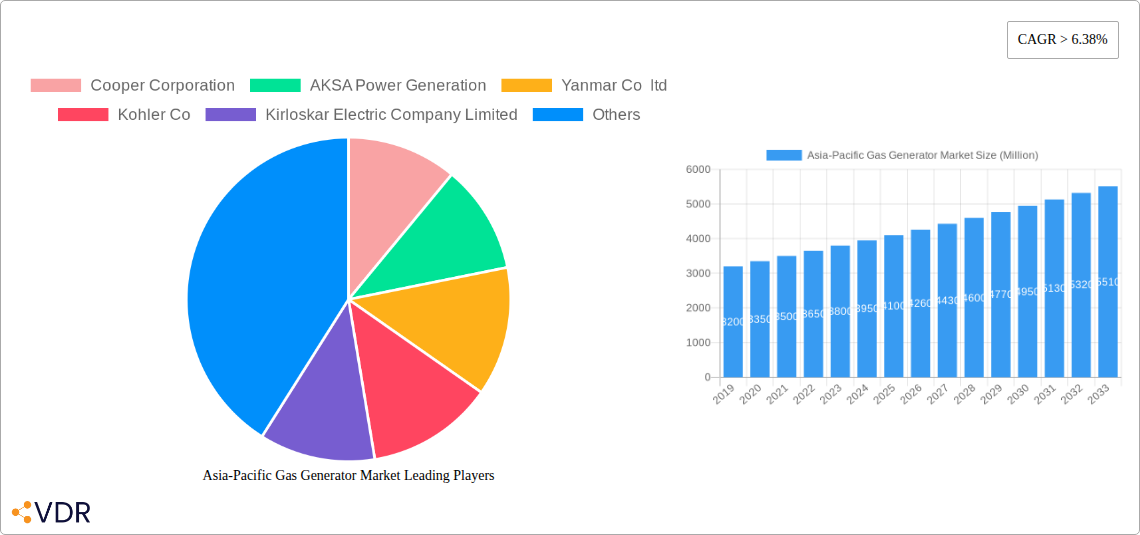

Asia-Pacific Gas Generator Market Company Market Share

Asia-Pacific Gas Generator Market: Comprehensive Industry Analysis and Future Outlook (2019–2033)

This in-depth report provides a thorough analysis of the Asia-Pacific gas generator market, forecasting its trajectory from 2025 to 2033. Covering critical aspects from market dynamics and growth trends to regional dominance and competitive landscapes, this report is an essential resource for industry professionals seeking to understand and capitalize on market opportunities. We present values in Million units for clarity and offer a detailed breakdown of segments, including capacity, end-user, and geography.

Asia-Pacific Gas Generator Market Market Dynamics & Structure

The Asia-Pacific gas generator market exhibits a moderately concentrated structure, with key players like Caterpillar Inc., Cummins Inc., and Generac Holdings Inc. holding significant market shares. Technological innovation is a primary driver, fueled by advancements in fuel efficiency, reduced emissions, and smart grid integration. Regulatory frameworks, particularly those focused on environmental sustainability and emissions standards, are increasingly shaping market entry and product development. The competitive landscape is characterized by intense rivalry, with established manufacturers continuously innovating to offer superior performance and cost-effectiveness. End-user demographics are diverse, ranging from rapidly urbanizing residential sectors seeking reliable backup power to large-scale industrial operations demanding continuous energy supply. Mergers and acquisitions (M&A) are notable trends, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, strategic acquisitions of smaller, innovative firms by larger corporations are common, aiming to integrate new technologies and gain a competitive edge. The market is also influenced by the availability and pricing of natural gas and other alternative fuels, impacting the cost-competitiveness of gas generators against other power solutions.

- Market Concentration: Moderately concentrated, with a few key players dominating.

- Technological Innovation: Driven by fuel efficiency, emissions reduction, and smart grid integration.

- Regulatory Frameworks: Increasingly stringent environmental and emissions standards influencing product development.

- Competitive Product Substitutes: Natural gas, diesel generators, renewable energy sources.

- End-User Demographics: Diverse, spanning residential, commercial, and industrial sectors.

- M&A Trends: Active M&A landscape for portfolio expansion and technological acquisition.

- Quantitative Insights: Specific market share data and M&A deal volumes available within the full report.

- Qualitative Factors: Innovation barriers include high R&D costs and long product development cycles.

Asia-Pacific Gas Generator Market Growth Trends & Insights

The Asia-Pacific gas generator market is poised for substantial growth, driven by a confluence of economic, technological, and societal factors. The projected market size evolution indicates a steady upward trajectory, with increasing adoption rates across various end-user segments. Technological disruptions, such as the development of more efficient and environmentally friendly gas generator models, are playing a pivotal role in enhancing market penetration. Consumer behavior shifts are also contributing significantly, with a growing demand for reliable and sustainable backup power solutions in the face of increasing grid instability and natural disasters. The base year of 2025 sets the benchmark for this dynamic market, with the forecast period of 2025–2033 expected to witness a remarkable compound annual growth rate (CAGR).

Key growth trends include the rising demand for distributed power generation, particularly in developing economies within the Asia-Pacific region, where grid infrastructure may be underdeveloped or unreliable. The increasing industrialization and urbanization across countries like China and India are creating a sustained need for robust power solutions to support manufacturing, commercial activities, and residential needs. Furthermore, a growing awareness of climate change and the push for cleaner energy alternatives are making gas generators, which generally have lower emissions compared to diesel alternatives, a more attractive option for many applications. The advancements in natural gas infrastructure, including pipelines and liquefied natural gas (LNG) terminals, are also facilitating wider accessibility and affordability of natural gas as a fuel source, thereby bolstering the demand for gas generators.

The residential segment is experiencing growth due to increased disposable incomes and a desire for uninterrupted power supply, especially in areas prone to power outages. For commercial enterprises, uninterrupted operations are paramount, making gas generators an essential component of their power backup strategies, particularly for data centers, hospitals, and retail establishments. The industrial sector, encompassing manufacturing plants, mining operations, and oil & gas facilities, relies heavily on continuous power to avoid costly production disruptions. Therefore, the demand for high-capacity gas generators in this segment remains robust.

Technological innovations are not only focused on improving the efficiency and reducing the emissions of gas generators but also on enhancing their intelligence and connectivity. Smart features, remote monitoring capabilities, and integration with renewable energy sources are becoming increasingly important. These advancements allow for optimized performance, predictive maintenance, and better management of energy resources, aligning with the broader trend towards smart grids and the Internet of Things (IoT). The market penetration of gas generators is expected to deepen as these benefits become more widely recognized and as the total cost of ownership becomes more competitive.

The study period of 2019–2033, with a focus on the historical period of 2019–2024, provides valuable insights into past market performance and lays the groundwork for future projections. Understanding these historical trends is crucial for accurately forecasting the market's future trajectory. The estimated year of 2025 serves as a pivotal point, reflecting current market conditions and leading into the comprehensive forecast.

- Market Size Evolution: Steady upward trajectory projected.

- Adoption Rates: Increasing across residential, commercial, and industrial sectors.

- Technological Disruptions: Advancements in efficiency, emissions, and smart grid integration.

- Consumer Behavior Shifts: Growing demand for reliable and sustainable backup power.

- Key Growth Drivers: Distributed power generation, industrialization, urbanization, cleaner energy alternatives.

- Fuel Availability: Expanding natural gas infrastructure and affordability.

- Segmental Growth: Robust demand in residential, commercial, and industrial sectors.

- Technological Advancements: Smart features, remote monitoring, renewable integration.

- CAGR: Significant positive growth expected during the forecast period.

- Market Penetration: Deepening as benefits become more recognized.

Dominant Regions, Countries, or Segments in Asia-Pacific Gas Generator Market

The Asia-Pacific gas generator market is characterized by significant regional variations and dominant segments that are propelling overall growth. Among the geographical segments, China stands out as a dominant region, driven by its massive industrial base, rapid urbanization, and substantial investments in infrastructure development. The sheer scale of manufacturing and the continuous need for reliable power to support these operations make China a prime market for gas generators. Its government's focus on energy security and increasingly stringent environmental regulations also favors cleaner fuel-based power generation solutions like gas.

Within the country-specific analysis, India is another powerhouse, witnessing a burgeoning demand for power across all sectors. Its growing economy, expanding manufacturing capabilities, and the need to bridge power deficits in many regions make it a fertile ground for gas generator adoption. The government's push for industrial growth under initiatives like "Make in India" further amplifies the demand for reliable and efficient power backup solutions.

Examining the segments by Capacity, the Above 375 kVA category is a significant driver, particularly within the industrial and large commercial sectors. These high-capacity generators are essential for operations that cannot afford any downtime, such as large manufacturing plants, data centers, and critical infrastructure facilities like hospitals and airports. The increasing complexity and scale of industrial operations in the region necessitate these robust power solutions.

In terms of End-User segments, the Industrial sector holds a dominant position. The continuous operations required in manufacturing, mining, oil and gas, and other heavy industries necessitate a constant and reliable power supply. Gas generators provide an efficient and often more cost-effective solution compared to other alternatives for meeting these substantial power demands. The industrial sector's growth is directly correlated with the demand for industrial-grade gas generators.

The "Rest of Asia-Pacific" region also presents a nuanced picture, with countries like South Korea and Japan showcasing advanced technological adoption and a strong emphasis on energy efficiency and emission control. While their market sizes might be smaller compared to China and India, they represent a segment with high purchasing power and a keen interest in innovative and sustainable energy solutions. South Korea's robust manufacturing and technology sectors, coupled with Japan's focus on disaster preparedness and resilient infrastructure, contribute significantly to the demand for advanced gas generator systems.

The driving forces behind this dominance are multifaceted:

- Economic Policies: Government initiatives promoting industrial growth and energy independence directly impact generator sales.

- Infrastructure Development: Expansive infrastructure projects require reliable power solutions for construction and ongoing operations.

- Urbanization: Rapid urban expansion necessitates robust power grids and backup solutions for a growing population.

- Industrialization: The backbone of many Asia-Pacific economies, driving demand for continuous and high-capacity power.

- Environmental Regulations: Increasingly strict emission standards favor cleaner alternatives like natural gas generators.

- Energy Security: Countries are seeking diverse and reliable energy sources, including distributed generation.

- Technological Adoption: Advanced economies are quick to adopt efficient and smart generator technologies.

- Market Share: China and India command substantial market shares due to their economic scale and power needs.

- Growth Potential: Emerging economies within the "Rest of Asia-Pacific" offer significant untapped potential.

The dominance of these regions and segments underscores the broad-based demand for gas generators, driven by economic development, industrial necessity, and evolving environmental consciousness.

Asia-Pacific Gas Generator Market Product Landscape

The Asia-Pacific gas generator market is characterized by a dynamic product landscape focused on enhancing efficiency, reducing emissions, and improving reliability. Innovations are centered on optimizing fuel combustion for lower NOx and CO2 emissions, aligning with stricter environmental regulations. Manufacturers are integrating advanced control systems for seamless integration with smart grids and existing power infrastructure, enabling features like remote monitoring, diagnostics, and automatic load sharing. Product offerings span a wide range of capacities, from compact units suitable for residential backup to high-power solutions for industrial applications. Key performance metrics emphasized include fuel efficiency (g/kWh), power output stability, noise reduction, and extended operational lifespan. Unique selling propositions often revolve around enhanced fuel flexibility, modular design for scalability, and robust construction for demanding environments.

Key Drivers, Barriers & Challenges in Asia-Pacific Gas Generator Market

Key Drivers:

- Growing Demand for Reliable Power: Increasing frequency of power outages due to aging infrastructure and extreme weather events.

- Industrial Growth and Expansion: Booming manufacturing and infrastructure sectors across the region require uninterrupted power supply.

- Environmental Regulations: Stricter emissions standards favor cleaner-burning natural gas generators over diesel.

- Advancements in Natural Gas Infrastructure: Expanding pipeline networks and LNG availability improve fuel accessibility.

- Technological Innovations: Development of more fuel-efficient, quieter, and smarter generator systems.

- Cost-Effectiveness: Competitive operational costs of natural gas fuel compared to alternatives in many regions.

Barriers & Challenges:

- High Initial Investment Cost: Gas generators can have a higher upfront purchase price compared to some alternatives.

- Natural Gas Infrastructure Limitations: Inadequate pipeline networks in remote or developing areas can hinder adoption.

- Fuel Price Volatility: Fluctuations in natural gas prices can impact operational costs and competitiveness.

- Competition from Alternatives: Continued strong presence of diesel generators and the growing adoption of renewable energy solutions.

- Skilled Workforce Shortage: Demand for trained technicians for installation, maintenance, and repair of advanced gas generators.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of components and finished products.

- Regulatory Hurdles: Navigating diverse and sometimes complex local regulatory environments for permits and emissions compliance.

Emerging Opportunities in the Asia-Pacific Gas Generator Market

Emerging opportunities in the Asia-Pacific gas generator market are primarily driven by the increasing adoption of distributed generation and the growing demand for energy resilience. The expansion of natural gas infrastructure into new territories, especially in Southeast Asia, presents a significant untapped market. Furthermore, the development of hybrid power solutions that combine gas generators with renewable energy sources like solar and battery storage offers a pathway for more sustainable and cost-effective power generation. The increasing demand for portable and modular gas generators for temporary power needs in construction, disaster relief, and remote operations also presents a lucrative avenue. Evolving consumer preferences for smart, connected devices are pushing for the development of IoT-enabled gas generators with advanced monitoring and control capabilities, opening opportunities for service-based business models.

Growth Accelerators in the Asia-Pacific Gas Generator Market Industry

Several key catalysts are accelerating the growth of the Asia-Pacific gas generator market. Technological breakthroughs in engine design are leading to improved fuel efficiency and reduced emissions, making gas generators more attractive from both economic and environmental perspectives. Strategic partnerships between manufacturers and energy providers are expanding market reach and facilitating the integration of gas generators into wider energy networks. The increasing government focus on energy security and diversification is also a significant growth accelerator, encouraging investment in reliable backup power solutions. Furthermore, market expansion strategies by key players, including the establishment of local manufacturing facilities and robust distribution networks in high-growth regions, are further fueling market expansion. The growing adoption of combined heat and power (CHP) systems, which utilize waste heat from generators for heating or cooling, also adds to the growth momentum by improving overall energy efficiency.

Key Players Shaping the Asia-Pacific Gas Generator Market Market

- Cooper Corporation

- AKSA Power Generation

- Yanmar Co ltd

- Kohler Co

- Kirloskar Electric Company Limited

- Caterpillar Inc

- Cummins Inc

- MTU America Inc

- Generac Holdings Inc

- General Electric Company

Notable Milestones in Asia-Pacific Gas Generator Market Sector

- 2020:03 - Kohler Co. launched a new series of advanced gas generators designed for enhanced efficiency and lower emissions in the commercial sector.

- 2021:01 - Cummins Inc. announced a strategic partnership to expand its gas generator offerings in Southeast Asia, focusing on developing markets.

- 2021:09 - Caterpillar Inc. unveiled its latest range of gas generator sets with improved fuel flexibility and integration capabilities for smart grids.

- 2022:05 - Generac Holdings Inc. acquired a specialized technology firm to bolster its smart grid integration and IoT capabilities for generators.

- 2023:02 - AKSA Power Generation expanded its manufacturing capacity in Turkey to meet the growing demand from the Asia-Pacific region.

- 2023:07 - Yanmar Co. Ltd. introduced a new compact gas generator model optimized for residential and small commercial applications in urban areas.

- 2024:01 - Kirloskar Electric Company Limited announced significant advancements in their engine technology for enhanced performance and reduced environmental impact.

In-Depth Asia-Pacific Gas Generator Market Market Outlook

The Asia-Pacific gas generator market is projected for robust and sustained growth, driven by the ongoing demand for reliable and increasingly sustainable power solutions. Growth accelerators such as continuous technological advancements in fuel efficiency and emission reduction, coupled with expanding natural gas infrastructure across the region, will be pivotal. Strategic market expansion by key players, including localized manufacturing and distribution, will further solidify market presence. The increasing adoption of hybrid power systems and smart grid integration presents significant future market potential, catering to the evolving needs for energy resilience and efficiency. The market is well-positioned to capitalize on industrial expansion, urbanization, and a growing emphasis on energy security and cleaner energy alternatives.

Asia-Pacific Gas Generator Market Segmentation

-

1. Capacity

- 1.1. Less than 75 kVA

- 1.2. 75-375 kVA

- 1.3. Above 375 kVA

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Gas Generator Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Gas Generator Market Regional Market Share

Geographic Coverage of Asia-Pacific Gas Generator Market

Asia-Pacific Gas Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Inclination towards Renewable Sources

- 3.4. Market Trends

- 3.4.1. Industrial Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less than 75 kVA

- 5.1.2. 75-375 kVA

- 5.1.3. Above 375 kVA

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. China Asia-Pacific Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Less than 75 kVA

- 6.1.2. 75-375 kVA

- 6.1.3. Above 375 kVA

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. India Asia-Pacific Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Less than 75 kVA

- 7.1.2. 75-375 kVA

- 7.1.3. Above 375 kVA

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Japan Asia-Pacific Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Less than 75 kVA

- 8.1.2. 75-375 kVA

- 8.1.3. Above 375 kVA

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. South Korea Asia-Pacific Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Less than 75 kVA

- 9.1.2. 75-375 kVA

- 9.1.3. Above 375 kVA

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Rest of Asia Pacific Asia-Pacific Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. Less than 75 kVA

- 10.1.2. 75-375 kVA

- 10.1.3. Above 375 kVA

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cooper Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AKSA Power Generation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yanmar Co ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kohler Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kirloskar Electric Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Caterpillar Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cummins Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MTU America Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Generac Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Company*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cooper Corporation

List of Figures

- Figure 1: Asia-Pacific Gas Generator Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Gas Generator Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 2: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 3: Asia-Pacific Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 10: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 11: Asia-Pacific Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 13: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 18: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 19: Asia-Pacific Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 21: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 26: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 27: Asia-Pacific Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 29: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 34: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 35: Asia-Pacific Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 37: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 42: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 43: Asia-Pacific Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 45: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Gas Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Gas Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Gas Generator Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Asia-Pacific Gas Generator Market?

Key companies in the market include Cooper Corporation, AKSA Power Generation, Yanmar Co ltd, Kohler Co, Kirloskar Electric Company Limited, Caterpillar Inc, Cummins Inc, MTU America Inc, Generac Holdings Inc, General Electric Company*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Gas Generator Market?

The market segments include Capacity, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide.

6. What are the notable trends driving market growth?

Industrial Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Inclination towards Renewable Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Gas Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Gas Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Gas Generator Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Gas Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence